Healthcare Advertising Market Synopsis

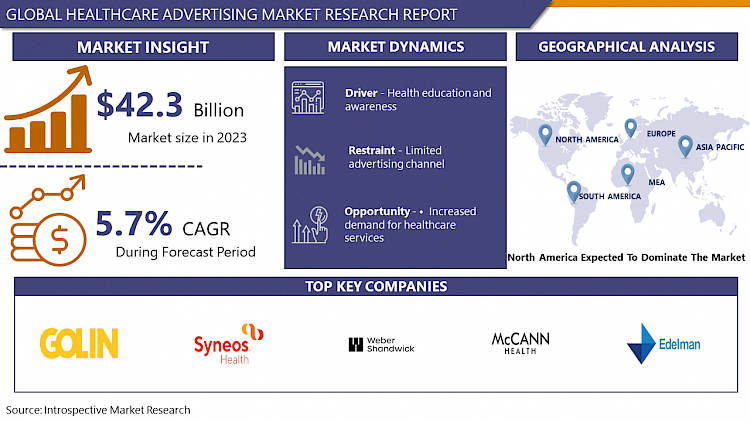

Healthcare Advertising Market Size Was Valued at USD 42.3 Billion in 2023, and is Projected to Reach USD 69.67 Billion by 2032, Growing at a CAGR of 5.7% From 2024-2032.

Healthcare advertising refers to the promotional activities and strategies used by healthcare organizations, pharmaceutical companies, medical device manufacturers, and other healthcare-related businesses to communicate information about their products, services, and facilities to patients, caregivers, and healthcare professionals. These advertising efforts may include various channels such as television, radio, print media, online platforms, and social media. The goal is to raise awareness, educate, and ultimately persuade individuals to use their healthcare products or services.

- Healthcare advertising informs the public about services offered by healthcare providers, raising awareness about new treatments, specialized care, and advanced medical technologies. It educates patients about health conditions, treatment options, preventative measures, and healthy lifestyle choices, empowering them to make informed decisions. Healthcare advertising helps organizations build brand awareness and establish themselves as trusted providers of quality care. It attracts new patients by highlighting unique offerings, such as specialized expertise or personalized care approaches, helping to grow its patient base and increase revenue.

- It also strengthens patient-provider relationships by communicating a commitment to patient-centered care, compassion, and service excellence, fostering trust and loyalty. The healthcare industry is facing increased competition due to telemedicine, healthcare startups, and online pharmacies. Consumer empowerment is also increasing, leading to increased demand for advertising to educate patients about healthcare providers, treatments, and products.

- Technological advancements, such as digital marketing tools and data analytics, have made it easier for healthcare organizations to target specific demographics and track campaign effectiveness. The aging population is also driving demand for healthcare services and products, and advertising helps providers reach this growing demographic. Regulatory changes, like the Affordable Care Act, have created new opportunities and challenges for healthcare providers, making advertising crucial for compliance.

Healthcare Advertising Market Trend Analysis

Health education and awareness

- Health education and awareness is a crucial driver of healthcare advertising. This driver emphasizes the importance of educating individuals about various health-related topics, including preventive measures, disease management, healthy lifestyle choices, and available healthcare services. By increasing public awareness and understanding of health issues, healthcare advertisers aim to empower individuals to make informed decisions about their health and seek appropriate medical care when needed.

- Health education and awareness campaigns often use various channels and mediums to reach their target audience, including television commercials, print advertisements, social media, websites, and community events. These campaigns may focus on raising awareness about specific health conditions, promoting screenings and vaccinations, encouraging healthy behaviors such as exercise and balanced nutrition, or providing information about available healthcare resources and services.

- The effectiveness of healthcare advertising efforts aimed at health education and awareness depends on the clarity of messaging, the credibility of the information provided, and the accessibility of resources for further support or assistance. By promoting health literacy and empowering individuals to take control of their health, these campaigns play a vital role in improving overall public health outcomes.

Restraint

Limited advertising channels

- Limited advertising channels in healthcare advertising refer to restrictions on where healthcare providers, pharmaceutical companies, and other related entities can advertise their services or products. These limitations may be imposed by regulatory bodies, industry standards, or ethical guidelines. healthcare advertising is the restriction on advertising certain prescription medications on television or radio.

