Insulation Market Synopsis

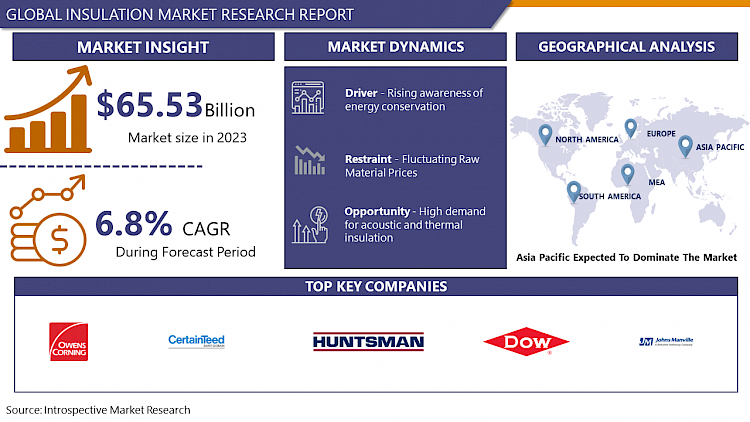

Insulation Market Size Was Valued at USD 65.53 Billion in 2023 and is Projected to Reach USD 118.46 Billion by 2032, Growing at a CAGR of 6.8% From 2024-2032.

Insulation is a material used to reduce heat, sound, or electricity transfer between surfaces, improving energy efficiency, indoor comfort, and cost reduction. It traps air pockets within a structure, creating a barrier that slows down the heat or sound flow. Materials like fiberglass, foam, mineral wool, and cellulose are used, each offering unique properties. Effective insulation maintains consistent temperatures, reduces noise transmission, and contributes to sustainable living and working environments.

- Insulation is a crucial component in various industries, offering numerous benefits such as energy efficiency, thermal comfort, and noise reduction. It reduces heat transfer, heating, and cooling costs, and provides consistent indoor temperatures, creating a more comfortable environment. The demand for insulation is driven by rising energy costs, stringent energy efficiency regulations, and environmental awareness. Industries like construction, manufacturing, automotive, and oil and gas rely on insulation for thermal insulation, soundproofing, fire protection, and process control.

- In the construction sector, insulation is essential for residential, commercial, and industrial buildings to meet energy codes, improve indoor comfort, and reduce environmental impact. Market trends in the insulation industry include the use of eco-friendly materials, high-performance insulation solutions, and smart insulation technologies. Applications of insulation include walls, roofs, floors, HVAC systems, pipelines, vehicles, and appliances.

- Insulation materials like fiberglass, foam, mineral wool, cellulose, and reflective insulation are tailored based on factors like thermal conductivity, density, compressive strength, and fire resistance. Insulation is crucial in modern construction, manufacturing, and automotive applications for improving building envelope performance and reducing energy consumption and greenhouse gas emissions. It helps control temperature, preserves product quality, and reduces energy costs. As urbanization increases, insulation becomes increasingly vital for energy efficiency, comfort, and sustainability in buildings, transportation, and infrastructure, driving innovation and market expansion.

Insulation Market Trend Analysis

Rising awareness of energy conservation

- The insulation market is growing due to increasing awareness of energy conservation and the need to reduce energy consumption and carbon emissions. Insulation plays a crucial role in this by minimizing heat transfer, improving thermal efficiency, and reducing the need for HVAC systems. The economic benefits of insulation include reduced energy bills, particularly in regions with high energy costs. Governments worldwide are implementing stringent building codes, energy standards, and environmental regulations to promote sustainable development and resilience to climate-related risks. Public awareness campaigns, educational initiatives, and green building certifications are raising awareness about the importance of insulation in achieving energy conservation.

- Consumers are becoming more knowledgeable about the energy-saving benefits of insulation and are actively seeking eco-friendly and sustainable building solutions. The transition towards renewable energy sources, such as solar and wind power, also amplifies the importance of energy conservation. Insulation helps maximize the efficiency of renewable energy systems by reducing heat loss and optimizing energy utilization, supporting the transition towards a cleaner and more sustainable energy future.

