Global Ethnic Food Market Overview

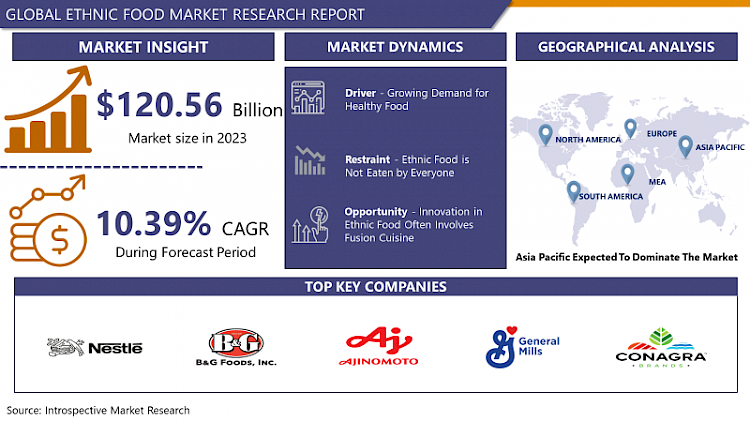

Global Ethnic Food Market Size Was Valued at USD 120.56 Billion In 2023 And Is Projected to Reach USD 293.47 Billion By 2032, Growing at A CAGR of 10.39% From 2024-2032.

Ethnic cuisine embodies the culinary traditions and cooking methods of distinct cultural or regional communities, featuring distinct tastes, components, and customs that have been handed down for generations.

- Cultural preservation is enhanced through the maintenance of culinary traditions and heritage by ethnic food. The varied nutritional compositions in various cultural foods provide a well-rounded, healthy diet, including a variety of ingredients and cooking techniques.

- These dishes also offer distinct flavors and tastes, broadening palates and providing a culinary adventure. Also, a lot of traditional recipes emphasize the importance of using fresh, unprocessed ingredients for their health benefits, which could help lower the chances of developing certain illnesses.

- Ethnic cuisine encourages social bonding and cross-cultural interaction, uniting individuals and enhancing mutual comprehension. It inspires chefs and home cooks, impacting culinary methods and imagination.

- Furthermore, tourists are drawn by ethnic cuisine, which helps boost local economies and preserve biodiversity by showcasing traditional farming methods and native ingredients. In essence, ethnic cuisine goes beyond the food, encompassing its influence on culture, health, social ties, and biodiversity.

Market Dynamics and Factors For Ethnic Food Market

Drivers:

Growing Demand for Healthy Food

The restaurant industry is experimenting with beneficial earthy and natural flavors, moving towards more plant-based food, thanks to the health halo surrounded by local spices that are rich in aromas. Today's consumers are on the lookout for new and improved varieties of ethnic gastronomy available in urban culture. Consumers have increasingly begun to seek out meals and beverages that provide not only physical but also emotional and spiritual benefits as a result of the pandemic. Adaptogenic ingredients like Haldi, ashwagandha, cumin, nachni, holy basils, reishi, and tulsi are making their way into new food and drink introductions as a result of this mindfulness. Ayurvedic plant flavors like ginseng and turmeric are showing up in a variety of food and beverage categories, from kombucha to yogurt and even chocolates. Over sweetened smoothies and shakes, raw hot chocolate with reishi mushroom, ashwagandha, cacao, coconut milk, and cinnamon will be favored.

Growing Demand for Particular Spice and Flavor Blends

More locally-specific seasonings are paving the way for more spiciness and authenticity in the countries' traditional flares, adding layers of flavor to the traditional flares. Inventive flavor blends that merge and match lesser-known components have been stirred by a desire to navigate the old-style taste frontiers. Superfoods with natural and clean label components that have probiotic and gastrointestinal benefits are in high demand these days. Because most people do not eat out, they crave the powerful flavor enhancers and spices associated with restaurant-quality meals. The ability of herbs and spices like turmeric and cumin to combine flavor with health-promoting characteristics is a distinct benefit.

Restraints:

Increasing customer demand for totally natural products will reduce the market's decline. Additionally, the market's expansion will be hampered by increased transit times and costs. Moreover, a negative factor of ethnic food is not every people can eat especially tourists who come from another country, it will become very monotonous food if you eat it too often, and this will affect the growth of the market over the forecast period.

Opportunities:

Mission Foods Inc. was the biggest supplier of hard tortillas, soft tortillas, and taco kits in 2021, with sales of approximately 1.24 billion dollars in the United States. New trends in the out-of-home market, such as Peruvian or Korean cuisine, were emerging. On U.S. breakfast/brunch menus, ethnic-inspired breakfast products such as Asian-flavored syrups or coconut milk pancakes were also highlighted as an innovation. Furthermore, due to worldwide social media trends, internet sales channels are likely to generate profitable prospects for major and local companies. For instance, Nomads Marketplace has created a brand-new ethnic food bazaar on the internet. The new online store was established to provide individuals all around the world with a more convenient option to purchase ethnic spices and products for their culinary excursions. Nomads Marketplace is shaping up to be the go-to answer for consumers with global tastes, with a vast selection of shelf-stable products and more to come in the future.

