Identity Analytics Market Synopsis

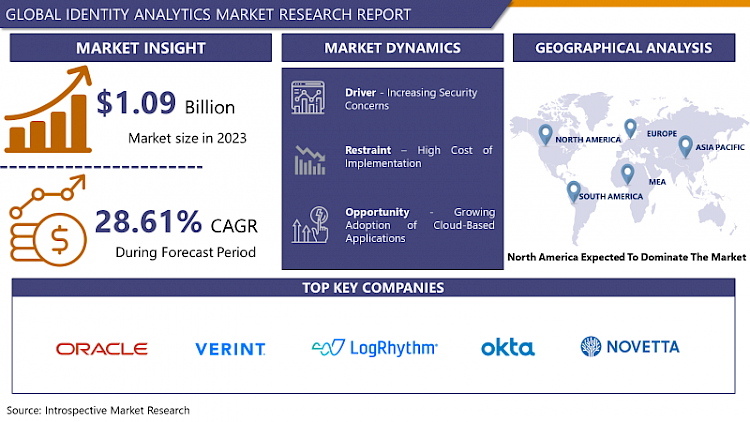

Identity Analytics Market Size Was Valued at USD 1.09 Billion in 2023, and is Projected to Reach USD 10.49 Billion by 2032, Growing at a CAGR of 28.61% From 2024-2032

Identity Analytics is a field of data analysis focused on understanding and managing digital identities within an organization. It involves examining patterns, behaviors, and attributes associated with user identities to detect anomalies, assess risks, and ensure compliance with security policies. By leveraging data from various sources, including authentication logs and user activity records, Identity Analytics helps organizations enhance security, streamline access management, and mitigate threats related to identity-based vulnerabilities.

- Identity analytics is a subset of identity and access management (IAM) that analyzes user behaviors and attributes to detect anomalies and potential security threats within an organization's network. It leverages advanced algorithms, machine learning, and data analysis techniques to scrutinize user activities, access patterns, and data usage across various systems and applications. By correlating vast amounts of identity-related data, identity analytics helps organizations identify unauthorized access attempts, insider threats, and other suspicious activities that could compromise their security posture.

- The Identity Analytics Market is a segment within the broader cybersecurity industry dedicated to providing solutions and services specifically tailored to identity analytics. This market encompasses a range of vendors offering diverse capabilities such as user behavior analytics (UBA), identity governance and administration (IGA), risk-based authentication, and privileged access management (PAM). These solutions aim to enhance organizations' ability to proactively detect and mitigate identity-related risks while ensuring compliance with regulatory requirements.

- The Identity Analytics Market includes the increasing adoption of cloud services, the proliferation of mobile devices, and the rising sophistication of cyber threats. Organizations across various sectors, including finance, healthcare, government, and retail, are recognizing the importance of bolstering their IAM capabilities with advanced analytics to safeguard sensitive data and mitigate the impact of security breaches.

- The Identity Analytics Market presents significant opportunities for organizations to strengthen their security posture and protect their digital assets in an increasingly interconnected and dynamic environment.

Identity Analytics Market Trend Analysis

Increasing Security Concerns

- Increasing security concerns are a driving factor behind the growth of the Identity Analytics Market due to several key reasons. As technology advances and becomes more integral to daily life and business operations, the threat landscape expands accordingly. Cyberattacks, data breaches, and identity theft are becoming more sophisticated and prevalent, necessitating robust identity management solutions.

- Identity analytics offer a proactive approach to security by leveraging advanced algorithms and machine learning techniques to analyze vast amounts of data and detect anomalies or suspicious activities associated with user identities. This proactive stance is crucial in mitigating risks and preventing potential security breaches before they occur.

- Moreover, regulatory requirements such as GDPR, CCPA, and others impose stringent guidelines on data protection and privacy, compelling organizations to implement robust identity management solutions to ensure compliance.

- The propagation of cloud computing, IoT devices, and remote work arrangements further underscores the importance of identity analytics in safeguarding sensitive data and resources across diverse digital environments.

- The rising security concerns coupled with regulatory pressures and evolving technology trends drive the demand for identity analytics solutions as organizations seek to fortify their cybersecurity posture and protect against emerging threats.

