Hardware as a Service (HaaS) Market Synopsis

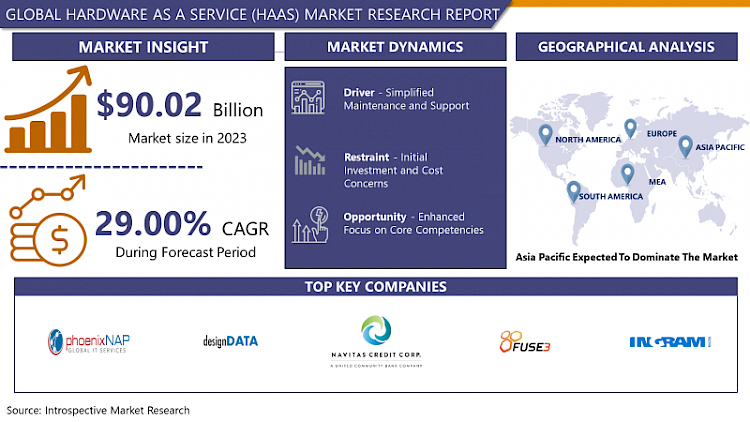

Hardware as a Service (HaaS) Market Size Was Valued at USD 90.02 Billion in 2023, and is Projected to Reach USD 890.49 Billion by 2032, Growing at a CAGR of 29.00% From 2024-2032.

Hardware as a Service (HaaS) is a concept that refers to the practice of offering hardware, including computers, servers and networking instruments, to customers on a lease basis rather than selling it to them. This allows businesses to request and use hardware resources without having to make a large financial commitment at the beginning, as well as to receive maintenance and support from the provider on an ongoing basis.

- The Hardware as a Service (HaaS) market has also shown remarkable growth trends in the recent past owing to factors such as increased innovation in technology, shift in consumer behavior trends, and the growing need for more versatile IT solutions. HaaS is a model of cooperation, where instead of buying hardware, the client pays for its usage on a regular basis, that is, on a subscription basis, and the hardware is leased or rented to him/her. This model has become very popular among business organizations that seek efficient, cost-effective, and scalable IT solutions.

- Several factors are responsible for the unprecedented growth of HaaS market, which include the emergence of OpEx model in place of CapEx in the IT industry. Historically, to set up a data center, companies have had to invest large amounts of capital in physical hardware, which in turn puts a lot of financial pressure on them and leaves them with little room to maneuver. However, in the case of HaaS, businesses can get modern hardware without having to invest a huge amount of money to buy the equipment, so they can manage the costs better and adjust their infrastructure to their changing needs.

- In addition, the advancement in technology has resulted in shorter life cycle of hardware, which is a problem to most organizations especially when it comes to upgrading their hardware to meet the current technological advancement while at the same time ensuring it is safe to use. To overcome this challenge, HaaS providers include hardware upgrade and replacement services as one of the packages that are offered to businesses so that they are always in a position to have the latest hardware without having to worry about the management of these resources.

- Also, the trend of working from home and home office and the development of new economy based on digital technologies have highlighted the necessity of the possibility of IT solutions adjustments. HaaS makes it easier for businesses to manage their hardware requirements in a world where employees are often working remotely, workloads can vary, and business needs are in a constant state of flux – making it more valuable and resilient in today’s volatile environment.

- Another important factor that is also contributing to the growth of the HaaS market is the trend for environmental friendliness and green technologies. By opting to lease rather than buy equipment, companies can also reduce the chances of contributing to the problem of electronic waste and subsequently, lower overall emissions. HAAS providers also make sure that they take back end of life hardware to be refurbished and recycled thus helping reduce the negative impact of IT on the environment.

- Besides the above drivers, the HaaS market is also driven by the ever-increasing uptake of cloud computing and managed services. Most of the HaaS providers provide all-in-one tools where they combine the hardware leasing services with other options such as cloud services, infrastructure management, tools for data backup and security, among others, making it easier for businesses to get an advanced tools solution to suit their business needs.

- However, the HaaS market has some barriers and limitations even with the positive future outlook. A big concern of any organization is data protection and privacy, especially in sectors that are regulated by specific rules and regulation like healthcare and finance sectors. Due to such concerns, HaaS providers should ensure they meet certain standards involving security features and compliance with legal requirements to ensure they can gain the confidence of their clients.

