Industrial Services Market Synopsis

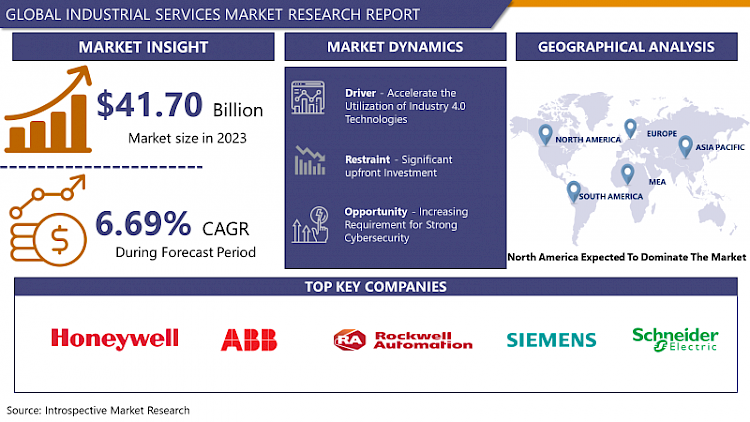

Industrial Services Market Size Was Valued at USD 41.70 Billion in 2023 and is Projected to Reach USD 74.69 Billion by 2032, Growing at a CAGR of 6.69% From 2024-2032.

Industrial services market is an economic sector that includes a wide range of services for companies operating in various industries. Specialized services are commonly provided to industrial companies. The market includes both specialized service providers and internal services of industrial organizations.

- Industrial service applications span a wide range of industries, from manufacturing and logistics to energy and construction. These services play a key role in operational efficiency, maintenance, and safety in all industries. Benefits of industrial services include smoother operations, reduced downtime through preventative maintenance, improved safety protocols, and access to specialist expertise. This means cost savings, improved productivity, and better overall performance for businesses.

- Industrial service demand is expected to grow significantly in the future due to various factors. These include advances such as the Internet of Things, artificial intelligence, and automation that enable predictive maintenance and real-time monitoring. Additionally, industrial processes are becoming more complex, and sustainable practices require the assistance of specialists. As the industry evolves, reliance on outsourcing non-core functions to specialists increases, increasing demand for industrial service providers.

- The industrial services sector is expected to experience continued growth as industries prioritize efficiency, sustainability and safety. Emerging trends such as digitization, remote monitoring and data analytics continue to shape the landscape and create new opportunities for service providers. With its focus on innovation and customized solutions, the industrial services sector is well-positioned to meet the changing needs of modern businesses in various sectors.

Industrial Services Market Trend Analysis

Accelerate the Utilization of Industry 4.0 Technologies

- The widespread adoption of Industry 4.0 technologies stands out as an important catalyst that accelerates the growth of the industrial service market. These advanced technologies, including IoT, artificial intelligence, big data analytics, and robotics, are revolutionizing industrial operations and asset maintenance. For instance, predictive maintenance powered by IoT sensors allows companies to identify equipment problems before they escalate, reducing downtime and improving overall efficiency.

- The growing adoption of Industry 4.0 technologies is an effort to improve operations. Enterprises use data-driven insights from connected devices to optimize their processes, streamline workflows, and make informed decisions. This leads to better productivity, cost savings, and competitive advantages in the market.

- In addition, Industry 4.0 technologies enable a move towards proactive and predictive maintenance strategies, moving away from traditional reactive approaches. By leveraging real-time data and analytics, industrial service providers can provide more efficient and customized maintenance solutions to their customers. This not only improves equipment reliability but also reduces unplanned downtime, increasing customer satisfaction and loyalty.

Increasing Requirement for Strong Cybersecurity

- The growing need for robust cyber security offers a significant opportunity for expansion of industrial services. With the rise of digitization and interconnected systems in industries, cyber security has become a primary concern. Industry service providers are uniquely positioned to take advantage of this demand by offering comprehensive cybersecurity solutions tailored to the specific needs of different sectors. For example, companies that specialize in industrial cyber security can provide services such as network security assessments, vulnerability management, and incident response planning to protect critical infrastructure and data.

