FM Software Market Synopsis

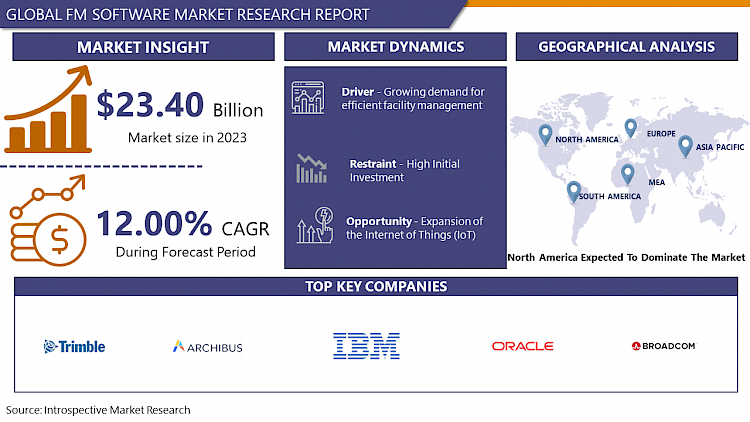

FM Software Market Size Was Valued at USD 23.40 Billion in 2023, and is Projected to Reach USD 57.95 Billion by 2032, Growing at a CAGR of 12.00% From 2024-2032

The facility management software, otherwise known as FS, exists as a special tool used by organizations to their operations in the aspect of facilities, assets, and maintenance. The health of buildings usually consists of these maintenance scheduling functions namely asset tracking, space management, and the reporting. FM software is a tool of facilities management which is used to streamline operations, meanwhile reduce costs, and achieve facilities compliance by eliminating non-compliance.

- Finger prints mobile biometric (FM) software market is the main cause of leading the finger print mobile biometrics market likely due to the increasing mobile device adoption of finger recognition technology. Because it offers to users authentication which is secure and convenient on the other hand, fingerprint recognition is included in the smartphones, tablets, and all other mobile devices.

- The mass respond to fears for privacy and security has also played a role in the implementation of FC software as it continues to gain popularity. Additionally, the rise of e-commerce, mobile finance, and mobile payments in the market has reinforced the demand of biometric authentication systems as a solution of detecting via fingerprint recognition.

- Furthermore, there is a synergy between FM software and other technical developments such as improved accuracy, velocity, and integration simplicity, the development of which together have resulted in the growth of the FM market. As we are constantly seeing the mobile devices becoming more and more sophisticated in their biological sensor functions, this trend is going to lead to the further growth of the FM software market.

FM Software Market Trend Analysis

The Convergence of IoT and AI in FM Software, Enhancing Predictive Maintenance and Energy Efficiency

- Integration of IoT and AI: In this way, FM software becomes a means to facilitate predictive maintenance, energy management, and space utilization optimization by taking in data from IoT sensors and employing AI.

- In recent time, more and more facilities have adopted a cloud-based solution option for facility management (FM), which enables the provision of advanced cloud-based facilities management for distributed facilities with the bonus of flexibility, scalability and remote accessibility.

- The growth of mobile application of the facility management (FM) software gives facility managers the ability to vaccinate and supervise facilities from everywhere, encouraging a prompt and easy response and operations.

- Noticing infirm blocks, there is a growing demand for the performance of data analytics as well as generation and submission of reports in the software. The features of advanced meteorological sensors cover not only the data flow in real time but they can also provide the access to historical metrics.

- Sustainability and Energy Efficiency: The function of enterprise software is focused on helping firms in reaching their environmental targets and minimizing the expenses. This goal is pursued through integration of sustainability and energy efficiency functions.

Governments Drive Demand, The Role of FM Software in Identity Verification and Access Control

- The use of biometrics as a method of authentication is on the rise in mobile device and software due to the rise in digital transactions and the desire to have foolproof modes of authentication. Fingerprint recognition is sure one of the biometric technologies that has been utilized or used.

- A number of nations are taking up the roles of movers & shakers by implementing biometrics technology to manage access control, identity verification, and border control; thereby a great aspect behind the development & demand for FM software is its convenience.

- The rise of mobile payment and banking services adoption comes with secure biometric authentication methods such as fingerprint as crucial enablers, hence.

- As the cyber threats are getting more and more complex the security issues start to grow, so it is necessary to provide authentication methods which do not available to hackers. Upload authentification by fingerprint recognition is held a reasonable and secure process.

