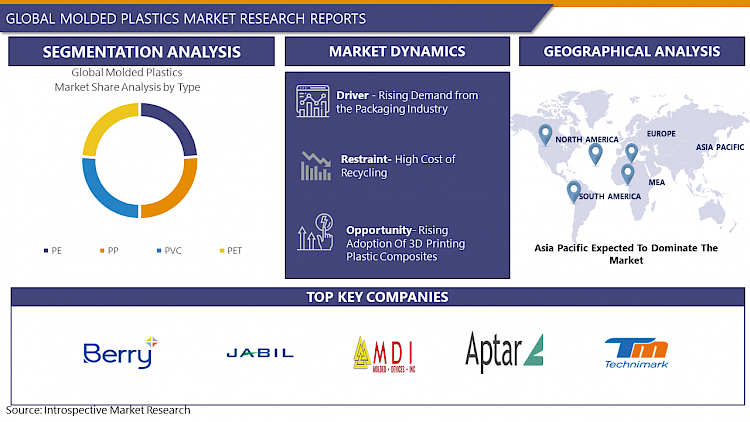

Molded Plastics Market Synopsis

Molded Plastics Market Size Was Valued at USD 801 Billion in 2022, and is Projected to Reach USD 1100 Billion by 2030, Growing at a CAGR of 4.3% From 2023-2030.

Molded plastic refers to the process of shaping and forming plastic materials into specific shapes and structures using various molding techniques. In order to get the required form, it includes heating and melting plastic resins, injecting or pouring the molten plastic into a mold, and letting it cool and solidify. Numerous sectors, including automotive, packaging, consumer goods, electronics, and healthcare, use molded plastic products.

- The initial step in molding plastics is choosing the right plastic resin depending on the required properties of the finished product. Polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), polystyrene (PS), and acrylonitrile butadiene styrene (ABS) are examples of common plastic resin types used in molding. Strength, flexibility, heat resistance, and chemical resistance are just a few of the distinctive qualities that make each resin suitable for a particular purpose.

- There are several molding techniques Hollow plastic items, including bottles, containers, and automobile parts, are frequently made by blow molding. It entails melting plastic resin, expanding it into a mold cavity, then shaping it against the mold walls with compressed air. The completed product is taken from the mold when it has cooled. Plastic goods that are lightweight and durable may be produced in big quantities at a reasonable cost using blow molding.

- Rotational molding, commonly referred to as roto-molding, is a process used to create huge, hollow plastic objects with complicated geometries, such as playground equipment, storage tanks, and automobile parts. An oven is used to rotate a mold that is loaded with plastic resin powder. The heat causes the resin to melt, covering the inside surface of the mold with a thick coating. The completed product is taken from the mold when it has cooled.

Molded Plastics Market Trend Analysis

Rising Demand from the Packaging Industry

- Molded plastics offer lightweight and cost-effective packaging solutions compared to traditional materials like glass or metal. They are adaptable and may be molded into several sizes and forms, giving packaging designs versatility. Molded plastics' capacity to lower transportation costs, use less material, and provide durability while ensuring product safety advantages the packaging business.

- Molded plastics allow for customization and branding options in packaging. They can be easily Molded with intricate designs, logos, and colors, enhancing brand visibility and recognition. Packaging manufacturers can create unique packaging solutions that align with their clients' branding requirements, helping products stand out on store shelves and attract consumer attention.

- Moulded plastics provide possibilities for package improvements, including creative closures, simple-to-open elements, and tamper-evident designs. Using components made of molded plastic, manufacturers may add ease and usability to their packaging solutions. Additionally, there is an increasing focus on sustainable packaging techniques, and molded plastics can help achieve this objective by utilizing recyclable materials and environmentally friendly manufacturing techniques.

- The food and beverage industry are a major consumer of Molded plastic packaging. With the increasing demand for convenience foods, ready-to-eat meals, and on-the-go beverages, there is a need for packaging solutions that provide product protection, hygiene, and extended shelf life.

