Glutathione Market Synopsis

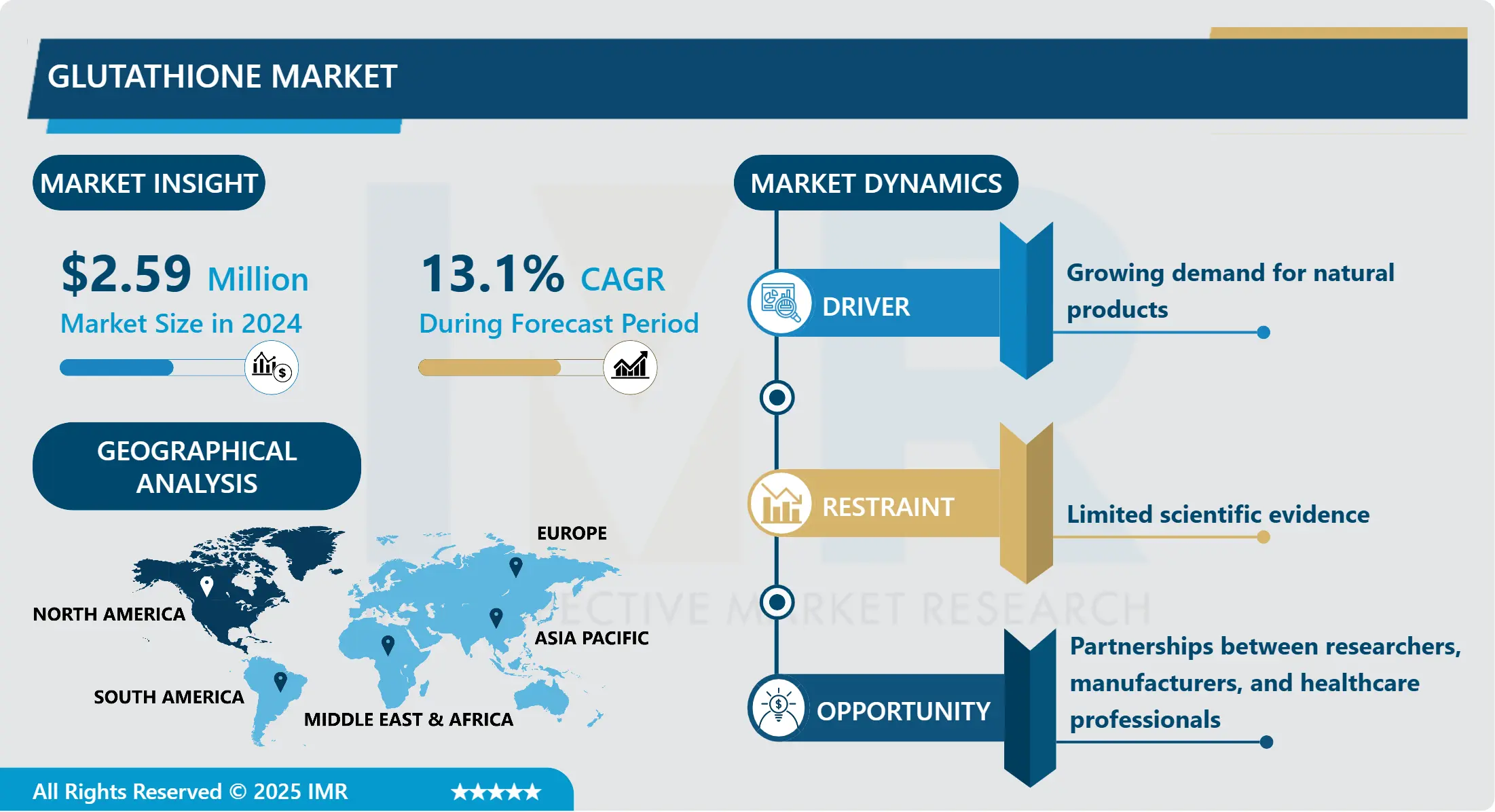

Glutathione Market Size Was Valued at USD 2.59 Billion in 2024, and is Projected to Reach USD 10.03 Billion by 2035, Growing at a CAGR of 13.1% From 2025-2035.

Glutathione is a common antioxidant that is associated with living organisms belonging to the plant, animal, fungal, and some bacterial kingdoms. It has a useful function in maintaining guard against oxidative stress that affects cells and is a cause of damage and aging. Chemically, glutathione is a tripeptide composed of three amino acids: Non-essential amino acids thus include; glutamine, cysteine and glycine. It is able to function as a strong antioxidant since it can fight free radicals and reactive oxygen species that may harm the cells.