- Increased precision and speed in fingerprint recognition technology, which reduces the complexity and improves accuracy of the transaction, is leading to the free market to include new processing functions and support more diverse customer base.

- At present, the joining of FM software with artificial intelligence (AI) techniques and Internet of Things (IoT) devices is changing the opportunities for all types of health, intelligent living and many other industries.

- The wave of these regulatory requirements is becoming a powerful driver behind the massive implementation of FM protocols associated with security in finance and healthcare into other sectors.

FM Software Market Segment Analysis:

FM Software Market is Segmented on the basis of type, Deployment, Enterprise size and Industry.

By Type, Integrated Software segment is expected to dominate the market during the forecast period

- There are two different types of FMs, the ones designed to control plant and facilities, and the ones designed to look after the contents and people. In this classification, segmentation consists of such segments as healthcare facilities, educational spaces, government places, commercial offices and manufacturing facilities, etc. A few of them (i.e., each segment) may have their bespoke specification and dash, which is relevant for their needs. As an illustration, hospitals/medical institutions can require functionality related to patient health and regulatory compliance, and educational institutions may need solutions for course management and student services.

- Whether it is government buildings with specific security and regulatory norms or commercial offices that are keen on space management and employee productivity, designer is always cognizant of the needs and requirements of each client. The same applies for manufacturing factories in terms of the specialties like featuring the equipment maintenance and the production scheduling. Through the provision of either stand-alone applications or particular requirements modules, FM software developers can tailor their offerings to be more pertinent and important for their customers needs in a specific way.

By Deployment, Cloud based segment held the largest share in 2023

- FM software deployment can be categorized into two main types: Concurrently, companies are shifting from on-premises and cloud-based solutions. In case of on-premises solutions the software is installed on the company computers and edited/managed by the internal IT team. In contrast, the cloud-based solutions fed and buried by the providers are an internet access tool for the users to use them.

- This segregation is the function of the portfolio being selected by the organization or the mode of managing them. In the case of on-premises systems, the organization has more power and freedom for individual modification, but it is more challenging to manage them that require to allocate more resources. Different than Cloud-based solutions which are offering scalability, ease of access, and a lower IT overhead, therefore, they can compete with organizations expecting to spend less of money and more make flexible solutions.

FM Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Currently the North American market for FM (Facility Management) software is flourishing and is very fluent. Diversification is the key characteristic attributing to the industry providing a variety of software solutions, such as asset management, maintenance management, space management and sustainability management and many others.

- Among of the notable stimulate for North American FM software market is the increasing number of firms that embrace innovations to boost operation productivity and minimize inefficiencies. Both large corporations and small businesses employ the FM software as it may help their companies in cutting costs and using resources more rationally. Moreover, due to the progress in technology it is also possible to increase the level of services’ delivery.

- The other most important trend which a platform for media management software in North America is enjoying is the fulfilment of the growing demand for integrated and cloud-based solutions. The aggregation of individual software apps into a single internet interface, which features a combined set of functions for managing infrastructure, is now in trend, as it represents an all-rounded approach to facility management. Moreover, the cloud-based alternatives are have the potential to scale, adapt to changes, low cost of initial setup.

- Both the USA and Canada are seeing a rapid rise in the software field aimed at the provision of FM services via mobile applications. Featured apps can connect facility managers to real-time data, help to locate assets, process work orders, and communicate with colleagues anywhere using a mobile device, further increasing productivity.

Active Key Players in the FM Software Market

- IBM (United States)

- Broadcom (CA Technologies) (United States)

- Oracle Corporation (United States)

- SAP SE (Germany)

- Archibus (United States)

- Trimble (United States)

- Accruent (United States)

- Planon (Netherlands)

- FM Systems (United States)

- iOffice (United States), and Others

Key Industry Developments in the FM Software Market:

- On September 2022 Autodesk has disclosed its intention to acquire facilities management company IOFFICE, which recently merged with SpaceIQ. The organization focuses primarily on digital transformation of workspaces and asset management.

