Hydrogen Market Synopsis

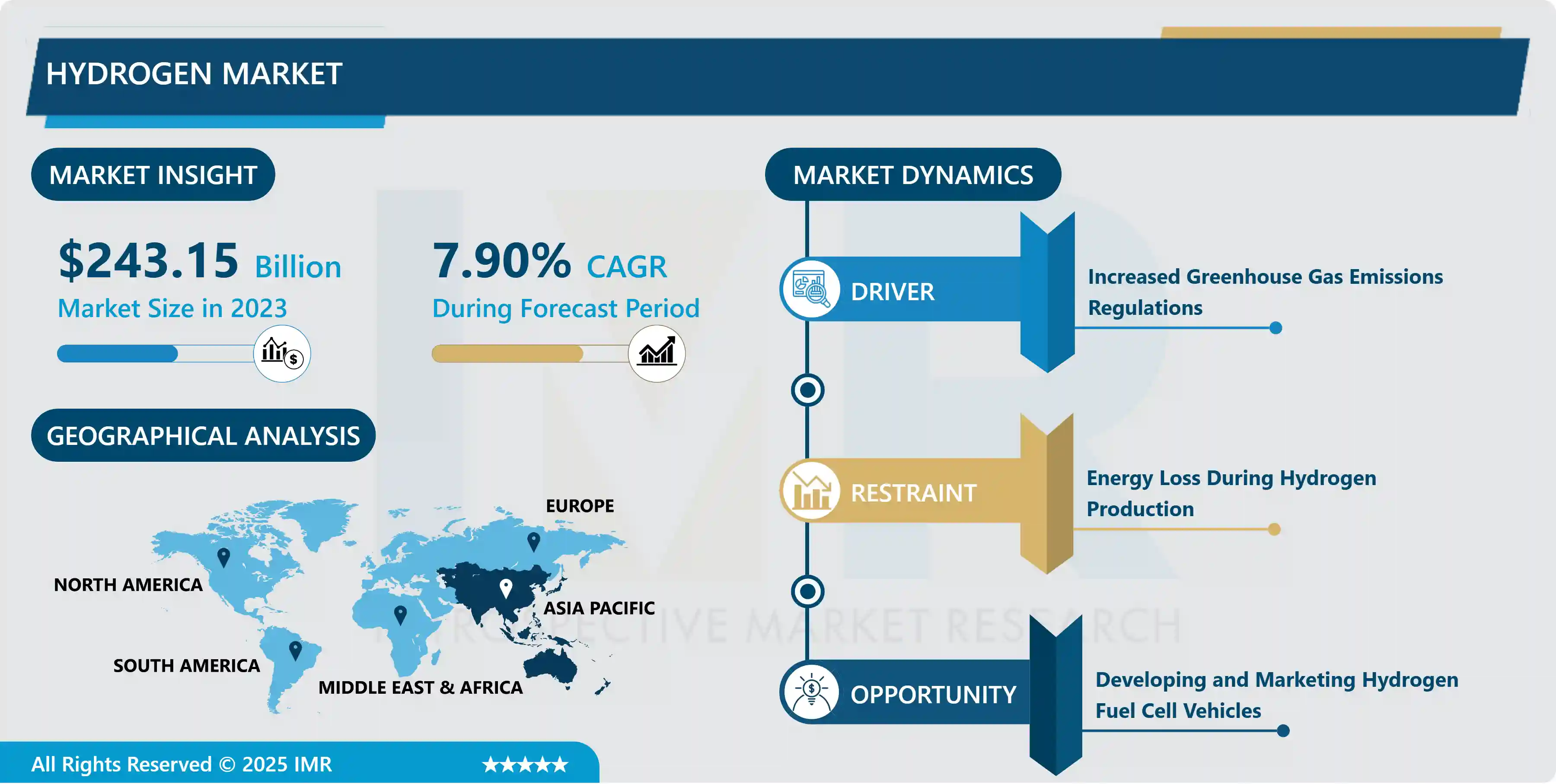

The Hydrogen Market was valued at USD 243.15 Billion in 2023 and is projected to reach USD 482.02 Billion by 2032, growing at a CAGR of 7.9% from 2024 to 2032.