- As cyber threats become increasingly sophisticated and frequent, businesses across industries are realizing the importance of proactive cyber security measures. Industry service providers can seize this opportunity by integrating advanced technologies such as AI-based threat detection, blockchain for secure data transactions, and cloud-based security solutions into their offerings. Faced with new threats and compliance requirements, these service providers can provide added value to their customers and foster long-term partnerships.

- The ever-increasing emphasis on regulatory compliance and data protection is increasing the demand for robust cybersecurity services in the industry. Service providers can use their expertise to help clients navigate complex regulatory environments, implement data protection best practices, and achieve compliance with industry standards such as GDPR or the NIST Cybersecurity Framework. Such a comprehensive approach not only reduces risks, but also improves the overall sustainability of industrial operations in an increasingly digitized environment.

Industrial Services Market Segment Analysis:

Industrial Services Market is segmented on the basis of Type, Application, and End-User.

By Type, Installation & Commissioning segment is expected to dominate the market during the forecast period

- The installation and commission segment are poised to lead the growth of the industrial services market. Included in this category are the types of work required for the establishment of new equipment, systems, or facilities in various industries. As companies invest in modernizing their infrastructure and using new technologies, the demand for professional installation and application services is increasing. Industrial service providers play an important role in this area to ensure smooth integration, optimal performance, and compliance with regulatory standards.

- The main factors driving the dominance of the installation and commissioning sector are the increasing complexity of industrial systems, the need for precision engineering, and a focus on operational efficiency. Companies rely on skilled professionals to operate complex and demanding equipment, from machines in manufacturing plants to operating systems in power plants. Growth in this sector will be driven by industries such as renewable energy, automotive, and pharmaceuticals, which require integrated processes to ensure regulatory compliance and compliance.

By End-User, Oil & Gas segment held the largest share of 28.12% in 2023

- The oil and gas sector has emerged as one of the major contributors to the growth of the industrial services market. This segment includes a range of services tailored to the unique needs of the oil and gas industry, including maintenance, inspection, engineering, and project management. Demand for industrial services in this sector is driven by ongoing operations and maintenance requirements for machinery, pipelines, offshore platforms and petrochemical plants.

- The global energy demand, continued investments in infrastructure, and increased oil and gas operations. Companies rely heavily on specialized industrial service providers as they work to optimize production, ensure safety, and meet environmental regulations. These providers contribute significantly to the overall growth and sustainability of the oil and gas sector by providing expertise in areas such as asset management, risk assessment, and compliance with industry standards.

Industrial Services Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is poised to take the lead as the dominant region for the growth of the industrial services market. This region boasts a diverse industrial landscape spanning sectors such as manufacturing, energy, aerospace, automotive, and healthcare. The demand for industrial services in North America is driven by factors like technological advancements, stringent regulatory standards, and the need for efficient maintenance and optimization of industrial assets.

- The region's strong emphasis on innovation, research, and development. Industries in North America prioritize leveraging cutting-edge technologies such as IoT, AI, automation, and data analytics to enhance productivity, reduce downtime, and improve overall operational performance. Additionally, the region's proactive approach to sustainability and environmental compliance further fuels the demand for specialized industrial services tailored to eco-friendly practices. These factors collectively position North America as a key market for industrial service providers looking to capitalize on emerging opportunities and meet evolving client demands.

Industrial Services Market Top Key Players:

- Honeywell International Inc. (U.S.)

- Rockwell Automation, Inc. (U.S.)

- Cognizant Technology Solutions Corp. (U.S.)

- General Electric Company (GE) (U.S.)

- Emerson Electric Co. (U.S.)

- Siemens AG (Germany)

- Schneider Electric SE (France)

- SKF AB (Sweden)

- ABB Ltd. (Switzerland)

- SGS SA (Switzerland)

- Johnson Controls International plc (Ireland)

- Eaton Corporation plc (Ireland)

- Mitsubishi Electric Corporation (Japan)

- Daikin Industries, Ltd. (Japan)

- Yokogawa Electric Corporation (Japan), and Other Major Players

Key Industry Developments in the Industrial Services Market:

- In January 2024, Honeywell and Analog Devices, Inc. announced at CES 2024 that they have entered into a Memorandum of Understanding to explore the digitization of commercial buildings by upgrading to digital connectivity technologies without replacing existing wiring, which will help reduce cost, waste, and downtime. The strategic alliance would bring this new technology to building management systems for the first time.