High demand for acoustic and thermal insulation

- The insulation market is experiencing a surge in demand for both acoustic and thermal insulation. Thermal insulation is a crucial component for enhancing energy efficiency and reducing heating and cooling costs in buildings, industrial facilities, and transportation. High-performance insulation materials minimize heat transfer, ensuring comfortable indoor temperatures and reducing reliance on mechanical systems. This demand is growing due to rising energy costs and environmental sustainability goals.

- Acoustic insulation, on the other hand, is needed to mitigate noise pollution and improve acoustic comfort in residential, commercial, and industrial environments. Sound-absorbing insulation materials help reduce noise transmission, enhancing privacy and reducing disruptions. As urbanization intensifies and population densities increase, the demand for acoustic insulation in buildings, transportation infrastructure, and industrial facilities increases.

- Advancements in insulation technologies, such as aerogels, vacuum insulation panels, and composite materials, enable the development of high-performance insulation solutions that effectively address both thermal and acoustic requirements. The growing emphasis on indoor environmental quality and occupant well-being is driving a surge in demand for acoustic and thermal insulation. As people spend more time indoors, the demand for energy-efficient, productive, and healthy spaces is increasing. Effective insulation ensures optimal temperatures, minimizes energy waste, and creates quieter, more comfortable environments. This presents growth opportunities for the insulation market.

Insulation Market Segment Analysis:

Insulation Market Segmented on the basis of Material Type, Application, End-User.

By Material Type, Fiberglass segment is expected to dominate the market during the forecast period

- The fiberglass insulation market is expected to be dominant due to its widespread use, favorable properties, and continuous innovation. Fiberglass insulation is widely used in residential, commercial, industrial, and automotive sectors due to its affordability, versatility, and ease of installation. It is available in various forms, including batts, rolls, and loose-fill, and is known for its excellent thermal resistance, non-combustibility, and resistance to moisture, mold, and pests. Its lightweight nature simplifies handling and installation, reducing labor costs and project timelines.

- Continuous advancements in the fiberglass insulation industry enhance its performance and sustainability. Manufacturers invest in research and development to improve thermal efficiency, fire resistance, environmental impact, and manufacturing processes. High-performance fiberglass insulation with enhanced R-values and reduced environmental footprint addresses growing demands for energy-efficient and eco-friendly building solutions.

- Foam insulation manufacturers also adapt to market trends and regulations, such as energy efficiency standards and green building certifications, to ensure their products meet or exceed industry requirements. This proactive approach enables fiberglass insulation to maintain its competitive edge and meet the evolving needs of customers and industries worldwide.

By Application, Residential segment is expected to dominate the market during the forecast period

- The residential sector is expected to dominate the insulation market due to various factors. Energy efficiency regulations and sustainability initiatives have increased the importance of reducing energy consumption in residential buildings, which in turn reduces the need for HVAC systems. Insulation plays a crucial role in improving energy efficiency by minimizing heat loss in winter and heat gain in summer, thereby reducing the need for HVAC systems. The demand for insulation in residential properties is also driven by the desire for enhanced thermal comfort, as properly insulated homes maintain stable indoor temperatures, especially in regions with extreme climates.

- The growing trend towards sustainable and eco-friendly construction practices has fueled the demand for environmentally responsible insulation materials in the residential sector. Homeowners are increasingly opting for insulation products made from recycled or renewable materials, aligning with societal concerns about climate change and resource conservation. The renovation and retrofit market presents a significant opportunity for insulation manufacturers and suppliers, as homeowners invest in upgrading their homes with insulation to improve energy efficiency and indoor comfort.

Insulation Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region is poised to dominate the insulation market due to its rapid growth and expansion. Rapid urbanization and industrialization in the region have led to a surge in construction activities, infrastructure development, and industrial projects, driving the demand for insulation materials to enhance energy efficiency, comply with building codes, and improve indoor comfort levels. With a burgeoning population and expanding middle class, there is a growing need for residential, commercial, and industrial spaces equipped with insulation to ensure thermal comfort and energy efficiency.