In the human body, such compound as glutathione is produced mainly in the liver, and it is used for many significant reactions in the organism. One broad role involves removing toxins in the body and binding to organisms, heavy metals and other similar substances in the body making it easier to expel the body. This detoxifying function is important for good health and avoiding sicknesses associated with accumulation of toxic substances in the body.

The antioxidant and detoxification impacts of glutathione are crucial; however, the substance also has an immunomodulating effect. It also regulate immunological reaction by controlling the performance of immune cells and also in cytokines formation which are the messengers of the immune system. Some of the features of glutathione in this subject establish its relevance in antioxidation besides the immune system.

Furthermore, the function of glutathione has been considered in multiple health disorders and in certain cases, is used as a treatment, especially in instances of higher oxidation and impaired detoxification medicine categories. Yet, when consumed in the form of oral supplement, its benefits are still a subject of discussion mainly because of its ability as well as inability to be absorbed and utilized by the human body. Thus, glutathione remains an object of further investigation concerning its effectiveness and impact in the frameworks of medical and nutritional sciences.

Glutathione Market Trend Analysis

Glutathione Market Growth Driver- Development of new delivery forms like liposomal glutathione

- The past few years witnessed a marked shift in the glutathione market in the direction of new delivery forms, one of which is liposomal glutathione. Glutathione is an antioxidant with no synthetic elements and is usually found in every individual’s body, with the responsibility of detoxification and protection of cells. Nonetheless, when used orally has proved to be less effective due to the problems that come with its absorption and stability in the digestive tract.

- As a result of the mentioned challenges, liposomal delivery systems provide promising solutions. Liposomes are small particles formed from lipids that create a protective shell to the glutathione molecules and guard them from enzymatic degradation in the gastrointestinal tract with resultant free passage of glutathione to systemic circulation. This increases the levels of glutathione in the body and as a result the supplement works better. It is therefore for this reasons that liposomal glutathione products have flooded the market and are being more preferred by the consumers as a better way of exploiting glutathione’s antioxidant nature.

- Besides, through the enhancement of the liposomal glutathione, new advancement by the formation of new products in the nutraceuticals and pharmaceutical sectors has been witnessed. Companies are now devoting resources into developing better and more efficient liposomal formulations, developing stabilities of the formulations and examining new methods of getting the liposomes and the substance attached to them even better absorbed into the body. This trend indicates a push for improved forms of science-boosted vitamins that are biologically available and offer a therapeutic component to the body. With the researches growing effectively, the form of liposomal glutathione and other delivery forms shall be the key in determining the future of the glutathione market as it satisfies majority clients who are concerned with their health and seeking effective support from antioxidant.

Glutathione Market Expansion Opportunity- Rising health awareness

- Increased Health consciousness created a favourable market condition for the Glutathione market on the ground of increasing consciousness among customers regarding Healthcare and Preventive healthcare. The antioxidant that is naturally made by the body and which is popular in detoxification and immune boosting is called glutathione. With the increased awareness of people on their health, there is a rising interest in products that can support and improve the body’s functions and fight the effects of oxidative stress. The best-known types of glutathione supplements are being demanded due to their claimed impact on the immune system, the skin, and the liver.

- Also, the growth in the proportion of the geriatric population globally can be attributed to the growth of the Glutathione market. Hence, the need to take glutathione supplement increases with age since the body’s ability to produce this compound reduces with age hence considered more important to those with aging issues. This demographic factor shows the market’s future growth, given that healthcare transitions from the focus on treatment to prevention and healthy longevity. With an emphasis placed on scientific analysis of Glutathione’s effectiveness and possible health benefits, and with the upward trend in consumers’ confidence in scientifically proven dietary supplements the market holds enormous potential in capturing and meeting the internationally expanding need for health and wellness products.

- In addition, development in formulation sciences and new product launches are improving the efficacy and availability of Glutathione supplements. From normal gel capsules to liposomal delivery systems that enhance the uptake of some ingredients in the body, the manufacturers are paying attention to the different aspects of consumers’ preferences and their health status. This diversification together with the development of other distribution mechanisms including E-Commerce retail also enlarges the market and customer base of Glutathione. Having stated that, it becomes easy for the market to sustain itself and encourage innovation in formulating solutions tied to Glutathione with the increased guidance provided by different regulatory bodies on the intake of dietary supplements.

Glutathione Market Segment Analysis:

Glutathione Market Segmented based on Type, Application, and Region.

