Micro Irrigation System Market Synopsis

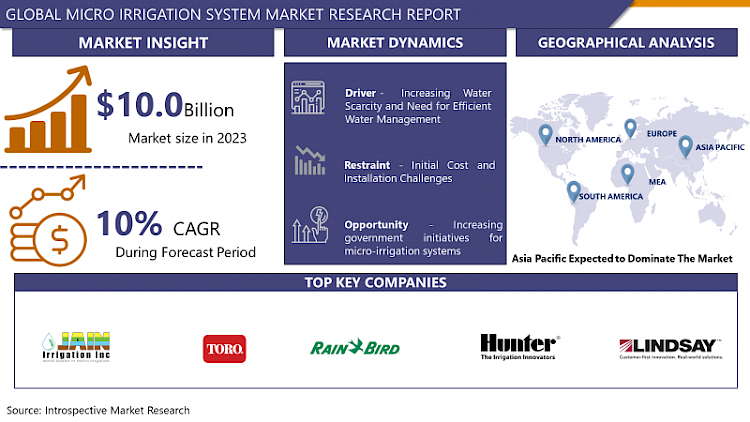

Micro Irrigation System Market Size Was Valued at USD 10.0 Billion in 2023, and is Projected to Reach USD 23.01 Billion by 2032, Growing at a CAGR of 10 % From 2024-2032.

Micro irrigation system is one of the channels through which water and nutrients are delivered to the root zone of plants with much precision and accuracy. Usually, this is done through drip irrigation or micro sprinklers. Naturellement, différe des méthodes d'irrigation conventionnelles qui inondent tout le champ, les systèmes d'irrigation micro répandent l'eau directement à la hauteur du pied des plantes ou au long des rangées de leur culture. This the core that helps to minimize water wastage, generate soil erosion, and cause the plants to have high yields because he/she gives the plants the right amount of moisture and nutrients that they need for the plants to grow to their maximum rate.

- The market for the micro irrigation system globally registered steady upsurge in recent years and promises to keep growing the next couple of years. Micro irrigation system such as drip irrigation and sprinkler irrigation are gaining popularity by virtue of their competence to avoid tremendous wastage of water directly by delivering adequate water supply to roots of plants. This helps in maximizing the crop yield as well as improving the water use efficiency. It is the more essential technology in regions where water is getting scarcer and the rainfall is becoming irregular. Hence, the conventional irrigation methods, which are not sustainable technologies, can’t be used in these regions.

- Conversely, the main reason for the current relevance of micro irrigation system market is the development of the sustainable agriculture technologies which is the other name for the agricultural sustainability as well. Water scarcity and environmental damage causing more concern each day, farmers and agricultural stakeholders now adopt micro irrigation systems as a means to conserve water and at the same time increase crop production rate. Alongside that, authorities offer measures and assignments shared on water preservation and sustainable agriculture principles facilitating market growth.

- The increase in this demand is also associated with rising expectations relating to the improvement of crop quality as well as the need to deal with unpredictable climate. Through carefully managed irrigation and nutrient distribution, these systems allow for the diminishing of the negative effects on vegetation health which originate from drought, salinity, and other environmental stress factors. Furthermore, because these systems bring us fertigation i.e. the simultaneous application of water and plant nutrients, plants receive their nutrients, as a result, the quality of the overall crop production is enhanced.

- What further powers the micro irrigation system market growth is the enforcement of the adoption of innovative technologies which includes sensor-based irrigation systems as well as remote monitoring systems. These tools help measure in real time the levels of soil moisture, weather conditions as well as the irrigation requirements of crops; farmers can thus apply the right water quantities at the right times. In addition to that, inclusive of automation and smart control system pushes the efficiencies and reliability level of micro irrigation system and hence motivates the application of such system in various agriculture fields.

Micro Irrigation System Market Trend Analysis

Technological Advancements and Smart Irrigation Solutions

- Farming technologies have benefited significantly from the innovations of smart irrigation that has enhanced water management and increased the cropping throughput and quality. A crucial innovation for water management solutions is developing of IoT (Internet of Things) sensors and actuators.

