Logistics Automation Market Synopsis

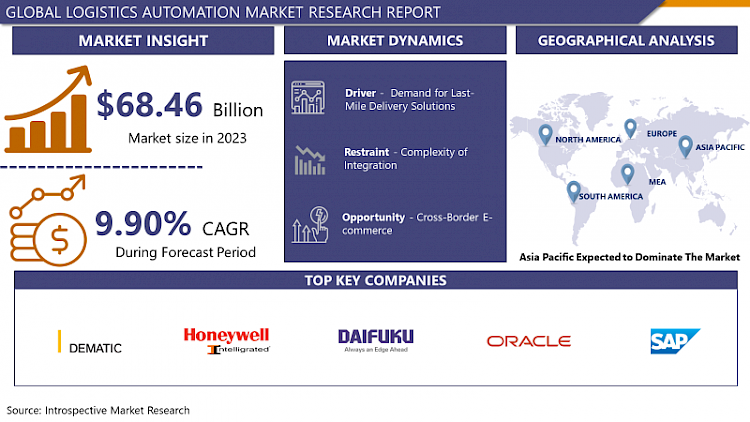

Logistics Automation Market Size Was Valued at USD 68.46 Billion in 2023, and is Projected to Reach USD 160.11 Billion by 2032, Growing at a CAGR of 9.90% From 2024-2032.

The logistics automation market is experiencing exponential growth driven by the increasing demand for efficient and cost-effective supply chain operations across various industries. With advancements in technologies like robotics, artificial intelligence, and Internet of Things (IoT), logistics companies are automating processes such as warehouse management, inventory tracking, transportation, and last-mile delivery. This automation not only enhances operational efficiency but also improves accuracy, reduces labor costs, and accelerates order fulfillment, thus enabling businesses to meet the growing demands of customers in a timely manner. Moreover, the COVID-19 pandemic has further accelerated the adoption of logistics automation solutions as companies seek to minimize human contact and ensure business continuity amidst disruptions. As a result, the logistics automation market is poised for continued expansion in the coming years, offering lucrative opportunities for both established players and new entrants.

- Logistics automation is a rather emerging market that within the recent years experienced a consistent growth due to constant technological progress and need for the effective supply chain management solutions. Technological advancements for instance Robotics, Artificial intelligence, and Machine learning and the use of IOT (Internet of Things) have made radical changes on the way logistic operations are carried out. Such technologies help in simplification of business operations, optimization costs of operation, and enhancement of general business performance.

- The most notable trends that underpin the logistics automation market include the following: Thus, there are emerging demands among the consumers for rapid and efficient order processing that became more prevalent due to the existence of online purchasing. Using automation technologies that can enable the e-commerce companies to execute functions such as order processing, restocking, and shipping lead to minimization of errors and increase in the rate at which the products are delivered to customers. This has become crucial especially since customers are demanding short delivery periods and efficient paths to purchase.

- Additionally, there is expansion to automation use in warehouses and distribution centres that ease productivity and scalability. Picking, packing and sorting as well as traversing, horizontal transportation can easily and precisely be performed by automated guided vehicle (AGVs) and robots like robotic arms. This is not only efficient but also cuts out much of the possibility of harm and cost of having many employees doing manual labor.

- Besides increasing flow and effectiveness, logistics automation also comes with advantages of tracking and inventory in live time across the complete supply chain. IoT sensors and RFID are effective tools that can help organizations track the movement of products in real time to gain greater control over supply chains and improve their sales forecasts.

- In sum, it is also projected that the demand for logistics automation will remain on the relentless rise in the near future due to the growing desire of various enterprises to maintain competitiveness on the global market amid the rising role of digital technologies. The implementation of automation technologies within a supply chain process can lead to better supply chain performance, decreased expenses and increased customer satisfaction.

