HVAC Maintenance Service Market Synopsis

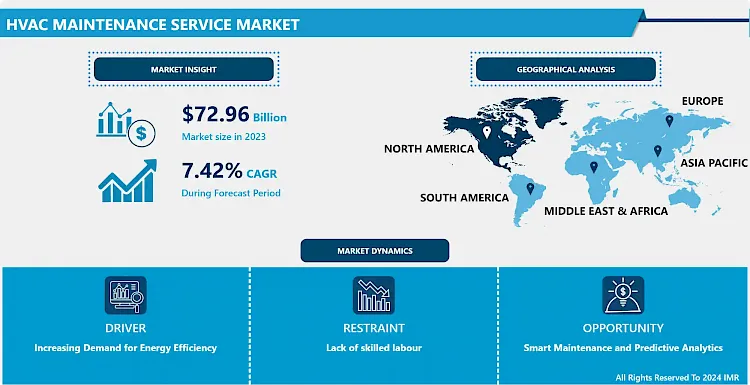

HVAC Maintenance Service Market Size Was Valued at USD 72.96 Billion in 2023, and is Projected to Reach USD 138.95 Billion by 2032, Growing at a CAGR of 7.42% From 2024-2032.

HVAC maintenance service refers to the proactive and regular servicing of Heating, Ventilation, and Air Conditioning (HVAC) systems to ensure their optimal performance, efficiency, and longevity. It involves a range of tasks carried out by trained technicians or professionals to inspect, clean, repair, and tune-up HVAC equipment, including heating units, air conditioners, ventilation systems, and related components.

These services typically include routine inspections to detect potential issues or areas of concern, such as worn-out parts, leaks, or blockages, before they become major problems. HVAC maintenance also entails cleaning or replacing filters, coils, and other components to improve air quality and system performance. Businesses, institutions, and homeowners all recognize the value of proactive maintenance in avoiding costly repairs, improving system performance, and reducing downtime. Rather than waiting for HVAC systems to fail before acting, many organizations are investing in preventative maintenance programs to identify and address potential problems early on. Advancements in HVAC technology, as well as the increasing complexity of modern HVAC systems, help to drive the expansion of the maintenance service market. The growing emphasis on sustainability and environmental responsibility encourages the use of energy-efficient HVAC solutions, which increases demand for maintenance services aimed at improving system performance and lowering energy consumption.

.webp)

HVAC Maintenance Service Market Trend Analysis

Increasing Demand for Energy Efficiency

- With rising energy costs and growing environmental concerns, both businesses and homeowners are looking for ways to reduce energy consumption and lower utility bills. As a result, there is a greater emphasis on routine maintenance to ensure that HVAC systems run at peak efficiency. Maintenance service providers can help customers save money on their energy bills by performing routine inspections, cleanings, and adjustments.

- Furthermore, the increasing complexity of modern HVAC systems supports the growth of the maintenance service market. Maintenance service providers with expertise in the most recent HVAC technologies are in high demand to handle the complexities of advanced equipment. Service providers can meet changing customer needs and capitalize on market growth opportunities by staying up to date on technological advancements and providing tailored maintenance solutions.

- The growing emphasis on sustainability and environmental responsibility fuels the demand for energy-efficient HVAC systems and regular maintenance. Businesses and homeowners understand the significance of lowering their carbon footprint and minimizing environmental impact. The growing awareness of environmental issues, as well as the desire to adopt eco-friendly practices, are driving the steady growth of the HVAC maintenance service market.

Smart Maintenance and Predictive Analytics

- The HVAC maintenance service market is growing rapidly as smart maintenance technologies and predictive analytics become more widely adopted. With the rise of Internet of Things (IoT) sensors, artificial intelligence (AI), and machine learning, HVAC systems can now be monitored in real time and analysed for potential problems. This shift toward smart maintenance enables predictive maintenance scheduling, optimizing maintenance routines, and reducing downtime.

- HVAC maintenance providers can predict potential equipment failures using IoT sensors and AI-driven analytics, allowing for timely intervention and avoiding costly breakdowns. This proactive approach to maintenance not only increases system reliability, but it also improves operational efficiency by reducing unplanned downtime. Customers benefit from lower maintenance costs and improved system performance, resulting in increased demand for HVAC maintenance services.

- The integration of predictive analytics into HVAC maintenance practices is consistent with broader industry trends toward digitization and automation. The increasing demand for smart maintenance solutions is expected to drive the steady growth of the HVAC maintenance service market, as providers continue to invest in innovative technologies to meet their customers' changing needs.

