EV Battery Thermal Management System Market Synopsis

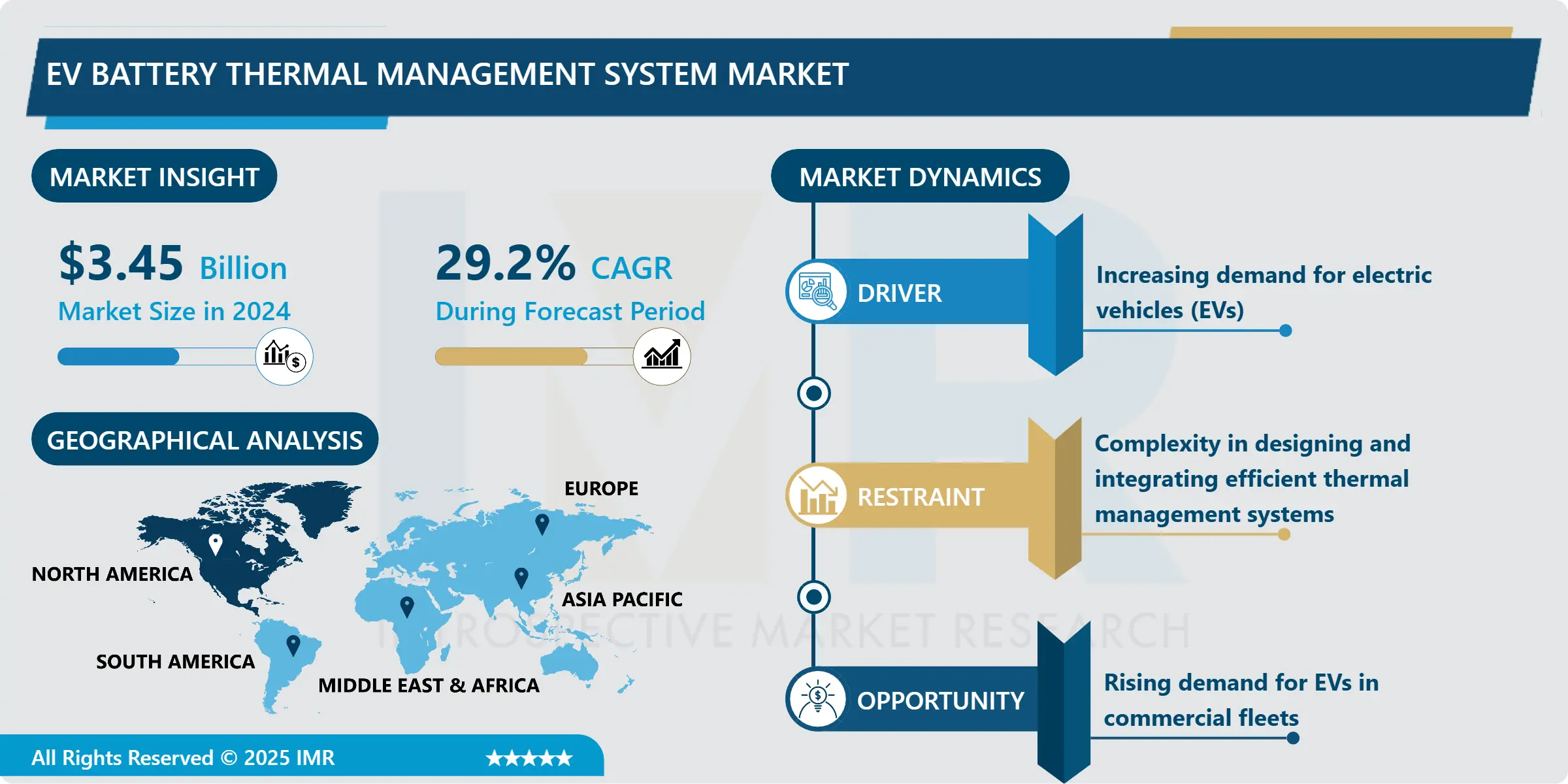

EV Battery Thermal Management System Market Size Was Valued at USD 3.45 Billion in 2024 and is Projected to Reach USD 26.78 Billion by 2032, Growing at a CAGR of 29.2% From 2025-2032.

