Global Baobab Market Overview

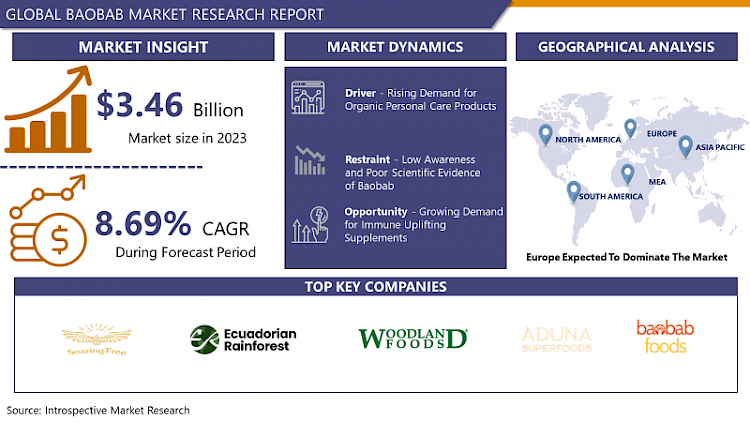

Baobab Market Size Was Valued at USD 3.46 Billion in 2023 and is Projected to Reach USD 7.32 Billion by 2032, Growing at a CAGR of 8.69% From 2024-2032

Baobab (Adansonia digitata) is the largest tree species of the genus Adansonia, from which its fruits are obtained. Baobab is native to the African continent, typically observed in sub-Saharan African countries. The baobab tree takes about 16–23 years to mature and produce its flowers. Baobab is a multi-purpose tree; its fruit pulp, roots, seeds, leaves, flowers, and bark can be utilized for human consumption. Baobab is rich in vitamin C, calcium, protein, phosphorus, fiber, carbohydrates, potassium, and lipids. Furthermore, the powder is made of baobab fruit, which is a prominent ingredient on the European market. Baobab has an extensive range of active properties, such as anti-inflammatory, anti-malarial, antioxidant, and anti-microbial.

The seeds are used as a thickener for meals, while its leaves are eaten as a vegetable. Baobab leaves, roots, bark, fruits, and seeds can also be used to treat diarrhea, asthma, anemia, infections, and skin issues. Furthermore, baobab fruit is a wholesome nutrient fruit that has different uses as per its form. Baobab is gaining popularity in various sectors such as functional foods, beverages, nutraceuticals, cosmetics, sauces & seasonings, and others, which is triggering the growth of the market. The high shelf life of the product is having a positive impact on the growth of the market. Growing consciousness of the baobab in various regions is anticipated to surge the growth of the market. In addition, continuous R&D is probably to lubricate the growth of the baobab market with various innovations worldwide.

Market Dynamics And Key Factors For Baobab Market:

Drivers:

For the consumers, quality and contamination are two major concerns. The processing and storage methods do not meet standards. In addition, during its production process, baobab powder can be contaminated by dirt, stones, nuts, and other foreign matter. Furthermore, inappropriate storage facilities can lead to infection by pests and insects along with causing mould growth. Consequently, buyers are increasingly demanding certified organic baobab, as it is a sign of quality and trustability. At the same time, there is also a rising market for organic products, and trends are anticipated to continue. Organic product sales in the market have been rising since the COVID-19 outbreak; consumers are buying organic products as they look to improve their immunity.

Baobab market from cosmetic & personal care has observed a crucial growth in last few years, due to its health beneficial properties and rising demand for organic personal care products. The baobab-based cosmetic products have nutritive compounds which assist in dermis protection and soothing of the skin. It contributes to restoring smoothness of hair and skin to assure defense against the inflammatory phenomenon. It is appropriate for moisturizing skin, after-sun skin care, anti-aging skincare, and restructuring hair care. Rising demand for organic cosmetics & personal care products would grow the market growth in the forecast period.