- These sensors gather live data in the form of moisture levels, weather conditions, and plant health which farmers use as a direction to provide the desired water rationing amounts. AI algorithms study such data to make actionable insights from which they can be provided with automation in water distribution based on irrigation schedules and flow rates.

- In spite of the advanced irrigation systems such as drip and micro-irrigation , the efficiency of water-use has been significantly improved by the action of targeting the roots of plants directly and thus decreasing evaporation and runoff.

- The integration of smart irrigation with internet of things (IoT), big data analytics, machine learning, and remote sensing has unlocked innovations that has facilitated broader uptake of precision agriculture. The example would be the drones which are coupled with the multispectral imaging cameras to monitor large agricultural fields and detect spots where water stress or the absence of nutrition takes place. The reason for this is to then address these issues from their roots.

- Furthermore, pastures utilize cloud technology for irrigators to be at a distance through internet connection to review performance, monitor activities in the fields and make informed decisions anywhere. These new technologies not only help preserve water supply but also provide farmers a way to fulfill the needed requirements, achieving the desired results, as well.

Increasing government initiatives for micro irrigation systems

- Amid the disappearing water and improved farming technology requirements, more governments around the globe are embracing policies and strategies to promote usage of micro-irrigations.

- These mechanisms; i.e. drip and sprinkler irrigation, convey waters directly to the base of the plants under controlled circumstances hence no wastage is possible and efficiencies are maximized. These initiatives include subsidies, incentives and technical advices to make the farmgears to use these technologies however they are capable.

- What the micro irrigation is entailed in, farmers can achieve a yield over 60% while using 40% less water. This is endorsing sustainable agriculture and food security.

- Also, governments promote tiny irrigation to act in line with the broader environmental and economic missions. These projects promote the reduction of water usage in the agriculture sector, which creates a decreased stress in areas where water is a scarce resource, particularly in drought and water stressed regions.

- However, the improved agricultural productivity which is is brought about by micro irrigation would equally enhance food production hence enhacing food security and in turn improve rural livelihoods. Additionally, decision-making and the promotion of high-value irrigation equipment and technologies will help in creating job opportunities, which will positively impact the economy in the agricultural sector through the promotion of micro irrigation, hence being a solution to both the agricultural industry and the society at large.

Micro Irrigation System Market Segment Analysis:

Micro Irrigation System Market is segmented based on Type, Cultivation Type and Application.

By Type, Drip Irrigation Systemsegment is expected to dominate the market during the forecast period

- Micro irrigation system market includes a range of irrigation technics that handle the deficiency of water and make the output of crops more profitable in farming. Room sprinkling systems which rescue water straight to plant roots via pipe network and emitters are widely used because of the efficiency benefit they possess which helps to minimize water waste and nutrient loss.

- While sprinkler irrigation systems are a different story, this method of watering uniformly covers crops with water in controlled manner, much like actual rainfall, overlapping with each other and ensuring that the whole area is reached in a more efficient way.

- Besides the two of the most important types, pivot and sprinkler irrigation systems both belong to micro irrigation systems that provide benefits especially for soils and crops varieties with specific features.

- The world market is witnessing a dynamic growth in the production of micro irrigation systems that needs to continue, as it is guided by the vital need to combat water scarcity, boost agricultural productivity and wisely use natural resources in an environmentally friendly manner.

- Technological advancements and society's growing concerns for the environment, source water, rainwater, and even groundwater can be incorporated in micro sprinkler systems. Thus, as the challenges of modern agriculture evolve, innovations in micro irrigation systems will continue.

By Cultivation Type, Open Field segment held the largest share in 2023

- Open Field:These systems are made to suit just those varieties of crops which are grown in the open field, e.g. wheat, vegetables, some kinds of fruit, and so on.

- Such irrigation systems are commonly comprised of drip irrigation equipment or micro sprinkler systems which deliver water directly into the root area only of plants.

- Open field systems can be more complicated to install in terms of infrastructure and have a higher ability to be affected by influencing factors like wind and soil damage.

- Protected Cultivation:These technoloies have been developed that are meant for plant species in the environment purposely made to conserve such environments as greenhouses, tunnels and shade houses.

