Fixed Vehicle Loader Market Synopsis

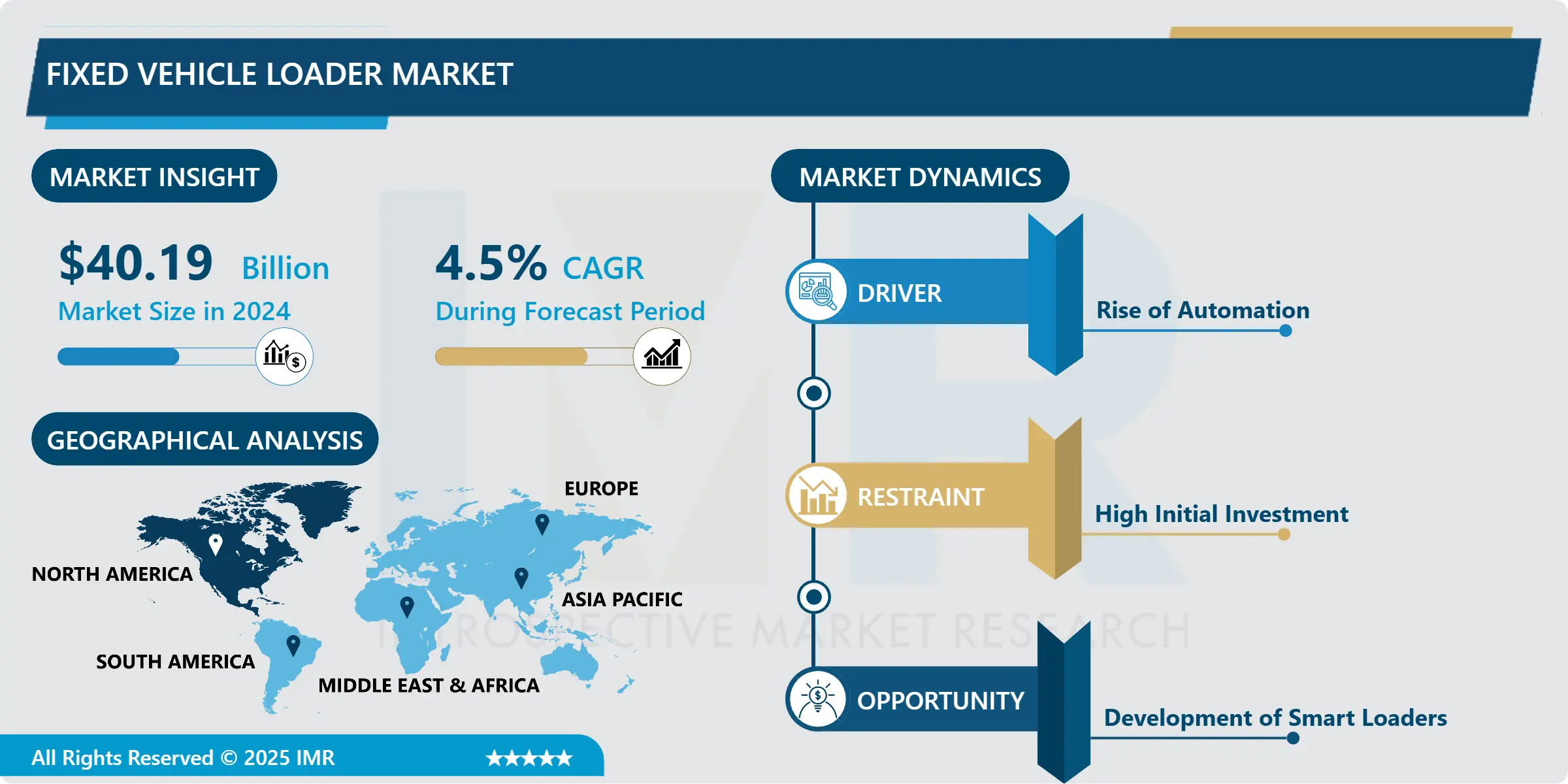

Fixed Vehicle Loader Market Size Was Valued at USD 40.19 Billion in 2024, and is Projected to Reach USD 57.15 Billion by 2032, Growing at a CAGR of 4.5% From 2025-2032.

A Fixed Vehicle Loader is a category of MHE equipment with the primary function of loading and unloading of products or goods from vehicles like trucks and trailers which are endemic at a particular location. This equipment finds its use in warehouses, distribution centers and shipping facilities where safety during loading and offloading is a major factor.

