Location as a Service Market Synopsis

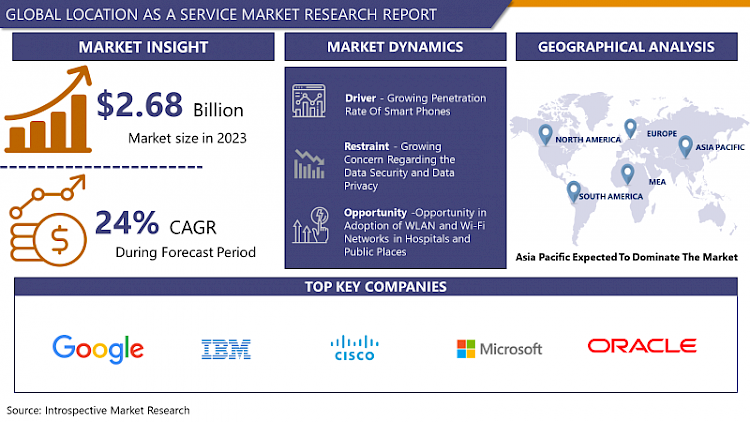

Location as a Service Market Size Was Valued at USD 2.68 Billion in 2023 and is Projected to Reach USD 18.56 Billion by 2032, Growing at a CAGR of 24% From 2024-2032.

The market for LaaS is today experiencing rapid growth due to the development in technologies related to location-based and the increasing trend in usage of mobile and IoT devices. LaaS platform provides the following solutions based on location intelligence like Geofencing, Mapping & Navigation, Analytics & Insights for various sectors of enterprises, including Retail, Transportation & Logistics, and Healthcare. Concerning market prospects, the analysts state that the growth of the LaaS market will accelerate, owing to the growing real-time location information for Personalised Customer Engagement, supply chain optimization, and marketing.

- Some of the key players that will be covered in the LaaS market report are Google, Apple, HERE Technologies, and Mapbox are some of the world-renowned market players along with several other emerging market players that deal in several specialized LaaS solutions for various industries. With the IoT devices and AI integration, LaaS is fast becoming effective in allowing businesses to get key insights from location data that can help in analytics and entrepreneurship.

- The LaaS market has achieved promising growth but it has undergone problems such as the lack of privacy, the protection of data, and regulatory laws so, stakeholders can enhance the data governance structure and encryption. The said report indicates that the LaaS market holds profound business potential for utilizing location data to make itself more efficient for consumers and other businesses.

- LaaS has vast potential for vendors and customers, but it has certain disadvantages like privacy violations, susceptibility to data risks, and vital legal requirements. On the same note, the rising uptake of LaaS solutions in various industries and the technological development of this market are expected to drive market growth in the future.

Location as a Service Market Trend Analysis

Integration with IoT and Sensor Technologies

- The convergence between LaaS and IoT and sensor technology is another significant movement that redefines industries with its coherent blend of data pipelines. Through this synergy, businesses can access timely information and manage their function with pinpoint acuity, leading to extraordinary refinements in productivity and agility.

- With the support of IoT and sensors, LaaS has smart tracking of assets, vehicles, as well as of people, with high accuracy and real-time data that gives a chance to make correct decisions in critical situations. The marriage of these technologies gives processes a smart shading of intelligence, turning supply chains, customer interactions, and more, into smarter experiences.

- This has not only optimized the process and operational excellence but also younger, different, and innovative possibilities to disrupt the market. The integration of IoT devices and sensors means that many companies have access to unparalleled information on customer preferences, resource use, and other patterns, which can also be used for predictive analytics.

- Furthermore, this integration has the dynamics of increasing the LaaS market’s maturity and bringing its development to new, unimagined heights. This development shows that businesses continue to see the benefits of acquiring real-time location intelligence as a sustainable competitive advantage for enterprises and consequently, the high demand for LaaS that features IoT and sensor elements. Indeed, this trend signifies a new age of highly connected enterprises for which location awareness has bowed as one of the determinants of strategic management decisions.