Rising Adoption Of 3D Printing Plastic Composites Create an Opportunity for Molded Plastics Market

- The need for plastic composites for 3D printing has accelerated the development of new materials. To improve the strength, durability, heat resistance, and conductivity of printed components, manufacturers are experimenting with novel materials and additive combinations. By offering novel materials or formulas that can be employed in conventional molding processes, these material advances can also help the molded plastics sector. These material advancements can be used to increase the performance and application range of molded plastics.

- Complex and specialized designs are made possible by 3D printing, which might be difficult to do with conventional molding procedures. New design and functionality options for products are made possible by the capacity to produce complex geometries and distinctive structures. Molded plastics can make use of 3D printing's design flexibility to add complicated features or create specialized components. Manufacturers may construct hybrid solutions that use 3D-printed elements within molded plastic assemblies, maximizing design options and functionality, by leveraging the advantages of both technologies.

- Rapid prototyping and small-batch production are both common uses for 3D printing. Before investing in large production tooling, it enables speedy iteration and design validation. The 3D printing method may be complemented with molded polymers, which offer a scalable and effective option for higher manufacturing numbers.

Molded Plastics Market Segment Analysis:

Molded Plastics Market Segmented on the basis of type, application.

By Type, PVC segment is expected to dominate the market during the forecast period

- PVC is a highly adaptable substance that can be molded into a variety of forms and sizes, making it useful for a variety of uses. For pipes, fittings, window frames, flooring, and roofing in the building sector.

- PVC is also often used in consumer goods, automotive, packaging, healthcare, and electronic and electrical components. PVC has a wide range of uses, which helps to explain the high market demand for it.

- Furthermore, compared to many other polymers, PVC is a more affordable substance. Manufacturers and end users appreciate it because of its favorable price-performance ratio. PVC is a desirable alternative because of its reduced cost, particularly for large-scale applications where cost reduction is essential, such as building projects or the mass manufacture of consumer items.

By Application, Packaging segment held the largest share of 37% in 2022

- The packaging segment is anticipated to maintain its dominance in the molded plastic market due to a confluence of factors driving its growth. Molded plastics have become integral in the packaging industry owing to their versatility, cost-effectiveness, and lightweight properties. As global demand for efficient and sustainable packaging solutions rises, molded plastics offer a compelling option. Their ability to be molded into various shapes and sizes makes them ideal for custom packaging solutions, meeting diverse industry needs.

- Moreover, molded plastics excel in providing protection for fragile items and perishable goods during transportation, reducing the risk of damage. The packaging industry's emphasis on eco-friendly materials further propels the demand for molded plastics, as advancements in recyclable and biodegradable formulations contribute to sustainability goals.

- Additionally, the consumer goods sector, particularly food and beverages, pharmaceuticals, and personal care products, heavily relies on molded plastics for packaging solutions. With ongoing innovations in packaging design and technology, the molded plastic segment is poised to continue dominating the market, meeting the evolving demands of industries worldwide and contributing to the broader landscape of sustainable and efficient packaging solutions.

Molded Plastics Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific has a large and rapidly growing population, which drives the demand for consumer goods and infrastructure development. As urbanization continues to expand, there is a greater need for molded plastic products in construction, housing, and urban infrastructure projects. The increasing middle-class population in the region also leads to higher consumption of packaged products, boosting the demand for molded plastic packaging.

- Asia Pacific has competitive advantages in terms of labor availability and manufacturing prices. Due to factors including reduced labor costs, an abundance of raw materials, and a supportive regulatory framework, the area enjoys cheaper manufacturing prices. Due to its lower costs, Asia Pacific is a desirable location for multinational corporations and producers looking for efficient supply chains and manufacturing methods.

