Friction Materials Market Synopsis

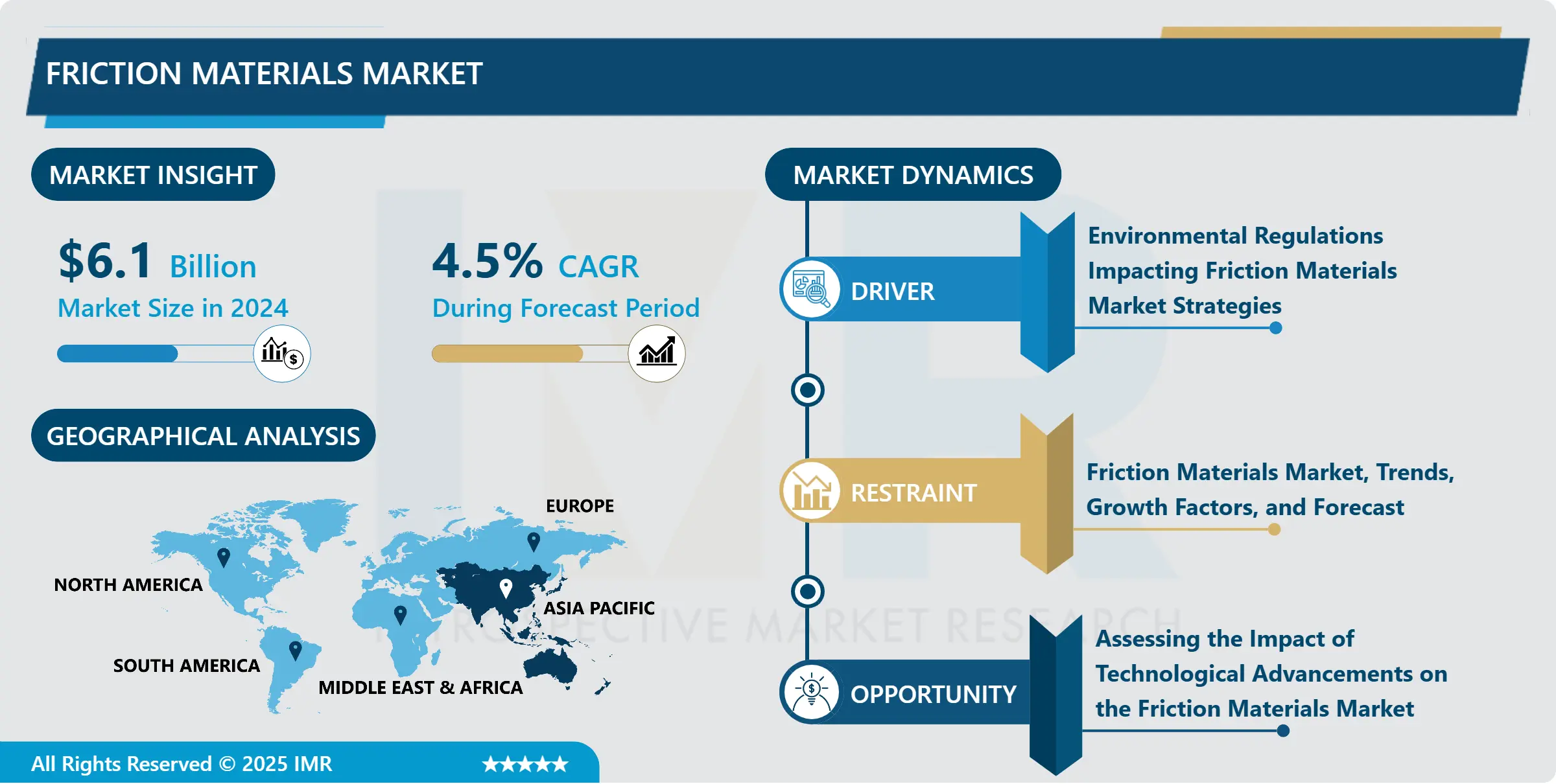

Friction Materials Market Size is Valued at USD 6.1 Billion in 2024, and is Projected to Reach USD 9.9 Billion by 2035, Growing at a CAGR of 4.5% From 2025-2035.

