Feeder Automation Market Synopsis

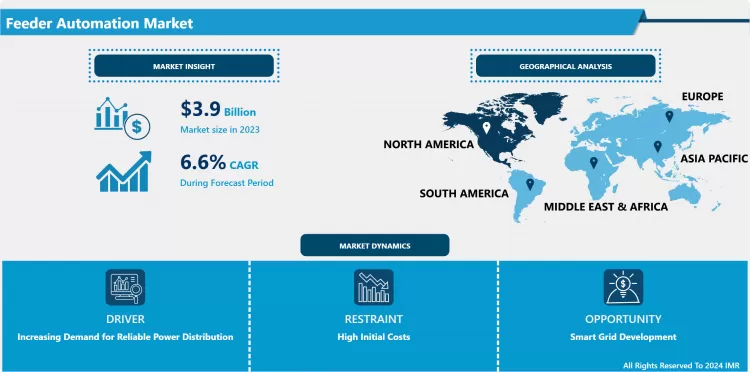

Feeder Automation Market Size Was Valued at USD 3.9 Billion in 2023, and is Projected to Reach USD 7.0 Billion by 2032, Growing at a CAGR of 6.6% From 2024-2032.

Feeder automation therefore means the incorporation of more sophisticated technologies &systems for ensuring improved availability, performance and supervision of electrical distribution networks. Such systems facilitate real time control, automatic fault diagnosis and power restoral by determining the appropriate feeder to deliver electrical power. Feeder automation systems are necessary components in upgrading old power infrastructure and balancing supply and demand, especially in the rapidly developing urban and industrial areas. Categorized below are some of the functions of these systems: By reducing time and costs of downtimes, these systems are important for integrity and performance of the electrical grid.

- It has therefore been noted that the feeder automation market has been growing steadily at the global level because of the constantly rising need for reliable power distribution networks. As the usage of electric power increases in households, businesses, and factories, the load on current electrical networks has increased as well. Feeder automation solutions provide an approach to tackling these issues since the utilities are able to detect, isolate faults and reroute power supply; as well as restore power with minimal physical intervention. The market has been expanding due to the rising application of smart grid technologies that involve improvements in communication in the grid’s power distribution system. Ecosystems across the globe are spending a lot of money for grid upgrade initiatives, which is also increasing the requirement for feeder automation services. Further, the emphasis on the integration of the renewable energy resource into the grid has necessitated development of improved automation systems for handling the fluctuations inherent with these sources. Therefore, feeder automation is gradually emerging as a necessary addition in the world energy system as utilities and electricity suppliers aim to improve their grid systems with the utilization of IT solutions in order to meet future electricity requirements.

- Furthermore, feeder automation is another area where railroad companies are engaging third companies because of cutting of operating cost as well as increasing system efficiency. The use of automated systems proves useful in minimizing on power outages by reducing on manual interferences, this means that the chances of human interferes are greatly eliminated, and the response time is much faster during power blackouts. It also improves the satisfaction of the customer by ensuring that there is little time wasted and at the same time it also offers resources and cost of labor for the utilities and other expenses than can be incurred for the maintenance. It is also getting the positive impact of these technologies like Internet of Things (IoT) and artificial intelligence (AI) that are getting implemented in feeder automation systems to offer real time data analyzing and prognosis of situations needing maintenance. Such innovations should propel the market even further as utilities look for ways to enhance their generation and distribution of power to consumers.

Feeder Automation Market Trend Analysis

Integration of AI and IoT in Feeder Automation

- One of the recent trends being adopted by feeder automation systems is the incorporation of artificial intelligence (AI) and the Internet of Things (IoT) into feeder automation systems which is changing the ways distribution networks are controlled. AI makes predictive analysis possible in determination of possible faults and other maintenance issues that may arise within utilities before they turn out to be serious problems. While microgrids allow distributed decision making, IoT helps in real-time data acquisition and communication with other sub-sections of the grid for improved power distribution robustness. These features are improving feeder automation systems as utilities can control their networks and assess the Feeders’ performance at any time to decide on what adjustments to make. The integration of AI and IoT is expected to be on an upward rise as utilities aim at optimizing operating expenses and build system reliability and efficiency as well as deliver superior customer service.