Focus on Indoor Positioning and Navigation

- It is a rapidly growing sub-segment in a broader market called Location as a Service or LaaS which deals in providing accurate navigation and positioning within enclosed spaces such as malls, airports, hospitals, and warehouses. This is because there is a growing demand for solutions that allow natural and efficient movement along with also boosting productivity and managing complexities within indoor environments.

- It indicates that with the help of integrated sensors such as Wi-Fi, Bluetooth, and inertial, positioning technologies have been developed with the use of smartphones. BLE, wi-fi markerless positioning, and UWB are popular for offering accurate and efficient solutions for indoor positioning and navigation.

- Indoor navigation plays an essential role in a variety of fields, given the broad use of GPS. It provides the retail industry with customer-specific shopping experiences and localization solutions for indoors. In healthcare, it helps in inventory control and guiding patients to the right places in facilities. In the same respect, indoor positioning technology also increases the effectiveness of operations, especially in logistics, and also provides safer conditions in working environments.

- It can be stated that demand for indoor positioning and navigation solutions will rise further with the help of the increased rate of smart building construction, development of indoor mapping platforms, and greater need for location-based services indoors. Consequently, there is a great opportunity to expand the LaaS market and saturate it with vendors providing solutions for positions inside buildings.

Location as a Service Market Segment Analysis:

Location as a Service Market is segmented based on Product, Application, and Verticals

By Product, the GPS segment is expected to dominate the market during the forecast period.

- By leveraging satellite signals, GPS technology continues to be a cornerstone of location-based services, delivering precise outdoor positioning data. The transportation, logistics, and outdoor recreation sectors are among the many that utilize GPS-enabled devices and applications for asset tracking, fleet management, and navigation.

- By facilitating the transmission of data over cellular networks, GPRS technology enables mobile devices to provide location-based services. GPRS technology facilitates instantaneous communication and location monitoring, particularly in densely populated urban areas where GPS signals may encounter obstructions. Instances where GPRS is indispensable include social networking, location-based advertising, and emergency services.

- RFID technology uses radio waves to identify and monitor objects equipped with RFID tags or labels. RFID is an essential component in the LaaS market, serving critical functions including inventory monitoring, asset management, and access control systems in indoor settings including warehouses, retail establishments, and healthcare facilities.

- To analyze, visualize, and interpret spatial patterns and relationships, GIS incorporates geographical data. GIS technology facilitates the generation of digital maps and geospatial analysis for a wide range of purposes, such as environmental monitoring, natural resource management, and urban planning.

By Application, Tracking & Navigation segment held the largest share in 2023

- LaaS enables real-time monitoring and navigation services, enabling users to precisely determine their locations and navigate to their intended destinations. Precise location data is of the utmost importance in sectors including transportation, logistics, and emergency services, where it ensures safe and efficient operations.

- LaaS enables users to connect, share, and discover content based on their geographic proximity through location-based social networking platforms. These platforms facilitate increased user involvement and offer tailored experiences, thereby stimulating social exchanges and nurturing community involvement in domains including tourism, events, and the promotion of local enterprises.

- LaaS enables marketers to provide users with location-data-driven advertisements that are both targeted and contextually pertinent. Organizations the utilization of geo-fencing, proximity marketing, and location-based analytics, organizations can optimize their marketing initiatives, attract consumers to their brick-and-mortar locations, and generate interest at opportune moments.

- Apart from its application in monitoring, navigation, social networking, and marketing, LaaS finds its application in a wide range of other sectors and scenarios. These include, among others, environmental monitoring, asset management, fleet optimization, urban planning, and smart city initiatives.

Location as a Service Market Regional Insights:

Asia Pacific dominated the largest market in 2024

- The Asia-Pacific region is experiencing unprecedented urbanization, which coincides with a surge in smartphone penetration and digital connectivity. This development has stimulated the demand for location-based services, thereby propelling the expansion of the LaaS industry in the area.

- The retail industry is a major contributor to the prospering e-commerce ecosystem in the Asia-Pacific region. Platform as a Service (PaaS) solutions play a crucial role in augmenting the online purchasing experience by allowing merchants to provide customized suggestions, focused promotional activities, and streamlined delivery operations.

