Industrial Coatings Market Synopsis

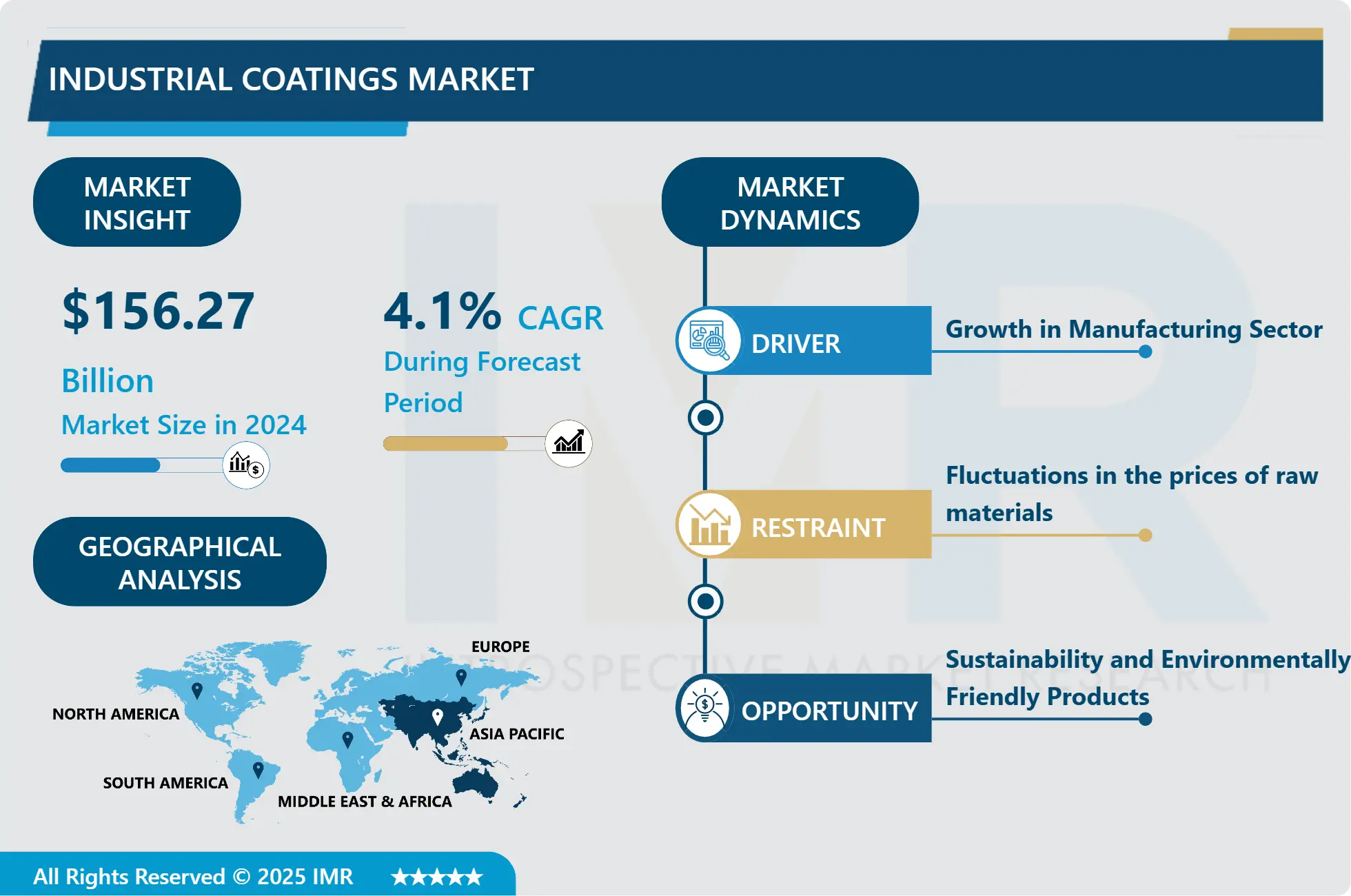

Industrial Coatings Market Size Was Valued at USD 156.27 Billion in 2024, and is Projected to Reach USD 215.52 Billion by 2032, Growing at a CAGR of 4.1% From 2025-2032.

The industrial coatings market refers to the sector of the coatings industry that focuses on producing and supplying coatings specifically designed for industrial applications. These coatings are used to protect, preserve, and enhance the appearance of various surfaces and materials in industrial environments

The global industrial coatings market is still working through some significant headwinds, such as raw material shortages, economic headwinds and ongoing supply chain challenges, said Mike Bourdeau, president of General Industrial Coatings, Sherwin-Williams. “However, we are starting to see some of these issues gradually resolve and we can refocus on growth, which is invigorating.