Growing Adoption of Cloud-Based Applications

- The growing adoption of cloud-based applications presents a significant opportunity for the Identity Analytics Market for several reasons. As businesses increasingly migrate their operations to the cloud, the complexity of managing user identities across various cloud platforms intensifies. Identity analytics solutions offer streamlined and centralized identity management, providing businesses with the ability to efficiently govern access to cloud-based applications.

- The distributed nature of cloud environments makes traditional perimeter-based security measures less effective. Identity analytics solutions leverage advanced analytics and machine learning algorithms to detect unusual access patterns and potential security threats in real time, enhancing overall security posture in cloud environments.

- Moreover, the scalability and flexibility of cloud-based identity analytics solutions make them well-suited for businesses of all sizes. Small and medium enterprises, in particular, can benefit from the cost-effective nature of cloud deployments, allowing them to access sophisticated identity analytics capabilities without significant upfront investments in infrastructure.

- The increasing adoption of cloud-based applications amplifies the need for robust identity analytics solutions to effectively manage identities, enhance security, and adapt to evolving business needs, thereby presenting a lucrative opportunity for the Identity Analytics Market.

Identity Analytics Market Segment Analysis:

Identity Analytics Market Segmented based on Component Type, Deployment, End-user.

By Component Type, Solutions segment is expected to dominate the market during the forecast period

- The Solutions segment encompasses a range of integrated tools, platforms, and services tailored to specific organizational requirements. These offerings provide end-to-end solutions, from data collection and analysis to actionable insights and decision-making support. Additionally, Solutions often incorporate advanced technologies such as machine learning, AI, and predictive analytics, enhancing their effectiveness in identity analytics.

- By offering customizable solutions that can adapt to evolving security threats and regulatory requirements, this segment appeals to a broad spectrum of businesses seeking robust identity management solutions. Furthermore, the Solutions segment typically provides seamless integration with existing IT infrastructures, reducing implementation barriers and accelerating adoption rates. Overall, the comprehensive and adaptable nature of Solutions positions this segment as the dominant force in the identity analytics market, catering to the diverse needs of organizations worldwide.

By Deployment, Cloud segment held the largest share of 62.45% in 2022

- The cloud-based solutions offer scalability, allowing businesses to easily expand their identity analytics capabilities as their needs grow. Secondly, cloud deployments typically require lower upfront investment and offer more flexible pricing models, making them attractive to organizations of all sizes. Additionally, cloud-based identity analytics solutions often come with built-in security features and compliance measures, providing reassurance to businesses concerned about data protection.

- Furthermore, cloud deployments enable seamless integration with other cloud-based services and applications, enhancing interoperability and overall efficiency. Lastly, the accessibility of cloud-based solutions allows for easier deployment across geographically dispersed teams, facilitating collaboration and knowledge sharing. Collectively, these advantages position cloud deployment as the dominant choice in the identity analytics market, driving its widespread adoption among businesses seeking to leverage the power of data-driven insights while maximizing operational agility and cost-effectiveness.

Identity Analytics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America's dominance in the identity analytics market is attributable to several key factors. The region boasts a highly developed technological infrastructure, providing a fertile ground for the adoption of identity analytics solutions. Major tech hubs like Silicon Valley attract top talent and investment, and innovation in the field.

- Moreover, stringent regulatory frameworks such as GDPR and CCPA have compelled organizations to prioritize identity management and data security, driving demand for advanced analytics solutions. North American enterprises, particularly in sectors like finance, healthcare, and e-commerce, are increasingly investing in robust identity analytics platforms to mitigate security risks and ensure compliance.

- Additionally, the region's large-scale enterprises have significant data volumes and diverse user bases, making effective identity analytics imperative for maintaining operational efficiency and safeguarding against cyber threats.

- Furthermore, North America benefits from a mature vendor ecosystem comprising established players and startups, offering a wide array of identity analytics solutions tailored to various industry needs. This competitive landscape fosters innovation and drives continuous advancements in the field.

Identity Analytics Market Top Key Players:

- Oracle (US)

- Verint Systems (US)

- LogRhythm (US)

- Okta (US)

- Novetta (US)

- Prolifics (US)

- NetOwl (US)

- Anomalix (US)

- Quantum Secure (US)

- SailPoint Technologies (US)

- NetIQ (US)

- Gurucul (US)

- Centrify (US)

- One Identity (US)

- Confluxsys (US)

- ID Analytics (US)

- Evidian (US)

- Hitachi ID Systems (Canada)

- IDAX Software (UK)

- Brainwave GRC (France)

- Nexis GmbH (Germany)

- Traxion (Netherlands)

- Happiest Minds (India), and other major players.