Hydrogen plays a vital role in the chemicals and oil & and gas industry. Hydrogen extracted from various processes is classified into three types—blue hydrogen, grey hydrogen, and green hydrogen. Grey hydrogen is hydrogen produced from fossil fuel resources where the carbon capture and storage process are not implemented. Furthermore, this type of hydrogen releases carbon dioxide into the environment as a by-product.

The industry is seeing a lot of growth in the development of environmentally friendly industrial technologies including photobiological processes and photobioreactors, etc. The development of the current hydrogen manufacturing process in a carbon-free manner is also being pursued by several businesses, which is anticipated to accelerate the growth of the hydrogen industry shortly.

The adoption of hydrogen as a substitute for conventional fuels will have lucrative prospects thanks to the ongoing energy transition and active programs that place a strong emphasis on energy-efficient fuels. Globally, both developed and developing economies are stepping up their efforts to promote the use of renewable energy alternatives and quicken climate change activities. To promote hydrogen production and achieve challenging climate-neutral goals, several government authorities and agencies have offered supportive initiatives, investments, grants, and incentives.

For instance, the U.S. Department of Energy (DOE) stated in September 2022 that it would invest USD 7 billion to promote clean hydrogen hubs (H2Hubs) around the country to achieve a net-zero carbon economy by the year 2050. Furthermore, substantial technological developments are assisting energy businesses in expanding their hydrogen production capacity, which is bolstering the growth of the hydrogen market.

Hydrogen Market Trend Analysis

Hydrogen Market Trend Analysis

Increased Greenhouse Gas Emissions Regulations

- Greenhouse gases can absorb infrared radiation (net heat energy) from the earth's surface and then reradiate it to the surface, increasing the greenhouse effect. The use of fossil fuels and industrialization are the main causes of the rise in global greenhouse gas emissions.

- Due to the Safer Affordable Fuel-Efficient (SAFE) Vehicles Rule, the US Environmental Protection Agency (EPA) and National Highway Traffic Safety Administration (NHTSA) have lowered the GHG emissions and Corporate Average Fuel Economy (CAFE) standards for cars in the US from 2021 to 2026. Through the target year of 2026, the 2020 regulation strengthens the CO2 emission and CAFE standards. By 2026, it is anticipated that the combined GHG and CAFE limits for cars and trucks will be 202 g/mile of CO2 and 40.4 mpg.

- In 2021, CO2 emissions increased in almost all regions, with annual changes varying from more than 10% in Brazil and India to less than 1% in Japan. Emissions rose by 5% in China, compared to an increase of about 7% in the US and the EU. The graph below displays the percentage of US industries that are responsible for greenhouse gas emissions. Over 900 million tonnes (Mt) more CO2 were released into the atmosphere in 2021 due to the production of electricity and heat. A 46% increase in global emissions has been caused by the use of primarily fossil fuels to meet the growing energy demand.

Developing and Marketing Hydrogen Fuel Cell Vehicles

- The growth of the hydrogen economy necessitates the development of hydrogen infrastructure, including hydrogen refueling stations, pipelines, and distribution networks. FCVs offer numerous advantages, including zero tailpipe emissions, long driving ranges, quick refueling, high efficiency, and quiet operation. These benefits contribute to a cleaner and more sustainable transportation sector, driving increased demand for hydrogen fuel.

- As FCV adoption grows, it stimulates investment in hydrogen production facilities and infrastructure, leading to a more extensive and efficient hydrogen market. This expansion creates new jobs across industries, stimulates economic activity, and enhances energy security by reducing dependence on imported fossil fuels. Moreover, the environmental benefits, such as reduced greenhouse gas emissions and improved air quality, align with global efforts to address climate change.

- Internationally, regions like the Asia-Pacific (APAC) are embracing hydrogen for various transportation modes, further fueling the demand for hydrogen. Government investments and collaborative efforts contribute to the advancement of technologies, cost reduction, and market growth, positioning the hydrogen market as a key player in the transition to a cleaner and more sustainable energy future.