- On April 2022 Global software company VertiGIS has announced the acquisition of KMS Computer Gmbh, a German software company. Additionally, VertiGIS is placing a significant emphasis on the global expansion of its product portfolio.

|

Global FM Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2024 |

Market Size in 2023: |

USD 23.40 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.00 % |

Market Size in 2032: |

USD 57.95 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment Type |

|

||

|

By Enterprise Size |

|

||

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- FM SOFTWARE MARKET BY TYPE (2017-2032)

- FM SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- INTEGRATED SOFTWARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- STANDALONE SOFTWARE

- FM SOFTWARE MARKET BY DEPLOYMENT TYPE (2017-2032)

- FM SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ON-PREMISES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- STANDALONE SOFTWARE

- FM SOFTWARE MARKET BY ENTERPRISE SIZE (2017-2032)

- FM SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SMALL AND MID-SIZED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LARGE ENTERPRISE

- FM SOFTWARE MARKET BY INDUSTRY (2017-2032)

- FM SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HEALTHCARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TRAVEL & MANUFACTURING

- MANUFACTURING

- EDUCATION

- TRANSPORTATION & LOGISTICS

- GOVERNMENT

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- FM SOFTWARE Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- IBM (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BROADCOM (CA TECHNOLOGIES) (UNITED STATES)

- ORACLE CORPORATION (UNITED STATES)

- SAP SE (GERMANY)

- ARCHIBUS (UNITED STATES)

- TRIMBLE (UNITED STATES)

- ACCRUENT (UNITED STATES)

- PLANON (NETHERLANDS)

- FM SYSTEMS (UNITED STATES)

- IOFFICE (UNITED STATES)

- COMPETITIVE LANDSCAPE

- GLOBAL FM SOFTWARE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Deployment Type

- Historic And Forecasted Market Size By Enterprise Size

- Historic And Forecasted Market Size By Industry

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global FM Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2024 |

Market Size in 2023: |

USD 23.40 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.00 % |

Market Size in 2032: |

USD 57.95 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment Type |

|

||

|

By Enterprise Size |

|

||

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. FM SOFTWARE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. FM SOFTWARE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. FM SOFTWARE MARKET COMPETITIVE RIVALRY

TABLE 005. FM SOFTWARE MARKET THREAT OF NEW ENTRANTS

TABLE 006. FM SOFTWARE MARKET THREAT OF SUBSTITUTES

TABLE 007. FM SOFTWARE MARKET BY TYPE

TABLE 008. CLOUD BASED MARKET OVERVIEW (2016-2028)

TABLE 009. ON-PREMISES MARKET OVERVIEW (2016-2028)

TABLE 010. FM SOFTWARE MARKET BY APPLICATION

TABLE 011. BANKING MARKET OVERVIEW (2016-2028)

TABLE 012. MARKET OVERVIEW (2016-2028)

TABLE 013. FINANCIAL SERVICES AND INSURANCE (BFSI) MARKET OVERVIEW (2016-2028)

TABLE 014. MARKET OVERVIEW (2016-2028)

TABLE 015. IT AND TELECOM MARKET OVERVIEW (2016-2028)

TABLE 016. MARKET OVERVIEW (2016-2028)

TABLE 017. GOVERNMENT AND PUBLIC ADMINISTRATION MARKET OVERVIEW (2016-2028)

TABLE 018. MARKET OVERVIEW (2016-2028)

TABLE 019. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 020. MARKET OVERVIEW (2016-2028)

TABLE 021. EDUCATION MARKET OVERVIEW (2016-2028)

TABLE 022. MARKET OVERVIEW (2016-2028)

TABLE 023. RETAIL MARKET OVERVIEW (2016-2028)

TABLE 024. MARKET OVERVIEW (2016-2028)

TABLE 025. ENERGY AND UTILITIES MARKET OVERVIEW (2016-2028)

TABLE 026. MARKET OVERVIEW (2016-2028)

TABLE 027. MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 028. MARKET OVERVIEW (2016-2028)

TABLE 029. CONSTRUCTION AND REAL ESTATE MARKET OVERVIEW (2016-2028)

TABLE 030. NORTH AMERICA FM SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 031. NORTH AMERICA FM SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 032. N FM SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 033. EUROPE FM SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 034. EUROPE FM SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 035. FM SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 036. ASIA PACIFIC FM SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 037. ASIA PACIFIC FM SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 038. FM SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA FM SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA FM SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 041. FM SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 042. SOUTH AMERICA FM SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 043. SOUTH AMERICA FM SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 044. FM SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 045. IBM: SNAPSHOT

TABLE 046. IBM: BUSINESS PERFORMANCE

TABLE 047. IBM: PRODUCT PORTFOLIO

TABLE 048. IBM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. ORACLE: SNAPSHOT