- Given that a significant proportion of the populace relies on smartphones for routine tasks, Asia Pacific has adopted a mobile-first strategy for technology adoption. Location-based applications thrive in the current climate, driving the demand for LaaS solutions tailored to mobile users' needs.

- Governments throughout the Asia-Pacific region are making substantial investments in smart city initiatives that utilize location-based technologies to enhance public services, urban infrastructure, and transportation efficiency. The proliferation of these endeavors has accelerated the integration of LaaS solutions into sectors including environmental monitoring, public safety, and urban planning.

Active Key Players in the Location as a Service Market

- Cisco Systems (U.S.),

- Google Inc. (U.S.),

- Qualcomm (U.S.),

- Location Labs (U.S),

- LocationSmart (U.S),

- Microsoft Corp. (U.S.),

- Ericsson (Sweden.),

- IBM Corp. (U.S.),

- Oracle Corp. (U.S.),

- Esri (U.S),

- Accelerite (U.S)

- HERE Technologies (Netherlands)

- TomTom N.V. (Netherlands)

- Apple Inc. (U.S.)

- Amazon Web Services (AWS) (U.S.)

- Samsung Electronics (South Korea)

- Intel Corporation (U.S.)

- Nokia Corporation (Finland)

- Telenav, Inc. (U.S.)

- Trimble Inc. (U.S.)

- Garmin Ltd. (Switzerland)

Key Industry Developments in the Location as a Service Market:

- In April 2024, Iridium Communications Inc., a prominent provider of global voice and data satellite communications, announced today that it has completed the acquisition of Satelles, Inc. This acquisition has positioned Iridium as the frontrunner in secure satellite-based time and location services, enhancing and safeguarding GPS and other GNSS-dependent systems. The integration of Satellite capabilities strengthens Iridium's portfolio, ensuring robust offerings in critical infrastructure and applications requiring precise and secure positioning information globally.

- In January 2024, Accenture completed its acquisition of NaviSite, a provider of digital transformation and managed services. This acquisition enhanced Accenture's capabilities in application and infrastructure-managed services, enabling them to assist clients in North America in modernizing their IT for the AI era.

|

Global Location as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.68 Bn. |

|

Forecast Period 2024-32 CAGR: |

24% |

Market Size in 2032: |

USD 18.56 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Verticals |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- LOCATION AS A SERVICE MARKET BY PRODUCT TYPE (2017-2032)

- LOCATION AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GPS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GPRS

- RFID

- GIS

- LOCATION AS A SERVICE MARKET BY APPLICATION (2017-2032)

- LOCATION AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TRACKING & NAVIGATION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LOCATION-BASED SOCIAL NETWORK

- MARKETING & ADVERTISING

- OTHERS

- LOCATION AS A SERVICE MARKET BY VERTICALS (2017-2032)

- LOCATION AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONSUMER ELECTRONICS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GOVERNMENT

- BFSI

- RETAIL

- TRANSPORTATION

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- LOCATION AS A SERVICE Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CISCO SYSTEMS (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- GOOGLE INC. (U.S.)

- QUALCOMM (U.S.)

- LOCATION LABS (U.S)

- LOCATIONSMART (U.S)

- MICROSOFT CORP. (U.S.)

- ERICSSON (SWEDEN.)

- IBM CORP. (U.S.)

- ORACLE CORP. (U.S.)

- ESRI (U.S)

- ACCELERITE (U.S)

- COMPETITIVE LANDSCAPE

- GLOBAL LOCATION AS A SERVICE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Verticals

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Location as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.68 Bn. |

|

Forecast Period 2024-32 CAGR: |

24% |

Market Size in 2032: |

USD 18.56 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Verticals |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. LOCATION AS A SERVICE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. LOCATION AS A SERVICE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. LOCATION AS A SERVICE MARKET COMPETITIVE RIVALRY

TABLE 005. LOCATION AS A SERVICE MARKET THREAT OF NEW ENTRANTS

TABLE 006. LOCATION AS A SERVICE MARKET THREAT OF SUBSTITUTES

TABLE 007. LOCATION AS A SERVICE MARKET BY PRODUCT TYPE

TABLE 008. GPS MARKET OVERVIEW (2016-2028)