HVAC Maintenance Service Market Segment Analysis:

HVAC Maintenance Service Market Segmented on the basis of type, application, and end-users.

By Service, Maintenance & Repair segment is expected to dominate the market during the forecast period

- HVAC systems are becoming more advanced and integrated into building operations, and businesses and property owners are prioritizing proactive maintenance to ensure optimal performance and avoid costly breakdowns. This emphasis on preventive maintenance drives the growth of maintenance and repair services as essential components of facility management.

- Rising awareness of energy efficiency and sustainability initiatives drives up demand for HVAC maintenance and repair services. Businesses and building owners understand the value of maintaining energy-efficient HVAC systems in order to reduce operating costs and minimize environmental impact. Regular maintenance and timely repairs are critical for improving system efficiency, maximizing energy savings, and meeting sustainability objectives.

- The growing use of smart technologies and connected HVAC systems necessitates the need for specialized maintenance and repair services. Smart HVAC systems frequently include advanced sensors, data analytics capabilities, and remote monitoring functionalities, necessitating specialized knowledge for maintenance and troubleshooting. As a result, maintenance and repair services have emerged as critical solutions for ensuring the long-term performance and sustainability of HVAC infrastructure across multiple industries.

By Application, Commercial segment held the largest share of xx% in 2022

- Commercial buildings, such as offices, retail stores, and hotels, rely heavily on HVAC systems to keep occupants comfortable indoors. As a result, regular maintenance is required to ensure the efficient operation of these systems, reduce energy consumption, and avoid costly breakdowns. Commercial property owners and facility managers prioritize HVAC maintenance services to improve system performance, extend equipment life, and increase occupant comfort and satisfaction.

- Continued growth in the commercial sector, combined with stringent regulatory requirements and increased awareness of energy efficiency, drives up demand for HVAC maintenance services. The rise of smart building technologies, such as building automation systems (BAS) and energy management systems (EMS), has increased the demand for advanced HVAC maintenance solutions that integrate seamlessly with these systems to enable remote monitoring, diagnostics, and predictive maintenance.

- Rapid urbanization, combined with the development of commercial real estate projects, drives up demand for HVAC systems and related maintenance services. As commercial buildings become more sophisticated and technologically advanced, the complexity of HVAC systems grows, necessitating specialized maintenance skills. As a result, the commercial application segment continues to dominate the HVAC Maintenance Service Market, with consistent growth.

HVAC Maintenance Service Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America emerges as the dominant and fastest-growing region in the HVAC Maintenance Service Market, owing to the region's strong commercial and industrial sectors, which drive significant demand for HVAC maintenance services. North America is home to a diverse range of commercial buildings, including offices, retail spaces, healthcare facilities, and manufacturing plants, all of which rely heavily on HVAC systems for temperature control and comfort.

- North America's stringent regulations and building codes require regular inspections, maintenance, and compliance with energy efficiency standards for HVAC systems. This regulatory environment promotes a culture of proactive maintenance among building owners and facility managers, which increases demand for HVAC maintenance services. Technological advancements and the adoption of smart building solutions in North America are driving the expansion of the HVAC maintenance service market.

- The United States and Canada dominate the North American HVAC maintenance service market, owing to significant commercial and industrial infrastructure and stringent regulatory frameworks that drive demand for maintenance services. Compliance with environmental regulations and energy efficiency initiatives encourages investment in preventive maintenance programs, fostering the growth of the regional maintenance service market.

HVAC Maintenance Service Market Top Key Players:

- Johnson Controls (US)

- Carrier Global Corporation (US)

- EMCOR Group Inc. (US)

- CBRE Group, Inc. (US)

- Ameresco (US)

- Linc Service Corporation (US)

- Comfort Systems USA (US)

- Mechanical Service Corporation (US)

- McQuay International (US)

- JCI Mechanical (US)

- Siemens (Germany)

- Engie (France)

- Vinci Facilities (France)

- Caisse d'Épargne (France)

- Emcor UK (UK)

- Trane Technologies (Ireland)

- Daikin Industries, Ltd. (Japan)

- Hitachi Johnson Controls Air Conditioning (Japan)

- Mitsubishi Heavy Industries (Japan)

- C&W Services (Australia) , and other Major Players

Key Industry Developments in the HVAC Maintenance Service Market:

- In March 2024, LG Electronics launched its innovative Dual Air Conditioner, combining style and functionality. The unit featured a dual outlet structure for rapid, precise temperature control and indirect airflow to ensure comfort. Equipped with the Dual Inverter Heat Pump Compressor™, it delivered efficient year-round performance, earning an A+++ EU energy efficiency rating. The launch marked a significant advancement in providing both comfort and energy efficiency to consumers.

