Global Health Insurance Exchange Market Synopsis

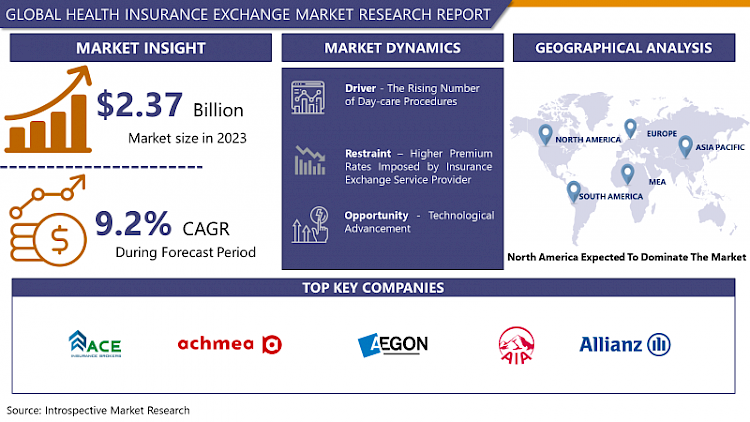

Global Health Insurance Exchange Market Size Was Valued at USD 2.37 Billion in 2023 and is Projected to Reach USD 5.23 Billion by 2032, Growing at a CAGR of 9.2% From 2024-2032.

Ahealth insurance exchange is referred to as an online health insurance marketplace. It is an insurance platform run by the government. This platform is designed for small businesses and individuals can compare and search for health insurance exchange.

- The health exchanges first began to work in the private sector in the early 1980s. Obamacare is the Affordable Care Act (ACA) that maintained the health insurance exchanges component as a key component of health care. There are two types of health insurance exchange such as public health insurance and private health insurance exchange.

- A primary function of the exchanges is to facilitate enrollment. This generally includes operating a web portal that allows for the comparison and purchase of coverage; making determinations of eligibility for coverage and financial assistance; and offering different forms of enrollment assistance, including Navigators and a call center. Exchanges also are responsible for several administrative functions, including certifying the plans that will be offered in their marketplaces.

- They provide a list of health plans with the exchange; people can compare this health plan and select one on the basis of their budget. The insurance plan helps the consumer to meet their need, thus it is anticipated to have propelled the growth of the market in the forecast year.

Global Health Insurance Exchange Market Trend Analysis

The Rising Number of Day-care Procedures

- Daycare procedures encompass medical treatments or minor surgeries that require shorter hospital stays. They include diagnostics, medications, hospital admissions, vital checks, injections, and post-hospitalization costs. Many insurance plans now cover daycare procedures for surgeries without the necessity of a 24-hour hospital stay. These plans also offer financial aid in cases of accidents or illnesses.

- The escalating costs of medical services, from hospital stays to surgeries, have led to a widespread financial burden, prompting people to rely on insurance plans for support. This trend, coupled with the increasing prevalence of daycare procedures, is anticipated to drive the growth of the health insurance exchange market in the foreseeable future.

Technological Advancement

- Technological advancements have become a cornerstone for maintaining efficient health insurance exchange services, presenting lucrative opportunities for market profitability. In particular, the adoption of an e-commerce model by most private health exchange insurers has revolutionized the insurance exchange landscape. This shift towards digitization has streamlined the process, making insurance exchanges more accessible and user-friendly for consumers. The ease of navigating these online platforms has significantly enhanced the efficiency and convenience of obtaining healthcare coverage.

- The global surge in smartphone and smart device adoption has further propelled the growth of online healthcare service sales, significantly impacting the health insurance exchange market. With a growing number of individuals relying on these devices for various services, including healthcare-related transactions, the market for health insurance exchange experiences a substantial boost in online engagement. The convenience and accessibility afforded by these devices have catalyzed a shift towards digital health solutions, creating a ripe environment for insurance exchange platforms to thrive.