Global Hydrogen Market Segment Analysis:

Global Hydrogen Market Segmented Based on Type, Production Source, Application, and Mode of Delivery.

By Type, Green segment is expected to dominate the market during the forecast period

- The global hydrogen market is witnessing a shift towards sustainability, with the Green hydrogen segment expected to dominate. This type of hydrogen is produced using renewable energy sources, aligning with the growing emphasis on clean energy solutions and the global transition to a low-carbon economy. Factors driving the dominance of Green hydrogen include increased focus on renewable energy, supportive government policies, technological advancements in electrolysis, and corporate sustainability initiatives. Leaders in business and government are focusing on hydrogen, an energy source that was previously underutilized, to lessen the global carbon footprint.

- There has been a lot of interest in green hydrogen, especially the type produced by electrolysis using renewable fuels. Australia is the country that has constructed the greenest hydrogen plants globally as of 2022. In 2022, the Americas produced 45% of the world's electrolyzers, or devices that use electricity to produce hydrogen. The most economic potential for producing green hydrogen at less than two dollars per kilogram is found in North and South America.

- The cost of producing one kilogram of green hydrogen currently ranges from three to 7.5 dollars, while hydrogen produced from fossil fuels is still far less expensive. Large-scale green hydrogen projects are anticipated to have widely varying projected selling prices, contingent upon the size and accessibility of local energy resources. As the demand for environmentally friendly alternatives rises, the Green hydrogen segment is positioned for continued growth, reflecting a pivotal role in the future of the hydrogen market.

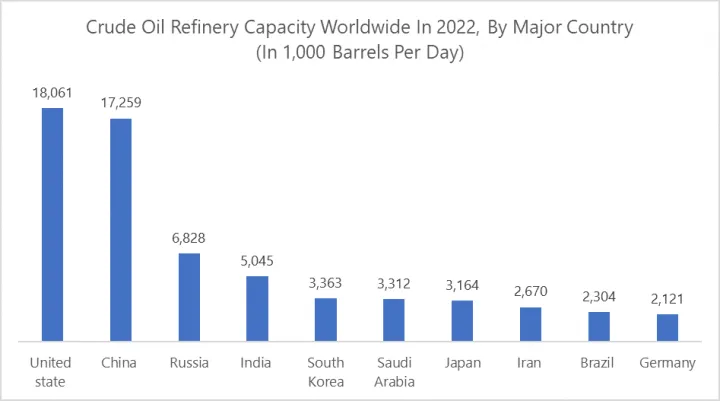

By Application, Refineries segment held the largest share of 49.89% in 2022

- The Refineries segment stands as the dominant force in the burgeoning hydrogen market. The surge in demand is propelled by a strategic shift within the oil refining industry towards cleaner and more sustainable practices. Hydrogen finds widespread use in crucial refining processes, including hydrocracking, hydrotreating, and reforming. These operations are vital for breaking down heavy hydrocarbons, removing sulfur from crude oil, and converting naphtha into higher-octane gasoline.

- The dominance of the Refineries segment in the global hydrogen market is underscored by the substantial oil refining capacity, particularly in the United States. As per the company database, as of 2022, the U.S. boasted the world's largest oil refinery capacity, reaching a staggering 18.1 million barrels of oil per day. Oil refineries play a pivotal role in processing crude oil into various valuable products, including diesel fuel, heating oil, and gasoline.

- Globally, the refinery capacity for crude oil has witnessed a consistent upward trend since 1970, reaching around 101 million barrels per day in 2021. Despite this vast capacity, the actual refinery throughput worldwide was slightly over 79 million barrels of oil per day. In the United States alone, the oil refinery capacity in 2021 stood at approximately 17.9 million barrels per day, with an actual throughput of 17.5 million barrels of oil per day. This consistent leadership in oil refinery capacity establishes the U.S. as a key player in the global energy landscape.

