Global Kale Chips Market Overview:

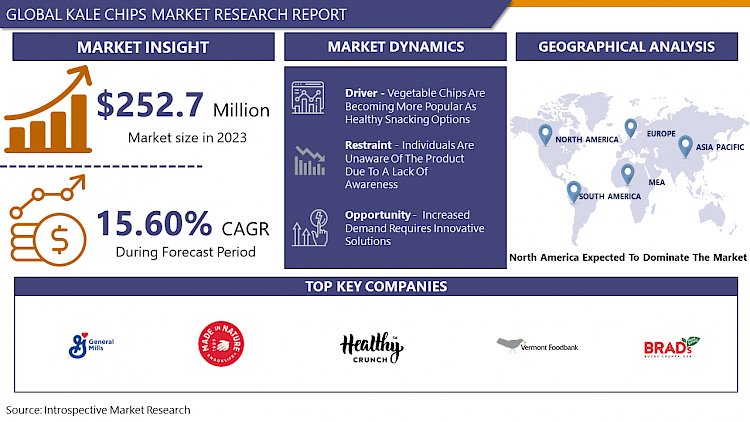

Global Kale Chips Market Size Was Valued at USD 252.7 Million In 2023 And Is Projected to Reach USD 931.74 Million By 2032, Growing at A CAGR of 15.60% From 2024 to 2032.

Kale chips are a crunchy snack prepared from the leaves of the kale plant (Brassica oleracea). The dark green leaves are fried, roasted, or desiccated at low temperatures. Cashews, sunflower seeds, tahini, and a variety of seasonings may be included in kale chip products for flavor. Previously only available in health food stores, kale chips are now widely available in the snack department of most supermarkets. Kale is a nutrient-dense food that is high in water content and rich in vitamins and minerals. It is also low in calories. Kale chips can be a major source of fat depending on how they're prepared, but when eaten in moderation, they can be a nutrient-dense supplement to your diet. It contains a lot of antioxidants and can help maintain normal cholesterol levels and cardiovascular health. Kale chips are crunchy and delicious when seasoned with cayenne pepper for a spicy snack, or simply with sea salt, ranch dressing, or hummus for a protein boost. Over the forecast period, the market would rise due to rising demand for snacks and rising health consciousness among individuals.

Market Dynamics and Factors of Kale Chips Market

Drivers:

Vegetable Chips Are Becoming More Popular As Healthy Snacking Options

The nutrients in kale are likely to be the source of any health benefits you get from eating kale chips. The oil used to make the chips is most likely utilized in such little amounts that it provides no significant benefits. Vitamin K and A, iron, and fiber are all abundant in kale chips. Kale is also low in calories, high in antioxidants, and can help maintain appropriate cholesterol levels and cardiovascular health. For example, researchers have looked into the health advantages of kale and other foods labeled as "superfoods" in terms of illness prevention. According to the authors of a study published in the journal Nutrients in 2015, kale and lentils, as well as other foods high in prebiotic carbohydrates and dietary fiber, can help to reduce the risk of noncommunicable diseases like obesity, cancer, heart disease, and diabetes. Furthermore, the advent of raw, gluten-free, organic, and vegan concepts has further enhanced the reputation of these chips, resulting in significant market growth. The Kale Factory, a leading manufacturer, has recently introduced a Paleo-friendly tag on their chips, encouraging people to eat a healthy whole-food-based diet.

Adults should consume 22–34 grams of fiber per day, depending on sex and age, according to the USDA's 2020-2025 Dietary Guidelines for Americans. Kale chips can help you achieve that objective while also providing essential nutrients. Other factors projected to drive market expansion include rising health consciousness and demand for healthier snacks.

Restraints:

Individuals Are Unaware Of The Product Due To A Lack Of Awareness

Several chemicals in kale chips might trigger allergic reactions, which can stifle market expansion. Furthermore, due to a lack of knowledge about its health benefits, kale is still not a popular snack. These factors are predicted to hinder the market's exponential expansion until individuals change their snacking habits.

