Procurement as a Service (PaaS) Market Synopsis

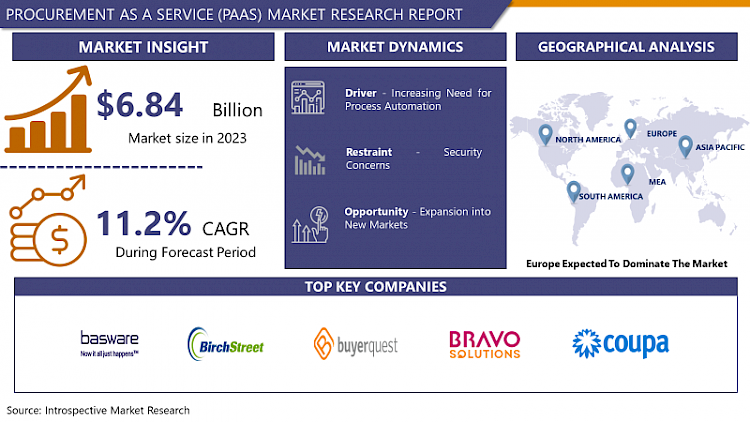

Procurement as a Service (PaaS) Market Size Was Valued at USD 6.84 Billion in 2023, and is Projected to Reach USD 17.94 Billion by 2032, Growing at a CAGR of 11.2% From 2024-2032.

Procure to pay as a service also known as Procurement as a Service (PaaS) business model is a type of outsourcing that involves the delegation of procurement activities to a third party service provider. In fact, it makes outsourcing the tackling of sourcing, purchasing, supplier management and even negotiation and award of contracts to an independent party.

- The technology platforms and technology expertise that are normally utilized by PaaS providers can be utilized to enhance or simplify the procurement processes for their clients. The risks with this model include reduced control, high costs associated with outsourcing, securing of proprietary information and issues arise showing lack of understanding cultural differences.

- A key advantage that organizations can derive from a Procurement as a Service provider is that they are able to coat on their core competence and leave the entire procurement process to competent procurement practitioners. PaaS also offers a flexible way for organizations to expand their procurement resources for it does not require the recruitment or training of more personnel and installation of the technological platform.

- Furthermore, SC analysts reveal that PaaS providers integrate convenient and sophisticated advanced analytics and data insights to enhance their decision-making and supply chain efficiency. In summary, the concept of Procurement as a Service is a concept that can create value for organizations, and can help these to be more competitive within the current challenging context that characterizes business execution strategies.

Procurement as a Service (PaaS) Market Trend Analysis

Integration of AI and Machine Learning

- One of the most significant PaaS market trends is integrating AI and Machine learning into systems to transform how organizations source goods and managing procurement. Dependable on modern AI and Machine Learning technologies PaaS providers can make available complex analytics, prognostications, and automated methods to optimize procurement processes and improve their efficacy at every stage of the purchase fabric.

- In this case, using super ordinate algorithms, PaaS platforms can extract, pattern and trend data that can be sourced from so many platforms in order to enhance sourcing strategies, supplier’s choices and contract negations.

- Also, even in supply chain management, Machine Learning algorithms can be used to learn from procurement historical data and forecast future demand, to detect dangerous conditions or to suggest the best procurement approach. This predictive efficacy allows organizations to foresee the difficulties or issues of supply chain and respond adequately to those challenges, reduce losses detrimental to the financial strength of an organization and maximize the overall cost effectiveness.

- Furthermore, it automates several operational and predictable procurement processes including invoice processing, purchase order creation as well as contracting activities – and often with increased efficiency – so that procurement staff can concentrate on more strategic initiatives. With the development of AI and machine learning capabilities, hope to be introduced more into the PaaS servitude as it has a critical importance in the continuation of innovation, effectiveness, and competitiveness in the market.

Growth in Small and Medium-Sized Businesses (SMBs)

- The market is rich with opportunities especially because of the ever expanding SMBs market which can benefit from Procurement as a Service (PaaS). Following are the main challenges that are inherent to and specific for SMBs: Limited resources, including human capital, Insufficient or lacking procurement departments and expertise. By engaging PaaS providers to outsource their procurement functions, SMBs can effectively leverage technical competencies of advanced strategic sourcing, spend management and process optimization like their large counterparts while declining high levels of upfront investment.

- PaaS solutions provide a practical and cost-effective means of purchasing procurement services in a form that is adaptable to their potential client base and financial capability and, therefore, allows the SMBs to achieve market competitiveness and grow in a sustainable manner.