TABLE 009. GPRS MARKET OVERVIEW (2016-2028)

TABLE 010. RFID MARKET OVERVIEW (2016-2028)

TABLE 011. GIS MARKET OVERVIEW (2016-2028)

TABLE 012. LOCATION AS A SERVICE MARKET BY APPLICATION

TABLE 013. TRACKING & NAVIGATION MARKET OVERVIEW (2016-2028)

TABLE 014. LOCATION-BASED SOCIAL NETWORK MARKET OVERVIEW (2016-2028)

TABLE 015. MARKETING & ADVERTISING MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. LOCATION AS A SERVICE MARKET BY VERTICALS

TABLE 018. CONSUMER ELECTRONICS MARKET OVERVIEW (2016-2028)

TABLE 019. GOVERNMENT MARKET OVERVIEW (2016-2028)

TABLE 020. BFSI MARKET OVERVIEW (2016-2028)

TABLE 021. RETAIL MARKET OVERVIEW (2016-2028)

TABLE 022. TRANSPORTATION MARKET OVERVIEW (2016-2028)

TABLE 023. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA LOCATION AS A SERVICE MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 025. NORTH AMERICA LOCATION AS A SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 026. NORTH AMERICA LOCATION AS A SERVICE MARKET, BY VERTICALS (2016-2028)

TABLE 027. N LOCATION AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 028. EUROPE LOCATION AS A SERVICE MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 029. EUROPE LOCATION AS A SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 030. EUROPE LOCATION AS A SERVICE MARKET, BY VERTICALS (2016-2028)

TABLE 031. LOCATION AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 032. ASIA PACIFIC LOCATION AS A SERVICE MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 033. ASIA PACIFIC LOCATION AS A SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 034. ASIA PACIFIC LOCATION AS A SERVICE MARKET, BY VERTICALS (2016-2028)

TABLE 035. LOCATION AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA LOCATION AS A SERVICE MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA LOCATION AS A SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA LOCATION AS A SERVICE MARKET, BY VERTICALS (2016-2028)

TABLE 039. LOCATION AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 040. SOUTH AMERICA LOCATION AS A SERVICE MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 041. SOUTH AMERICA LOCATION AS A SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 042. SOUTH AMERICA LOCATION AS A SERVICE MARKET, BY VERTICALS (2016-2028)

TABLE 043. LOCATION AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 044. CISCO SYSTEMS: SNAPSHOT

TABLE 045. CISCO SYSTEMS: BUSINESS PERFORMANCE

TABLE 046. CISCO SYSTEMS: PRODUCT PORTFOLIO

TABLE 047. CISCO SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. GOOGLE INC.: SNAPSHOT

TABLE 048. GOOGLE INC.: BUSINESS PERFORMANCE

TABLE 049. GOOGLE INC.: PRODUCT PORTFOLIO

TABLE 050. GOOGLE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. ERICSSON: SNAPSHOT

TABLE 051. ERICSSON: BUSINESS PERFORMANCE

TABLE 052. ERICSSON: PRODUCT PORTFOLIO

TABLE 053. ERICSSON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. IBM CORP.: SNAPSHOT

TABLE 054. IBM CORP.: BUSINESS PERFORMANCE

TABLE 055. IBM CORP.: PRODUCT PORTFOLIO

TABLE 056. IBM CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. QUALCOMM: SNAPSHOT

TABLE 057. QUALCOMM: BUSINESS PERFORMANCE

TABLE 058. QUALCOMM: PRODUCT PORTFOLIO

TABLE 059. QUALCOMM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. LOCATION LABS: SNAPSHOT

TABLE 060. LOCATION LABS: BUSINESS PERFORMANCE

TABLE 061. LOCATION LABS: PRODUCT PORTFOLIO

TABLE 062. LOCATION LABS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. LOCATIONSMART: SNAPSHOT

TABLE 063. LOCATIONSMART: BUSINESS PERFORMANCE

TABLE 064. LOCATIONSMART: PRODUCT PORTFOLIO

TABLE 065. LOCATIONSMART: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. MICROSOFT CORP.: SNAPSHOT

TABLE 066. MICROSOFT CORP.: BUSINESS PERFORMANCE

TABLE 067. MICROSOFT CORP.: PRODUCT PORTFOLIO

TABLE 068. MICROSOFT CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. ORACLE CORP.: SNAPSHOT