An Electric Vehicle (EV) Battery Thermal Management System simply referred to as the EV-BTMS is a sub-system of the electric vehicle aimed at controlling the temperature of a battery pack. A battery pack is simply an energy storage system in an EV, which relies on temperature, and its performance or duration is highly affected by it.

For instance, a BTMS guarantees that the battery works under the right temperature that is preferred, mainly in the range of 15 – 35 degrees Celsius, through cooling as well as heating systems. This system is useful in charging and discharging processes, which affect the batteries’ performance and lifetime by overheating, and it also thwarts the impact of freezing temperature on batteries’ behavior. The BTMS guarantees the security, durability, and consistent performance of the battery pack as well as also increasing the overall range of the electric car.

Effective thermal management is crucial to use electricity and other components in the battery of electric cars up to their potential and for its longest possible life. The BTMS usually comprises liquid coolant loops, fans, heat exchangers, and thermal insulation. There are flow loops within the liquid coolant system which circulates the liquid coolant without mixing with the rest of the system. In the course of functioning, it constantly tracks the battery packs’ temperature and engages in cooling or heating procedures if required that will support a reasonable temperature interval.

Furthermore, a new generation of BTMS might also include machine learning models and temperature sensors to pre-act the change in temperature and lock/juggle the appropriate heat control techniques ahead of time. Due to the controlled operating conditions of the BTMS, electric automobiles demonstrate constant performance, extended battery durability, and thus the optimization of the efficiency and reliability of electric automobiles in the automotive market, thus catalyzing the advance of eco-friendly transport options.

EV Battery Thermal Management System Market Trend Analysis

EV Battery Thermal Management System Market Growth Drivers- Increasing demand for electric vehicles (EVs)

- Some of the key drivers of the EV Battery Thermal Management System (BTMS) market include the growing concern for green technology, the availability of charging infrastructure, and the rising demand for electric vehicles. Currently, after the automotive manufacturers shifted their priority towards electric vehicles to control emissions directly affecting the environment and meeting current environmental standards and regulations, the demand for EVs has rapidly escalated.

- Due to this increased uptake of EVs, there has also been the need to ask for better solutions for batteries since battery packs do have an added value when used efficiently. The system is also central to concerns dating to the battery temperature management area, which factors into elements like battery efficiency, charging rate, or total number of miles a vehicle is capable of traveling on a single charge.

- Furthermore, the increasing development of EV technology, increased customer expectation of range and improved performance along with the need for a better thermal management system calls for better novel technology. This means that Manufacturers are putting effort and money into their developments to bring new and enhanced forms of the BTMS that provide more effective cooling, heating, and charging features, along with efficiency.

- Since governments across the world are liberalizing the standards of adoption of electric vehicles and tightening the standards on emissions from traditional internal combustion engine vehicles, this will continuously fuel the demand for EVs and therefore the related battery management systems to market value, creating great value in the EV BTMS market.

EV Battery Thermal Management System Market Opportunities- Rising demand for EVs in commercial fleets

- The opportunity, such as the growing popularity of electric vehicles (EVs) in commercial fleets, stands to increase the market for EV Battery Thermal Management Systems (BTMS). Larger goods and passenger vehicles, such as delivery trucks, taxis, and ride-share, other than delivery and public transport vehicles, consumers also turn towards the use of electric engines for energy efficiency and less pollution.

- But to serve the intense and differentiated usage pattern higher need of commercial vehicles, management issues such the thermal characteristics and durability concerns have been critical in the case of batteries. Commercial fleet use is a common application of BTMS, and employing solutions that are designed to respond to these problems will help make battery packs run effectively while lasting longer under heavy use.

- For those operating fleets specifically for commercial use, issues like the durability and capabilities of electric vehicles are critical in terms of service delivery, which affects customers. A sound BTMS should ideally reduce the anxiety and worries associated with battery depletion, charging capability, and vehicle time-out due to heat-related incidents. Therefore, through improved battery temperature management, BTMS solutions can lead to increased battery longevity, lower maintenance and component costs, and an overall increase in vehicle availability.

- Further, as commercial fleets become more electrically charged, there is also a rising need for integrated bottom-up BTMS solutions that address varying shapes, sizes, and applications of each vehicle and environment in which it is placed. With electrification of the fleets now on the rise across the world, the EV BTMS market has a lot of room left to grow, especially with the increasing prospects offered by the global market shift to electric vehicles in the commercial segment.