- In March 2024, Midea launched the MARS series R290 commercial heat pump, earning the prestigious Ultra-High-Temperature Hot Water Performance Certification from Intertek. This certification recognized the exceptional efficiency and performance of the product. The MARS series also highlighted Midea's commitment to sustainability, as it utilized the eco-friendly R290 refrigerant, ensuring a lower environmental impact while providing reliable, high-performance heating solutions for commercial applications.

|

HVAC Maintenance Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 72.96 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.42 % |

Market Size in 2032: |

USD 138.95 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Service |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: HVAC Maintenance Service Market by Type (2018-2032)

4.1 HVAC Maintenance Service Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cooling

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Heating

4.5 Ventilation

Chapter 5: HVAC Maintenance Service Market by Service (2018-2032)

5.1 HVAC Maintenance Service Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Consulting

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Installation

5.5 Maintenance & Repair

5.6 Upgrade/Replacement

Chapter 6: HVAC Maintenance Service Market by Application (2018-2032)

6.1 HVAC Maintenance Service Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Commercial

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Industrial

6.5 Residential

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 HVAC Maintenance Service Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 NEWDEALDESIGN (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 MOTOROLA CORPORATION (USA)

7.4 GOOGLE INC. (USA)

7.5 VIVALNK INC. (USA)

7.6 MICROSOFT CORPORATION (USA)

7.7 GE MEASUREMENT & CONTROL SOLUTIONS (USA)

7.8 3M (USA)

7.9 CYMBET CORPORATION INC. (USA)

7.10 CAREE TECHNOLOGIES INC. (CANADA)

7.11 THINFILM ELECTRONICS ASA (NORWAY)

7.12 SAMSUNG GROUP (SOUTH KOREA)

7.13 PRAGMATIC PRINTING LTD. (UNITED KINGDOM)

7.14 LG CORPORATION (SOUTH KOREA)

7.15 SOLAR FRONTIER K.K. (JAPAN)

7.16

Chapter 8: Global HVAC Maintenance Service Market By Region

8.1 Overview

8.2. North America HVAC Maintenance Service Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Cooling

8.2.4.2 Heating

8.2.4.3 Ventilation

8.2.5 Historic and Forecasted Market Size by Service

8.2.5.1 Consulting

8.2.5.2 Installation

8.2.5.3 Maintenance & Repair

8.2.5.4 Upgrade/Replacement

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Commercial

8.2.6.2 Industrial

8.2.6.3 Residential

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe HVAC Maintenance Service Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Cooling

8.3.4.2 Heating

8.3.4.3 Ventilation

8.3.5 Historic and Forecasted Market Size by Service

8.3.5.1 Consulting

8.3.5.2 Installation

8.3.5.3 Maintenance & Repair

8.3.5.4 Upgrade/Replacement

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Commercial

8.3.6.2 Industrial

8.3.6.3 Residential

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe HVAC Maintenance Service Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Cooling

8.4.4.2 Heating

8.4.4.3 Ventilation

8.4.5 Historic and Forecasted Market Size by Service

8.4.5.1 Consulting

8.4.5.2 Installation

8.4.5.3 Maintenance & Repair

8.4.5.4 Upgrade/Replacement

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Commercial

8.4.6.2 Industrial

8.4.6.3 Residential

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific HVAC Maintenance Service Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Cooling

8.5.4.2 Heating

8.5.4.3 Ventilation

8.5.5 Historic and Forecasted Market Size by Service

8.5.5.1 Consulting

8.5.5.2 Installation

8.5.5.3 Maintenance & Repair

8.5.5.4 Upgrade/Replacement

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Commercial

8.5.6.2 Industrial

8.5.6.3 Residential

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa HVAC Maintenance Service Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Cooling

8.6.4.2 Heating

8.6.4.3 Ventilation

8.6.5 Historic and Forecasted Market Size by Service

8.6.5.1 Consulting

8.6.5.2 Installation

8.6.5.3 Maintenance & Repair

8.6.5.4 Upgrade/Replacement

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Commercial

8.6.6.2 Industrial

8.6.6.3 Residential

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America HVAC Maintenance Service Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Cooling

8.7.4.2 Heating

8.7.4.3 Ventilation

8.7.5 Historic and Forecasted Market Size by Service

8.7.5.1 Consulting

8.7.5.2 Installation

8.7.5.3 Maintenance & Repair

8.7.5.4 Upgrade/Replacement

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Commercial

8.7.6.2 Industrial

8.7.6.3 Residential

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

HVAC Maintenance Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 72.96 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.42 % |

Market Size in 2032: |

USD 138.95 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Service |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||