According to Bourdeau, the performance of the industrial coatings market varies by region and specific segment. We are seeing some segments performing better than pre-pandemic levels, while others are slowing due to economic conditions. We are also seeing some of the big industry trends continue to gain momentum. For example, interest in powder coatings has increased, which we like to see. French As sustainability becomes a top industry priority and manufacturers look for innovative products to support their sustainability goals, I believe the pace of progress will accelerate.

We have seen continued adoption of Powdura ECO, our recent innovation that uses recycled resins as a raw material to deliver sustainable powder coatings without compromising performance. And we have seen increased interest in our liquid coatings, which also offer a range of sustainability benefits. I look forward to seeing other advancements come to market as customers continue to prioritize sustainability. Over the past year, our assessment of the industry has been very mixed,” said Kevin Braun, PPG vice president, Global Industrial Coatings. “We have seen continued strength in sub-segments such as heavy equipment and construction-related sectors. Furthermore, consumer-focused products have seen a fairly significant decline from their COVID-era peaks in late 2020 and 2021. From a regional perspective, it’s clear that both China and Europe have been hurt for different reasons, while our Americas region has seen relative strength across the global industrial landscape. Industrial coatings include a variety of market segments: onshore oil and gas, commercial architecture, and industrial maintenance.

Currently, the heavy equipment and oil and gas segments offer the most growth opportunities. The best-performing markets are those related to the industrial world, such as heavy equipment and energy,” Bourdeau said. “These are markets that continue to see their technology evolve, which has encouraged investment in new equipment.

They also benefit from favorable legislative measures, such as the infrastructure bill in the United States, which provide strong investment prospects over the next five years. We also see strong growth potential in emerging markets, such as electric vehicles and the many adjacent markets that support this growth area. This technology will continue to develop and grow in all regions of the world in the coming years. We look forward to being a part of this growth.

Industrial Coatings Market Trend Analysis

Industrial Coatings Market Growth Driver- Increasing Focus on Corrosion Protection

- The expanding center on erosion assurance could be a critical driver within the mechanical coatings advertise, especially in businesses such as oil and gas, chemicals, and marine. These divisions are characterized by unforgiving working situations that uncover hardware and foundation to destructive components, counting saltwater, chemicals, and extraordinary climate conditions. Erosion can lead to the disintegration of metal surfaces, causing basic harm, gear disappointment, and security hazards. This makes erosion assurance a basic concern for these businesses, because it straightforwardly impacts operational effectiveness, security, and costs.

- Mechanical coatings give a defensive boundary that shields metal surfaces from destructive operators, in this manner essentially expanding the life expectancy of hardware and framework. By avoiding erosion, these coatings diminish the need for visit support and repairs, driving to lower upkeep costs and minimizing operational downtime. Usually particularly pivotal within the oil and gas industry, where gear disappointments can result in expensive shutdowns and potential natural dangers. Additionally, within the marine industry, ensuring ships and seaward structures from erosion is basic for keeping up seaworthiness and security.

- As a result, the request for high-performance coatings that offer prevalent erosion resistance is developing. Advancements in coating innovations, such as epoxy, polyurethane, and fluoropolymer coatings, are being created to provide enhanced protection and solidness. The critical require for erosion assurance in these businesses not as it were driving the request for mechanical coatings but moreover empowers continuous inquire about and improvement to form more viable and long-lasting arrangements.

Industrial Coatings Market Opportunity- Increasing Focus on Corrosion Protection

- The expanding request for keen and utilitarian coatings speaks to a noteworthy opportunity within the mechanical coatings showcase, driven by the require for progressed materials that offer more than fair conventional security and tasteful upgrades. Keen coatings are designed with inventive properties that empower them to reply to natural jolts or perform particular capacities, making them exceedingly important in high-tech businesses and specialized applications. For occasion, self-healing coatings can independently repair minor harms, such as scratches or breaks, hence drawing out the life expectancy of the coated surface and lessening the require for visit upkeep.

- So also, anti-microbial coatings are outlined to hinder the development of microbes and other pathogens on surfaces, which is especially significant in healthcare, food processing, and open transport divisions where cleanliness may be a best need. These coatings contribute to moved forward security and cleanliness, tending to developing concerns around wellbeing and sanitation. Anti-corrosion coatings, on the other hand, go past basic erosion resistance by joining innovations that effectively anticipate erosion forms, in this way advertising predominant security in profoundly destructive situations such as marine, oil and gas, and chemical businesses.