Restraints:

Low awareness and poor scientific evidence of baobab is an obstacle for baobab exporters in emerging economies. Nevertheless, the consciousness of baobab is anticipated to increase in the coming years. Following this, exporters should target countries with the most sophisticated consumer markets along with those with high levels of baobab consumer awareness. It is expected that the awareness of baobab products will slowly increase in the future, as new product launches continue to enter the market.

Opportunities:

Growing Demand for Immune Uplifting Supplements

From spring 2020, there has been rising consumer demand for health products around the globe, in particular supplements enhancing immunity. This is a trend that is anticipated to continue in the forecast period. The global coronavirus pandemic is driving this trend, as consumers are looking to improve their immune systems. Following the outbreak of COVID-19, consumers have begun to pay greater attention to their diets and health as they try to grow their immunity. Consumers are therefore switching towards vitamins and supplements. Natural ingredients for health products such as baobab contain beneficial health properties that can assist to improve levels of immunity as well as strengthen it. For instance, baobab's high vitamin C content helps the body fight infections. To maximize this opportunity, exporters of baobab in emerging economies should ensure their products contain the highest levels of active nutrients, as well as be prepared to send high-quality samples to prospective buyers. To further maximize this opportunity, exporters should inform prospective buyers about their products' beneficial health properties, particularly baobab's high vitamin C content. In addition, this should also be highlighted on marketing materials and the company website.

Market Segmentation

Based on the form, the powder form segment is expected to register the highest market share during the forecast period. The baobab powder, which is made out of the dry baobab fruit pulp, is good for skin, hair, and metabolism. Traditionally it stands for a natural source of health and wellbeing. The beverage industry highly utilizes powder form for making nutritional and brewing beverages. Hence, switching trends over the countries for the adoption of nutritional beverages is another factor that has driven the powder form's growth.

Based on the source, the organic segment is expected to register the maximum market growth during the forecast period. Increasing demand for organic cosmetics & personal care products would upsurge the market growth in the projected period. Baobab market from cosmetic & personal care has observed a crucial growth in the last couple of years, due to its health beneficial properties and rising demand for organic personal care products. The baobab-based cosmetic products have nutritive compounds which provide dermis protection and soothing of the skin.

Based on the species, the baobab market is segmented into Adansonia Digitata, Kilima, Grandidieri, Madagascariensis, and others. Among all, the Digitata is the most commonly accessible source for baobab, which cultivate in various parts of Africa and the Middle East including Yemen, Oman, and Ghana.

Based on the application, the food and beverage segment is anticipated to dominate the market share during the forecast period. Food and beverage are observed to grow at a higher CAGR in the market over the forecast period. Growing health benefits from baobab are attracting major stakeholders to incorporate it in baking, confectionery, and flavoring applications. Baobab powder requirements are anticipated to raise as it helps to overcome risks for chronic diseases, leading to the highest adoption rate of the product in the food and beverage industry.

Based on the distribution channel, the online segment is projected to dominate the market during the forecast period. Due to the ease of accessibility of a wide selection of products in different forms and applications as in various flavoring ingredients given by all brands at reasonable discounts. Moreover, the rising number of smartphone and internet users is the primary driver of sector growth. These businesses offer cashback and home delivery services, which contribute to the market's growth. Customers frequently purchase Baobab products for various applications from online websites to save time owing to the growing hectic lifestyle of the consumers.

Players Covered In Baobab Market are:

- Soaring Free Superfoods

- Ecuadorian Rainforest LLC

- Woodland Foods

- Mighty Baobab Limited

- ADUNA Ltd.

- Organic Africa

- ALAFFIA

- Atacora Essential Inc.

- Baobab Foods Inc.

- Organic Herb Trading Company

- Afriplex (PTY)

- Superfruit Scandinavia AB

- Baobab Fruit Company Senegal

- B'Ayoba (Pvt) Ltd.

- EcoProducts

- Farafena

- Holland & Barrett Retail Ltd.

- Soaring Free Superfoods

- Indigo Herbs Ltd.

- Kiki Ltd.