- Also, since PaaS providers need to streamline procurement with their technology platforms and have larger economies of scale, such solutions at reasonable cost with attractive value propositions can be offered to SMBs. Through efficient capturing of repetitive procurement functions, enhancing organizational flow and offering important real-time data, PaaS solutions serve to assist the SMBs optimize their procurement processes, minimize the overhead costs and boost the functional performance.

- Furthermore, sourcing procurement from PaaS providers Christoffersen & Turner, 2013, outsourcing, SMBs are free to direct resources to other renowned areas of the business and innovations, thereby enhancing their growth plot. The market for Paas is thus expected to grow significantly in the coming years, because as SMB realizes its beneficial value proposition offered by the procurement it will continue to surge forward to adopt it.

Procurement as a Service (PaaS) Market Segment Analysis:

Procurement as a Service (PaaS) Market Segmented based on Component, Enterprise Size, and Vertical.

By Component, Strategic Sourcing is expected to dominate the market during the forecast period

- Amid the PaaS market, Strategic Sourcing initiates as the segment that has the greatest market share because it serves as the foundation for achieving cost reductions, supplier improvements, and risk minimizations. Strategic sourcing therefore entails activities that include identification, assessment and approval of proposed suppliers on the basis of the cost, quality, reliability and innovative initiatives.

- Outsourcing experts then utilize advanced technologies and their know-how in order to assist the organizations in identifying ideal sourcing strategies, assessing and analysing the market conditions, as well as negotiating with the suppliers for optimal deals. With their strategic and technical expertise, the services of PaaS providers allow companies to make their procurement function more effective and efficient resulting in cost savings and risk minimization.

- Furthermore, Spend Management is also found in the Procurement as a Service market place to have a considerable power in the market place for the segment. Purchase control involves the monitoring of the amount spent across the different categories for the purpose of enhancing the flow of procurement and reduction of costs. Spend analysis is well supported by PaaS providers through all encompassing application and service that COs wish to have in order to get real view, uncover opportunities for consolidation and standardization, as well as compliance check on spend.

- Thus, the possibilities for business optimization through the capabilities for advanced analytics, reporting and various other features of the spend management solutions are tremendous. Controlling and optimizing organizational spending is yet another PaaS area of focus on increased organizational and operational importance given the centrality of cost optimization and efficiency within organizational supply chains.

By Enterprise Size, Large Enterprises segment held the largest share

- In PaaS, the large enterprises are the key customer segment due to the large requirements and the available resources to procure from different suppliers. This may be due to the fact that large enterprises may engage a variety of suppliers or contractors, have greater transactional demands for materials, and potentially source a broad spectrum of commodities and services.

- Consequently, they are better placed to acquire the best procurement technologies, products, or services like procurement platform as a service (PaaS), innovate their procurement functions, and leverage such solutions for strategic value enhancement. These enterprises have also got the financial capabilities that can enable them to engage PaaS providers, and put in place, end to end procurement platforms that will suit their business needs. Furthermore, it has been reported that large enterprises possess expertise in the implementation of PaaS solutions due to a dedicated procurement team, making them stronger market players.

- Small and medium enterprises, or SMEs are also potential Procurement as a Service consumers, but this case study suggests that they are more likely to lack the financial means and/or may have inhibitions and qualms toward new and innovative technologies or outsourcing strategies.

- Nonetheless, since the concept of using PaaS is still relatively new, the understanding of its advantages is gradually increasing, new delivery models are being developed, and PaaS suppliers are presenting products and services that can be adjusted for SMEs’ scale, The usage of this segment will reach its peak shortly. However, because of the large companies’ size, their significance, and the complicated procurement processes that they dictate, large enterprises continue to lead and constitute the main consumers of the Procurement as a Service market.

Procurement as a Service (PaaS) Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast Period

- Europe's dominance in the Procurement as a Service (PaaS) market can be attributed to several factors. Firstly, Europe has a highly developed business ecosystem with a significant number of multinational corporations spanning various industries. These enterprises often have complex procurement needs and seek innovative solutions to optimize their supply chain operations.

- As a result, there is a robust demand for PaaS offerings that can deliver advanced procurement capabilities such as strategic sourcing, spend management, and contract automation. Europe's mature market environment and emphasis on efficiency and compliance further drive the adoption of PaaS solutions among businesses seeking to enhance their procurement processes.

- Moreover, Europe boasts a strong regulatory framework and a culture of innovation, which fosters the growth of the PaaS market. The European Union (EU) regulations, such as GDPR (General Data Protection Regulation) and directives on public procurement, encourage businesses to adopt digital solutions that ensure transparency, data security, and compliance with legal requirements.