TABLE 069. ORACLE CORP.: BUSINESS PERFORMANCE

TABLE 070. ORACLE CORP.: PRODUCT PORTFOLIO

TABLE 071. ORACLE CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. ESRI: SNAPSHOT

TABLE 072. ESRI: BUSINESS PERFORMANCE

TABLE 073. ESRI: PRODUCT PORTFOLIO

TABLE 074. ESRI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. ACCELERITE: SNAPSHOT

TABLE 075. ACCELERITE: BUSINESS PERFORMANCE

TABLE 076. ACCELERITE: PRODUCT PORTFOLIO

TABLE 077. ACCELERITE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 078. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 079. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 080. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. LOCATION AS A SERVICE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. LOCATION AS A SERVICE MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. GPS MARKET OVERVIEW (2016-2028)

FIGURE 013. GPRS MARKET OVERVIEW (2016-2028)

FIGURE 014. RFID MARKET OVERVIEW (2016-2028)

FIGURE 015. GIS MARKET OVERVIEW (2016-2028)

FIGURE 016. LOCATION AS A SERVICE MARKET OVERVIEW BY APPLICATION

FIGURE 017. TRACKING & NAVIGATION MARKET OVERVIEW (2016-2028)

FIGURE 018. LOCATION-BASED SOCIAL NETWORK MARKET OVERVIEW (2016-2028)

FIGURE 019. MARKETING & ADVERTISING MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. LOCATION AS A SERVICE MARKET OVERVIEW BY VERTICALS

FIGURE 022. CONSUMER ELECTRONICS MARKET OVERVIEW (2016-2028)

FIGURE 023. GOVERNMENT MARKET OVERVIEW (2016-2028)

FIGURE 024. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 025. RETAIL MARKET OVERVIEW (2016-2028)

FIGURE 026. TRANSPORTATION MARKET OVERVIEW (2016-2028)

FIGURE 027. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA LOCATION AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE LOCATION AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC LOCATION AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA LOCATION AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA LOCATION AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Location as a Service Market research report is 2024-2032.

• Cisco Systems (U.S.), ,• Google Inc. (U.S.), ,• Qualcomm (U.S.), ,• Location Labs (U.S), ,• LocationSmart (U.S), ,• Microsoft Corp. (U.S.), ,• Ericsson (Sweden.), ,• IBM Corp. (U.S.), ,• Oracle Corp. (U.S.), ,• Esri (U.S), ,• Accelerite (U.S),• HERE Technologies (Netherlands),• TomTom N.V. (Netherlands),• Apple Inc. (U.S.),• Amazon Web Services (AWS) (U.S.),• Samsung Electronics (South Korea),• Intel Corporation (U.S.),• Nokia Corporation (Finland),• Telenav, Inc. (U.S.),• Trimble Inc. (U.S.),• Garmin Ltd. (Switzerland).

The By Product Type (GPS, GPRS, RFID, GIS), Application (Tracking & Navigation, Location-Based Social Network, Marketing & Advertising, Others), Verticals (Consumer Electronics, Government, BFSI, Retail, Transportation, Others), and By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Location as a Service (LaaS) refers to the provision of real-time geographical data, analytics, and services through cloud-based platforms, enabling businesses and organizations to access accurate location information and leverage it for various applications. LaaS offers a comprehensive suite of location-based services, including mapping, geocoding, routing, tracking, and analytics, delivered as a scalable and cost-effective solution. By outsourcing location-related functionalities to LaaS providers, businesses can streamline their operations, enhance customer experiences, and gain valuable insights into spatial patterns and trends, thus driving efficiency, innovation, and competitive advantage in today's digital landscape.

Location as a Service Market Size Was Valued at USD 2.68 Billion in 202 and is Projected to Reach USD 18.56 Billion by 2032, Growing at a CAGR of 24% From 2024-2032.