eSIM Market Synopsis

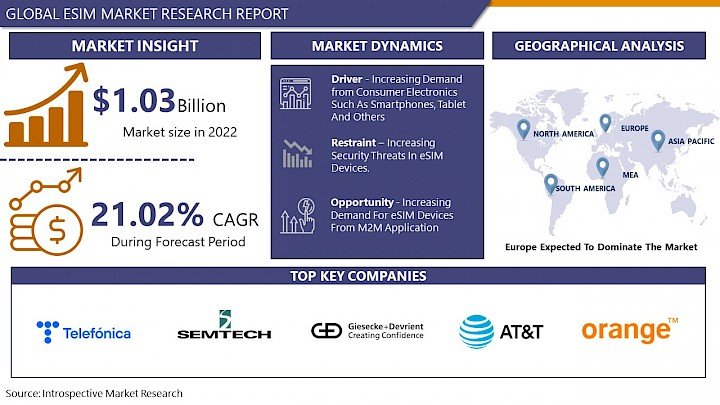

Global eSIM Market size was valued at USD 1.03 billion in 2022 and is projected to reach USD 4.74 billion by 2030, growing at a CAGR of 21.02% from 2023 to 2030.

The eSIM (embedded Subscriber Identity Module) market refers to the rapidly evolving landscape within the telecommunications industry, where traditional physical SIM cards are being replaced by virtual, embedded SIM technology. This innovative approach to mobile connectivity allows consumers and businesses to remotely and seamlessly switch between mobile carriers and plans without the need for a physical SIM card swap. The eSIM market encompasses various stakeholders, including mobile network operators, device manufacturers, and end-users, all contributing to the growth and adoption of this transformative technology.

- One key driver behind the expanding eSIM market is the increasing proliferation of connected devices beyond smartphones. These include tablets, smartwatches, laptops, IoT (Internet of Things) devices, and even vehicles. ESIMs offer a convenient solution for managing connectivity across these diverse devices, enabling users to activate, deactivate, or switch between mobile plans with greater ease. This flexibility is particularly valuable for frequent travelers, as it allows for local carrier selection without the hassle of acquiring a physical SIM card for each destination.

- Moreover, the eSIM market promotes environmental sustainability by reducing the need for disposable plastic SIM cards and their associated packaging. This shift aligns with broader efforts to minimize e-waste and adopt eco-friendly practices within the technology sector.

- For mobile network operators, eSIM technology represents an opportunity to streamline operations, reduce costs, and improve customer satisfaction. It allows for over-the-air provisioning, simplifying the on boarding of new subscriber,s and enhancing the management of existing ones. Device manufacturers also benefit from eSIM integration, as it enables slimmer and more versatile designs, eliminating the need for SIM card slots and trays.

eSIM Market Key Players:

- Telefónica

- Semtech Corporation

- Giesecke+Devrient GmbH

- AT&T, Orange

- Arm Limited

- KORE Wireless

- Workz

- Oasis Smart-SIM

- Vodafone Group

- STMicroelectronics

- Thales

- Deutsche Telekom AG

- NXP Semiconductors

- Infineon Technologies AG

- Telit

- IDEMIA

- TP Global Operations Limited

- Sinch

- Singtel

- Etisalat

- Other major players.

The eSIM Market Trend Analysis

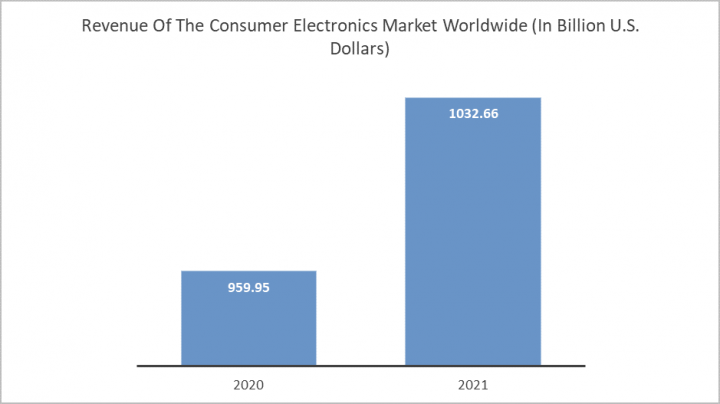

Increasing Demand from Consumer Electronics Such as Smartphones, Tablets and Others

- The increasing demand for consumer electronics, such as smartphones, tablets, and other connected devices, serves as a significant driver for the eSIM (embedded Subscriber Identity Module) market. This demand is propelled by several key factors that highlight the transformative impact of eSIM technology on the consumer electronics industry.

