Global Hip Replacement Market Synopsis:

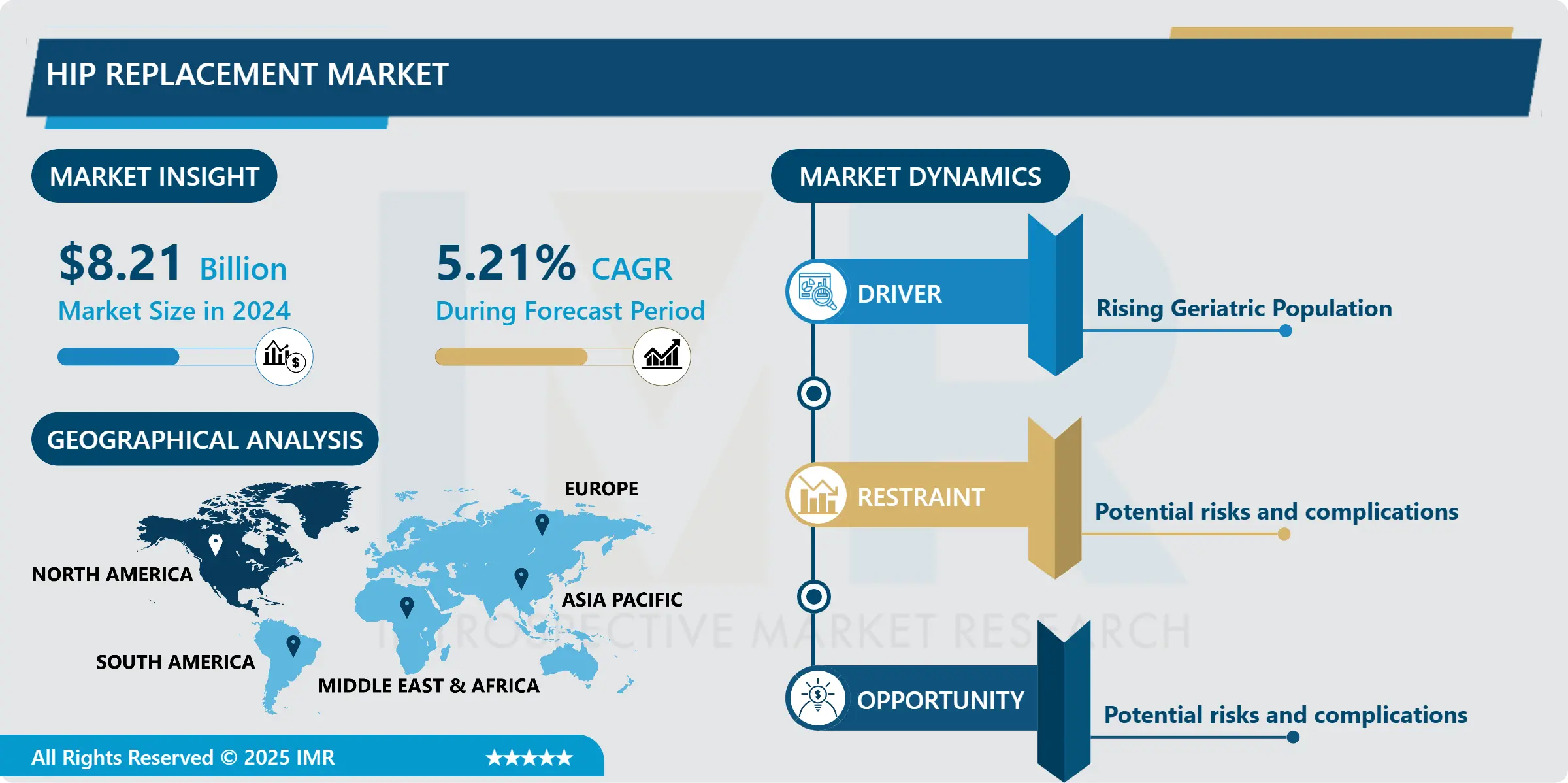

Global Hip Replacement Market size is expected to grow from USD 8.21 Billion in 2024 to USD 14.35 Billion by 2035, at a CAGR of 5.21% during the forecast period (2025-2035).

A hip replacement, also known as hip arthroplasty, is a surgical procedure where a damaged or worn-out hip joint is replaced with an artificial joint, called a prosthesis. This procedure is typically done to relieve pain and improve mobility in individuals with severe hip arthritis or other conditions that cause significant hip joint damage.