- They could be illustrations of the optimal irrigation techniques, the drip irrigation, the fogging systems, and the misting systems, which are specialized for the enclosed nature of the greenhouse cultivation. The good thing about the protected cultivation systems is that they provide accurately reliable sources of water and nutrients that leads to the right growth conditions for the crops.

Micro Irrigation System Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific (APAC) is on the commando to claim the highest billing for its contribution to the market of micro irrigation system during the forecast period. The region's morphological feature of innumerable farming landscapes and rise in population coupled with rise in water conservation awareness are playing leading roles in this projection.

- While micro irrigation systems are being grown more popular between farmers in India, China and Australian as sustainable farming techniques and use of scarce water resources are emphasized, farmers are keen to adopt them as a means of boosting their crop yields and at the same time conserving water.

- Also, government institutions that develop modern irrigation systems and infuse more irrigation infrastructure could also be a factor that enhance the implementation of micro irrigation systems in the region. While Asia Pacific is expected to show signs of its dominance in leading the total micro irrigation systems market worldwide, other regions may contribute as well in the near future.

- There are also the new technologies and innovations leading to increase of micro irrigation systems which contribute to the market to have more control in the Asia Pacific region.

- Developers among them as combining this technique with sensors and automated controls, enabling farmers to remotely check on and manage water use, are putting forth smart irrigation systems. This integration of technology not only increases the involvement of technologies in irrigation which leads to an improved performance of irrigation practice but also provides labor cost and productivity increase.

- Therefore, the rising use of precision agriculture alongside the government policy support for sustainable water management is fundamental in providing a fertile environment for the extension of micro irrigation system market in Asia Pacific. The territory is undisputedly holding the top spot and is fully in control of the global business environment during the forecast period.

Active Key Players in the Micro Irrigation System Market

- Jain Irrigation Systems Ltd. (India)

- The Toro Company (U.S.)

- Rain Bird Corporation (U.S.)

- HUNTER INDUSTRIES (U.S.)

- Lindsay Corporation (U.S.)

- Mahindra (India)

- NETAFIM (Israel)

- Chinadrip Irrigation Equipment Co., Ltd. (China)

- Rivulis (Israel)

- HARVEL AGUA INDIA PRIVATE LIMITED (India)

- Deere & Company. (U.S.)

- HARVEL AGUA INDIA PRIVATE LIMITED (India)

- Antelco (en-AU). (Australia)

- Kothari Agritech Private Limited (India)

- Other Key Players

Key Industry Developments in the Micro Irrigation System Market

- In April 2023, Rain Bird Corporation and Flume collaborate to develop Next Gen water management and data solutions.

- In March 2023, Netafim opened its first manufacturing plant in North Africa to support precision irrigation in Morocco and promote food security.

|

Global Micro Irrigation System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.0 Bn. |

|

Forecast Period 2024-32 CAGR: |

10 % |

Market Size in 2032: |

USD 23.01 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Cultivation Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- MICRO IRRIGATION SYSTEM MARKET BY TYPE (2017-2032)

- MICRO IRRIGATION SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DRIP IRRIGATION SYSTEM

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SPRINKLER IRRIGATION SYSTEM

- OTHER IRRIGATION SYSTEMS

- MICRO IRRIGATION SYSTEM MARKET BY CULTIVATION TYPE (2017-2032)

- MICRO IRRIGATION SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- OPEN FIELD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PROTECTED CULTIVATION

- MICRO IRRIGATION SYSTEM MARKET BY APPLICATION (2017-2032)

- MICRO IRRIGATION SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FIELD CROPS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ORCHARDS & VINEYARDS

- VEGETABLES

- PLANTATION CROPS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Luxury Goods Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- JAIN IRRIGATION SYSTEMS LTD. (INDIA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- THE TORO COMPANY (U.S.)

- RAIN BIRD CORPORATION (U.S.)

- HUNTER INDUSTRIES (U.S.)

- LINDSAY CORPORATION (U.S.)