Logistics Automation Market Trend Analysis

Advancements in Robotics and Automation Solutions Revolutionize Supply Chain Operations

- The use of robotics and automation solution in the logistics industry signifies the right step towards all logistics industries to improve and increase productivity. Automated mobile robots or known as AMRs is widely implemented in operations of warehouses and distribution centers to perform activities like transportation of goods, picking as well as sorting. These robots are self-driven and thus able to make their way through the facility with most of the planning done by themselves. Hence, by implementing AMRs in the operation of warehouses, firms are in a position to surge efficiency, accuracy of orders and fulfill all the plans set out in a warehouse.

- Robotic arms depend control systems are also essential part of automation solutions in logistics field. Solutions from these flexible machines can handle a lot of operations and applications like palletizing, depalletizing, packing, and loading/unloading products. Earlier, these arms were relatively immobile, unintelligent, and bulky, but thanks to improvements in the robotics field, they are now becoming smarter, precise, and usable in any warehouse setting. The integration of robotics arms into the various processes within the organizations would improve efficiency and productivity because it would cut down on the cycle time and almost eliminate cases of work – related injuries, especial among workers in the manufacturing industries.

- Another revolutionary invention which is also considered as one of the most significant tools of logistics automation is, the automated guided vehicles (AGVs). They have integrations of sensors, cameras, and navigation systems through which such vehicles are capable of moving products on its own within a warehouse or even through manufacturing plants. Due to its maneuverability, AGVs can carry pallets, containers, as well as other material, which reduces the use of toweling trucks, forklifts, and other material handling equipment. This paper has shown that the use of AGVs can improve the material flow within organizations and minimize costs as well as hazards related to employing human labor to distribute materials within organizations, ultimately improving the efficacy of supply chains.

The Role of Artificial Intelligence in Revolutionizing Logistics Automation

- The advancement in the application of artificial intelligence (AI) and machine learning algorithms as part of logistics automation systems is a significant turning point in several ways. Artificial intelligence based software applications are unique tools for analysis of past and present data to make smart assumptions about the future, allowing businesses to foresee demand changes and potential constraints, and adjust their operations alive. Operational data from the past and also sensory data from other connected devices can then be processed by AI algorithms to provide better insights and these can aid in making better decisions throughout the supply chain.

- Another benefit that can be obtained through the use of artificial intelligence in logistics automation is the possibility of choosing optimal itineraries and managing fleets. As traffic databases, climatic conditions, and constraints on the delivery of commodities and machines are fed into the loops of neural networks, the networks’ computers can determine the best routes for the conveyance of commodities and machines. This not only reduces the costs of moving goods from one place to the other but also the time taken in delivery and thus the satisfaction of customers. Furthermore, the application of technologies in AI-based predictive maintenance can help identify anomalies or potential failures and apply necessary fixations before their occurrence, thus avoiding interruptions to logistics and maintaining efficiency of equipment.

- In addition, it can engage in decision making in logistics, independent of human intervention, by employing AI to make adjustments based on ongoing changes and sudden occurrences. For instance, it can predict inventory requirements dynamically to ensure demand, or find an alternate rout for delivery due to traffic jam or arrange the warehouse layout which has changed over time to ensure product mix. Since AI and ML based logistics automation learn from data, the system can self-develop and adapt, constantly creating new patterns and methods, which have a positive impact on operations and performance of the supply chain.

Logistics Automation Market Segment Analysis:

Logistics Automation Market is segmented based on Components, Function, Logistics Type, Organization size, Software Application and Vertical.

By Components, De-palletizing/Palletizing Systems segment is expected to dominate the market during the forecast period

- De-palletizing/Palletizing Systems has become the most essential tools in manufacturing and production industries logistics processes and controls and hence demand a big market share rate. These systems transform the dealing of pallets in distribution centers and warehouses because they affect the intricate process of pallet handling mechanisms. These systems are highly beneficial in manufacturing processes where accuracy and efficiency play a vital role in operations because they require minimum disruption to integrate into the operation and reduce the time and complexity of pallet-related processes. Specifically, pallet loading and unloading, sorting, and arrangement functions are among the primary activities that the systems help automate and minimize reliance on manual labor, thus increasing production output and streamlining operations.