- The request for these progressed coatings is additionally fueled by the want for multi-functional arrangements that can perform beneath extraordinary conditions, such as tall temperatures, tall stickiness, or forceful chemicals. In the aviation industry, for illustration, coatings that can withstand extraordinary warm and mechanical stresses whereas giving lightweight assurance are in tall request. In gadgets, coatings that offer electrical separator or conductivity, depending on the application, are progressively looked for after.

- The rise of shrewd and utilitarian coatings not as it were improves item execution and strength but moreover adjusts with broader industry patterns toward supportability and effectiveness. For occasion, coatings that diminish vitality utilization, improve fuel effectiveness, or diminish natural affect are picking up footing. This advancement in coating innovation opens modern markets and applications, empowering ceaseless development and advertising considerable development openings for producers and providers within the industrial coatings segment.

Industrial Coatings Market Segment Analysis:

Industrial Coatings market is segmented on the basis of Product, Technology, and region.

By Product, Epoxy Segment Is Expected to Dominate the Market During the Forecast Period

By Product it is segmented as Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, And Others

- Epoxy coatings have risen as the overwhelming portion within the mechanical coatings advertise due to their extraordinary execution characteristics and flexibility. These coatings are profoundly esteemed for their prevalent defensive properties, advertising strong resistance against erosion, scraped area, and chemical presentation. This makes them especially appropriate for utilize in requesting situations, such as marine, oil and gas, car, and aviation divisions, where surfaces are continually uncovered to unforgiving conditions. Epoxy coatings can be custom fitted to meet particular application prerequisites, advertising properties such as tall warm resistance, adaptability, and conductivity. This flexibility and customization capability permit them to be utilized in a wide extend of applications, from defensive floor coatings in mechanical settings to specialized coatings in electronic gadgets.

- Another key figure contributing to the dominance of epoxy coatings is their solid grip and toughness. They follow well to a assortment of substrates, counting metals, concrete, and wood, guaranteeing long-lasting security. The solidness of these coatings is basic for applications where support get to is restricted or exorbitant, as they give a difficult, flexible wrap up that withstands wear and tear over time. Moreover, the ease of application and curing of epoxy coatings makes them a commonsense choice for different ventures. They can be connected utilizing different strategies, such as spraying, rolling, and brushing, and they remedy generally rapidly, which is useful for minimizing extend downtime and guaranteeing productive application forms.

- Additionally, epoxy coatings offer tasteful and useful upgrades, contributing to their broad utilize. They can make strides the appearance of surfaces with a assortment of color choices and wraps up, and they can moreover give particular functionalities, such as non-slip or anti-static properties, which are vital in certain mechanical settings. Whereas other sorts of coatings, like acrylic, alkyd, polyurethane, and polyester, have their claim specialty applications and benefits, the combination of the defensive, flexible, strong, and tasteful qualities of epoxy coatings secure their overwhelming position within the showcase. This dominance is strengthened by ceaseless advancements and headways in epoxy advances, guaranteeing that they meet advancing mechanical requests and keep up their pertinence over different divisions.

By Technology, BBB Segment Held the Largest Share In 2024

By Technology it is segmented as Solvent Borne, Water Borne, Powder Based, Others.

- Waterborne coatings have cemented their position as the overwhelming innovation within the mechanical coatings showcase, driven by a meeting of natural, administrative, security, and mechanical components. The utilize of water as the essential dissolvable in these coatings essentially diminishes the outflow of unstable natural compounds (VOCs), which are hurtful poisons contributing to discuss quality debasement and related wellbeing dangers. This eco-friendly property makes waterborne coatings an appealing choice for producers and businesses pointing to comply with progressively rigid natural controls around the world.

- Governments and administrative bodies have actualized these rules to check discuss contamination, and waterborne coatings' lower VOC emanations adjust well with these administrative requests, encouraging less demanding compliance and decreasing the environmental impression of mechanical forms. In expansion to natural benefits, waterborne coatings offer considerable wellbeing and security points of interest. They are by and large more secure to handle and apply than solvent-borne coatings, which regularly contain combustible and harmful chemicals. The utilize of water as a dissolvable in waterborne coatings decreases the dangers related with combustibility and introduction to dangerous vapor, hence making a more secure working environment for implements and lessening wellbeing dangers for laborers.