Expanding Renewable Energy Integration

- Among the chances according to the feeder automation market one of the most promising trends is the increasing application of renewable energy sources into power system. Thus, as nations globally are motivated towards lowering their carbon footprint and increasing reliance on renewable energy, the need for automation systems that can address the challenges of managing RE integration is now emerging. Systems for feeder automation are needed to cope with fluctuating supply from distributed sources like solar or wind energy. These systems help utilities to manage demands and supply more efficiently with emphasis on consistent power supply during the implementation of an enhanced percentage of renewable energy sources. This opportunity is especially apparent in areas with high green energy penetration targets where feeder automation systems can contribute significantly to enhancing a distributed generation mix by offering essential supporting systems.

Feeder Automation Market Segment Analysis:

Feeder Automation Market Segmented on the basis of Product and application.

By Product, Software segment is expected to dominate the market during the forecast period

- The feeder automation market likely to expand its penetration at the software segment within the forecast span owing to the rising necessity for the modern and efficient management of electricity supply systems characterized by increasing complexity of the power distribution networks. Since utilities and power companies dedicate resources on upgrading the grids and wanting to enhance the dependability and performance of the distribution network, programmatic applications are already becoming impossible to avoid. These solutions support functionalities like predictive maintenance, auto fault detection, energy management, and others which are mainly useful in reducing outages and overall expenditure. In addition, the use of artificial intelligence (AI) and machine learning algorithms in these various software platforms is stretching the effectiveness in analysing various data sets and make more informed decisions. Widespread usage of Cloud solutions and IoT devices also enhance the significance of feeder automation software making this segment dominate as utilites seek better, more efficient, grid assets.

By Application, Commercial segment expected to held the largest share

- it is evident that in the feeder automation market, the commercial segment is expected to dominate the feeder automation market during the given period owing to growing demand for the uninterrupted as well as reliable power supply in the commercial premises. Feeder automation solutions are required due to the constant load and dependency on uninterrupted electricity that commercial building like offices, shopping mall, data center, hospitals etc. require. These systems help one confirm whether there is a problem with power supply and in case there is the problem is solved as early as possible to prevent disruption of the business.

- The escalating use of smart building solutions that incorporate feeder automation into the core commercial system to improve energy consumption and building functionality contribute to the commercial segment’s strengthened market control. Also there is a trend towards sustainability and usage of energy efficient technologies in commercial buildings; this calls for development of intelligent feeder automation systems to improve distribution of power, to minimize wastage and cut expenses. Consequently, the domination of the commercial sector in the market is expected, indicating the importance of feeder automation for the development of the necessary base of the modern commercial companies.

Feeder Automation Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is anticipated to lead the feeder automation market in the coming years to 2023 due to the increasing interests of the region in upgrading the existing grid along with high acceptance of new age feeder automation systems. The use of feeder automation systems has been the most common in the United States since most utilities across the power distribution network have adopted the automation systems. It is expected that the feeder automation market hold nearly 35% from North America due to the region’s push to modernize their ageing infrastructure system and incorporate RE into its network. The presence of market leader technology providers and the accessibility of excellent research facilities play a significant role in North America’s firm hold on this market.

Active Key Players in the Feeder Automation Market

- ABB Ltd. (Switzerland)

- Cisco Systems, Inc. (USA)

- Eaton Corporation (Ireland)

- G&W Electric Company (USA)

- General Electric (USA)

- Honeywell International Inc. (USA)

- Landis+Gyr (Switzerland)

- Mitsubishi Electric Corporation (Japan)

- Power System Engineering, Inc. (USA)

- S&C Electric Company (USA)

- Schneider Electric SE (France)

- Schweitzer Engineering Laboratories, Inc. (USA)

- Siemens AG (Germany)

- Trilliant Holdings, Inc. (USA)

- Xylem Inc. (USA)

- Other key Players

|

Global Feeder Automation Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.9 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.6% |