EV Battery Thermal Management System Market Segment Analysis:

EV Battery Thermal Management System Market is segmented based on System Type and Application.

By System Type, Active is expected to dominate the market during the forecast period

- In the EV Battery Thermal Management System (BTMS) market, both active and passive systems have their significance, and the large use of the active system segment is observed at this moment. Active BTMS concerns the direct control of the temperature of the battery pack of the vehicle through systems like liquid coolants or heaters, fans, or pumps.

- These systems can consist of sensors and other components that can instantaneously manage battery temperature by pumping coolant or controlling heater coils depending on the assessment of the battery’s state. Operative BTMS thus must maintain the proper temperature of battery cells, which then has a direct impact on battery efficiency, safety, and durability, especially in extreme conditions such as a high rate charge or high ambient temperature.

- Furthermore, active systems tend to be more lightweight and adaptable across various conditions of use as well as are competent in regulating temperatures; for that reason, they are desirable for utilization in high-end electric cars and commercial fleets where the significance of reliability and performance is considered.

- Passive BTMS, in contrast, utilizes natural convection or insulation materials to regulate the battery temperature without the need for a cooler or heater. First of all, it is important to understand that, despite being easier to install, costing less, and less sensitive to the car exterior conditions, as opposed to active systems, passive ones might not offer as tight temperature regulation and might have lower energy efficiency in extreme conditions or high load situations such as sports car racing.

- Therefore, passive BTMS is used mainly in cheaper electric vehicles or vehicles and electric bicycles which are cheaper than traditional automobile industry products and where the cost factor takes priority over other features. However, rising technological advancements in battery power and increasing flame or thermal management concerns may augment the active BTMS market growth trends more potent than passive BTMS because of the better performance in high-end electric cars as well as business vehicles.

By Applications, the Passenger Vehicle segment held the largest share in 2024

- It can be observed from the trends of the EV Battery Thermal Management System (BTMS) market that the passenger vehicle segment is expected to rule the roost more than commercial vehicles owing to the increased usage of electric passenger cars than commercial ones. Passenger vehicles are electric cars such as Tesla, SUVs, wind cars, and hatchbacks that have experienced growth in the global markets due to changed attitudes to the environment and the switch to green cars instead of conventional internal combustion engine vehicles.

- As the number of electric vehicles increases on the roads, original equipment manufacturers are progressively devoting time and resources to the research and production of next-generation BTMS systems that will cater to the safety and power requirements of the universally demanded passenger vehicles. These systems are those used in charge of battery temperature control while charging, discharging, and during driving to enhance or consumers’ comfort while driving.

- At the current, the most popular segment of electrified vehicle BTMS is the passenger car segment, however, thanks to rapidly growing interest in EV the segment of CV, including delivery vans, buses, trucks, and other fleet vehicles is also developing. Nonetheless, the electric commercial vehicles’ market penetration is dwarfed that of the passenger electric vehicles due to some of the factors including; high initial costs, longer time to break even, and challenges faced in developing flexible infrastructure.

- However, with emissions standards and regulatory policies becoming more stringent across countries, while incentives are being offered for fleets to switch to electric vehicles, thereby, the prospects of commercial EVs are strong enough to drive BTMS solutions designed for such sectors. These systems will be imperative for increasing the efficiency of battery packs in commercial vehicles and thus improving operating efficiency, maximizing uptime, and minimizing costs that directly and indirectly are associated with battery pack power output required to meet environmental targets and gain competitive advantage in the marketplace for fleet operators.

EV Battery Thermal Management System Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- Market Segment Analysis: When it comes to the EV Battery Thermal Management System (BTMS), the passenger vehicles segment is expected to have a stronger hold due to a larger number of electric passenger vehicles produced and in use as opposed to commercial vehicles. Such types of Passenger vehicles include electric cars, SUVs, and hatchbacks, which have observed an enhanced demand in international markets due to the focus of the consumer on sustainability to opt for the products rather than the traditional internal combustion engine vehicles. With market trends shifting toward electric vehicles, automakers are increasingly focusing on improving battery technology with advanced BTMS solutions for batteries to maximize their potential provide safety for passengers, and increase driving range in passenger vehicles.