Global Health Insurance Exchange Market Segment Analysis:

Global Health Insurance Exchange Market Segmented on the basis of type, application, and end-users.

By Type public exchanges segment is expected to dominate the market during the forecast period

- public exchanges are anticipated to have maximum market share in health insurance exchange. It provides the benefits like cost-saving, better patient satisfaction, and improved health benefits. Under the Affordable Care Act (ACA) the public exchange performs some important functions such as they execute certifying, re-certifying, or de-certifying health plans procedure, and offers a toll-free telephone hotline to respond to enrollee requests for help, managing the website of standardized comparative information about health plans, develops the navigator programs to assist individuals and small employers participate in the exchange. Thus, most people select the public health insurance exchange platform that supports the growth of the market over the forecasted period.

By End-users, Third Party Administrators segment held the largest share of 25% in 2022

- Third Party Administrators (TPAs) play a pivotal role in the healthcare landscape, managing claims processing and administrative responsibilities for health plans and self-insured employers. Their significance has grown considerably, particularly in cost management and fraud detection within the healthcare sector. This expansion is fueled by a rising demand for data analytics solutions that enable TPAs to streamline operations, enhance efficiency, and identify potential instances of fraud or abuse within insurance claims.

- The current market positioning suggests that TPAs hold a substantial share, estimated to be around 25-30%, indicating their substantial influence within the healthcare insurance ecosystem. This significant market presence is attributed to their specialized expertise in managing various aspects of claims processing, ranging from verifying coverage to processing payments and ensuring regulatory compliance. Their role extends beyond mere administrative tasks, encompassing strategic cost containment measures and leveraging data analytics to detect irregularities or fraudulent activities.

Global Health Insurance Exchange Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In the United States, the growth of the Health Insurance Exchange market is propelled by the established Affordable Care Act (ACA) marketplaces. These platforms have significantly expanded access to health insurance, allowing individuals to compare and purchase plans conveniently. Despite variances in enrollment among states and some opting out of running their own exchanges, the ACA has still widened coverage opportunities, fostering a competitive marketplace that encourages participation from insurers. The evolving regulatory environment and the need for affordable, accessible healthcare continue to drive the growth of these exchanges.

- In Canada, the rise of health insurance exchanges is notable within a predominantly single-payer healthcare system. The presence of private health insurance, primarily for supplemental coverage, has spurred the emergence of exchanges catering to individual and small group plans.

Global Health Insurance Exchange Market Top Key Players:

- ACE Insurance (USA)

- Achmea(Netherlands)

- AEGON (Netherlands)

- AIA Group (Hong Kong)

- AlfaStrakhovanie (Russia)

- Allianz

- Anadolu Hayat Emeklilik (Turkey)

- Assicurazioni Generali (Italy)

- Assurant (United States)

- Aviva (UK)

- AXA (France)

- Banamex (Mexico)

- Banco Bilbao Vizcaya Argentaria (Spain)

- Banco Bradesco (Brazil)

- BNP Paribas Cardif (Paris)

- China Life Insurance Company (China)

- China Pacific Insurance (China)

- CNP Assurances (France)

- Credit Agricole (France)

- DZ Bank (Germany)

- Garanti Emeklilik ve Hayat (Turkey)

- Great Eastern Holdings (Singapore)

- Grupo Nacional Provincial (Mexico), and Other Major Players

Key Industry Developments in the Global Health Insurance Exchange Market:

In January 2023, Humana, a leading healthcare company, has introduced an innovative Medicare Advantage plan tailored to meet the needs of cost-conscious consumers. This groundbreaking offering boasts a zero monthly premium and has been strategically rolled out across selected counties, aiming to provide affordable and accessible healthcare options for eligible individuals.

In April 2023, Kaiser Permanente, renowned for its commitment to comprehensive healthcare, has made a significant stride by expanding its exchange presence to three additional states. The healthcare giant is now offering its highly acclaimed Health Maintenance Organization (HMO) plans in these states, prioritizing preventive care and coordinated health management for enrolled members.