The main roles therefore of a fixed vehicle loader is to ensure there is a connection between the dock and the vehicle to enable efficient transfer of goods with the least human intervention. And because of this, it’s fixed design provides stability and this makes it a standard element where large volumes of freights are transited.

Speaking about the construction of a fixed vehicle loader, one has to note that the base of such a machine is a rather heavy-duty platform with mechanical or hydraulic means of lifting. They are adjustable to the particular dock levels and vehicles, which allows for loading and unloading of different types of vehicles.

Moreover, they have safety aspects including guard rails, anti-skid surfaces, and loading ramps in order to increase efficiency and safety for use. In some of the later models, more automatic control systems can be incorporated to load the trailers, making it even faster and easier to load while at the same time, there is less possibility of the goods and the trailer unit getting damaged.

As will be seen, there are very many benefits that are associated with the fixing of a vehicle loader. They increase the rate of loading operations and thus yield better results in the flow of logistics and warehousing. Through the integration and application of these loaders, there is likely to be a decrease in the physical strain and thus work-related injuries are prevented or minimized. Moreover, high durability along with less requirement for maintenance make them more economical when the long run is taken into consideration. What the fixed vehicle loader demonstrates as a systems enabler in environments where space and time are instruments is the efficient organisation and management of material handling.

Fixed Vehicle Loader Market Trend Analysis

Fixed Vehicle Loader Market Growth Drivers- Rise of Automation

- The advancement made in the technological sector like automation has a major impact on the RFixed Vehicle Loader market due to increasing importance towards efficient & accurate handling of parts in logistics. Current trend displayed by conveyor systems manufacturers is making automatic vehicle loaders due to the numerous benefits offered by this technology as compared to manual or semi automatic models.

- These advanced systems can effectively manage loading and unloading procedures, solve the problem of staff shortages, as well as lower the general probability of errors occurring during their work, making operations more effective in general. Businesses want to expedite their operations and increase the efficiency in which they complete tasks to satisfy the fast growth industries including e-commerce, manufacturing and automotive industries.

- The pTFLP analysis shows that technological factors are more important in the decision to adopt RFixed Vehicle Loaders. Robotics, sensors, and artificial intelligence advances have boosted complex and multifaceted abilities of a system that can perform several assignments in a very effective manner. These automatic loader can operate on a shift basis, which is beneficial in unintermitting running and the flow rate. Moreover, they can be interfaced with WMS and any other automation tools, which makes it perfect for the complication supply chain. The use of IoT and data analytics takes it to the next level of performance by not only monitoring equipment but by also helping to avoid breakdowns and carry out timely maintenance.

- However, improvements in safety and ergonomic concerns have taken precedence and this has acted as the main stimulus towards automation in the formation of the vehicle loader market. In their operations, these activities require a lot of effort and energy and expose the workers to several dangers, hence the risks of getting injured, and the consequent costs.

- These risks are eliminated by automated loaders and thus maintain human workers away from hazardous parts of loading and unloading whereby they spend most of their time handling other intricate work as part of the process. Thus, it not only increases the safety of the workers, but also helps to raise morale and subsequently, production rates. Thus, with the increased safety and efficiency, companies are encouraged to integrate automated vehicle loaders to minimize work-related accidents.

Fixed Vehicle Loader Market Opportunities- Development of Smart Loaders

- Smart loaders are a new addition to the fixed vehicle loader market, which offer an opportunity for improvement through their technology and capabilities that increase the efficiency, safety control, and performance of these vehicles. Smart loaders are primarily automated versions of loaders that incorporate IoT and AI for use in minimising on-loading schematics, labour interference, and mistakes. This integration facilitates efficient control of the loading activities, resources and the overall duration required in the order. For example, sensors and real time data analysis are capable of identifying weight of the load, the balance or imbalance of load and even the problem related to loading technique and device which will add value to the productivity of loading systems.

- In addition, its further advantage is the safety enhancement and the reduction of business risks regarding the loaders. A traditional method of loading requires a lot of handling, raising and moving of boxes or other loads which often results to several injuries in the workplace. While these risks can be potentially hazardous to employees performing the tasks in the vessels or structures, smart loaders help in reducing these threats as a way of creating a safer workplace.

- Other additional technologies include collision detection where the robot halts on collision course, automated stoppage, and Remote monitoring among others in order to minimize on the dangers posed by the robots. Apart from timesaving, this closure in accidents and the down time they bring helps assure safety for employees as well as help ensure uninterrupted operations, which is of paramount importance to industries requiring timely delivery of products and services.

