India Paddy Fungicides Market Synopsis

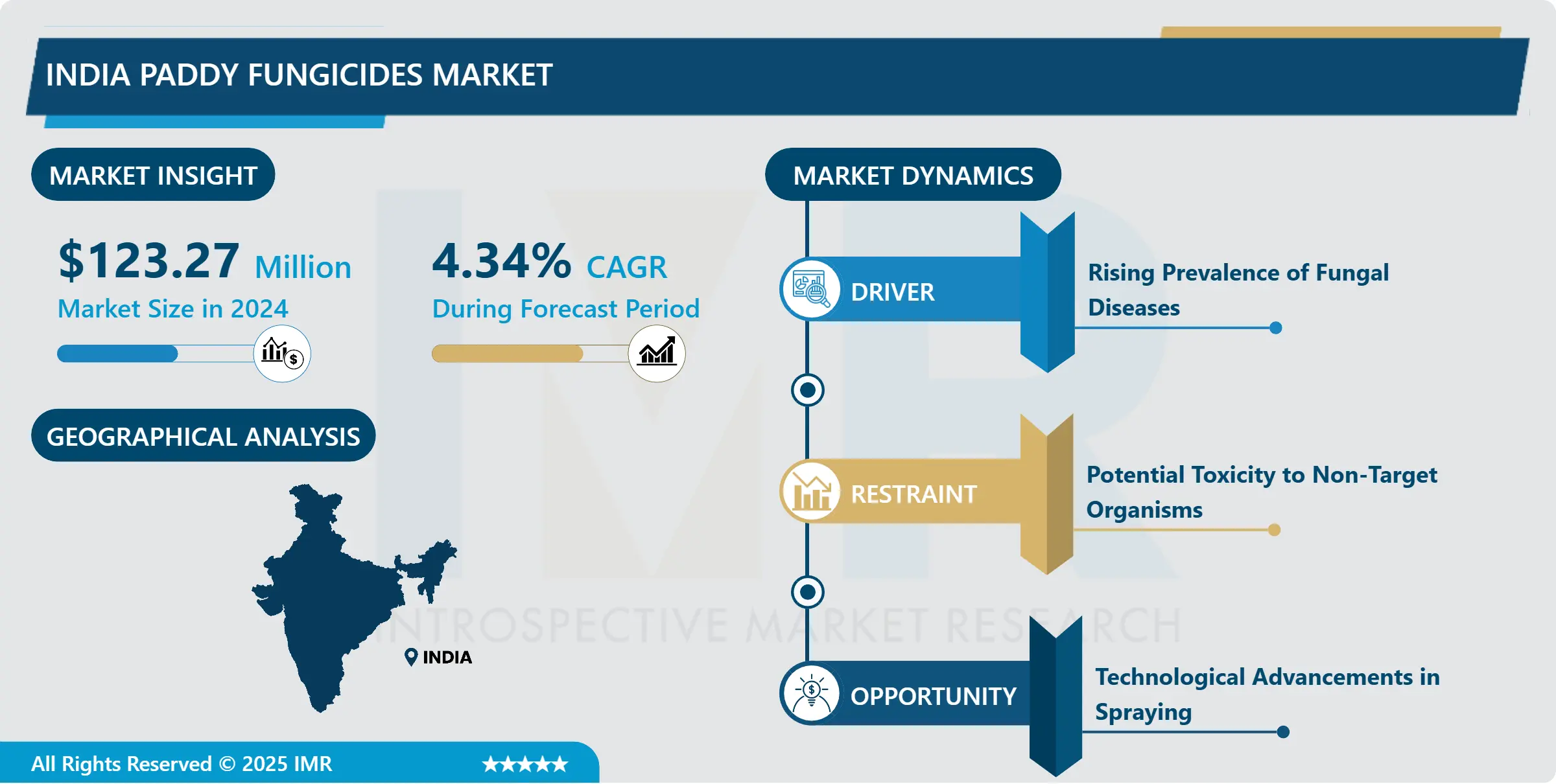

India Paddy Fungicides Market Size Was Valued at USD 123.27 Million in 2024 and is Projected to Reach USD 173.17 Million by 2032, Growing at a CAGR of 4.34% From 2025-2032.

Fungicides are chemicals created to prevent the development of fungi and their bacteria. They are used to control fungi that cause damage to plants, such as rust, mildew, and blight. Moreover, they can also be used to manage mold and mildew in different settings.

Rice, a staple food, is of utmost importance in India's agricultural landscape, which requires effective management of diseases such as rash susceptibility, mantle disease, and brown spot for food security and agricultural productivity.

Farmers are increasingly using fungicides to protect their crops from these diseases due to increased awareness of the benefits of using fungicides. In addition, population growth and the subsequent increase in food demand are forcing farmers to optimize their crops, leading to the fungicide market.

The development of technology and the introduction of new, more effective fungicides also contribute to the expansion of the market. Breakthroughs in agrochemicals have led to products that offer broader disease control, greater efficacy, and less environmental impact, appealing to farmers who want to protect their crops by following sustainable agricultural practices.