In February 2024, ManipalCigna Health Insurance has launched its new campaign, "Mere Choice ka Health Insurance" (MCHI), aimed at empowering young adults with the financial security of health insurance as they navigate adulthood. The campaign supports young individuals through various firsts—from budgeting to caregiving—offering them a reliable health insurance partner. As they step into the responsibilities of adult life, ManipalCigna is committed to ensuring their journey is backed by comprehensive health coverage.

|

Global Health Insurance Exchange Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.37 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.2 % |

Market Size in 2032: |

USD 5.23 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End-user |

|

||

|

By Phase |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- HEALTH INSURANCE EXCHANGE MARKET BY TYPE (2017-2032)

- HEALTH INSURANCE EXCHANGE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PRIVATE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PUBLIC

- HEALTH INSURANCE EXCHANGE MARKET BY END-USER (2017-2032)

- HEALTH INSURANCE EXCHANGE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- THIRD-PARTY ADMINISTRATORS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HEALTH PLAN PLAYERS

- GOVERNMENT AGENCIES

- HEALTH INSURANCE EXCHANGE MARKET BY PHASE (2017-2032)

- HEALTH INSURANCE EXCHANGE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- EXCHANGE INFRASTRUCTURE DELIVERY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PRE-IMPLEMENTATION SERVICES

- INDEPENDENT VERIFICATION & VALIDATION

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Health Insurance Exchange Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ACE INSURANCE

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- Achmea

- AEGON

- AIA Group

- AlfaStrakhovanie

- Allianz

- Anadolu Hayat Emeklilik

- Assicurazioni Generali

- Assurant

- Aviva

- AXA

- Banamex

- Banco Bilbao Vizcaya Argentaria

- Banco Bradesco

- BNP Paribas Cardif

- China Life Insurance Company

- China Pacific Insurance

- CNP Assurances

- Credit Agricole

- DZ Bank

- Garanti Emeklilik ve Hayat

- Great Eastern Holdings

- Grupo Nacional Provincial

- COMPETITIVE LANDSCAPE

- GLOBAL HEALTH INSURANCE EXCHANGE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By End-user

- Historic And Forecasted Market Size By Phase

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Health Insurance Exchange Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.37 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.2 % |

Market Size in 2032: |

USD 5.23 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End-user |

|

||

|

By Phase |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HEALTH INSURANCE EXCHANGE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HEALTH INSURANCE EXCHANGE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HEALTH INSURANCE EXCHANGE MARKET COMPETITIVE RIVALRY

TABLE 005. HEALTH INSURANCE EXCHANGE MARKET THREAT OF NEW ENTRANTS

TABLE 006. HEALTH INSURANCE EXCHANGE MARKET THREAT OF SUBSTITUTES

TABLE 007. HEALTH INSURANCE EXCHANGE MARKET BY TYPE

TABLE 008. PRIVATE MARKET OVERVIEW (2016-2028)

TABLE 009. PUBLIC MARKET OVERVIEW (2016-2028)

TABLE 010. HEALTH INSURANCE EXCHANGE MARKET BY END-USER

TABLE 011. THIRD PARTY ADMINISTRATORS MARKET OVERVIEW (2016-2028)

TABLE 012. HEALTH PLAN PLAYERS MARKET OVERVIEW (2016-2028)

TABLE 013. GOVERNMENT AGENCIES MARKET OVERVIEW (2016-2028)

TABLE 014. HEALTH INSURANCE EXCHANGE MARKET BY PHASE

TABLE 015. EXCHANGE INFRASTRUCTURE DELIVERY MARKET OVERVIEW (2016-2028)

TABLE 016. PRE-IMPLEMENTATION SERVICES MARKET OVERVIEW (2016-2028)

TABLE 017. INDEPENDENT VERIFICATION & VALIDATION MARKET OVERVIEW (2016-2028)

TABLE 018. NORTH AMERICA HEALTH INSURANCE EXCHANGE MARKET, BY TYPE (2016-2028)