- MAHINDRA (INDIA)

- NETAFIM (ISRAEL)

- CHINADRIP IRRIGATION EQUIPMENT CO., LTD. (CHINA)

- RIVULIS (ISRAEL)

- HARVEL AGUA INDIA PRIVATE LIMITED (INDIA)

- DEERE & COMPANY. (U.S.)

- HARVEL AGUA INDIA PRIVATE LIMITED (INDIA)

- ANTELCO (EN-AU). (AUSTRALIA)

- KOTHARI AGRITECH PRIVATE LIMITED (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL MICRO IRRIGATION SYSTEM MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Cultivation Type

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Micro Irrigation System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.0 Bn. |

|

Forecast Period 2024-32 CAGR: |

10 % |

Market Size in 2032: |

USD 23.01 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Cultivation Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MICRO IRRIGATION SYSTEM MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MICRO IRRIGATION SYSTEM MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MICRO IRRIGATION SYSTEM MARKET COMPETITIVE RIVALRY

TABLE 005. MICRO IRRIGATION SYSTEM MARKET THREAT OF NEW ENTRANTS

TABLE 006. MICRO IRRIGATION SYSTEM MARKET THREAT OF SUBSTITUTES

TABLE 007. MICRO IRRIGATION SYSTEM MARKET BY TYPE

TABLE 008. DRIP IRRIGATION SYSTEM MARKET OVERVIEW (2016-2028)

TABLE 009. SPRINKLER IRRIGATION SYSTEM MARKET OVERVIEW (2016-2028)

TABLE 010. OTHER IRRIGATION SYSTEM MARKET OVERVIEW (2016-2028)

TABLE 011. MICRO IRRIGATION SYSTEM MARKET BY APPLICATION

TABLE 012. FIELD CROPS MARKET OVERVIEW (2016-2028)

TABLE 013. ORCHARDS & VINEYARDS MARKET OVERVIEW (2016-2028)

TABLE 014. VEGETABLES MARKET OVERVIEW (2016-2028)

TABLE 015. PLANTATION CROPS MARKET OVERVIEW (2016-2028)

TABLE 016. MICRO IRRIGATION SYSTEM MARKET BY CULTIVATION TYPE

TABLE 017. OPEN FIELD MARKET OVERVIEW (2016-2028)

TABLE 018. PROTECTED CULTIVATION MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA MICRO IRRIGATION SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 020. NORTH AMERICA MICRO IRRIGATION SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 021. NORTH AMERICA MICRO IRRIGATION SYSTEM MARKET, BY CULTIVATION TYPE (2016-2028)

TABLE 022. N MICRO IRRIGATION SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE MICRO IRRIGATION SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 024. EUROPE MICRO IRRIGATION SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 025. EUROPE MICRO IRRIGATION SYSTEM MARKET, BY CULTIVATION TYPE (2016-2028)

TABLE 026. MICRO IRRIGATION SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC MICRO IRRIGATION SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 028. ASIA PACIFIC MICRO IRRIGATION SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 029. ASIA PACIFIC MICRO IRRIGATION SYSTEM MARKET, BY CULTIVATION TYPE (2016-2028)

TABLE 030. MICRO IRRIGATION SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA MICRO IRRIGATION SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA MICRO IRRIGATION SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA MICRO IRRIGATION SYSTEM MARKET, BY CULTIVATION TYPE (2016-2028)

TABLE 034. MICRO IRRIGATION SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA MICRO IRRIGATION SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 036. SOUTH AMERICA MICRO IRRIGATION SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 037. SOUTH AMERICA MICRO IRRIGATION SYSTEM MARKET, BY CULTIVATION TYPE (2016-2028)

TABLE 038. MICRO IRRIGATION SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 039. HUNTER INDUSTRIES: SNAPSHOT

TABLE 040. HUNTER INDUSTRIES: BUSINESS PERFORMANCE

TABLE 041. HUNTER INDUSTRIES: PRODUCT PORTFOLIO

TABLE 042. HUNTER INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. NETAFIM: SNAPSHOT

TABLE 043. NETAFIM: BUSINESS PERFORMANCE

TABLE 044. NETAFIM: PRODUCT PORTFOLIO

TABLE 045. NETAFIM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. RIVULIS: SNAPSHOT