- Also, the current market environment for HaaS is highly saturated with many competitors offering almost the same services. In order to stand out from the competition and sustain themselves in the market, HaaS providers need to leverage some value added services such as offering more personalized customer support, smooth integration services to the existing IT systems, and innovative pricing models as per the requirements of different customer segments.

- Thus, it is possible to state that the Hardware as a Service market is rapidly growing due to the following factors: the transition to the OpEx model, technological advancement, the increase of remote work, and the focus on environmental protection. However, there are still certain challenges that HaaS providers are likely to encounter, including the issues related to data security as well as the market saturation that affects the adoption of new services to some extent; yet there are considerable opportunities for HaaS providers to address the growing needs of organizations for more flexible, efficient, and affordable IT solutions in the world that is becoming more digital and interconnected.

Hardware as a Service (HaaS) Market Trend Analysis

Increased Adoption of Edge Computing Solutions

- There is a significant increase in the demand for Hardware as a Service (HaaS), with the primary driver being the increasing implementation of edge computing technologies in many industries. Edge computing is rapidly gaining importance as data is processed near to their source rather than transferring it to centralized data centers due to the increasing amount of data generated through IoT devices, Artificial Intelligence applications and other digital technologies. This has led to the emergence of hardware that is tailored for specific edge computing operations such as edge servers, gateways and accelerators.

- The HaaS models address the needs of businesses that want to have edge computing infrastructure in place while avoiding capital expenditures and operational expenditures of buying and maintaining hardware. In particular, HaaS models allow organizations to get access to the most up-to-date edge computing hardware without having to make a large capital investment in hardware, thus giving them more flexibility, scalability, and cost control. As the business requirements for edge computing are still growing due to the need for real-time analysis, fast processing, and efficient use of bandwidth, the HaaS market is expected to grow further, with vendors offering new and advanced solutions targeted at various industries.

Enhanced Focus on Core Competencies

- The Hardware as a Service (HaaS) market has been growing rapidly as the business organizations are outsourcing their hardware management and purchasing needs. This model enables companies to use advanced and new hardware without having to make large capital investments or bear the costs of maintenance. Hence, through the HaaS model, an organization can cut down the running costs, minimize the expenses on the capital assets and at the same time be guaranteed of acquiring only new technology. This is even more evident in industries that rely heavily on technological advancements like IT services, healthcare, and financial sectors.

- In addition, the HaaS model also comes with other services such as installation, management, and upgrade services by the HaaS providers to help organizations save time and money and focus on core business development. The HaaS market is well positioned to experience steady growth in the coming years, as organizations of all sizes seek out more adaptable and cost-effective solutions, leading to advancements and optimizations across a range of industries.

Hardware as a Service (HaaS) Market Analysis:

Hardware as a Service (HaaS) Market is segmented based on Hardware Model , Deployment and End-User.

By Hardware Model, Platform As A Service segment is expected to dominate the market during the forecast period

- Hardware as a Service (HaaS) is a new form of solution in the technology sector that has various services that are specially designed to meet different hardware requirements. The market for HaaS is divided into several sectors that serve needs and demands in the market for different purposes. Platform as a Service (PaaS) offers a platform that developers can utilize to create, deploy, and maintain applications and is designed to simplify the process of infrastructure management. Desktop as a Service (DaaS) is a virtual desktop environment that is available on any device to provide flexibility and improved efficiency in the workplace.

- Device as a Service (DaaS) is a concept that takes this further to include hardware devices so that users can lease devices and have them managed and maintained throughout their usage lifecycle. IaaS is a form of cloud computing that delivers virtual infrastructure over the Internet; it allows companies to outsource infrastructure and scale it on demand. Combined, these models are part of the growth of HaaS, helping businesses find affordable solutions while simultaneously enhancing the technological landscape. With companies moving towards the adoption of the cloud and looking for more versatile and scalable ways of addressing their IT hardware requirements, the HaaS model is expected to grow and evolve in the next few years.

By End Use Sector, IT & Telecommunication segment held the largest share in 2023

- In the HaaS market, end user segmentation is an important factor that helps to analyze the trends of the market and provide corresponding solutions according to the needs of different spheres. Out of these, the BFSI sector is a sector that requires high security and a strong infrastructure as it deals with transactions that are vital in the financial domain. Likewise, the IT & Telecommunication industry requires versatile and effective hardware systems that can support networks and data centers and thus demands HaaS. The Retail business needs a solution that can easily and inexpensively address point-of-sale systems and inventory control, and this is where HaaS comes in.