TABLE 019. NORTH AMERICA HEALTH INSURANCE EXCHANGE MARKET, BY END-USER (2016-2028)

TABLE 020. NORTH AMERICA HEALTH INSURANCE EXCHANGE MARKET, BY PHASE (2016-2028)

TABLE 021. N HEALTH INSURANCE EXCHANGE MARKET, BY COUNTRY (2016-2028)

TABLE 022. EUROPE HEALTH INSURANCE EXCHANGE MARKET, BY TYPE (2016-2028)

TABLE 023. EUROPE HEALTH INSURANCE EXCHANGE MARKET, BY END-USER (2016-2028)

TABLE 024. EUROPE HEALTH INSURANCE EXCHANGE MARKET, BY PHASE (2016-2028)

TABLE 025. HEALTH INSURANCE EXCHANGE MARKET, BY COUNTRY (2016-2028)

TABLE 026. ASIA PACIFIC HEALTH INSURANCE EXCHANGE MARKET, BY TYPE (2016-2028)

TABLE 027. ASIA PACIFIC HEALTH INSURANCE EXCHANGE MARKET, BY END-USER (2016-2028)

TABLE 028. ASIA PACIFIC HEALTH INSURANCE EXCHANGE MARKET, BY PHASE (2016-2028)

TABLE 029. HEALTH INSURANCE EXCHANGE MARKET, BY COUNTRY (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA HEALTH INSURANCE EXCHANGE MARKET, BY TYPE (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA HEALTH INSURANCE EXCHANGE MARKET, BY END-USER (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA HEALTH INSURANCE EXCHANGE MARKET, BY PHASE (2016-2028)

TABLE 033. HEALTH INSURANCE EXCHANGE MARKET, BY COUNTRY (2016-2028)

TABLE 034. SOUTH AMERICA HEALTH INSURANCE EXCHANGE MARKET, BY TYPE (2016-2028)

TABLE 035. SOUTH AMERICA HEALTH INSURANCE EXCHANGE MARKET, BY END-USER (2016-2028)

TABLE 036. SOUTH AMERICA HEALTH INSURANCE EXCHANGE MARKET, BY PHASE (2016-2028)

TABLE 037. HEALTH INSURANCE EXCHANGE MARKET, BY COUNTRY (2016-2028)

TABLE 038. ACE INSURANCE: SNAPSHOT

TABLE 039. ACE INSURANCE: BUSINESS PERFORMANCE

TABLE 040. ACE INSURANCE: PRODUCT PORTFOLIO

TABLE 041. ACE INSURANCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. ACHMEA: SNAPSHOT

TABLE 042. ACHMEA: BUSINESS PERFORMANCE

TABLE 043. ACHMEA: PRODUCT PORTFOLIO

TABLE 044. ACHMEA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. AEGON: SNAPSHOT

TABLE 045. AEGON: BUSINESS PERFORMANCE

TABLE 046. AEGON: PRODUCT PORTFOLIO

TABLE 047. AEGON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. AIA GROUP: SNAPSHOT

TABLE 048. AIA GROUP: BUSINESS PERFORMANCE

TABLE 049. AIA GROUP: PRODUCT PORTFOLIO

TABLE 050. AIA GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. ALFASTRAKHOVANIE: SNAPSHOT

TABLE 051. ALFASTRAKHOVANIE: BUSINESS PERFORMANCE

TABLE 052. ALFASTRAKHOVANIE: PRODUCT PORTFOLIO

TABLE 053. ALFASTRAKHOVANIE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. ALLIANZ: SNAPSHOT

TABLE 054. ALLIANZ: BUSINESS PERFORMANCE

TABLE 055. ALLIANZ: PRODUCT PORTFOLIO

TABLE 056. ALLIANZ: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. ANADOLU HAYAT EMEKLILIK: SNAPSHOT

TABLE 057. ANADOLU HAYAT EMEKLILIK: BUSINESS PERFORMANCE

TABLE 058. ANADOLU HAYAT EMEKLILIK: PRODUCT PORTFOLIO

TABLE 059. ANADOLU HAYAT EMEKLILIK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. ASSICURAZIONI GENERALI: SNAPSHOT