Opportunities:

Increased Demand Requires Innovative Solutions

Brandneu prides itself on the natural, healthy profile and high quality of its kale chips as a prominent provider. Brandneu's kale chips have grown in prominence as a result of the rising consumer desire for healthy alternatives to potato chips. To meet this demand and remain competitive in an increasingly crowded industry, the company needed to review its production capacities. "The current trend toward healthier snacks has had a significant impact on the food business," says Sekhar Chakkingal, tna North America's regional sales manager. "Consumers are becoming increasingly concerned about their fat, sugar, and salt intake. As a result, several manufacturers, such as Brandneu, are searching for new technologies to help them develop healthier, more delicious snacks to meet this demand. When Brandneu reached us, we knew exactly what cutting-edge technology they needed to maximize the manufacture of their natural baked kale chips."

Segmentation Analysis Of Kale Chips Market

By Product Type, the dehydrated chips segment Is anticipated to hold the maximum market share over the forecast period. One of the oldest ways of food preservation is dehydration. Dehydrated foods can be used in salads, cereals, baked goods, and smoothies as a healthier alternative to numerous snacks. They're also simple to utilize in recipes because they rehydrate in liquid. Foods that have been dehydrated retain their nutritional value. Dehydrated meals are a go-to for hikers and tourists trying to save space because they are lightweight and nutrient-dense. Dried food, on the other hand, is usually smaller in size and has more calories per pound because it has lost its water content. To avoid overeating, keep quantities of dehydrated foods less than those recommended for unprocessed foods.

By Distribution Channel, the Supermarkets/Hypermarkets segment is expected to dominate the market over the forecast period. These channels allow customers to physically inspect a product before purchasing it, which influences their decision. They can choose the proper product with the help of store personnel. Kale chips from various brands are widely distributed through supermarkets such as Walmart and Martin's, among others. Brad's Raw Food partnered with Kroger to expand the availability of its kale chips across North America.

Regional Analysis Of Kale Chips Market

The North American region is expected to dominate the kale chips market during the projected period. Americans are steadily becoming more health-conscious, which leads to an increase in demand for nutritious foods. Snack makers in the region are successfully addressing increased consumer demand for healthful dietary snacks by continuously improving their goods. Because of the fierce competition among the competitors in North America, manufacturers are creating novel snacks to stand apart. The Angel Kale Company, for example, makes kale chips in sweet, salty, spicy, and savory flavors to appeal to a wide range of consumer tastes. They are also investing heavily in R&D to introduce new products to the market and extend their product line. Apart from that, the well-organized retail sector has fueled market growth by making potato chips readily available in hypermarkets, supermarkets, and convenience stores.

The kale chips market in the Asia Pacific is expected to grow rapidly in the next years. The rapid expansion of the market is aided by the quick emergence of modern distribution channels such as supermarkets and hypermarkets. The increasing popularity of snack foods in Asian countries has forced regional competitors to adapt strategic improvements to acquire a competitive advantage in the snack food market. The kale chips market in Asian countries is also predicted to grow as a result of product and packaging innovation efforts.

The European kale chips market is expanding as a result of rising packaged goods demand, urbanization, rising consumer disposable incomes, and economic expansion in developing countries. Over the decades, rapid socioeconomic development has resulted in diseases such as heart disease, cancer, and diabetes in various segments of the population. As people become more health-conscious, they prefer fortified Chips and Crisps. In the future, the UK market is expected to be extremely competitive. Western European countries lead the market due to the widespread practice of consuming chips as a regular snack.

COVID-19 Impact Analysis On Kale Chips Market

Since the ingredients in kale chips are obtained from vegetables like kale leaf, fluctuations in the supply of these materials have a direct impact on the supply of kale chips. The supply chain was severely harmed as a result of the COVID-19 epidemic. Manufacturers of raw materials had supplies on hand, but there was insufficient demand. Furthermore, because the majority of the country was shut down, businesses faced numerous challenges in obtaining raw materials. Manufacturers were faced with a shortage of raw resources in this situation. Another element that influenced the supply chain for kale chips was labor availability. Several producers were having difficulty obtaining raw materials, while others were having difficulty delivering the product. The end product was ready for a few producers, but they were unable to reach their consumers owing to transportation constraints, resulting in revenue loss. As a result, the influence on supply was caused by several factors rather than a single one.