Market Size in 2032: |

USD 7.0 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Feeder Automation Market by Product (2018-2032)

4.1 Feeder Automation Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Software

4.5 Services

4.6 Others

Chapter 5: Feeder Automation Market by Application (2018-2032)

5.1 Feeder Automation Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Commercial

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Industrial

5.5 Residential

5.6 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Feeder Automation Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABB LTD. (SWITZERLAND)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 CISCO SYSTEMS INC. (USA)

6.4 EATON CORPORATION (IRELAND)

6.5 G&W ELECTRIC COMPANY (USA)

6.6 GENERAL ELECTRIC (USA)

6.7 HONEYWELL INTERNATIONAL INC. (USA)

6.8 LANDIS+GYR (SWITZERLAND)

6.9 MITSUBISHI ELECTRIC CORPORATION (JAPAN)

6.10 POWER SYSTEM ENGINEERING INC. (USA)

6.11 S&C ELECTRIC COMPANY (USA)

6.12 SCHNEIDER ELECTRIC SE (FRANCE)

6.13 SCHWEITZER ENGINEERING LABORATORIES INC. (USA)

6.14 SIEMENS AG (GERMANY)

6.15 TRILLIANT HOLDINGS INC. (USA)

6.16 XYLEM INC. (USA)

6.17 OTHER KEY PLAYERS

6.18

Chapter 7: Global Feeder Automation Market By Region

7.1 Overview

7.2. North America Feeder Automation Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product

7.2.4.1 Hardware

7.2.4.2 Software

7.2.4.3 Services

7.2.4.4 Others

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Commercial

7.2.5.2 Industrial

7.2.5.3 Residential

7.2.5.4 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Feeder Automation Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product

7.3.4.1 Hardware

7.3.4.2 Software

7.3.4.3 Services

7.3.4.4 Others

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Commercial

7.3.5.2 Industrial

7.3.5.3 Residential

7.3.5.4 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Feeder Automation Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product

7.4.4.1 Hardware

7.4.4.2 Software

7.4.4.3 Services

7.4.4.4 Others

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Commercial

7.4.5.2 Industrial

7.4.5.3 Residential

7.4.5.4 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Feeder Automation Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product

7.5.4.1 Hardware

7.5.4.2 Software

7.5.4.3 Services

7.5.4.4 Others

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Commercial

7.5.5.2 Industrial

7.5.5.3 Residential

7.5.5.4 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Feeder Automation Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product

7.6.4.1 Hardware

7.6.4.2 Software

7.6.4.3 Services

7.6.4.4 Others

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Commercial

7.6.5.2 Industrial

7.6.5.3 Residential

7.6.5.4 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Feeder Automation Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product

7.7.4.1 Hardware

7.7.4.2 Software

7.7.4.3 Services

7.7.4.4 Others

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Commercial

7.7.5.2 Industrial

7.7.5.3 Residential

7.7.5.4 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Feeder Automation Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.9 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.6% |

Market Size in 2032: |

USD 7.0 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Feeder Automation Market research report is 2024-2032.

ABB Ltd. (Switzerland), Cisco Systems, Inc. (USA), Eaton Corporation (Ireland), G&W Electric Company (USA), General Electric (USA) and Other Major Players.

The Feeder Automation Market is segmented into Product, Application, End User and region. By Product, the market is categorized into Hardware, Software, Services, Others. By Application, the market is categorized into Commercial, Industrial, Residential, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Feeder automation therefore means the incorporation of more sophisticated technologies &systems for ensuring improved availability, performance and supervision of electrical distribution networks. Such systems facilitate real time control, automatic fault diagnosis and power restoral by determining the appropriate feeder to deliver electrical power. Feeder automation systems are necessary components in upgrading old power infrastructure and balancing supply and demand, especially in the rapidly developing urban and industrial areas. Categorized below are some of the functions of these systems: By reducing time and costs of downtimes, these systems are important for integrity and performance of the electrical grid.

Feeder Automation Market Size Was Valued at USD 3.9 Billion in 2023, and is Projected to Reach USD 7.0 Billion by 2032, Growing at a CAGR of 6.6% From 2024-2032.