- The adoption of smart technologies in fixed vehicle loaders provides new opportunities for predictive analysis of the equipment’s wear and tear, therefore optimizing and prolonging the duration of the equipment without causing extremely high costs to the users. Predictive maintenancesys-tems are used to forecast the possibilities of equipment failure, using data obtained from the different sensors.

- This means that most of the maintenance and repairs are done before the equipment breaks down completely minimizing on any loss of time an a great way of ensuring that the lifespan of the equipment is fully utilized. Further, smart loaders are capable of doing the right load management and may consume less power when in operation, hence the cost of operation is reduced. There is little doubt that smart loaders are a leader in what today’s industries need and require, and as global business owners maintain sustainability and efficiency as their primary objectives, it is beneficial to invest in such solutions that will help them remain relevant in the future market.

Fixed Vehicle Loader Market Segment Analysis:

Fixed Vehicle Loader Market is segmented based on Loader Type, Type, and End-User.

By Loader Type, Wheeled Loade is expected to dominate the market during the forecast period

- Fixed Vehicle Loader market share by tonnage is mostly captured by Wheeled Loader segment. Front End/ Bucket/ Wheeled Loaders are versatile machines widely employed in numerous sectors like construction, mining, and handling and transportation industry. Owing to these characteristics they are well suited for fixed vehicle loading; this is because they can easily maneuver from one place to the other and they are able to move heavy loads over short distances. It is also globally available being flexible on the type of attachments including buckets, forks and grapples in addition to flexibility related to functionality making them useful in material handling as well as earthmoving.

- It is important to note that efficiency and productivity serve as probably the main causes of Wheeled Loaders’ market domination in the category of Fixed Vehicle Loader. Wheeled loaders can move with high speeds and this is useful in cases that require fast operations such as in ports, and ware houses where discharging and loading needs to be fast in order to enable the continuity of operation. These machines have powerful engines and strong hydraulic systems that facilitate high capacity and in turn, few cycles are needed in fully loading a vehicle. This functionality propels cost cutting in the usage, and an increase in the performance hence making wheeled loaders economical for business entities.

- In addition, wheeled loader manufacturers have been able to harness the opportunities offered by technology to design better loaders and this has placed these loaders in a vantage point in the market. While the basic structure of the modem wheeled loaders is a truck-like, laden with numerous technological amenities including sophisticated telematics, automated controls, and well-advanced safety features that enhance their performance and usability. These changes have made wheeled loaders more dependable, easier to service which has added to potentials for it as an appealing equipment choice for operators as well as managers of fleets. The enhancements in emission standards and fuel efficiency classified with wheeled loaders have also synchronized them to global environmental standards thus making wheeled loaders a more environmentally friendly option for various industries. Therefore fixed vehicle loading has become a pivot of wheeled loaders by the awareness of flexibility, performance and technological advancement.

By Type, Heavy segment held the largest share in 2024

- The Fixed Vehicle Loader market is more dominated by Heavy segment and growing significantly in the market. A fixed vehicle load is a unit that is necessary in those production fields which demand much shipment and transport like mines, construction fields, and manufacturing industries. These loaders are intended to move greater quantities of mass, enough to make the necessary oomph and brawn for handling the turnaround of materials. While compact loaders are relatively lightweight and small in size with small engines that give them a amount of capabilities, the larger ones’ structure and powerful engines make them suitable for carrying out tasks that cannot be done using compact loaders.

- The capability to handle extensive loading tasks is among the essential properties where the machines of the Heavy segment show the highest efficiency, that is why most Fixed Vehicle Loaders belong to this segment. It has better lifting capability, comes with higher buckets which enable the heavy loaders to load or unload vehicles to complete set within few cycles.

- This efficiency is especially important when dealing with large quantities of equipment and movement of people in environments such as ports, construction companies with many projects, and bulk material handling facilities. The operational capacity of the heavy loaders thus enable businesses to move large volume of material or stock withinrelatively short period of time thus reducing operation costs and enhancing productivity – the reason why heavy loaders remain dominant in the market.

- Furthermore, it is necessary to dwell on the technological and engineering progress In the course of the study, fixed vehicle loaders became more reliable and versatile due to the advanced technology. The new heavy loaders come with technological innovations like GPS, telematics technology, advanced control mechanisms, and improved safety features.

