Fusion Splicer Market Synopsis

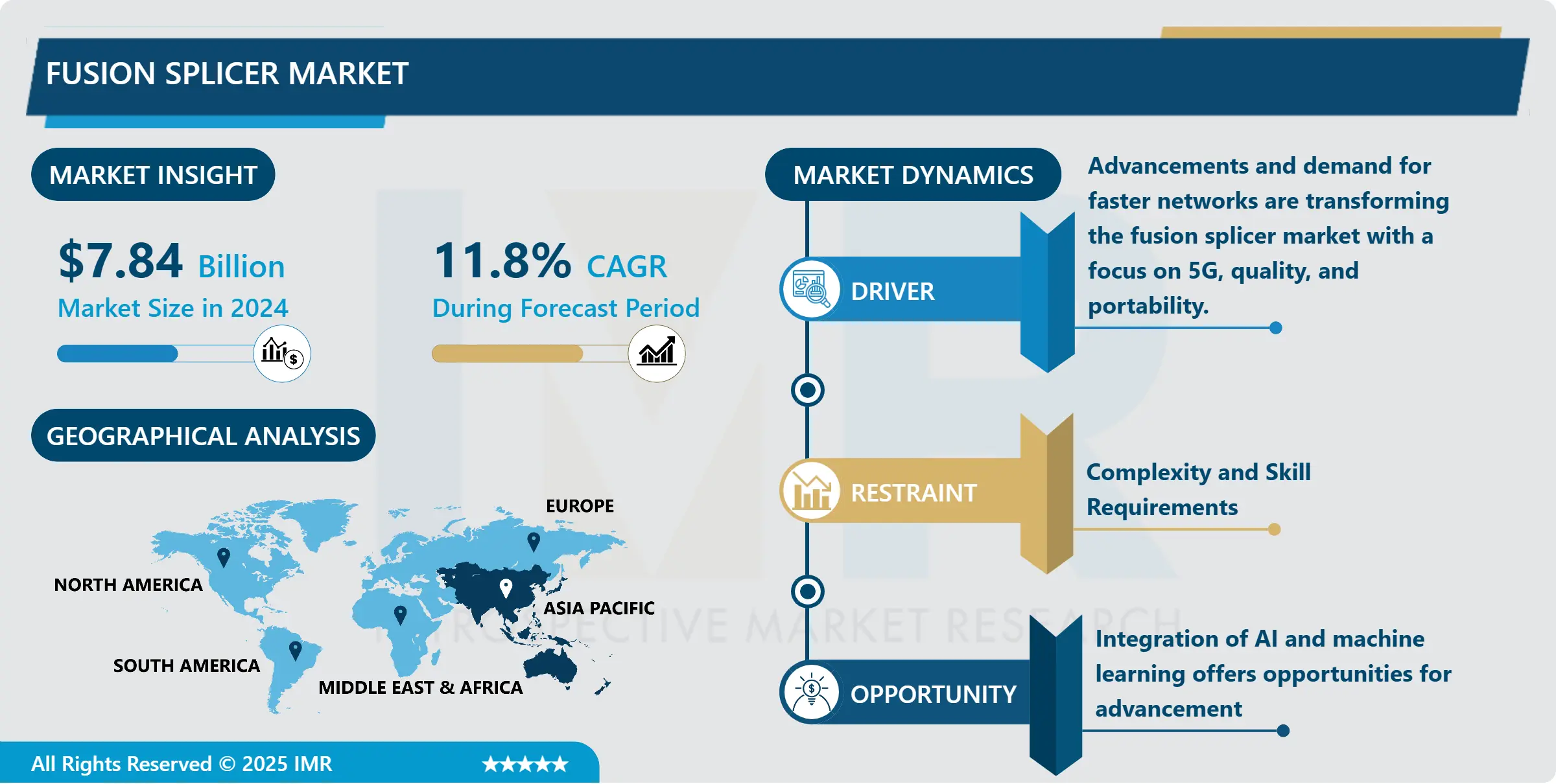

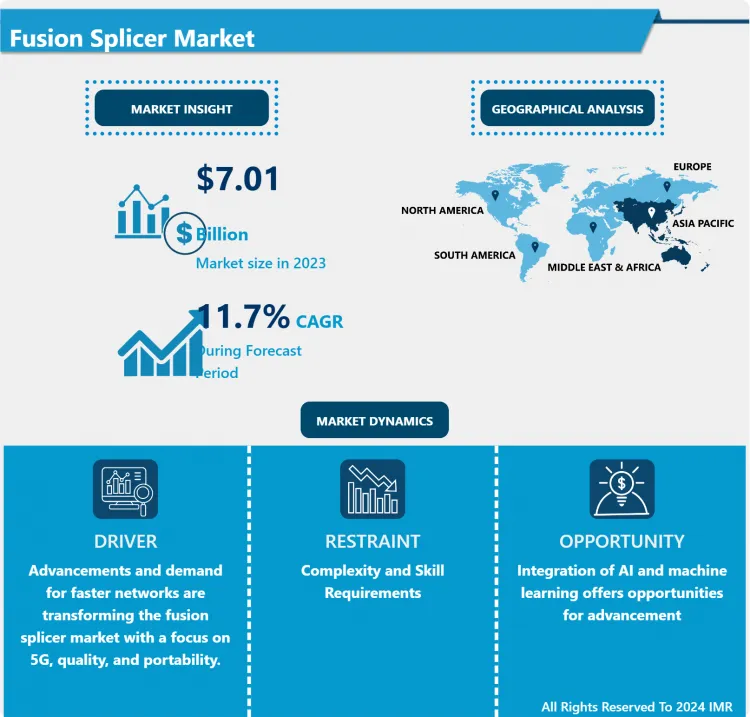

Fusion Splicer Market Size Was Valued at USD 7.84 Billion in 2024 and is Projected to Reach USD 26.74 Billion by 2035, Growing at a CAGR of 11.8% From 2025-2035.

Fusion splicing is used to physically join together two optical fiber ends. The process may vary, depending on the type of fusion splicer used. The S178 Single-Fiber Fusion Splicer has an active core aligning mechanism to align the fiber ends, and a controllable electric arc to melt the glass and butt the ends together. This results in a strong joint, with very low loss and very low back-reflection.

RECENTLY there has been considerable interest in using small core holey fibers (HF) for nonlinear applications. To fully integrate these fibers into device and sensor systems, low-loss robust splicing with conventional single-mode fiber (SMF) is required. Since the first demonstration of splicing HF and standard SMFs, many splicing techniques have been used, including the use of a filament splicer, a CO laser, and gradient index fiber lenses.

The most commonly used method is electric arc fusion because such splicers are widely available. In this letter, we demonstrate a simple method to splice HF with a subwavelength-diameter core and a high numerical aperture (NA) SMF by using a common arc fusion splicer. A splice loss of 1 dB was achieved.

Fusion Splicer Market Trend Analysis

Advancements and demand for faster networks are transforming the fusion splicer market with a focus on 5G, quality, and portability.

- Technological advances and a growing need for fast internet and communication networks are driving rapid changes in the fusion splicer market, with key trends being the move to 5G networks and the demand for top-notch splicing quality.

- The move towards making fusion splicers smaller and more portable enables technicians to maintain performance while working in tough environments. Automation and intelligent fusion capabilities, such as automated alignment and cloud integration, enhance efficiency and expedite the implementation of fiber networks.

- The increasing need for fusion splicers in data centers is fueled by the rise in cloud computing, big data, and IoT. Improvements in core alignment technology and splice loss reduction are boosting the reliability and performance of fiber optic networks by focusing on quality and precision.

Integration of AI and machine learning offers opportunities for advancement.

- Africa, the Middle East, and Southeast Asia offer potential for growth by investing in telecommunications infrastructure in emerging markets. The rise in global Fiber-to-the-Home (FTTH) services is anticipated to drive the growth of the fusion splicer market.