Active Key Players in the EV Battery Thermal Management System Market

- Avid Technology Limited (United Kingdom)

- BorgWarner Inc. (United States)

- Calsonic Kansei Corporation (Japan)

- Continental AG (Germany)

- Dana Incorporated (United States)

- DENSO Corporation (Japan)

- Eberspaecher Climate Control Systems GmbH & Co. KG (Germany)

- Gentherm Incorporated (United States)

- Gotion High-Tech Co., Ltd. (China)

- Hanon Systems (South Korea)

- LG Chem (South Korea)

- MAHLE Behr GmbH & Co. KG (Germany)

- Mahle GmbH (Germany)

- Modine Manufacturing Company (United States)

- Panasonic Corporation (Japan)

- Ricardo plc (United Kingdom)

- Robert Bosch GmbH (Germany)

- Samsung SDI (South Korea)

- Valeo SA (France)

- Visteon Corporation (United States)

- Other Active Players

|

Global EV Battery Thermal Management System Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024 : |

USD 3.45 Bn. |

|

Forecast Period 2023-32 CAGR: |

29.2% |

Market Size in 2032 : |

USD 26.78 Bn. |

|

Segments Covered: |

By System Type |

|

|

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: EV Battery Thermal Management System Market by System Type (2018-2032)

4.1 EV Battery Thermal Management System Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Active

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Passive

Chapter 5: EV Battery Thermal Management System Market by Applications (2018-2032)

5.1 EV Battery Thermal Management System Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Passenger Vehicle

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial Vehicle

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 EV Battery Thermal Management System Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABB (SWITZERLAND)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ALFEN (NETHERLANDS)

6.4 BLINK CHARGING (UNITED STATES)

6.5 BYD (CHINA)

6.6 CHARGEPOINT (UNITED STATES)

6.7 DELTA ELECTRONICS (TAIWAN)

6.8 EFACEC (PORTUGAL)

6.9 ENGIE (FRANCE)

6.10 EVBOX (NETHERLANDS)

6.11 GREENLOTS (UNITED STATES)

6.12 HELIOX (NETHERLANDS)

6.13 JIANGSU SFERE ELECTRIC (CHINA)

6.14 LEGRAND (FRANCE)

6.15 POD POINT (UNITED KINGDOM)

6.16 SCHNEIDER ELECTRIC (FRANCE)

6.17 SIEMENS (GERMANY)

6.18 SIGNET EV (INDIA)

6.19 TESLA (UNITED STATES)

6.20 TRITIUM (AUSTRALIA)

6.21 WEBASTO (GERMANY)

6.22 OTHER KEY PLAYERS

6.23

Chapter 7: Global EV Battery Thermal Management System Market By Region

7.1 Overview

7.2. North America EV Battery Thermal Management System Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by System Type

7.2.4.1 Active

7.2.4.2 Passive

7.2.5 Historic and Forecasted Market Size by Applications

7.2.5.1 Passenger Vehicle

7.2.5.2 Commercial Vehicle

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe EV Battery Thermal Management System Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by System Type

7.3.4.1 Active

7.3.4.2 Passive

7.3.5 Historic and Forecasted Market Size by Applications

7.3.5.1 Passenger Vehicle

7.3.5.2 Commercial Vehicle

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe EV Battery Thermal Management System Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by System Type

7.4.4.1 Active

7.4.4.2 Passive

7.4.5 Historic and Forecasted Market Size by Applications

7.4.5.1 Passenger Vehicle

7.4.5.2 Commercial Vehicle

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific EV Battery Thermal Management System Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by System Type

7.5.4.1 Active

7.5.4.2 Passive

7.5.5 Historic and Forecasted Market Size by Applications

7.5.5.1 Passenger Vehicle

7.5.5.2 Commercial Vehicle

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa EV Battery Thermal Management System Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by System Type

7.6.4.1 Active

7.6.4.2 Passive

7.6.5 Historic and Forecasted Market Size by Applications

7.6.5.1 Passenger Vehicle

7.6.5.2 Commercial Vehicle

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America EV Battery Thermal Management System Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by System Type

7.7.4.1 Active

7.7.4.2 Passive

7.7.5 Historic and Forecasted Market Size by Applications

7.7.5.1 Passenger Vehicle

7.7.5.2 Commercial Vehicle

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global EV Battery Thermal Management System Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024 : |

USD 3.45 Bn. |

|

Forecast Period 2023-32 CAGR: |

29.2% |

Market Size in 2032 : |

USD 26.78 Bn. |

|

Segments Covered: |

By System Type |

|

|

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||