Architectural Acoustic Panels Market Synopsis

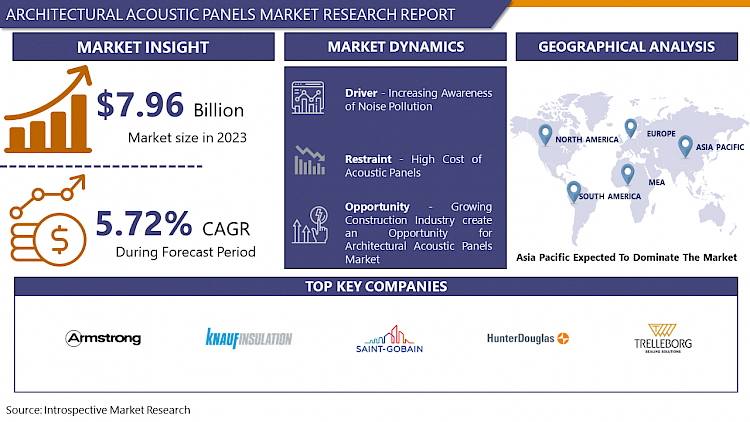

Architectural Acoustic Panels Market Size Was Valued at USD 7.96 billion in 2023 and is Projected to Reach USD 13.14 billion by 2032, Growing at a CAGR of 5.72% From 2024-2032.

Architectural acoustic panels are specialized elements designed to enhance the acoustic properties of interior spaces, particularly in buildings where sound quality and noise control are crucial considerations. These panels are crafted from various materials, including fabric, foam, wood, or metal, and are strategically placed on walls or ceilings to absorb, diffuse, or reflect sound waves.

- By mitigating echoes, reducing background noise, and improving overall sound clarity, architectural acoustic panels contribute to creating more comfortable and acoustically optimized environments. Beyond their functional benefits, these panels also offer versatile design options, allowing architects and designers to integrate them seamlessly into a space while simultaneously enhancing its aesthetic appeal.

- The market is fueled by the rising need for comfortable and noise-free environments in commercial spaces, educational institutions, healthcare facilities, and residential buildings. Advancements in technology and innovative designs have also played a crucial role in expanding the market, offering consumers a wide range of options to address their specific acoustic requirements. As sustainable building practices gain prominence, the market is likely to witness further growth, with eco-friendly and recyclable materials becoming key considerations in the design and production of architectural acoustic panels.

- The market is characterized by intense competition among key players, leading to continuous product innovations and strategic partnerships. Major players in the Architectural Acoustic Panels market are investing in research and development to introduce new materials and designs that not only provide effective sound control but also align with modern aesthetic preferences. The market is expected to experience sustained growth as industries prioritize creating acoustically optimized environments, recognizing the impact of sound quality on occupant well-being and productivity.

Architectural Acoustic Panels Market Trend Analysis

Increasing Awareness of Noise Pollution

- The escalating awareness of noise pollution has emerged as a pivotal driver propelling the growth of the Architectural Acoustic Panels market. In urban environments, the incessant rise in noise levels from traffic, industrial activities, and crowded spaces has become a pressing concern, adversely affecting human health and well-being. This heightened awareness has prompted a surge in demand for effective noise mitigation solutions, with Architectural Acoustic Panels being at the forefront.

- Architectural Acoustic Panels offer a versatile and aesthetically pleasing means to address noise-related challenges in various settings, including offices, educational institutions, healthcare facilities, and public spaces. These panels are designed not only to absorb sound but also to enhance the overall acoustic environment by reducing echoes and improving speech intelligibility. The market's growth is further propelled by stringent noise regulations and standards, encouraging the integration of acoustic solutions in architectural designs.

- As individuals and organizations recognize the importance of creating acoustically comfortable spaces, the Architectural Acoustic Panels market is witnessing a substantial upswing. Architects, designers, and facility managers are increasingly incorporating these panels into their projects, underscoring the pivotal role they play in fostering healthier and more conducive environments in the face of the escalating global concern over noise pollution.

Growing Construction Industry create an Opportunity for Architectural Acoustic Panels Market

- The burgeoning growth of the construction industry presents a significant opportunity for the Architectural Acoustic Panels market. As urbanization and infrastructure development continue to surge globally, there is an increasing demand for innovative solutions to address the challenges posed by noise pollution in built environments. Architectural Acoustic Panels offer a compelling solution by enhancing sound control and improving acoustics in various spaces, ranging from commercial buildings to residential complexes.