- Organic Burst UK Ltd.

- Powbab Inc.

- Stern Ingredients Inc.

- Z Natural Foods LLC and other major players.

Regional Analysis For Baobab Market:

Europe has an attractive market for baobab since there is a rising demand for supplements as well as ingredients with high nutrient content and antioxidant properties. The growing number of consumers toward functional food and beverages, which is turning the growth of the market in the region. The European market for baobab ingredients is anticipated to rise by about 4% in the upcoming years. Moreover, the UK, Germany, France, the Netherlands, and Austria are the European countries providing the most opportunities to baobab exporters in emerging economies. These countries have a prominent natural health product industry, as well as having some of the largest consumer markets in Europe. The UK and Germany are home to different producers of baobab products.

North America is expected to capture a significant market share in the baobab market due to the growing requirements for natural and healthy ingredients among the food producers is driving the market growth in the region.

Asia Pacific region is driving the baobab market due to its increasing application in the nutraceutical and food industry for its taste and texture. Additionally, rising health awareness and growing demand for plant-based and organic foods help to the growth of the market over the forecast period.

Key Industry Developments in Baobab Market

In November 2023, Evonik launched a sustainable baobab oil sourced from the Sahel region of Ghana as the latest product in its ECOHANCE program. ECOHANCE Soft Baobab is refined from the non-edible seeds of the baobab fruit and can be used in a wide range of natural cosmetic formulations such as hand creams, hair conditioners, and body butter.

|

Global Baobab Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2030 |

|

Historical Data: |

2016 to 2022 |

Market Size in 2023: |

USD 3.46 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.69% |

Market Size in 2032: |

USD 7.32 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Species |

|

||

|

By Application |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Species

3.3 By Application

3.4 By Distribution Channels

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Baobab Market by Type

5.1 Baobab Market Overview Snapshot and Growth Engine

5.2 Baobab Market Overview

5.3 Oil

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Oil: Grographic Segmentation

5.4 Powder

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Powder: Grographic Segmentation

5.5 Pulp

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Pulp: Grographic Segmentation

5.6 Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others: Grographic Segmentation

Chapter 6: Baobab Market by Species

6.1 Baobab Market Overview Snapshot and Growth Engine

6.2 Baobab Market Overview

6.3 Adansonia Digitata

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Adansonia Digitata: Grographic Segmentation

6.4 Kilima

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Kilima: Grographic Segmentation

6.5 Grandidieri

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Grandidieri: Grographic Segmentation

6.6 Madagascariensis

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Madagascariensis: Grographic Segmentation

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Grographic Segmentation

Chapter 7: Baobab Market by Application

7.1 Baobab Market Overview Snapshot and Growth Engine

7.2 Baobab Market Overview

7.3 Food & Beverages

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Food & Beverages: Grographic Segmentation

7.4 Personal Care

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Personal Care: Grographic Segmentation

7.5 Nutraceuticals

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Nutraceuticals: Grographic Segmentation

7.6 Others

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Others: Grographic Segmentation

Chapter 8: Baobab Market by Distribution Channels

8.1 Baobab Market Overview Snapshot and Growth Engine

8.2 Baobab Market Overview

8.3 Assemblers

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2016-2028F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Assemblers: Grographic Segmentation

8.4 Rural Wholesalers

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2016-2028F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Rural Wholesalers: Grographic Segmentation

8.5 Urban Buyers

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2016-2028F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Urban Buyers: Grographic Segmentation

8.6 Online

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size (2016-2028F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Online: Grographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Baobab Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Ansoff Matrix

9.1.5 Baobab Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Baobab Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 SOARING FREE SUPERFOODS