- Healthcare, which is another major end user, stresses on dependability and conformity within its hardware infrastructure for the delivery of patient care and storing of critical health information. Besides these primary sectors, the “Others” category comprises of numerous other industries, all having specific hardware requirements that may be best met through the HaaS model. In conclusion, by assessing the end-users’ preferences and needs, HaaS providers can adjust their offerings to meet the needs of certain industries and expand HaaS adoption to various sectors.

Hardware as a Service (HaaS) Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific is projected to emerge as one of the most influential regions in the growth of the Hardware as a Service (HaaS) market within the stipulated period. The following are the factors that lead to this projected supremacy of these two hemispheres. First of all, due to the fast growing economy of the region especially in countries like China, India and in other Southeast Asian countries there has been a significant investment in IT infrastructure as well as the use of technology. This is because today there is a rise in the use of technology solutions, and with this, there is a need for hardware that is efficient, reliable, and low-cost, which is what HaaS provides.

- Also, the current growth of Small and Medium Sized Enterprises (SMEs) in the Asia-Pacific region requires affordable and versatile IT solutions that do not warrant colossal investments. This approach is ideal for these needs because HaaS offers companies a way to take advantage of the newest technologies without having to spend a lot of money on new hardware. Also, the growing adoption of IT services outsourcing by organizations in the region leads to the growth of HaaS market as the companies prefer the ease of having a professional handle the hardware needs. Being one of the largest and most rapidly developing regions with a high level of technological development and a large number of potential customers in the HaaS market, the Asia-Pacific region will become a driving force for the development of innovations and will define new trends in the consumption of hardware as a service.

Active Key Players in the Hardware as a Service (HaaS) Market

- Navitas Lease Corporation: (US)

- FUSE3 Communications: (US)

- Ingram Micro Inc.: (US)

- Design Data Systems, Inc.: (US)

- Phoenix NAP LLC: (US)

- Machado Consulting: (US)

- Managed IT Solutions: (US)

- Fujitsu Ltd.: (Japan)

- Lenovo Group Ltd.: (China), Other Key Players

|

Global Hardware as a Service (HaaS) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 90.02 Bn. |

|

Forecast Period 2024-32 CAGR: |

29.00% |

Market Size in 2032: |

USD 890.49 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- HARDWARE AS A SERVICE (HAAS) MARKET BY TYPE (2017-2032)

- HARDWARE AS A SERVICE (HAAS) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PLATFORM AS A SERVICE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DESKTOP-AS-A-SERVICE

- DEVICE AS A SERVICE

- INFRASTRUCTURE AS A SERVICE

- HARDWARE AS A SERVICE (HAAS) MARKET BY DEPLOYMENT (2017-2032)

- HARDWARE AS A SERVICE (HAAS) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ON-PREMISES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CLOUD

- HARDWARE AS A SERVICE (HAAS) MARKET BY END-USER (2017-2032)

- HARDWARE AS A SERVICE (HAAS) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BFSI

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- IT & TELECOMMUNICATION

- RETAIL

- HEALTHCARE

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- HARDWARE AS A SERVICE (HAAS) Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- NAVITAS LEASE CORPORATION: (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- FUSE3 COMMUNICATIONS: (US)

- INGRAM MICRO INC.: (US)

- DESIGN DATA SYSTEMS, INC.: (US)

- PHOENIX NAP LLC: (US)

- MACHADO CONSULTING: (US)

- MANAGED IT SOLUTIONS: (US)

- FUJITSU LTD.: (JAPAN)

- LENOVO GROUP LTD.: (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL HARDWARE AS A SERVICE (HAAS) MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Deployment

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Hardware as a Service (HaaS) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 90.02 Bn. |

|

Forecast Period 2024-32 CAGR: |

29.00% |

Market Size in 2032: |

USD 890.49 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HARDWARE AS A SERVICE (HAAS) MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HARDWARE AS A SERVICE (HAAS) MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HARDWARE AS A SERVICE (HAAS) MARKET COMPETITIVE RIVALRY

TABLE 005. HARDWARE AS A SERVICE (HAAS) MARKET THREAT OF NEW ENTRANTS

TABLE 006. HARDWARE AS A SERVICE (HAAS) MARKET THREAT OF SUBSTITUTES

TABLE 007. HARDWARE AS A SERVICE (HAAS) MARKET BY HARDWARE MODEL

TABLE 008. PLATFORM AS A SERVICE MARKET OVERVIEW (2016-2028)

TABLE 009. DESKTOP-AS A SERVICE MARKET OVERVIEW (2016-2028)