- Mechanical headways have played a significant part within the rising dominance of waterborne coatings. These developments have improved the execution characteristics of waterborne coatings, making them competitive with, or indeed predominant to, conventional solvent-borne choices. Advanced definitions presently offer amazing solidness, attachment, erosion resistance, and tasteful quality. As a result, waterborne coatings are presently broadly appropriate over different businesses, counting car, aviation, marine, and mechanical fabricating, where these properties are fundamental.

- As businesses and buyers proceed to prioritize supportability and natural duty, the selection of waterborne coatings is likely to grow assist. Whereas other coating innovations like solvent-borne, powder-based, and high-solids coatings still have their particular employments and preferences, the comprehensive benefits advertised by waterborne coatings—ranging from administrative compliance and security to mechanical modernity and advertise alignment—ensure their proceeded dominance and development within the mechanical coatings advertise.

Industrial Coatings Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia-Pacific region dominates the global industrial coatings market. This dominance is primarily driven by the rapid industrialization and urbanization in major economies like China, India, Japan, and South Korea. The region has seen significant growth in various end-use industries, including automotive, construction, marine, and electronics, all of which are major consumers of industrial coatings. China's large manufacturing base and infrastructure projects, along with India's growing industrial sector, significantly contribute to the demand for coatings.

- Additionally, the presence of a large number of local and international manufacturers in the region provides a wide range of products and innovations tailored to meet diverse industrial needs. The relatively lower labor and production costs, combined with favorable government policies in some countries, further bolster the market. The growing automotive industry, coupled with increased investments in infrastructure and construction projects, continues to fuel demand. Moreover, advancements in coating technologies and the increasing focus on sustainable and eco-friendly coatings align with global environmental trends, enhancing the market's growth in the Asia-Pacific region.

Industrial Coatings Market Active Players

- AkzoNobel N.V. (Netherlands)

- Ppg Industries, Inc. (Usa)

- Sherwin-Williams Company (Usa)

- Axalta Coating Systems Ltd. (Usa)

- Basf Se (Germany)

- Rpm International Inc. (Usa)

- Nippon Paint Holdings Co., Ltd. (Japan)

- Jotun Group (Norway)

- Kansai Paint Co., Ltd. (Japan)

- Asian Paints Ltd. (India)

- Tikkurila Oyj (Finland)

- Hempel A/S (Denmark)

- Valspar Corporation (Now Part Of Sherwin-Williams) (Usa)

- Beckers Group (Sweden)

- Berger Paints India Ltd. (India)

- Masco Corporation (Usa)

- Sika Ag (Switzerland)

- Other Active Players

|

Global Industrial Coatings Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 156.27 Bn. |

|

Forecast Period 2025-32 CAGR: |

4.1 % |

Market Size in 2032: |

USD 215.52 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Technology |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Industrial Coatings Market by Product (2018-2032)

4.1 Industrial Coatings Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Acrylic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Alkyd

4.5 Polyurethane

4.6 Epoxy

4.7 Polyester

4.8 Others

Chapter 5: Industrial Coatings Market by Technology (2018-2032)

5.1 Industrial Coatings Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Solvent Borne

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Water Borne

5.5 Powder Based

5.6 Others

Chapter 6: Industrial Coatings Market by End-Use (2018-2032)

6.1 Industrial Coatings Market Snapshot and Growth Engine

6.2 Market Overview

6.3 General Industrial

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Marine

6.5 Automotive & Vehicle Refinish

6.6 Electronics

6.7 Aerospace

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Industrial Coatings Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AKZONOBEL N.V. (NETHERLANDS)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 PPG INDUSTRIES INC. (USA)

7.4 SHERWIN-WILLIAMS COMPANY (USA)

7.5 AXALTA COATING SYSTEMS LTD. (USA)

7.6 BASF SE (GERMANY)

7.7 RPM INTERNATIONAL INC. (USA)

7.8 NIPPON PAINT HOLDINGS COLTD. (JAPAN)

7.9 JOTUN GROUP (NORWAY)

7.10 KANSAI PAINT COLTD. (JAPAN)

7.11 ASIAN PAINTS LTD. (INDIA)

7.12 TIKKURILA OYJ (FINLAND)

7.13 HEMPEL A/S (DENMARK)

7.14 VALSPAR CORPORATION (NOW PART OF SHERWIN-WILLIAMS) (USA)

7.15 BECKERS GROUP (SWEDEN)

7.16 BERGER PAINTS INDIA LTD. (INDIA)

7.17 MASCO CORPORATION (USA)

7.18 SIKA AG (SWITZERLAND)

7.19 RPM INTERNATIONAL INC. (USA)

7.20 3M COMPANY (USA)