- All-optical networks allow for faster data transmission by removing the need for converting electrical signals to optical signals. Fusion splicers are essential for installation, providing notable chances. The increasing need for fusion splicers in healthcare and military industries is fueling market expansion. Multi-fiber splicing technology is on the rise in enhancing efficacy and reducing expenses, particularly in extensive installations such as data centers.

- Incorporating AI and machine learning in fusion splicers is a new chance to improve precision and effectiveness. Businesses that embrace change and come up with new ideas will benefit from the increasing need for fiber optic networks across different industries, resulting in more growth in the fusion splicer market.

Fusion Splicer Market Segment Analysis:

Fusion Splicer Market is Segmented on the basis of Type, Component Type, Alignment Type, Product, Application, And End-use.

By Alignment Type, Core Alignment Fusion Splicers Segment Is Expected to Dominate the Market During the Forecast Period

- Core Alignment Fusion Splicers are the top choice in the market due to their precision, reliability, and wide range of industry uses. Advanced technology is utilized to ensure accurate core alignment, which is essential for maintaining low signal loss in industries such as telecommunications and data centers.

- Core alignment fusion splicers have become more user-friendly thanks to recent developments, including automation and simple interfaces. Now, they are both easy to carry around and strong, providing a great return on investment due to their lasting dependability and enhanced network efficiency.

- Core alignment fusion splicers play a critical role in ensuring signal integrity and network performance meet stringent regulatory and industry requirements, especially in the fields of telecommunications and data centers. Due to the growing implementation of strict regulations worldwide, these splicers are now necessary for the construction and upkeep of strong fiber optic networks. With the increasing use of the internet and IoT applications, the demand for fiber optic networks is on the rise, indicating that core alignment fusion splicers will remain the top choice in the market.

By End-use, IT and Telecommunication Segment Held the Largest Share

- The IT and Telecommunication industries control the Fusion Splicer market because they heavily depend on fiber optic networks for fast data transmission and communication infrastructure. Expanding fiber networks, deploying 5G, and constructing data centers with high-capacity connections are increasing the need for Fusion Splicers.

- The demand for fiber optic networks is increasing because of the growth of IoT and smart cities, along with the emergence of edge computing. Growing need for bandwidth due to video streaming, online

- Investments and initiatives to ensure universal broadband access in emerging markets are fueling the need for fiber optic networks in the telecom industry. Advanced technologies are driving the development of next-generation networks such as FTTH and FTTP to improve network performance. Fusion splicers are necessary tools for establishing high-quality connections with minimal loss in these networks. The IT and telecommunication industries heavily depend on fusion splicers to uphold their growing infrastructure and new technologies, securing their market dominance. E-services and enterprise networks are fueling the adoption of fusion splicers.

Fusion Splicer Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The infusion splicer market in the Asia-Pacific region is led by the high demand for fiber optic networks and technological advancements. Nations such as China, Japan, and South Korea are making investments in telecommunication infrastructure, leading to a growing demand for infusion splicers.

- Governments and companies are putting money into fiber optic infrastructure to meet the growing demand for internet, increasing internet access, and the need for additional infusion splicers.

- Introducing 5G networks in Asia-Pacific drives growth in the infusion splicer market. The need for splicing equipment is increasing because of the strong fiber optic infrastructure required for 5G. Major companies in Asia-Pacific, send products worldwide. Region's dominance reinforced.

Fusion Splicer Market Active Players

- Fujikura Ltd. (Japan)

- Sumitomo Electric Industries, Ltd. (Japan)

- Furukawa Electric Co., Ltd. (Japan)

- Corning Incorporated (USA)

- INNO Instrument Inc. (South Korea)

- Nokia Corporation (Formerly Alcatel-Lucent) (Finland)

- Fitel (A Furukawa Company) (Japan)

- AFL (A subsidiary of Fujikura Ltd.) (USA)

- Shenzhen TTI Fiber Communication Tech Co., Ltd. (China)

- Skycom (China)

- Ilsintech Co., Ltd. (South Korea)