- Government initiatives and regulations promoting energy efficiency and sustainable building practices further boost the demand for insulation materials in the Asia-Pacific region. Many countries have implemented stringent energy efficiency standards, green building certifications, and incentive programs to encourage the adoption of energy-efficient building solutions. This drives the demand for insulation materials to reduce energy consumption, lower utility bills, and mitigate environmental impact.

- The Asia-Pacific region is home to some of the world's largest emerging economies, such as China, India, and Southeast Asia, which are witnessing robust economic growth and infrastructure investments. The increasing awareness among consumers, builders, and industries about the benefits of energy efficiency and sustainability drives the adoption of insulation materials in the region.

Insulation Market Top Key Players:

- Owens Corning Corp (US)

- CertainTeed Corporation (US)

- Huntsman International (US)

- Dow Chemical Company (US)

- Johns Manville (US)

- Atlas Roofing Corporation (US)

- Duro-Last Roofing Inc (US)

- BASF (Germany)

- Knauf Gips KG (Germany)

- Rockwool International A/S (Denmark)

- Armacell International S.A (Luxembourg)

- Recticel Insulation (Belgium)

- Kingspan Group (Ireland)

- Supreme Petrochem Limited (India)

- SY Panel Company Limited (South Korea)

- Shinwoo Industrial Company Limited (South Korea)

- Sae Rom Panel (South Korea)

- KCC Corporation (South Korea)

- Byucksan Corporation (South Korea)

- Bondor Indonesia (Indonesia)

- Nichias Corporation (Japan)

- Kaneka Corporation (Japan)

- Luyang Energy-Saving Materials (China)

- Beijing New Building Material Group (China)

- Huamei Group (China), and Other Major Players.

Key Industry Developments in the Insulation Market:

- In July 2023, Kingspan Group announced its plan to acquire majority of Steico SE’s shares, a key wood fibre insulation manufacturer. The acquisition is based on regulatory clearance and is scheduled for early 2024.

- In February 2023, Saint-Gobain completed the acquisition of U.P. Twiga Fiberglass Ltd. (UP Twiga), the leading player in the Indian glass wool insulation market. This strategic move is anticipated to strengthen Saint-Gobain's presence in India's energy-efficient solutions sector, particularly in the realm of façade solutions.

- In September 2022, GAF unveiled plans to broaden its insulation and roofing operations across Savannah, Cumming, and Statesboro in Georgia. This expansion initiative aimed to enhance GAF's manufacturing capabilities for thermoplastic polyolefin (TPO) roofing materials.

|

Global Insulation Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 65.53 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.8 % |

Market Size in 2032: |

USD 118.46 Bn. |

|

Segments Covered: |

By Material Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- INSULATION MARKET BY MATERIAL TYPE (2017-2032)

- INSULATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FIBERGLASS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FOAM

- MINERAL WOOL

- CELLULOSE

- INSULATION MARKET BY APPLICATION (2017-2032)

- INSULATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RESIDENTIAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL

- INDUSTRIAL

- HVAC SYSTEMS

- INSULATION MARKET BY END-USER (2017-2032)

- INSULATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONSTRUCTION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MANUFACTURING

- OIL & GAS

- AUTOMOTIVE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Insulation Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- OWENS CORNING CORP (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- CERTAINTEED CORPORATION (US)

- HUNTSMAN INTERNATIONAL (US)

- DOW CHEMICAL COMPANY (US)

- JOHNS MANVILLE (US)

- ATLAS ROOFING CORPORATION (US)

- DURO-LAST ROOFING INC (US)

- BASF (GERMANY)

- KNAUF GIPS KG (GERMANY)

- ROCKWOOL INTERNATIONAL A/S (DENMARK)

- ARMACELL INTERNATIONAL S.A (LUXEMBOURG)

- RECTICEL INSULATION (BELGIUM)

- KINGSPAN GROUP (IRELAND)

- SUPREME PETROCHEM LIMITED (INDIA)