- These panels contribute to creating a more comfortable and productive environment and align with the growing awareness of the importance of well-designed acoustic spaces in modern architecture. The Construction industry's expansion, marked by the rise in new construction projects and renovations, provides a fertile ground for the widespread adoption of Architectural Acoustic Panels.

- Architects and builders are increasingly recognizing the value of integrating acoustic solutions into their designs, ensuring that structures meet aesthetic and functional requirements and prioritize occupant well-being. This trend positions the Architectural Acoustic Panels market as a key player in the construction landscape, poised to capitalize on the escalating need for sound management solutions in diverse architectural settings.

Architectural Acoustic Panels Market Segment Analysis:

Architectural Acoustic Panels Market Segmented on the basis of Material, type, and end-users.

By Type, Vertical acoustic panels segment is expected to dominate the market during the forecast period

- The Architectural Acoustic Panels market is anticipated to witness the dominance of the vertical acoustic panels segment, driven by its versatile applications and superior sound control features. Vertical acoustic panels are designed to address specific acoustic challenges in architectural spaces, offering a tailored solution for sound absorption and noise reduction.

- These panels are characterized by their vertical orientation, allowing for effective coverage of wall surfaces and enhancing both aesthetic appeal and acoustic performance. The vertical arrangement enables seamless integration into various architectural designs, making them a preferred choice for interior spaces across different industries, such as commercial, residential, and institutional.

- Moreover, vertical acoustic panels excel in optimizing room acoustics by minimizing reverberation, echoes, and unwanted noise, thereby creating a more comfortable and productive environment. Their adaptability to diverse architectural styles and configurations positions them as a sought-after solution for architects, designers, and project managers aiming to achieve both acoustic excellence and visual harmony in their projects.

By End-Users, Commercial segment held the largest share of 61% in 2022

- The Commercial segment is poised to emerge as the dominant force in the Architectural Acoustic Panels market. This projection is underpinned by several key factors that highlight the growing significance of these panels in commercial spaces. As businesses increasingly prioritize creating conducive and aesthetically pleasing environments, the demand for architectural acoustic panels has witnessed a surge.

- In commercial settings such as offices, conference rooms, and retail spaces, the need for effective noise control and acoustic enhancement has become paramount. Architectural acoustic panels offer a versatile solution by mitigating sound reverberation, reducing ambient noise, and enhancing overall acoustics. The Commercial segment, encompassing diverse industries, recognizes the instrumental role these panels play in fostering better communication, concentration, and customer experience.

Architectural Acoustic Panels Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to emerge as a dominant force in the architectural acoustic panels market, reflecting a confluence of factors driving its growth. With rapid urbanization, burgeoning construction activities, and a rising awareness of the importance of acoustics in architectural design, the demand for acoustic panels has witnessed a substantial uptick.

- Countries within the Asia Pacific, such as China and India, are experiencing robust economic growth, leading to increased investments in commercial and residential infrastructure. As these nations focus on modern, innovative architectural designs, the incorporation of acoustic solutions becomes pivotal, further propelling the market forward.

- Moreover, the region's thriving entertainment and hospitality industries are contributing to the heightened demand for effective sound management solutions, creating a lucrative market for architectural acoustic panels. The growing emphasis on creating sustainable and energy-efficient buildings also aligns with the eco-friendly characteristics of many acoustic panels, boosting their adoption.

Architectural Acoustic Panels Market Top Key Players:

- Owens Corning(U.S.)

- Armstrong (U.S.)

- Knauf Insulation (U.S.)

- G&S Acoustics (U.S.)

- Saint-Gobain (France)

- Hunter Douglas (Netherlands)

- Trelleborg AB (Sweden)

- Beijing New Building Material (China)

- Jiangsu Burgeree New Technology Materials Co, LTD. (China)

- Beiyang (China)

- Leeyin Acoustic Panel (China)

- Hebei Bo Run-de (China)

- Vicoustic (Portugal)

- STAR-USG (China)

- Greener Acoustics (South Africa)

Key Industry Developments in the Architectural Acoustic Panels Market:

- In April 2024, Armstrong World Industries Expands Architectural Specialties Portfolio with the Acquisition of Architectural Resin Leader 3form, LLC, Armstrong World Industries. Inc. a leader in the innovation and manufacture of ceiling and wall solutions, announced that it had acquired 3form, LLC. Based in Salt Lake City, Utah, 3form is a leading designer and manufacturer of sustainably crafted architectural resins and glass for ceilings, walls, and other interior applications.