- These technological improvements do not only affect positively the availability and reliability of the loaders as to operations and safety but also enhances the longevity of the equipment and lowers on maintenance expenses. Besides, owing to the rising focus on sustainable working practices, new and advanced heavy loaders have been designed to consume lower fuel and give out lesser emissions in line with environmental compliance. These factors consciosuly make has the preferred solution for mature industries seeking robust, reliable and efficient material handling equipment.

Fixed Vehicle Loader Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- The Fixed Vehicle Loader Market in North America is growing because of the fixity of the following factors. Firstly, managing events, distribution, and transportation within the region is easy due to well-connected railways, roads, efficient warehouse space, and ports. This framework is used for mobile transfer of commodities which in turn fosters the usage of fixed vehicle loaders. Large-scale manufacturers and distributors of construction vehicles are also found in these areas, making it easy to access the huge supply chain network of these loaders. Also, the region has demonstrated a strong capacity to invest in automation and Material Handling Technologies to improve operations achievement and performance, therefore FVLs as key equipment for logistics and Distribution centres.

- North American has a large industrial structure with many automotive, e-commerce and retail industries, and therefore encourages the use of efficient load and unload devices. The automotive industry for instance, uses fixed vehicle loaders to transport and manage the parts and the finished automobiles efficiently as a means of improving its operations. Likewise, the growing entity of e-commerce demands swift and effective logistics since parcels and packages are copious. This, in turn, has a positive impact on the increased. speed and accuracy that is required in these industries to help them incorporate fixed vehicle loaders throughout the region.

- Also, the regulatory framework and the labour market conditions in the North American region are also involved in affecting the market of fixed vehicle loaders. Safety and labor standards require the industry to employ automatic and semi-automatic ways of loading to reduce the number of manual operations and possible worker casualties. Moreover, the lack of skilled labor in the region has raised the concerns of logistics firms which has to automate some processes to regulate the labor expenses moreover to keep efficiency intact. And due to the presence of such factors, high emphasis on innovation and technology front and overall favorable conditions governing the Fixed Vehicle Loader Market, the onus lies in North America.

Active Key Players in the Fixed Vehicle Loader Market

- BEUMER Group GmbH & Co. KG (Germany)

- Cargotec Corporation (Finland)

- Conveyco Technologies (USA)

- Crown Equipment Corporation (USA)

- Daifuku Co., Ltd. (Japan)

- Dematic Corporation (USA)

- Fives Group (France)

- Flexicon Corporation (USA)

- Hyster-Yale Materials Handling, Inc. (USA)

- Interroll Group (Switzerland)

- JBT Corporation (USA)

- Jungheinrich AG (Germany)

- KION Group AG (Germany)

- KUKA AG (Germany)

- Lödige Industries GmbH (Germany)

- Murata Machinery, Ltd. (Japan)

- Siemens AG (Germany)

- SSI SCHÄFER AG (Germany)

- Swisslog Holding AG (Switzerland)

- Toyota Material Handling Group (Japan)

- Other Key Players

Key Industry Developments in the Fixed Vehicle Loader Market:

- In September 2023, Triton International announced that its shareholders have approved the proposed acquisition by Brookfield Infrastructure. This previously promised transaction offers substantial value to Triton's shareholders, with a cash payment of $68.50 per share and no stock exchange. This equates to 3185 BIPC Class A exchangeable shares for each Triton common share. With the support of Brookfield Infrastructure, Triton aims to leverage this strategic move to strengthen its position in the industry.

|

Global Fixed Vehicle Loader Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 40.19 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.5% |

Market Size in 2032: |

USD 57.15 Bn. |

|

Segments Covered: |

By Loader Type |

|

|

|

By Type |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fixed Vehicle Loader Market by Loader Type (2018-2032)

4.1 Fixed Vehicle Loader Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Compact Track Loader

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Skid Steer Loader

4.5 Wheeled Loader

4.6 Backhoe Loader

Chapter 5: Fixed Vehicle Loader Market by Type (2018-2032)

5.1 Fixed Vehicle Loader Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Heavy

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Compact

Chapter 6: Fixed Vehicle Loader Market by End-User (2018-2032)

6.1 Fixed Vehicle Loader Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Construction

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Mining

6.5 Manufacturing

6.6 Other

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Fixed Vehicle Loader Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BEUMER GROUP GMBH & CO. KG (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CARGOTEC CORPORATION (FINLAND)