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 ECUADORIAN RAINFOREST LLC

9.4 WOODLAND FOODS

9.5 MIGHTY BAOBAB LIMITED

9.6 ADUNA LTD.

9.7 ORGANIC AFRICA

9.8 ALAFFIA

9.9 ATACORA ESSENTIAL INC.

9.10 BAOBAB FOODS INC.

9.11 ORGANIC HERB TRADING COMPANY

9.12 AFRIPLEX (PTY)

9.13 SUPERFRUIT SCANDINAVIA AB

9.14 BAOBAB FRUIT COMPANY SENEGAL

9.15 B'AYOBA (PVT) LTD.

9.16 ECOPRODUCTS

9.17 FARAFENA

9.18 HOLLAND & BARRETT RETAIL LTD.

9.19 SOARING FREE SUPERFOODS

9.20 INDIGO HERBS LTD.

9.21 KIKI LTD.

9.22 ORGANIC BURST UK LTD.

9.23 POWBAB INC.

9.24 STERN INGREDIENTS INC.

9.25 Z NATURAL FOODS LLC

9.26 OTHER MAJOR PLAYERS

Chapter 10: Global Baobab Market Analysis, Insights and Forecast, 2016-2028

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Type

10.2.1 Oil

10.2.2 Powder

10.2.3 Pulp

10.2.4 Others

10.3 Historic and Forecasted Market Size By Species

10.3.1 Adansonia Digitata

10.3.2 Kilima

10.3.3 Grandidieri

10.3.4 Madagascariensis

10.3.5 Others

10.4 Historic and Forecasted Market Size By Application

10.4.1 Food & Beverages

10.4.2 Personal Care

10.4.3 Nutraceuticals

10.4.4 Others

10.5 Historic and Forecasted Market Size By Distribution Channels

10.5.1 Assemblers

10.5.2 Rural Wholesalers

10.5.3 Urban Buyers

10.5.4 Online

Chapter 11: North America Baobab Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Oil

11.4.2 Powder

11.4.3 Pulp

11.4.4 Others

11.5 Historic and Forecasted Market Size By Species

11.5.1 Adansonia Digitata

11.5.2 Kilima

11.5.3 Grandidieri

11.5.4 Madagascariensis

11.5.5 Others

11.6 Historic and Forecasted Market Size By Application

11.6.1 Food & Beverages

11.6.2 Personal Care

11.6.3 Nutraceuticals

11.6.4 Others

11.7 Historic and Forecasted Market Size By Distribution Channels

11.7.1 Assemblers

11.7.2 Rural Wholesalers

11.7.3 Urban Buyers

11.7.4 Online

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe Baobab Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Oil

12.4.2 Powder

12.4.3 Pulp

12.4.4 Others

12.5 Historic and Forecasted Market Size By Species

12.5.1 Adansonia Digitata

12.5.2 Kilima

12.5.3 Grandidieri

12.5.4 Madagascariensis

12.5.5 Others

12.6 Historic and Forecasted Market Size By Application

12.6.1 Food & Beverages

12.6.2 Personal Care

12.6.3 Nutraceuticals

12.6.4 Others

12.7 Historic and Forecasted Market Size By Distribution Channels

12.7.1 Assemblers

12.7.2 Rural Wholesalers

12.7.3 Urban Buyers

12.7.4 Online

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific Baobab Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Oil

13.4.2 Powder

13.4.3 Pulp

13.4.4 Others

13.5 Historic and Forecasted Market Size By Species

13.5.1 Adansonia Digitata

13.5.2 Kilima

13.5.3 Grandidieri

13.5.4 Madagascariensis

13.5.5 Others

13.6 Historic and Forecasted Market Size By Application

13.6.1 Food & Beverages

13.6.2 Personal Care

13.6.3 Nutraceuticals

13.6.4 Others

13.7 Historic and Forecasted Market Size By Distribution Channels

13.7.1 Assemblers

13.7.2 Rural Wholesalers

13.7.3 Urban Buyers

13.7.4 Online

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa Baobab Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Oil