TABLE 060. ASSICURAZIONI GENERALI: BUSINESS PERFORMANCE

TABLE 061. ASSICURAZIONI GENERALI: PRODUCT PORTFOLIO

TABLE 062. ASSICURAZIONI GENERALI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. ASSURANT: SNAPSHOT

TABLE 063. ASSURANT: BUSINESS PERFORMANCE

TABLE 064. ASSURANT: PRODUCT PORTFOLIO

TABLE 065. ASSURANT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. AVIVA: SNAPSHOT

TABLE 066. AVIVA: BUSINESS PERFORMANCE

TABLE 067. AVIVA: PRODUCT PORTFOLIO

TABLE 068. AVIVA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. AXA: SNAPSHOT

TABLE 069. AXA: BUSINESS PERFORMANCE

TABLE 070. AXA: PRODUCT PORTFOLIO

TABLE 071. AXA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. BANAMEX: SNAPSHOT

TABLE 072. BANAMEX: BUSINESS PERFORMANCE

TABLE 073. BANAMEX: PRODUCT PORTFOLIO

TABLE 074. BANAMEX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. BANCO BILBAO VIZCAYA: SNAPSHOT

TABLE 075. BANCO BILBAO VIZCAYA: BUSINESS PERFORMANCE

TABLE 076. BANCO BILBAO VIZCAYA: PRODUCT PORTFOLIO

TABLE 077. BANCO BILBAO VIZCAYA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. ARGENTARIA: SNAPSHOT

TABLE 078. ARGENTARIA: BUSINESS PERFORMANCE

TABLE 079. ARGENTARIA: PRODUCT PORTFOLIO

TABLE 080. ARGENTARIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. BANCO BRADESCO: SNAPSHOT

TABLE 081. BANCO BRADESCO: BUSINESS PERFORMANCE

TABLE 082. BANCO BRADESCO: PRODUCT PORTFOLIO

TABLE 083. BANCO BRADESCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. BNP PARIBAS CARDIF: SNAPSHOT

TABLE 084. BNP PARIBAS CARDIF: BUSINESS PERFORMANCE

TABLE 085. BNP PARIBAS CARDIF: PRODUCT PORTFOLIO

TABLE 086. BNP PARIBAS CARDIF: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. CHINA LIFE INSURANCE COMPANY: SNAPSHOT

TABLE 087. CHINA LIFE INSURANCE COMPANY: BUSINESS PERFORMANCE

TABLE 088. CHINA LIFE INSURANCE COMPANY: PRODUCT PORTFOLIO

TABLE 089. CHINA LIFE INSURANCE COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. CHINA PACIFIC INSURANCE: SNAPSHOT

TABLE 090. CHINA PACIFIC INSURANCE: BUSINESS PERFORMANCE

TABLE 091. CHINA PACIFIC INSURANCE: PRODUCT PORTFOLIO

TABLE 092. CHINA PACIFIC INSURANCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. CNP ASSURANCES: SNAPSHOT

TABLE 093. CNP ASSURANCES: BUSINESS PERFORMANCE

TABLE 094. CNP ASSURANCES: PRODUCT PORTFOLIO

TABLE 095. CNP ASSURANCES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. CREDIT AGRICOLE: SNAPSHOT

TABLE 096. CREDIT AGRICOLE: BUSINESS PERFORMANCE

TABLE 097. CREDIT AGRICOLE: PRODUCT PORTFOLIO

TABLE 098. CREDIT AGRICOLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. DZ BANK: SNAPSHOT