- The increasing use of Depal/ Pal systems in manufacturing and production logistics is fueled by a positive change in work flow optimization. Indeed, by automating pallet handling tasks, these systems help to avoid time-consuming and function stoppages or slotting limitations, so that manufacturers can hit the production deadlines of an established schedule. Furthermore, since selection can respond to as assorted pallet sizes and configurations, they are definite solutions for warehouses that have variable requirements in terms of pallet handling. According to the general trends, which are in the constant change due to the progressive development as well as the constant growth in the demand for more efficiency, it can be also forseen that the importance of the De-palletizing/Palletizing Systems will only continue to grow and become an essential tools to achieve the ultimate goal of operational improvement.

By Function, Inventory and Storage Management segment held the largest share in 2023

- Competing in the ever-evolving environment of logistics, inventory, and storage management categories, these two plays a role of factories by maintaining order and supply throughout different industries. Serving as the foundational success constitutors of business operational smoothness, these components can facilitate organizational processes for inventory management in accordance with the dynamic market demands while maximising the returning statuses. However, with the advancement of globalization and the subsequent emergence of e-commerce, inventory and storage management have become even more crucial since the proper flow of a particular good requires the appropriate management of relations with suppliers, warehousing, and consumer expectations.

- Sales logistics is recognized as one of the many types of logistics that exists in the market which are prevalent in the current business world and out of all of them sales logistics takes the largest slice of the market share. In its strictest definition, sales logistics is all about ordering and rearranging product flows from manufacturer to end consumer in the most remarkable and efficient way. This involves complex coordination between the storage and issuing of stock, ordering of services and goods and their transportation to the right location at the right time. In the case of companies within the retail and e-commerce industry where client satisfaction is measured by the degree of timely delivery and successful sales transactions and inquiries, sale logistics is the backbone of the organization that fuels operations as well as expansion.

- In today’s highly evolved world of commerce cut throat competition is a reality and thus the effectiveness of sales logistics is often the deciding factor for a business venture’s success. Lacking creative and innovative ideas in customer expectations towards product availability and logistic delivery speed, the firms must develop or implement a strong sales logistics plan. With the help of such advanced technologies, data analysis, and cooperation with other companies, the sales logistics processes in the companies become effective for the further increasing of the companies’ opportunities in the conditions of the modern world and the constant rising of the customer’s requirements. Thus, sales logistics remains the key, unchallenged and undisputed and the backbone of supply chain management and catalyst to innovation, growth, and commitment to the heartbeat of customers in numerous industries.

Logistics Automation Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- In the Asia-Pacific region, particularly in countries like China, Japan, and South Korea, the logistics automation market holds a dominant share propelled by the exponential growth of the e-commerce sector. With the rise of online shopping platforms and the increasing preference for digital transactions, there has been a surge in the volume of goods moving through supply chains. This heightened demand for efficient and timely delivery has necessitated the adoption of automation technologies to streamline logistics processes, from warehousing to last-mile delivery.

- Moreover, the manufacturing sector in these countries plays a pivotal role in driving the demand for logistics automation solutions. China, known as the world's manufacturing powerhouse, relies heavily on efficient logistics operations to support its vast production networks. By integrating automation technologies such as robotics, conveyor systems, and warehouse management software, manufacturers can optimize inventory management, reduce lead times, and enhance overall operational efficiency.

- Furthermore, the retail sector in the Asia-Pacific region has undergone a significant transformation, with traditional brick-and-mortar stores increasingly embracing online platforms to reach a wider customer base. This shift in consumer behavior has placed immense pressure on retailers to ensure swift and accurate order fulfillment, driving the need for advanced logistics automation solutions. From automated order processing to robotic picking systems, retailers are investing in technologies that can streamline their supply chain operations and provide customers with seamless shopping experiences.

- In addition to market-driven factors, government initiatives aimed at modernizing logistics infrastructure have played a crucial role in accelerating the growth of the logistics automation market in the Asia-Pacific region. Recognizing the importance of efficient logistics networks for economic development, governments have been actively investing in infrastructure upgrades and implementing policies to encourage the adoption of automation technologies. These efforts have not only enhanced the competitiveness of businesses operating in the region but have also contributed to the overall growth and resilience of the Asia-Pacific logistics industry.

