Hydrophobic Coatings Market Synopsis

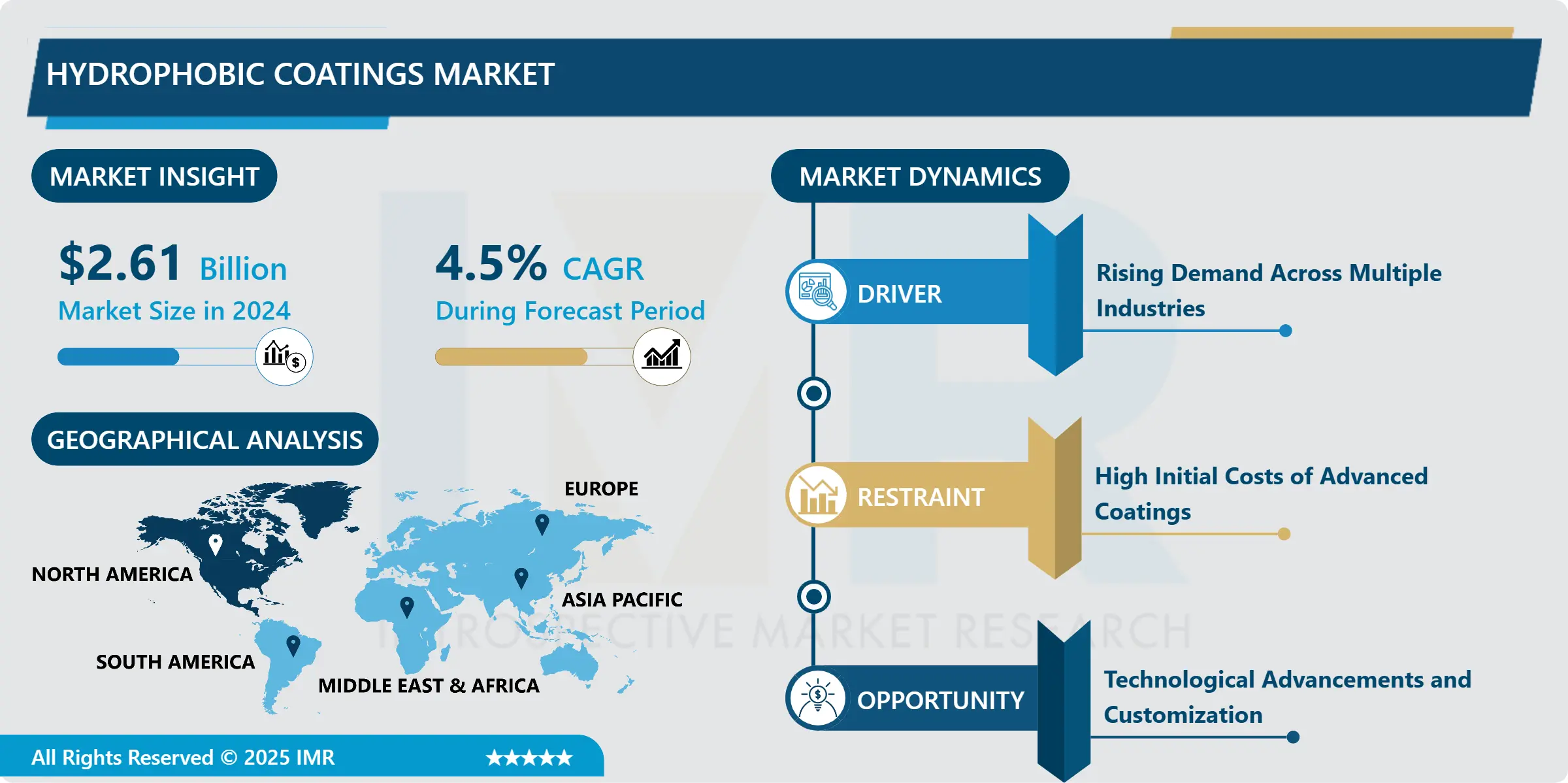

Hydrophobic Coatings Market Size Was Valued at USD 2.61 Billion in 2024, and is Projected to Reach USD 4.24 Billion by 2035, Growing at a CAGR of 4.5% From 2025-2035.