- A significant manufacturing and export base, Asia-Pacific now provides molded plastic goods to both local and foreign markets. The region's well-established infrastructure and logistical networks make it easy to ship and distribute molded plastic goods internationally. A large amount of money has also been invested in manufacturing technology in Asia and the Pacific, which has boosted output and product quality

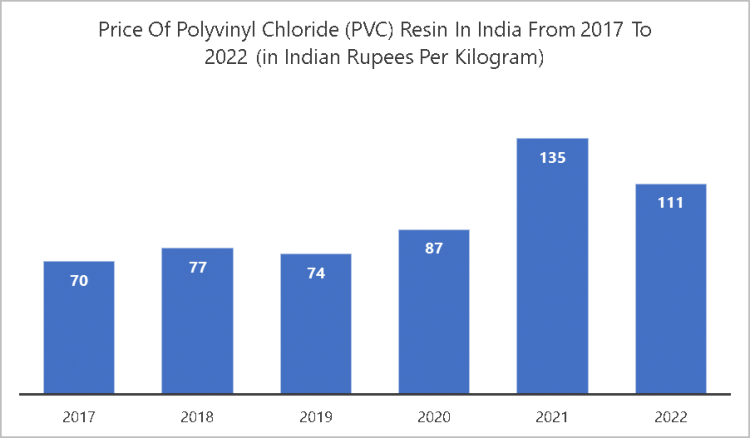

- In 2022, the price of polyvinyl chloride (PVC) resin in India reached 111 Indian rupees per kilogram. Compared to 2017, that was 70 Indian rupees per kilogram. The price increase of PVC was attributed to rising crude oil, natural gas, and coal prices as well as increased demand.

Molded Plastics Market Top Key Players:

- Berry Global Inc. (USA)

- Jabil Inc. (USA)

- Molded Devices, Inc. (USA)

- AptarGroup, Inc. (USA)

- Technimark(USA)

- Quick Plastics, Inc. (USA)

- Plastics One Group (USA)

- Husky Injection Molding Systems Ltd. (Canada)

- Berry Berry Superfos A/S (Denmark)

- Greiner Holding GmbH & Co. KG (Austria)

- Huhtamaki Oyj (Finland)

- DSM (Netherlands)

- AptarGroup Inc. (Luxembourg)

- Sofema S.p.A. (Italy)

- Biesse Group S.p.A. (Italy)

- Wipak AB (Sweden)

- Sinclair Holdings (Malaysia)

- CCP Industries Sdn Bhd (Malaysia)

- Mitsui Chemicals, Inc. (Japan)

- Sekisui Chemical Co., Ltd. (Japan)

- Toyoda Gosei Co., Ltd. (Japan)

- Sumitomo Bakelite Co., Ltd. (Japan)

- Huaying (Zhangzhou) Plastic Products Co., Ltd. (China)

- Dongguan Yulong Precision Mould Co., Ltd. (China)

Key Industry Developments in the Molded Plastics Market:

In September 2023, BASF Launched its Ultramid® B3EG7 BK27F1 HF black polyamide (PA) compound with improved flame retardancy for electrical and electronic applications. This PA offers high heat resistance and meets stringent fire safety standards.

In September 2023, DuPont Unveiled its Zytel® FR90 polyamide (PA) resin for lightweight flame-retardant electrical and electronic components. This PA provides excellent fire resistance while maintaining high strength and mechanical properties.

|

Global Molded Plastics Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 801Bn. |

|

Forecast Period 2023-30 CAGR: |

4.3% |

Market Size in 2030: |

USD 1100 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- MOLDED PLASTICS MARKET BY TYPE (2016-2030)

- MOLDED PLASTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PP

- PVC

- PET

- MOLDED PLASTICS MARKET BY APPLICATION (2016-2030)

- MOLDED PLASTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PACKAGING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AUTOMOTIVE & TRANSPORTATION

- CONSTRUCTION & INFRASTRUCTURE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- MOLDED PLASTICS Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BERRY GLOBAL INC. (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- JABIL INC. (USA)

- MOLDED DEVICES, INC. (USA)

- APTARGROUP, INC. (USA)

- TECHNIMARK (USA)

- QUICK PLASTICS, INC. (USA)

- PLASTICS ONE GROUP (USA)

- HUSKY INJECTION MOLDING SYSTEMS LTD. (CANADA)

- BERRY BERRY SUPERFOS A/S (DENMARK)

- GREINER HOLDING GMBH & CO. KG (AUSTRIA)