- eSIMs offer unparalleled convenience for users of these devices. Unlike traditional physical SIM cards, which require manual insertion and removal, eSIMs are embedded within the device during manufacturing. This means that consumers can easily activate their mobile plans and switch carriers without the need for physical SIM card swaps. This flexibility is particularly appealing to smartphone and tablet users who value the ability to switch between different mobile carriers or plans to find the most suitable options for their needs, whether it's for cost savings, improved network coverage, or international travel.

- Moreover, the eSIM's ability to support multiple profiles on a single device is a game-changer for consumers. It enables the seamless management of multiple phone numbers or data plans on a single device, eliminating the need to carry multiple devices for work and personal use. This functionality is highly coveted by professionals and business users who rely on smartphones and tablets for both personal and work-related communications and applications.

- In addition, the trend toward slimmer and more compact designs in consumer electronics benefits from eSIM integration. With no need for a physical SIM card slot, device manufacturers can create sleeker, more space-efficient designs. This contributes to the overall aesthetics and ergonomics of smartphones, tablets, and other devices.

- Furthermore, eSIM technology aligns with the broader push for sustainability in the electronics industry. It reduces the consumption of plastic SIM cards and packaging, thereby reducing e-waste and environmental impact.

Increasing Demand for eSIM Devices From M2M Application

- The increasing demand for eSIM devices from Machine-to-Machine (M2M) applications represents a significant opportunity for the eSIM market. M2M applications involve the communication and data exchange between interconnected devices and systems without human intervention. This sector spans a wide range of industries, including IoT (Internet of Things), industrial automation, healthcare, smart cities, and more. Several factors contribute to the growing importance of eSIM technology in M2M applications and how it presents opportunities within the market.

- The scalability and remote management capabilities of eSIMs make them ideal for M2M deployments. In large-scale IoT networks, managing and swapping out physical SIM cards for each device can be logistically challenging and costly. ESIMs allow for over-the-air provisioning, activation, and configuration, enabling easier and more cost-effective management of M2M device connectivity on a massive scale. This is crucial for industries like agriculture, logistics, and utilities, where thousands or even millions of devices need to be connected and monitored efficiently.

- The long lifecycle of M2M devices often outlasts the typical two-year contract associated with traditional SIM cards. ESIMs, which can be reprogrammed and reused, offer a sustainable solution for these applications. This not only reduces waste but also provides cost savings over time, as there is no need to replace physical SIM cards when devices are upgraded or repurposed.

- Moreover, the security features inherent to eSIM technology are vital for M2M applications, where data integrity and confidentiality are paramount. ESIMs offer robust security measures, including remote SIM provisioning and strong authentication protocols, to protect sensitive information in critical industries like healthcare, financial services, and smart infrastructure.

- The demand for eSIMs in M2M applications extends beyond traditional sectors. Emerging technologies like autonomous vehicles and smart grids rely on M2M communication, driving the need for reliable and scalable connectivity solutions. ESIMs play a pivotal role in ensuring seamless, secure, and efficient data exchange in these advanced applications.

eSIM Market Segmentation Analysis

eSIM Market segments cover the Component, Application, and Vertical. By application M2M segment is Anticipated to Dominate the Market Over the Forecast period.

- The M2M (Machine-to-Machine) application segment is emerging as a dominating force in the eSIM (embedded Subscriber Identity Module) market, reshaping the landscape of connectivity solutions across various industries. This dominance is attributed to the unique demands and requirements of M2M applications, which align closely with the capabilities of eSIM technology.

- One of the key factors driving the prominence of M2M in the eSIM market is scalability. M2M deployments often involve vast networks of interconnected devices, ranging from sensors and meters to industrial machinery and vehicles. Managing traditional physical SIM cards across these networks can be logistically challenging and cost-prohibitive. ESIMs provide an elegant solution by allowing remote provisioning and management of connectivity, simplifying the activation and configuration of devices on a massive scale. This scalability is crucial in industries like logistics, agriculture, and smart cities, where the efficient operation of a multitude of devices is paramount.

- The longevity of M2M devices is another factor amplifying the role of eSIMs. Many M2M devices have lifecycles far exceeding the typical two-year contract associated with physical SIM cards. ESIMs, being programmable and reusable, offer a sustainable alternative. This not only reduces e-waste but also delivers cost savings over time, as there's no need to replace SIM cards when devices are upgraded or repurposed.