Key Industry Developments in the Identity Analytics Market:

- In February 2024, Cisco Systems announced the launch of Cisco Identity Intelligence at Cisco Live EMEA in Amsterdam, enhancing its Security Cloud with a focus on identity as a critical attack surface. Jeetu Patel, EVP and GM of Security and Collaboration emphasized the integration of identity, networking, and security as essential for robust business protection. This strategic expansion into identity intelligence aims to address vulnerabilities exposed by recent significant breaches, positioning identity as the new security perimeter.

- In August 2022, Gurucul, a supplier of identity and access analytics, XDR, UEBA, and next-generation SIEM, announced enhanced multi-cloud deployments, cross-cloud compatibility with all major cloud stacks, including Amazon, and extended support for poly-cloud architectures. These new cross-cloud capabilities offer sophisticated linking, correlation,and behavior baselines on access and activity across cloud environments in addition to deployment support.

- In June 2022, Oracle Corporation announced Oracle Access Governance, which would enhance overall security value and risk reduction through access reviews. This is accomplished mostly by a strong focus on usability, which is driven by powerful analytics. The study concludes with a normative suggestion for the impacts of each validation task.

|

Global Identity Analytics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.09 Bn. |

|

Forecast Period 2024-32 CAGR: |

28.61 % |

Market Size in 2032: |

USD 10.49 Bn. |

|

Segments Covered: |

By Component Type |

|

|

|

By Deployment |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- IDENTITY ANALYTICS MARKET BY COMPONENT TYPE (2017-2032)

- IDENTITY ANALYTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOLUTIONS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SERVICES

- IDENTITY ANALYTICS MARKET BY DEPLOYMENT (2017-2032)

- IDENTITY ANALYTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ON-PREMISE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CLOUD

- IDENTITY ANALYTICS MARKET BY END-USER (2017-2032)

- IDENTITY ANALYTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- IT AND TELECOMMUNICATION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BFSI

- GOVERNMENT

- RETAIL & CONSUMER

- HEALTHCARE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Identity Analytics Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ORACLE (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- VERINT SYSTEMS (US)

- LOGRHYTHM (US)

- OKTA (US)

- NOVETTA (US)

- PROLIFICS (US)

- NETOWL (US)

- ANOMALIX (US)

- QUANTUM SECURE (US)

- SAILPOINT TECHNOLOGIES (US)

- NETIQ (US)

- GURUCUL (US)

- CENTRIFY (US)

- ONE IDENTITY (US)

- CONFLUXSYS (US)

- ID ANALYTICS (US)

- EVIDIAN (US)

- HITACHI ID SYSTEMS (CANADA)

- IDAX SOFTWARE (UK)

- BRAINWAVE GRC (FRANCE)

- NEXIS GMBH (GERMANY)

- TRAXION (NETHERLANDS)

- HAPPIEST MINDS (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL IDENTITY ANALYTICS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Component Type

- Historic And Forecasted Market Size By Deployment

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Identity Analytics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.09 Bn. |

|

Forecast Period 2024-32 CAGR: |

28.61 % |

Market Size in 2032: |

USD 10.49 Bn. |

|

Segments Covered: |

By Component Type |

|

|

|

By Deployment |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. IDENTITY ANALYTICS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. IDENTITY ANALYTICS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. IDENTITY ANALYTICS MARKET COMPETITIVE RIVALRY

TABLE 005. IDENTITY ANALYTICS MARKET THREAT OF NEW ENTRANTS

TABLE 006. IDENTITY ANALYTICS MARKET THREAT OF SUBSTITUTES

TABLE 007. IDENTITY ANALYTICS MARKET BY TYPE

TABLE 008. ON-PREMISE MARKET OVERVIEW (2016-2028)

TABLE 009. CLOUD-BASED MARKET OVERVIEW (2016-2028)

TABLE 010. IDENTITY ANALYTICS MARKET BY APPLICATION

TABLE 011. APPLICATION A MARKET OVERVIEW (2016-2028)

TABLE 012. APPLICATION B MARKET OVERVIEW (2016-2028)

TABLE 013. APPLICATION C MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA IDENTITY ANALYTICS MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA IDENTITY ANALYTICS MARKET, BY APPLICATION (2016-2028)