- In some countries, regulations require that advertisements for prescription drugs must include detailed information about potential side effects, which may not be feasible within the time constraints of a typical television or radio ad. As a result, pharmaceutical companies may be limited to advertising their products through other channels such as print media, online platforms, or direct-to-consumer marketing.

- Restriction on advertising certain medical procedures or treatments that are considered to be controversial or potentially harmful. For example, some healthcare providers may be prohibited from advertising experimental treatments or procedures that have not been approved by regulatory agencies or proven to be safe and effective through clinical trials.

Opportunity

Increased demand for healthcare services

- The increased demand for healthcare services presents a significant opportunity for healthcare advertising. As more individuals seek medical care, healthcare providers, pharmaceutical companies, and other related businesses have a chance to reach a larger audience through advertising.

- Healthcare advertising can capitalize on this trend by promoting various services, treatments, and products to meet the growing needs of consumers. This can include advertisements for hospitals, clinics, medical practices, telemedicine services, prescription medications, medical devices, wellness programs, and more.

- The rise of digital marketing channels, such as social media, search engines, and mobile apps, healthcare advertisers can target specific demographics and geographic locations with precision. They can also utilize data analytics to track the effectiveness of their advertising campaigns and make adjustments as needed to maximize their return on investment.

- Moreover, as consumers become more proactive in managing their health and well-being, there is a growing demand for educational content related to healthcare. Advertisers can create informative and engaging content to empower consumers to make informed decisions about their healthcare choices.

Challenge

Increasingly leveraging emerging technologies

- Healthcare advertising faces a challenge in keeping up with the rapidly evolving landscape of emerging technologies. To effectively leverage these tools, advertisers need to stay ahead of the curve, understand how they can be integrated into advertising campaigns, and ensure compliance with regulations and ethical standards.

- Emerging technologies include artificial intelligence (AI) and machine learning, which can analyze vast amounts of data to identify patterns, personalize advertising messages, and target specific audience segments. Augmented reality (AR) and virtual reality (VR) can create immersive experiences, such as VR simulations for educating healthcare providers about new drugs or devices.

- Telemedicine and telehealth services offer new advertising opportunities, as providers can reach patients through digital channels. Wearable devices and IoT (Internet of Things) can also be used to target consumers with personalized health and wellness messages. Blockchain technology can improve transparency and security in healthcare advertising, such as data privacy and fraud prevention.

Healthcare Advertising Market Segment Analysis:

The Healthcare Advertising Market is Segmented based on Type, and Application.

By Type, Social Media Advertising segment is expected to dominate the market during the forecast period

- Social media platforms like Facebook, Instagram, LinkedIn, and Twitter offer advanced targeting options for healthcare advertisers, allowing them to reach specific demographics, interests, and behaviors. With billions of active users worldwide, these platforms are effective channels for reaching large audiences quickly and cost-effectively.

- Healthcare advertisers can create engaging content formats like images, videos, carousel ads, and interactive features like polls and quizzes. Real-time feedback on campaign performance allows advertisers to optimize campaigns in real-time.

- Social media platforms also facilitate influencer marketing, allowing healthcare brands to partner with influential individuals or organizations to promote their products or services. Social media platforms have robust advertising policies and tools to help advertisers comply with regulations like HIPAA and FDA guidelines, using features like age gating, audience restrictions, and ad disclaimers.

By Application, Pharmaceuticals segment held the largest share of 51.9% in 2023

- The pharmaceutical industry is highly competitive, with numerous companies competing for market share in various therapeutic areas. Advertising is crucial in differentiating products and brands, especially in crowded markets with multiple treatment options.

- Pharmaceutical companies often invest heavily in research and development, gaining exclusive rights to market and sell drugs. Direct-to-consumer advertising, particularly in the United States, drives demand for specific drugs and influences patient preferences, increasing sales and market share.

- The regulatory environment for pharmaceutical advertising is generally more permissive than other healthcare sectors, but companies have more flexibility in promoting their products. High profit margins, especially for patented drugs, allow pharmaceutical companies to allocate resources to advertising and marketing activities as part of their overall sales and marketing strategy.

Healthcare Advertising Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- The US, with its large pharmaceutical industry, heavily invests in advertising to promote prescription drugs to consumers and healthcare professionals. The country allows direct-to-consumer advertising, allowing pharmaceutical companies to advertise their products through various channels. North America's advanced healthcare infrastructure, particularly in the US and Canada, provides opportunities for advertising various healthcare services and products.