Hip replacement, referred to medically as total hip arthroplasty, is a surgical intervention designed to reduce pain and improve movement for individuals experiencing significant hip joint damage or conditions like osteoarthritis. This operation entails extracting the impaired or diseased segments of the hip joint, such as the femoral head and the affected socket, and substituting them with synthetic components crafted from metal, plastic, or ceramic materials.

Hip replacement surgery serves as a solution for a range of conditions leading to hip joint deterioration, such as arthritis, fractures, avascular necrosis, and other musculoskeletal disorders. It is usually contemplated when conservative treatments like medication, physical therapy, or lifestyle adjustments prove ineffective in alleviating discomfort or enhancing mobility.

Hip replacement offers a multitude of benefits. Most notably, it effectively diminishes persistent pain, thereby improving the patient's quality of life through the restoration of mobility and function. Furthermore, advancements in surgical methods and materials have bolstered the resilience and lifespan of artificial hip joints, leading to better long-term results and decreased instances of additional surgeries. Following the procedure, individuals commonly encounter heightened joint stability and expanded range of motion, enabling a seamless transition back to daily routines and a more active way of life.

Global Hip Replacement Market Trend Analysis:

Rising Geriatric Population

- The global market for hip replacement has experienced significant influence from the increasing elderly population across the globe. As demographics undergo a shift, the aging demographic becomes more prone to degenerative joint conditions, particularly osteoarthritis, which stands as a primary cause of hip joint degradation. This demographic shift has led to a substantial surge in hip replacement surgery requests.

- Elderly individuals commonly face hip joint wear and tear over time, resulting in diminished mobility and persistent discomfort. This has consequently generated a heightened necessity for hip replacement procedures to alleviate pain and reinstate functional abilities within this specific age group. With a larger portion of the population entering old age, instances of hip-related conditions have escalated, consequently driving the global demand for hip replacement surgeries.

- Moreover, advancements in healthcare technologies, materials used in implants, and surgical methodologies have played a role in encouraging the adoption of hip replacement surgeries among the elderly. The ongoing enhancements in implant durability, along with improved surgical precision and faster recovery periods, have made this procedure more attractive to older individuals seeking an improved standard of living and increased mobility. As the elderly population continues to grow, the demand for hip replacement surgeries is anticipated to sustain its upward trajectory in the global market.

Growing Demand for Outpatient Surgery

- The increasing preference for outpatient surgery, particularly in the realm of hip replacement operations, stands as a significant opportunity within the global hip replacement market. This trend primarily stems from concerted efforts within healthcare systems to manage expenses while upholding superior patient care standards. Outpatient hip replacements, conducted in ambulatory surgery centers or outpatient facilities, present distinct advantages compared to traditional inpatient surgeries, thereby creating favorable prospects within the market.

- The focus on reducing healthcare costs has spurred the development and enhancement of outpatient hip replacement methods. Contrasted with inpatient procedures, outpatient surgeries often lead to shorter hospital stays or, in many instances, discharge on the same day. This streamlined approach not only diminishes healthcare expenses associated with prolonged hospitalization but also lessens the overall financial burden on healthcare systems.

- Furthermore, outpatient hip replacements benefit from advancements in minimally invasive surgical techniques, anaesthesia protocols, and postoperative care strategies. These innovations contribute to swifter recovery periods, reduced risks of complications, and heightened levels of patient satisfaction.

- The shift toward outpatient procedures aligns with patient preferences for convenience and faster rehabilitation, further bolstering the market's potential for growth. As healthcare systems persist in prioritizing cost-effective solutions without compromising patient outcomes, the adoption of outpatient hip replacement procedures is expected to offer significant opportunities for expansion within the global hip replacement market.

Global Hip Replacement Market Segment Analysis:

By Type, Total Hip Replacement is the dominant segment in Global Hip Replacement Market

- The total hip replacement has indeed been a significant segment within the global hip replacement market. This procedure involves replacing a damaged or diseased hip joint with an artificial joint or implant. Total hip replacement surgery is commonly performed to relieve pain and improve function in individuals suffering from conditions like osteoarthritis, rheumatoid arthritis, fractures, or other hip-related issues.