TABLE 049. ORACLE: BUSINESS PERFORMANCE

TABLE 050. ORACLE: PRODUCT PORTFOLIO

TABLE 051. ORACLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. SAP: SNAPSHOT

TABLE 052. SAP: BUSINESS PERFORMANCE

TABLE 053. SAP: PRODUCT PORTFOLIO

TABLE 054. SAP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. ARCHIBUS: SNAPSHOT

TABLE 055. ARCHIBUS: BUSINESS PERFORMANCE

TABLE 056. ARCHIBUS: PRODUCT PORTFOLIO

TABLE 057. ARCHIBUS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. TRIMBLE: SNAPSHOT

TABLE 058. TRIMBLE: BUSINESS PERFORMANCE

TABLE 059. TRIMBLE: PRODUCT PORTFOLIO

TABLE 060. TRIMBLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. CA TECHNOLOGIES: SNAPSHOT

TABLE 061. CA TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 062. CA TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 063. CA TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. ACCRUENT: SNAPSHOT

TABLE 064. ACCRUENT: BUSINESS PERFORMANCE

TABLE 065. ACCRUENT: PRODUCT PORTFOLIO

TABLE 066. ACCRUENT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. PLANON: SNAPSHOT

TABLE 067. PLANON: BUSINESS PERFORMANCE

TABLE 068. PLANON: PRODUCT PORTFOLIO

TABLE 069. PLANON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. FM:SYSTEMS: SNAPSHOT

TABLE 070. FM:SYSTEMS: BUSINESS PERFORMANCE

TABLE 071. FM:SYSTEMS: PRODUCT PORTFOLIO

TABLE 072. FM:SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. IOFFICE: SNAPSHOT

TABLE 073. IOFFICE: BUSINESS PERFORMANCE

TABLE 074. IOFFICE: PRODUCT PORTFOLIO

TABLE 075. IOFFICE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. MAINTENANCE CONNECTION: SNAPSHOT

TABLE 076. MAINTENANCE CONNECTION: BUSINESS PERFORMANCE

TABLE 077. MAINTENANCE CONNECTION: PRODUCT PORTFOLIO

TABLE 078. MAINTENANCE CONNECTION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. MCS SOLUTIONS: SNAPSHOT

TABLE 079. MCS SOLUTIONS: BUSINESS PERFORMANCE

TABLE 080. MCS SOLUTIONS: PRODUCT PORTFOLIO

TABLE 081. MCS SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. JADETRACK: SNAPSHOT

TABLE 082. JADETRACK: BUSINESS PERFORMANCE

TABLE 083. JADETRACK: PRODUCT PORTFOLIO

TABLE 084. JADETRACK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. METRICSTREAM: SNAPSHOT

TABLE 085. METRICSTREAM: BUSINESS PERFORMANCE

TABLE 086. METRICSTREAM: PRODUCT PORTFOLIO

TABLE 087. METRICSTREAM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. FACILITIES MANAGEMENT EXPRESS: SNAPSHOT

TABLE 088. FACILITIES MANAGEMENT EXPRESS: BUSINESS PERFORMANCE

TABLE 089. FACILITIES MANAGEMENT EXPRESS: PRODUCT PORTFOLIO

TABLE 090. FACILITIES MANAGEMENT EXPRESS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. EMAINT: SNAPSHOT

TABLE 091. EMAINT: BUSINESS PERFORMANCE

TABLE 092. EMAINT: PRODUCT PORTFOLIO

TABLE 093. EMAINT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. HIPPO CMMS: SNAPSHOT

TABLE 094. HIPPO CMMS: BUSINESS PERFORMANCE

TABLE 095. HIPPO CMMS: PRODUCT PORTFOLIO

TABLE 096. HIPPO CMMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. APLEONA: SNAPSHOT

TABLE 097. APLEONA: BUSINESS PERFORMANCE

TABLE 098. APLEONA: PRODUCT PORTFOLIO

TABLE 099. APLEONA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. FSI: SNAPSHOT

TABLE 100. FSI: BUSINESS PERFORMANCE

TABLE 101. FSI: PRODUCT PORTFOLIO

TABLE 102. FSI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. INDUS SYSTEMS: SNAPSHOT

TABLE 103. INDUS SYSTEMS: BUSINESS PERFORMANCE

TABLE 104. INDUS SYSTEMS: PRODUCT PORTFOLIO

TABLE 105. INDUS SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 105. AUTODESK: SNAPSHOT