- SY PANEL COMPANY LIMITED (SOUTH KOREA)

- SHINWOO INDUSTRIAL COMPANY LIMITED (SOUTH KOREA)

- SAE ROM PANEL (SOUTH KOREA)

- KCC CORPORATION (SOUTH KOREA)

- BYUCKSAN CORPORATION (SOUTH KOREA)

- BONDOR INDONESIA (INDONESIA)

- NICHIAS CORPORATION (JAPAN)

- KANEKA CORPORATION (JAPAN)

- LUYANG ENERGY-SAVING MATERIALS (CHINA)

- BEIJING NEW BUILDING MATERIAL GROUP (CHINA)

- HUAMEI GROUP (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL INSULATION MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Material Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Insulation Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 65.53 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.8 % |

Market Size in 2032: |

USD 118.46 Bn. |

|

Segments Covered: |

By Material Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. INSULATION MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. INSULATION MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. INSULATION MARKET COMPETITIVE RIVALRY

TABLE 005. INSULATION MARKET THREAT OF NEW ENTRANTS

TABLE 006. INSULATION MARKET THREAT OF SUBSTITUTES

TABLE 007. INSULATION MARKET BY TYPE

TABLE 008. CELLULOSE MARKET OVERVIEW (2016-2028)

TABLE 009. FIBERGLASS MARKET OVERVIEW (2016-2028)

TABLE 010. MINERAL WOOL MARKET OVERVIEW (2016-2028)

TABLE 011. INSULATION MARKET BY APPLICATION

TABLE 012. BUILDING & CONSTRUCTION MARKET OVERVIEW (2016-2028)

TABLE 013. HVAC & OEM MARKET OVERVIEW (2016-2028)

TABLE 014. INDUSTRIAL MARKET OVERVIEW (2016-2028)

TABLE 015. INSULATION MARKET BY FUNCTION

TABLE 016. THERMAL MARKET OVERVIEW (2016-2028)

TABLE 017. ACOUSTIC MARKET OVERVIEW (2016-2028)

TABLE 018. ELECTRIC MARKET OVERVIEW (2016-2028)

TABLE 019. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 020. NORTH AMERICA INSULATION MARKET, BY TYPE (2016-2028)

TABLE 021. NORTH AMERICA INSULATION MARKET, BY APPLICATION (2016-2028)

TABLE 022. NORTH AMERICA INSULATION MARKET, BY FUNCTION (2016-2028)

TABLE 023. N INSULATION MARKET, BY COUNTRY (2016-2028)

TABLE 024. EUROPE INSULATION MARKET, BY TYPE (2016-2028)

TABLE 025. EUROPE INSULATION MARKET, BY APPLICATION (2016-2028)

TABLE 026. EUROPE INSULATION MARKET, BY FUNCTION (2016-2028)

TABLE 027. INSULATION MARKET, BY COUNTRY (2016-2028)

TABLE 028. ASIA PACIFIC INSULATION MARKET, BY TYPE (2016-2028)

TABLE 029. ASIA PACIFIC INSULATION MARKET, BY APPLICATION (2016-2028)

TABLE 030. ASIA PACIFIC INSULATION MARKET, BY FUNCTION (2016-2028)

TABLE 031. INSULATION MARKET, BY COUNTRY (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA INSULATION MARKET, BY TYPE (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA INSULATION MARKET, BY APPLICATION (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA INSULATION MARKET, BY FUNCTION (2016-2028)

TABLE 035. INSULATION MARKET, BY COUNTRY (2016-2028)

TABLE 036. SOUTH AMERICA INSULATION MARKET, BY TYPE (2016-2028)

TABLE 037. SOUTH AMERICA INSULATION MARKET, BY APPLICATION (2016-2028)

TABLE 038. SOUTH AMERICA INSULATION MARKET, BY FUNCTION (2016-2028)

TABLE 039. INSULATION MARKET, BY COUNTRY (2016-2028)