- The demand for total hip replacement surgeries is rising due to several factors. Primarily, there's an increase in hip-related conditions owing to aging populations, sedentary lifestyles, obesity, and sports injuries. Furthermore, continuous advancements in implant materials, surgical techniques, and prosthetic designs have improved the success rates of hip replacements, attracting patients and surgeons. Additionally, greater awareness among patients about the benefits of hip replacement, such as pain relief and improved mobility, has increased acceptance of this surgical procedure.

- Moreover, the surge in healthcare spending and favorable reimbursement policies in many regions have enhanced patient access to these surgeries, further driving market growth.

Global Hip Replacement Market Regional Insights:

North America Region Dominate the Market

- North America remained a dominant force in the global hip replacement market, representing a significant share. The region's prominence was attributed to several factors, including a robust healthcare infrastructure, technological advancements, a rising geriatric population, and high healthcare expenditure.

- The United States and Canada boasted advanced medical facilities and a higher acceptance rate of innovative medical technologies. Moreover, an aging population in these countries increased the prevalence of hip-related ailments, thereby driving the demand for hip replacement surgeries. Accessibility to specialized healthcare services and favorable reimbursement policies also contributed to the region's market dominance.

- The ongoing research and development initiatives, coupled with the presence of key market players and collaborations between medical institutions and manufacturers, continued to propel the growth of hip replacement technologies in North America.

- The landscape might have evolved since then, potentially influenced by emerging trends such as the increased adoption of outpatient procedures, advancements in implant materials and surgical techniques, and a continued focus on cost-effectiveness in healthcare delivery. These factors could further impact the distribution of market shares among regions, potentially altering the dominance of North America in the global hip replacement market.

Global Hip Replacement Market Key Players:

- Zimmer Biomet (U.S.)

- Stryker (U.S.)

- Exactech, Inc. (U.S.)

- Conformis (U.S.)

- Globus Medical, Inc. (U.S)

- ConforMIS Inc. (U.S)

- Integra LifeSciences (U.S)

- Smith & Nephew (U.K.)

- Corin Group PLC (U.K)

- GRUPPO BIOIMPIANTI s.r.l. (Italy)

- B. Braun Melsungen AG (Germany)

- Merete GmbH (Germany)

- Medacta International (Switzerland)

- MicroPort Scientific Corporation (China)

- Kyocera Corporation (Japan), and Other Major Players

Key Industry Developments in the Global Hip Replacement Market:

- In February 2024, Zimmer Biomet Holdings, Inc. announced U.S. Food and Drug Administration (FDA) 510(k) clearance of the ROSA Shoulder System for robotic-assisted shoulder replacement surgery. ROSA Shoulder is the world's first robotic surgery system for shoulder replacement, and the fourth application for the Company's comprehensive ROSA® Robotics portfolio, which includes the ROSA® Knee System for total knee arthroplasty and ROSA® Hip System for total hip replacement.

- In August 2023, Smith+Nephew announced the launch of its OR3O Dual Mobility System for use in primary and revision hip arthroplasty in India. Compared with traditional solutions, dual mobility implants have a small diameter femoral head that locks into a larger polyethylene insert - increasing stability, reducing dislocation risk, and offering improved range of motion.

|

Global Hip Replacement Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 8.21 Bn. |

|

Forecast Period 2025-35 CAGR: |

5.21 % |

Market Size in 2035: |

USD 14.35 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Implant Type |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Hip Replacement Market by Type (2018-2032)

4.1 Hip Replacement Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Total Hip Replacement

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Partial Hip Replacement

4.5 Hip Resurfacing

4.6 Revision Hip Replacement

Chapter 5: Hip Replacement Market by Implant Type (2018-2032)

5.1 Hip Replacement Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Metal on Metal

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Metal on Polyethylene

5.5 Ceramic on Metal

5.6 Others

Chapter 6: Hip Replacement Market by End Users (2018-2032)

6.1 Hip Replacement Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals & Surgery Centers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Orthopaedic Clinics

6.5 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Hip Replacement Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ALTANA (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AMERILUBES