- In August 2023, Schneider Electric, the leader in the digital transformation of energy management and industrial automation, today launched a Managed Security Services (MSS) offering to help customers in operational technology (OT) environments address the increased cyber risk associated with the demand for remote access and connectivity technologies.

|

Global Industrial Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 41.70 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.69% |

Market Size in 2032: |

USD 74.69 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- INDUSTRIAL SERVICES MARKET BY TYPE (2017-2032)

- INDUSTRIAL SERVICES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ENGINEERING & CONSULTING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INSTALLATION & COMMISSIONING

- IMPROVEMENT & MAINTENANCE

- INDUSTRIAL SERVICES MARKET BY APPLICATION (2017-2032)

- INDUSTRIAL SERVICES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MOTOR & DRIVES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DISTRIBUTION CONTROL SYSTEM

- PROGRAMMABLE LOGIC CONTROLLER

- SUPERVISORY CONTROL & DATA ACQUISITION

- HUMAN MACHINE INTERFACE

- OTHERS

- INDUSTRIAL SERVICES MARKET BY END-USER (2017-2032)

- INDUSTRIAL SERVICES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AEROSPACE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AUTOMOTIVE

- CHEMICALS

- OIL & GAS

- FOOD & BEVERAGES

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Industrial Services Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- HONEYWELL INTERNATIONAL INC. (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ROCKWELL AUTOMATION, INC. (U.S.)

- COGNIZANT TECHNOLOGY SOLUTIONS CORP. (U.S.)

- GENERAL ELECTRIC COMPANY (GE) (U.S.)

- EMERSON ELECTRIC CO. (U.S.)

- SIEMENS AG (GERMANY)

- SCHNEIDER ELECTRIC SE (FRANCE)

- SKF AB (SWEDEN)

- ABB LTD. (SWITZERLAND)

- SGS SA (SWITZERLAND)

- JOHNSON CONTROLS INTERNATIONAL PLC (IRELAND)

- EATON CORPORATION PLC (IRELAND)

- MITSUBISHI ELECTRIC CORPORATION (JAPAN)

- DAIKIN INDUSTRIES, LTD. (JAPAN)

- YOKOGAWA ELECTRIC CORPORATION (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL INDUSTRIAL SERVICES MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Industrial Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 41.70 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.69% |

Market Size in 2032: |

USD 74.69 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. INDUSTRIAL SERVICES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. INDUSTRIAL SERVICES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. INDUSTRIAL SERVICES MARKET COMPETITIVE RIVALRY

TABLE 005. INDUSTRIAL SERVICES MARKET THREAT OF NEW ENTRANTS

TABLE 006. INDUSTRIAL SERVICES MARKET THREAT OF SUBSTITUTES

TABLE 007. INDUSTRIAL SERVICES MARKET BY TYPE

TABLE 008. ENGINEERING AND CONSULTING MARKET OVERVIEW (2016-2028)

TABLE 009. INSTALLATION AND COMMISSIONING MARKET OVERVIEW (2016-2028)

TABLE 010. IMPROVEMENT AND MAINTENANCE MARKET OVERVIEW (2016-2028)

TABLE 011. INDUSTRIAL SERVICES MARKET BY APPLICATION

TABLE 012. DISTRIBUTED CONTROL SYSTEM (DCS) MARKET OVERVIEW (2016-2028)

TABLE 013. MARKET OVERVIEW (2016-2028)

TABLE 014. PROGRAMMABLE CONTROLLER LOGIC (PLC) MARKET OVERVIEW (2016-2028)

TABLE 015. MARKET OVERVIEW (2016-2028)

TABLE 016. SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA) MARKET OVERVIEW (2016-2028)

TABLE 017. MARKET OVERVIEW (2016-2028)

TABLE 018. ELECTRIC MOTORS & DRIVES MARKET OVERVIEW (2016-2028)