Hydrophobic coatings are concentrated, highly specific anti-adsorbent coatings to prevent water accumulation on surfaces, and the market mainly concerns such anti-adsorbent materials. These coatings work to an impediment of chemistries that fashion a surface which is hydrophobic in nature to reduce liquid wetting. Mainly used in automotive, construction, electronics, textile industries the hydrophobic coatings increase durability and the efficiency of several products through protection from corrosion, stains and microbial formation. This accounts by growing market knowledge of protective co films and increasing application of coating systems, development of nanotechnology, and rising carriage for high performance coatings in variety applications.

The market for hydrophobic coatings has expanded largely in recent years because of the growing demand for protective products in various industries. Hitherto, these coatings have simply been associated with technology and on the advancement in technology and formulation of novel coatings, they have become complex structures with enhanced functionality. Automotive for example use the hydrophobic coatings on wind screens and car surface to retain visibility during unfavourable weather conditions and also for protection against dirt on the surface. In the same way, in construction, hydrophobic coatings are used for facades and roofs because this helps to avoid water leaks, and hence increase the longevity of buildings and decrease costs for their maintenance.

Additionally, the electronics industry is presently on the demand for hydrophobic coatings as a way of minimizing the effects of moisture to offend the components hence causing short product lives. Nanotechnology has also played a key role when comes to improving and advancing the areas of hydrophobic coatings where it is possible to create the thinnest of layers with incredibly increased stability and improved performance parameters. With the growing concern for environmental issues and stricter environmental laws being implemented, sectors prefer using environmentally friendly hydrophobic coatings that will significantly drive the market growth. In conclusion, there are many opportunities for growth for hydrophobic coatings due to constant research, larger usability and greater adoption of moisture resistant technologies.

Hydrophobic Coatings Market Trend Analysis

Growing Adoption of Eco-Friendly Hydrophobic Coatings

- One of the most apparent trends characterizing the development of the hydrophobic coatings market is the focus on ecological and, therefore, non-harmful products. As customer and industrial consciousness regarding environmental impacts grows, it has become paramount for manufacturers to work on creating hydrophobic coatings with no toxic or biologically hazardous components and no noxious solvents. These changes not only allow company to be in compliance with the regulations but also provide an opportunity to respond to the increase demand for the green solutions in different fields. Biological and more environmentally friendly advancements in the fields of green chemistry and other bio based materials are leading to water repellent coatings that work effectively and are ecologically friendly. Meanwhile, people and companies are working to make their businesses more environmentally friendly; the demand for such technologies as applying hydrophobic coatings should increase in the years to come as the result, thus building a more sustainable future for the market.

Expansion in Emerging Markets

- There is a great potential for hydrophobic coatings in the emerging economies encouraged by high industrialization, urbanization, and exponential shift towards construction. Some of the major growth areas are in Asia-Pacific and Latin American nations undergoing construction, automotive and consumer product industries, thus requiring hi-pec coatings solutions. With development of industries in these regions, the application of surface protection coatings to improve performance and prolong service life of products is becoming more essential. Also, the demographics of these areas reveal that many people are advanced in their middle age and therefore their spending power increase, the middle-class population consumes quality products such as vehicles and electrical appliances, which are used hydrophobic coatings. Thus, occupying these emerging markets, manufacturers will be able to tap into new demand for hydrophobic products and thus scale their businesses and increase market share.

Hydrophobic Coatings Market Segment Analysis:

Hydrophobic Coatings Market Segmented on the basis of type, Material and Application.

By Type, Anti-corrosion segment is expected to dominate the market during the forecast period

- Among all the end-user applications of hydrophobic coatings, the global anti-corrosion segment is expected to hold the largest share in the hydrophobic coatings market throughout the forecast period due to the growing demand for protective materials across different industries. With ever increasing life capabilities of products, anti-corrosive coatings have been a necessity in holding off rust and dilapidation by moisture, chemical and physical influences. This segment is especially larger in automotive, aerospace, marine, and the construction industry where the metal parts are exposed to conditions that enhance corrosion.

- As more people become aware of the maintenance costs entailed when using corroded surfaces and with the current focus on improved sustainability, the global anti-corrosion hydrophobic coatings market is expected to receive an added boost. Furthermore, the existing coating technologies have been extent to cover high performance and environmentally sustainable solutions that satisfy the requirement of better corrosion protection standards by the manufacturers. Whether in vehicle manufacturing or other demands for durable finish and material stability, the anti-corrosion segment will remain the dominant player in the hydrophobic coatings market through the forecast period.