- HUHTAMAKI OYJ (FINLAND)

- DSM (NETHERLANDS)

- APTARGROUP INC. (LUXEMBOURG)

- SOFEMA S.P.A. (ITALY)

- BIESSE GROUP S.P.A. (ITALY)

- WIPAK AB (SWEDEN)

- SINCLAIR HOLDINGS (MALAYSIA)

- CCP INDUSTRIES SDN BHD (MALAYSIA)

- MITSUI CHEMICALS, INC. (JAPAN)

- SEKISUI CHEMICAL CO., LTD. (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL MOLDED PLASTICS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Molded Plastics Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 801Bn. |

|

Forecast Period 2023-30 CAGR: |

4.3% |

Market Size in 2030: |

USD 1100 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MOLDED PLASTICS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MOLDED PLASTICS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MOLDED PLASTICS MARKET COMPETITIVE RIVALRY

TABLE 005. MOLDED PLASTICS MARKET THREAT OF NEW ENTRANTS

TABLE 006. MOLDED PLASTICS MARKET THREAT OF SUBSTITUTES

TABLE 007. MOLDED PLASTICS MARKET BY TYPE

TABLE 008. PE MARKET OVERVIEW (2016-2030)

TABLE 009. PP MARKET OVERVIEW (2016-2030)

TABLE 010. PVC MARKET OVERVIEW (2016-2030)

TABLE 011. PET MARKET OVERVIEW (2016-2030)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 013. MOLDED PLASTICS MARKET BY APPLICATION

TABLE 014. PACKAGING MARKET OVERVIEW (2016-2030)

TABLE 015. AUTOMOTIVE & TRANSPORTATION MARKET OVERVIEW (2016-2030)

TABLE 016. CONSTRUCTION & INFRASTRUCTURE MARKET OVERVIEW (2016-2030)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 018. NORTH AMERICA MOLDED PLASTICS MARKET, BY TYPE (2016-2030)

TABLE 019. NORTH AMERICA MOLDED PLASTICS MARKET, BY APPLICATION (2016-2030)

TABLE 020. N MOLDED PLASTICS MARKET, BY COUNTRY (2016-2030)

TABLE 021. EASTERN EUROPE MOLDED PLASTICS MARKET, BY TYPE (2016-2030)

TABLE 022. EASTERN EUROPE MOLDED PLASTICS MARKET, BY APPLICATION (2016-2030)

TABLE 023. MOLDED PLASTICS MARKET, BY COUNTRY (2016-2030)

TABLE 024. WESTERN EUROPE MOLDED PLASTICS MARKET, BY TYPE (2016-2030)

TABLE 025. WESTERN EUROPE MOLDED PLASTICS MARKET, BY APPLICATION (2016-2030)

TABLE 026. MOLDED PLASTICS MARKET, BY COUNTRY (2016-2030)

TABLE 027. ASIA PACIFIC MOLDED PLASTICS MARKET, BY TYPE (2016-2030)

TABLE 028. ASIA PACIFIC MOLDED PLASTICS MARKET, BY APPLICATION (2016-2030)

TABLE 029. MOLDED PLASTICS MARKET, BY COUNTRY (2016-2030)

TABLE 030. MIDDLE EAST & AFRICA MOLDED PLASTICS MARKET, BY TYPE (2016-2030)

TABLE 031. MIDDLE EAST & AFRICA MOLDED PLASTICS MARKET, BY APPLICATION (2016-2030)

TABLE 032. MOLDED PLASTICS MARKET, BY COUNTRY (2016-2030)

TABLE 033. SOUTH AMERICA MOLDED PLASTICS MARKET, BY TYPE (2016-2030)

TABLE 034. SOUTH AMERICA MOLDED PLASTICS MARKET, BY APPLICATION (2016-2030)

TABLE 035. MOLDED PLASTICS MARKET, BY COUNTRY (2016-2030)

