Feed Binders Market Synopsis

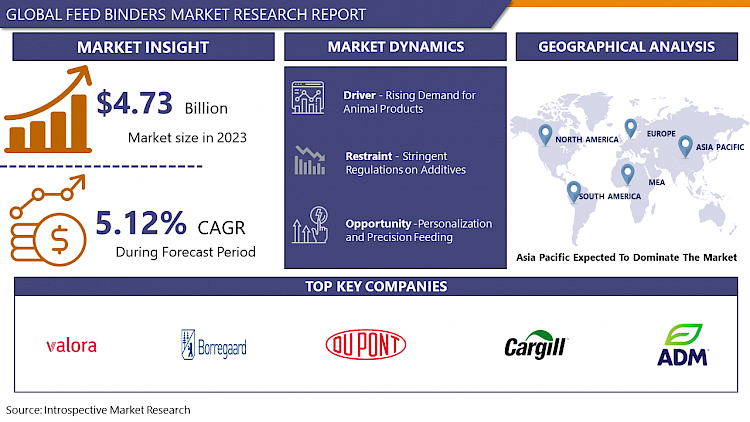

Feed Binders Market Size Was Valued at USD 4.73 Billion in 2023, and is Projected to Reach USD 7.41 Billion by 2032, Growing at a CAGR of 5.12% From 2024-2032.

Feed binders are materials that improve the bonding and stability of feed ingredients in animal nutrition. By enhancing the grains or pellets physical quality and integrity, these binders are essential to the formulation of animal feeds. Preventing feed disintegration during handling, transportation, and storage is the main objective of feed binders.

Feed binders can be of various types, including natural or synthetic compounds, and they work by forming a cohesive matrix that holds together the different components of the feed. Common examples of feed binders include lignin, bentonite, guar gum, wheat gluten, and starch. These binders not only contribute to the structural integrity of the feed but also aid in optimizing the feeding process and ensuring that animals receive a balanced and uniform diet.

- Feed binders are in high demand due to increased emphasis on animal nutrition for better livestock performance. As the world's population grows, there is a greater emphasis on efficient and sustainable animal farming practices, which drives up demand for high-quality feed additives such as binders. Different animal species have specific nutritional needs, and the use of appropriate binders helps meet these requirements while ensuring cost-effective and sustainable feed production.

- The feed binders’ market is expected to expand as demand for high-quality animal products rises, creating a need for improved feed formulations. Ongoing research and development efforts aimed at improving binder efficiency and sustainability are likely to shape the market's future trajectory.

Feed Binders Market Trend Analysis

Rising Demand for Animal Products

- The steady growth of the global population, combined with rising incomes in various regions, has resulted in increased demand for animal-derived foods such as meat, dairy, and eggs. Changes in dietary preferences, as well as increased awareness of the nutritional benefits of animal products, all contribute to their popularity. Urbanisation and lifestyle changes cause this demand, as convenience and accessibility drive consumers towards a diet high in animal proteins.

- Additionally, Urbanisation and lifestyle changes also contribute, with convenience and accessibility playing a role in the preference for animal proteins. Population growth, particularly in developing countries, is expected to lead to an increased demand for protein sources, with animal products playing an important role. Technological advances in farming practices increase production efficiency in order to meet rising demand.

- Animal farming and processing operations are expanding in response to increased demand for animal products, creating a parallel need for effective feed additives. Feed binders, which are essential for maintaining the quality and nutritional integrity of animal feeds, have become increasingly important in meeting the demands of intensified animal agriculture. This interconnected growth emphasises the importance of understanding and addressing the changing dynamics within both the animal product and feed binder markets.

Personalization and Precision Feeding

- The significance of customised nutrition for various animal species and production objectives has become more widely recognised as the emphasis on personalisation and precision feeding in animal nutrition has grown. In order to improve the general health, growth, and performance of their animals, livestock producers are looking for ways to optimise the feed formulations they use. The market is moving towards specialised feed formulations due to the increasing demand for animal nutrition precision.

