Healthcare IT Market Synopsis

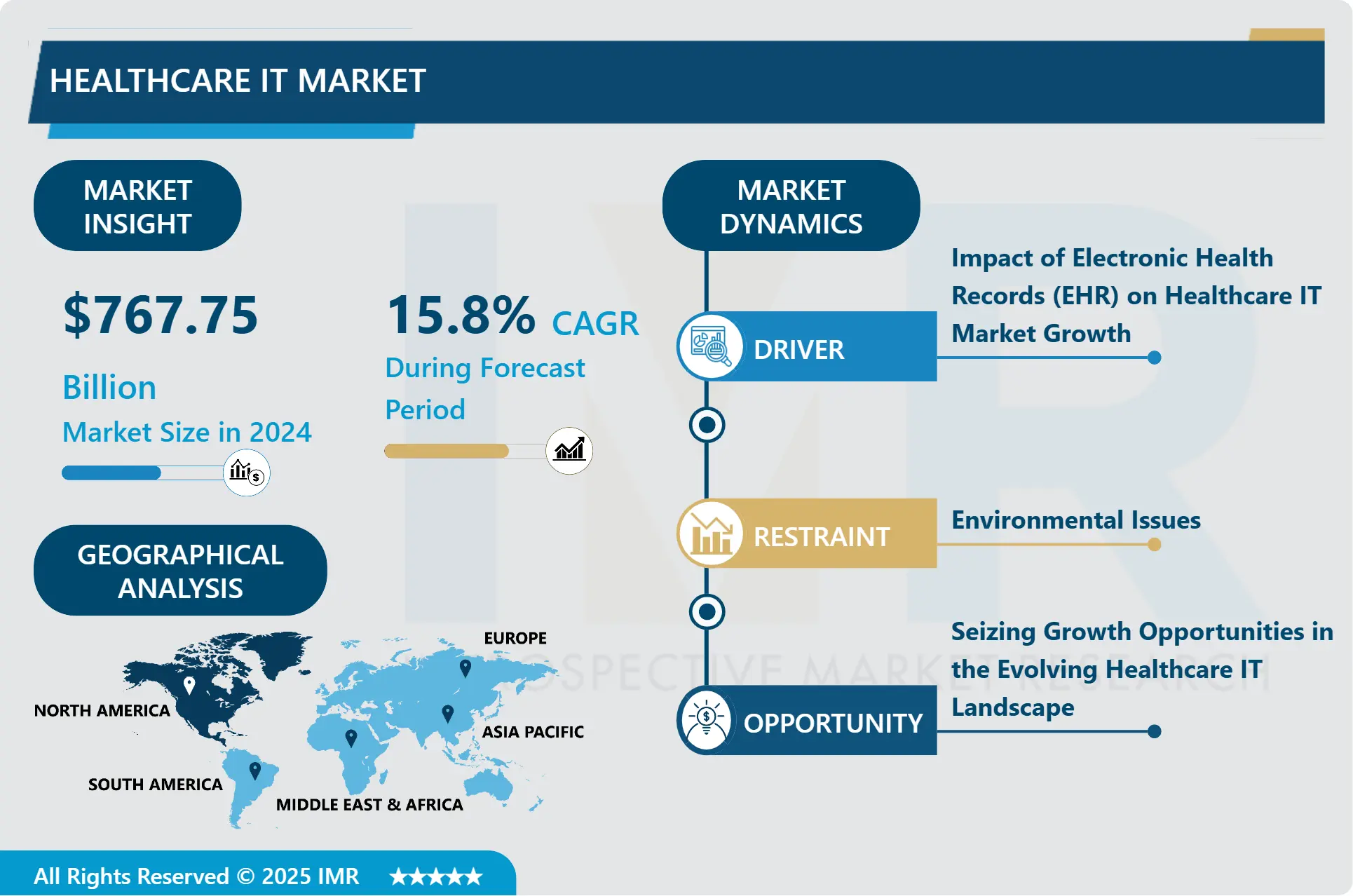

Healthcare IT Market Size is Valued at USD 767.75 Billion in 2024, and is Projected to Reach USD 2482.50 Billion by 2032, Growing at a CAGR of 15.80% From 2025-2032.

