Cyber security as a Service Market Synopsis

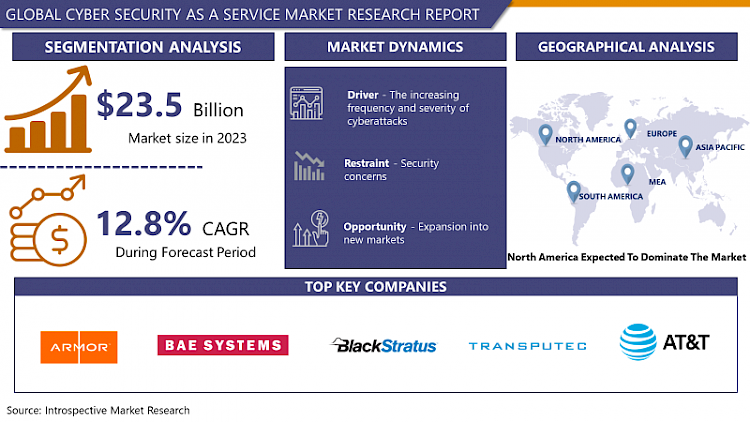

Cyber security as a Service Market Size Was Valued at USD 23.5 Billion in 2023, and is Projected to Reach USD 69.47 Billion by 2032, Growing at a CAGR of 12.8% From 2024-2032.

Cybersecurity as a Service (CSaaS) is the delivery of cybersecurity products and services through a subscription-based model, whereby the end-user accesses the same through the internet. It includes a number of services such as threat and incident management, vulnerability management, security monitoring and analysis, compliance, and incident handling. In simple terms, CSaaS providers provide a range of security solutions and services that make it possible for organizations to delegate their security requirements to other companies in the market.

- This model provides organisations with the opportunity to acquire modern cybersecurity solutions and services, without the need to spend a lot of money on the acquisition of hardware or the employment of security personnel. It is especially beneficial for SMEs that may not have sufficient funds or personnel to design and maintain effective cybersecurity measures independently.

- The Cybersecurity as a Service market has been rapidly growing in the last several years due to the increasing occurrence and complexity of cyber threats, increased attention towards the compliance issues and a changing perception of the threats among businesses. As organizations embrace cloud computing, remote work, and the Internet of Things, the risks are increasing, and thus, proper cybersecurity measures are more than necessary.

- Moreover, the lack of qualified personnel in the cybersecurity domain only adds to the need for companies to turn to CSaaS providers as they try to strengthen their defenses with the help of outside professionals. The key vendors in the CSaaS market are cybersecurity vendors, MSSPs, CSPs, and niche players including start-ups that provide specialized services and solutions. This occurs as organizations remain focused on cybersecurity as a strategic business enabler, while advancements in technology and the constant emergence of new threats ensure that the CSaaS market has significant room for expansion in the future.

Cyber security as a Service Market Trend Analysis

Increased adoption of cloud computing

- The general trend towards the use of cloud computing technologies is one of the main factors that contribute to the growth of the Cybersecurity as a Service (CSaaS) market. There are several advantages of using cloud computing in organizations such as scalability, flexibility and economic benefits.

- However, it also presents specific cybersecurity threats, including data breaches, unauthorized access, and services denial. This is because as organizations are increasingly shifting their work and data to the cloud, they require strong cyber security measures in order to safeguard their valuable information and ensure that their cloud resources are secure and accessible.

- These challenges are well understood by the CSaaS providers as they offer unique services that focus on cybersecurity in the cloud. These services may include cloud security posture management, identity and access management, data encryption, and threat intelligence tailored for cloud-native applications and infrastructure.

- Through CSaaS, organizations can ramp up the security of their cloud environment while making minimal investments in hardware, software, and human resources. This trend is further driven by the need to meet compliance standards and regulations within the cloud environment since most businesses have to protect their data from being exposed to the public domain. This is because, as cloud computing adoption continues to expand, so too will the need for CSaaS solutions, thus propelling the cybersecurity industry forward.

Development of new security solutions

- The emergence of new security solutions can be considered as a promising opportunity for the Cybersecurity as a Service (CSaaS) market. In the today’s world full of cyber threats that are becoming more complex and numerous, there is a perpetual demand for new and improved methods of protecting information and systems. This puts pressure on the CSaaS providers to innovate their strategies and solutions, including the integration of the latest technologies, including Artificial Intelligence (AI), Machine Learning (ML), and Blockchain to improve threat identification, response, and the efficiency and effectiveness of security.