Active Key Players in the Logistics Automation Market

- Dematic

- Honeywell Intelligrated

- Daifuku

- Oracle

- SAP

- IBM

- SSI Schaefer

- Knapp

- Manhattan Associates

- Swisslog

- Blue Yonder

- Mantis

- Murata Machinery

- TGW Logistics Group

- Jungheinrich

- System Logistics

- Zebra Technologies

- ABB

- BEUMER Group

- Korber

- O9 Solutions

- JR Automation(US),

- Automated Logistics Systems(US),

- SBS Toshiba Logistics (Japan),

- Other Key Players

Key Industry Developments in the Logistics Automation Market:

- In January 2023, Jungheinrich acquired the Indiana-based Storage Solutions group (Storage Solutions), a leading provider of racking and warehouse automation solutions in the US to gain enhanced access to the US warehousing and automation.

- In January 2023, Jungheinrich acquired the Indiana-based Storage Solutions group (Storage Solutions), a leading provider of racking and warehouse automation solutions in the US to gain enhanced access to the US warehousing and automation.

- In October 2022, Supply Sensing, a new generation solution introduced by 09 Solutions, would assist businesses in better anticipating supply disruptions by localizing the impact of macro-level shocks on their particular supply chains and developing mitigating strategies to minimize any negative effects on their operations.

- In May 2022, Oracle announced new logistics management capabilities within Oracle Fusion Cloud Supply Chain & Manufacturing (SCM). The updates to oracle fusion cloud transportation management and oracle fusion cloud global trade management can help organizations reduce costs and risks, improve customer experience, and become more adaptable to business disruptions.

|

Global Logistics Automation Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 75.24Bn. |

|

Forecast Period 2024-32 CAGR: |

9.90% |

Market Size in 2032: |

USD 160.11Bn. |

|

Segments Covered: |

By Components |

|

|

|

|||

|

By Logistics Type |

|

||

|

By Organization size |

|

||

|

By Software Application |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- LOGISTICS AUTOMATION MARKET BY COMPONENT (2016-2030)

- LOGISTICS AUTOMATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HARDWARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SOFTWARE

- SERVICES

- LOGISTICS AUTOMATION MARKET BY FUNCTION (2016-2030)

- LOGISTICS AUTOMATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- Inventory and Storage Management

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TRANSPORTATION LOGISTICS

- LOGISTICS AUTOMATION MARKET BY LOGISTICS TYPE (2016-2030)

- LOGISTICS AUTOMATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SALES LOGISTICS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PRODUCTION LOGISTICS

- RECOVERY LOGISTICS

- PROCUREMENT LOGISTICS

- LOGISTICS AUTOMATION MARKET BY ORGANIZATION SIZE (2016-2030)

- LOGISTICS AUTOMATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LARGE ENTERPRISE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

- LOGISTICS AUTOMATION MARKET BY SOFTWARE (2016-2030)

- LOGISTICS AUTOMATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- Inventory Management

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ORDER MANAGEMENT

- YARD MANAGEMENT

- SHIPPING MANAGEMENT

- LABOUR MANAGEMENT

- VENDOR MANAGEMENT

- CUSTOMER SUPPORT

- TRANSPORTATION MANAGEMENT

- ORDER MANAGEMENT

- WAREHOUSE MANAGEMENT

- LOGISTICS AUTOMATION MARKET BY MODE OF FREIGHT TRANSPORT(2016-2030)

- LOGISTICS AUTOMATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AIR

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ROAD

- SEA

- LOGISTICS AUTOMATION MARKET BY APPLICATION (2016-2030)

- LOGISTICS AUTOMATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TRANSPORTATION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INFOTAINMENT SYSTEM

- SAFETY AND ALERTING SYSTEM

- OTHERS

- LOGISTICS AUTOMATION MARKET BY END-USER (2016-2030)

- LOGISTICS AUTOMATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MANUFACTURING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HEALTHCARE AND PHARMACEUTICALS