TABLE 016. N IDENTITY ANALYTICS MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE IDENTITY ANALYTICS MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE IDENTITY ANALYTICS MARKET, BY APPLICATION (2016-2028)

TABLE 019. IDENTITY ANALYTICS MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC IDENTITY ANALYTICS MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC IDENTITY ANALYTICS MARKET, BY APPLICATION (2016-2028)

TABLE 022. IDENTITY ANALYTICS MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA IDENTITY ANALYTICS MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA IDENTITY ANALYTICS MARKET, BY APPLICATION (2016-2028)

TABLE 025. IDENTITY ANALYTICS MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA IDENTITY ANALYTICS MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA IDENTITY ANALYTICS MARKET, BY APPLICATION (2016-2028)

TABLE 028. IDENTITY ANALYTICS MARKET, BY COUNTRY (2016-2028)

TABLE 029. ORACLE: SNAPSHOT

TABLE 030. ORACLE: BUSINESS PERFORMANCE

TABLE 031. ORACLE: PRODUCT PORTFOLIO

TABLE 032. ORACLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. VERINT SYSTEMS: SNAPSHOT

TABLE 033. VERINT SYSTEMS: BUSINESS PERFORMANCE

TABLE 034. VERINT SYSTEMS: PRODUCT PORTFOLIO

TABLE 035. VERINT SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. SYMANTEC: SNAPSHOT

TABLE 036. SYMANTEC: BUSINESS PERFORMANCE

TABLE 037. SYMANTEC: PRODUCT PORTFOLIO

TABLE 038. SYMANTEC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. LOGRHYTHM: SNAPSHOT

TABLE 039. LOGRHYTHM: BUSINESS PERFORMANCE

TABLE 040. LOGRHYTHM: PRODUCT PORTFOLIO

TABLE 041. LOGRHYTHM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. HAPPIEST MINDS: SNAPSHOT

TABLE 042. HAPPIEST MINDS: BUSINESS PERFORMANCE

TABLE 043. HAPPIEST MINDS: PRODUCT PORTFOLIO

TABLE 044. HAPPIEST MINDS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. GURUCUL: SNAPSHOT

TABLE 045. GURUCUL: BUSINESS PERFORMANCE

TABLE 046. GURUCUL: PRODUCT PORTFOLIO

TABLE 047. GURUCUL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. QUANTUM SECURE: SNAPSHOT

TABLE 048. QUANTUM SECURE: BUSINESS PERFORMANCE

TABLE 049. QUANTUM SECURE: PRODUCT PORTFOLIO

TABLE 050. QUANTUM SECURE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. HITACHI ID SYSTEMS: SNAPSHOT

TABLE 051. HITACHI ID SYSTEMS: BUSINESS PERFORMANCE

TABLE 052. HITACHI ID SYSTEMS: PRODUCT PORTFOLIO

TABLE 053. HITACHI ID SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. SAILPOINT TECHNOLOGIES: SNAPSHOT

TABLE 054. SAILPOINT TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 055. SAILPOINT TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 056. SAILPOINT TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. CENTRIFY: SNAPSHOT

TABLE 057. CENTRIFY: BUSINESS PERFORMANCE

TABLE 058. CENTRIFY: PRODUCT PORTFOLIO

TABLE 059. CENTRIFY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. ANOMALIX: SNAPSHOT

TABLE 060. ANOMALIX: BUSINESS PERFORMANCE

TABLE 061. ANOMALIX: PRODUCT PORTFOLIO

TABLE 062. ANOMALIX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. ONE IDENTITY: SNAPSHOT

TABLE 063. ONE IDENTITY: BUSINESS PERFORMANCE

TABLE 064. ONE IDENTITY: PRODUCT PORTFOLIO

TABLE 065. ONE IDENTITY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. EVIDIAN: SNAPSHOT

TABLE 066. EVIDIAN: BUSINESS PERFORMANCE

TABLE 067. EVIDIAN: PRODUCT PORTFOLIO

TABLE 068. EVIDIAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. BRAINWAVE GRC: SNAPSHOT

TABLE 069. BRAINWAVE GRC: BUSINESS PERFORMANCE

TABLE 070. BRAINWAVE GRC: PRODUCT PORTFOLIO

TABLE 071. BRAINWAVE GRC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. NEXIS GMBH: SNAPSHOT