By Material, Polysiloxanes segment expected to held the largest share

- The polysiloxanes segment was identified to be the largest in 2018, owing to features inherent to these coatings and their applicability across industry sectors. Silicone based materials commonly known as polysiloxanes have remarkable thermal stability, hydrolysis and UV stability; property that makes them suitable to act as surface protectants in harsh conditions. Herein, material flexibility and resilience are highly valuable for automotive, construction, and electronics industries due to chemical characteristics. Moreover, polysiloxanes for their part possess superior water-repellent properties, ensuring that no water come into contact with the coated surface and introduce contaminants that wear away the coating and spoil the appearance of the coated substrate.

- The need for higher performing coatings which provide long-durable protection and thereby, stress-free protection also fuels the use of polysiloxanes. Further, current advancements in formulation technologies have seen the emergence of other superior polysiloxane coatings on the market making the substance more appealing to manufacturers. With industries expanding their understanding of the advantages of polysiloxane coatings this segment should remain at the forefront of the hydrophobic coatings industry.

Hydrophobic Coatings Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- According to the analysis conducted for this report in 2023, North America is the leading region in the hydrophobic coatings market with an approximate market share of 40%. This has been due to increased technological and industrial growth, well-equipped automotive industry and huge amounts of money spent on research. The United States is especially considered a prime consumer of hydrophobic coatings throughout numerous industries; the country is interested in implementing and improving its products due to its focus on innovations. Also, poor product quality and or performance regulation has forced producers to introduce hydrophobic coatings in order to meet the set standards. The hydrophobic coatings market is expected to remain dynamic in the coming decade as industries experiment with further advancements and consumers expand their requests for high-performance materials originating from North America.

Active Key Players in the Hydrophobic Coatings Market

- 3M Company (USA)

- AkzoNobel N.V. (Netherlands)

- Avery Dennison Corporation (USA)

- BASF SE (Germany)

- Clariant AG (Switzerland)

- E. I. du Pont de Nemours and Company (USA)

- Hempel A/S (Denmark)

- Hydron Protective Coatings (USA)

- Mitsubishi Chemical Corporation (Japan)

- Nanovere Technologies, LLC (USA)

- NeverWet (USA)

- P2i Ltd. (UK)

- Rust-Oleum Corporation (USA)

- SABIC (Saudi Arabia)

- Sto Corp. (USA) Other key Players

|

Global Hydrophobic Coatings Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.61 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.5% |

Market Size in 2035: |

USD 4.24 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Hydrophobic Coatings Market by Type (2018-2035)

4.1 Hydrophobic Coatings Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Anti-corrosion

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Anti-Microbial

4.5 Anti-Icing

4.6 Self –cleaning

4.7 Anti-fouling

4.8 Other

Chapter 5: Hydrophobic Coatings Market by Material (2018-2035)

5.1 Hydrophobic Coatings Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Polysiloxanes

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 FluoroAlkylsilanes

5.5 Fluoropolymers

5.6 Others

Chapter 6: Hydrophobic Coatings Market by Application (2018-2035)

6.1 Hydrophobic Coatings Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Building & construction

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Electronics

6.5 Automotive

6.6 Textiles

6.7 Consumer Goods

6.8 Medical & Healthcare

6.9 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Hydrophobic Coatings Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 3M COMPANY (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AKZONOBEL N.V. (NETHERLANDS)