- FAST-MOVING CONSUMER GOODS

- RETAIL AND E-COMMERCE

- AUTOMOTIVE

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- LOGISTICS AUTOMATION Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- DEMATIC (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- HONEYWELL INTELLIGRATED (US)

- MANHATTAN ASSOCIATES (US)

- MANTIS (US)

- BLUE YONDER (US)

- ORACLE (US)

- IBM(US)

- ZEBRA TECHNOLOGIES (US)

- O9 SOLUTIONS (US)

- JR AUTOMATION (US)

- AUTOMATED LOGISTICS SYSTEMS (US)

- SYMBOTIC (US)

- LOCUS ROBOTICS (US)

- GREYORANGE (US)

- LOGISTICALLY (US)

- LOGIWA(US)

- SAP (GERMANY)

- SSI SCHAEFER (GERMANY)

- BEUMER GROUP (GERMANY)

- KORBER(GERMANY)

- SAVOYE(FRANCE)

- EYESEE (HARDIS GROUP) (FRANCE)

- SYSTEM LOGISTICS (ITALY)

- JUNGHEINRICH (GERMANY)

- TGW LOGISTICS GROUP (AUSTRIA)

- KNAPP (AUSTRIA)

- ABB (SWITZERLAND)

- SWISSLOG (SWITZERLAND)

- FALCON AUTOTECH (INDIA)

- DAIFUKU (JAPAN)

- SBS TOSHIBA LOGISTICS (JAPAN)

- MURATA MACHINERY (JAPAN), AND OTHER MAJOR PLAYERS.

- COMPETITIVE LANDSCAPE

- GLOBAL LOGISTICS AUTOMATION MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Function

- Historic And Forecasted Market Size By Logistics Type

- Historic And Forecasted Market Size By Organization Size

- Historic And Forecasted Market Size By Software

- Historic And Forecasted Market Size By Mode of Freight Transport

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Logistics Automation Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 75.24Bn. |

|

Forecast Period 2024-32 CAGR: |

9.90% |

Market Size in 2032: |

USD 160.11Bn. |

|

Segments Covered: |

By Components |

|

|

|

|||

|

By Logistics Type |

|

||

|

By Organization size |

|

||

|

By Software Application |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- LOGISTICS AUTOMATION MARKET BY COMPONENTS (2017-2032)

- LOGISTICS AUTOMATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HARDWARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SOFTWARE

- SERVICES

- LOGISTICS AUTOMATION MARKET BY FUNCTION (2017-2032)

- LOGISTICS AUTOMATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- INVENTORY AND STORAGE MANAGEMENT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SEGMENT2B

- TRANSPORTATION LOGISTICS

- LOGISTICS AUTOMATION MARKET BY LOGISTICS TYPE (2017-2032)

- LOGISTICS AUTOMATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SALES LOGISTICS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PRODUCTION LOGISTICS

- RECOVERY LOGISTICS

- PROCUREMENT LOGISTICS

- LOGISTICS AUTOMATION MARKET BY ORGANIZATION SIZE (2017-2032)

- LOGISTICS AUTOMATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SMES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LARGE ENTERPRISES

- LOGISTICS AUTOMATION MARKET BY SOFTWARE APPLICATION (2017-2032)

- LOGISTICS AUTOMATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- INVENTORY MANAGEMENT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ORDER MANAGEMENT

- YARD MANAGEMENT

- SHIPPING MANAGEMENT

- LABOR MANAGEMENT

- VENDOR MANAGEMENT

- CUSTOMER SUPPORT

- OTHER APPLICATIONS

- LOGISTICS AUTOMATION MARKET BY VERTICAL (2017-2032)

- LOGISTICS AUTOMATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RETAIL & E-COMMERCE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MANUFACTURING

- HEALTHCARE & PHARMACEUTICALS

- FOOD & BEVERAGES

- AUTOMOTIVE

- AEROSPACE AND DEFENSE

- CHEMICALS

- OTHER VERTICALS (PAPER AND PRINTING, AND TEXTILES AND CLOTHING)

