Hospital Information System Market Synopsis

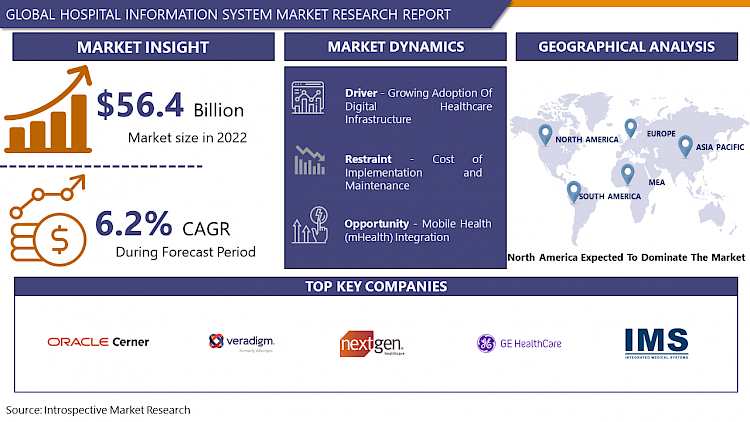

Hospital Information System Market Size Was Valued at USD 56.4 Billion in 2022, and is Projected to Reach USD 91.6 Billion by 2030, Growing at a CAGR of 6.2 % From 2023-2030.

A hospital information system (HIS) is an element of health informatics that focuses mainly on the administrational needs of hospitals. Hospital information systems provide a common source of information about a patient's health history, and doctors schedule timing.

- An electronic health record (EHR) is a real-time and patient-centred record that transfers information about patient availability quickly and securely to the concerned and authorized user. The EHRs contain the patient's medical history, treatment plans, and the test results from the laboratory. EHRs improve the ability to diagnose the disease and reduce the chances of errors in the results, which ultimately improve the outcome for patients.

- Hospital Information Systems (HIS) help healthcare facilities to improve their operational outcomes and reduce the workload on the staff, which is expected to boost industry growth. Various initiatives undertaken by governments across the globe and rising demand for the deployment of advanced IT solutions in hospitals for enhanced operational efficiency are some of the key factors that are expected to boost the adoption of HIS.

- Growing patient pool across the globe is a considerably prominent factor for projected adoption of hospital information systems during the forecast period. Additionally, certain benefits offered by hospital information systems such as efficiency in workflow, reduction in waste, improved time scheduling and most prominently superior patient care are expected to boost the growth of the global hospital information systems market.

Hospital Information System Market Trend Analysis

Growing Adoption Of Digital Healthcare Infrastructure

- Increased adoption of advanced technologies in healthcare facilities and growing use of digital healthcare infrastructure, which enables the collection and management of data generated by hospitals, clinics, and institutes, have increased the efficiency of their services, which will continue to drive the market's growth. Additionally, growing number of patients suffering from chronic illnesses and increasing demand for cloud-based solutions is expected to boost the market during the forecast period.

- As healthcare providers embrace digital technologies to enhance patient care, streamline operations, and improve efficiencies, the demand for robust HIS solutions are escalating. This trend is further fueled by government initiatives promoting the adoption of electronic health records (EHRs) and other digital health solutions, as well as the growing prevalence of chronic diseases and the aging population, which are leading to a surge in healthcare data that needs to be effectively managed.

- The adoption of digital healthcare infrastructure is transforming the way healthcare providers operate, enabling them to access and share patient data seamlessly, improve clinical decision-making, and deliver personalized care. HIS solutions are playing a pivotal role in this transformation by providing a centralized platform for managing patient information, including medical records, billing data, and appointment scheduling. These systems are also facilitating the integration of various healthcare technologies, such as telehealth, remote patient monitoring, and wearable devices, further enhancing the coordination and efficiency of care delivery.