TABLE 019. MARKET OVERVIEW (2016-2028)

TABLE 020. VALVES & ACTUATORS MARKET OVERVIEW (2016-2028)

TABLE 021. MARKET OVERVIEW (2016-2028)

TABLE 022. MANUFACTURING EXECUTION SYSTEM MARKET OVERVIEW (2016-2028)

TABLE 023. MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA INDUSTRIAL SERVICES MARKET, BY TYPE (2016-2028)

TABLE 025. NORTH AMERICA INDUSTRIAL SERVICES MARKET, BY APPLICATION (2016-2028)

TABLE 026. N INDUSTRIAL SERVICES MARKET, BY COUNTRY (2016-2028)

TABLE 027. EUROPE INDUSTRIAL SERVICES MARKET, BY TYPE (2016-2028)

TABLE 028. EUROPE INDUSTRIAL SERVICES MARKET, BY APPLICATION (2016-2028)

TABLE 029. INDUSTRIAL SERVICES MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC INDUSTRIAL SERVICES MARKET, BY TYPE (2016-2028)

TABLE 031. ASIA PACIFIC INDUSTRIAL SERVICES MARKET, BY APPLICATION (2016-2028)

TABLE 032. INDUSTRIAL SERVICES MARKET, BY COUNTRY (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA INDUSTRIAL SERVICES MARKET, BY TYPE (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA INDUSTRIAL SERVICES MARKET, BY APPLICATION (2016-2028)

TABLE 035. INDUSTRIAL SERVICES MARKET, BY COUNTRY (2016-2028)

TABLE 036. SOUTH AMERICA INDUSTRIAL SERVICES MARKET, BY TYPE (2016-2028)

TABLE 037. SOUTH AMERICA INDUSTRIAL SERVICES MARKET, BY APPLICATION (2016-2028)

TABLE 038. INDUSTRIAL SERVICES MARKET, BY COUNTRY (2016-2028)

TABLE 039. ABB (SWITZERLAND): SNAPSHOT

TABLE 040. ABB (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 041. ABB (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 042. ABB (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. SIEMENS AG (GERMANY): SNAPSHOT

TABLE 043. SIEMENS AG (GERMANY): BUSINESS PERFORMANCE

TABLE 044. SIEMENS AG (GERMANY): PRODUCT PORTFOLIO

TABLE 045. SIEMENS AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. GENERAL ELECTRIC (US): SNAPSHOT

TABLE 046. GENERAL ELECTRIC (US): BUSINESS PERFORMANCE

TABLE 047. GENERAL ELECTRIC (US): PRODUCT PORTFOLIO

TABLE 048. GENERAL ELECTRIC (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. EMERSON ELECTRIC (US): SNAPSHOT

TABLE 049. EMERSON ELECTRIC (US): BUSINESS PERFORMANCE

TABLE 050. EMERSON ELECTRIC (US): PRODUCT PORTFOLIO

TABLE 051. EMERSON ELECTRIC (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. HONEYWELL INTERNATIONAL INC. (US): SNAPSHOT

TABLE 052. HONEYWELL INTERNATIONAL INC. (US): BUSINESS PERFORMANCE

TABLE 053. HONEYWELL INTERNATIONAL INC. (US): PRODUCT PORTFOLIO

TABLE 054. HONEYWELL INTERNATIONAL INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. SCHNEIDER ELECTRIC (FRANCE): SNAPSHOT

TABLE 055. SCHNEIDER ELECTRIC (FRANCE): BUSINESS PERFORMANCE

TABLE 056. SCHNEIDER ELECTRIC (FRANCE): PRODUCT PORTFOLIO

TABLE 057. SCHNEIDER ELECTRIC (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. WOOD GROUP MUSTANG (US): SNAPSHOT

TABLE 058. WOOD GROUP MUSTANG (US): BUSINESS PERFORMANCE

TABLE 059. WOOD GROUP MUSTANG (US): PRODUCT PORTFOLIO

TABLE 060. WOOD GROUP MUSTANG (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. SKF AB (SWEDEN): SNAPSHOT

TABLE 061. SKF AB (SWEDEN): BUSINESS PERFORMANCE

TABLE 062. SKF AB (SWEDEN): PRODUCT PORTFOLIO

TABLE 063. SKF AB (SWEDEN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. ATS AUTOMATION (CANADA): SNAPSHOT

TABLE 064. ATS AUTOMATION (CANADA): BUSINESS PERFORMANCE

TABLE 065. ATS AUTOMATION (CANADA): PRODUCT PORTFOLIO

TABLE 066. ATS AUTOMATION (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. INTECH PROCESS AUTOMATION (US): SNAPSHOT