7.4 L.L.C. (U.S.)

7.5 BROTHER (JAPAN)

7.6 CALWAX CORPORATION (U.S.)

7.7 CARMEL INDUSTRIES (ISRAEL)

7.8 CLARIANT CORPORATION (SWITZERLAND)

7.9 DHARIWAL CORP. PRIVATE LIMITED (INDIA)

7.10 EXCEL INTERNATIONAL (U.S.)

7.11 FIRST SOURCE WORLDWIDE LLC. (U.S.)

7.12 FRANK B. ROSS CO. INC. (U.S.)

7.13 LUMITOS AG (GERMANY)

7.14 MAYUR DYES & CHEMICALS CORPORATION

7.15 PARAMELT B.V. (NETHERLANDS)

7.16 PARCHVALE LTD. (U.K.)

7.17 POTH HILLE (U.K.)

7.18 ROMONTA GMBH (GERMANY)

7.19 S. KATO & CO. (JAPAN)

7.20 STEVENSON-SEELEY INC. (U.S.)

7.21 TER HELL & CO. GMBH (GERMANY)

7.22 TIANSHI WAX (CHINA)

7.23 VÖLPKER SPEZIALPRODUKTE GMBH

7.24 YUNAN SHANGCHENG BIOTECHNOLOGY CO LTD. (CHINA)

7.25 YUNPHOS (CHINA)

Chapter 8: Global Hip Replacement Market By Region

8.1 Overview

8.2. North America Hip Replacement Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Total Hip Replacement

8.2.4.2 Partial Hip Replacement

8.2.4.3 Hip Resurfacing

8.2.4.4 Revision Hip Replacement

8.2.5 Historic and Forecasted Market Size by Implant Type

8.2.5.1 Metal on Metal

8.2.5.2 Metal on Polyethylene

8.2.5.3 Ceramic on Metal

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size by End Users

8.2.6.1 Hospitals & Surgery Centers

8.2.6.2 Orthopaedic Clinics

8.2.6.3 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Hip Replacement Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Total Hip Replacement

8.3.4.2 Partial Hip Replacement

8.3.4.3 Hip Resurfacing

8.3.4.4 Revision Hip Replacement

8.3.5 Historic and Forecasted Market Size by Implant Type

8.3.5.1 Metal on Metal

8.3.5.2 Metal on Polyethylene

8.3.5.3 Ceramic on Metal

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size by End Users

8.3.6.1 Hospitals & Surgery Centers

8.3.6.2 Orthopaedic Clinics

8.3.6.3 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Hip Replacement Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Total Hip Replacement

8.4.4.2 Partial Hip Replacement

8.4.4.3 Hip Resurfacing

8.4.4.4 Revision Hip Replacement

8.4.5 Historic and Forecasted Market Size by Implant Type

8.4.5.1 Metal on Metal

8.4.5.2 Metal on Polyethylene

8.4.5.3 Ceramic on Metal

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size by End Users

8.4.6.1 Hospitals & Surgery Centers

8.4.6.2 Orthopaedic Clinics

8.4.6.3 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Hip Replacement Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Total Hip Replacement

8.5.4.2 Partial Hip Replacement

8.5.4.3 Hip Resurfacing

8.5.4.4 Revision Hip Replacement

8.5.5 Historic and Forecasted Market Size by Implant Type

8.5.5.1 Metal on Metal

8.5.5.2 Metal on Polyethylene

8.5.5.3 Ceramic on Metal

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size by End Users

8.5.6.1 Hospitals & Surgery Centers

8.5.6.2 Orthopaedic Clinics

8.5.6.3 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Hip Replacement Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Total Hip Replacement

8.6.4.2 Partial Hip Replacement

8.6.4.3 Hip Resurfacing

8.6.4.4 Revision Hip Replacement

8.6.5 Historic and Forecasted Market Size by Implant Type

8.6.5.1 Metal on Metal

8.6.5.2 Metal on Polyethylene

8.6.5.3 Ceramic on Metal

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size by End Users

8.6.6.1 Hospitals & Surgery Centers

8.6.6.2 Orthopaedic Clinics

8.6.6.3 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Hip Replacement Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Total Hip Replacement

8.7.4.2 Partial Hip Replacement

8.7.4.3 Hip Resurfacing

8.7.4.4 Revision Hip Replacement

8.7.5 Historic and Forecasted Market Size by Implant Type

8.7.5.1 Metal on Metal

8.7.5.2 Metal on Polyethylene

8.7.5.3 Ceramic on Metal

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size by End Users

8.7.6.1 Hospitals & Surgery Centers

8.7.6.2 Orthopaedic Clinics

8.7.6.3 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Hip Replacement Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 8.21 Bn. |

|

Forecast Period 2025-35 CAGR: |

5.21 % |

Market Size in 2035: |

USD 14.35 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Implant Type |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||