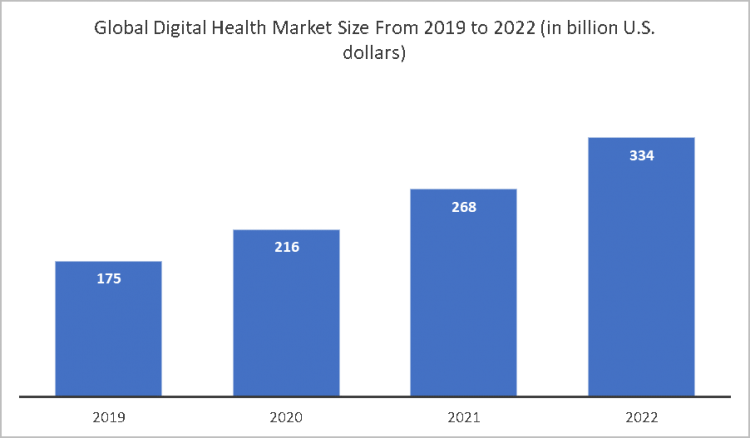

As per company data base above graph shows that the growth of digital health market during last four year is increased due to the Consumers want to be able to access healthcare services when and where it is convenient for them. Digital health solutions, such as telehealth, remote patient monitoring, and wearable devices, make it easier for people to get the care they need without having to travel to a doctor's office or hospital. This factor are boosting the growth of hospital information system.

Mobile Health (mHealth) Integration

- Mobile Health (mHealth) integration within Hospital Information Systems (HIS) presents a myriad of opportunities for healthcare providers, ushering in a new era of patient-centric and efficient healthcare delivery. The seamless integration of mHealth applications with HIS enhances accessibility to medical information, empowering both healthcare professionals and patients.

- Physicians can securely access real-time patient data, enabling informed decision-making and timely interventions. Concurrently, patients can conveniently retrieve their health records, fostering a more collaborative approach to healthcare management.

- mHealth integration contributes to the optimization of hospital workflows. Mobile applications facilitate streamlined communication among healthcare staff, reducing response times and enhancing overall efficiency. This is particularly crucial in emergency situations where quick access to patient information can make a significant difference in outcomes.

- Additionally, mHealth solutions offer a platform for remote patient monitoring, allowing healthcare providers to extend their reach beyond the hospital walls. This not only improves patient engagement but also enables early detection of health issues, thereby preventing complications and reducing hospital readmissions.

- Patient engagement is another area where mHealth integration with HIS excels. Mobile applications provide patients with tools for self-management, such as appointment scheduling, medication reminders, and personalized health education resources.

Hospital Information System Market Segment Analysis:

Hospital Information System Market Segmented on the basis of Type, Application, Delivery Mode, and Component.

By Type, Population Health Management segment is expected to dominate the market during the forecast period

- The population health management type segment dominated the global industry in 2022 and accounted for the maximum share of more than 49.65% of the overall revenue. Factors, such as the rising adoption of IT solutions in the healthcare and rising demand for value-based care delivery by healthcare professionals, contributed to the growth of this segment.

- Moreover, increasing demand for effective disease management at lower costs is expected to boost software adoption, fueling segment growth during the forecast period. The software also helps reduce the re-admission of patients and optimum interventions for patients. This is also expected to boost segment growth. The segment is projected to expand further at the fastest CAGR maintaining its leading position throughout the forecast period. The population health management systems help in cost control by providing cost-effective alternatives to physicians. Moreover, the solutions also enable risk stratification, data aggregation, and patient communication. and care coordination, which helps improve patient outcomes.

By Delivery Mode, web-based segment held the largest share of 41.95 % in 2022

- The web-based deployment segment dominated the global market in 2022 and accounted for the maximum share of more than 41.95% of the overall revenue. An increasing number of hospitals adopting web-based deployments as compared to on-premises deployments is expected to boost the growth of this segment. The web-based platforms include electronic medical records and other information systems, which are expected to have a high demand from small- and medium-sized healthcare providers to improve their operational workflows.

- Moreover, other benefits of web-based deployments, such as easy installment and maintenance, are expected to further drive the segment's growth. The cloud-based segment is expected to witness the fastest CAGR during the forecast period. This is due to the increasing demand for cloud-based technology by small-, medium- and large-scale hospitals to streamline their operations, such as legal, financial, and administrational operations. Cloud-based information systems witnessed considerable growth in recent years due to the rising security breaches on the on-platform and web-based deployments. Cloud-based platforms offer higher security as compared to the other deployments, which is also expected to contribute to segment growth.

Hospital Information System Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The Hospital Information System (HIS) market in North America can be attributed to a combination of technological advancements, robust healthcare infrastructure, and favorable regulatory frameworks. The region has been at the forefront of adopting cutting-edge technologies in the healthcare sector, and this includes the widespread implementation of Hospital Information Systems.