14.4.2 Powder

14.4.3 Pulp

14.4.4 Others

14.5 Historic and Forecasted Market Size By Species

14.5.1 Adansonia Digitata

14.5.2 Kilima

14.5.3 Grandidieri

14.5.4 Madagascariensis

14.5.5 Others

14.6 Historic and Forecasted Market Size By Application

14.6.1 Food & Beverages

14.6.2 Personal Care

14.6.3 Nutraceuticals

14.6.4 Others

14.7 Historic and Forecasted Market Size By Distribution Channels

14.7.1 Assemblers

14.7.2 Rural Wholesalers

14.7.3 Urban Buyers

14.7.4 Online

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America Baobab Market Analysis, Insights and Forecast, 2016-2028

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Type

15.4.1 Oil

15.4.2 Powder

15.4.3 Pulp

15.4.4 Others

15.5 Historic and Forecasted Market Size By Species

15.5.1 Adansonia Digitata

15.5.2 Kilima

15.5.3 Grandidieri

15.5.4 Madagascariensis

15.5.5 Others

15.6 Historic and Forecasted Market Size By Application

15.6.1 Food & Beverages

15.6.2 Personal Care

15.6.3 Nutraceuticals

15.6.4 Others

15.7 Historic and Forecasted Market Size By Distribution Channels

15.7.1 Assemblers

15.7.2 Rural Wholesalers

15.7.3 Urban Buyers

15.7.4 Online

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Baobab Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2030 |

|

Historical Data: |

2016 to 2022 |

Market Size in 2023: |

USD 3.46 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.69% |

Market Size in 2032: |

USD 7.32 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Species |

|

||

|

By Application |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BAOBAB MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BAOBAB MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BAOBAB MARKET COMPETITIVE RIVALRY

TABLE 005. BAOBAB MARKET THREAT OF NEW ENTRANTS

TABLE 006. BAOBAB MARKET THREAT OF SUBSTITUTES

TABLE 007. BAOBAB MARKET BY TYPE

TABLE 008. OIL MARKET OVERVIEW (2016-2028)

TABLE 009. POWDER MARKET OVERVIEW (2016-2028)

TABLE 010. PULP MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. BAOBAB MARKET BY SPECIES

TABLE 013. ADANSONIA DIGITATA MARKET OVERVIEW (2016-2028)

TABLE 014. KILIMA MARKET OVERVIEW (2016-2028)

TABLE 015. GRANDIDIERI MARKET OVERVIEW (2016-2028)

TABLE 016. MADAGASCARIENSIS MARKET OVERVIEW (2016-2028)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 018. BAOBAB MARKET BY APPLICATION

TABLE 019. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 020. PERSONAL CARE MARKET OVERVIEW (2016-2028)

TABLE 021. NUTRACEUTICALS MARKET OVERVIEW (2016-2028)

TABLE 022. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 023. BAOBAB MARKET BY DISTRIBUTION CHANNELS

TABLE 024. ASSEMBLERS MARKET OVERVIEW (2016-2028)

TABLE 025. RURAL WHOLESALERS MARKET OVERVIEW (2016-2028)

TABLE 026. URBAN BUYERS MARKET OVERVIEW (2016-2028)

TABLE 027. ONLINE MARKET OVERVIEW (2016-2028)

TABLE 028. NORTH AMERICA BAOBAB MARKET, BY TYPE (2016-2028)

TABLE 029. NORTH AMERICA BAOBAB MARKET, BY SPECIES (2016-2028)

TABLE 030. NORTH AMERICA BAOBAB MARKET, BY APPLICATION (2016-2028)

TABLE 031. NORTH AMERICA BAOBAB MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 032. N BAOBAB MARKET, BY COUNTRY (2016-2028)

TABLE 033. EUROPE BAOBAB MARKET, BY TYPE (2016-2028)

TABLE 034. EUROPE BAOBAB MARKET, BY SPECIES (2016-2028)

TABLE 035. EUROPE BAOBAB MARKET, BY APPLICATION (2016-2028)

TABLE 036. EUROPE BAOBAB MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 037. BAOBAB MARKET, BY COUNTRY (2016-2028)

TABLE 038. ASIA PACIFIC BAOBAB MARKET, BY TYPE (2016-2028)