The market for friction materials entails the manufacture and sale of materials intended for the generation of friction in mechanical systems. They are crucial as they help in the functioning of various parts including the brakes, clutches, and transmissions in automobiles, aircrafts, and other machinery. The major products involved here are brake pads and lining, brake discs, and clutch facings that are made from composites, metals, and mineral ceramics. It is fueled by the demand for carbon partite material that is tough to maintain the velocity standard with capacity to endure different climate for vehicular safety and optimum performance.

The Driver Friction Materials Market is indeed an important market in the automotive sector that deals directly with the designing and manufacturing of products crucial to the operation of vehicles and ensuring the safety of drivers and passengers besides increasing the performance of the vehicle through effective and safe braking. These are commonly known as friction material and they include brake pads, discs, linings, and shoes all of which are very vital for efficiency in the braking system since it is a critical factor in controlling the vehicle and also safety. It has been pulled by the steady growth in automobile manufacturing, new systems development in brakes, and regulatory policies from governments all over the world towards enhanced safety aspect of automobiles. There is an increasing need to develop new friction materials that are suited for the new class of automobiles increasingly being produced namely the electric and hybrid vehicles which possess different characteristics than the traditional vehicles including the utilization of regenerative braking systems.

Also, it is observed that research and development applications are increasing due to the rising demand for sustainable and low-friction friction materials in the market. Managers are paying attention to the overall emissions of the company by bringing changes in the parts and pieces that are manufactured with minimum resistance, low wear and tear, and high endurance. The same change towards sustainable solutions is also driving the use of non-asbestos organic (NAO) and low metallic materials to resist the normal asbestos based products. Key drivers in the Asia-Pacific region – especially China and India – are seeing a rise in demand due to increased vehicle manufacturing, urbanization, and infrastructure developments. The same areas are also reflected as important regions in the future, especially North America and Europe due to ongoing technology integration and many auto makers.

Friction Materials Market Trend Analysis

Emerging Trends and Growth Drivers in the Friction Materials Market

- This article aims to explain why the Friction Materials Market is in a condition of robust growth in the present time and in the near future, considering the demands of the automotive and industrial fields. These materials are very important for brake pad and clutch assembly and other parts that need high friction coefficient for their efficient operation. For example, brake linings of automobiles and clutches of vehicles also come under friction material and the automotive industry cannot come out of them as they play the key role in braking of vehicles and smooth transmission of the same. Also, the growing automotive production and sales over the years, especially in the mature as well as emerging countries, are giving the boost to the growth of exotic friction material.

- Other factors such as technology enhancement and increasing varieties of friction materials are also influencing the market. For the past four years, there has been a trend of manufacturers investing on materials that can perform better, last long and are safer than their counterparts. There emerging developments like steel ceramic-based friction materials and the application of environmental-friendly materials. The increase need for weight reduction of vehicles to improve fuel managing is also other factor that is boosting the demand for frictional materials that are light in nature. That apart, other industries such as the industrial sector, the machinery and equipment manufacturing sector, are also among the major buyers and hence supports this market. The global demand for friction materials is indeed expected to remain strong, primarily because industries are innovating and growing, and modernization processes are bound to need more abrasives and more effective materials and products in the future years.

Eco-Friendly Advances and Market Expansion in Friction Materials

- The global Friction Materials Market is recording significant growth of untapped potential owing to its application in automotive, construction, and industrial segments. They note that with more vehicles being manufactured and issues to do with safety being given top priority producers needed improved brake systems and clutch materials. These systems require friction materials and these can bring immense longevity, productivity, and dependability. Improved environmental aspects and technological innovations -including light weight & high-performance composites –further improving market prospects. Furthermore, enhanced governments rules and regulation regarding the vehicular safety norms are constantly encouraging the use of better friction materials, which is also fostering the growth in the market.

- Industrialisation especially within the Asia-Pacific region is gradually intensifying hence greater machinery utilisations which in turn creates greater demand for these friction materials. Its growth in such industries in also increases the need of friction material in different equipments and tools in the regions. Furthermore, the growth of electric vehicles (EVs) presents opportunities for new market segments since the brakes of EVs rely on different friction materials than traditional vehicles. This is due to the fact that firms that are fully invested in product research, innovation and provision of sustainable, high performance friction products are well-positioned to effectively seize on these growing trends hence guaranteeing good market growth in the years to come.