- Furthermore, technological advances in data analytics and sensors are expected to enable more precise monitoring of animal health and nutritional requirements. This, combined with a growing understanding of the impact of personalised nutrition on livestock productivity, creates a scenario in which feed binders can make a significant contribution. As the industry moves towards sustainable and efficient farming practices, the demand for personalised and precisely formulated feeds is likely to increase.

- Considering all factors, the growing use of personalisation and precision feeding practices in animal nutrition reflects the critical role that feed binders play in ensuring the efficacy of these specialised diets. This opens up opportunities for innovation and strategic development in the feed binder industry to meet the demands of a more personalised and precise approach to animal feeding.

Feed Binders Market Segment Analysis:

Feed Binders Market Segmented on the basis of type, application, and end-users.

By Type, Lignosulfonates segment is expected to dominate the market during the forecast period

- Lignosulfonates currently dominate the feed binder market due to these natural polymers are derived from wood pulping and have excellent binding properties, making them effective in forming cohesive feed pellets. Lignosulfonates are an excellent binding agent, adding strength and stability to animal feeds. Their widespread use can be attributed to their availability, low cost, and versatility in binding a variety of feed ingredients.

- Furthermore, lignosulfonates improve the nutritional profile of feed, increasing its quality and ensuring that animals consume a well-balanced diet. The growing emphasis on sustainable and environmentally friendly feed additives is consistent with the natural origin of lignosulfonates, positioning them as a preferred option. As environmental concerns and consumer preferences for natural ingredients increase, lignosulfonates continue to dominate the market.

- taken all factors into consideration Lignosulfonates have inherent advantages, such as binding efficiency, natural origin, and cost-effectiveness, which make them well-suited to meeting the industry's changing needs. The continued demand for high-quality animal feeds, combined with the environmentally conscious shift in the market, suggests that lignosulfonates will play a key role in driving growth within the feed binder market.

By Livestock, Poultry segment held the largest share of xx% in 2022

- The increased demand for poultry products, including chicken eggs and meat, worldwide Being an economical source of animal protein, poultry farming is frequently chosen due to its effectiveness in turning feed into protein. The demand for effective feed binders has increased due to the intensification of poultry production and the requirement for optimised feed formulations.

- Additionally, Poultry feed formulations, in particular, require precise and long-lasting binders to ensure that birds' nutritional needs are met while the feed pellets remain intact. As a result of this demand, poultry has become the primary driver of feed binder consumption. The projected global population growth and growing middle-class population, particularly in developing countries, are expected to drive demand for poultry products.

- This surge in demand is likely to necessitate the development of advanced and specialised poultry feed formulations, increasing the demand for effective binders. As consumers place a higher value on the quality and safety of poultry products, there may be a shift towards more customised and premium feed formulations, opening up opportunities for innovative feed binders that address the specific nutritional needs of poultry.

Feed Binders Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific dominates the feed binder market due to the region's large and diverse livestock population, which includes poultry, swine, and aquaculture, resulting in a high demand for animal feed. Increased meat consumption, urbanisation, and a growing middle-class population all help to drive the livestock industry forward. To meet these animals' nutritional requirements, there is a corresponding demand for effective feed binders.

- Furthermore, the presence of key agricultural economies in Asia Pacific, such as China and India, boosts the market because these countries prioritise animal husbandry and modern farming practices. The projected population growth in the region, coupled with an increasing per capita income, is anticipated to boost the demand for animal products. This increased demand will drive advancements in animal nutrition and feed formulations, resulting in opportunities for feed binders.

- The region's dominance is expected to persist as the demand for high-quality animal products continues to rise. Feed binder manufacturers can seize the opportunity by adapting to evolving trends, such as personalized nutrition and sustainable practices. With Asia Pacific remaining a key player in the global agricultural landscape, the feed binder market is poised for growth, driven by the diverse and expanding needs of the livestock industry in the region.