7.4 CONVEYCO TECHNOLOGIES (USA)

7.5 CROWN EQUIPMENT CORPORATION (USA)

7.6 DAIFUKU COLTD. (JAPAN)

7.7 DEMATIC CORPORATION (USA)

7.8 FIVES GROUP (FRANCE)

7.9 FLEXICON CORPORATION (USA)

7.10 HYSTER-YALE MATERIALS HANDLING INC. (USA)

7.11 INTERROLL GROUP (SWITZERLAND)

7.12 JBT CORPORATION (USA)

7.13 JUNGHEINRICH AG (GERMANY)

7.14 KION GROUP AG (GERMANY)

7.15 KUKA AG (GERMANY)

7.16 LÖDIGE INDUSTRIES GMBH (GERMANY)

7.17 MURATA MACHINERY LTD. (JAPAN)

7.18 SIEMENS AG (GERMANY)

7.19 SSI SCHÄFER AG (GERMANY)

7.20 SWISSLOG HOLDING AG (SWITZERLAND)

7.21 TOYOTA MATERIAL HANDLING GROUP (JAPAN)

7.22 OTHER KEY PLAYERS

Chapter 8: Global Fixed Vehicle Loader Market By Region

8.1 Overview

8.2. North America Fixed Vehicle Loader Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Loader Type

8.2.4.1 Compact Track Loader

8.2.4.2 Skid Steer Loader

8.2.4.3 Wheeled Loader

8.2.4.4 Backhoe Loader

8.2.5 Historic and Forecasted Market Size by Type

8.2.5.1 Heavy

8.2.5.2 Compact

8.2.6 Historic and Forecasted Market Size by End-User

8.2.6.1 Construction

8.2.6.2 Mining

8.2.6.3 Manufacturing

8.2.6.4 Other

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Fixed Vehicle Loader Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Loader Type

8.3.4.1 Compact Track Loader

8.3.4.2 Skid Steer Loader

8.3.4.3 Wheeled Loader

8.3.4.4 Backhoe Loader

8.3.5 Historic and Forecasted Market Size by Type

8.3.5.1 Heavy

8.3.5.2 Compact

8.3.6 Historic and Forecasted Market Size by End-User

8.3.6.1 Construction

8.3.6.2 Mining

8.3.6.3 Manufacturing

8.3.6.4 Other

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Fixed Vehicle Loader Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Loader Type

8.4.4.1 Compact Track Loader

8.4.4.2 Skid Steer Loader

8.4.4.3 Wheeled Loader

8.4.4.4 Backhoe Loader

8.4.5 Historic and Forecasted Market Size by Type

8.4.5.1 Heavy

8.4.5.2 Compact

8.4.6 Historic and Forecasted Market Size by End-User

8.4.6.1 Construction

8.4.6.2 Mining

8.4.6.3 Manufacturing

8.4.6.4 Other

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Fixed Vehicle Loader Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Loader Type

8.5.4.1 Compact Track Loader

8.5.4.2 Skid Steer Loader

8.5.4.3 Wheeled Loader

8.5.4.4 Backhoe Loader

8.5.5 Historic and Forecasted Market Size by Type

8.5.5.1 Heavy

8.5.5.2 Compact

8.5.6 Historic and Forecasted Market Size by End-User

8.5.6.1 Construction

8.5.6.2 Mining

8.5.6.3 Manufacturing

8.5.6.4 Other

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Fixed Vehicle Loader Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Loader Type

8.6.4.1 Compact Track Loader

8.6.4.2 Skid Steer Loader

8.6.4.3 Wheeled Loader

8.6.4.4 Backhoe Loader

8.6.5 Historic and Forecasted Market Size by Type

8.6.5.1 Heavy

8.6.5.2 Compact

8.6.6 Historic and Forecasted Market Size by End-User

8.6.6.1 Construction

8.6.6.2 Mining

8.6.6.3 Manufacturing

8.6.6.4 Other

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Fixed Vehicle Loader Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Loader Type

8.7.4.1 Compact Track Loader

8.7.4.2 Skid Steer Loader

8.7.4.3 Wheeled Loader

8.7.4.4 Backhoe Loader

8.7.5 Historic and Forecasted Market Size by Type

8.7.5.1 Heavy

8.7.5.2 Compact

8.7.6 Historic and Forecasted Market Size by End-User

8.7.6.1 Construction

8.7.6.2 Mining

8.7.6.3 Manufacturing

8.7.6.4 Other

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Fixed Vehicle Loader Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 40.19 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.5% |

Market Size in 2032: |

USD 57.15 Bn. |

|

Segments Covered: |

By Loader Type |

|

|

|

By Type |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||