Industrial Machinery Market Synopsis

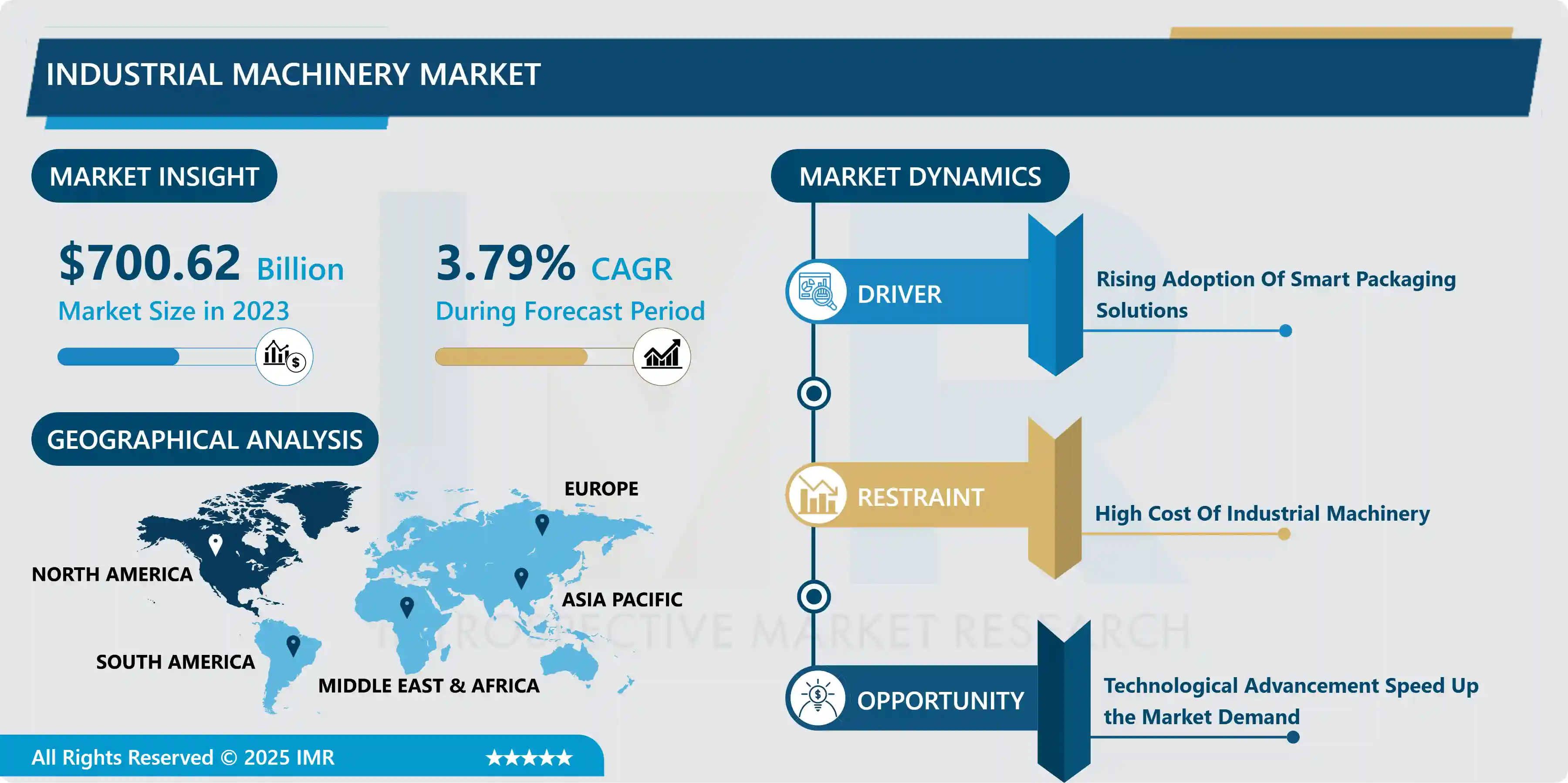

Industrial Machinery Market size was valued at USD 700.62 billion in 2023 and is projected to reach USD 979.22 billion by 2032, growing at a CAGR of 3.79% from 2024 to 2032