TABLE 099. DZ BANK: BUSINESS PERFORMANCE

TABLE 100. DZ BANK: PRODUCT PORTFOLIO

TABLE 101. DZ BANK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. GARANTI EMEKLILIK VE HAYAT: SNAPSHOT

TABLE 102. GARANTI EMEKLILIK VE HAYAT: BUSINESS PERFORMANCE

TABLE 103. GARANTI EMEKLILIK VE HAYAT: PRODUCT PORTFOLIO

TABLE 104. GARANTI EMEKLILIK VE HAYAT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 104. GREAT EASTERN HOLDINGS: SNAPSHOT

TABLE 105. GREAT EASTERN HOLDINGS: BUSINESS PERFORMANCE

TABLE 106. GREAT EASTERN HOLDINGS: PRODUCT PORTFOLIO

TABLE 107. GREAT EASTERN HOLDINGS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 107. GRUPO NACIONAL PROVINCIAL: SNAPSHOT

TABLE 108. GRUPO NACIONAL PROVINCIAL: BUSINESS PERFORMANCE

TABLE 109. GRUPO NACIONAL PROVINCIAL: PRODUCT PORTFOLIO

TABLE 110. GRUPO NACIONAL PROVINCIAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 110. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 111. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 112. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 113. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HEALTH INSURANCE EXCHANGE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HEALTH INSURANCE EXCHANGE MARKET OVERVIEW BY TYPE

FIGURE 012. PRIVATE MARKET OVERVIEW (2016-2028)

FIGURE 013. PUBLIC MARKET OVERVIEW (2016-2028)

FIGURE 014. HEALTH INSURANCE EXCHANGE MARKET OVERVIEW BY END-USER

FIGURE 015. THIRD PARTY ADMINISTRATORS MARKET OVERVIEW (2016-2028)

FIGURE 016. HEALTH PLAN PLAYERS MARKET OVERVIEW (2016-2028)

FIGURE 017. GOVERNMENT AGENCIES MARKET OVERVIEW (2016-2028)

FIGURE 018. HEALTH INSURANCE EXCHANGE MARKET OVERVIEW BY PHASE

FIGURE 019. EXCHANGE INFRASTRUCTURE DELIVERY MARKET OVERVIEW (2016-2028)

FIGURE 020. PRE-IMPLEMENTATION SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 021. INDEPENDENT VERIFICATION & VALIDATION MARKET OVERVIEW (2016-2028)

FIGURE 022. NORTH AMERICA HEALTH INSURANCE EXCHANGE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. EUROPE HEALTH INSURANCE EXCHANGE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. ASIA PACIFIC HEALTH INSURANCE EXCHANGE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. MIDDLE EAST & AFRICA HEALTH INSURANCE EXCHANGE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. SOUTH AMERICA HEALTH INSURANCE EXCHANGE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Global Health Insurance Exchange Market research report is 2024-2032.

ACE Insurance, Achmea, AEGON, AIA Group, AlfaStrakhovanie, Allianz, Anadolu Hayat Emeklilik, Assicurazioni Generali, Assurant, Aviva, AXA, Banamex, Banco Bilbao Vizcaya Argentaria, Banco Bradesco, BNP Paribas Cardif, China Life Insurance Company, China Pacific Insurance, CNP Assurances, Credit Agricole, DZ Bank, Garanti Emeklilik ve Hayat ,Great Eastern Holdings, Grupo Nacional Provincial and Other Major Players.

The Health Insurance Exchange Market is segmented into type, end-users, phase, and region. By Type, the market is categorized into Private, and Public. By End-users, the market is categorized into Third-Party Administrators, Health Plan Players, and Government Agencies. By Phase, the market is categorized into Exchange Infrastructure Delivery, Pre-implementation Services, and Independent Verification & Validation. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A health insurance exchange is referred to as an online health insurance marketplace. It is an insurance platform run by the government. This platform is designed for small businesses and individuals can compare and search for health insurance exchange.

Global Health Insurance Exchange Market Size Was Valued at USD 2.37 Billion in 2023 and is Projected to Reach USD 5.23 Billion by 2032, Growing at a CAGR of 9.2% From 2024-2032.