Healthcare IT (Information Technology) Market is the market of IT solution in the context of healthcare business and its management with the main objectives of delivering efficient data management for patient’s records, care continuous care delivery and enhancement of the patient care. They are a family of technologies and solutions including EHRs, CDSS, health care analytics and telemedicine. Hence the application of technologies will help the market to improve the efficiency of health delivery systems, reduce the incidence of medical errors and also enhance patients’ care.

Global demand for a better and improved health care information technology is the main driver which fuels this market. People are looking for EHR technology solutions, telemedicine more often and other tools that are associated with the subject of digital health as the healthcare sector is seeking for effectiveness and reliability in managing patients. Further, the rise in demand for more effective processing and interpretation of a tremendous volume of healthcare information advances Healthcare IT solutions such as data analytics and the population health management solutions used in clinical decision-making and in the enhancement of patient care.

However, the new government policies and incentives toward the spending in Healthcare IT in the market is also driving the growth of the market. Just like it has been described above to encourage the usage of e-Health some incentive plans and policies like the HITECH Act to encourage the usage of EHR and other related technologies have been started. In addition, the shift to value-based care coupled with changing landscape in care delivery puts pressure on the heath care organizations to adopt IT solutions in restoring issues to do with quality of care, patients’ experience and costs.

Healthcare IT Market Trend Analysis

Healthcare IT Trends, Unlocking the Potential of Digital Transformation

- Healthcare IT is a rapidly growing market around the world due to technology such as Health information technology, need to improve methods of delivering health care and to bring down the costs. The COVID-19 pandemic has seen increased adoption of Health IT solutions in development of the management of the disease as the providers look for new ways to get services to their patients. It is a new strategy, telecare and remote patient monitoring has supplanted information exchange as a priority in Healthcare IT systems.

- The fourth trend that it is possible to single out in Healthcare IT market is the raise in the Utilization of intelligence apparatus and computing machines. They are been used in diagnosing patients, this has improved the outcomes that they get and the quality of attention that is provided to the patients. Also, more emphasis has shifted towards data analysis and big data in the health care sector because of the elapsed analytics that promote the stewardship of decisions in the improvement of patient experiences. In conclusion, it can be realized that trends and advancement in technology are the key drivers that would most probably see the Healthcare IT market grow due to increasing adoption of technology in health systems of nations.

Transforming Healthcare Through Technology, A Look at IT Market Opportunities

- The global market of Healthcare IT is still in progress and has a highly substantial growth, owing largely to the increasing global need for better, cheap and efficient health care. In this market, there is still the opportunity to get EHRs as a standard service among providers. Electronic health records improve on the quality of delivered care because it provides healthcare personnel with the most appropriate knowledge. They also enhance productivity through streamling bureaucratic aspects where a task is accomplished at the workplace with less reliance on paper work. This growth in EHR Systems is due to the increasing IT solutions in healthcare facilities like CDSS and PACS around the globe for better patient outcomes which is likely to create a favorable growth domain for the EHR market in the coming years.

- The second growing area for development concerns this market is telemedicine and remote patient monitoring. Telemedicine means that it is possible to administer health services to patients without actually coming into contact with the healthcare provider, therefore can be used to ensure that patients in areas where there are few or no health facilities at all can get health care services. Telemedicine technologies enable monitoring of the health status of the patient even though he is rarely physically present in conventional health care facilities and hence may help improve the quality of life of the patient and also decrease the cost of health care. With the current advancement of digital technology across the world especially in the healthcare departments telemedicine and remote patient monitoring solutions will be adopted and will help the expansion of the Healthcare IT market.

Healthcare IT Market Segment Analysis:

Healthcare IT Market Segmented on the basis of Product type, Component, and end-users.