Industrial machinery refers to a broad category of specialized equipment and machines designed for various industrial applications across diverse sectors such as manufacturing, construction, agriculture, mining, and more. These machines are pivotal for automating processes, enhancing productivity, and ensuring precision and efficiency in industrial operations. Industrial machinery encompasses a wide range of equipment, from heavy-duty manufacturing machines like CNC (Computer Numerical Control) machines, robotic assembly lines, and industrial robots to smaller tools and equipment used in production and maintenance tasks.

The industrial machinery sector serves as the backbone of many industries, facilitating the production of goods and the construction of infrastructure worldwide. This sector is characterized by constant technological advancements aimed at improving functionality, reliability, and safety. Industrial machinery manufacturers range from large multinational corporations to specialized niche companies, each offering a unique set of products tailored to specific industrial needs.

The health of the industrial machinery market is closely linked to the overall economic conditions, as industries invest in machinery to meet demand and stay competitive. Additionally, factors such as regulatory changes, environmental concerns, and the pursuit of sustainable practices drive innovation within this sector. As industries continue to seek ways to streamline operations and optimize efficiency, the industrial machinery market remains a crucial component of global industrial development.

The Industrial Machinery Market Trend Analysis

Rising Adoption of Smart Packaging Solutions

- The industrial machinery market is experiencing significant growth during the forecast period, thanks to the rising adoption of smart packaging solutions across various industries. Smart packaging, which integrates advanced technologies into traditional packaging materials, is transforming the way products are stored, transported, and monitored, offering a plethora of benefits that are reshaping the industrial landscape.

- One of the key drivers behind the industrial machinery market's symbiotic relationship with smart packaging is the increasing consumer demand for transparency, traceability, and convenience. Smart packaging solutions leverage technologies such as RFID (Radio-Frequency Identification), QR codes, sensors, and real-time data analytics to provide consumers and businesses with insights into product authenticity, freshness, and usage. This not only fosters trust in the supply chain but also enhances the overall customer experience.

- Moreover, the implementation of smart packaging allows for more efficient inventory management and supply chain optimization. Manufacturers and retailers can track the movement of products in real-time, enabling them to streamline logistics, reduce wastage, and better manage stock levels. This level of data-driven decision-making is made possible through industrial machinery that can integrate these smart features into packaging materials during the production process.

- The food and beverage industry, in particular, is witnessing a significant surge in the adoption of smart packaging solutions. These innovations enable the monitoring of temperature and humidity levels, ensuring the freshness and safety of perishable goods throughout the supply chain. Industrial machinery that can efficiently produce these smart packaging materials is in high demand, as food manufacturers strive to meet stringent quality standards and regulations while maintaining cost-effectiveness.

- Furthermore, the healthcare and pharmaceutical sectors are embracing smart packaging to enhance medication adherence, monitor patient health, and prevent counterfeiting. This entails the integration of sensors and data communication capabilities into packaging, creating a demand for specialized machinery that can accommodate these complex requirements.

Technological Advancement Speed Up the Market Demand

- The industrial machinery market is poised to harness a significant opportunity in the form of accelerating market demand fueled by technological advancements. In an era characterized by rapid innovation and digital transformation, the integration of cutting-edge technologies into industrial machinery has become a driving force behind the growth and evolution of this sector.

- One of the primary drivers behind this opportunity is the ongoing digitalization of industries worldwide. As businesses increasingly adopt Industry 4.0 principles, the demand for smart, connected machinery has surged. These machines are equipped with sensors, IoT (Internet of Things) capabilities, and advanced data analytics, enabling them to gather real-time performance data, predict maintenance needs, and optimize production processes.