Feed Binders Market Top Key Players:

- Archer Daniels Midland Company (US)

- Cargill, Inc. (US)

- DuPont (US)

- Darling Ingredients Inc. (US)

- Ingredion Inc. (US)

- CP Kelco Inc. (US)

- Lallemand Inc. (Canada)

- Roquette Freres (France)

- Borregaard ASA (Norway)

- Gelita AG (Germany)

- JRS Holding GmbH & Co. KG (Germany)

- Avebe U.A. (Netherlands)

- Sensus Group (Netherlands)

- Tereos Group (France)

- Lyreco (France)

- Imerys SA (France)

- Valora Holding AG (Switzerland)

- Shandong Longda Agro-Biotechnology Co., Ltd. (China)

- Jiangsu Tiancheng Pharmaceutical Group Co., Ltd. (China)

- Inner Mongolia Yili Industrial Group Co., Ltd. (China)

- Tianjin Haisheng Feed Co., Ltd. (China)

- Qingdao Haiwang Aquatics Co., Ltd. (Japan)

- Nutreco N.V. (Brazil)

- Coamo Agroindustrial Cooperativa (Brazil)

Key Industry Developments in the Feed Binders Market:

- In December 2023, ADM, a global leader in human and animal nutrition, has acquired PT Trouw Nutrition Indonesia, a Nutreco subsidiary and the leading provider of functional and nutritional solutions for livestock farming in Indonesia. The planned acquisition will strengthen the company's animal nutrition capabilities in Indonesia.

- In November 2023, Cargill has introduced a new pelletizing binder called Cargill OPTIBIND Pro+, which is designed to improve pellet durability and reduce dust generation in poultry and swine feeds.

|

Global Feed Binders Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 4.73 Bn. |

|

Forecast Period 2023-30 CAGR: |

5.12 % |

Market Size in 2032: |

USD 7.43 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Nature |

|

||

|

By Livestock |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- FEED BINDERS MARKET BY TYPE (2016-2030)

- FEED BINDERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LIGNOSULFONATES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PLANT GUMS & STARCHES

- GELATIN & OTHER HYDROCOLLOIDS

- CLAY

- MOLASSES

- WHEAT GLUTEN

- FEED BINDERS MARKET BY NATURE (2016-2030)

- FEED BINDERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONVENTIONAL BINDERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NATURAL BINDERS

- FEED BINDERS MARKET BY LIVESTOCK (2016-2030)

- FEED BINDERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- POULTRY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CATTLE

- SWINE

- AQUATIC ANIMALS

- DOGS & CATS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Feed Binders Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ARCHER DANIELS MIDLAND COMPANY (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- CARGILL, INC. (US)

- DUPONT (US)

- DARLING INGREDIENTS INC. (US)

- INGREDION INC. (US)

- CP KELCO INC. (US)

- LALLEMAND INC. (CANADA)

- ROQUETTE FRERES (FRANCE)

- BORREGAARD ASA (NORWAY)

- GELITA AG (GERMANY)

- JRS HOLDING GMBH & CO. KG (GERMANY)

- AVEBE U.A. (NETHERLANDS)

- SENSUS GROUP (NETHERLANDS)

- TEREOS GROUP (FRANCE)

- LYRECO (FRANCE)

- IMERYS SA (FRANCE)

- VALORA HOLDING AG (SWITZERLAND)

- SHANDONG LONGDA AGRO-BIOTECHNOLOGY CO., LTD. (CHINA)

- JIANGSU TIANCHENG PHARMACEUTICAL GROUP CO., LTD. (CHINA)

- INNER MONGOLIA YILI INDUSTRIAL GROUP CO., LTD. (CHINA)

- TIANJIN HAISHENG FEED CO., LTD. (CHINA)

- QINGDAO HAIWANG AQUATICS CO., LTD. (JAPAN)