By Type, L-glutathione is expected to dominate the market during the forecast period

- In the Glutathione market, L-glutathione trends to be the mostly used type over the acetyl-glutathione. Natural and active form of the glutathione is referred to as L-glutathione or the reduced glutathione. It is involved in antioxidant defense, detoxification, and immune reaction, which makes its demand extremely high in the pharmaceuticals, functional foods/nutraceuticals, and cosmetics industries. It is said that it is widely used since it can help to counteract the free radicals, decrease the level of oxidative stress, and promote the healthy function of cells. These attributes of L-glutathione have endeared the compound into supplements that seek to boost the skin, liver and general health.

- Acetyl-glutathione involves an addition of an acetyl group to the original glutathione molecule and is used in aesthetic treatments. This change aimed at enhancing stability and solubility, especially of oral formulas, because regular L-glutathione can hardly be taken with ease through the gastrointestinal tract. The over-the-counter skin lightening agents like acetyl-glutathione may also have better absorption capability but L-glutathione has still not establish its market domination. Minor concerns also include the likely instability of the modified product or the modification may change the biological activity of the product may put its use in the shadow of the more established L-glutathione.

- Therefore, L-glutathione is still the most popular segment in the Glutathione market because of its effectiveness, availability as an amino acid in the body, and the research confirming the positive impacts on health. Its capability of acting as free radical scavengers and its applicability across the Rx, Nx and Pax sectors give it an edge as a client and manufacturer’s favorite. Hence, even though acetyl-glutathione seems to possess certain features that may be useful when it comes to bioavailability, it still constitutes a relatively small segment of the market, primarily due to the continuous research and development endeavors to counteract the particular issues with stability and efficacy that are associated with this type of supplement.

By Application, Pharmaceuticals segment held the largest share

- In the Glutathione market, the major application segment identified is the Pharmaceuticals segment. Otherwise, the antioxidant characteristic of glutathione, and the ability to take part in detoxification processes makes it very valuable in pharmaceutical preparations. It is applied in treatments of diseases caused by oxidative stress data, hepatic disorders, and immunological diseases. Pharmaceutical firms rely on the explanatory of glutathione to create medication that improves cellular standard of living as well as to successfully address numerous diseases. This dominance is further supported by current clinical trials that are seeking to discover more uses and forms of glutathione in treating diseases.

- The second largest user group of glutathione is cosmetics industry, which is next to the pharmaceutical sector. Thus, glutathione has gained fame primarily as an outstanding product for skin lightening as well as anti-aging creams. As a skin brightening agent it is also used to help in the reduction of the skin melody and hence the skin becomes light with less of the age spots. Cosmetic producers use glutathione in the creams, serums, and supplements that are used to nourish the skin and make it look younger. The increase in the beauty products consumption and the desire to have natural useless and effective substances is has led to the proliferation of glutathione in cosmetic industry.

- Furthermore, glutathione is used in the categories of food and beverages, although not as common as it is in the pharmaceuticals and cosmetics category. It is an oral supplement that is taken into the body and marketed for its antioxidant compounds and for containing health enhancing compounds. This segment is not as large, but there is growing attention to enhance the application of glutathione in foods and beverages to meet consumers’ demand for functional foods. On balance, the results indicate that glutathione holds a premier position among all the applications in the global market due to its ubiquity in the therapeutic and cosmetic formulations because of its documented health benefits, and the consumers’ constant search for highly effective wellness products.

Glutathione Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- Glutathione market is led by North America mainly because of some factors. Firstly, high spending on healthcare and having one of the most developed health care systems in the world, Europe needs Glutathione, which is widely acknowledged as the antioxidant and potentially has a lot of health improving functions. Patients in this country have access to quality health care facilities; thus, backing research and development processes that involves concoction of as well as demand for, the Glutathione-based products.

- There is the proactive regulatory advantage that North America affords business. The changes protect the purity and efficiency of healthcare merchandise such as Glutathione pills and the pharmaceutical products hence promoting consumer trust and the market expansion. Another noteworthy aspect is that the region’s legal environment encourages the development of change and adaptation of new formulas and uses of Glutathione.

- North America favourably positioned in terms of the well-developed consumer base that appreciates the concept of wellness as well as prevention rather than treatment. This social awareness on the part of antioxidants and its importance to health and disease has led to the need to take Glutathione products from different groups of the population. Combined with the good distribution network and marketing approaches, these reasons together contribute to the situation that North America occupies the largest Glutathione market.