- Given the integral role of hydrogen in refining processes, such as hydrocracking and hydrotreating, the Refineries segment emerges as the primary driver of hydrogen demand. The reliance on crude oil refining in the U.S., with Chevron as a significant player with a global refining capacity of 1.8 billion barrels of crude oil per day, further solidifies the Refineries segment's stronghold in the expanding hydrogen market. This trend is indicative of the crucial role refineries play in shaping the trajectory of the hydrogen industry, aligning with global efforts toward sustainability and cleaner energy practices.

Global Hydrogen Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is poised to emerge as the dominant force in the global hydrogen market over the forecast period. With a rapidly evolving energy landscape and a strong emphasis on sustainable practices, countries in the Asia Pacific are driving the surge in hydrogen demand. The presence of a high number of refineries in major countries such as China and India have resulted in driving the utilization of hydrogen generation. Furthermore, governments in some Asia Pacific countries such as Japan and Australia are evaluating greener and cleaner technologies for hydrogen generation.

- The region is set to emerge as a lucrative hotspot for the development of the global market with significant efforts by multiple government agencies. Moreover, in January 2023, the Union Cabinet of India rolled out the National Green Hydrogen Mission with an initial outlay of USD 2.38 billion to create a green hydrogen production capacity of 5 MMT per annum along with a renewable energy capacity expansion of 125 GW in the country. Hence, the growing demand for hydrogen across refineries, and chemical sectors, and supportive government policies and funding will enhance the regional sector growth.

- Abundant, low-cost renewable resources in parts of the Middle East, Australia, and Asia, coupled with the region's commitment to green initiatives, position it as a key player in the burgeoning hydrogen economy. While global hydrogen production predominantly relies on fossil fuels, the Asia Pacific is leading the transition towards green hydrogen, utilizing renewable electricity for electrolysis.

- Current production costs in the region range from €3 to €5/kg, making it a cost-effective hub for green hydrogen. As economies of scale, technological advancements, and falling renewable energy production costs continue, green hydrogen is expected to become more economical, further enhancing the region's dominance. Pioneering initiatives in countries like China and Japan, coupled with large-scale collaborations and infrastructure development, are propelling the Asia Pacific to the forefront of the hydrogen market.

- Anticipating future trends and acting promptly will be crucial as hydrogen demand is projected to grow steadily, with significant increases expected from 2030 onwards. The Asia Pacific's potential to meet ambitious climate targets, coupled with its strategic positioning in the global trade of green hydrogen, positions the region as a key player in shaping the future of the hydrogen market.

Global Hydrogen Market Top Key Players:

- Oxygen Service Company, Inc. (OSC) (US)

- Plug Power Inc (US)

- Quantum Fuel Systems LLC (US)

- Teledyne Technologies Incorporated (US)

- Weldship Corporation (US)

- Worthington Industries (US)

- Air Products and Chemicals, Inc. (US)

- BayoTech (US)

- Chart Industries (US)

- Chevron Corporation (US)

- Air Liquide(France)

- AMS Composite Cylinders (UK)

- Luxfer Gas Cylinders (UK)

- NPROXX (Netherlands)

- Pragma Industries (France)

- Uniper SE (Germany)

- Cryolor (France)

- Hexagon Purus (Norway)

- Linde plc (Ireland)

- Mahler AGS GmbH (Germany)

- Messer Group GmbH (Germany)

- Nel ASA (Norway)

- BNH Gas Tanks (India)

- INOX India Limited (India)

- Iwatani Corporation (Japan)

- Taiyo Nippon Sanso Corporation (Japan)

- Saudi Arabian Oil Co., (Saudi Arabia), and Other Major Players.

Key Industry Developments in the Global Hydrogen Market:

- In July 2023, Air Liquide and KBR collaborated to provide fully integrated low-carbon ammonia solutions based on Autothermal Reforming (ATR) technology. Recognized as a global authority in ATR technology, Air Liquide is positioned as a leading provider of large-scale, low-carbon hydrogen (H2) production. This hydrogen is subsequently blended with nitrogen (N2) to produce environmentally friendly low-carbon ammonia (NH3). The partnership between Air Liquide and KBR signifies a concerted commitment to advancing sustainable solutions in the production of ammonia through innovative and efficient technologies.