- NUTRECO N.V. (BRAZIL)

- COAMO AGROINDUSTRIAL COOPERATIVA (BRAZIL)

- COMPETITIVE LANDSCAPE

- GLOBAL FEED BINDERS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Nature

- Historic And Forecasted Market Size By Livestock

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Feed Binders Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 4.73 Bn. |

|

Forecast Period 2023-30 CAGR: |

5.12 % |

Market Size in 2032: |

USD 7.43 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Nature |

|

||

|

By Livestock |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. FEED BINDERS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. FEED BINDERS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. FEED BINDERS MARKET COMPETITIVE RIVALRY

TABLE 005. FEED BINDERS MARKET THREAT OF NEW ENTRANTS

TABLE 006. FEED BINDERS MARKET THREAT OF SUBSTITUTES

TABLE 007. FEED BINDERS MARKET BY TYPE

TABLE 008. CLAY MARKET OVERVIEW (2016-2028)

TABLE 009. PLANT GUMS & STARCHES MARKET OVERVIEW (2016-2028)

TABLE 010. LIGNOSULPHONATES MARKET OVERVIEW (2016-2028)

TABLE 011. HEMICELLULOSE MARKET OVERVIEW (2016-2028)

TABLE 012. CMC & OTHER HYDROCOLLOIDS MARKET OVERVIEW (2016-2028)

TABLE 013. MOLASSES MARKET OVERVIEW (2016-2028)

TABLE 014. WHEAT GLUTEN & MIDDLINGS MARKET OVERVIEW (2016-2028)

TABLE 015. OTHER TYPES MARKET OVERVIEW (2016-2028)

TABLE 016. FEED BINDERS MARKET BY APPLICATION

TABLE 017. POULTRY MARKET OVERVIEW (2016-2028)

TABLE 018. RUMINANTS MARKET OVERVIEW (2016-2028)

TABLE 019. SWINE MARKET OVERVIEW (2016-2028)

TABLE 020. OTHER ANIMALS MARKET OVERVIEW (2016-2028)

TABLE 021. NORTH AMERICA FEED BINDERS MARKET, BY TYPE (2016-2028)

TABLE 022. NORTH AMERICA FEED BINDERS MARKET, BY APPLICATION (2016-2028)

TABLE 023. N FEED BINDERS MARKET, BY COUNTRY (2016-2028)

TABLE 024. EUROPE FEED BINDERS MARKET, BY TYPE (2016-2028)

TABLE 025. EUROPE FEED BINDERS MARKET, BY APPLICATION (2016-2028)

TABLE 026. FEED BINDERS MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC FEED BINDERS MARKET, BY TYPE (2016-2028)

TABLE 028. ASIA PACIFIC FEED BINDERS MARKET, BY APPLICATION (2016-2028)

TABLE 029. FEED BINDERS MARKET, BY COUNTRY (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA FEED BINDERS MARKET, BY TYPE (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA FEED BINDERS MARKET, BY APPLICATION (2016-2028)

TABLE 032. FEED BINDERS MARKET, BY COUNTRY (2016-2028)

TABLE 033. SOUTH AMERICA FEED BINDERS MARKET, BY TYPE (2016-2028)

TABLE 034. SOUTH AMERICA FEED BINDERS MARKET, BY APPLICATION (2016-2028)

TABLE 035. FEED BINDERS MARKET, BY COUNTRY (2016-2028)

TABLE 036. PLAYER 1: SNAPSHOT

TABLE 037. PLAYER 1: BUSINESS PERFORMANCE

TABLE 038. PLAYER 1: PRODUCT PORTFOLIO

TABLE 039. PLAYER 1: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. PLAYER 2: SNAPSHOT

TABLE 040. PLAYER 2: BUSINESS PERFORMANCE

TABLE 041. PLAYER 2: PRODUCT PORTFOLIO

TABLE 042. PLAYER 2: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. PLAYER 3: SNAPSHOT

