Hydrogen Storage Market Synopsis

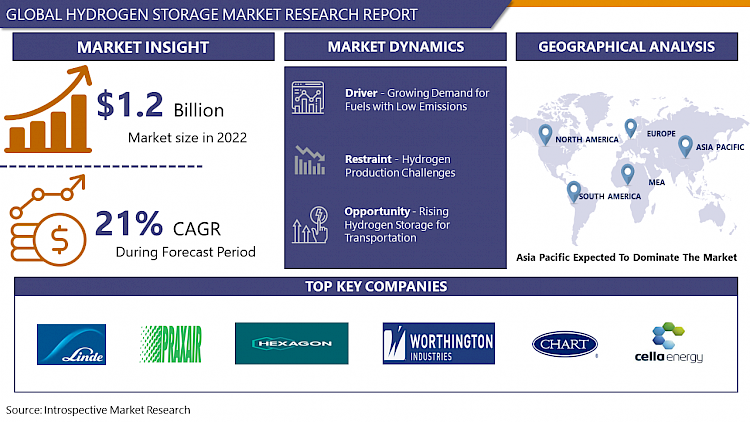

Hydrogen Storage Market Size Was Valued at USD 1.2 Billion in 2022, and is Projected to Reach USD 5.7 Billion by 2030, Growing at a CAGR of 21% From 2023-2030.

Hydrogen can be stored as a liquid or a gas. While storing hydrogen gas often involves the use of high-pressure tanks storing hydrogen liquid frequently necessitates freezing conditions to prevent it from boiling back into a gas. Hydrogen can be kept inside a solid as well as on its surface.

- A liquid form of hydrogen can be kept frozen for storage. To prevent the liquid hydrogen from evaporating back into a gas, which happens at -252.8°C, low temperatures are necessary. Hydrogen that is liquid has a higher energy density than hydrogen that is gaseous, but it can be expensive to heat it to the necessary temperatures.

- In order to prevent evaporation in the case that heat is transferred into the liquid hydrogen through conduction, convection, or radiation, cryogenic liquid hydrogen storage tanks and facilities must also be insulated. In spite of these difficulties, liquid hydrogen is in demand for applications needing high degrees of purity and is utilized in space flight.

- Hydrogen can be kept in materials in addition to being compressed as a gas or kept in liquid form. Three different types of materials can store hydrogen those that use adsorption to store hydrogen on the material's surface, those that use absorption to store hydrogen inside the material, and those that employ hydride storage, which combines solid and liquid materials.

Hydrogen Storage Market Trend Analysis

Growing Demand for Fuels with Low Emissions

- Hydrogen gas is mostly used in oil refineries to de-sulfurize fuels like gasoline and diesel for use in transportation. The need for hydrogen will increase dramatically as more sour and heavier crude oil is consumed globally. The availability of merchant sources of hydrogen is increasing as a result of the difficulty of the current hydrogen production capacity to meet the escalating demand.

- The demand for fuels with low emissions reflects the public's increased concern over environmental issues, particularly climate change. The burning of conventional fossil fuels like coal, oil, and natural gas releases greenhouse gases (GHGs) like carbon dioxide (CO2) into the atmosphere, which aids in global warming and its negative effects like rising temperatures, extreme weather, and sea level rise.

- The global concern over climate change and the need to reduce greenhouse gas emissions has intensified the search for cleaner energy sources. Low-emission fuels, such as hydrogen, natural gas, and biofuels, are seen as viable alternatives to traditional fossil fuels, like coal and oil, which contribute significantly to carbon dioxide emissions.

- Depending primarily on one energy source, such as fossil fuels, can make a country vulnerable to supply disruptions and price instability. To improve energy security, diversification is required. Low-emission fuels, like hydrogen, provide a flexible and sustainable energy source in addition to lessening dependency on fossil fuels and lowering the geopolitical risks associated with resource-rich nations.

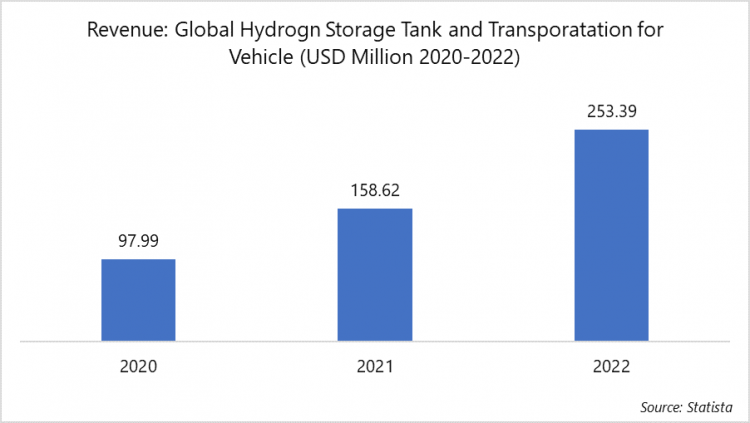

Rising Hydrogen Storage for Transportation

- Hydrogen is considered a clean energy carrier because when it's used in fuel cells or combustion engines, the only byproduct is water vapor. This makes it an attractive option for reducing greenhouse gas emissions in the transportation sector, which is a major contributor to global emissions.

