HVDC Converter Station Market Synopsis

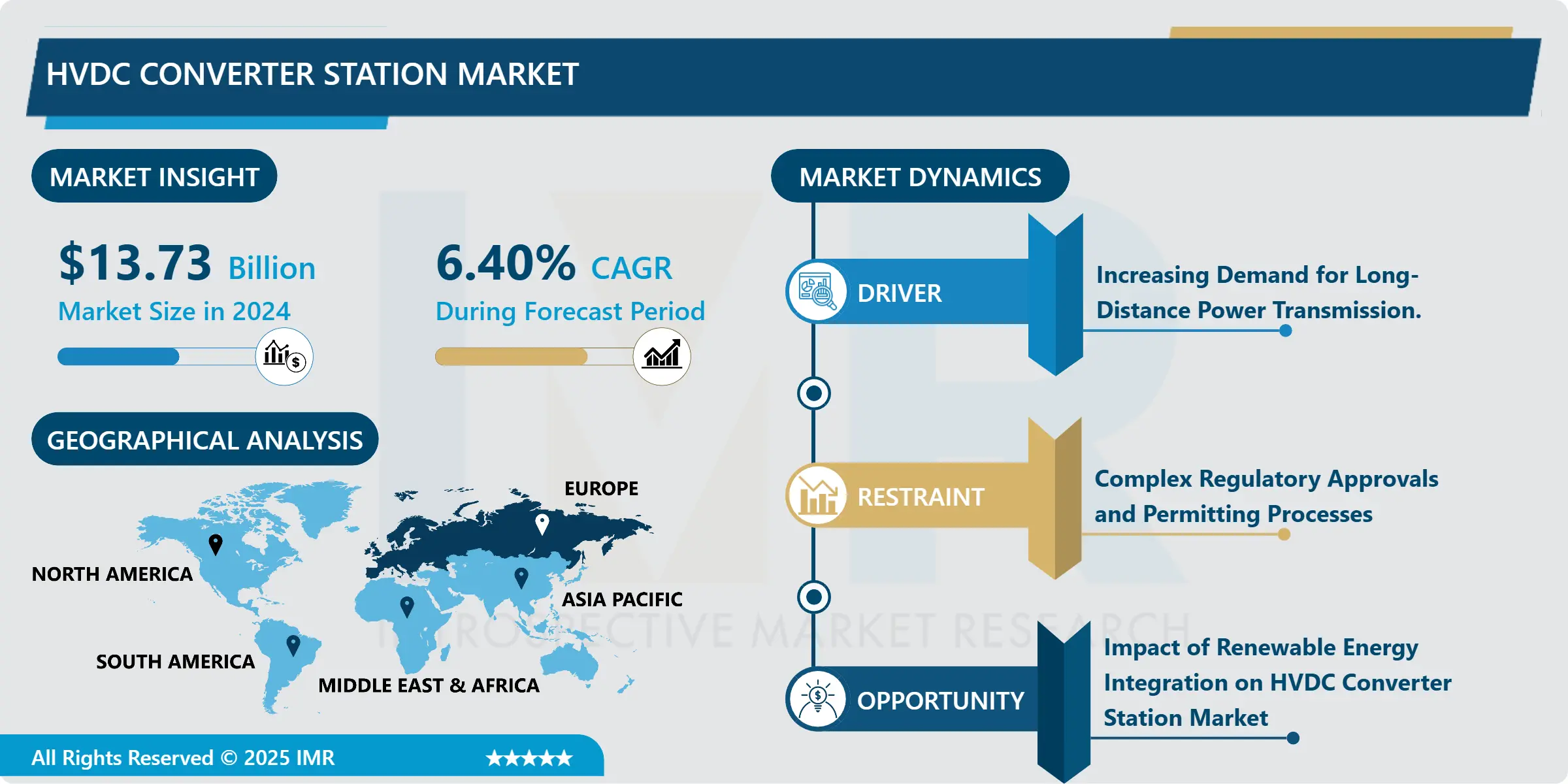

HVDC Converter Station Market Size is Valued at USD 13.73 Billion in 2024 and is Projected to Reach USD 22.55 Billion by 2032, Growing at a CAGR of 6.40% From 2025-2032.

HVDC Converter Station Market includes the products for the conversion of AC to DC and DC to AC for the purpose of efficient transmission of electricity over long distances. These stations have the major functions of connecting renewable electricity, improving electricity grid reliability, and providing an interface for connecting the various electricity transmission networks. These are the converters, transformers, and the control systems that are fitted into the hybrid vehicles. The market’s growth is attributed to the rising necessities for energy transfer and distribution especially for long distance and underwater cable, along with evolution of converter type and integration of renewable energy into the grid.

The HVDC Converter Station Market is mainly fueled by the evolving power transmission requirement over long distances with a high level of reliability. HVDC technology allows transmitting electrical energy with low losses when transmitting electricity over great distances, a factor that makes it suitable for transmitting power from renewable energy sources in remote areas to the central business districts. The use of renewable energy including wind and solar to the grid also increase the requirement for HVDC converter stations to well control fluctuating power levels.