- For instance, AI and ML can process large volumes of data in real-time to recognize patterns and anomalies that are symptomatic of cyber threats, thus, improving the effectiveness of threat detection and response. On the other hand, the use of blockchain is associated with the provision of secure and unchangeable records of transactions, which can be used for increasing the reliability and transparency of records in the field of cybersecurity.

- Further, the dynamic nature of technological developments, especially IoT, 5G, and edge computing, raises new threats and possibilities to contend with. These are trends that CSaaS providers can leverage in developing specific security solutions that address such technologies. For instance, the IoT is a system of interconnected devices which lacks robust security features and can easily be compromised; the CSaaS provider can offer protection for the IoT networks and devices.

- Likewise, the launch of 5G networks, which is characterized by enhanced speed and connection, needs better security to prevent various risks. This because, CSaaS providers can develop new-age security solutions for these technologies and because of the unique problems presented by these technologies, they can meet the specific client requirements hence increasing the chances of growing the business and the cybersecurity market..

Cyber security as a Service Market Segment Analysis:

Cyber security as a Service Market is segmented based on Type, Organisation Size, and Industrial vertical.

By Type, Cloud Security is expected to dominate the market during the forecast period

- The Cloud Security is currently the leading segment in the Cybersecurity as a Service (CSaaS) market. This dominance is attributed to the increasing and global use of cloud computing services across various industries. This has been due to the current trend where most organizations are moving their resources such as data, applications and services to the cloud.

- Cloud security is the protection of the cloud environment, the applications, and other resources that are located on the cloud from different forms of cybercrimes. These services are data encryption, identity and access management, threat detection and response and compliance monitoring services. Cloud-based security solutions provide the scalability, flexibility, and cost-effectiveness that are crucial for organizations of all sizes as they attempt to safeguard their data and meet compliance requirements in the cloud environment.

- The Cloud Security segment has also been boosted by factors such as the dynamic threat environment and the rising complexity of cyber threats that specifically target cloud infrastructures. Hackers are not sparing any effort to discover new ways of exploiting the vulnerabilities that exist in cloud infrastructures, and this has led to major data leaks and service disruptions.

- Therefore, today’s organizations are working towards strengthening the security of cloud to secure their data and operations. In addition, new-age technologies, including artificial intelligence and machine learning, are improving the efficacy of threat detection and mitigation in clouds, consequently increasing the demand for CSaaS. Thus, the demand for more sophisticated and effective CSaaS solutions will also persist as the market for cloud computing experiences further expansion, which will contribute to the growth of the main Cloud Security segment.

By Industry Vertical, BFSI segment held the largest share

- The analysis of the current market trends shows that the BFSI (Banking, Financial Services, and Insurance) is currently the leading segment in the Cybersecurity as a Service (CSaaS) market. This sector is most vulnerable to cybercrimes because of the information that it processes, which includes personal and financial data. This sector, especially the BFSI industry, has to meet and adhere to various compliance standards and regulations like GDPR, PCI-DSS, as well as national data protection laws that necessitate the need for enhanced security against cyber threats.

- Hence, BFSI organizations are focusing on CSaaS to secure the digital assets and personal information of the customers, and to build trust. Functions such as threat identification and remediation, identification and management of users and authorized access, and monitoring are vital for BFSI organizations to counter the evolving threats.

- In addition, the importance of cybersecurity has been exacerbated by the increased adoption of the digital transactions and online services in the financial sector. The growth in innovation in the financial services industry especially in the fintech sector, mobile banking and other online financial services has opened new channels for cybercriminals. To meet these needs, CSaaS providers have launched industry-specific security solutions that focus on the BFSI sector and the challenges emerging from digital transformation.

- They not only defend against outside threats, but also prevent internal ones using the help of analytics and monitoring tools and techniques. Thus, the BFSI sector, which is among the most dynamic in terms of the implementation of new technologies, will require advanced cybersecurity services, and this segment of the CSaaS market will provide the most dynamic growth.