- Security is a paramount concern in M2M applications, particularly in critical sectors like healthcare, finance, and infrastructure. eSIMs offer advanced security features, including robust authentication protocols and remote SIM provisioning, ensuring the integrity and confidentiality of data exchanges in M2M networks. This heightened security is a crucial aspect of eSIM technology that resonates strongly with industries that demand trustworthiness.

eSIM Market Regional Analysis

Europe is dominating the Market Over the Forecast Period.

- Europe was emerging as a leading and dominant region for eSIM adoption. Several factors contributed to Europe's prominence in the eSIM market.

- Europe was at the forefront of regulatory initiatives that promoted eSIM adoption. European regulatory bodies have been proactive in encouraging the implementation of eSIM technology, which created a favourable environment for its growth. Regulations, such as the European Electronic Communications Code (EECC), facilitated consumer access to eSIM-enabled devices and services.

- Europe's strong presence in the automotive sector played a significant role. The region is home to many leading automobile manufacturers who have been integrating eSIM technology into connected cars and vehicles. This trend was driven by the demand for advanced telematics services, in-car connectivity, and over-the-air software updates, which all leverage eSIM capabilities.

- Furthermore, Europe's robust IoT ecosystem contributed to eSIM adoption. The continent saw substantial deployments of eSIMs in various IoT applications, including smart meters, healthcare devices, and industrial automation. The ability of eSIMs to facilitate remote provisioning and management of IoT devices aligned well with the needs of these industries.

COVID-19 Impact Analysis on eSIM Market

Due to COVID-19 pandemic, several industries have witnessed significant shift in their business. There has also been significant impact on the growth of eSIM market as manufacturing operations were temporarily suspended across many countries to contain the coronavirus. Furthermore, shortage of 5G chipsets in the market disrupted the production so many manufacturing companies such as Samsung, Xiaomi, OPPO and LG Display had suspended their manufacturing operations in China, India, South Korea and in European countries. For instance, in May 2020, OPPO Company shut down its operations in Noida, India as six employees tested positive for COVID-19. Hence, demand for eSIM devices has decreased due to lockdown imposed in several countries.

Key Industry Developments in the ESIM Market

In May 2020, Thales has deployed a public cloud version of its embedded SIM (eSIM) remote subscription platform on Google Cloud to help telcos manage the increase of mobile subscriptions for eSIM-capable devices. As part of the deployment, the platform is GSMA-certified, will be accessible by telcos on Google Cloud in more than 200 countries and territories.

In March 2020, STMicroelectronics and Truphone collaborated to launched a full-stack embedded SIM (eSIM) infrastructure solution compliant with GSMA M2M standards. S.T. provides its ST4SIM-200A/M, a GSMA-certified SOC solution with eSIM software and industrial and automotive-qualified secure hardware, while Truphone provides its seamless connectivity and remote SIM provisioning (RSP) capabilities.

|

ESIM Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 1.03 Bn. |

|

Forecast Period 2023-30 CAGR: |

21.02 % |

Market Size in 2030: |

USD 4.74 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ESIM MARKET BY COMPONENT (2016-2030)

- ESIM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- Hardware

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- Services

- ESIM MARKET BY APPLICATION (2016-2030)

- ESIM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- Connected Cars

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- Laptops

- M2M

- Smartphones

- Tablets

- Others

- ESIM MARKET BY VERTICAL (2016-2030)

- ESIM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- Automotive

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- Consumer Electronics

- Energy & Utilities

- Manufacturing

- Retail

- Transportation & Logistics

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- ESIMMarket Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- COMPETITIVE LANDSCAPE

- TELEFÓNICA

-

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- SEMTECH CORPORATION

- GIESECKE+DEVRIENT GMBH

- AT&T

- ORANGE

- ARM LIMITED

- KORE WIRELESS

- WORKZ

- OASIS SMART-SIM

- VODAFONE GROUP

- STMICROELECTRONICS

- THALES

- DEUTSCHE TELEKOM AG

- NXP SEMICONDUCTORS

- INFINEON TECHNOLOGIES AG

- TELIT

- IDEMIA

- TP GLOBAL OPERATIONS LIMITED

- SINCH

- SINGTEL

- ETISALAT

- OTHER MAJOR PLAYERS

-

- GLOBAL ESIM MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Vertical

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

ESIM Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 1.03 Bn. |

|

Forecast Period 2023-30 CAGR: |

21.02 % |

Market Size in 2030: |

USD 4.74 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ESIM MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ESIM MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ESIM MARKET COMPETITIVE RIVALRY