- Nanjing Jilong Optical Communication Co., Ltd. (China)

- DVP OE Tech Communications Ltd. (China)

- Ericsson AB (Sweden)

- GAO Tek Inc. (Canada)

- Signal Fire Technology Co., Ltd. (China)

- Sumitomo Electric Lightwave Corp. (USA)

- Fujikura Europe Ltd. (United Kingdom)

- Rhomberg Sersa Rail Group (Switzerland)

- Greenlee (A Textron Company) (USA)

- CommScope (USA)

- Anritsu Corporation (Japan)

- OFS (A Furukawa Company) (USA)

- AFL Telecommunications Europe (United Kingdom)

- Dynamix Technologies Ltd. (New Zealand)

- Fiberfox (South Korea)

- Darkhorsechina (Beijing) Telecom. Tech Co., Ltd. (China)

- Softel Optic Co., Ltd. (China)

- Shanghai Xianghe Fiber Optic Communications Co., Ltd. (China)

- Laser Components Germany GmbH (Germany), and other Active Players

|

Fusion Splicer Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 7.84 Bn. |

|

Forecast Period 2025-35 CAGR: |

11.8% |

Market Size in 2035: |

USD 26.74 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Component Type |

|

||

|

By Alignment Type |

|

||

|

By Product |

|

||

|

By Application |

|

||

|

By End-use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fusion Splicer Market by Type (2018-2035)

4.1 Fusion Splicer Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Field Splicing

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Factory Splicing

4.5 Laboratory Splicing

Chapter 5: Fusion Splicer Market by Component Type (2018-2035)

5.1 Fusion Splicer Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hardware

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Software

5.5 Service

Chapter 6: Fusion Splicer Market by Alignment Type (2018-2035)

6.1 Fusion Splicer Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Core Alignment

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Cladding Alignment

Chapter 7: Fusion Splicer Market by Product (2018-2035)

7.1 Fusion Splicer Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Single Fiber Fusion Splicer

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Ribbon Fiber Fusion Splicer

7.5 Special Fiber Fusion Splicer

Chapter 8: Fusion Splicer Market by Application (2018-2035)

8.1 Fusion Splicer Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Communication

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Safety and security

8.5 Surveillance

Chapter 9: Fusion Splicer Market by End-use (2018-2035)

9.1 Fusion Splicer Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Commercial

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 IT and Telecommunication

9.5 Aerospace & defence

9.6 Automotive

9.7 Healthcare

9.8 Residential

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Fusion Splicer Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 FUJIKURA LTD. (JAPAN)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 SUMITOMO ELECTRIC INDUSTRIES LTD. (JAPAN)