TABLE 043. PLAYER 3: BUSINESS PERFORMANCE

TABLE 044. PLAYER 3: PRODUCT PORTFOLIO

TABLE 045. PLAYER 3: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. OTHERS: SNAPSHOT

TABLE 046. OTHERS: BUSINESS PERFORMANCE

TABLE 047. OTHERS: PRODUCT PORTFOLIO

TABLE 048. OTHERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. FEED BINDERS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. FEED BINDERS MARKET OVERVIEW BY TYPE

FIGURE 012. CLAY MARKET OVERVIEW (2016-2028)

FIGURE 013. PLANT GUMS & STARCHES MARKET OVERVIEW (2016-2028)

FIGURE 014. LIGNOSULPHONATES MARKET OVERVIEW (2016-2028)

FIGURE 015. HEMICELLULOSE MARKET OVERVIEW (2016-2028)

FIGURE 016. CMC & OTHER HYDROCOLLOIDS MARKET OVERVIEW (2016-2028)

FIGURE 017. MOLASSES MARKET OVERVIEW (2016-2028)

FIGURE 018. WHEAT GLUTEN & MIDDLINGS MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHER TYPES MARKET OVERVIEW (2016-2028)

FIGURE 020. FEED BINDERS MARKET OVERVIEW BY APPLICATION

FIGURE 021. POULTRY MARKET OVERVIEW (2016-2028)

FIGURE 022. RUMINANTS MARKET OVERVIEW (2016-2028)

FIGURE 023. SWINE MARKET OVERVIEW (2016-2028)

FIGURE 024. OTHER ANIMALS MARKET OVERVIEW (2016-2028)

FIGURE 025. NORTH AMERICA FEED BINDERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. EUROPE FEED BINDERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. ASIA PACIFIC FEED BINDERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. MIDDLE EAST & AFRICA FEED BINDERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. SOUTH AMERICA FEED BINDERS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Feed Binders Market research report is 2024-2032.

Archer Daniels Midland Company (US), Cargill, Inc. (US), DuPont (US), Darling Ingredients Inc. (US), Ingredion Inc. (US), CP Kelco Inc. (US), Lallemand Inc. (Canada), Roquette Freres (France) , Borregaard ASA (Norway), Gelita AG (Germany), JRS Holding GmbH & Co. KG (Germany), Avebe U.A. (Netherlands), Sensus Group (Netherlands), Tereos Group (France), Lyreco (France), Imerys SA (France), Valora Holding AG (Switzerland), Shandong Longda Agro-Biotechnology Co., Ltd. (China), Jiangsu Tiancheng Pharmaceutical Group Co., Ltd. (China), Inner Mongolia Yili Industrial Group Co., Ltd. (China), Tianjin Haisheng Feed Co., Ltd. (China), Qingdao Haiwang Aquatics Co., Ltd. (Japan), Nutreco N.V. (Brazil), Coamo Agroindustrial Cooperativa (Brazil) and Other Major Players.

The Feed Binders Market is segmented into Type, Nature, Livestock, and region. By Type, the market is categorized into Lignosulfonates, Plant Gums & Starches, Gelatin & Other Hydrocolloids, Clay, Molasses and Wheat Gluten. By Nature, the market is categorized into Conventional Binders and Natural Binders. By Livestock, the market is categorized into Poultry, Cattle, Swine, Aquatic Animals and Dogs & Cats. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Feed binders are materials that improve the bonding and stability of feed ingredients in animal nutrition. By enhancing the grains or pellets physical quality and integrity, these binders are essential to the formulation of animal feeds. Preventing feed disintegration during handling, transportation, and storage is the main objective of feed binders

Feed Binders Market Size Was Valued at USD 4.73 Billion in 2023, and is Projected to Reach USD 7.41 Billion by 2032, Growing at a CAGR of 5.12% From 2024-2032.