TABLE 005. ESIM MARKET THREAT OF NEW ENTRANTS

TABLE 006. ESIM MARKET THREAT OF SUBSTITUTES

TABLE 007. ESIM MARKET BY PRODUCT

TABLE 008. BUTADIENE RUBBER MARKET OVERVIEW (2016-2028)

TABLE 009. STYRENE BUTADIENE RUBBER MARKET OVERVIEW (2016-2028)

TABLE 010. ACRYLONITRILE BUTADIENE RUBBER MARKET OVERVIEW (2016-2028)

TABLE 011. NITRILE BUTADIENE RUBBER MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. ESIM MARKET BY END-USERS

TABLE 014. AUTOMOBILE INDUSTRIES MARKET OVERVIEW (2016-2028)

TABLE 015. BUILDING & CONSTRUCTION MARKET OVERVIEW (2016-2028)

TABLE 016. CONSUMER PRODUCTS INDUSTRIES MARKET OVERVIEW (2016-2028)

TABLE 017. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA ESIM MARKET, BY PRODUCT (2016-2028)

TABLE 020. NORTH AMERICA ESIM MARKET, BY END-USERS (2016-2028)

TABLE 021. N ESIM MARKET, BY COUNTRY (2016-2028)

TABLE 022. EUROPE ESIM MARKET, BY PRODUCT (2016-2028)

TABLE 023. EUROPE ESIM MARKET, BY END-USERS (2016-2028)

TABLE 024. ESIM MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC ESIM MARKET, BY PRODUCT (2016-2028)

TABLE 026. ASIA PACIFIC ESIM MARKET, BY END-USERS (2016-2028)

TABLE 027. ESIM MARKET, BY COUNTRY (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA ESIM MARKET, BY PRODUCT (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA ESIM MARKET, BY END-USERS (2016-2028)

TABLE 030. ESIM MARKET, BY COUNTRY (2016-2028)

TABLE 031. SOUTH AMERICA ESIM MARKET, BY PRODUCT (2016-2028)

TABLE 032. SOUTH AMERICA ESIM MARKET, BY END-USERS (2016-2028)

TABLE 033. ESIM MARKET, BY COUNTRY (2016-2028)

TABLE 034. INFINEON TECHNOLOGIES AG (GERMANY): SNAPSHOT

TABLE 035. INFINEON TECHNOLOGIES AG (GERMANY): BUSINESS PERFORMANCE

TABLE 036. INFINEON TECHNOLOGIES AG (GERMANY): PRODUCT PORTFOLIO

TABLE 037. INFINEON TECHNOLOGIES AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. STMICROELECTRONICS (SWITZERLAND): SNAPSHOT

TABLE 038. STMICROELECTRONICS (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 039. STMICROELECTRONICS (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 040. STMICROELECTRONICS (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. DEUTSCHE TELEKOM AG (GERMANY): SNAPSHOT

TABLE 041. DEUTSCHE TELEKOM AG (GERMANY): BUSINESS PERFORMANCE

TABLE 042. DEUTSCHE TELEKOM AG (GERMANY): PRODUCT PORTFOLIO

TABLE 043. DEUTSCHE TELEKOM AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. GIESECKE+DEVRIENT MOBILE SECURITY GMBH (GERMANY): SNAPSHOT

TABLE 044. GIESECKE+DEVRIENT MOBILE SECURITY GMBH (GERMANY): BUSINESS PERFORMANCE

TABLE 045. GIESECKE+DEVRIENT MOBILE SECURITY GMBH (GERMANY): PRODUCT PORTFOLIO

TABLE 046. GIESECKE+DEVRIENT MOBILE SECURITY GMBH (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. THALES GROUP (FRANCE): SNAPSHOT