Market Segmentation

Segmentation Analysis of Ethnic Food Market:

By Culture, the Mexican (Hispanic) food segment is anticipated to hold the maximum ethnic food market share over the projected period. By far the most popular, with the highest sales, is Hispanic food. Asian and Mediterranean/Middle Eastern foods are expected to grow at a significantly quicker rate by 2021, according to Mintel. Asian food has witnessed a 41% increase in new product introductions in the last two years, whereas other ethnic foods have seen little change. Furthermore, consumption in countries such as the United States, Canada, Mexico, the United Arab Emirates, and India has been rising in recent years, and this feature presents potential growth opportunities for the global market.

By Food Type, non-veg food is expected to capture the significant ethnic food market growth over the forecast period. In practically every home in Europe, North America, South America, China, and the Middle East, non-vegetarian food is a part of the daily diet. Non-vegetarian food makes up a higher portion of their daily meals than vegetarian cuisine. Non-vegetarian consumption is substantially larger than vegetarian consumption around the world; hence non-vegetarian ethnic food has a large market share. Some consumers are leaning towards vegetarian diets as a result of increased awareness about the benefits of vegan diets and vegetarian food consumption, and this factor is expected to boost the market for vegetarian ethnic food during the forecast period, making it the fastest-growing segment in this segment.

Regional Analysis of Ethnic Food Market:

The Asia-Pacific region's growing young population, along with a fast-paced habit of often eating and experimenting with diverse interstate and inter-country culinary cuisines, has created a multitude of growth potential for ethnic food services enterprises. People in India and other developing nations are increasingly using social media to share their culinary experiences, encouraging consumers to try new food alternatives and outlets based on the feedback given. Consumers in Asia-Pacific are increasingly seeking out new culinary experiences, including global and original regional cuisines. Furthermore, manufacturers are attempting to meet consumer demand for new and unique food products by including more international favorites, added diversity, spices, and robust flavors. As consumers, particularly millennials gravitate toward ethnic cuisines, specialty and international food lanes are growing in Asia-Pacific supermarkets. Other elements that are positively influencing the market include international travel and globalization policy.

North America region, which comprises the United States, Canada, and Mexico, is predicted to develop steadily due to rising demand for Asian food as a result of an influx of Asian customers to the region. Furthermore, the growing popularity of Asian ethnic group food items and other new ethnic cuisine foods in North America has fueled demand for regional ethnic group foods imports. Consumers have been drawn to this food sector by the rising popularity of frozen foods and regional food products from smaller nations such as Thailand, Vietnam, and the Philippines. The growth of the U.S. ethnic cuisine food industry, particularly in the region, is likely to be fueled by ongoing improvements and technological advancements in the preservation and freezing of ethnic cuisine foods.

In comparison to other developed regions, the ethnic food market share in Europe is predicted to rise at a slower rate. The presence of local ethnic group food items in Europe, such as Italian, Spanish, French, and Greek products, limits the exponential expansion of other ethnic group food categories, but demand is likely to continue to expand slowly. For a long time, there has been a great demand for Italian and Spanish cuisine, and as a result, consumption of Mexican cuisine is not rapidly increasing, but rather growing slowly and steadily.

Even with its geographical range, which includes varied maritime sceneries, the South American market for ethnic cuisines is predicted to increase at a steady rate over the forecast period. Brazil and Argentina are the two most important countries in South America for ethnic cuisine and specialty food production. By enhancing freezing technologies and making other ethnic cuisine food items available in this region, the ethnic group food market in this region is predicted to offer significant potential.

Players Covered In Ethnic Food Market are:

- Nestle S.A. (Switzerland)

- B&G Foods (U.S.)

- Ajinomoto Co. Inc. (Japan)

- Associated British Foods PLC (U.K.)

- McCormick & Company Inc. (U.S.)

- MTR Foods (India)

- General Mills (U.S.)

- Conagra Brands Inc. (U.S.)

- Tasty Bite Edibles Pvt. Ltd. (India)

- Taco Bell (U.S.) and others major players.

Key Industry Developments in Ethnic Food Market

- In August 2023, General Mills announced the launch of DJ Carmella Creeper, adding to the Monsters Cereals lineup, with a "Monster Mash Remix" song and limited-edition merchandise ahead of Halloween.