7.4 AVERY DENNISON CORPORATION (USA)

7.5 BASF SE (GERMANY)

7.6 CLARIANT AG (SWITZERLAND)

7.7 E. I. DU PONT DE NEMOURS AND COMPANY (USA)

7.8 HEMPEL A/S (DENMARK)

7.9 HYDRON PROTECTIVE COATINGS (USA)

7.10 MITSUBISHI CHEMICAL CORPORATION (JAPAN)

7.11 NANOVERE TECHNOLOGIES

7.12 LLC (USA)

7.13 NEVERWET (USA)

7.14 P2I LTD. (UK)

7.15 RUST-OLEUM CORPORATION (USA)

7.16 SABIC (SAUDI ARABIA)

7.17 STO CORP. (USA)

7.18 OTHER KEY PLAYERS

7.19

Chapter 8: Global Hydrophobic Coatings Market By Region

8.1 Overview

8.2. North America Hydrophobic Coatings Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Anti-corrosion

8.2.4.2 Anti-Microbial

8.2.4.3 Anti-Icing

8.2.4.4 Self –cleaning

8.2.4.5 Anti-fouling

8.2.4.6 Other

8.2.5 Historic and Forecasted Market Size by Material

8.2.5.1 Polysiloxanes

8.2.5.2 FluoroAlkylsilanes

8.2.5.3 Fluoropolymers

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Building & construction

8.2.6.2 Electronics

8.2.6.3 Automotive

8.2.6.4 Textiles

8.2.6.5 Consumer Goods

8.2.6.6 Medical & Healthcare

8.2.6.7 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Hydrophobic Coatings Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Anti-corrosion

8.3.4.2 Anti-Microbial

8.3.4.3 Anti-Icing

8.3.4.4 Self –cleaning

8.3.4.5 Anti-fouling

8.3.4.6 Other

8.3.5 Historic and Forecasted Market Size by Material

8.3.5.1 Polysiloxanes

8.3.5.2 FluoroAlkylsilanes

8.3.5.3 Fluoropolymers

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Building & construction

8.3.6.2 Electronics

8.3.6.3 Automotive

8.3.6.4 Textiles

8.3.6.5 Consumer Goods

8.3.6.6 Medical & Healthcare

8.3.6.7 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Hydrophobic Coatings Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Anti-corrosion

8.4.4.2 Anti-Microbial

8.4.4.3 Anti-Icing

8.4.4.4 Self –cleaning

8.4.4.5 Anti-fouling

8.4.4.6 Other

8.4.5 Historic and Forecasted Market Size by Material

8.4.5.1 Polysiloxanes

8.4.5.2 FluoroAlkylsilanes

8.4.5.3 Fluoropolymers

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Building & construction

8.4.6.2 Electronics

8.4.6.3 Automotive

8.4.6.4 Textiles

8.4.6.5 Consumer Goods

8.4.6.6 Medical & Healthcare

8.4.6.7 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Hydrophobic Coatings Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Anti-corrosion

8.5.4.2 Anti-Microbial

8.5.4.3 Anti-Icing

8.5.4.4 Self –cleaning

8.5.4.5 Anti-fouling

8.5.4.6 Other

8.5.5 Historic and Forecasted Market Size by Material

8.5.5.1 Polysiloxanes

8.5.5.2 FluoroAlkylsilanes

8.5.5.3 Fluoropolymers

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Building & construction

8.5.6.2 Electronics

8.5.6.3 Automotive

8.5.6.4 Textiles

8.5.6.5 Consumer Goods

8.5.6.6 Medical & Healthcare

8.5.6.7 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Hydrophobic Coatings Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Anti-corrosion

8.6.4.2 Anti-Microbial

8.6.4.3 Anti-Icing

8.6.4.4 Self –cleaning

8.6.4.5 Anti-fouling

8.6.4.6 Other

8.6.5 Historic and Forecasted Market Size by Material

8.6.5.1 Polysiloxanes

8.6.5.2 FluoroAlkylsilanes

8.6.5.3 Fluoropolymers

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Building & construction

8.6.6.2 Electronics

8.6.6.3 Automotive

8.6.6.4 Textiles

8.6.6.5 Consumer Goods

8.6.6.6 Medical & Healthcare

8.6.6.7 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Hydrophobic Coatings Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Anti-corrosion

8.7.4.2 Anti-Microbial

8.7.4.3 Anti-Icing

8.7.4.4 Self –cleaning

8.7.4.5 Anti-fouling

8.7.4.6 Other

8.7.5 Historic and Forecasted Market Size by Material

8.7.5.1 Polysiloxanes

8.7.5.2 FluoroAlkylsilanes

8.7.5.3 Fluoropolymers

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Building & construction

8.7.6.2 Electronics

8.7.6.3 Automotive

8.7.6.4 Textiles

8.7.6.5 Consumer Goods

8.7.6.6 Medical & Healthcare

8.7.6.7 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Hydrophobic Coatings Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.61 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.5% |

Market Size in 2035: |

USD 4.24 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||