- In January 2024, Armstrong World Industries introduced ULTIMA TEMPLOK ceiling panels, an innovative new product addressing demands for solutions that reduce energy consumption and carbon emissions in buildings. By integrating the Phase Change Material (PCM) technology with Armstrong mineral fiber ceiling panels, ULTIMA TEMPLOK panels can reduce energy costs and consumption by as much as 15%.

- In December 2022, Spacekit was able to sell its one-of-a-kind modular acoustical wall art on Armstrong's digital sales platform, KanopibyArmstrong.com, thanks to a partnership with Armstrong World Industries, Inc., a leader in the design, innovation, and manufacturing of ceiling and wall solutions in the Americas. The Spacekit products add to Kanopi's collection of high-design, customizable, and acoustically beneficial solutions for office, retail, restaurant, and hospitality settings.

- In September 2022, Armstrong World Industries, Inc. and Irving Consumer Products announced a collaboration between their Macon, Georgia, facilities with the goal of reducing both organizations' environmental footprints. Armstrong will no longer have to search for and purchase recycled newsprint as an input raw material for its ceilings because Irving Consumer Products will begin diverting its tissue fiber waste to AWI's mineral fiber plant.

|

Architectural Acoustic Panels Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.96 Bn. |

|

|

CAGR (2024-2032): |

5.72% |

Market Size in 2032: |

USD 13.14 Bn. |

|

|

Segments Covered: |

By Material |

|

|

|

|

By Type |

|

|

||

|

By End-users |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ARCHITECTURAL ACOUSTIC PANELS MARKET BY MATERIAL (2017-2032)

- ARCHITECTURAL ACOUSTIC PANELS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PLASTIC PANELS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NON-PLASTIC PANELS

- ARCHITECTURAL ACOUSTIC PANELS MARKET BY TYPE (2017-2032)

- ARCHITECTURAL ACOUSTIC PANELS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HORIZONTAL ACOUSTIC PANEL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- VERTICAL ACOUSTIC PANEL

- ARCHITECTURAL ACOUSTIC PANELS MARKET BY END USERS (2017-2032)

- ARCHITECTURAL ACOUSTIC PANELS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- COMMERCIAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- RESIDENTIAL

- INDUSTRIAL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Architectural Acoustic Panels Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- OWENS CORNING (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ARMSTRONG (U.S.)

- KNAUF INSULATION (U.S.)

- G&S ACOUSTICS (U.S.)

- SAINT-GOBAIN (FRANCE)

- HUNTER DOUGLAS (NETHERLANDS)

- TRELLEBORG AB (SWEDEN)

- BEIJING NEW BUILDING MATERIAL (CHINA)

- JIANGSU BURGEREE NEW TECHNOLOGY MATERIALS CO, LTD. (CHINA)

- BEIYANG (CHINA)

- LEEYIN ACOUSTIC PANEL (CHINA)

- HEBEI BO RUN-DE (CHINA)

- VICOUSTIC (PORTUGAL)

- STAR-USG (CHINA)

- GREENER ACOUSTICS (SOUTH AFRICA)

- COMPETITIVE LANDSCAPE

- GLOBAL ARCHITECTURAL ACOUSTIC PANELS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Material

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By End Users

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Architectural Acoustic Panels Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.96 Bn. |

|

|

CAGR (2024-2032): |

5.72% |

Market Size in 2032: |

USD 13.14 Bn. |

|

|

Segments Covered: |

By Material |

|

|

|

|

By Type |

|

|

||

|

By End-users |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ARCHITECTURAL ACOUSTIC PANELS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ARCHITECTURAL ACOUSTIC PANELS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ARCHITECTURAL ACOUSTIC PANELS MARKET COMPETITIVE RIVALRY

TABLE 005. ARCHITECTURAL ACOUSTIC PANELS MARKET THREAT OF NEW ENTRANTS

TABLE 006. ARCHITECTURAL ACOUSTIC PANELS MARKET THREAT OF SUBSTITUTES

TABLE 007. ARCHITECTURAL ACOUSTIC PANELS MARKET BY BY MATERIAL

TABLE 008. PLASTIC PANELS MARKET OVERVIEW (2016-2030)