- In July 2023, Air Products & Chemicals, Inc. announced that it had been chosen as the hydrogen and technology provider for Alberta's first hydrogen fuel cell passenger vehicle fleet by Edmonton International Airport. The company is set to introduce a mobile hydrogen refueling station at the airport, catering to the hydrogen needs of the Toyota Mirai hydrogen fuel cell vehicle fleet. This collaboration signifies a significant step toward advancing hydrogen technology and infrastructure for sustainable transportation at Edmonton International Airport.

- In April 2023, Linde plc signed a long-term arrangement with Evonik, a well-known specialty chemicals firm, to supply green hydrogen. Linde will build, own, and operate a nine-megawatt alkaline electrolyzer facility on Jurong Island in Singapore under this arrangement. This plant's major output will be green hydrogen, which Evonik wants to employ in the synthesis of methionine, an essential element in animal feed.

|

Global Hydrogen Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 243.15 Bn |

|

Forecast Period 2024-32 CAGR: |

7.9 % |

Market Size in 2032: |

USD 482.02 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Production Source |

|

||

|

By Application |

|

||

|

By Mode of Delivery |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Hydrogen Market by Type (2018-2032)

4.1 Hydrogen Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Grey

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Blue

4.5 Green

Chapter 5: Hydrogen Market by Production Source (2018-2032)

5.1 Hydrogen Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Natural gas

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Coal

5.5 Other hydrocarbons

5.6 Electrolysis & other sources

Chapter 6: Hydrogen Market by Application (2018-2032)

6.1 Hydrogen Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Refineries

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Ammonia

6.5 Methanol & Other Chemicals

6.6 Metals & Fabrication

6.7 Electronic Food & Beverage

6.8 Glass & Ceramics

6.9 Others

Chapter 7: Hydrogen Market by Mode of Delivery (2018-2032)

7.1 Hydrogen Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Merchant

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Captive

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Hydrogen Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 MOLSON COORS (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 STONE BREWING (US)

8.4 MATT BREWING CO. (US)

8.5 THE BOSTON BEER COMPANY INC (US)

8.6 CONSTELLATION BRANDS INC (US)

8.7 STELLA ARTOIS (US)

8.8 GREAT LAKES BREWING COMPANY (US)

8.9 ABITA BREWING CO. (US)

8.10 DOGFISH HEAD (US)

8.11 GROUPO MODELO (MEXICO)

8.12 DIAGEO (UK)

8.13 HEINEKEN NV (NETHERLAND)

8.14 BOGOTA BEER COMPANY (COLOMBIA)

8.15 PATAGONIA BREWERY (BELGIUM)

8.16 ANHEUSER-BUSCH INBEV SA/NV(BELGUIM)

8.17 BITBURGER BREWERY (GERMANY)

8.18 MOHAN MEAKIN (INDIA)

8.19 UNITED BREWERIES LTD. (INDIA)

8.20 GATEWAY BREWING CO. LLP (INDIA)

8.21 FERAL BREWING COMPANY (AUSTRALIA)

8.22 DB BREWERIES LIMITED (NEW ZEALAND)

8.23 BEIJING YANJING BREWERY COMPANY LIMITED (CHINA)

8.24

Chapter 9: Global Hydrogen Market By Region

9.1 Overview

9.2. North America Hydrogen Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Grey

9.2.4.2 Blue

9.2.4.3 Green

9.2.5 Historic and Forecasted Market Size by Production Source

9.2.5.1 Natural gas

9.2.5.2 Coal

9.2.5.3 Other hydrocarbons

9.2.5.4 Electrolysis & other sources

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Refineries

9.2.6.2 Ammonia

9.2.6.3 Methanol & Other Chemicals

9.2.6.4 Metals & Fabrication

9.2.6.5 Electronic Food & Beverage

9.2.6.6 Glass & Ceramics

9.2.6.7 Others

9.2.7 Historic and Forecasted Market Size by Mode of Delivery

9.2.7.1 Merchant

9.2.7.2 Captive

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Hydrogen Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Grey