TABLE 010. DEVICE AS A SERVICE MARKET OVERVIEW (2016-2028)

TABLE 011. INFRASTRUCTURE AS A SERVICE MARKET OVERVIEW (2016-2028)

TABLE 012. HARDWARE AS A SERVICE (HAAS) MARKET BY DEPLOYMENT

TABLE 013. ON-PREMISES MARKET OVERVIEW (2016-2028)

TABLE 014. CLOUD MARKET OVERVIEW (2016-2028)

TABLE 015. HARDWARE AS A SERVICE (HAAS) MARKET BY END-USER

TABLE 016. BFSI MARKET OVERVIEW (2016-2028)

TABLE 017. IT & TELECOMMUNICATION MARKET OVERVIEW (2016-2028)

TABLE 018. RETAIL MARKET OVERVIEW (2016-2028)

TABLE 019. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 020. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 021. NORTH AMERICA HARDWARE AS A SERVICE (HAAS) MARKET, BY HARDWARE MODEL (2016-2028)

TABLE 022. NORTH AMERICA HARDWARE AS A SERVICE (HAAS) MARKET, BY DEPLOYMENT (2016-2028)

TABLE 023. NORTH AMERICA HARDWARE AS A SERVICE (HAAS) MARKET, BY END-USER (2016-2028)

TABLE 024. N HARDWARE AS A SERVICE (HAAS) MARKET, BY COUNTRY (2016-2028)

TABLE 025. EUROPE HARDWARE AS A SERVICE (HAAS) MARKET, BY HARDWARE MODEL (2016-2028)

TABLE 026. EUROPE HARDWARE AS A SERVICE (HAAS) MARKET, BY DEPLOYMENT (2016-2028)

TABLE 027. EUROPE HARDWARE AS A SERVICE (HAAS) MARKET, BY END-USER (2016-2028)

TABLE 028. HARDWARE AS A SERVICE (HAAS) MARKET, BY COUNTRY (2016-2028)

TABLE 029. ASIA PACIFIC HARDWARE AS A SERVICE (HAAS) MARKET, BY HARDWARE MODEL (2016-2028)

TABLE 030. ASIA PACIFIC HARDWARE AS A SERVICE (HAAS) MARKET, BY DEPLOYMENT (2016-2028)

TABLE 031. ASIA PACIFIC HARDWARE AS A SERVICE (HAAS) MARKET, BY END-USER (2016-2028)

TABLE 032. HARDWARE AS A SERVICE (HAAS) MARKET, BY COUNTRY (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA HARDWARE AS A SERVICE (HAAS) MARKET, BY HARDWARE MODEL (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA HARDWARE AS A SERVICE (HAAS) MARKET, BY DEPLOYMENT (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA HARDWARE AS A SERVICE (HAAS) MARKET, BY END-USER (2016-2028)

TABLE 036. HARDWARE AS A SERVICE (HAAS) MARKET, BY COUNTRY (2016-2028)

TABLE 037. SOUTH AMERICA HARDWARE AS A SERVICE (HAAS) MARKET, BY HARDWARE MODEL (2016-2028)

TABLE 038. SOUTH AMERICA HARDWARE AS A SERVICE (HAAS) MARKET, BY DEPLOYMENT (2016-2028)

TABLE 039. SOUTH AMERICA HARDWARE AS A SERVICE (HAAS) MARKET, BY END-USER (2016-2028)

TABLE 040. HARDWARE AS A SERVICE (HAAS) MARKET, BY COUNTRY (2016-2028)

TABLE 041. NAVITAS LEASE CORPORATION: SNAPSHOT

TABLE 042. NAVITAS LEASE CORPORATION: BUSINESS PERFORMANCE

TABLE 043. NAVITAS LEASE CORPORATION: PRODUCT PORTFOLIO

TABLE 044. NAVITAS LEASE CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. FUSE3 COMMUNICATIONS: SNAPSHOT

TABLE 045. FUSE3 COMMUNICATIONS: BUSINESS PERFORMANCE

TABLE 046. FUSE3 COMMUNICATIONS: PRODUCT PORTFOLIO

TABLE 047. FUSE3 COMMUNICATIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. INGRAM MICRO INC.: SNAPSHOT

TABLE 048. INGRAM MICRO INC.: BUSINESS PERFORMANCE

TABLE 049. INGRAM MICRO INC.: PRODUCT PORTFOLIO

TABLE 050. INGRAM MICRO INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. DESIGN DATA SYSTEMS: SNAPSHOT

TABLE 051. DESIGN DATA SYSTEMS: BUSINESS PERFORMANCE

TABLE 052. DESIGN DATA SYSTEMS: PRODUCT PORTFOLIO

TABLE 053. DESIGN DATA SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. INC.: SNAPSHOT