Cyber security as a Service Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America dominates the global cybersecurity as a service market due to the digitized ecosystem and proliferation of smart devices. Moreover, it owns the primary market for adopting innovative technologies and has various cybersecurity companies that will drive the market. The CSaaS market in North America is set to increase due to the growing demand from organizations to protect their employees from misuse of the Internet, increase employee productivity and to address threats to their IT infrastructures.

- There are also many companies in the region today this have greatly enhanced the consistency in the growth of the market in the region in addition to the extension of their services in the market. For example, in January 2020, Accenture planned a move to acquire Broadcom Inc. ’s Cyber Security Services business from Symantec, which offers some services like global threat intelligence, protection through a network of security operation centers, adversary and sector-specific intelligence in real time, and incident response services.

- Furthermore, by regions, it was as expected for data breaches in the United States to remain expensive than those in the other countries. In as much as data breaches go, the costs on average in the country approximate to USD 8. 19 million, that is more than twofold the average level across the world, and it grew by 113% during the last 14 years.

- As for the NEC CIP regulation, the regulation is currently implemented in the United States, with security at the substation level used as the focus. According to Presidential Policy Directive 21 of the United States, the energy sector falls under the critical infrastructure sectors, mainly because it has the capacity to perform the enabling function. In March 2019, an office for Cybersecurity, Energy Security, & Emergency Response for the United States was approved with a budget amount of USD 96 million.

Active Key Players in the Cyber security as a Service Market

- Akamai Technologies (United States)

- AT&T Cybersecurity (United States)

- BlackBerry Cylance (Canada)

- Check Point Software Technologies (Israel)

- Cisco Systems (United States)

- CrowdStrike (United States)

- Darktrace (United Kingdom)

- FireEye (now part of Trellix) (United States)

- Fortinet (United States)

- F-Secure (Finland)

- IBM Security (United States)

- Kaspersky Lab (Russia)

- McAfee (United States)

- Palo Alto Networks (United States)

- Proofpoint (United States)

- Rapid7 (United States)

- SecureWorks (United States)

- Sophos (United Kingdom)

- Symantec (now part of Broadcom) (United States)

- Trend Micro (Japan), and Other Key Players

|

Global Cyber security as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 23.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.8% |

Market Size in 2032: |

USD 69.47 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Organization Size |

|

||

|

By Industry Verticals |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- CYBER SECURITY AS A SERVICE MARKET BY TYPE (2017-2032)

- CYBER SECURITY AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ENTERPRISE SECURITY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ENDPOINT SECURITY

- CLOUD SECURITY

- NETWORK SECURITY

- APPLICATION SECURITY

- CYBER SECURITY AS A SERVICE MARKET BY ORGANIZATION SIZE (2017-2032)

- CYBER SECURITY AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LARGE ENTERPRISE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SMES

- CYBER SECURITY AS A SERVICE MARKET BY INDUSTRY VERTICALS (2017-2032)

- CYBER SECURITY AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- IT AND TELECOM

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- RETAIL

- BFSI

- HEALTHCARE

- GOVERNMENT AND DEFENSE

- AUTOMOTIVE

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- CYBER SECURITY AS A SERVICE Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AKAMAI TECHNOLOGIES (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- AT&T CYBERSECURITY (UNITED STATES)

- BLACKBERRY CYLANCE (CANADA)

- CHECK POINT SOFTWARE TECHNOLOGIES (ISRAEL)

- CISCO SYSTEMS (UNITED STATES)

- CROWDSTRIKE (UNITED STATES)

- DARKTRACE (UNITED KINGDOM)

- FIREEYE (NOW PART OF TRELLIX) (UNITED STATES)

- FORTINET (UNITED STATES)

- F-SECURE (FINLAND)

- IBM SECURITY (UNITED STATES)

- KASPERSKY LAB (RUSSIA)

- MCAFEE (UNITED STATES)

- PALO ALTO NETWORKS (UNITED STATES)

- PROOFPOINT (UNITED STATES)

- RAPID7 (UNITED STATES)

- SECUREWORKS (UNITED STATES)

- SOPHOS (UNITED KINGDOM)

- SYMANTEC (NOW PART OF BROADCOM) (UNITED STATES)

- TREND MICRO (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL CYBER SECURITY AS A SERVICE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Organization Size

- Historic And Forecasted Market Size By Industry Verticals

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Cyber security as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 23.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.8% |