TABLE 009. NON-PLASTIC PANELS MARKET OVERVIEW (2016-2030)

TABLE 010. ARCHITECTURAL ACOUSTIC PANELS MARKET BY TYPE

TABLE 011. HORIZONTAL ACOUSTIC PANEL MARKET OVERVIEW (2016-2030)

TABLE 012. VERTICAL ACOUSTIC PANEL MARKET OVERVIEW (2016-2030)

TABLE 013. ARCHITECTURAL ACOUSTIC PANELS MARKET BY END-USERS

TABLE 014. COMMERCIAL MARKET OVERVIEW (2016-2030)

TABLE 015. RESIDENTIAL MARKET OVERVIEW (2016-2030)

TABLE 016. INDUSTRIAL MARKET OVERVIEW (2016-2030)

TABLE 017. NORTH AMERICA ARCHITECTURAL ACOUSTIC PANELS MARKET, BY BY MATERIAL (2016-2030)

TABLE 018. NORTH AMERICA ARCHITECTURAL ACOUSTIC PANELS MARKET, BY TYPE (2016-2030)

TABLE 019. NORTH AMERICA ARCHITECTURAL ACOUSTIC PANELS MARKET, BY END-USERS (2016-2030)

TABLE 020. N ARCHITECTURAL ACOUSTIC PANELS MARKET, BY COUNTRY (2016-2030)

TABLE 021. EASTERN EUROPE ARCHITECTURAL ACOUSTIC PANELS MARKET, BY BY MATERIAL (2016-2030)

TABLE 022. EASTERN EUROPE ARCHITECTURAL ACOUSTIC PANELS MARKET, BY TYPE (2016-2030)

TABLE 023. EASTERN EUROPE ARCHITECTURAL ACOUSTIC PANELS MARKET, BY END-USERS (2016-2030)

TABLE 024. ARCHITECTURAL ACOUSTIC PANELS MARKET, BY COUNTRY (2016-2030)

TABLE 025. WESTERN EUROPE ARCHITECTURAL ACOUSTIC PANELS MARKET, BY BY MATERIAL (2016-2030)

TABLE 026. WESTERN EUROPE ARCHITECTURAL ACOUSTIC PANELS MARKET, BY TYPE (2016-2030)

TABLE 027. WESTERN EUROPE ARCHITECTURAL ACOUSTIC PANELS MARKET, BY END-USERS (2016-2030)

TABLE 028. ARCHITECTURAL ACOUSTIC PANELS MARKET, BY COUNTRY (2016-2030)

TABLE 029. ASIA PACIFIC ARCHITECTURAL ACOUSTIC PANELS MARKET, BY BY MATERIAL (2016-2030)

TABLE 030. ASIA PACIFIC ARCHITECTURAL ACOUSTIC PANELS MARKET, BY TYPE (2016-2030)

TABLE 031. ASIA PACIFIC ARCHITECTURAL ACOUSTIC PANELS MARKET, BY END-USERS (2016-2030)

TABLE 032. ARCHITECTURAL ACOUSTIC PANELS MARKET, BY COUNTRY (2016-2030)

TABLE 033. MIDDLE EAST & AFRICA ARCHITECTURAL ACOUSTIC PANELS MARKET, BY BY MATERIAL (2016-2030)

TABLE 034. MIDDLE EAST & AFRICA ARCHITECTURAL ACOUSTIC PANELS MARKET, BY TYPE (2016-2030)

TABLE 035. MIDDLE EAST & AFRICA ARCHITECTURAL ACOUSTIC PANELS MARKET, BY END-USERS (2016-2030)

TABLE 036. ARCHITECTURAL ACOUSTIC PANELS MARKET, BY COUNTRY (2016-2030)

TABLE 037. SOUTH AMERICA ARCHITECTURAL ACOUSTIC PANELS MARKET, BY BY MATERIAL (2016-2030)

TABLE 038. SOUTH AMERICA ARCHITECTURAL ACOUSTIC PANELS MARKET, BY TYPE (2016-2030)

TABLE 039. SOUTH AMERICA ARCHITECTURAL ACOUSTIC PANELS MARKET, BY END-USERS (2016-2030)