- Technological innovation, such as artificial intelligence, telemedicine, and digital health solutions, is driving advertising efforts. The US's favorable regulatory environment allows for more aggressive marketing tactics and greater flexibility in advertising campaigns, despite its stricter regulations compared to other regions.

Healthcare Advertising Market Top Key Players:

- Omnicom Group Inc. (US)

- Interpublic Group of Companies, Inc. (US)

- CDM (US)

- FCB Health Network (US)

- Weber Shandwick (US)

- Edelman (US)

- McCann Health (US)

- Syneos Health (US)

- W2O Group (US)

- Saatchi & Saatchi Wellness (US)

- Grey Group (US)

- GSW Advertising (US)

- CDM Princeton (US)

- Golin (US)

- WPP plc (UK)

- Havas Group (France)

- Accenture (Ireland)

- Publicis Groupe (France)

- Dentsu Group Inc. (Japan), and other major players

Key Industry Developments in the Healthcare Advertising Market:

- In November 2023, the industry continues to grapple with generative AI, Weber Shandwick launched a new service aimed at promoting better understanding and use of the technology among comms and marketing pros.

- In May 2024, JPA Health continued its expansion by acquiring the medical communications agency BioCentric. This marked JPA's second acquisition within a year. Based in Washington, D.C., JPA acquired BioCentric, which had offices in New Jersey and Switzerland. Over its more than two decades of operation, BioCentric established a reputation for equipping its life sciences partners with scientific platforms for drug development and commercialization.

|

Global Healthcare Advertising Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

42.3 Bn |

|

Forecast Period 2024-32 CAGR: |

5.7 Bn |

Market Size in 2032: |

69.67 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Approach |

|

||

|

By Mode |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- SEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- HEALTHCARE ADVERTISING MARKET BY TYPE (2017-2032)

- HEALTHCARE ADVERTISING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TRADITIONAL ADVERTISING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DIGITAL ADVERTISING

- PUBLIC RELATIONS ADVERTISING

- REFERRALS ADVERTISING

- SOCIAL MEDIA ADVERTISING

- HEALTHCARE ADVERTISING MARKET BY APPLICATION (2017-2032)

- HEALTHCARE ADVERTISING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOSPITALS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PHARMACEUTICALS

- DIAGNOSTICS

- MEDICAL EQUIPMENT

- MEDICAL INSURANCE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- HEALTHCARE ADVERTISING Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- OMNICOM GROUP INC. (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- INTERPUBLIC GROUP OF COMPANIES, INC. (US)

- CDM (US)

- FCB HEALTH NETWORK (US)

- WEBER SHANDWICK (US)

- EDELMAN (US)

- MCCANN HEALTH (US)

- SYNEOS HEALTH (US)

- W2O GROUP (US)

- SAATCHI & SAATCHI WELLNESS (US)

- GREY GROUP (US)

- GSW ADVERTISING (US)

- CDM PRINCETON (US)

- GOLIN (US)

- WPP PLC (UK)

- HAVAS GROUP (FRANCE)

- ACCENTURE (IRELAND)

- PUBLICIS GROUPE (FRANCE)

- DENTSU GROUP INC. (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL HEALTHCARE ADVERTISING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Healthcare Advertising Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

42.3 Bn |

|

Forecast Period 2024-32 CAGR: |

5.7 Bn |

Market Size in 2032: |

69.67 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Approach |

|

||

|

By Mode |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HEALTHCARE ADVERTISING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HEALTHCARE ADVERTISING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HEALTHCARE ADVERTISING MARKET COMPETITIVE RIVALRY

TABLE 005. HEALTHCARE ADVERTISING MARKET THREAT OF NEW ENTRANTS

TABLE 006. HEALTHCARE ADVERTISING MARKET THREAT OF SUBSTITUTES

TABLE 007. HEALTHCARE ADVERTISING MARKET BY TYPE

TABLE 008. TRADITIONAL MARKET OVERVIEW (2016-2028)

TABLE 009. ONLINE MARKET OVERVIEW (2016-2028)

TABLE 010. PUBLIC RELATION MARKET OVERVIEW (2016-2028)

TABLE 011. UNIQUE BRANDING AND AWARENESS MARKET OVERVIEW (2016-2028)