- Hydrogen has a high energy density, which means it can store a large amount of energy in a relatively small volume or mass. This is crucial for applications like long-range electric vehicles (EVs) and heavy-duty transport, where space and weight constraints are significant.

- The transportation industry has become a major source of carbon emissions as the globe struggles with the urgent need to cut greenhouse gas emissions and combat climate change. As a clean and sustainable energy source for transportation, hydrogen has drawn increasing interest as a solution to this problem. Hydrogen storage is a crucial component of using hydrogen since it is essential to making this exciting energy source practical for a variety of uses.

Hydrogen Storage Market Segment Analysis:

Hydrogen Storage Market Segmented on the basis of Storage Form, Storage Type, and End-Users.

By Storage Form, Physical segment is expected to dominate the market during the forecast period

- Physical storage methods, such as compression and liquefaction, offer a higher energy density compared to other hydrogen storage methods like chemical or solid-state storage. This means that more hydrogen can be stored in a smaller volume, making it suitable for applications where space is limited, such as onboard vehicle storage.

- Solid-state and liquid-state hydrogen storage systems are often considered safer than gaseous storage options. Storing hydrogen as a liquid or within solid materials reduces the risk of leaks or accidental releases, which is crucial for ensuring the safety of hydrogen-based technologies. This enhanced safety profile is particularly important for hydrogen-powered vehicles and infrastructure.

By Storage Type, Cylinder segment held the largest share of xx% in 2022

- Hydrogen storage is a complex field, and different methods are suitable for different applications. Cylinders can complement other storage methods like liquid hydrogen or solid-state storage by offering flexibility in terms of capacity and refueling . Cylinders are a well-established and relatively simple method for storing compressed gases. Hydrogen cylinders can be designed to meet strict safety standards, making them a viable option for storing hydrogen in a compact and transportable form.

- In the metalworking industry, hydrogen gas is mixed with argon for use in plasma and tungsten inert gas (TAG) welding. In electronics, hydrogen gas is used for lithography (gases for laser operations), purging, and generator cooling.

Hydrogen Storage Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific (APAC) region is experiencing significant growth in hydrogen storage. Many countries in the APAC region, including Japan, South Korea, China, and Australia, have committed to ambitious decarbonization goals and are actively seeking cleaner energy sources to reduce their carbon emissions. Hydrogen is seen as a key enabler in achieving these goals, as it can be produced from renewable sources and used as a clean energy carrier.

- The APAC region is home to some of the world's largest renewable energy resources, including solar and wind. These resources can be harnessed to produce green hydrogen through processes like electrolysis, which involves splitting water into hydrogen and oxygen using electricity generated from renewable sources.

- APAC countries are actively developing the necessary infrastructure for hydrogen production, distribution, and storage. This includes building hydrogen refueling stations, upgrading ports to handle hydrogen imports and exports, and establishing hydrogen pipelines and storage facilities.

COVID-19 Impact Analysis on Hydrogen Storage Market:

- The pandemic disrupted global supply chains, affecting the production and distribution of hydrogen storage technologies. Delays in the delivery of critical components and materials led to project delays and increased costs. Many companies in the hydrogen sector faced financial challenges due to the economic downturn caused by COVID-19. This led to reduced investments in research and development, which could have slowed down advancements in hydrogen storage technologies.

- The pandemic underscored the importance of sustainable and environmentally friendly solutions. As a result, there has been a growing emphasis on green hydrogen, which is produced using renewable energy sources, further driving interest in advanced hydrogen storage technologies.

- Some countries reevaluated their energy priorities during the pandemic. While hydrogen is seen as a promising clean energy carrier, governments had to allocate resources to address immediate health and economic concerns, potentially diverting attention and funding away from hydrogen storage projects.

Hydrogen Storage Market Top Key Players:

- Air Liquide (France)

- Linde plc (Ireland)

- Praxair Technology Inc. (U.S.)

- Worthington Industries (U.S.)

- McPhy Energy S.A. (France)

- Luxfer Holdings PLC (U.K.)

- Hexagon Composites ASA (Norway)

- H Bank Technologies Inc. (Taiwan)

- Inoxwind (India)

- VRV S.r.L. (Italy)

- Cella Energy (U.K.)

- American Elements (U.S.)

- Sigma-Aldrich Co. (US)

- Hanwha Solutions/Chemical Corporation (South Korea)

- Eutectix (U.S.)

- Pragma Industries (France)

- Ilika (U.K.)