The COVID-19 outbreak in the United States increased the demand for kale chips. As a result of the lockdown, the consumption of kale chips surged, as it falls under the category of ready-to-eat foods, which saw a spike in demand during the lockdown period. As a result of COVID-19's breakout, the kale chips market is expected to grow in the fiscal year 2020. In the fiscal year 2020-2021, leading businesses in the food industry saw an increase in revenue as the consumption of kale chips and other types of snacks increased.

Top Key Players Analyzed In Kale Chips Market

- General Mills Inc

- Made in Nature

- Rhythm Superfoods

- Healthy Crunch

- Vermont Kale Chips

- Brad's Plant Based LLC.

- Simply 7 Snacks LLC.

- The Angel Kale Company

- Lydia's Foods Inc

- The Kale Factory and other major players.

Key Industry Developments In Kale Chips Market

By installing the high-performance tna Intelli-flav® OMS 5 at its Toronto factory, Brandneu Foods was able to shorten lead times for its popular line of kale chips by 75%. In addition to reducing production lead times from 60 to 15 days, the new installation allowed Brandneu to consolidate its workspace, allowing it to better respond to client requests. tna supplied whole project management services from start to finish to ensure a smooth installation, giving Brandneu complete peace of mind so they could focus on their day-to-day business goals.

|

Global Kale Chips Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 252.7 Mn |

|

Forecast Period 2024–32 CAGR: |

15.60 % |

Market Size in 2032: |

USD 931.74 Mn |

|

Segments Covered: |

By Product Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2: Executive Summary

Chapter 3: Growth Opportunities By Segment

3.1 By Product Type

3.2 By Distribution Channel

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on Pricing

Chapter 5: Kale Chips Market by Product Type

5.1 Kale Chips Market Overview Snapshot and Growth Engine

5.2 Kale Chips Market Overview

5.3 Dehydrated Chips

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Dehydrated Chips: Geographic Segmentation

5.4 Extruded Chips

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Extruded Chips: Geographic Segmentation

Chapter 6: Kale Chips Market by Distribution Channel

6.1 Kale Chips Market Overview Snapshot and Growth Engine

6.2 Kale Chips Market Overview

6.3 Supermarkets/Hypermarkets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Supermarkets and Hypermarkets: Geographic Segmentation

6.4 Specialty Stores

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Specialty Stores: Grographic Segmentation

6.5 Convenience Stores

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Convenience Stores: Grographic Segmentation

6.6 Online Stores

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Online Stores: Geographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Kale Chips Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Kale Chips Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Kale Chips Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 GENERAL Mills, Inc..

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 MADE IN NATURE

7.4 RHYTHM SUPERFOODS

7.5 HEALTHY CRUNCH

7.6 VERMONT KALE CHIPS

7. BRAD'S PLANT BASED LLC.

7.8 SIMPLY 7 SNACKS LLC.

7.9 THE ANGEL KALE COMPANY

7.10 Lyda'S Foods, Inc..

7.11: THE KALE FACTORY

7.12 OTHER MAJOR PLAYERS

Chapter 8: Global Kale Chips Market Analysis, Insights and Forecast, 2017-2032

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Product Type

8.2.1 Dehydrated Chips

8.2.2 Extruded Chips

8.3 Historic and Forecasted Market Size By Distribution Channel

8.3.1 Supermarkets/Hypermarkets

8.3.2 Specialty Stores

8.3.3 Convenience Stores

8.3.4 Online Stores

Chapter 9: North America Kale Chips Market Analysis, Insights and Forecast, 2017-2032