TABLE 067. INTECH PROCESS AUTOMATION (US): BUSINESS PERFORMANCE

TABLE 068. INTECH PROCESS AUTOMATION (US): PRODUCT PORTFOLIO

TABLE 069. INTECH PROCESS AUTOMATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. INDUSTRIAL SERVICES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. INDUSTRIAL SERVICES MARKET OVERVIEW BY TYPE

FIGURE 012. ENGINEERING AND CONSULTING MARKET OVERVIEW (2016-2028)

FIGURE 013. INSTALLATION AND COMMISSIONING MARKET OVERVIEW (2016-2028)

FIGURE 014. IMPROVEMENT AND MAINTENANCE MARKET OVERVIEW (2016-2028)

FIGURE 015. INDUSTRIAL SERVICES MARKET OVERVIEW BY APPLICATION

FIGURE 016. DISTRIBUTED CONTROL SYSTEM (DCS) MARKET OVERVIEW (2016-2028)

FIGURE 017. MARKET OVERVIEW (2016-2028)

FIGURE 018. PROGRAMMABLE CONTROLLER LOGIC (PLC) MARKET OVERVIEW (2016-2028)

FIGURE 019. MARKET OVERVIEW (2016-2028)

FIGURE 020. SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA) MARKET OVERVIEW (2016-2028)

FIGURE 021. MARKET OVERVIEW (2016-2028)

FIGURE 022. ELECTRIC MOTORS & DRIVES MARKET OVERVIEW (2016-2028)

FIGURE 023. MARKET OVERVIEW (2016-2028)

FIGURE 024. VALVES & ACTUATORS MARKET OVERVIEW (2016-2028)

FIGURE 025. MARKET OVERVIEW (2016-2028)

FIGURE 026. MANUFACTURING EXECUTION SYSTEM MARKET OVERVIEW (2016-2028)

FIGURE 027. MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA INDUSTRIAL SERVICES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE INDUSTRIAL SERVICES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC INDUSTRIAL SERVICES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA INDUSTRIAL SERVICES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA INDUSTRIAL SERVICES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Industrial Services Market research report is 2024-2032.

Honeywell International Inc. (U.S.), Rockwell Automation, Inc. (U.S.), Cognizant Technology Solutions Corp. (U.S.), General Electric Company (GE) (U.S.), Emerson Electric Co. (U.S.), Siemens AG (Germany), Schneider Electric SE (France), SKF AB (Sweden), ABB Ltd. (Switzerland), SGS SA (Switzerland), Johnson Controls International plc (Ireland), Eaton Corporation plc (Ireland), Mitsubishi Electric Corporation (Japan), Daikin Industries, Ltd. (Japan), Yokogawa Electric Corporation (Japan) and Other Major Players.

The Industrial Services Market is segmented into Type, Application, End-User, and region. By Type, the market is categorized into Engineering & Consulting, Installation & Commissioning, and Improvement & Maintenance. By Application, the market is categorized into Motor & Drives, Distribution Control Systems, Programmable Logic Controller, Supervisory Control & Data Acquisition, Human Machine Interface, and Others. By End-User, the market is categorized into Aerospace, Automotive, Chemicals, Oil & Gas, Food & Beverages, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Industrial services market is an economic sector that includes a wide range of services for companies operating in various industries. Specialized services are commonly provided to industrial companies. The market includes both specialized service providers and internal services of industrial organizations.

Industrial Services Market Size Was Valued at USD 41.70 Billion in 2023 and is Projected to Reach USD 74.69 Billion by 2032, Growing at a CAGR of 6.69% From 2024-2032