TABLE 040. ARKEMA SA (FRANCE): SNAPSHOT

TABLE 041. ARKEMA SA (FRANCE): BUSINESS PERFORMANCE

TABLE 042. ARKEMA SA (FRANCE): PRODUCT PORTFOLIO

TABLE 043. ARKEMA SA (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. BASF SE (GERMANY): SNAPSHOT

TABLE 044. BASF SE (GERMANY): BUSINESS PERFORMANCE

TABLE 045. BASF SE (GERMANY): PRODUCT PORTFOLIO

TABLE 046. BASF SE (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. BEIJING NEW BUILDING MATERIAL (GROUP) CO. LTD. (CHINA): SNAPSHOT

TABLE 047. BEIJING NEW BUILDING MATERIAL (GROUP) CO. LTD. (CHINA): BUSINESS PERFORMANCE

TABLE 048. BEIJING NEW BUILDING MATERIAL (GROUP) CO. LTD. (CHINA): PRODUCT PORTFOLIO

TABLE 049. BEIJING NEW BUILDING MATERIAL (GROUP) CO. LTD. (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. CLARIANT AG (SWITZERLAND): SNAPSHOT

TABLE 050. CLARIANT AG (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 051. CLARIANT AG (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 052. CLARIANT AG (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. COVESTRO AG (GERMANY): SNAPSHOT

TABLE 053. COVESTRO AG (GERMANY): BUSINESS PERFORMANCE

TABLE 054. COVESTRO AG (GERMANY): PRODUCT PORTFOLIO

TABLE 055. COVESTRO AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. DOWDUPONT INC. (U.S.): SNAPSHOT

TABLE 056. DOWDUPONT INC. (U.S.): BUSINESS PERFORMANCE

TABLE 057. DOWDUPONT INC. (U.S.): PRODUCT PORTFOLIO

TABLE 058. DOWDUPONT INC. (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. EASTMAN CHEMICAL CO. (U.S.): SNAPSHOT

TABLE 059. EASTMAN CHEMICAL CO. (U.S.): BUSINESS PERFORMANCE

TABLE 060. EASTMAN CHEMICAL CO. (U.S.): PRODUCT PORTFOLIO

TABLE 061. EASTMAN CHEMICAL CO. (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. EVONIK INDUSTRIES AG (GERMANY): SNAPSHOT

TABLE 062. EVONIK INDUSTRIES AG (GERMANY): BUSINESS PERFORMANCE

TABLE 063. EVONIK INDUSTRIES AG (GERMANY): PRODUCT PORTFOLIO

TABLE 064. EVONIK INDUSTRIES AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. FLETCHER BUILDING LTD. (NEW ZEALAND): SNAPSHOT

TABLE 065. FLETCHER BUILDING LTD. (NEW ZEALAND): BUSINESS PERFORMANCE

TABLE 066. FLETCHER BUILDING LTD. (NEW ZEALAND): PRODUCT PORTFOLIO

TABLE 067. FLETCHER BUILDING LTD. (NEW ZEALAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. GAF INDUSTRIES INC. (U.S.): SNAPSHOT

TABLE 068. GAF INDUSTRIES INC. (U.S.): BUSINESS PERFORMANCE

TABLE 069. GAF INDUSTRIES INC. (U.S.): PRODUCT PORTFOLIO

TABLE 070. GAF INDUSTRIES INC. (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. JOHNS MANVILLE CORP. (U.S.): SNAPSHOT

TABLE 071. JOHNS MANVILLE CORP. (U.S.): BUSINESS PERFORMANCE

TABLE 072. JOHNS MANVILLE CORP. (U.S.): PRODUCT PORTFOLIO

TABLE 073. JOHNS MANVILLE CORP. (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. KINGSPAN GROUP PLC (IRELAND): SNAPSHOT

TABLE 074. KINGSPAN GROUP PLC (IRELAND): BUSINESS PERFORMANCE

TABLE 075. KINGSPAN GROUP PLC (IRELAND): PRODUCT PORTFOLIO

TABLE 076. KINGSPAN GROUP PLC (IRELAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. KNAUF INSULATION(U.S.): SNAPSHOT