Market Size in 2032: |

USD 69.47 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Organization Size |

|

||

|

By Industry Verticals |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. CYBER SECURITY AS A SERVICE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. CYBER SECURITY AS A SERVICE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. CYBER SECURITY AS A SERVICE MARKET COMPETITIVE RIVALRY

TABLE 005. CYBER SECURITY AS A SERVICE MARKET THREAT OF NEW ENTRANTS

TABLE 006. CYBER SECURITY AS A SERVICE MARKET THREAT OF SUBSTITUTES

TABLE 007. CYBER SECURITY AS A SERVICE MARKET BY TYPE

TABLE 008. DELIVERY SERVICES MARKET OVERVIEW (2016-2028)

TABLE 009. RENTAL TRANSPORTATION MARKET OVERVIEW (2016-2028)

TABLE 010. CAR RENTAL SERVICE MARKET OVERVIEW (2016-2028)

TABLE 011. RIDESHARE SERVICES MARKET OVERVIEW (2016-2028)

TABLE 012. CAR SUBSCRIPTION SERVICES MARKET OVERVIEW (2016-2028)

TABLE 013. CYBER SECURITY AS A SERVICE MARKET BY DEPLOYMENT MODEL

TABLE 014. ANDROID PLATFORM MARKET OVERVIEW (2016-2028)

TABLE 015. IOS PLATFORM MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA CYBER SECURITY AS A SERVICE MARKET, BY TYPE (2016-2028)

TABLE 017. NORTH AMERICA CYBER SECURITY AS A SERVICE MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 018. N CYBER SECURITY AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE CYBER SECURITY AS A SERVICE MARKET, BY TYPE (2016-2028)

TABLE 020. EUROPE CYBER SECURITY AS A SERVICE MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 021. CYBER SECURITY AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC CYBER SECURITY AS A SERVICE MARKET, BY TYPE (2016-2028)

TABLE 023. ASIA PACIFIC CYBER SECURITY AS A SERVICE MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 024. CYBER SECURITY AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA CYBER SECURITY AS A SERVICE MARKET, BY TYPE (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA CYBER SECURITY AS A SERVICE MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 027. CYBER SECURITY AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA CYBER SECURITY AS A SERVICE MARKET, BY TYPE (2016-2028)

TABLE 029. SOUTH AMERICA CYBER SECURITY AS A SERVICE MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 030. CYBER SECURITY AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 031. ARMOR DEFENSE INC.: SNAPSHOT

TABLE 032. ARMOR DEFENSE INC.: BUSINESS PERFORMANCE

TABLE 033. ARMOR DEFENSE INC.: PRODUCT PORTFOLIO

TABLE 034. ARMOR DEFENSE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. AT&T: SNAPSHOT

TABLE 035. AT&T: BUSINESS PERFORMANCE

TABLE 036. AT&T: PRODUCT PORTFOLIO

TABLE 037. AT&T: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. BAE SYSTEMS: SNAPSHOT

TABLE 038. BAE SYSTEMS: BUSINESS PERFORMANCE

TABLE 039. BAE SYSTEMS: PRODUCT PORTFOLIO

TABLE 040. BAE SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. BLACKSTRATUS: SNAPSHOT

TABLE 041. BLACKSTRATUS: BUSINESS PERFORMANCE

TABLE 042. BLACKSTRATUS: PRODUCT PORTFOLIO

TABLE 043. BLACKSTRATUS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. CAPGEMINI: SNAPSHOT

TABLE 044. CAPGEMINI: BUSINESS PERFORMANCE

TABLE 045. CAPGEMINI: PRODUCT PORTFOLIO

TABLE 046. CAPGEMINI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. CHOICE CYBERSECURITY: SNAPSHOT

TABLE 047. CHOICE CYBERSECURITY: BUSINESS PERFORMANCE

TABLE 048. CHOICE CYBERSECURITY: PRODUCT PORTFOLIO

TABLE 049. CHOICE CYBERSECURITY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. TRANSPUTEC LTD: SNAPSHOT

TABLE 050. TRANSPUTEC LTD: BUSINESS PERFORMANCE

TABLE 051. TRANSPUTEC LTD: PRODUCT PORTFOLIO

TABLE 052. TRANSPUTEC LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. CLOUDLOCK (CISCO): SNAPSHOT

TABLE 053. CLOUDLOCK (CISCO): BUSINESS PERFORMANCE

TABLE 054. CLOUDLOCK (CISCO): PRODUCT PORTFOLIO

TABLE 055. CLOUDLOCK (CISCO): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. FIREEYE: SNAPSHOT