- The United States, in particular, has been a pioneer in embracing electronic health records (EHRs) and other IT solutions within the healthcare ecosystem. The push for digitization and the adoption of HIS has been driven by various factors, including the need for improved patient care, streamlined administrative processes, and enhanced data accessibility for healthcare providers.

- North America benefits from a well-established and extensive healthcare infrastructure. The presence of numerous healthcare facilities, ranging from small clinics to large hospital networks, has created a substantial market for HIS. The demand for interoperability and integrated healthcare solutions has further fueled the adoption of HIS across various healthcare organizations in the region. The ability of HIS to centralize patient data, automate workflows, and improve communication between different departments has resonated well with the diverse and complex healthcare landscape in North America.

- Regulatory support has played a crucial role in the dominance of HIS in North America. Governments and healthcare regulatory bodies in the region have implemented policies and standards that encourage the adoption of information technology in healthcare settings. Meaningful Use initiatives in the United States, for example, provided financial incentives for healthcare providers to adopt EHRs, thereby catalyzing the growth of the HIS market.

COVID-19 Impact Analysis on Hospital Information System Market:

The outbreak of COVID-19 has disrupted workflows in the healthcare sector across the world. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of healthcare. Moreover, there has also been a positive effect on various healthcare services, including the including hospital information system market. The ‘digital front door’ is really a key to how providers should be responding to the COVID-19 situation in terms of access, triage, and even treatment. With surge in demand for hospital capacity, one of the challenges faced by hospital IT staffers is figuring out how to quickly deploy EHR systems to alternative care locations.

Furthermore, the healthcare facilities such as hospitals, diagnostic centers, and clinics, are showing interest toward clinical decision support systems, electronic health records (EHRs) and other systems in minimizing medication prescription errors, adverse drug events monitoring and other medical errors. Furthermore, COVID-19 is acting as a key factor for a sharp uptake of teleconsultations. The restrictions on free movement and travel, the limitation of medical services to emergency situations, and the overall increase in suspected and confirmed COVID-19 infections have contributed to the recent surge in teleconsultation platforms.

Hospital Information System Market Top Key Players

- McKesson Corporation (US)

- Cerner Corporation (US)

- Carestream Health (US)

- Allscripts Healthcare LLC (US)

- Merge Healthcare Inc. (IBM) (US)

- NextGen Healthcare (US)

- GE Healthcare (US)

- General Electric Company (US)

- Integrated Medical Systems (US)

- Epic Systems Corporation (US)

- NXGN Management, LLC (US)

- Philips Healthcare (Netherlands)

- Computer Programs and Systems Inc (US)

- OpenEMR (US)

- Medidata Solutions Inc. (US)

- Eclipsys (US)

- Medical Information Technology Inc. (US)

- Greenway Health, LLC (US)

- Siemens Healthineers (Germany)

- Comarch SA. (Poland)

- Agfa-Gevaert N.V. (Belgium)

- Dedalus SpA (Italy)

- Wipro Limited (India)

- Napier Healthcare Solutions Pte. Ltd. (Singapore)

- Neusoft Medical Systems Co., Ltd. (China), and Other Major Player

Key Industry Developments in the Hospital Information System Market:

- In January 2021, Philips Healthcare, a Netherlands-based company that provides laboratory information systems acquired Capsule Technologies. The acquisition is complimentary to Philips’ strategy to transform delivery of healthcare with integrated solutions. Capsule technologies is a US-based provider of medical device integration and data technologies for hospitals.

- In August 2021, the Government of Delhi approved the INR 13.9 billion project for setting up a cloud-based integrated health information management system across its hospitals.

|

Hospital Information System Market |

||||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 56.4 Bn. |

|

|

CAGR (2023-2030) : |

6.2% |

Market Size in 2030: |

USD 91.6 Bn. |

|

|

Segments Covered: |

By Type |

|

|

|

|

By Application |

|

|

||

|

By Delivery Mode |

|

|

||

|

By Component |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- HOSPITAL INFORMATION SYSTEM MARKET BY TYPE (2016-2030)

- HOSPITAL INFORMATION SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ELECTRONIC HEALTH RECORD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ELECTRONIC MEDICAL RECORD

- REAL-TIME HEALTHCARE

- PATIENT ENGAGEMENT SOLUTION

- POPULATION HEALTH MANAGEMENT

- HOSPITAL INFORMATION SYSTEM MARKET BY APPLICATION (2016-2030)