- PaaS providers in Europe often prioritize these factors in their offerings, making them attractive to enterprises looking for reliable and regulatory-compliant procurement solutions. Additionally, Europe's diverse economy and presence of leading technology providers and consulting firms contribute to the proliferation of PaaS solutions tailored to the specific needs of European businesses, further solidifying the region's dominance in the Procurement as a Service market.

Active Key Players in the Procurement as a Service (PaaS) Market

- Basware Corporation (Finland)

- BirchStreet Systems (United States)

- BravoSolution (Italy)

- BuyerQuest Holdings Inc. (United States)

- Coupa Software (United States)

- Determine, Inc. (United States)

- GEP (United States)

- IBM (United States)

- Ivalua Inc. (France)

- Jaggaer (United States)

- OpusCapita Group (Finland)

- Oracle Corporation (United States)

- Proactis Holdings (United Kingdom)

- SAP Ariba (Germany)

- SynerTrade SA (France)

- Tradeshift (United States)

- Vroozi, Inc. (United States)

- Wax Digital Ltd. (United Kingdom)

- Xeeva, Inc. (United States)

- Zycus Inc. (United States)

- Other Key Players

Key Industry Developments in the Pea Protein Market:

- In May 2022, Bain & Company bought Proxima, where such a move gives Proxima an opportunity to expand Bain & Company’s existing procurement solutions offering depth in procurement and supply chain sectors. Proxima may function autonomously within various service lines implemented under the Bain & Company brand.

- In February 2022, Its Global acquisition was of ArcBlue a leading procurement consulting firm across the Asia Pacific region. ArcBlue may perform as a distinct division for special procurement implementation service within Bain. The acquisition may complement some of the existing procurement solutions offered by Bain or enhance the ways it operates in the Asia Pacific region.

|

Global Procurement as a Service (PaaS) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.84 Bn. |

|

Forecast Period 2023-34 CAGR: |

11.2% |

Market Size in 2032: |

USD 17.94 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Enterprise Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PROCUREMENT AS A SERVICE (PAAS) MARKET BY COMPONENT (2017-2032)

- PROCUREMENT AS A SERVICE (PAAS) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- STRATEGIC SOURCING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SPEND MANAGEMENT

- PROCESS MANAGEMENT

- CATEGORY MANAGEMENT

- CONTRACT MANAGEMENT

- TRANSACTION MANAGEMENT

- PROCUREMENT AS A SERVICE (PAAS) MARKET BY ENTERPRISE SIZE (2017-2032)

- PROCUREMENT AS A SERVICE (PAAS) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SMES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LARGE ENTERPRISES

- PROCUREMENT AS A SERVICE (PAAS) MARKET BY VERTICAL (2017-2032)

- PROCUREMENT AS A SERVICE (PAAS) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BFSI

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MANUFACTURING

- RETAIL

- IT & TELECOM

- HEALTHCARE

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Procurement as a Service (PaaS) Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BASWARE CORPORATION (FINLAND)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BIRCHSTREET SYSTEMS (UNITED STATES)

- BRAVOSOLUTION (ITALY)

- BUYERQUEST HOLDINGS INC. (UNITED STATES)

- COUPA SOFTWARE (UNITED STATES)

- DETERMINE, INC. (UNITED STATES)

- GEP (UNITED STATES)

- IBM (UNITED STATES)

- IVALUA INC. (FRANCE)

- JAGGAER (UNITED STATES)

- OPUSCAPITA GROUP (FINLAND)

- ORACLE CORPORATION (UNITED STATES)

- PROACTIS HOLDINGS (UNITED KINGDOM)

- SAP ARIBA (GERMANY)

- SYNERTRADE SA (FRANCE)

- TRADESHIFT (UNITED STATES)

- VROOZI, INC. (UNITED STATES)

- WAX DIGITAL LTD. (UNITED KINGDOM)

- XEEVA, INC. (UNITED STATES)

- ZYCUS INC. (UNITED STATES)

- COMPETITIVE LANDSCAPE

- GLOBAL PROCUREMENT AS A SERVICE (PAAS) MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Enterprise Size

- Historic And Forecasted Market Size By Vertical

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Procurement as a Service (PaaS) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.84 Bn. |

|

Forecast Period 2023-34 CAGR: |

11.2% |

Market Size in 2032: |

USD 17.94 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Enterprise Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PROCUREMENT AS A SERVICE (PAAS) MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PROCUREMENT AS A SERVICE (PAAS) MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PROCUREMENT AS A SERVICE (PAAS) MARKET COMPETITIVE RIVALRY