TABLE 012. INTERNAL MARKETING MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. HEALTHCARE ADVERTISING MARKET BY FORM OF ENGAGEMENT

TABLE 015. HEALTHCARE FACILITY MARKET OVERVIEW (2016-2028)

TABLE 016. ONLINE MARKET OVERVIEW (2016-2028)

TABLE 017. IN HOME / IN PERSON MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. HEALTHCARE ADVERTISING MARKET BY TECHNOLOGY

TABLE 020. TELEMEDICINE MARKET OVERVIEW (2016-2028)

TABLE 021. ARTIFICIAL INTELLIGENCE MARKET OVERVIEW (2016-2028)

TABLE 022. PERSONAL DATA TRACKING MARKET OVERVIEW (2016-2028)

TABLE 023. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 024. HEALTHCARE ADVERTISING MARKET BY APPLICATION

TABLE 025. DIET PRODUCT & SERVICE MARKET OVERVIEW (2016-2028)

TABLE 026. HEALTH HYGIENE MARKET OVERVIEW (2016-2028)

TABLE 027. MEDICAL INSURANCE MARKET OVERVIEW (2016-2028)

TABLE 028. MEDICAL DEVICES & EQUIPMENT MARKET OVERVIEW (2016-2028)

TABLE 029. PHARMACEUTICAL MARKET OVERVIEW (2016-2028)

TABLE 030. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 031. NORTH AMERICA HEALTHCARE ADVERTISING MARKET, BY TYPE (2016-2028)

TABLE 032. NORTH AMERICA HEALTHCARE ADVERTISING MARKET, BY FORM OF ENGAGEMENT (2016-2028)

TABLE 033. NORTH AMERICA HEALTHCARE ADVERTISING MARKET, BY TECHNOLOGY (2016-2028)

TABLE 034. NORTH AMERICA HEALTHCARE ADVERTISING MARKET, BY APPLICATION (2016-2028)

TABLE 035. N HEALTHCARE ADVERTISING MARKET, BY COUNTRY (2016-2028)

TABLE 036. EUROPE HEALTHCARE ADVERTISING MARKET, BY TYPE (2016-2028)

TABLE 037. EUROPE HEALTHCARE ADVERTISING MARKET, BY FORM OF ENGAGEMENT (2016-2028)

TABLE 038. EUROPE HEALTHCARE ADVERTISING MARKET, BY TECHNOLOGY (2016-2028)

TABLE 039. EUROPE HEALTHCARE ADVERTISING MARKET, BY APPLICATION (2016-2028)

TABLE 040. HEALTHCARE ADVERTISING MARKET, BY COUNTRY (2016-2028)

TABLE 041. ASIA PACIFIC HEALTHCARE ADVERTISING MARKET, BY TYPE (2016-2028)

TABLE 042. ASIA PACIFIC HEALTHCARE ADVERTISING MARKET, BY FORM OF ENGAGEMENT (2016-2028)

TABLE 043. ASIA PACIFIC HEALTHCARE ADVERTISING MARKET, BY TECHNOLOGY (2016-2028)

TABLE 044. ASIA PACIFIC HEALTHCARE ADVERTISING MARKET, BY APPLICATION (2016-2028)

TABLE 045. HEALTHCARE ADVERTISING MARKET, BY COUNTRY (2016-2028)

TABLE 046. MIDDLE EAST & AFRICA HEALTHCARE ADVERTISING MARKET, BY TYPE (2016-2028)

TABLE 047. MIDDLE EAST & AFRICA HEALTHCARE ADVERTISING MARKET, BY FORM OF ENGAGEMENT (2016-2028)

TABLE 048. MIDDLE EAST & AFRICA HEALTHCARE ADVERTISING MARKET, BY TECHNOLOGY (2016-2028)

TABLE 049. MIDDLE EAST & AFRICA HEALTHCARE ADVERTISING MARKET, BY APPLICATION (2016-2028)

TABLE 050. HEALTHCARE ADVERTISING MARKET, BY COUNTRY (2016-2028)

TABLE 051. SOUTH AMERICA HEALTHCARE ADVERTISING MARKET, BY TYPE (2016-2028)

TABLE 052. SOUTH AMERICA HEALTHCARE ADVERTISING MARKET, BY FORM OF ENGAGEMENT (2016-2028)