The supporting role of the government through various agricultural programs and subsidies is important in this market, making fungicides more accessible to small and marginal farmers. These initiatives aim to enhance crop protection and productivity, which will drive the growth of the fungicides market.

India's rice production has consistently grown from 2017 to 2023. Beginning at 109.7 million metric tons in 2017, the amount increased to 112.76 million metric tons in 2018, then continued to rise to 116.48 million metric tons in 2019. Production levels hit 118.87 million metric tons in 2020, then rose to 124.37 million metric tons in 2021, and increased further to 129.47 million metric tons in 2022. In the year 2023, it reached its highest point with a total of 135.76 million metric tons. These numbers highlight the steady increase in India's rice output. There is a strong connection between the use of paddy fungicides and rice production, as managing diseases effectively becomes crucial for increased production.

India Paddy Fungicides Market Trend Analysis

India Paddy Fungicides Market Growth Drivers- Rising Prevalence of Fungal Diseases

- Fungal diseases such as shock sensitivity, pod disease, and paddy in Indian rice fields are the major drivers for paddy fungicide market growth. These diseases have long threatened rice fields, resulting in significant economic losses due to reduced production and reduced quality. The blast caused by Magnaporthe oryzae is particularly well known for its destructive effect on crops.

- In addition, farmers face additional challenges caused by leaf blight caused by Rhizoctonia solani and insect-borne rice wilt. To combat these threats, farmers are increasingly using fungicides to protect their crops. The use of fungicides helps control the spread of fungal infections, resulting in stronger crops and higher yields. This increasing reliance on fungicides is directly driving market demand for these products. In addition, the development of new fungicides that offer broader spectrum protection and longer action will encourage farmers to adopt these solutions more quickly.

- Government actions in increasing agricultural productivity and supporting farmers are also important. Assistance and programs are available to help farmers, especially those with limited funding, purchase agrochemicals such as fungicides by increasing their availability. In general, the increasing incidence of fungal infections in rice fields is driving the expansion of the rice fungicide industry in India.

India Paddy Fungicides Market Opportunities- Technological Advancements in Spraying

- Agricultural drones are revolutionizing precision agriculture providing unparalleled precision in fungicide spraying. This technological development serves the rice industry by focusing on the precise use of fungicides to control disease and increase yield.

- In precision agriculture, drones for spraying in the agricultural sector are distinguished by their ability to precisely target certain parts of rice fields. This precision ensures that fungicides are used only in areas where they are needed, improving their effectiveness and reducing overuse. These drones play an important role in promoting sustainable farming methods by minimizing environmental impact and reducing waste.

- In addition, agrodrone technology has a profitable opportunity in the Irish fungicide market. Fungal diseases are a major threat to rice crops and can cause significant yield losses if not managed properly. Agricultural drones capable of spraying provide a proactive approach that allows farmers to effectively control the disease.

- In addition, the need for Irish fungicides is expected to increase as global food demand increases. This creates a significant market for agricultural drones, and farmers are looking for new tools to improve crop protection and productivity.

India Paddy Fungicides Market Segment Analysis:

India Paddy Fungicides Market is segmented based on Type, Formulation, Mode of Action, Mode of Application, and Distribution Channel.

By Type, Chemical Fungicide segment is expected to dominate the market during the forecast period

- Chemical fungicides overwhelm the India paddy fungicide advertise for different reasons. To start with, chemical fungicides are well-known for their speedy and solid viability in treating a wide extent of parasitic diseases that influence rice crops.

- Additionally, chemical fungicides are planned to viably center on diverse pathogens, guaranteeing consistent and solid results year after year. The reasonableness calculation may be a major advantage, particularly for the larger part of India's agrarian labor constraint made up of little and negligible agriculturists.

- Progressing inquiries about and improvements within the agrochemical industry have brought about the creation of more progressed definitions that move forward the productivity and security of chemical fungicides.

- By combining chemical fungicides with natural and social strategies, chemical fungicides still hold the larger part. Their consideration in IPM programs makes a difference in overseeing resistance by turning different fungicide classes and combining non-chemical strategies, guaranteeing long-term infection administration techniques for rice crops in India.

By Mode of Application, Foliar Application segment held the largest share sin 2024

- Foliar fungicides are formulated for application on leaf surfaces to fight fungal pathogens such as powdery mildew and rust. Determining whether these solutions are most effective as preventive measures or for treating current illnesses is essential. Being able to identify the symptoms of foliar diseases in your crops is crucial for timely and successful intervention.

- Within the realm of natural and non-manmade foliar fungicides, there is a wide variety of active ingredients to choose from. Minerals such as copper and sulfur dust, known for their fungicidal properties, have been utilized in agriculture for a long time. Also, commonly selected are biorationals like Bacillus subtilis and Streptomyces. These options for disease management are sourced from organisms found in nature and are eco-friendly.

- Foliar applications are especially popular for applying fungicides in paddy crops. This highlights the necessity of choosing the right fungicide for these particular crops. Farmers can protect their crops effectively and reduce environmental impact by being knowledgeable about foliar diseases and organic fungicides.