TABLE 039. ASIA PACIFIC BAOBAB MARKET, BY SPECIES (2016-2028)

TABLE 040. ASIA PACIFIC BAOBAB MARKET, BY APPLICATION (2016-2028)

TABLE 041. ASIA PACIFIC BAOBAB MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 042. BAOBAB MARKET, BY COUNTRY (2016-2028)

TABLE 043. MIDDLE EAST & AFRICA BAOBAB MARKET, BY TYPE (2016-2028)

TABLE 044. MIDDLE EAST & AFRICA BAOBAB MARKET, BY SPECIES (2016-2028)

TABLE 045. MIDDLE EAST & AFRICA BAOBAB MARKET, BY APPLICATION (2016-2028)

TABLE 046. MIDDLE EAST & AFRICA BAOBAB MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 047. BAOBAB MARKET, BY COUNTRY (2016-2028)

TABLE 048. SOUTH AMERICA BAOBAB MARKET, BY TYPE (2016-2028)

TABLE 049. SOUTH AMERICA BAOBAB MARKET, BY SPECIES (2016-2028)

TABLE 050. SOUTH AMERICA BAOBAB MARKET, BY APPLICATION (2016-2028)

TABLE 051. SOUTH AMERICA BAOBAB MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 052. BAOBAB MARKET, BY COUNTRY (2016-2028)

TABLE 053. SOARING FREE SUPERFOODS: SNAPSHOT

TABLE 054. SOARING FREE SUPERFOODS: BUSINESS PERFORMANCE

TABLE 055. SOARING FREE SUPERFOODS: PRODUCT PORTFOLIO

TABLE 056. SOARING FREE SUPERFOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. ECUADORIAN RAINFOREST LLC: SNAPSHOT

TABLE 057. ECUADORIAN RAINFOREST LLC: BUSINESS PERFORMANCE

TABLE 058. ECUADORIAN RAINFOREST LLC: PRODUCT PORTFOLIO

TABLE 059. ECUADORIAN RAINFOREST LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. WOODLAND FOODS: SNAPSHOT

TABLE 060. WOODLAND FOODS: BUSINESS PERFORMANCE

TABLE 061. WOODLAND FOODS: PRODUCT PORTFOLIO

TABLE 062. WOODLAND FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. MIGHTY BAOBAB LIMITED: SNAPSHOT

TABLE 063. MIGHTY BAOBAB LIMITED: BUSINESS PERFORMANCE

TABLE 064. MIGHTY BAOBAB LIMITED: PRODUCT PORTFOLIO

TABLE 065. MIGHTY BAOBAB LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. ADUNA LTD.: SNAPSHOT

TABLE 066. ADUNA LTD.: BUSINESS PERFORMANCE

TABLE 067. ADUNA LTD.: PRODUCT PORTFOLIO

TABLE 068. ADUNA LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. ORGANIC AFRICA: SNAPSHOT

TABLE 069. ORGANIC AFRICA: BUSINESS PERFORMANCE

TABLE 070. ORGANIC AFRICA: PRODUCT PORTFOLIO

TABLE 071. ORGANIC AFRICA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. ALAFFIA: SNAPSHOT