7.21 HENKEL AG & CO. KGAA (GERMANY)

7.22 TEKNOS GROUP OY (FINLAND)

7.23 CARPOLY CHEMICAL GROUP COLTD. (CHINA)

7.24 BENJAMIN MOORE & CO. (USA)

7.25 VALSPAR CORPORATION (PART OF SHERWIN-WILLIAMS) (USA)

7.26 ASHLAND INC. (USA) OTHER ACTIVE MEMBERS

Chapter 8: Global Industrial Coatings Market By Region

8.1 Overview

8.2. North America Industrial Coatings Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product

8.2.4.1 Acrylic

8.2.4.2 Alkyd

8.2.4.3 Polyurethane

8.2.4.4 Epoxy

8.2.4.5 Polyester

8.2.4.6 Others

8.2.5 Historic and Forecasted Market Size by Technology

8.2.5.1 Solvent Borne

8.2.5.2 Water Borne

8.2.5.3 Powder Based

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size by End-Use

8.2.6.1 General Industrial

8.2.6.2 Marine

8.2.6.3 Automotive & Vehicle Refinish

8.2.6.4 Electronics

8.2.6.5 Aerospace

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Industrial Coatings Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product

8.3.4.1 Acrylic

8.3.4.2 Alkyd

8.3.4.3 Polyurethane

8.3.4.4 Epoxy

8.3.4.5 Polyester

8.3.4.6 Others

8.3.5 Historic and Forecasted Market Size by Technology

8.3.5.1 Solvent Borne

8.3.5.2 Water Borne

8.3.5.3 Powder Based

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size by End-Use

8.3.6.1 General Industrial

8.3.6.2 Marine

8.3.6.3 Automotive & Vehicle Refinish

8.3.6.4 Electronics

8.3.6.5 Aerospace

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Industrial Coatings Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product

8.4.4.1 Acrylic

8.4.4.2 Alkyd

8.4.4.3 Polyurethane

8.4.4.4 Epoxy

8.4.4.5 Polyester

8.4.4.6 Others

8.4.5 Historic and Forecasted Market Size by Technology

8.4.5.1 Solvent Borne

8.4.5.2 Water Borne

8.4.5.3 Powder Based

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size by End-Use

8.4.6.1 General Industrial

8.4.6.2 Marine

8.4.6.3 Automotive & Vehicle Refinish

8.4.6.4 Electronics

8.4.6.5 Aerospace

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Industrial Coatings Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product

8.5.4.1 Acrylic

8.5.4.2 Alkyd

8.5.4.3 Polyurethane

8.5.4.4 Epoxy

8.5.4.5 Polyester

8.5.4.6 Others

8.5.5 Historic and Forecasted Market Size by Technology

8.5.5.1 Solvent Borne

8.5.5.2 Water Borne

8.5.5.3 Powder Based

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size by End-Use

8.5.6.1 General Industrial

8.5.6.2 Marine

8.5.6.3 Automotive & Vehicle Refinish

8.5.6.4 Electronics

8.5.6.5 Aerospace

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Industrial Coatings Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product

8.6.4.1 Acrylic

8.6.4.2 Alkyd

8.6.4.3 Polyurethane

8.6.4.4 Epoxy

8.6.4.5 Polyester

8.6.4.6 Others

8.6.5 Historic and Forecasted Market Size by Technology

8.6.5.1 Solvent Borne

8.6.5.2 Water Borne

8.6.5.3 Powder Based

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size by End-Use

8.6.6.1 General Industrial

8.6.6.2 Marine

8.6.6.3 Automotive & Vehicle Refinish

8.6.6.4 Electronics

8.6.6.5 Aerospace

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Industrial Coatings Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product

8.7.4.1 Acrylic

8.7.4.2 Alkyd

8.7.4.3 Polyurethane

8.7.4.4 Epoxy

8.7.4.5 Polyester

8.7.4.6 Others

8.7.5 Historic and Forecasted Market Size by Technology

8.7.5.1 Solvent Borne

8.7.5.2 Water Borne

8.7.5.3 Powder Based

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size by End-Use

8.7.6.1 General Industrial

8.7.6.2 Marine

8.7.6.3 Automotive & Vehicle Refinish

8.7.6.4 Electronics

8.7.6.5 Aerospace

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Industrial Coatings Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 156.27 Bn. |

|

Forecast Period 2025-32 CAGR: |

4.1 % |

Market Size in 2032: |

USD 215.52 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Technology |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||