- This not only enhances operational efficiency but also reduces downtime, ultimately leading to substantial cost savings. The industrial machinery market, therefore, finds itself at the forefront of providing the essential tools required for industries to remain competitive in this data-driven landscape.

- Automation is another pivotal aspect of technological advancement that presents a compelling opportunity. Automation solutions, including robotics and AI-powered systems, are revolutionizing manufacturing and other industrial sectors. These technologies can perform repetitive tasks with unparalleled precision, speed, and consistency, reducing the need for human labor in hazardous or monotonous work environments.

- As labor costs rise and the need for increased production efficiency grows, industrial machinery equipped with automation capabilities becomes a valuable asset for industries seeking to enhance their competitiveness. This trend is particularly evident in industries like automotive manufacturing, where robots have become indispensable for tasks such as welding, painting, and assembly.

Industrial Machinery Market Segment Analysis

Industrial Machinery Market segments cover the Type, Application. By Application, construction segment is Anticipated to Dominate the Market Over the Forecast period.

- The construction segment is a dominating force in the Industrial Machinery Market. It stands as a linchpin, driving substantial demand for heavy machinery, earthmoving equipment, and specialized construction machinery. This sector's immense infrastructure projects, urbanization, and expanding construction activities worldwide create a consistent and significant market for industrial machinery.

- Catering to the needs of construction, manufacturers in this segment produce equipment like excavators, bulldozers, cranes, and concrete mixers. The construction industry's insatiable appetite for machinery to enhance productivity and meet ambitious project timelines solidifies its pivotal role in the industrial machinery market's enduring success.

Industrial Machinery Market Regional Insights:

Asia Pacific is dominating the Market Over the Forecast Period.

- Asia Pacific industrial machinery market accounted for 45% of revenue share in 2022. Countries in the APAC region are investing in construction projects including transportation, energy, and urban development. This trend is augmenting the demand for industrial equipment such as construction machinery, earthmoving equipment, and material handling equipment.

- Asia Pacific is also witnessing massive urbanization as the growing population is migrating to cities. This surge in urbanization is leading to an increased demand for the construction of residential buildings, commercial complexes, and other infrastructure, propelling the demand for industrial equipment.

COVID-19 Impact Analysis on Industrial Machinery Market

- The COVID-19 pandemic significantly impacted the market for industrial machinery. The decreased production and growth for industrial machinery are due to lockdowns, travel restrictions, and disrupted supply chains. Capital investments decreased as many manufacturing facilities were temporarily shut down. Businesses had to also postpone or cancel the purchase of machinery due to economic uncertainties and decreased operations.

Industrial Machinery Market Key Players

- AO SMITH CORP (U.S.)

- LINCOLN ELECTRIC HOLDINGS (U.S.)

- MANITOWOC COMPANY (U.S.)

- ILLINOIS TOOL WORKS (U.S.)

- TEREX CORP (U.S.)

- ASTEC INDUSTRIES (U.S.)

- TOYOTA (JAPAN)

- SAMSUNG ELECTRONICS (SOUTH KOREA)

- AGCO CORPORATION (U.S.)

- ALAMO GROUP (U.S.)

- FORD (U.S.)

- HEWLETT-PACKARD (U.S.)

- HITACHI (JAPAN)

- IBM (U.S.)

- LINDSAY CORPORATION (U.S.)

- SIEMENS (GERMANY)

- GENERAL ELECTRIC (U.S.)

Key Industry Developments in the Industrial Machinery Market

-

In October 2024, Toyota Motor Corporation and Joby Aviation, Inc. a company developing electric air taxis for commercial passenger service, today announced that Toyota will invest an additional $500 million to support the certification and commercial production of Joby's electric air taxi, with the aim of realizing the two companies' shared vision of air mobility.