TABLE 047. THALES GROUP (FRANCE): BUSINESS PERFORMANCE

TABLE 048. THALES GROUP (FRANCE): PRODUCT PORTFOLIO

TABLE 049. THALES GROUP (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. KORE WIRELESS (US): SNAPSHOT

TABLE 050. KORE WIRELESS (US): BUSINESS PERFORMANCE

TABLE 051. KORE WIRELESS (US): PRODUCT PORTFOLIO

TABLE 052. KORE WIRELESS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. ARM LIMITED (UK): SNAPSHOT

TABLE 053. ARM LIMITED (UK): BUSINESS PERFORMANCE

TABLE 054. ARM LIMITED (UK): PRODUCT PORTFOLIO

TABLE 055. ARM LIMITED (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. TRUPHONE LIMITED (UK): SNAPSHOT

TABLE 056. TRUPHONE LIMITED (UK): BUSINESS PERFORMANCE

TABLE 057. TRUPHONE LIMITED (UK): PRODUCT PORTFOLIO

TABLE 058. TRUPHONE LIMITED (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. WORKZ GROUP (DUBAI): SNAPSHOT

TABLE 059. WORKZ GROUP (DUBAI): BUSINESS PERFORMANCE

TABLE 060. WORKZ GROUP (DUBAI): PRODUCT PORTFOLIO

TABLE 061. WORKZ GROUP (DUBAI): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. SIERRA WIRELESS: SNAPSHOT

TABLE 062. SIERRA WIRELESS: BUSINESS PERFORMANCE

TABLE 063. SIERRA WIRELESS: PRODUCT PORTFOLIO

TABLE 064. SIERRA WIRELESS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. (CANADA): SNAPSHOT

TABLE 065. (CANADA): BUSINESS PERFORMANCE

TABLE 066. (CANADA): PRODUCT PORTFOLIO

TABLE 067. (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. NXP SEMICONDUCTOR (NETHERLANDS): SNAPSHOT

TABLE 068. NXP SEMICONDUCTOR (NETHERLANDS): BUSINESS PERFORMANCE

TABLE 069. NXP SEMICONDUCTOR (NETHERLANDS): PRODUCT PORTFOLIO

TABLE 070. NXP SEMICONDUCTOR (NETHERLANDS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. AT&T (DALLAS): SNAPSHOT

TABLE 071. AT&T (DALLAS): BUSINESS PERFORMANCE

TABLE 072. AT&T (DALLAS): PRODUCT PORTFOLIO

TABLE 073. AT&T (DALLAS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 074. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 075. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 076. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ESIM MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ESIM MARKET OVERVIEW BY PRODUCT

FIGURE 012. BUTADIENE RUBBER MARKET OVERVIEW (2016-2028)

FIGURE 013. STYRENE BUTADIENE RUBBER MARKET OVERVIEW (2016-2028)

FIGURE 014. ACRYLONITRILE BUTADIENE RUBBER MARKET OVERVIEW (2016-2028)

FIGURE 015. NITRILE BUTADIENE RUBBER MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. ESIM MARKET OVERVIEW BY END-USERS

FIGURE 018. AUTOMOBILE INDUSTRIES MARKET OVERVIEW (2016-2028)

FIGURE 019. BUILDING & CONSTRUCTION MARKET OVERVIEW (2016-2028)

FIGURE 020. CONSUMER PRODUCTS INDUSTRIES MARKET OVERVIEW (2016-2028)

FIGURE 021. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA ESIM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE ESIM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC ESIM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA ESIM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA ESIM MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the ESIM Market research report is 2023-2030.

Telefónica, Semtech Corporation, Giesecke+Devrient GmbH, AT&T, Orange, Arm Limited, KORE Wireless, Workz, Oasis Smart-SIM, Vodafone Group, STMicroelectronics, Thales, Deutsche Telekom AG, NXP Semiconductors, Infineon Technologies AG, Telit, IDEMIA, TP Global Operations Limited, Sinch, Singtel, Etisalat, Other Major Players.

The ESIM Market is segmented into Component, Application, Vertical, and region. By Component, the market is categorized into Hardware, Services. By Application, the market is categorized into Connected Cars, Laptops, M2M, Smartphones, Tablets, Others. By Vertical, the market is categorized into Automotive, Consumer Electronics, Energy & Utilities, Manufacturing, Retail, Transportation & Logistics. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The eSIM (embedded Subscriber Identity Module) market refers to the rapidly evolving landscape within the telecommunications industry, where traditional physical SIM cards are being replaced by virtual, embedded SIM technology. This innovative approach to mobile connectivity allows consumers and businesses to remotely and seamlessly switch between mobile carriers and plans without the need for a physical SIM card swap. The eSIM market encompasses various stakeholders, including mobile network operators, device manufacturers, and end-users, all contributing to the growth and adoption of this transformative technology.

Global ESIM Market size was valued at USD 1.03 billion in 2022 and is projected to reach USD 4.74 Billion by 2030, growing at a CAGR of 21.02 %from 2023 to 2030.