TABLE 056. FIREEYE: BUSINESS PERFORMANCE

TABLE 057. FIREEYE: PRODUCT PORTFOLIO

TABLE 058. FIREEYE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. INC.: SNAPSHOT

TABLE 059. INC.: BUSINESS PERFORMANCE

TABLE 060. INC.: PRODUCT PORTFOLIO

TABLE 061. INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. LOOKINGGLASS CYBER SOLUTIONS INC.: SNAPSHOT

TABLE 062. LOOKINGGLASS CYBER SOLUTIONS INC.: BUSINESS PERFORMANCE

TABLE 063. LOOKINGGLASS CYBER SOLUTIONS INC.: PRODUCT PORTFOLIO

TABLE 064. LOOKINGGLASS CYBER SOLUTIONS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. OPTIV SECURITY INC.: SNAPSHOT

TABLE 065. OPTIV SECURITY INC.: BUSINESS PERFORMANCE

TABLE 066. OPTIV SECURITY INC.: PRODUCT PORTFOLIO

TABLE 067. OPTIV SECURITY INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. TATA CONSULTANCY SERVICES LIMITED: SNAPSHOT

TABLE 068. TATA CONSULTANCY SERVICES LIMITED: BUSINESS PERFORMANCE

TABLE 069. TATA CONSULTANCY SERVICES LIMITED: PRODUCT PORTFOLIO

TABLE 070. TATA CONSULTANCY SERVICES LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 071. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 072. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 073. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. CYBER SECURITY AS A SERVICE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. CYBER SECURITY AS A SERVICE MARKET OVERVIEW BY TYPE

FIGURE 012. DELIVERY SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 013. RENTAL TRANSPORTATION MARKET OVERVIEW (2016-2028)

FIGURE 014. CAR RENTAL SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 015. RIDESHARE SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 016. CAR SUBSCRIPTION SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 017. CYBER SECURITY AS A SERVICE MARKET OVERVIEW BY DEPLOYMENT MODEL

FIGURE 018. ANDROID PLATFORM MARKET OVERVIEW (2016-2028)

FIGURE 019. IOS PLATFORM MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA CYBER SECURITY AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE CYBER SECURITY AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC CYBER SECURITY AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA CYBER SECURITY AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA CYBER SECURITY AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Cyber security as a Service Market research report is 2024-2032.

Akamai Technologies (United States), AT&T Cybersecurity (United States), BlackBerry Cylance (Canada), Check Point Software Technologies (Israel), Cisco Systems (United States), CrowdStrike (United States), Darktrace (United Kingdom), FireEye (now part of Trellix) (United States), Fortinet (United States), F-Secure (Finland), IBM Security (United States), Kaspersky Lab (Russia), McAfee (United States), Palo Alto Networks (United States), Proofpoint (United States), Rapid7 (United States), SecureWorks (United States), Sophos (United Kingdom), Symantec (now part of Broadcom) (United States), Trend Micro (Japan) and Other Major Players.

The Cyber security as a Service Market is segmented into Type, Industry Verticals, Organisation Size, and region. By Type, the market is categorized into Enterprise Security, Endpoint Security, Cloud Security, Network Security, Application Security. By Organisation Size, the market is categorized into Large Enterpris, SMEs. By Industry Verticals, the market is IT and Telecom, Retail BFSI, Healthcare, Government and defense, Automotive, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Cybersecurity as a Service (CSaaS) is a business model that involves providing cybersecurity solutions and services to organizations in a subscription-based or consumption-based model and accessing it through the internet. It encompasses various solutions that are used in the areas like threat intelligence and incident response, vulnerability assessment and management, security information and event management, compliance management and others. CSaaS makes resources and solutions only available to large organizations with specialized security teams and budgets more accessible to companies of all sizes. This model is particularly helpful for SMEs in their efforts to strengthen their cybersecurity without breaking the bank.

Cyber security as a Service Market Size Was Valued at USD 23.5 Billion in 2023, and is Projected to Reach USD 69.47 Billion by 2032, Growing at a CAGR of 12.8% From 2024-2032.