- In April 2023, Paulig PRO introduced Santa Maria Snack Bases, innovative pellets that expand when cooked to create crispy Corn Cones and Lentil Waves, allowing establishments to offer customizable, signature snacks in less than a minute to cater to the growing demand for out-of-home snacking experiences.

|

Global Ethnic Food Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 120.56 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.39% |

Market Size in 2032: |

USD 293.47Bn. |

|

Segments Covered: |

By Culture |

|

|

|

By Food Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ETHNIC FOOD MARKET BY CULTURE (2017-2032)

- ETHNIC FOOD MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ASIAN

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- JAPANESE

- ITALIAN

- MEXICAN

- OTHERS

- ETHNIC FOOD MARKET BY FOOD TYPE (2017-2032)

- ETHNIC FOOD MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- VEG

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NON-VEG

- ETHNIC FOOD MARKET BY APPLICATION (2017-2032)

- ETHNIC FOOD MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RESTAURANT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HOUSEHOLD

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- ETHNIC FOOD Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- NESTLE S.A. (SWITZERLAND)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- B&G FOODS (U.S.)

- AJINOMOTO CO. INC. (JAPAN)

- ASSOCIATED BRITISH FOODS PLC (U.K.)

- MCCORMICK & COMPANY INC. (U.S.)

- MTR FOODS (INDIA)

- GENERAL MILLS (U.S.)

- CONAGRA BRANDS INC. (U.S.)

- TASTY BITE EDIBLES PVT. LTD. (INDIA)

- TACO BELL (U.S.)

- COMPETITIVE LANDSCAPE

- GLOBAL ETHNIC FOOD MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Culture

- Historic And Forecasted Market Size By Food Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

-

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

-

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Ethnic Food Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 120.56 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.39% |

Market Size in 2032: |

USD 293.47Bn. |

|

Segments Covered: |

By Culture |

|

|

|

By Food Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ETHNIC FOOD MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ETHNIC FOOD MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ETHNIC FOOD MARKET COMPETITIVE RIVALRY

TABLE 005. ETHNIC FOOD MARKET THREAT OF NEW ENTRANTS

TABLE 006. ETHNIC FOOD MARKET THREAT OF SUBSTITUTES

TABLE 007. ETHNIC FOOD MARKET BY CULTURE

TABLE 008. ASIAN MARKET OVERVIEW (2016-2028)

TABLE 009. JAPANESE MARKET OVERVIEW (2016-2028)

TABLE 010. ITALIAN MARKET OVERVIEW (2016-2028)

TABLE 011. MEXICAN MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. ETHNIC FOOD MARKET BY FOOD TYPE

TABLE 014. VEG MARKET OVERVIEW (2016-2028)

TABLE 015. NON-VEG MARKET OVERVIEW (2016-2028)

TABLE 016. ETHNIC FOOD MARKET BY APPLICATION

TABLE 017. RESTAURANT MARKET OVERVIEW (2016-2028)

TABLE 018. HOUSEHOLD MARKET OVERVIEW (2016-2028)

TABLE 019. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 020. NORTH AMERICA ETHNIC FOOD MARKET, BY CULTURE (2016-2028)

TABLE 021. NORTH AMERICA ETHNIC FOOD MARKET, BY FOOD TYPE (2016-2028)

TABLE 022. NORTH AMERICA ETHNIC FOOD MARKET, BY APPLICATION (2016-2028)

TABLE 023. N ETHNIC FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 024. EUROPE ETHNIC FOOD MARKET, BY CULTURE (2016-2028)

TABLE 025. EUROPE ETHNIC FOOD MARKET, BY FOOD TYPE (2016-2028)

TABLE 026. EUROPE ETHNIC FOOD MARKET, BY APPLICATION (2016-2028)

TABLE 027. ETHNIC FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 028. ASIA PACIFIC ETHNIC FOOD MARKET, BY CULTURE (2016-2028)

TABLE 029. ASIA PACIFIC ETHNIC FOOD MARKET, BY FOOD TYPE (2016-2028)

TABLE 030. ASIA PACIFIC ETHNIC FOOD MARKET, BY APPLICATION (2016-2028)

TABLE 031. ETHNIC FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA ETHNIC FOOD MARKET, BY CULTURE (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA ETHNIC FOOD MARKET, BY FOOD TYPE (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA ETHNIC FOOD MARKET, BY APPLICATION (2016-2028)

TABLE 035. ETHNIC FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 036. SOUTH AMERICA ETHNIC FOOD MARKET, BY CULTURE (2016-2028)

TABLE 037. SOUTH AMERICA ETHNIC FOOD MARKET, BY FOOD TYPE (2016-2028)

TABLE 038. SOUTH AMERICA ETHNIC FOOD MARKET, BY APPLICATION (2016-2028)

TABLE 039. ETHNIC FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 040. NESTLE S.A.: SNAPSHOT