Nevertheless, the government factors associated with investment in improved grid infrastructure and energy security transition have huge shares in the global market. A boost in the expansion of the network of power transmission and augmentation of the transmission lines and towers in developing countries also fuels the advancement in the market. Furthermore, HVDC acronym technological progress that manifests HVDC system flexibility, increase of converter station efficiency and capacity stipulates upgrading respective industrial and commercial segments contributing to the market’s further growth.

HVDC Converter Station Market Trend Analysis

HVDC Converter Station Market Growth Drivers- From Renewable Integration to Cross-Border Connectivity, Trends Shaping HVDC Converter Stations

- The HVDC Converter Station Market is on the rise mainly due to the raise of renewable energy connections and growth of Interconnection projects across the globe. The conversion of the world to renewable energy like wind and solar also requires power transmission over long distances, where HVDC is more effective in offering minimal loss of power and better stability in the transmission grid as compared to AC system. Also, governments and utilities are spending capital on strengthening and extending their electricity facilities to meet increasing electricity needs as well as improve the transmission services. Some of these are projects aimed at linking far flung renewable power sources to cities and enhancing the tie lines between regional grids which will require more HVDC converter stations.

- Also, features like technological enhancement in HVDC system which consists Voltage Source Converter (VSC) technology are some of the factors which have been intensively influencing the market progress. VSC-based HVDC systems improve the grid control capability, efficiency and decrease the amount of the environmental pollutants thus creating the foundation of a new generation of onshore and offshore conversion systems. Besides this, there is much regulatory support and ongoing campaigns which are expected to fuel the HVDC converter station market comprising of clean energy and grid modernization across planet, with Asia-Pacific and Europe as potential markets of installation and evolution in the course of time.

HVDC Converter Station Market Opportunities- Empowering Grid Resilience, Market Dynamics of HVDC Converter Stations

- Based on the nature of the application, the HVDC converter station market holds a great potential for growth due to the growing need of efficient long distance power transmission across the world. WHEREAS, in the current efforts of the station’s towards the promotion and inclusion of renewable energy systems and improvement of the reliability of the grid, HVDC systems surfaces as imperative. There is growth in the market due to continuing infrastructure projects such as grid connections in Asia-Pacific and Europe areas and renewable energy integration projects. Also, the improvements in the converter station including voltage source converters which offer increased control and efficiency act as market multipliers.

- In addition, the market which is benefiting from linking factors rising investments in Off-shore wind farms and other large scale Renewable energy projects require efficient transmission over long distance. Furthermore, government policies that boost demand for clean energy and the projects related to grid modernisation is expected to drive the demand in HVDC converter stations. Major players are aiming at upgrading the performing features of a converter station, introducing energy loss minimization strategies and raising overall dependability to meet the increasing energy infrastructure requirements all across the world. All these factors put together would go a long way in providing a sound growth profile for the HVDC converter station market in the future.

HVDC Converter Station Market Segment Analysis:

HVDC Converter Station Market Segmented on the basis of type, Technology, application.

By Type, Monopolar segment is expected to dominate the market during the forecast period

- Based on the configuration and their operations, HVDC converter stations fall under the following classifications. Monopolar stations use a single wire for the transmission and return path and is used mostly over long distances across the land. Bipolar stations involve the use of two conductors, where one works as a positive conductor while the other works as the negative conductor this allows for much higher voltage transmission and a lot of freedom in terms of controlling power flows. That is two AC systems tied end-to-end that do not require intermediate transmission, best used to strengthen secondary regional grids or adopt renewable resources. AC stations link three and more converting stations, which can make complicated power interchanges in interconnected grids, or improve grid resilience with additional levels of the station. All of them are quite important for increasing the efficiency of the power transmission and for the reliability depending on the grids and operational goals.

By Application, Power Industry segment held the largest share in 2024

- Converter stations are of great use in numerous fields and industries involved in HVDC transmission and substations. In the power industry, they are an essential element for transportation of large amounts of power, the stability of the grid, and incorporation of the renewable energy sources. In the oil & gas industry HVDC substation are used for offshore platform illumination where it would be very expensive to provide electricity. HVDC technology assists in conversion of railways and improvement of energy use to minimize the effects caused by transportation on the environment. Besides, HVDC converter stations are used in other applications including connecting islanded grids, strengthening grids, cross border power trading which plays a big role in energy security and sustainability worldwide.

HVDC Converter Station Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

- Europe HVDC Converter Station Market has the propensity to high technology implementation along with rising trend towards renewable energy system integration. The region has for instance been most active in the use of HVDC technology for the development of long-distance transmission particularly where it incorporates offshore wind projects and cross border grids. Some of the nations that have developed strong HVDC systems include Germany, Norway, and the UK to increase the reliability of the existing power network and also to transmit and distribute clean electricity over vast distances.