TABLE 053. SOUTH AMERICA HEALTHCARE ADVERTISING MARKET, BY TECHNOLOGY (2016-2028)

TABLE 054. SOUTH AMERICA HEALTHCARE ADVERTISING MARKET, BY APPLICATION (2016-2028)

TABLE 055. HEALTHCARE ADVERTISING MARKET, BY COUNTRY (2016-2028)

TABLE 056. XANDR INC. (U.S): SNAPSHOT

TABLE 057. XANDR INC. (U.S): BUSINESS PERFORMANCE

TABLE 058. XANDR INC. (U.S): PRODUCT PORTFOLIO

TABLE 059. XANDR INC. (U.S): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. VERIZON (U.S): SNAPSHOT

TABLE 060. VERIZON (U.S): BUSINESS PERFORMANCE

TABLE 061. VERIZON (U.S): PRODUCT PORTFOLIO

TABLE 062. VERIZON (U.S): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. KAYZEN (CHINA): SNAPSHOT

TABLE 063. KAYZEN (CHINA): BUSINESS PERFORMANCE

TABLE 064. KAYZEN (CHINA): PRODUCT PORTFOLIO

TABLE 065. KAYZEN (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. NEXTROLL INC. (U.S): SNAPSHOT

TABLE 066. NEXTROLL INC. (U.S): BUSINESS PERFORMANCE

TABLE 067. NEXTROLL INC. (U.S): PRODUCT PORTFOLIO

TABLE 068. NEXTROLL INC. (U.S): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. GOOGLE (U.S): SNAPSHOT

TABLE 069. GOOGLE (U.S): BUSINESS PERFORMANCE

TABLE 070. GOOGLE (U.S): PRODUCT PORTFOLIO

TABLE 071. GOOGLE (U.S): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. ADOBE (U.S): SNAPSHOT

TABLE 072. ADOBE (U.S): BUSINESS PERFORMANCE

TABLE 073. ADOBE (U.S): PRODUCT PORTFOLIO

TABLE 074. ADOBE (U.S): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. MAGNITE INC (U.S): SNAPSHOT

TABLE 075. MAGNITE INC (U.S): BUSINESS PERFORMANCE

TABLE 076. MAGNITE INC (U.S): PRODUCT PORTFOLIO

TABLE 077. MAGNITE INC (U.S): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. MEDIAMATH (U.S): SNAPSHOT

TABLE 078. MEDIAMATH (U.S): BUSINESS PERFORMANCE

TABLE 079. MEDIAMATH (U.S): PRODUCT PORTFOLIO

TABLE 080. MEDIAMATH (U.S): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. IPONWEB LIMITED (U.S): SNAPSHOT

TABLE 081. IPONWEB LIMITED (U.S): BUSINESS PERFORMANCE

TABLE 082. IPONWEB LIMITED (U.S): PRODUCT PORTFOLIO

TABLE 083. IPONWEB LIMITED (U.S): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. VOYAGE GROUP (JAPAN): SNAPSHOT

TABLE 084. VOYAGE GROUP (JAPAN): BUSINESS PERFORMANCE

TABLE 085. VOYAGE GROUP (JAPAN): PRODUCT PORTFOLIO

TABLE 086. VOYAGE GROUP (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. INTEGRAL AD SCIENCE INC. (DENMARK): SNAPSHOT

TABLE 087. INTEGRAL AD SCIENCE INC. (DENMARK): BUSINESS PERFORMANCE

TABLE 088. INTEGRAL AD SCIENCE INC. (DENMARK): PRODUCT PORTFOLIO

TABLE 089. INTEGRAL AD SCIENCE INC. (DENMARK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. THE TRADE DESK (U.S): SNAPSHOT

TABLE 090. THE TRADE DESK (U.S): BUSINESS PERFORMANCE

TABLE 091. THE TRADE DESK (U.S): PRODUCT PORTFOLIO

TABLE 092. THE TRADE DESK (U.S): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. CONNEXITY (U.S): SNAPSHOT

TABLE 093. CONNEXITY (U.S): BUSINESS PERFORMANCE

TABLE 094. CONNEXITY (U.S): PRODUCT PORTFOLIO

TABLE 095. CONNEXITY (U.S): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. CENTRO INCORPORATED (U.S): SNAPSHOT

TABLE 096. CENTRO INCORPORATED (U.S): BUSINESS PERFORMANCE

TABLE 097. CENTRO INCORPORATED (U.S): PRODUCT PORTFOLIO

TABLE 098. CENTRO INCORPORATED (U.S): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. RHYTHMONE LLC (U.S): SNAPSHOT