Active Key Players in the India Paddy Fungicides Market

- Corteva Agriscience (United States)

- FMC Corporation (United States)

- BASF Se (Germany)

- Bayer Ag (Germany)

- Isagro S.P.A. (Italy)

- Syngenta Group (Switzerland)

- Upl (India)

- Dhanuka Agritech Ltd (India)

- Insecticides India (India)

- Crop Chemicals India Ltd. (India)

- Indofil Industries Limited (India)

- Pi Industries (India)

- Rallis India Limited (India)

- Parijat Industries (India) Pvt. Ltd. (India)

- Mankind Agritech (India)

- NACL Industries Limited (India)

- Advance Pesticide (India)

- Gharda Chemicals Limited (India)

- Crystal Crop Protection Ltd. (India)

- Anu Products Limited (India)

- Krishi Rasayan Group (India)

- Willowood Chemicals Pvt. Ltd. (India)

- Nippon Soda Co., Ltd. (Japan)

- Sumitomo Chemical Co., Ltd. (Japan)

- Nufarm (Australia)

- Adama (Israel) and Other Active Players

Key Industry Developments in the India Paddy Fungicides Market:

- In April 2024, ADAMA launched its new cereal fungicide, Forapro, in Europe. Forapro combined two active ingredients with ADAMA's Asorbital Formulation Technology, delivering a double-boosting effect. The product was announced by ADAMA Ltd., a prominent crop protection company. Forapro offered farmers a powerful solution against cereal fungicides, enhancing their ability to protect their crops effectively.

- In January 2024, UPL acquired Corteva Agriscience's solo mancozeb global fungicide business outside of China, Japan, South Korea, and EU member countries to bolster its fungicide portfolio. The acquisition granted UPL ownership of Dithane®, the original global mancozeb brand renowned for providing farmers with a dependable disease management solution. Mancozeb, a highly efficient protective fungicide utilized to prevent plant diseases across various crops like rice, soybean, wheat, onions, potatoes, and other vegetables and fruits, played a crucial role in managing fungicide resistance in the crop protection industry.

|

India Paddy Fungicides Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 123.27 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.34 % |

Market Size in 2032: |

USD 173.17 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

Mode of Action |

|

||

|

Mode of Application |

|

||

|

Distribution Channel |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: India Paddy Fungicides Market by Type (2018-2032)

4.1 India Paddy Fungicides Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Chemical

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Biological

Chapter 5: India Paddy Fungicides Market by Application (2018-2032)

5.1 India Paddy Fungicides Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Liquid

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Solid

5.5 Mode of Action

5.6 Contact

5.7 Systemic

5.8 Translaminar

5.9 Mode of Application

5.10 Fumigation

5.11 Foliar Treatment

5.12 Seed Treatment

5.13 Post-Harvest

5.14 Distribution Channel

5.15 Direct Sales

5.16 Retail Stores

5.17 Online

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 India Paddy Fungicides Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 CORTEVA AGRISCIENCE (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 FMC CORPORATION (UNITED STATES)

6.4 BASF SE (GERMANY)

6.5 BAYER AG (GERMANY)

6.6 ISAGRO S.P.A. (ITALY)

6.7 SYNGENTA GROUP (SWITZERLAND)

6.8 UPL (INDIA)

6.9 DHANUKA AGRITECH LTD (INDIA)

6.10 INSECTICIDES INDIA (INDIA)

6.11 CROP CHEMICALS INDIA LTD. (INDIA)

6.12 INDOFIL INDUSTRIES LIMITED (INDIA)

6.13 PI INDUSTRIES (INDIA)

6.14 RALLIS INDIA LIMITED (INDIA)

6.15 PARIJAT INDUSTRIES (INDIA) PVT. LTD. (INDIA)

6.16 MANKIND AGRITECH (INDIA)

6.17 NACL INDUSTRIES LIMITED (INDIA)

6.18 ADVANCE PESTICIDE (INDIA)

6.19 GHARDA CHEMICALS LIMITED (INDIA)

6.20 CRYSTAL CROP PROTECTION LTD. (INDIA)

6.21 ANU PRODUCTS LIMITED (INDIA)

6.22 KRISHI RASAYAN GROUP (INDIA)

6.23 WILLOWOOD CHEMICALS PVT. LTD. (INDIA)

6.24 NIPPON SODA COLTD. (JAPAN)

6.25 SUMITOMO CHEMICAL COLTD. (JAPAN)

6.26 NUFARM (AUSTRALIA)

6.27 ADAMA (ISRAEL)

Chapter 7 Analyst Viewpoint and Conclusion

7.1 Recommendations and Concluding Analysis

7.2 Potential Market Strategies

Chapter 8 Research Methodology

8.1 Research Process

8.2 Primary Research

8.3 Secondary Research

|

India Paddy Fungicides Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 123.27 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.34 % |

Market Size in 2032: |

USD 173.17 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

Mode of Action |

|

||

|

Mode of Application |

|

||

|

Distribution Channel |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||