TABLE 036. BERRY GLOBAL INC. (USA): SNAPSHOT

TABLE 037. BERRY GLOBAL INC. (USA): BUSINESS PERFORMANCE

TABLE 038. BERRY GLOBAL INC. (USA): PRODUCT PORTFOLIO

TABLE 039. BERRY GLOBAL INC. (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. LYONDELLBASELL INDUSTRIES (NETHERLANDS): SNAPSHOT

TABLE 040. LYONDELLBASELL INDUSTRIES (NETHERLANDS): BUSINESS PERFORMANCE

TABLE 041. LYONDELLBASELL INDUSTRIES (NETHERLANDS): PRODUCT PORTFOLIO

TABLE 042. LYONDELLBASELL INDUSTRIES (NETHERLANDS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. DOW CHEMICAL COMPANY (USA): SNAPSHOT

TABLE 043. DOW CHEMICAL COMPANY (USA): BUSINESS PERFORMANCE

TABLE 044. DOW CHEMICAL COMPANY (USA): PRODUCT PORTFOLIO

TABLE 045. DOW CHEMICAL COMPANY (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. EXXON MOBIL CORPORATION (USA): SNAPSHOT

TABLE 046. EXXON MOBIL CORPORATION (USA): BUSINESS PERFORMANCE

TABLE 047. EXXON MOBIL CORPORATION (USA): PRODUCT PORTFOLIO

TABLE 048. EXXON MOBIL CORPORATION (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. SABIC (SAUDI ARABIA): SNAPSHOT

TABLE 049. SABIC (SAUDI ARABIA): BUSINESS PERFORMANCE

TABLE 050. SABIC (SAUDI ARABIA): PRODUCT PORTFOLIO

TABLE 051. SABIC (SAUDI ARABIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. BASF SE (GERMANY): SNAPSHOT

TABLE 052. BASF SE (GERMANY): BUSINESS PERFORMANCE

TABLE 053. BASF SE (GERMANY): PRODUCT PORTFOLIO

TABLE 054. BASF SE (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. MITSUBISHI CHEMICAL (JAPAN): SNAPSHOT

TABLE 055. MITSUBISHI CHEMICAL (JAPAN): BUSINESS PERFORMANCE

TABLE 056. MITSUBISHI CHEMICAL (JAPAN): PRODUCT PORTFOLIO

TABLE 057. MITSUBISHI CHEMICAL (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. DUPONT DE NEMOURS INC. (USA): SNAPSHOT

TABLE 058. DUPONT DE NEMOURS INC. (USA): BUSINESS PERFORMANCE

TABLE 059. DUPONT DE NEMOURS INC. (USA): PRODUCT PORTFOLIO

TABLE 060. DUPONT DE NEMOURS INC. (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. RELIANCE INDUSTRIES (INDIA): SNAPSHOT

TABLE 061. RELIANCE INDUSTRIES (INDIA): BUSINESS PERFORMANCE

TABLE 062. RELIANCE INDUSTRIES (INDIA): PRODUCT PORTFOLIO

TABLE 063. RELIANCE INDUSTRIES (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. COVESTRO AG (GERMANY): SNAPSHOT

TABLE 064. COVESTRO AG (GERMANY): BUSINESS PERFORMANCE

TABLE 065. COVESTRO AG (GERMANY): PRODUCT PORTFOLIO

TABLE 066. COVESTRO AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. EASTMAN CHEMICAL COMPANY (USA): SNAPSHOT

TABLE 067. EASTMAN CHEMICAL COMPANY (USA): BUSINESS PERFORMANCE

TABLE 068. EASTMAN CHEMICAL COMPANY (USA): PRODUCT PORTFOLIO

TABLE 069. EASTMAN CHEMICAL COMPANY (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. FORMOSA PLASTICS CORPORATION (TAIWAN): SNAPSHOT

TABLE 070. FORMOSA PLASTICS CORPORATION (TAIWAN): BUSINESS PERFORMANCE

TABLE 071. FORMOSA PLASTICS CORPORATION (TAIWAN): PRODUCT PORTFOLIO

TABLE 072. FORMOSA PLASTICS CORPORATION (TAIWAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. LG CHEM LTD. (SOUTH KOREA): SNAPSHOT