TABLE 005. PROCUREMENT AS A SERVICE (PAAS) MARKET THREAT OF NEW ENTRANTS

TABLE 006. PROCUREMENT AS A SERVICE (PAAS) MARKET THREAT OF SUBSTITUTES

TABLE 007. PROCUREMENT AS A SERVICE (PAAS) MARKET BY PRODUCT TYPE

TABLE 008. STRATEGIC SOURCING MARKET OVERVIEW (2016-2028)

TABLE 009. SPEND MANAGEMENT MARKET OVERVIEW (2016-2028)

TABLE 010. CATEGORY MANAGEMENT MARKET OVERVIEW (2016-2028)

TABLE 011. PROCESS MANAGEMENT MARKET OVERVIEW (2016-2028)

TABLE 012. CONTRACT MANAGEMENT/TRANSACTIONS MANAGEMENT MARKET OVERVIEW (2016-2028)

TABLE 013. PROCUREMENT AS A SERVICE (PAAS) MARKET BY APPLICATION

TABLE 014. MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 015. BFSI MARKET OVERVIEW (2016-2028)

TABLE 016. RETAIL & CONSUMER GOODS MARKET OVERVIEW (2016-2028)

TABLE 017. IT & TELECOM MARKET OVERVIEW (2016-2028)

TABLE 018. ENERGY & UTILITIES/HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA PROCUREMENT AS A SERVICE (PAAS) MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 020. NORTH AMERICA PROCUREMENT AS A SERVICE (PAAS) MARKET, BY APPLICATION (2016-2028)

TABLE 021. N PROCUREMENT AS A SERVICE (PAAS) MARKET, BY COUNTRY (2016-2028)

TABLE 022. EUROPE PROCUREMENT AS A SERVICE (PAAS) MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 023. EUROPE PROCUREMENT AS A SERVICE (PAAS) MARKET, BY APPLICATION (2016-2028)

TABLE 024. PROCUREMENT AS A SERVICE (PAAS) MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC PROCUREMENT AS A SERVICE (PAAS) MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 026. ASIA PACIFIC PROCUREMENT AS A SERVICE (PAAS) MARKET, BY APPLICATION (2016-2028)

TABLE 027. PROCUREMENT AS A SERVICE (PAAS) MARKET, BY COUNTRY (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA PROCUREMENT AS A SERVICE (PAAS) MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA PROCUREMENT AS A SERVICE (PAAS) MARKET, BY APPLICATION (2016-2028)

TABLE 030. PROCUREMENT AS A SERVICE (PAAS) MARKET, BY COUNTRY (2016-2028)

TABLE 031. SOUTH AMERICA PROCUREMENT AS A SERVICE (PAAS) MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 032. SOUTH AMERICA PROCUREMENT AS A SERVICE (PAAS) MARKET, BY APPLICATION (2016-2028)

TABLE 033. PROCUREMENT AS A SERVICE (PAAS) MARKET, BY COUNTRY (2016-2028)

TABLE 034. IBM: SNAPSHOT

TABLE 035. IBM: BUSINESS PERFORMANCE

TABLE 036. IBM: PRODUCT PORTFOLIO

TABLE 037. IBM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. WNS: SNAPSHOT

TABLE 038. WNS: BUSINESS PERFORMANCE

TABLE 039. WNS: PRODUCT PORTFOLIO

TABLE 040. WNS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. INFOSYS: SNAPSHOT

TABLE 041. INFOSYS: BUSINESS PERFORMANCE

TABLE 042. INFOSYS: PRODUCT PORTFOLIO

TABLE 043. INFOSYS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. ACCENTURE: SNAPSHOT

TABLE 044. ACCENTURE: BUSINESS PERFORMANCE

TABLE 045. ACCENTURE: PRODUCT PORTFOLIO

TABLE 046. ACCENTURE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. HCL TECHNOLOGIES: SNAPSHOT

TABLE 047. HCL TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 048. HCL TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 049. HCL TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. CAPGEMINI: SNAPSHOT

TABLE 050. CAPGEMINI: BUSINESS PERFORMANCE

TABLE 051. CAPGEMINI: PRODUCT PORTFOLIO

TABLE 052. CAPGEMINI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. PROXIMA: SNAPSHOT

TABLE 053. PROXIMA: BUSINESS PERFORMANCE

TABLE 054. PROXIMA: PRODUCT PORTFOLIO

TABLE 055. PROXIMA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. WIPRO: SNAPSHOT

TABLE 056. WIPRO: BUSINESS PERFORMANCE

TABLE 057. WIPRO: PRODUCT PORTFOLIO

TABLE 058. WIPRO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. GENPACT: SNAPSHOT