TABLE 040. ARCHITECTURAL ACOUSTIC PANELS MARKET, BY COUNTRY (2016-2030)

TABLE 041. OWENS CORNING (U.S.): SNAPSHOT

TABLE 042. OWENS CORNING (U.S.): BUSINESS PERFORMANCE

TABLE 043. OWENS CORNING (U.S.): PRODUCT PORTFOLIO

TABLE 044. OWENS CORNING (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. SAINT-GOBAIN (FRANCE): SNAPSHOT

TABLE 045. SAINT-GOBAIN (FRANCE): BUSINESS PERFORMANCE

TABLE 046. SAINT-GOBAIN (FRANCE): PRODUCT PORTFOLIO

TABLE 047. SAINT-GOBAIN (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. ARMSTRONG (U.S.): SNAPSHOT

TABLE 048. ARMSTRONG (U.S.): BUSINESS PERFORMANCE

TABLE 049. ARMSTRONG (U.S.): PRODUCT PORTFOLIO

TABLE 050. ARMSTRONG (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. KNAUF INSULATION (U.S.): SNAPSHOT

TABLE 051. KNAUF INSULATION (U.S.): BUSINESS PERFORMANCE

TABLE 052. KNAUF INSULATION (U.S.): PRODUCT PORTFOLIO

TABLE 053. KNAUF INSULATION (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. TRELLEBORG AB (SWEDEN): SNAPSHOT

TABLE 054. TRELLEBORG AB (SWEDEN): BUSINESS PERFORMANCE

TABLE 055. TRELLEBORG AB (SWEDEN): PRODUCT PORTFOLIO

TABLE 056. TRELLEBORG AB (SWEDEN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. BEIJING NEW BUILDING MATERIAL (CHINA): SNAPSHOT

TABLE 057. BEIJING NEW BUILDING MATERIAL (CHINA): BUSINESS PERFORMANCE

TABLE 058. BEIJING NEW BUILDING MATERIAL (CHINA): PRODUCT PORTFOLIO

TABLE 059. BEIJING NEW BUILDING MATERIAL (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. JIANGSU BURGEREE NEW TECHNOLOGY MATERIALS CO LTD. (CHINA): SNAPSHOT

TABLE 060. JIANGSU BURGEREE NEW TECHNOLOGY MATERIALS CO LTD. (CHINA): BUSINESS PERFORMANCE

TABLE 061. JIANGSU BURGEREE NEW TECHNOLOGY MATERIALS CO LTD. (CHINA): PRODUCT PORTFOLIO

TABLE 062. JIANGSU BURGEREE NEW TECHNOLOGY MATERIALS CO LTD. (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. BEIYANG (CHINA): SNAPSHOT

TABLE 063. BEIYANG (CHINA): BUSINESS PERFORMANCE

TABLE 064. BEIYANG (CHINA): PRODUCT PORTFOLIO

TABLE 065. BEIYANG (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. GREENER ACOUSTICS (SOUTH AFRICA): SNAPSHOT

TABLE 066. GREENER ACOUSTICS (SOUTH AFRICA): BUSINESS PERFORMANCE

TABLE 067. GREENER ACOUSTICS (SOUTH AFRICA): PRODUCT PORTFOLIO

TABLE 068. GREENER ACOUSTICS (SOUTH AFRICA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. LEEYIN ACOUSTIC PANEL (CHINA): SNAPSHOT

TABLE 069. LEEYIN ACOUSTIC PANEL (CHINA): BUSINESS PERFORMANCE

TABLE 070. LEEYIN ACOUSTIC PANEL (CHINA): PRODUCT PORTFOLIO

TABLE 071. LEEYIN ACOUSTIC PANEL (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. HUNTER DOUGLAS (NETHERLANDS): SNAPSHOT

TABLE 072. HUNTER DOUGLAS (NETHERLANDS): BUSINESS PERFORMANCE

TABLE 073. HUNTER DOUGLAS (NETHERLANDS): PRODUCT PORTFOLIO

TABLE 074. HUNTER DOUGLAS (NETHERLANDS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. HEBEI BO RUN-DE (CHINA): SNAPSHOT