TABLE 099. RHYTHMONE LLC (U.S): BUSINESS PERFORMANCE

TABLE 100. RHYTHMONE LLC (U.S): PRODUCT PORTFOLIO

TABLE 101. RHYTHMONE LLC (U.S): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 102. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 103. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 104. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HEALTHCARE ADVERTISING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HEALTHCARE ADVERTISING MARKET OVERVIEW BY TYPE

FIGURE 012. TRADITIONAL MARKET OVERVIEW (2016-2028)

FIGURE 013. ONLINE MARKET OVERVIEW (2016-2028)

FIGURE 014. PUBLIC RELATION MARKET OVERVIEW (2016-2028)

FIGURE 015. UNIQUE BRANDING AND AWARENESS MARKET OVERVIEW (2016-2028)

FIGURE 016. INTERNAL MARKETING MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. HEALTHCARE ADVERTISING MARKET OVERVIEW BY FORM OF ENGAGEMENT

FIGURE 019. HEALTHCARE FACILITY MARKET OVERVIEW (2016-2028)

FIGURE 020. ONLINE MARKET OVERVIEW (2016-2028)

FIGURE 021. IN HOME / IN PERSON MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. HEALTHCARE ADVERTISING MARKET OVERVIEW BY TECHNOLOGY

FIGURE 024. TELEMEDICINE MARKET OVERVIEW (2016-2028)

FIGURE 025. ARTIFICIAL INTELLIGENCE MARKET OVERVIEW (2016-2028)

FIGURE 026. PERSONAL DATA TRACKING MARKET OVERVIEW (2016-2028)

FIGURE 027. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 028. HEALTHCARE ADVERTISING MARKET OVERVIEW BY APPLICATION

FIGURE 029. DIET PRODUCT & SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 030. HEALTH HYGIENE MARKET OVERVIEW (2016-2028)

FIGURE 031. MEDICAL INSURANCE MARKET OVERVIEW (2016-2028)

FIGURE 032. MEDICAL DEVICES & EQUIPMENT MARKET OVERVIEW (2016-2028)

FIGURE 033. PHARMACEUTICAL MARKET OVERVIEW (2016-2028)

FIGURE 034. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 035. NORTH AMERICA HEALTHCARE ADVERTISING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 036. EUROPE HEALTHCARE ADVERTISING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 037. ASIA PACIFIC HEALTHCARE ADVERTISING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 038. MIDDLE EAST & AFRICA HEALTHCARE ADVERTISING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 039. SOUTH AMERICA HEALTHCARE ADVERTISING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Healthcare Advertising Market research report is 2024-2032.

Omnicom Group Inc. (US), Interpublic Group of Companies, Inc. (US), CDM (US), FCB Health Network (US), Weber Shandwick (US), Edelman (US), McCann Health (US), Syneos Health (US), W2O Group (US), Saatchi & Saatchi Wellness (US), Grey Group (US), GSW Advertising (US), CDM Princeton (US), Golin (US), WPP plc (UK), Havas Group (France), Accenture (Ireland), Publicis Groupe (France), Dentsu Group Inc. (Japan), and Other Major Players.

The Healthcare Advertising Market is segmented into Type, Application, and region. By Type, the market is categorized into Traditional Advertising, Digital Advertising, Public Relations Advertising, Referrals Advertising, Social Media Advertising, and Others. By Application, the market is categorized into Hospitals, Pharmaceuticals, Diagnostics, Medical Equipment, and Medical Insurance. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The healthcare advertising market encompasses the promotion of healthcare products, services, and organizations to consumers, healthcare professionals, and other stakeholders. This includes advertising campaigns for pharmaceutical drugs, medical devices, hospitals, clinics, health insurance plans, and other healthcare-related offerings. The goal of healthcare advertising is to raise awareness, drive engagement, and ultimately influence behavior, such as encouraging patients to seek medical treatment or healthcare providers to prescribe certain medications.

Healthcare Advertising Market Size Was Valued at USD 42.3 Billion in 2023, and is Projected to Reach USD 69.67 Billion by 2032, Growing at a CAGR of 5.7% From 2024-2032.