TABLE 059. GENPACT: BUSINESS PERFORMANCE

TABLE 060. GENPACT: PRODUCT PORTFOLIO

TABLE 061. GENPACT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. GEP: SNAPSHOT

TABLE 062. GEP: BUSINESS PERFORMANCE

TABLE 063. GEP: PRODUCT PORTFOLIO

TABLE 064. GEP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. XCHANGING (DXC TECHNOLOGY): SNAPSHOT

TABLE 065. XCHANGING (DXC TECHNOLOGY): BUSINESS PERFORMANCE

TABLE 066. XCHANGING (DXC TECHNOLOGY): PRODUCT PORTFOLIO

TABLE 067. XCHANGING (DXC TECHNOLOGY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. AEGIS: SNAPSHOT

TABLE 068. AEGIS: BUSINESS PERFORMANCE

TABLE 069. AEGIS: PRODUCT PORTFOLIO

TABLE 070. AEGIS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. CA TECHNOLOGIES: SNAPSHOT

TABLE 071. CA TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 072. CA TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 073. CA TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. CORBUS: SNAPSHOT

TABLE 074. CORBUS: BUSINESS PERFORMANCE

TABLE 075. CORBUS: PRODUCT PORTFOLIO

TABLE 076. CORBUS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. TCS: SNAPSHOT

TABLE 077. TCS: BUSINESS PERFORMANCE

TABLE 078. TCS: PRODUCT PORTFOLIO

TABLE 079. TCS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 080. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 081. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 082. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PROCUREMENT AS A SERVICE (PAAS) MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PROCUREMENT AS A SERVICE (PAAS) MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. STRATEGIC SOURCING MARKET OVERVIEW (2016-2028)

FIGURE 013. SPEND MANAGEMENT MARKET OVERVIEW (2016-2028)

FIGURE 014. CATEGORY MANAGEMENT MARKET OVERVIEW (2016-2028)

FIGURE 015. PROCESS MANAGEMENT MARKET OVERVIEW (2016-2028)

FIGURE 016. CONTRACT MANAGEMENT/TRANSACTIONS MANAGEMENT MARKET OVERVIEW (2016-2028)

FIGURE 017. PROCUREMENT AS A SERVICE (PAAS) MARKET OVERVIEW BY APPLICATION

FIGURE 018. MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 019. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 020. RETAIL & CONSUMER GOODS MARKET OVERVIEW (2016-2028)

FIGURE 021. IT & TELECOM MARKET OVERVIEW (2016-2028)

FIGURE 022. ENERGY & UTILITIES/HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA PROCUREMENT AS A SERVICE (PAAS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE PROCUREMENT AS A SERVICE (PAAS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC PROCUREMENT AS A SERVICE (PAAS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA PROCUREMENT AS A SERVICE (PAAS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA PROCUREMENT AS A SERVICE (PAAS) MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Procurement as a Service (PaaS) Market research report is 2024-2032.

Basware Corporation (Finland), BirchStreet Systems (United States), BravoSolution (Italy), BuyerQuest Holdings Inc. (United States), Coupa Software (United States), Determine, Inc. (United States), GEP (United States), IBM (United States), Ivalua Inc. (France), Jaggaer (United States), OpusCapita Group (Finland), Oracle Corporation (United States), Proactis Holdings (United Kingdom), SAP Ariba (Germany), SynerTrade SA (France), Tradeshift (United States), Vroozi, Inc. (United States), Wax Digital Ltd. (United Kingdom), Xeeva, Inc. (United States), Zycus Inc. (United States) and Other Major Players.

The Procurement as a Service (PaaS) Market is segmented into Component, Enterprise Size, Vertical, and region. By Component, the market is categorized into Strategic Sourcing, Spend Management, Process Management, Category Management, Contract Management, Transaction Management. By Enterprise Size, the market is categorized into SMEs, Large Enterprises. By Vertical, the market is BFSI, Manufacturing, Retail, IT & Telecom, Healthcare, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Procurement as a Service (PaaS) is the strategy of shedding off some procurement activities and tasks to third-parties. It includes procurement and supply, in addition to supply chain, buying, selection of suppliers, and contracting, which may leverage elements like artificial intelligence and machine learning at times. Through PaaS, procurement receives a boost, it becomes cheaper, and companies can hire specialized services without massive in-house staffing.

Procurement as a Service (PaaS) Market Size Was Valued at USD 6.84 Billion in 2023, and is Projected to Reach USD 17.94 Billion by 2032, Growing at a CAGR of 11.2% From 2024-2032.