Active Key Players in the Glutathione Market

- AIDP Inc. (United States)

- Daiichi Sankyo Company, Limited (Japan)

- FarmaSino Pharmaceuticals (Jiangsu) Co., Ltd. (China)

- Gnosis by Lesaffre (Italy)

- Hubei A&S International Trade Co., Ltd. (China)

- Kaneka Corporation (Japan)

- Kohjin Life Sciences Co., Ltd. (Japan)

- Kyowa Hakko Bio Co., Ltd. (Japan)

- M.C.Biotec Inc. (China)

- Merck KGaA (Germany)

- Ningbo Honor Chemtech Co., Ltd. (China)

- Pangbo Health Co., Ltd. (China)

- Shaanxi Sciphar Natural Products Co., Ltd. (China)

- Shandong Jincheng Bio-Pharmaceutical Co., Ltd. (China)

- Shenzhen GSH Bio-technology Co., Ltd. (China)

- Spectrum Chemical Manufacturing Corp. (United States)

- Xi'an Lyphar Biotech Co., Ltd. (China)

- Zhejiang Watson Pharmaceuticals Co., Ltd. (China)

- Other Active Players

|

Global Glutathione Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.29 Bn. |

|

Forecast Period 2023-34 CAGR: |

13.1% |

Market Size in 2032: |

USD 6.93 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Glutathione Market by Type (2018-2032)

4.1 Glutathione Market Snapshot and Growth Engine

4.2 Market Overview

4.3 L-glutathione

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Acetyl-glutathione

Chapter 5: Glutathione Market by Application (2018-2032)

5.1 Glutathione Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Pharmaceuticals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cosmetics

5.5 Food & beverage

5.6 Other

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Glutathione Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 AIDP INC. (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 DAIICHI SANKYO COMPANY

6.4 LIMITED (JAPAN)

6.5 FARMASINO PHARMACEUTICALS (JIANGSU) COLTD. (CHINA)

6.6 GNOSIS BY LESAFFRE (ITALY)

6.7 HUBEI A&S INTERNATIONAL TRADE COLTD. (CHINA)

6.8 KANEKA CORPORATION (JAPAN)

6.9 KOHJIN LIFE SCIENCES COLTD. (JAPAN)

6.10 KYOWA HAKKO BIO COLTD. (JAPAN)

6.11 M.C.BIOTEC INC. (CHINA)

6.12 MERCK KGAA (GERMANY)

6.13 NINGBO HONOR CHEMTECH COLTD. (CHINA)

6.14 PANGBO HEALTH COLTD. (CHINA)

6.15 SHAANXI SCIPHAR NATURAL PRODUCTS COLTD. (CHINA)

6.16 SHANDONG JINCHENG BIO-PHARMACEUTICAL COLTD. (CHINA)

6.17 SHENZHEN GSH BIO-TECHNOLOGY COLTD. (CHINA)

6.18 SPECTRUM CHEMICAL MANUFACTURING CORP. (UNITED STATES)

6.19 XI'AN LYPHAR BIOTECH COLTD. (CHINA)

6.20 ZHEJIANG WATSON PHARMACEUTICALS COLTD. (CHINA)

6.21 OTHER ACTIVE KEY PLAYERS

6.22

Chapter 7: Global Glutathione Market By Region

7.1 Overview

7.2. North America Glutathione Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 L-glutathione

7.2.4.2 Acetyl-glutathione

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Pharmaceuticals

7.2.5.2 Cosmetics

7.2.5.3 Food & beverage

7.2.5.4 Other

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Glutathione Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 L-glutathione

7.3.4.2 Acetyl-glutathione

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Pharmaceuticals

7.3.5.2 Cosmetics

7.3.5.3 Food & beverage

7.3.5.4 Other

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Glutathione Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 L-glutathione

7.4.4.2 Acetyl-glutathione

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Pharmaceuticals

7.4.5.2 Cosmetics

7.4.5.3 Food & beverage

7.4.5.4 Other

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Glutathione Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 L-glutathione

7.5.4.2 Acetyl-glutathione

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Pharmaceuticals

7.5.5.2 Cosmetics

7.5.5.3 Food & beverage

7.5.5.4 Other

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Glutathione Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 L-glutathione

7.6.4.2 Acetyl-glutathione

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Pharmaceuticals

7.6.5.2 Cosmetics

7.6.5.3 Food & beverage

7.6.5.4 Other

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Glutathione Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 L-glutathione

7.7.4.2 Acetyl-glutathione

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Pharmaceuticals

7.7.5.2 Cosmetics

7.7.5.3 Food & beverage

7.7.5.4 Other

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Glutathione Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.29 Bn. |

|

Forecast Period 2023-34 CAGR: |

13.1% |

Market Size in 2032: |

USD 6.93 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||