10.4 FURUKAWA ELECTRIC COLTD. (JAPAN)

10.5 CORNING INCORPORATED (USA)

10.6 INNO INSTRUMENT INC. (SOUTH KOREA)

10.7 NOKIA CORPORATION (FORMERLY ALCATEL-LUCENT) (FINLAND)

10.8 FITEL (A FURUKAWA COMPANY) (JAPAN)

10.9 AFL (A SUBSIDIARY OF FUJIKURA LTD.) (USA)

10.10 SHENZHEN TTI FIBER COMMUNICATION TECH COLTD. (CHINA)

10.11 SKYCOM (CHINA)

10.12 ILSINTECH COLTD. (SOUTH KOREA)

10.13 NANJING JILONG OPTICAL COMMUNICATION COLTD. (CHINA)

10.14 DVP OE TECH COMMUNICATIONS LTD. (CHINA)

10.15 ERICSSON AB (SWEDEN)

10.16 GAO TEK INC. (CANADA)

10.17 SIGNAL FIRE TECHNOLOGY COLTD. (CHINA)

10.18 SUMITOMO ELECTRIC LIGHTWAVE CORP. (USA)

10.19 FUJIKURA EUROPE LTD. (UNITED KINGDOM)

10.20 RHOMBERG SERSA RAIL GROUP (SWITZERLAND)

10.21 GREENLEE (A TEXTRON COMPANY) (USA)

10.22 COMMSCOPE (USA)

10.23 ANRITSU CORPORATION (JAPAN)

10.24 OFS (A FURUKAWA COMPANY) (USA)

10.25 AFL TELECOMMUNICATIONS EUROPE (UNITED KINGDOM)

10.26 DYNAMIX TECHNOLOGIES LTD. (NEW ZEALAND)

10.27 FIBERFOX (SOUTH KOREA)

10.28 DARKHORSECHINA (BEIJING) TELECOM. TECH COLTD. (CHINA)

10.29 SOFTEL OPTIC COLTD. (CHINA)

10.30 SHANGHAI XIANGHE FIBER OPTIC COMMUNICATIONS COLTD. (CHINA)

10.31 LASER COMPONENTS GERMANY GMBH (GERMANY)

10.32 AND

Chapter 11: Global Fusion Splicer Market By Region

11.1 Overview

11.2. North America Fusion Splicer Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size by Type

11.2.4.1 Field Splicing

11.2.4.2 Factory Splicing

11.2.4.3 Laboratory Splicing

11.2.5 Historic and Forecasted Market Size by Component Type

11.2.5.1 Hardware

11.2.5.2 Software

11.2.5.3 Service

11.2.6 Historic and Forecasted Market Size by Alignment Type

11.2.6.1 Core Alignment

11.2.6.2 Cladding Alignment

11.2.7 Historic and Forecasted Market Size by Product

11.2.7.1 Single Fiber Fusion Splicer

11.2.7.2 Ribbon Fiber Fusion Splicer

11.2.7.3 Special Fiber Fusion Splicer

11.2.8 Historic and Forecasted Market Size by Application

11.2.8.1 Communication

11.2.8.2 Safety and security

11.2.8.3 Surveillance

11.2.9 Historic and Forecasted Market Size by End-use

11.2.9.1 Commercial

11.2.9.2 IT and Telecommunication

11.2.9.3 Aerospace & defence

11.2.9.4 Automotive

11.2.9.5 Healthcare

11.2.9.6 Residential

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Fusion Splicer Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size by Type

11.3.4.1 Field Splicing

11.3.4.2 Factory Splicing

11.3.4.3 Laboratory Splicing

11.3.5 Historic and Forecasted Market Size by Component Type

11.3.5.1 Hardware

11.3.5.2 Software

11.3.5.3 Service

11.3.6 Historic and Forecasted Market Size by Alignment Type

11.3.6.1 Core Alignment

11.3.6.2 Cladding Alignment

11.3.7 Historic and Forecasted Market Size by Product

11.3.7.1 Single Fiber Fusion Splicer

11.3.7.2 Ribbon Fiber Fusion Splicer

11.3.7.3 Special Fiber Fusion Splicer

11.3.8 Historic and Forecasted Market Size by Application

11.3.8.1 Communication

11.3.8.2 Safety and security

11.3.8.3 Surveillance

11.3.9 Historic and Forecasted Market Size by End-use

11.3.9.1 Commercial

11.3.9.2 IT and Telecommunication

11.3.9.3 Aerospace & defence

11.3.9.4 Automotive

11.3.9.5 Healthcare

11.3.9.6 Residential

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Fusion Splicer Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size by Type

11.4.4.1 Field Splicing

11.4.4.2 Factory Splicing

11.4.4.3 Laboratory Splicing

11.4.5 Historic and Forecasted Market Size by Component Type

11.4.5.1 Hardware

11.4.5.2 Software

11.4.5.3 Service

11.4.6 Historic and Forecasted Market Size by Alignment Type

11.4.6.1 Core Alignment

11.4.6.2 Cladding Alignment

11.4.7 Historic and Forecasted Market Size by Product

11.4.7.1 Single Fiber Fusion Splicer

11.4.7.2 Ribbon Fiber Fusion Splicer

11.4.7.3 Special Fiber Fusion Splicer

11.4.8 Historic and Forecasted Market Size by Application

11.4.8.1 Communication

11.4.8.2 Safety and security

11.4.8.3 Surveillance

11.4.9 Historic and Forecasted Market Size by End-use

11.4.9.1 Commercial

11.4.9.2 IT and Telecommunication

11.4.9.3 Aerospace & defence

11.4.9.4 Automotive

11.4.9.5 Healthcare

11.4.9.6 Residential

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Fusion Splicer Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size by Type