TABLE 041. NESTLE S.A.: BUSINESS PERFORMANCE

TABLE 042. NESTLE S.A.: PRODUCT PORTFOLIO

TABLE 043. NESTLE S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. B&G FOODS: SNAPSHOT

TABLE 044. B&G FOODS: BUSINESS PERFORMANCE

TABLE 045. B&G FOODS: PRODUCT PORTFOLIO

TABLE 046. B&G FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. AJINOMOTO CO. INC.: SNAPSHOT

TABLE 047. AJINOMOTO CO. INC.: BUSINESS PERFORMANCE

TABLE 048. AJINOMOTO CO. INC.: PRODUCT PORTFOLIO

TABLE 049. AJINOMOTO CO. INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. ASSOCIATED BRITISH FOODS PLC: SNAPSHOT

TABLE 050. ASSOCIATED BRITISH FOODS PLC: BUSINESS PERFORMANCE

TABLE 051. ASSOCIATED BRITISH FOODS PLC: PRODUCT PORTFOLIO

TABLE 052. ASSOCIATED BRITISH FOODS PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. MCCORMICK & COMPANY INC.: SNAPSHOT

TABLE 053. MCCORMICK & COMPANY INC.: BUSINESS PERFORMANCE

TABLE 054. MCCORMICK & COMPANY INC.: PRODUCT PORTFOLIO

TABLE 055. MCCORMICK & COMPANY INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. MTR FOODS: SNAPSHOT

TABLE 056. MTR FOODS: BUSINESS PERFORMANCE

TABLE 057. MTR FOODS: PRODUCT PORTFOLIO

TABLE 058. MTR FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. GENERAL MILLS: SNAPSHOT

TABLE 059. GENERAL MILLS: BUSINESS PERFORMANCE

TABLE 060. GENERAL MILLS: PRODUCT PORTFOLIO

TABLE 061. GENERAL MILLS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. CONAGRA BRANDS INC.: SNAPSHOT

TABLE 062. CONAGRA BRANDS INC.: BUSINESS PERFORMANCE

TABLE 063. CONAGRA BRANDS INC.: PRODUCT PORTFOLIO

TABLE 064. CONAGRA BRANDS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. TASTY BITE EDIBLES PVT. LTD.: SNAPSHOT

TABLE 065. TASTY BITE EDIBLES PVT. LTD.: BUSINESS PERFORMANCE

TABLE 066. TASTY BITE EDIBLES PVT. LTD.: PRODUCT PORTFOLIO

TABLE 067. TASTY BITE EDIBLES PVT. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 068. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 069. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 070. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ETHNIC FOOD MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ETHNIC FOOD MARKET OVERVIEW BY CULTURE

FIGURE 012. ASIAN MARKET OVERVIEW (2016-2028)

FIGURE 013. JAPANESE MARKET OVERVIEW (2016-2028)

FIGURE 014. ITALIAN MARKET OVERVIEW (2016-2028)

FIGURE 015. MEXICAN MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. ETHNIC FOOD MARKET OVERVIEW BY FOOD TYPE

FIGURE 018. VEG MARKET OVERVIEW (2016-2028)

FIGURE 019. NON-VEG MARKET OVERVIEW (2016-2028)

FIGURE 020. ETHNIC FOOD MARKET OVERVIEW BY APPLICATION

FIGURE 021. RESTAURANT MARKET OVERVIEW (2016-2028)

FIGURE 022. HOUSEHOLD MARKET OVERVIEW (2016-2028)

FIGURE 023. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 024. NORTH AMERICA ETHNIC FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. EUROPE ETHNIC FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. ASIA PACIFIC ETHNIC FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. MIDDLE EAST & AFRICA ETHNIC FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. SOUTH AMERICA ETHNIC FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Ethnic Food Market research report is 2024-2032.

Nestle S.A. (Switzerland), B&G Foods (U.S.), Ajinomoto Co. Inc. (Japan), Associated British Foods PLC (U.K.), McCormick & Company Inc. (U.S.), MTR Foods (India), General Mills (U.S.), Conagra Brands Inc. (U.S.), Tasty Bite Edibles Pvt. Ltd. (India), Taco Bell (U.S.), and Other Major Players.

Ethnic Food Market is segmented into Culture, Food Type, Application and region. By Culture, the market is categorized into Asian, Japanese, Italian, Mexican, Others. By Food Type, the market is categorized into Veg, Non-Veg. By Application, the market is categorized into Restaurant, Household, Others. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Ethnic food is customarily cooked without the use of any artificial colors, flavors, or preservatives. Ethnic foods are used to categorize foods based on country cultures and food availability. It gives clients the delight of consuming certain foods from their home country while living abroad

Global Ethnic Food Market Size Was Valued at USD 120.56 Billion In 2023 And Is Projected to Reach USD 293.47 Billion By 2032, Growing at A CAGR of 10.39% From 2024-2032.