TABLE 072. NEXIS GMBH: BUSINESS PERFORMANCE

TABLE 073. NEXIS GMBH: PRODUCT PORTFOLIO

TABLE 074. NEXIS GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. CONFLUXSYS: SNAPSHOT

TABLE 075. CONFLUXSYS: BUSINESS PERFORMANCE

TABLE 076. CONFLUXSYS: PRODUCT PORTFOLIO

TABLE 077. CONFLUXSYS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. IDAX SOFTWARE: SNAPSHOT

TABLE 078. IDAX SOFTWARE: BUSINESS PERFORMANCE

TABLE 079. IDAX SOFTWARE: PRODUCT PORTFOLIO

TABLE 080. IDAX SOFTWARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. NETIQ: SNAPSHOT

TABLE 081. NETIQ: BUSINESS PERFORMANCE

TABLE 082. NETIQ: PRODUCT PORTFOLIO

TABLE 083. NETIQ: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. OKTA: SNAPSHOT

TABLE 084. OKTA: BUSINESS PERFORMANCE

TABLE 085. OKTA: PRODUCT PORTFOLIO

TABLE 086. OKTA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. NOVETTA: SNAPSHOT

TABLE 087. NOVETTA: BUSINESS PERFORMANCE

TABLE 088. NOVETTA: PRODUCT PORTFOLIO

TABLE 089. NOVETTA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. NETOWL: SNAPSHOT

TABLE 090. NETOWL: BUSINESS PERFORMANCE

TABLE 091. NETOWL: PRODUCT PORTFOLIO

TABLE 092. NETOWL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. THREATMETRIX: SNAPSHOT

TABLE 093. THREATMETRIX: BUSINESS PERFORMANCE

TABLE 094. THREATMETRIX: PRODUCT PORTFOLIO

TABLE 095. THREATMETRIX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. VENAFI: SNAPSHOT

TABLE 096. VENAFI: BUSINESS PERFORMANCE

TABLE 097. VENAFI: PRODUCT PORTFOLIO

TABLE 098. VENAFI: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. IDENTITY ANALYTICS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. IDENTITY ANALYTICS MARKET OVERVIEW BY TYPE

FIGURE 012. ON-PREMISE MARKET OVERVIEW (2016-2028)

FIGURE 013. CLOUD-BASED MARKET OVERVIEW (2016-2028)

FIGURE 014. IDENTITY ANALYTICS MARKET OVERVIEW BY APPLICATION

FIGURE 015. APPLICATION A MARKET OVERVIEW (2016-2028)

FIGURE 016. APPLICATION B MARKET OVERVIEW (2016-2028)

FIGURE 017. APPLICATION C MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA IDENTITY ANALYTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE IDENTITY ANALYTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC IDENTITY ANALYTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA IDENTITY ANALYTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA IDENTITY ANALYTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Identity Analytics Market research report is 2024-2032.

Oracle (US), Verint Systems (US), LogRhythm (US), Okta (US), Novetta (US), Prolifics (US), NetOwl (US), Anomalix (US), Quantum Secure (US), SailPoint Technologies (US), NetIQ (US), Gurucul (US), Centrify (US), One Identity (US), Confluxsys (US), ID Analytics (US), Evidian (US), Hitachi ID Systems (Canada), IDAX Software (UK), Brainwave GRC (France), Nexis GmbH (Germany), Traxion (Netherlands), Happiest Minds (India), and Other Major Players.

The Identity Analytics Market is segmented into Component Type, Deployment, End-User, and region. By Component Type, the market is categorized into Solutions, and Services. By Deployment, the market is categorized into On-Premise, and Cloud. By End-User, the market is categorized into IT and Telecommunication, BFSI, Government, Retail & Consumer, and Healthcare. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Identity Analytics is a field of data analysis focused on understanding and managing digital identities within an organization. It involves examining patterns, behaviors, and attributes associated with user identities to detect anomalies, assess risks, and ensure compliance with security policies. By leveraging data from various sources, including authentication logs and user activity records, Identity Analytics helps organizations enhance security, streamline access management, and mitigate threats related to identity-based vulnerabilities.

Identity Analytics Market Size Was Valued at USD 1.09 Billion in 2023, and is Projected to Reach USD 10.49 Billion by 2032, Growing at a CAGR of 28.61% From 2024-2032