TABLE 073. LG CHEM LTD. (SOUTH KOREA): BUSINESS PERFORMANCE

TABLE 074. LG CHEM LTD. (SOUTH KOREA): PRODUCT PORTFOLIO

TABLE 075. LG CHEM LTD. (SOUTH KOREA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. INEOS GROUP (U.K): SNAPSHOT

TABLE 076. INEOS GROUP (U.K): BUSINESS PERFORMANCE

TABLE 077. INEOS GROUP (U.K): PRODUCT PORTFOLIO

TABLE 078. INEOS GROUP (U.K): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. ARKEMA S.A. (FRANCE): SNAPSHOT

TABLE 079. ARKEMA S.A. (FRANCE): BUSINESS PERFORMANCE

TABLE 080. ARKEMA S.A. (FRANCE): PRODUCT PORTFOLIO

TABLE 081. ARKEMA S.A. (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 082. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 083. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 084. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MOLDED PLASTICS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MOLDED PLASTICS MARKET OVERVIEW BY TYPE

FIGURE 012. PE MARKET OVERVIEW (2016-2030)

FIGURE 013. PP MARKET OVERVIEW (2016-2030)

FIGURE 014. PVC MARKET OVERVIEW (2016-2030)

FIGURE 015. PET MARKET OVERVIEW (2016-2030)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 017. MOLDED PLASTICS MARKET OVERVIEW BY APPLICATION

FIGURE 018. PACKAGING MARKET OVERVIEW (2016-2030)

FIGURE 019. AUTOMOTIVE & TRANSPORTATION MARKET OVERVIEW (2016-2030)

FIGURE 020. CONSTRUCTION & INFRASTRUCTURE MARKET OVERVIEW (2016-2030)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 022. NORTH AMERICA MOLDED PLASTICS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 023. EASTERN EUROPE MOLDED PLASTICS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 024. WESTERN EUROPE MOLDED PLASTICS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 025. ASIA PACIFIC MOLDED PLASTICS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 026. MIDDLE EAST & AFRICA MOLDED PLASTICS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 027. SOUTH AMERICA MOLDED PLASTICS MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Molded Plastics Market research report is 2023-2030.

Berry Global Inc. (USA), Jabil Inc. (USA), Molded Devices, Inc. (USA), AptarGroup, Inc. (USA), Technimark (USA), Quick Plastics, Inc. (USA), Plastics One Group (USA), Husky Injection Molding Systems Ltd. (Canada), Berry Berry Superfos A/S (Denmark), Greiner Holding GmbH & Co. KG (Austria), Huhtamaki Oyj (Finland), DSM (Netherlands), AptarGroup Inc. (Luxembourg), Sofema S.p.A. (Italy), Biesse Group S.p.A. (Italy), Wipak AB (Sweden), Sinclair Holdings (Malaysia), CCP Industries Sdn Bhd (Malaysia), Mitsui Chemicals, Inc. (Japan), Sekisui Chemical Co., Ltd. (Japan),Toyoda Gosei Co., Ltd. (Japan), Sumitomo Bakelite Co., Ltd. (Japan), Huaying (Zhangzhou) Plastic Products Co., Ltd. (China), Dongguan Yulong Precision Mould Co., Ltd. (China) and Other Major Players.

The Molded Plastics Market is segmented into Type, Application, and Region. By Type, the market is categorized PE, PP, PVC, PET. By Application, the market is categorized into Packaging, Automotive & Transportation, Construction & Infrastructure. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Molded plastic refers to the process of shaping and forming plastic materials into specific shapes and structures using various molding techniques. In order to get the required form, it includes heating and melting plastic resins, injecting or pouring the molten plastic into a mold, and letting it cool and solidify. Numerous sectors, including automotive, packaging, consumer goods, electronics, and healthcare, use molded plastic products.

Molded Plastics Market Size Was Valued at USD 801 Billion in 2022, and is Projected to Reach USD 1100 Billion by 2030, Growing at a CAGR of 4.3% From 2023-2030.