- As for the Europe market, both LCC and VSC technologies are commonly used now, but VSC technologies are becoming more important because they offer definite control over power transmission and can be used to support grid stability. Government backing along with increasing climate change concerns to minimize carbon footprint has other boosted the application of HVDC converter stations in Europe with ongoing projects include improving the integrity of the grid and smooth integration of renewable energy into the systems.

Active Key Players in the HVDC Converter Station Market

- ABB Ltd. (Switzerland)

- Siemens AG (Germany)

- General Electric Company (United States)

- Hitachi ABB Power Grids Ltd. (Switzerland)

- Toshiba Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- Crompton Greaves Limited (CG Power) (India)

- NR Electric Co., Ltd. (China)

- Prysmian Group (Italy)

- Schneider Electric SE (France), Others Active Players

|

Global HVDC Converter Station Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 13.73 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.40 % |

Market Size in 2032: |

USD 22.55 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: HVDC Converter Station Market by Type (2018-2032)

4.1 HVDC Converter Station Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Monopolar

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Bipolar

4.5 Back-to-Back

4.6 Multi-Terminal

Chapter 5: HVDC Converter Station Market by Technology (2018-2032)

5.1 HVDC Converter Station Market Snapshot and Growth Engine

5.2 Market Overview

5.3 LCC (Line Commutated Converter)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 VSC (Voltage Source Converter)

Chapter 6: HVDC Converter Station Market by Application (2018-2032)

6.1 HVDC Converter Station Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Power Industry

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Oil & Gas Industry

6.5 Transportation

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 HVDC Converter Station Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABB LTD. (SWITZERLAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SIEMENS AG (GERMANY)

7.4 GENERAL ELECTRIC COMPANY (UNITED STATES)

7.5 HITACHI ABB POWER GRIDS LTD. (SWITZERLAND)

7.6 TOSHIBA CORPORATION (JAPAN)

7.7 MITSUBISHI ELECTRIC CORPORATION (JAPAN)

7.8 CROMPTON GREAVES LIMITED (CG POWER) (INDIA)

7.9 NR ELECTRIC COLTD. (CHINA)

7.10 PRYSMIAN GROUP (ITALY)

7.11 SCHNEIDER ELECTRIC SE (FRANCE)

7.12 OTHERS

Chapter 8: Global HVDC Converter Station Market By Region

8.1 Overview

8.2. North America HVDC Converter Station Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Monopolar

8.2.4.2 Bipolar

8.2.4.3 Back-to-Back

8.2.4.4 Multi-Terminal

8.2.5 Historic and Forecasted Market Size by Technology

8.2.5.1 LCC (Line Commutated Converter)

8.2.5.2 VSC (Voltage Source Converter)

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Power Industry

8.2.6.2 Oil & Gas Industry

8.2.6.3 Transportation

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe HVDC Converter Station Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Monopolar

8.3.4.2 Bipolar

8.3.4.3 Back-to-Back

8.3.4.4 Multi-Terminal

8.3.5 Historic and Forecasted Market Size by Technology

8.3.5.1 LCC (Line Commutated Converter)

8.3.5.2 VSC (Voltage Source Converter)

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Power Industry

8.3.6.2 Oil & Gas Industry

8.3.6.3 Transportation

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe HVDC Converter Station Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Monopolar

8.4.4.2 Bipolar

8.4.4.3 Back-to-Back

8.4.4.4 Multi-Terminal

8.4.5 Historic and Forecasted Market Size by Technology

8.4.5.1 LCC (Line Commutated Converter)

8.4.5.2 VSC (Voltage Source Converter)

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Power Industry

8.4.6.2 Oil & Gas Industry

8.4.6.3 Transportation

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific HVDC Converter Station Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Monopolar

8.5.4.2 Bipolar

8.5.4.3 Back-to-Back

8.5.4.4 Multi-Terminal

8.5.5 Historic and Forecasted Market Size by Technology

8.5.5.1 LCC (Line Commutated Converter)

8.5.5.2 VSC (Voltage Source Converter)

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Power Industry

8.5.6.2 Oil & Gas Industry

8.5.6.3 Transportation

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa HVDC Converter Station Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Monopolar

8.6.4.2 Bipolar

8.6.4.3 Back-to-Back

8.6.4.4 Multi-Terminal

8.6.5 Historic and Forecasted Market Size by Technology

8.6.5.1 LCC (Line Commutated Converter)

8.6.5.2 VSC (Voltage Source Converter)

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Power Industry

8.6.6.2 Oil & Gas Industry

8.6.6.3 Transportation

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America HVDC Converter Station Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Monopolar

8.7.4.2 Bipolar

8.7.4.3 Back-to-Back

8.7.4.4 Multi-Terminal

8.7.5 Historic and Forecasted Market Size by Technology

8.7.5.1 LCC (Line Commutated Converter)

8.7.5.2 VSC (Voltage Source Converter)

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Power Industry

8.7.6.2 Oil & Gas Industry

8.7.6.3 Transportation

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global HVDC Converter Station Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 13.73 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.40 % |

Market Size in 2032: |

USD 22.55 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||