TABLE 072. ALAFFIA: BUSINESS PERFORMANCE

TABLE 073. ALAFFIA: PRODUCT PORTFOLIO

TABLE 074. ALAFFIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. ATACORA ESSENTIAL INC.: SNAPSHOT

TABLE 075. ATACORA ESSENTIAL INC.: BUSINESS PERFORMANCE

TABLE 076. ATACORA ESSENTIAL INC.: PRODUCT PORTFOLIO

TABLE 077. ATACORA ESSENTIAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. BAOBAB FOODS INC.: SNAPSHOT

TABLE 078. BAOBAB FOODS INC.: BUSINESS PERFORMANCE

TABLE 079. BAOBAB FOODS INC.: PRODUCT PORTFOLIO

TABLE 080. BAOBAB FOODS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. ORGANIC HERB TRADING COMPANY: SNAPSHOT

TABLE 081. ORGANIC HERB TRADING COMPANY: BUSINESS PERFORMANCE

TABLE 082. ORGANIC HERB TRADING COMPANY: PRODUCT PORTFOLIO

TABLE 083. ORGANIC HERB TRADING COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. AFRIPLEX (PTY): SNAPSHOT

TABLE 084. AFRIPLEX (PTY): BUSINESS PERFORMANCE

TABLE 085. AFRIPLEX (PTY): PRODUCT PORTFOLIO

TABLE 086. AFRIPLEX (PTY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. SUPERFRUIT SCANDINAVIA AB: SNAPSHOT

TABLE 087. SUPERFRUIT SCANDINAVIA AB: BUSINESS PERFORMANCE

TABLE 088. SUPERFRUIT SCANDINAVIA AB: PRODUCT PORTFOLIO

TABLE 089. SUPERFRUIT SCANDINAVIA AB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. BAOBAB FRUIT COMPANY SENEGAL: SNAPSHOT

TABLE 090. BAOBAB FRUIT COMPANY SENEGAL: BUSINESS PERFORMANCE

TABLE 091. BAOBAB FRUIT COMPANY SENEGAL: PRODUCT PORTFOLIO

TABLE 092. BAOBAB FRUIT COMPANY SENEGAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. B'AYOBA (PVT) LTD.: SNAPSHOT

TABLE 093. B'AYOBA (PVT) LTD.: BUSINESS PERFORMANCE

TABLE 094. B'AYOBA (PVT) LTD.: PRODUCT PORTFOLIO

TABLE 095. B'AYOBA (PVT) LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. ECOPRODUCTS: SNAPSHOT

TABLE 096. ECOPRODUCTS: BUSINESS PERFORMANCE

TABLE 097. ECOPRODUCTS: PRODUCT PORTFOLIO

TABLE 098. ECOPRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. FARAFENA: SNAPSHOT

TABLE 099. FARAFENA: BUSINESS PERFORMANCE

TABLE 100. FARAFENA: PRODUCT PORTFOLIO

TABLE 101. FARAFENA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. HOLLAND & BARRETT RETAIL LTD.: SNAPSHOT

TABLE 102. HOLLAND & BARRETT RETAIL LTD.: BUSINESS PERFORMANCE

TABLE 103. HOLLAND & BARRETT RETAIL LTD.: PRODUCT PORTFOLIO

TABLE 104. HOLLAND & BARRETT RETAIL LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 104. SOARING FREE SUPERFOODS: SNAPSHOT

TABLE 105. SOARING FREE SUPERFOODS: BUSINESS PERFORMANCE

TABLE 106. SOARING FREE SUPERFOODS: PRODUCT PORTFOLIO

TABLE 107. SOARING FREE SUPERFOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 107. INDIGO HERBS LTD.: SNAPSHOT

TABLE 108. INDIGO HERBS LTD.: BUSINESS PERFORMANCE

TABLE 109. INDIGO HERBS LTD.: PRODUCT PORTFOLIO

TABLE 110. INDIGO HERBS LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 110. KIKI LTD.: SNAPSHOT

TABLE 111. KIKI LTD.: BUSINESS PERFORMANCE

TABLE 112. KIKI LTD.: PRODUCT PORTFOLIO

TABLE 113. KIKI LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 113. ORGANIC BURST UK LTD.: SNAPSHOT