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Product Type

9.4.1 Dehydrated Chips

9.4.2 Extruded Chips

9.5 Historic and Forecasted Market Size By Distribution Channel

9.5.1 Supermarkets/Hypermarkets

9.5.2 Specialty Stores

9.5.3 Convenience Stores

9.5.4 Online Stores

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Kale Chips Market Analysis, Insights and Forecast, 2017-2032

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Product Type

10.4.1 Dehydrated Chips

10.4.2 Extruded Chips

10.5 Historic and Forecasted Market Size By Distribution Channel

10.5.1 Supermarkets/Hypermarkets

10.5.2 Specialty Stores

10.5.3 Convenience Stores

10.5.4 Online Stores

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Kale Chips Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Product Type

11.4.1 Dehydrated Chips

11.4.2 Extruded Chips

11.5 Historic and Forecasted Market Size By Distribution Channel

11.5.1 Supermarkets/Hypermarkets

11.5.2 Specialty Stores

11.5.3 Convenience Stores

11.5.4 Online Stores

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Kale Chips Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Product Type

12.4.1 Dehydrated Chips

12.4.2 Extruded Chips

12.5 Historic and Forecasted Market Size By Distribution Channel

12.5.1 Supermarkets/Hypermarkets

12.5.2 Specialty Stores

12.5.3 Convenience Stores

12.5.4 Online Stores

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Kale Chips Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Product Type

13.4.1 Dehydrated Chips

13.4.2 Extruded Chips

13.5 Historic and Forecasted Market Size By Distribution Channel

13.5.1 Supermarkets/Hypermarkets

13.5.2 Specialty Stores

13.5.3 Convenience Stores

13.5.4 Online Stores

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14: Investment Analysis

Chapter 15: Analyst Viewpoint and Conclusion

|

Global Kale Chips Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 252.7 Mn |

|

Forecast Period 2024–32 CAGR: |

15.60 % |

Market Size in 2032: |

USD 931.74 Mn |

|

Segments Covered: |

By Product Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001: EXECUTIVE SUMMARY

TABLE 002. KALE CHIPS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. KALE CHIPS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. KALE CHIPS MARKET COMPETITIVE RIVALRY

TABLE 005. KALE CHIPS MARKET THREAT OF NEW ENTRANTS

TABLE 006. KALE CHIPS MARKET THREAT OF SUBSTITUTES

TABLE 007. KALE CHIPS MARKET BY PRODUCT TYPE

TABLE 008. DEHYDRATED CHIPS MARKET OVERVIEW (2016-2028)

TABLE 009. EXTRUDED CHIPS MARKET OVERVIEW (2016-2028)

TABLE 010. KALE CHIPS MARKET BY DISTRIBUTION CHANNEL

TABLE 011. SUPERMARKETS/HYPERMARKETS MARKET OVERVIEW (2016-2028)

TABLE 012. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

TABLE 013. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

TABLE 014. ONLINE STORES MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA KALE CHIPS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 016. NORTH AMERICA KALE CHIPS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 017. N KALE CHIPS MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE KALE CHIPS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 019. EUROPE KALE CHIPS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 020. KALE CHIPS MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC KALE CHIPS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 022. ASIA PACIFIC KALE CHIPS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 023. KALE CHIPS MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA KALE CHIPS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 025: MIDDLE EAST & Africa: KALE CHIPS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 026. KALE CHIPS MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA KALE CHIPS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 028. SOUTH AMERICA KALE CHIPS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 029. KALE CHIPS MARKET, BY COUNTRY (2016-2028)