- HOSPITAL INFORMATION SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CLINICAL INFORMATION SYSTEMS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LABORATORY INFORMATION SYSTEMS

- PHARMACY INFORMATION SYSTEM

- HOSPITAL INFORMATION SYSTEM MARKET BY DELIVERY MODE (2016-2030)

- HOSPITAL INFORMATION SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- WEB-BASED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ON-PREMISE

- CLOUD-BASED

- HOSPITAL INFORMATION SYSTEM MARKET BY COMPONENT (2016-2030)

- HOSPITAL INFORMATION SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOFTWARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HARDWARE

- SERVICES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Hospital Information System Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- MCKESSON CORPORATION (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- CERNER CORPORATION (US)

- CARESTREAM HEALTH (US)

- ALLSCRIPTS HEALTHCARE LLC (US)

- MERGE HEALTHCARE INC. (IBM) (US)

- NEXTGEN HEALTHCARE (US)

- GE HEALTHCARE (US)

- GENERAL ELECTRIC COMPANY (US)

- INTEGRATED MEDICAL SYSTEMS (US)

- EPIC SYSTEMS CORPORATION (US)

- NXGN MANAGEMENT, LLC (US)

- PHILIPS HEALTHCARE (NETHERLANDS)

- COMPUTER PROGRAMS AND SYSTEMS INC (US)

- OPENEMR (US)

- MEDIDATA SOLUTIONS INC. (US)

- ECLIPSYS (US)

- MEDICAL INFORMATION TECHNOLOGY INC. (US)

- GREENWAY HEALTH, LLC (US)

- SIEMENS HEALTHINEERS (GERMANY)

- COMARCH SA. (POLAND)

- AGFA-GEVAERT N.V. (BELGIUM)

- DEDALUS SPA (ITALY)

- WIPRO LIMITED (INDIA)

- NAPIER HEALTHCARE SOLUTIONS PTE. LTD. (SINGAPORE)

- COMPETITIVE LANDSCAPE

- GLOBAL HOSPITAL INFORMATION SYSTEM MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Delivery Mode

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Hospital Information System Market |

||||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 56.4 Bn. |

|

|

CAGR (2023-2030) : |

6.2% |

Market Size in 2030: |

USD 91.6 Bn. |

|

|

Segments Covered: |

By Type |

|

|

|

|

By Application |

|

|

||

|

By Delivery Mode |

|

|

||

|

By Component |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

Frequently Asked Questions :

The forecast period in the Hospital Information System Market research report is 2023-2030.

McKesson Corporation (US), Cerner Corporation (US), Carestream Health (US), Allscripts Healthcare LLC (US), Merge Healthcare Inc. (IBM) (US), NextGen Healthcare (US), GE Healthcare (US), General Electric Company (US), Integrated Medical Systems (US), Epic Systems Corporation (US), NXGN Management, LLC (US), Philips Healthcare (Netherlands), Computer Programs and Systems Inc (US), OpenEMR (US), Medidata Solutions Inc. (US), Eclipsys (US), Medical Information Technology Inc. (US), Greenway Health, LLC (US), Siemens Healthineers (Germany), Comarch SA. (Poland), Agfa-Gevaert N.V. (Belgium), Dedalus SpA (Italy), Wipro Limited (India), Napier Healthcare Solutions Pte. Ltd. (Singapore), Neusoft Medical Systems Co., Ltd. (China), and Other Major Player.

The Hospital Information System Market is segmented into Type, Application, Delivery Mode, Component and region. By Type, the market is categorized into Electronic Health Record, Electronic Medical Record, Real-time Healthcare, Patient Engagement Solution, Population Health Management. By Application, the market is categorized into Clinical information systems, Laboratory information systems, Pharmacy Information System. By Delivery Mode, the market is categorized into Web-based, On-premise, Cloud-based. By Component, the market is categorized into Software, Hardware, Services. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A hospital information system (HIS) is an element of health informatics that focuses mainly on the administrational needs of hospitals. Hospital information systems provide a common source of information about a patient's health history, and doctors schedule timing.

Hospital Information System Market Size Was Valued at USD 56.4 Billion in 2022, and is Projected to Reach USD 91.6 Billion by 2030, Growing at a CAGR of 6.2 % From 2023-2030.