TABLE 077. KNAUF INSULATION(U.S.): BUSINESS PERFORMANCE

TABLE 078. KNAUF INSULATION(U.S.): PRODUCT PORTFOLIO

TABLE 079. KNAUF INSULATION(U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. MASCO CORP.(U.S.): SNAPSHOT

TABLE 080. MASCO CORP.(U.S.): BUSINESS PERFORMANCE

TABLE 081. MASCO CORP.(U.S.): PRODUCT PORTFOLIO

TABLE 082. MASCO CORP.(U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. OWENS CORNING CORPORATION (U.S.): SNAPSHOT

TABLE 083. OWENS CORNING CORPORATION (U.S.): BUSINESS PERFORMANCE

TABLE 084. OWENS CORNING CORPORATION (U.S.): PRODUCT PORTFOLIO

TABLE 085. OWENS CORNING CORPORATION (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 086. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 087. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 088. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. INSULATION MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. INSULATION MARKET OVERVIEW BY TYPE

FIGURE 012. CELLULOSE MARKET OVERVIEW (2016-2028)

FIGURE 013. FIBERGLASS MARKET OVERVIEW (2016-2028)

FIGURE 014. MINERAL WOOL MARKET OVERVIEW (2016-2028)

FIGURE 015. INSULATION MARKET OVERVIEW BY APPLICATION

FIGURE 016. BUILDING & CONSTRUCTION MARKET OVERVIEW (2016-2028)

FIGURE 017. HVAC & OEM MARKET OVERVIEW (2016-2028)

FIGURE 018. INDUSTRIAL MARKET OVERVIEW (2016-2028)

FIGURE 019. INSULATION MARKET OVERVIEW BY FUNCTION

FIGURE 020. THERMAL MARKET OVERVIEW (2016-2028)

FIGURE 021. ACOUSTIC MARKET OVERVIEW (2016-2028)

FIGURE 022. ELECTRIC MARKET OVERVIEW (2016-2028)

FIGURE 023. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 024. NORTH AMERICA INSULATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. EUROPE INSULATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. ASIA PACIFIC INSULATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. MIDDLE EAST & AFRICA INSULATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. SOUTH AMERICA INSULATION MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Insulation Market research report is 2024-2032.

Owens Corning Corp (US), CertainTeed Corporation (US), Huntsman International (US), Dow Chemical Company (US), Johns Manville (US), Atlas Roofing Corporation (US), Duro-Last Roofing Inc (US), BASF (Germany), Knauf Gips KG (Germany), Rockwool International A/S (Denmark), Armacell International S.A (Luxembourg), Recticel Insulation (Belgium), Kingspan Group (Ireland), Supreme Petrochem Limited (India), SY Panel Company Limited (South Korea), Shinwoo Industrial Company Limited (South Korea), Sae Rom Panel (South Korea), KCC Corporation (South Korea), Byucksan Corporation (South Korea), Bondor Indonesia (Indonesia), Nichias Corporation (Japan), Kaneka Corporation (Japan), Luyang Energy-Saving Materials (China), Beijing New Building Material Group (China), Huamei Group (China) and Other Major Players.

The Insulation Market is segmented into Material Type, Application, End-User, and region. By Material Type, the market is categorized into Fiberglass, Foam, Mineral Wool, and Cellulose. By Application, the market is categorized into Residential, Commercial, Industrial, and HVAC Systems. By End-User, the market is categorized into Construction, Manufacturing, Oil & Gas, and Automotive. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Insulation is a material used to reduce heat, sound, or electricity transfer between surfaces, improving energy efficiency, indoor comfort, and cost reduction. It traps air pockets within a structure, creating a barrier that slows down heat or sound flow. Materials like fiberglass, foam, mineral wool, and cellulose are used, each offering unique properties. Effective insulation maintains consistent temperatures, reduces noise transmission, and contributes to sustainable living and working environments.

Insulation Market Size Was Valued at USD 65.53 Billion in 2023 and is Projected to Reach USD 118.46 Billion by 2032, Growing at a CAGR of 6.8% From 2024-2032.