- Fosroc, Inc. (India)

- Chart Industries (US)

- Inoxcva (India) and Other Major Players.

Key Industry Developments in the Hydrogen Storage Market:

- In January 2023: Hexagon Purus opens a new hydrogen cylinder manufacturing facility in Westminster, Maryland, USA. The demand for zero-emission mobility & infrastructure is rising as the world is becoming ever more committed to combatting climate change. Hexagon Purus, with its purpose to help drive energy transformation through zero emission energy storage solutions, announces the opening of its new manufacturing facility for hydrogen Type 4 composite cylinders in Westminster, MD.

- In December 2021: Worthington Industries, Inc. announced that its Steel Processing segment has completed its acquisition of Tempel Steel Company, a leading global manufacturer of precision motor and transformer laminations for the electrical steel market that includes transformers, machine motors and electric vehicle (EV) motors. The purchase price was approximately $255 million and adds five manufacturing facilities located in Chicago, Canada, China, India and Mexico.

|

Hydrogen Storage Market |

||||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 1.2 Bn. |

|

|

Forecast Period 2023-30 CAGR: |

21% |

Market Size in 2030: |

USD 5.51 Bn. |

|

|

Segments Covered: |

By Storage Form |

|

||

|

By Storage Type |

|

|||

|

By End-Users |

|

|||

|

By Region |

|

|||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- GLOBAL HYDROGEN STORAGE MARKET BY STORAGE FORM (2017-2030)

- XXX MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PHYSICAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MATERIAL-BASED

- GLOBAL HYDROGEN STORAGE MARKET BY STORAGE TYPE (2017-2030)

- XXX MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CYLINDER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MERCHANT

- ON-SITE

- ON-BOARD

- GLOBAL HYDROGEN STORAGE MARKET BY END-USERS (2017-2030)

- XXX MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CHEMICALS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OIL REFINERIES

- INDUSTRIAL

- AUTOMOTIVE & TRANSPORTATION

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Global Hydrogen Storage Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AIR LIQUIDE

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- LINDE PLC

- PRAXAIR TECHNOLOGY INC.

- WORTHINGTON INDUSTRIES

- MCPHY ENERGY S.A.

- LUXFER HOLDINGS PLC

- HEXAGON COMPOSITES ASA

- H BANK TECHNOLOGIES INC.

- INOXWIND

- VRV S.R.L.

- CELLA ENERGY

- AMERICAN ELEMENTS

- SIGMA-ALDRICH CO.

- HANWHA SOLUTIONS/CHEMICAL CORPORATION

- EUTECTIX

- PRAGMA INDUSTRIES

- ILIKA

- FOSROC INC.

- CHART INDUSTRIES

- COMPETITIVE LANDSCAPE

- GLOBAL HYDROGEN STORAGE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Storage Form

- Historic And Forecasted Market Size By Storage Type

- Historic And Forecasted Market Size By End-Users

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Hydrogen Storage Market |

||||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 1.2 Bn. |

|

|

Forecast Period 2023-30 CAGR: |

21% |

Market Size in 2030: |

USD 5.51 Bn. |

|

|

Segments Covered: |

By Storage Form |

|

||

|

By Storage Type |

|

|||

|

By End-Users |

|

|||

|

By Region |

|

|||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

Frequently Asked Questions :

The forecast period in the Hydrogen Storage Market research report is 2023-2030.

Air Liquide (France), Linde plc (Ireland), Praxair Technology Inc. (U.S.), Worthington Industries (U.S.), McPhy Energy S.A. (France), Luxfer Holdings PLC (U.K.), Hexagon Composites ASA (Norway), H Bank Technologies Inc. (Taiwan), Inoxwind (India), VRV S.r.L. (Italy), Cella Energy (U.K.), American Elements (U.S.), Sigma-Aldrich Co. (US), Hanwha Solutions/Chemical Corporation (South Korea), Eutectix (U.S.), Pragma Industries (France), Ilika (U.K.), Fosroc, Inc. (India), Chart Industries (US) and Other Major Players.

The Hydrogen Storage Market is segmented into Storage Form, Storage Type, End-Users and region. By Storage Form, the market is categorized into Physical and Material-Based. By Storage Type, the market is categorized into Cylinder, Merchant, On-Site, and On-Board. By End-Users, the market is categorized into Chemicals, Oil Refineries, Industrial, Automotive & Transportation, and Metalworking. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The industry sector that deals with the creation, production, and implementation of tools and infrastructure for storing hydrogen gas is referred to as the hydrogen storage market. The hydrogen economy views hydrogen as a clean and adaptable energy carrier that can be utilized for a variety of applications, including transportation, industrial operations, and power generation. Hydrogen storage is an essential part of this economy.

Hydrogen Storage Market Size Was Valued at USD 1.2 Billion in 2022, and is Projected to Reach USD 5.7 Billion by 2030, Growing at a CAGR of 21% From 2023-2030.