TABLE 075. HEBEI BO RUN-DE (CHINA): BUSINESS PERFORMANCE

TABLE 076. HEBEI BO RUN-DE (CHINA): PRODUCT PORTFOLIO

TABLE 077. HEBEI BO RUN-DE (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. G&S ACOUSTICS (U.S.): SNAPSHOT

TABLE 078. G&S ACOUSTICS (U.S.): BUSINESS PERFORMANCE

TABLE 079. G&S ACOUSTICS (U.S.): PRODUCT PORTFOLIO

TABLE 080. G&S ACOUSTICS (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. VICOUSTIC (PORTUGAL): SNAPSHOT

TABLE 081. VICOUSTIC (PORTUGAL): BUSINESS PERFORMANCE

TABLE 082. VICOUSTIC (PORTUGAL): PRODUCT PORTFOLIO

TABLE 083. VICOUSTIC (PORTUGAL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. STAR-USG (CHINA): SNAPSHOT

TABLE 084. STAR-USG (CHINA): BUSINESS PERFORMANCE

TABLE 085. STAR-USG (CHINA): PRODUCT PORTFOLIO

TABLE 086. STAR-USG (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. OTHER MAJOR PLAYERS.: SNAPSHOT

TABLE 087. OTHER MAJOR PLAYERS.: BUSINESS PERFORMANCE

TABLE 088. OTHER MAJOR PLAYERS.: PRODUCT PORTFOLIO

TABLE 089. OTHER MAJOR PLAYERS.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ARCHITECTURAL ACOUSTIC PANELS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ARCHITECTURAL ACOUSTIC PANELS MARKET OVERVIEW BY BY MATERIAL

FIGURE 012. PLASTIC PANELS MARKET OVERVIEW (2016-2030)

FIGURE 013. NON-PLASTIC PANELS MARKET OVERVIEW (2016-2030)

FIGURE 014. ARCHITECTURAL ACOUSTIC PANELS MARKET OVERVIEW BY TYPE

FIGURE 015. HORIZONTAL ACOUSTIC PANEL MARKET OVERVIEW (2016-2030)

FIGURE 016. VERTICAL ACOUSTIC PANEL MARKET OVERVIEW (2016-2030)

FIGURE 017. ARCHITECTURAL ACOUSTIC PANELS MARKET OVERVIEW BY END-USERS

FIGURE 018. COMMERCIAL MARKET OVERVIEW (2016-2030)

FIGURE 019. RESIDENTIAL MARKET OVERVIEW (2016-2030)

FIGURE 020. INDUSTRIAL MARKET OVERVIEW (2016-2030)

FIGURE 021. NORTH AMERICA ARCHITECTURAL ACOUSTIC PANELS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 022. EASTERN EUROPE ARCHITECTURAL ACOUSTIC PANELS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 023. WESTERN EUROPE ARCHITECTURAL ACOUSTIC PANELS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 024. ASIA PACIFIC ARCHITECTURAL ACOUSTIC PANELS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 025. MIDDLE EAST & AFRICA ARCHITECTURAL ACOUSTIC PANELS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 026. SOUTH AMERICA ARCHITECTURAL ACOUSTIC PANELS MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Architectural Acoustic Panels Market research report is 2024-2032.

Owens Corning (U.S.), Saint-Gobain (France), Armstrong (U.S.), Knauf Insulation (U.S.), Trelleborg AB (Sweden), Beijing New Building Material (China), Jiangsu Burgeree New Technology Materials Co LTD. (China), Beiyang (China), Greener Acoustics (South Africa), Leeyin Acoustic Panel (China), Hunter Douglas (Netherlands), Hebei Bo Run-de (China), G&S Acoustics (U.S.), Vicoustic (Portugal), STAR-USG (China), And Other Major Players.

The Architectural Acoustic Panels Market is segmented into Material, Type, End-users and region. By Type, the market is categorized into Horizontal acoustic panel, Vertical acoustic panel. By Material, the market is categorized into Plastic panels, Non-plastic panels. By End-Users, the Market is categorized into Commercial, Residential, Industrial. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Architectural acoustic panels are specialized elements designed to enhance the acoustic properties of interior spaces, particularly in buildings where sound quality and noise control are crucial considerations. These panels are crafted from various materials, including fabric, foam, wood, or metal, and are strategically placed on walls or ceilings to absorb, diffuse, or reflect sound waves.

Architectural Acoustic Panels Market Size Was Valued at USD 7.96 billion in 2023 and is Projected to Reach USD 13.14 billion by 2032, Growing at a CAGR of 5.72% From 2024-2032.