11.5.4.1 Field Splicing

11.5.4.2 Factory Splicing

11.5.4.3 Laboratory Splicing

11.5.5 Historic and Forecasted Market Size by Component Type

11.5.5.1 Hardware

11.5.5.2 Software

11.5.5.3 Service

11.5.6 Historic and Forecasted Market Size by Alignment Type

11.5.6.1 Core Alignment

11.5.6.2 Cladding Alignment

11.5.7 Historic and Forecasted Market Size by Product

11.5.7.1 Single Fiber Fusion Splicer

11.5.7.2 Ribbon Fiber Fusion Splicer

11.5.7.3 Special Fiber Fusion Splicer

11.5.8 Historic and Forecasted Market Size by Application

11.5.8.1 Communication

11.5.8.2 Safety and security

11.5.8.3 Surveillance

11.5.9 Historic and Forecasted Market Size by End-use

11.5.9.1 Commercial

11.5.9.2 IT and Telecommunication

11.5.9.3 Aerospace & defence

11.5.9.4 Automotive

11.5.9.5 Healthcare

11.5.9.6 Residential

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Fusion Splicer Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size by Type

11.6.4.1 Field Splicing

11.6.4.2 Factory Splicing

11.6.4.3 Laboratory Splicing

11.6.5 Historic and Forecasted Market Size by Component Type

11.6.5.1 Hardware

11.6.5.2 Software

11.6.5.3 Service

11.6.6 Historic and Forecasted Market Size by Alignment Type

11.6.6.1 Core Alignment

11.6.6.2 Cladding Alignment

11.6.7 Historic and Forecasted Market Size by Product

11.6.7.1 Single Fiber Fusion Splicer

11.6.7.2 Ribbon Fiber Fusion Splicer

11.6.7.3 Special Fiber Fusion Splicer

11.6.8 Historic and Forecasted Market Size by Application

11.6.8.1 Communication

11.6.8.2 Safety and security

11.6.8.3 Surveillance

11.6.9 Historic and Forecasted Market Size by End-use

11.6.9.1 Commercial

11.6.9.2 IT and Telecommunication

11.6.9.3 Aerospace & defence

11.6.9.4 Automotive

11.6.9.5 Healthcare

11.6.9.6 Residential

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Fusion Splicer Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size by Type

11.7.4.1 Field Splicing

11.7.4.2 Factory Splicing

11.7.4.3 Laboratory Splicing

11.7.5 Historic and Forecasted Market Size by Component Type

11.7.5.1 Hardware

11.7.5.2 Software

11.7.5.3 Service

11.7.6 Historic and Forecasted Market Size by Alignment Type

11.7.6.1 Core Alignment

11.7.6.2 Cladding Alignment

11.7.7 Historic and Forecasted Market Size by Product

11.7.7.1 Single Fiber Fusion Splicer

11.7.7.2 Ribbon Fiber Fusion Splicer

11.7.7.3 Special Fiber Fusion Splicer

11.7.8 Historic and Forecasted Market Size by Application

11.7.8.1 Communication

11.7.8.2 Safety and security

11.7.8.3 Surveillance

11.7.9 Historic and Forecasted Market Size by End-use

11.7.9.1 Commercial

11.7.9.2 IT and Telecommunication

11.7.9.3 Aerospace & defence

11.7.9.4 Automotive

11.7.9.5 Healthcare

11.7.9.6 Residential

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

|

Fusion Splicer Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 7.84 Bn. |

|

Forecast Period 2025-35 CAGR: |

11.8% |

Market Size in 2035: |

USD 26.74 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Component Type |

|

||

|

By Alignment Type |

|

||

|

By Product |

|

||

|

By Application |

|

||

|

By End-use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||