TABLE 030. GENERAL MILLS INC.: SNAPSHOT

TABLE 031. GENERAL MILLS INC.: BUSINESS PERFORMANCE

TABLE 032. GENERAL Mills, Inc..: PRODUCT PORTFOLIO

TABLE 033. GENERAL MILLS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. MADE IN NATURE: SNAPSHOT

TABLE 034. MADE IN NATURE: BUSINESS PERFORMANCE

TABLE 035. MADE IN NATURE: PRODUCT PORTFOLIO

TABLE 036. MADE IN NATURE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. RHYTHM SUPERFOODS: SNAPSHOT

TABLE 037: RHYTHM SUPERFOODS: BUSINESS PERFORMANCE

TABLE 038. RHYTHM SUPERFOODS: PRODUCT PORTFOLIO

TABLE 039. RHYTHM SUPERFOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. HEALTHY CRUNCH: SNAPSHOT

TABLE 040. HEALTHY CRUNCH: BUSINESS PERFORMANCE

TABLE 041. HEALTHY CRUNCH: PRODUCT PORTFOLIO

TABLE 042. HEALTHY CRUNCH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. VERMONT KALE CHIPS: SNAPSHOT

TABLE 043. VERMONT KALE CHIPS: BUSINESS PERFORMANCE

TABLE 044. VERMONT KALE CHIPS: PRODUCT PORTFOLIO

TABLE 045. VERMONT KALE CHIPS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. BRAD'S PLANT BASED LLC.: SNAPSHOT

TABLE 046: BRAD'S Plant-Based LLC.: BUSINESS PERFORMANCE

TABLE 047. BRAD'S PLANT BASED LLC.: PRODUCT PORTFOLIO

TABLE 048. BRAD'S PLANT-BASED LLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. SIMPLY 7 SNACKS LLC.: SNAPSHOT

TABLE 049. SIMPLY 7 SNACKS LLC.: BUSINESS PERFORMANCE

TABLE 050. SIMPLY 7 SNACKS LLC.: PRODUCT PORTFOLIO

TABLE 051. SIMPLY 7 SNACKS LLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. THE ANGEL KALE COMPANY: SNAPSHOT

TABLE 052. THE ANGEL KALE COMPANY: BUSINESS PERFORMANCE

TABLE 053. THE ANGEL KALE COMPANY: PRODUCT PORTFOLIO

TABLE 054. THE ANGEL KALE COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. LYDIA'S FOODS INC.: SNAPSHOT

TABLE 055. LYDIA'S FOODS INC.: BUSINESS PERFORMANCE

TABLE 056. LYDIA'S FOODS INC.: PRODUCT PORTFOLIO

TABLE 057. LYDIA'S FOODS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. THE KALE FACTORY: SNAPSHOT

TABLE 058: The Kale Factory: Business Performance

TABLE 059. THE KALE FACTORY: PRODUCT PORTFOLIO

TABLE 060. THE KALE FACTORY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 061. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 062. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 063. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001: YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. KALE CHIPS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. KALE CHIPS MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. DEHYDRATED CHIPS MARKET OVERVIEW (2016-2028)

FIGURE 013. EXTRUDED CHIPS MARKET OVERVIEW (2016-2028)

FIGURE 014. KALE CHIPS MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 015. SUPERMARKETS/HYPERMARKETS MARKET OVERVIEW (2016-2028)

FIGURE 016. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

FIGURE 017. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

FIGURE 018. ONLINE STORES MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA KALE CHIPS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE KALE CHIPS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC KALE CHIPS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA KALE CHIPS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA KALE CHIPS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the kale chips market research report is 2024-2032.

General Mills Inc, Made in Nature, Rhythm Superfoods, Healthy Crunch, Vermont Kale Chips, Brad's Plant Based LLC., Simply 7 Snacks LLC., The Angel Kale Company, Lydia's Foods Inc, The Kale Factory, and Other Major Players.

Kale Chips Market is segmented into Product Type, Distribution Channel, and region. By Product Type, the market is categorized into Dehydrated Chips, Extruded Chips. By Distribution Channel, the market is categorized into Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online Stores. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Kale chips are a crunchy snack prepared from the leaves of the kale plant (Brassica oleracea). The dark green leaves are fried, roasted, or desiccated at low temperatures. Cashews, sunflower seeds, tahini, and a variety of seasonings may be included in kale chip products for flavour.

Global Kale Chips Market Size Was Valued at USD 252.7 Million In 2023 And Is Projected to Reach USD 931.74 Million By 2032, Growing at A CAGR of 15.60% From 2024 to 2032.