TABLE 106. AUTODESK: BUSINESS PERFORMANCE

TABLE 107. AUTODESK: PRODUCT PORTFOLIO

TABLE 108. AUTODESK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 108. NEMETSCHEK: SNAPSHOT

TABLE 109. NEMETSCHEK: BUSINESS PERFORMANCE

TABLE 110. NEMETSCHEK: PRODUCT PORTFOLIO

TABLE 111. NEMETSCHEK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 111. ARCHIDATA: SNAPSHOT

TABLE 112. ARCHIDATA: BUSINESS PERFORMANCE

TABLE 113. ARCHIDATA: PRODUCT PORTFOLIO

TABLE 114. ARCHIDATA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 114. OFFICESPACE: SNAPSHOT

TABLE 115. OFFICESPACE: BUSINESS PERFORMANCE

TABLE 116. OFFICESPACE: PRODUCT PORTFOLIO

TABLE 117. OFFICESPACE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 117. FACILITYONE TECHNOLOGIES: SNAPSHOT

TABLE 118. FACILITYONE TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 119. FACILITYONE TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 120. FACILITYONE TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. FM SOFTWARE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. FM SOFTWARE MARKET OVERVIEW BY TYPE

FIGURE 012. CLOUD BASED MARKET OVERVIEW (2016-2028)

FIGURE 013. ON-PREMISES MARKET OVERVIEW (2016-2028)

FIGURE 014. FM SOFTWARE MARKET OVERVIEW BY APPLICATION

FIGURE 015. BANKING MARKET OVERVIEW (2016-2028)

FIGURE 016. MARKET OVERVIEW (2016-2028)

FIGURE 017. FINANCIAL SERVICES AND INSURANCE (BFSI) MARKET OVERVIEW (2016-2028)

FIGURE 018. MARKET OVERVIEW (2016-2028)

FIGURE 019. IT AND TELECOM MARKET OVERVIEW (2016-2028)

FIGURE 020. MARKET OVERVIEW (2016-2028)

FIGURE 021. GOVERNMENT AND PUBLIC ADMINISTRATION MARKET OVERVIEW (2016-2028)

FIGURE 022. MARKET OVERVIEW (2016-2028)

FIGURE 023. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 024. MARKET OVERVIEW (2016-2028)

FIGURE 025. EDUCATION MARKET OVERVIEW (2016-2028)

FIGURE 026. MARKET OVERVIEW (2016-2028)

FIGURE 027. RETAIL MARKET OVERVIEW (2016-2028)

FIGURE 028. MARKET OVERVIEW (2016-2028)

FIGURE 029. ENERGY AND UTILITIES MARKET OVERVIEW (2016-2028)

FIGURE 030. MARKET OVERVIEW (2016-2028)

FIGURE 031. MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 032. MARKET OVERVIEW (2016-2028)

FIGURE 033. CONSTRUCTION AND REAL ESTATE MARKET OVERVIEW (2016-2028)

FIGURE 034. NORTH AMERICA FM SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. EUROPE FM SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 036. ASIA PACIFIC FM SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 037. MIDDLE EAST & AFRICA FM SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 038. SOUTH AMERICA FM SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the FM Software Market research report is 2024-2032.

IBM (United States), Broadcom (CA Technologies) (United States), Oracle Corporation (United States), SAP SE (Germany), Archibus (United States), Trimble (United States), Accruent (United States), Planon (Netherlands), FM Systems (United States), iOffice (United States), and others are key players in the Facility Management software market. and Other Major Players.

The FM Software Market is segmented into by Type (Integrated Software, Standalone Software) Deployment Mode (On Premises, Cloud based), Enterprise Size (Small and Mid-Sized), By Industry (Healthcare, Travel & Hospitality, Manufacturing, Education, Transportation & Logistics, Government, Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

FM software, or Facility Management software, is a tool that helps organizations manage their facilities, assets, and maintenance operations efficiently. It typically includes features such as maintenance scheduling, asset tracking, space management, and reporting. FM software is used to streamline facility operations, reduce costs, and ensure that facilities are well-maintained and compliant with regulations.

FM Software Market Size Was Valued at USD 23.40 Billion in 2023, and is Projected to Reach USD 57.95 Billion by 2032, Growing at a CAGR of 12.00% From 2024-2032.