TABLE 114. ORGANIC BURST UK LTD.: BUSINESS PERFORMANCE

TABLE 115. ORGANIC BURST UK LTD.: PRODUCT PORTFOLIO

TABLE 116. ORGANIC BURST UK LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 116. POWBAB INC.: SNAPSHOT

TABLE 117. POWBAB INC.: BUSINESS PERFORMANCE

TABLE 118. POWBAB INC.: PRODUCT PORTFOLIO

TABLE 119. POWBAB INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 119. STERN INGREDIENTS INC.: SNAPSHOT

TABLE 120. STERN INGREDIENTS INC.: BUSINESS PERFORMANCE

TABLE 121. STERN INGREDIENTS INC.: PRODUCT PORTFOLIO

TABLE 122. STERN INGREDIENTS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 122. Z NATURAL FOODS LLC: SNAPSHOT

TABLE 123. Z NATURAL FOODS LLC: BUSINESS PERFORMANCE

TABLE 124. Z NATURAL FOODS LLC: PRODUCT PORTFOLIO

TABLE 125. Z NATURAL FOODS LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 125. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 126. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 127. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 128. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BAOBAB MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BAOBAB MARKET OVERVIEW BY TYPE

FIGURE 012. OIL MARKET OVERVIEW (2016-2028)

FIGURE 013. POWDER MARKET OVERVIEW (2016-2028)

FIGURE 014. PULP MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. BAOBAB MARKET OVERVIEW BY SPECIES

FIGURE 017. ADANSONIA DIGITATA MARKET OVERVIEW (2016-2028)

FIGURE 018. KILIMA MARKET OVERVIEW (2016-2028)

FIGURE 019. GRANDIDIERI MARKET OVERVIEW (2016-2028)

FIGURE 020. MADAGASCARIENSIS MARKET OVERVIEW (2016-2028)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 022. BAOBAB MARKET OVERVIEW BY APPLICATION

FIGURE 023. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 024. PERSONAL CARE MARKET OVERVIEW (2016-2028)

FIGURE 025. NUTRACEUTICALS MARKET OVERVIEW (2016-2028)

FIGURE 026. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 027. BAOBAB MARKET OVERVIEW BY DISTRIBUTION CHANNELS

FIGURE 028. ASSEMBLERS MARKET OVERVIEW (2016-2028)

FIGURE 029. RURAL WHOLESALERS MARKET OVERVIEW (2016-2028)

FIGURE 030. URBAN BUYERS MARKET OVERVIEW (2016-2028)

FIGURE 031. ONLINE MARKET OVERVIEW (2016-2028)

FIGURE 032. NORTH AMERICA BAOBAB MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. EUROPE BAOBAB MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. ASIA PACIFIC BAOBAB MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. MIDDLE EAST & AFRICA BAOBAB MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 036. SOUTH AMERICA BAOBAB MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Baobab Market research report is 2024-2032.

Soaring Free Superfoods, Ecuadorian Rainforest LLC, Woodland Foods, Mighty Baobab Limited, ADUNA Ltd., Organic Africa, ALAFFIA, Atacora Essential Inc., Baobab Foods Inc., Organic Herb Trading Company, Afriplex (PTY), Superfruit Scandinavia AB, Baobab Fruit Company Senegal, B'Ayoba (Pvt) Ltd., EcoProducts, Farafena, Holland & Barrett Retail Ltd., Soaring Free Superfoods, Indigo Herbs Ltd., Kiki Ltd., Organic Burst UK Ltd., Powbab Inc., Stern Ingredients Inc., Z Natural Foods LLC., and other major players.

The Baobab Market is segmented into type, species, application, distribution channels, and region. By Type, the market is categorized into Oil, Powder, Pulp, and Others. By Species, the market is categorized into Adansonia Digitata, Kilima, Grandidieri, Madagascariensis, and Others. By Application, the market is categorized into Food & Beverages, Personal Care, Nutraceuticals, and Others. By Distribution Channels, the market is categorized into Assemblers, Rural Wholesalers, Urban Buyers, and Online. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Baobab (Adansonia digitata) is the largest tree species of the genus Adansonia, from which its fruits are obtained. Baobab is native to the African continent, typically observed in sub-Saharan African countries.

Baobab Market Size Was Valued at USD 3.46 Billion in 2023 and is Projected to Reach USD 7.32 Billion by 2032, Growing at a CAGR of 8.69% From 2024-2032