By Product Type, Healthcare Provider Solutions segment is expected to dominate the market during the forecast period

- Healthcare IT solutions encompass an enormous umbrella of services and products which address the needs of the stakeholders that include the care deliverers, the payers and the outsource services. These include the following; The Clinical Systems and others that are Non-clinical; The Electronic Health Record Systems, Picture Archiving and Communication Systems, The Revenue Cycle Management and the Financial Management Systems. The components of the payer solutions comprise of the claims and payments, customer relations, and fraud. Further, healthcare outsourcing services involve provider and payer outsourcing and also other operations which are directed to the enhancement of the operation of the health care system. These solutions and services constitute a valuable means of enhancing the efficiency of organizational work, enhancing the quality of services delivered to the patients, as well as increasing economic efficiency of healthcare organizations.

By Component, Software segment held the largest share in 2024

- In the Healthcare IT market, products are categorized into three main components: Applications, products and consulting are the three dominant types of solutions that the companies deal with. Other respective software solutions are Electronic Health Records (EHR), Clinical Decision Support Systems (CDSS) and others for handling the healthcare solutions. While hardware majorly concerned with the physical assets used within IT health support such as computers, servers, and other medical equipment, which are used to deliver healthcare services.

- There are consultancy services to enable an organization choose the right Healthcare IT solutions, the solutions’ installation services to enable the user organization install the adopted solutions in the right manner, training services in order to ensure that the staff at the user organization is well trained in order to use the adopted solutions and the maintenance services to ensure that the adopted solutions are used as expected by the user organization. This segmentation is done to accommodate all sorts of IT solutions that have been put forth in the realm of delivering health care services which plays major role in today’s advanced society.

Healthcare IT Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- It closely follows our concept of the Healthcare IT market having North America as one of the most developed and changing markets mainly due to its effective health care system and an early adoption to new health care IT technologies. Special attention is paid to the position of the United States in this market because of its highly developed health care service system and outstanding health care costs. A key area of interest includes electronic health records, computerised decision support systems, and telemedicine innovations. Altogether, a higher demand for healthcare analytics and population health tools to help deepen the effectiveness of the provision of the services and minimize the costs is characteristic for the region at the moment.

- It is believed that North America constitutes one of the most challenging locations concerning the number of players who provide diverse IT solutions and services to the healthcare sector. The market is also considerate competitive and has of matured market and have experienced innovation along with technology integration, most of the companies have incorporated the partnerships and collaborations as well as mergers and acquisitions so as to sustain in the market. This is so because local and foreign government authorities such as the United States has developed programs that will promote the use of the Healthcare IT solutions, for instance, the HITECH Act. However, there are some factors which has acted as a restrain for this market including governments regulation, data security concerns etc.; nonetheless; the North America Healthcare IT market will grow in future years because of increasing incorporation of various innovative technologies and need for efficient system to provide healthcare service delivery.

Active Key Players in the Healthcare IT Market

- Philips Healthcare (Netherlands)

- McKesson Corporation (United States)

- eMDs, Inc. (United States)

- Veradigm Inc. (formerly Allscripts Healthcare Solutions, Inc.) (United States)

- Carestream Health (United States)

- GE Healthcare (United States)

- Agfa- Gevaert Group (Belgium)

- Hewlett Packard Enterprise Development LP (United States)

- Novarad (United States)

- Optum, Inc. (United States)

- IBM (United States)

- Oracle (United States)

- Other Active Player

|

Global Healthcare IT Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 767.75 Bn. |

|

Forecast Period 2025-32 CAGR: |

15.80 % |

Market Size in 2032: |

USD 2482.50 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Component |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Healthcare It Market by Product Type (2018-2032)

4.1 Healthcare It Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Healthcare Provider Solutions

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Healthcare Payer Solutions

4.5 Healthcare Outsourcing Services

Chapter 5: Healthcare It Market by Component (2018-2032)