9.3.4.2 Blue

9.3.4.3 Green

9.3.5 Historic and Forecasted Market Size by Production Source

9.3.5.1 Natural gas

9.3.5.2 Coal

9.3.5.3 Other hydrocarbons

9.3.5.4 Electrolysis & other sources

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Refineries

9.3.6.2 Ammonia

9.3.6.3 Methanol & Other Chemicals

9.3.6.4 Metals & Fabrication

9.3.6.5 Electronic Food & Beverage

9.3.6.6 Glass & Ceramics

9.3.6.7 Others

9.3.7 Historic and Forecasted Market Size by Mode of Delivery

9.3.7.1 Merchant

9.3.7.2 Captive

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Hydrogen Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Grey

9.4.4.2 Blue

9.4.4.3 Green

9.4.5 Historic and Forecasted Market Size by Production Source

9.4.5.1 Natural gas

9.4.5.2 Coal

9.4.5.3 Other hydrocarbons

9.4.5.4 Electrolysis & other sources

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Refineries

9.4.6.2 Ammonia

9.4.6.3 Methanol & Other Chemicals

9.4.6.4 Metals & Fabrication

9.4.6.5 Electronic Food & Beverage

9.4.6.6 Glass & Ceramics

9.4.6.7 Others

9.4.7 Historic and Forecasted Market Size by Mode of Delivery

9.4.7.1 Merchant

9.4.7.2 Captive

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Hydrogen Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Grey

9.5.4.2 Blue

9.5.4.3 Green

9.5.5 Historic and Forecasted Market Size by Production Source

9.5.5.1 Natural gas

9.5.5.2 Coal

9.5.5.3 Other hydrocarbons

9.5.5.4 Electrolysis & other sources

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Refineries

9.5.6.2 Ammonia

9.5.6.3 Methanol & Other Chemicals

9.5.6.4 Metals & Fabrication

9.5.6.5 Electronic Food & Beverage

9.5.6.6 Glass & Ceramics

9.5.6.7 Others

9.5.7 Historic and Forecasted Market Size by Mode of Delivery

9.5.7.1 Merchant

9.5.7.2 Captive

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Hydrogen Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Grey

9.6.4.2 Blue

9.6.4.3 Green

9.6.5 Historic and Forecasted Market Size by Production Source

9.6.5.1 Natural gas

9.6.5.2 Coal

9.6.5.3 Other hydrocarbons

9.6.5.4 Electrolysis & other sources

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Refineries

9.6.6.2 Ammonia

9.6.6.3 Methanol & Other Chemicals

9.6.6.4 Metals & Fabrication

9.6.6.5 Electronic Food & Beverage

9.6.6.6 Glass & Ceramics

9.6.6.7 Others

9.6.7 Historic and Forecasted Market Size by Mode of Delivery

9.6.7.1 Merchant

9.6.7.2 Captive

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Hydrogen Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Grey

9.7.4.2 Blue

9.7.4.3 Green

9.7.5 Historic and Forecasted Market Size by Production Source

9.7.5.1 Natural gas

9.7.5.2 Coal

9.7.5.3 Other hydrocarbons

9.7.5.4 Electrolysis & other sources

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Refineries

9.7.6.2 Ammonia

9.7.6.3 Methanol & Other Chemicals

9.7.6.4 Metals & Fabrication

9.7.6.5 Electronic Food & Beverage

9.7.6.6 Glass & Ceramics

9.7.6.7 Others

9.7.7 Historic and Forecasted Market Size by Mode of Delivery

9.7.7.1 Merchant

9.7.7.2 Captive

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Hydrogen Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 243.15 Bn |

|

Forecast Period 2024-32 CAGR: |

7.9 % |

Market Size in 2032: |

USD 482.02 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Production Source |

|

||

|

By Application |

|

||

|

By Mode of Delivery |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||