TABLE 046. RIVULIS: BUSINESS PERFORMANCE

TABLE 047. RIVULIS: PRODUCT PORTFOLIO

TABLE 048. RIVULIS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. RAIN BIRD: SNAPSHOT

TABLE 049. RAIN BIRD: BUSINESS PERFORMANCE

TABLE 050. RAIN BIRD: PRODUCT PORTFOLIO

TABLE 051. RAIN BIRD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. TORO: SNAPSHOT

TABLE 052. TORO: BUSINESS PERFORMANCE

TABLE 053. TORO: PRODUCT PORTFOLIO

TABLE 054. TORO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. JAIN IRRIGATION SYSTEMS: SNAPSHOT

TABLE 055. JAIN IRRIGATION SYSTEMS: BUSINESS PERFORMANCE

TABLE 056. JAIN IRRIGATION SYSTEMS: PRODUCT PORTFOLIO

TABLE 057. JAIN IRRIGATION SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. LINDSAY: SNAPSHOT

TABLE 058. LINDSAY: BUSINESS PERFORMANCE

TABLE 059. LINDSAY: PRODUCT PORTFOLIO

TABLE 060. LINDSAY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 061. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 062. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 063. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MICRO IRRIGATION SYSTEM MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MICRO IRRIGATION SYSTEM MARKET OVERVIEW BY TYPE

FIGURE 012. DRIP IRRIGATION SYSTEM MARKET OVERVIEW (2016-2028)

FIGURE 013. SPRINKLER IRRIGATION SYSTEM MARKET OVERVIEW (2016-2028)

FIGURE 014. OTHER IRRIGATION SYSTEM MARKET OVERVIEW (2016-2028)

FIGURE 015. MICRO IRRIGATION SYSTEM MARKET OVERVIEW BY APPLICATION

FIGURE 016. FIELD CROPS MARKET OVERVIEW (2016-2028)

FIGURE 017. ORCHARDS & VINEYARDS MARKET OVERVIEW (2016-2028)

FIGURE 018. VEGETABLES MARKET OVERVIEW (2016-2028)

FIGURE 019. PLANTATION CROPS MARKET OVERVIEW (2016-2028)

FIGURE 020. MICRO IRRIGATION SYSTEM MARKET OVERVIEW BY CULTIVATION TYPE

FIGURE 021. OPEN FIELD MARKET OVERVIEW (2016-2028)

FIGURE 022. PROTECTED CULTIVATION MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA MICRO IRRIGATION SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE MICRO IRRIGATION SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC MICRO IRRIGATION SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA MICRO IRRIGATION SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA MICRO IRRIGATION SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Micro Irrigation System Market research report is 2024-2032.

Jain Irrigation Systems Ltd. (India), The Toro Company (U.S.), Rain Bird Corporation (U.S.), HUNTER INDUSTRIES (U.S.), Lindsay Corporation (U.S.), Mahindra (India), NETAFIM (Israel), and Other Major Players.

The Micro Irrigation System Market is segmented into Type, Cultivation, Application and Region. By Type, the market is categorized into Drip Irrigation System, Sprinkler Irrigation System, and Other Irrigation System. By Cultivation, the market is categorized into Open Field, Protected Cultivation.By Application, the market is categorized into Field Crops, Orchards & Vineyards, Vegetables, Plantation Crops. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A micro irrigation system is a method of delivering precise amounts of water and nutrients directly to the root zone of plants, typically through drip irrigation or micro-sprinklers. Unlike traditional irrigation methods that flood entire fields, micro irrigation systems use a network of tubing, emitters, and other components to deliver water directly to the base of individual plants or along rows of crops. This targeted approach helps to minimize water wastage, reduce soil erosion, and improve crop yields by providing plants with the right amount of moisture and nutrients they need for optimal growth.

Micro Irrigation System Market Size Was Valued at USD 10.0 Billion in 2023, and is Projected to Reach USD 23.01 Billion by 2032, Growing at a CAGR of 10 % From 2024-2032.