5.1 Healthcare It Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Software

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Hardware

5.5 Services

5.6 End User

5.7 Healthcare Providers

5.8 Healthcare Payers

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Healthcare It Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 PHILIPS HEALTHCARE (NETHERLANDS)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 MCKESSON CORPORATION (UNITED STATES)

6.4 EMDS INC. (UNITED STATES)

6.5 VERADIGM INC. (FORMERLY ALLSCRIPTS HEALTHCARE SOLUTIONS INC.) (UNITED STATES)

6.6 CARESTREAM HEALTH (UNITED STATES)

6.7 GE HEALTHCARE (UNITED STATES)

6.8 AGFA- GEVAERT GROUP (BELGIUM)

6.9 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP (UNITED STATES)

6.10 NOVARAD (UNITED STATES)

6.11 OPTUM INC. (UNITED STATES)

6.12 IBM (UNITED STATES)

6.13 ORACLE (UNITED STATES)

6.14 OTHERS

6.15

Chapter 7: Global Healthcare It Market By Region

7.1 Overview

7.2. North America Healthcare It Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product Type

7.2.4.1 Healthcare Provider Solutions

7.2.4.2 Healthcare Payer Solutions

7.2.4.3 Healthcare Outsourcing Services

7.2.5 Historic and Forecasted Market Size by Component

7.2.5.1 Software

7.2.5.2 Hardware

7.2.5.3 Services

7.2.5.4 End User

7.2.5.5 Healthcare Providers

7.2.5.6 Healthcare Payers

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Healthcare It Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product Type

7.3.4.1 Healthcare Provider Solutions

7.3.4.2 Healthcare Payer Solutions

7.3.4.3 Healthcare Outsourcing Services

7.3.5 Historic and Forecasted Market Size by Component

7.3.5.1 Software

7.3.5.2 Hardware

7.3.5.3 Services

7.3.5.4 End User

7.3.5.5 Healthcare Providers

7.3.5.6 Healthcare Payers

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Healthcare It Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product Type

7.4.4.1 Healthcare Provider Solutions

7.4.4.2 Healthcare Payer Solutions

7.4.4.3 Healthcare Outsourcing Services

7.4.5 Historic and Forecasted Market Size by Component

7.4.5.1 Software

7.4.5.2 Hardware

7.4.5.3 Services

7.4.5.4 End User

7.4.5.5 Healthcare Providers

7.4.5.6 Healthcare Payers

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Healthcare It Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product Type

7.5.4.1 Healthcare Provider Solutions

7.5.4.2 Healthcare Payer Solutions

7.5.4.3 Healthcare Outsourcing Services

7.5.5 Historic and Forecasted Market Size by Component

7.5.5.1 Software

7.5.5.2 Hardware

7.5.5.3 Services

7.5.5.4 End User

7.5.5.5 Healthcare Providers

7.5.5.6 Healthcare Payers

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Healthcare It Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product Type

7.6.4.1 Healthcare Provider Solutions

7.6.4.2 Healthcare Payer Solutions

7.6.4.3 Healthcare Outsourcing Services

7.6.5 Historic and Forecasted Market Size by Component

7.6.5.1 Software

7.6.5.2 Hardware

7.6.5.3 Services

7.6.5.4 End User

7.6.5.5 Healthcare Providers

7.6.5.6 Healthcare Payers

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Healthcare It Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product Type

7.7.4.1 Healthcare Provider Solutions

7.7.4.2 Healthcare Payer Solutions

7.7.4.3 Healthcare Outsourcing Services

7.7.5 Historic and Forecasted Market Size by Component

7.7.5.1 Software

7.7.5.2 Hardware

7.7.5.3 Services

7.7.5.4 End User

7.7.5.5 Healthcare Providers

7.7.5.6 Healthcare Payers

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Healthcare IT Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 767.75 Bn. |

|

Forecast Period 2025-32 CAGR: |

15.80 % |

Market Size in 2032: |

USD 2482.50 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Component |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||