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- LOGISTICS AUTOMATION Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- DEMATIC

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- HONEYWELL INTELLIGRATED

- DAIFUKU

- ORACLE

- SAP

- IBM

- SSI SCHAEFER

- KNAPP

- MANHATTAN ASSOCIATES

- SWISSLOG

- BLUE YONDER

- MANTIS

- MURATA MACHINERY

- TGW LOGISTICS GROUP

- JUNGHEINRICH

- SYSTEM LOGISTICS

- ZEBRA TECHNOLOGIES

- ABB

- BEUMER GROUP

- KORBER

- O9 SOLUTIONS

- JR AUTOMATION(US),

- AUTOMATED LOGISTICS SYSTEMS(US),

- SBS TOSHIBA LOGISTICS (JAPAN),

- COMPETITIVE LANDSCAPE

- GLOBAL LOGISTICS AUTOMATION MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Components

- Historic And Forecasted Market Size By Function

- Historic And Forecasted Market Size By Logistics Type

- Historic And Forecasted Market Size By Organization size

- Historic And Forecasted Market Size By Software Application

- Historic And Forecasted Market Size By Vertical

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

Frequently Asked Questions :

The forecast period in the Logistics Automation Market research report is 2024-2032.

Dematic , Honeywell Intelligrated ,Daifuku , Oracle, SAP ,IBM ,SSI Schaefer , Knapp, Manhattan Associates, Swisslog, Blue Yonder,Mantis,Murata Machinery, TGW Logistics Group, Jungheinrich, System Logistics, Zebra Technologies, ABB, BEUMER Group ,Korber, O9 Solutions, JR Automation(US), Automated Logistics Systems,SBS Toshiba Logistics , SAVOYE, Symbotic, Locus Robotics, GreyOrange , Eyesee (Hardis Group), Falcon Autotech , Logistically,and Logiwa, and Other Major Players.

The Logistics Automation Market is segmented into By Components, By Function, By Logistics Type, By Organization size, By Software Application and By Vertical and region. By Components, the market is categorized into Hardware (Autonomous Mobile Robots (AMRs), Automated Guided Vehicles (AGVs), Automated Storage and Retrieval Systems (AS/RS), Automated Sorting and Conveyor Systems, De-palletizing/Palletizing Systems, Automatic Identification and Data Collection (AIDC), Software (Warehouse Management System (WMS) software, Transportation Management System (TMS) software), and Services( Consulting, Deployment & Integration ,Support and Maintenance). By Function, the market is categorized into Inventory and Storage Management and Transportation logistics.By Logistics Type, the market is categorized into Inventory and Storage Management and Transportation logistics. By Organization size, the market is categorized into SMEs and Large Enterprises. By Software Application, the market is categorized into Inventory Management, Order Management, Yard Management, Shipping Management, Labor Management, Vendor Management, Customer Support and Other Applications. By Vertical, the market is categorized into Retail & eCommerce, Manufacturing, Healthcare & Pharmaceuticals, Food & Beverages, Automotive, Aerospace and Defense, Chemicals and Other Verticals (paper and printing, and textiles and clothing).By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The logistics automation market is experiencing exponential growth driven by the increasing demand for efficient and cost-effective supply chain operations across various industries. With advancements in technologies like robotics, artificial intelligence, and Internet of Things (IoT), logistics companies are automating processes such as warehouse management, inventory tracking, transportation, and last-mile delivery. This automation not only enhances operational efficiency but also improves accuracy, reduces labor costs, and accelerates order fulfillment, thus enabling businesses to meet the growing demands of customers in a timely manner. Moreover, the COVID-19 pandemic has further accelerated the adoption of logistics automation solutions as companies seek to minimize human contact and ensure business continuity amidst disruptions. As a result, the logistics automation market is poised for continued expansion in the coming years, offering lucrative opportunities for both established players and new entrants.

Logistics Automation Market Size Was Valued at USD 68.46 Billion in 2023, and is Projected to Reach USD 160.11 Billion by 2032, Growing at a CAGR of 9.90% From 2024-2032.