Friction Materials Market Segment Analysis:

Friction Materials Market Segmented on the basis of type, application, and end-users.

By Type, Dry Friction Materials segment is expected to dominate the market during the forecast period

- The Friction Materials Market is categorized into several types of products as listed below due to the uniqueness of their applications or use in various sectors. Dry friction materials are commonly used on automobile and industrial parts since they offer high performance particularly in dry operating conditions. Wet friction materials however are used in application areas that work under lubricated conditions and include; automatic transmissions and clutches. Semi-metallic friction materials are compounded with metals and organic filler, capable of long life and cost advantage for use for various automotive applications. Non-asbestos organic (NAO) friction materials is environmentally preferable substitute whose use does not pose health risks associated with asbestos but still offers high performance. The final type of ceramic friction materials are able to withstand high heat and pressures due to their long-wearing characteristics, making them ideal for high-performance and highly-stressed duties. This fact proves that friction material types are incredibly diverse, and the necessity to make it all accessible to the market makes the latter grow and develop.

By Application, Brake Pads segment held the largest share in 2024

- The Friction Materials Market is segmentation of application that serves different sectors of industries having particular functions. Brake pads occupy a fairly large market share at the moment, and this is justified by the consistent need for advanced braking structures across cars and industrial vehicles. Other significant use involves high-performance friction materials use in the manufacturing of clutches which are vital in transmission of power in manual as well as automatic cars. It also ensures the systems use ad., where friction material is crucial in the reliability of gears and transitions between them. Similarly, friction material can be used in other areas like using industrial machinery and aerospace parts in boosting their overall operation and safety as they work under pressure. Therefore, the applicability of friction materials in practically all branches of industry emphasizes their function as effective means to improve the efficiency, safety as well as prolong the service life of mechanical systems.

Friction Materials Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific is a major consumer of friction materials mainly because of rapid progress in the automotive industry and general industrialization. Some of the leading players around the world in this market are – China, India, Japan, South Korea, and Indonesia. Haven of Manufacturing Industries: China for instance has outcompeted many countries within this region due to its huge manufacturing base and auto industry. These factors boosted the industrial sector in the country; especially the automobile and construction industries to increase the demands for friction materials. Also, the concentration in infrastructural growth in regions such as the Asian continent particularly in giant industries like India and Indonesia serves to strengthen demand for friction materials.

- Notably, there is a growing trend on the adoption of electric vehicles (EVs) in the Asia Pacific region, which is reflecting to the friction materials market. Depending on the type of friction material used in brake system, many vehicle manufacturers are now focused on incorporating advanced EVs within their fleets due to the following reasons: This trend is influencing the competition level in the market since manufacturers continue introducing new materials that give improved performance and lasting capacity. On balance, it can be concluded that the Asia Pacific friction materials market will continue to experience growth in the years to come due to the ongoing advancement of the economy in the region that is supported by a focus placed on the use of ecologically friendly transportation.

Active Key Players in the Friction Materials Market

- Akebono Brake Industry Co., Ltd. (Japan)

- Aisin Corporation (Japan)

- Robert Bosch GmbH (Germany)

- ACDelco (USA)

- ASIMCO Technologies (China)

- EBC Brakes (UK)

- ZF Friedrichshafen AG (Germany)

- Brake Parts Inc LLC (USA)

- Brembo S.p.A. (Italy)

- Nisshinbo Brake Inc (Japan), Other Active Players

|

Global Friction Materials Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 6.1 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.5% |

Market Size in 2035: |

USD 9.9 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Friction Materials Market by Type (2018-2035)

4.1 Friction Materials Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Dry Friction Materials

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Wet Friction Materials

4.5 Semi-Metallic Friction Materials

4.6 Non-Asbestos Organic Friction Materials

4.7 Ceramic Friction Materials

Chapter 5: Friction Materials Market by Application (2018-2035)

5.1 Friction Materials Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Brake Pads

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Clutches

5.5 Transmission Systems

5.6 Others

5.7 End User

5.8 Automotive

5.9 Aerospace

5.10 Marine

5.11 Railway

5.12 Construction

5.13 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Friction Materials Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 AKEBONO BRAKE INDUSTRY COLTD. (JAPAN)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 AISIN CORPORATION (JAPAN)