TABLE 054. INC.: BUSINESS PERFORMANCE

TABLE 055. INC.: PRODUCT PORTFOLIO

TABLE 056. INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. PHOENIX NAP LLC: SNAPSHOT

TABLE 057. PHOENIX NAP LLC: BUSINESS PERFORMANCE

TABLE 058. PHOENIX NAP LLC: PRODUCT PORTFOLIO

TABLE 059. PHOENIX NAP LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. MACHADO CONSULTING: SNAPSHOT

TABLE 060. MACHADO CONSULTING: BUSINESS PERFORMANCE

TABLE 061. MACHADO CONSULTING: PRODUCT PORTFOLIO

TABLE 062. MACHADO CONSULTING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. MANAGED IT SOLUTIONS: SNAPSHOT

TABLE 063. MANAGED IT SOLUTIONS: BUSINESS PERFORMANCE

TABLE 064. MANAGED IT SOLUTIONS: PRODUCT PORTFOLIO

TABLE 065. MANAGED IT SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. FUJITSU LTD.: SNAPSHOT

TABLE 066. FUJITSU LTD.: BUSINESS PERFORMANCE

TABLE 067. FUJITSU LTD.: PRODUCT PORTFOLIO

TABLE 068. FUJITSU LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. LENOVO GROUP LTD.: SNAPSHOT

TABLE 069. LENOVO GROUP LTD.: BUSINESS PERFORMANCE

TABLE 070. LENOVO GROUP LTD.: PRODUCT PORTFOLIO

TABLE 071. LENOVO GROUP LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 072. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 073. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 074. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HARDWARE AS A SERVICE (HAAS) MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HARDWARE AS A SERVICE (HAAS) MARKET OVERVIEW BY HARDWARE MODEL

FIGURE 012. PLATFORM AS A SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 013. DESKTOP-AS A SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 014. DEVICE AS A SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 015. INFRASTRUCTURE AS A SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 016. HARDWARE AS A SERVICE (HAAS) MARKET OVERVIEW BY DEPLOYMENT

FIGURE 017. ON-PREMISES MARKET OVERVIEW (2016-2028)

FIGURE 018. CLOUD MARKET OVERVIEW (2016-2028)

FIGURE 019. HARDWARE AS A SERVICE (HAAS) MARKET OVERVIEW BY END-USER

FIGURE 020. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 021. IT & TELECOMMUNICATION MARKET OVERVIEW (2016-2028)

FIGURE 022. RETAIL MARKET OVERVIEW (2016-2028)

FIGURE 023. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 024. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 025. NORTH AMERICA HARDWARE AS A SERVICE (HAAS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. EUROPE HARDWARE AS A SERVICE (HAAS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. ASIA PACIFIC HARDWARE AS A SERVICE (HAAS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. MIDDLE EAST & AFRICA HARDWARE AS A SERVICE (HAAS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. SOUTH AMERICA HARDWARE AS A SERVICE (HAAS) MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Hardware as a Service (HaaS) Market research report is 2024-2032.

Navitas Lease Corporation: (US),FUSE3 Communications: (US), Ingram Micro Inc.: (US), Design Data Systems, Inc.: (US), Phoenix NAP LLC: (US), Machado Consulting: (US), Managed IT Solutions: (US), and Other Major Players.

The Hardware as a Service (HaaS) Market is segmented into Hardware Model, Deployment , End User and Region. By Hardware Model , the market is categorized into Platform As A Service, Desktop-As A Service, Device As A Service, Infrastructure As A Service. By Deployment , the market is categorized into On-Premises, Cloud. By End-User , the market is categorized into BFSI, IT & Telecommunication, Retail, Healthcare, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Hardware as a Service (HaaS) is a concept that refers to the practice of offering hardware, including computers, servers and networking instruments, to customers on a lease basis rather than selling it to them. This allows businesses to request and use hardware resources without having to make a large financial commitment at the beginning, as well as to receive maintenance and support from the provider on an ongoing basis.

Hardware as a Service (HaaS) Market Size Was Valued at USD 90.02 Billion in 2023, and is Projected to Reach USD 890.49 Billion by 2032, Growing at a CAGR of 29.00% From 2024-2032.