In February 2023, Volvo Construction Equipment (Volvo CE) has announced a significant investment of SEK 80 million ($7.8 million) into battery pack production at its Changwon excavator plant in South Korea, the company’s largest excavator production site. This move aligns with Volvo Group’s commitment to industry transformation through sustainable solutions, supporting its Science Based Targets and goal to achieve 35% electric machine sales by 2030. The Changwon plant will manufacture diverse battery pack solutions for Volvo Group, marking a pivotal step towards a fossil-free future and reinforcing Volvo CE’s leadership in sustainable construction technology.

|

Industrial Machinery Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 700.62 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.79 % |

Market Size in 2032: |

USD 979.22 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Industrial Machinery Market by Type (2018-2032)

4.1 Industrial Machinery Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Agriculture & Food Machinery

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Construction Machinery & Related Equipment

4.5 Power & Energy Equipment

4.6 Aerospace

4.7 Others

Chapter 5: Industrial Machinery Market by Application (2018-2032)

5.1 Industrial Machinery Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Printing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Food

5.5 Textile

5.6 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Industrial Machinery Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 YAKULT HONSHA (JAPAN)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 NESTLÉ (SWITZERLAND)

6.4 DANONE (FRANCE)

6.5 ANHEUSER-BUSCH (US)

6.6 SUJA LIFE (US)

6.7 PEPSICO (US)

6.8 BRIGHT FOOD (CHINA)

6.9 HAIN CELESTIAL (US)

6.10 KRAFT HEINZ (US)

6.11 COCA-COLA (US)

6.12 RED BULL (AUSTRIA)

6.13 BIONADE (GERMANY)

6.14 LIVING ESSENTIALS (US)

6.15 KEVITA (CALIFORNIA)

6.16 KOMBUCHA BREWERS (INDIA)

6.17 SYNERGY DRINKS (US)

6.18 HEALTH-ADE KOMBUCHA (US)

6.19 KEFIRLY (RUSSIA)

6.20 GOODBELLY (US)

6.21 SULA VINEYARDS (INDIA) AND OTHER MAJOR PLAYER.

Chapter 7: Global Industrial Machinery Market By Region

7.1 Overview

7.2. North America Industrial Machinery Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Agriculture & Food Machinery

7.2.4.2 Construction Machinery & Related Equipment

7.2.4.3 Power & Energy Equipment

7.2.4.4 Aerospace

7.2.4.5 Others

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Printing

7.2.5.2 Food

7.2.5.3 Textile

7.2.5.4 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Industrial Machinery Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Agriculture & Food Machinery

7.3.4.2 Construction Machinery & Related Equipment

7.3.4.3 Power & Energy Equipment

7.3.4.4 Aerospace

7.3.4.5 Others

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Printing

7.3.5.2 Food

7.3.5.3 Textile

7.3.5.4 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Industrial Machinery Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Agriculture & Food Machinery

7.4.4.2 Construction Machinery & Related Equipment

7.4.4.3 Power & Energy Equipment

7.4.4.4 Aerospace

7.4.4.5 Others

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Printing

7.4.5.2 Food

7.4.5.3 Textile

7.4.5.4 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Industrial Machinery Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Agriculture & Food Machinery

7.5.4.2 Construction Machinery & Related Equipment

7.5.4.3 Power & Energy Equipment

7.5.4.4 Aerospace

7.5.4.5 Others

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Printing

7.5.5.2 Food

7.5.5.3 Textile

7.5.5.4 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Industrial Machinery Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Agriculture & Food Machinery

7.6.4.2 Construction Machinery & Related Equipment

7.6.4.3 Power & Energy Equipment

7.6.4.4 Aerospace

7.6.4.5 Others

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Printing

7.6.5.2 Food

7.6.5.3 Textile

7.6.5.4 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Industrial Machinery Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Agriculture & Food Machinery

7.7.4.2 Construction Machinery & Related Equipment

7.7.4.3 Power & Energy Equipment

7.7.4.4 Aerospace

7.7.4.5 Others

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Printing

7.7.5.2 Food

7.7.5.3 Textile

7.7.5.4 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Industrial Machinery Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 700.62 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.79 % |

Market Size in 2032: |

USD 979.22 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||