6.4 ROBERT BOSCH GMBH (GERMANY)

6.5 ACDELCO (USA)

6.6 ASIMCO TECHNOLOGIES (CHINA)

6.7 EBC BRAKES (UK)

6.8 ZF FRIEDRICHSHAFEN AG (GERMANY)

6.9 BRAKE PARTS INC LLC (USA)

6.10 BREMBO S.P.A. (ITALY)

6.11 NISSHINBO BRAKE INC (JAPAN)

Chapter 7: Global Friction Materials Market By Region

7.1 Overview

7.2. North America Friction Materials Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Dry Friction Materials

7.2.4.2 Wet Friction Materials

7.2.4.3 Semi-Metallic Friction Materials

7.2.4.4 Non-Asbestos Organic Friction Materials

7.2.4.5 Ceramic Friction Materials

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Brake Pads

7.2.5.2 Clutches

7.2.5.3 Transmission Systems

7.2.5.4 Others

7.2.5.5 End User

7.2.5.6 Automotive

7.2.5.7 Aerospace

7.2.5.8 Marine

7.2.5.9 Railway

7.2.5.10 Construction

7.2.5.11 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Friction Materials Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Dry Friction Materials

7.3.4.2 Wet Friction Materials

7.3.4.3 Semi-Metallic Friction Materials

7.3.4.4 Non-Asbestos Organic Friction Materials

7.3.4.5 Ceramic Friction Materials

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Brake Pads

7.3.5.2 Clutches

7.3.5.3 Transmission Systems

7.3.5.4 Others

7.3.5.5 End User

7.3.5.6 Automotive

7.3.5.7 Aerospace

7.3.5.8 Marine

7.3.5.9 Railway

7.3.5.10 Construction

7.3.5.11 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Friction Materials Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Dry Friction Materials

7.4.4.2 Wet Friction Materials

7.4.4.3 Semi-Metallic Friction Materials

7.4.4.4 Non-Asbestos Organic Friction Materials

7.4.4.5 Ceramic Friction Materials

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Brake Pads

7.4.5.2 Clutches

7.4.5.3 Transmission Systems

7.4.5.4 Others

7.4.5.5 End User

7.4.5.6 Automotive

7.4.5.7 Aerospace

7.4.5.8 Marine

7.4.5.9 Railway

7.4.5.10 Construction

7.4.5.11 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Friction Materials Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Dry Friction Materials

7.5.4.2 Wet Friction Materials

7.5.4.3 Semi-Metallic Friction Materials

7.5.4.4 Non-Asbestos Organic Friction Materials

7.5.4.5 Ceramic Friction Materials

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Brake Pads

7.5.5.2 Clutches

7.5.5.3 Transmission Systems

7.5.5.4 Others

7.5.5.5 End User

7.5.5.6 Automotive

7.5.5.7 Aerospace

7.5.5.8 Marine

7.5.5.9 Railway

7.5.5.10 Construction

7.5.5.11 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Friction Materials Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Dry Friction Materials

7.6.4.2 Wet Friction Materials

7.6.4.3 Semi-Metallic Friction Materials

7.6.4.4 Non-Asbestos Organic Friction Materials

7.6.4.5 Ceramic Friction Materials

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Brake Pads

7.6.5.2 Clutches

7.6.5.3 Transmission Systems

7.6.5.4 Others

7.6.5.5 End User

7.6.5.6 Automotive

7.6.5.7 Aerospace

7.6.5.8 Marine

7.6.5.9 Railway

7.6.5.10 Construction

7.6.5.11 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Friction Materials Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Dry Friction Materials

7.7.4.2 Wet Friction Materials

7.7.4.3 Semi-Metallic Friction Materials

7.7.4.4 Non-Asbestos Organic Friction Materials

7.7.4.5 Ceramic Friction Materials

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Brake Pads

7.7.5.2 Clutches

7.7.5.3 Transmission Systems

7.7.5.4 Others

7.7.5.5 End User

7.7.5.6 Automotive

7.7.5.7 Aerospace

7.7.5.8 Marine

7.7.5.9 Railway

7.7.5.10 Construction

7.7.5.11 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Friction Materials Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 6.1 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.5% |

Market Size in 2035: |

USD 9.9 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||