Wire Market Synopsis

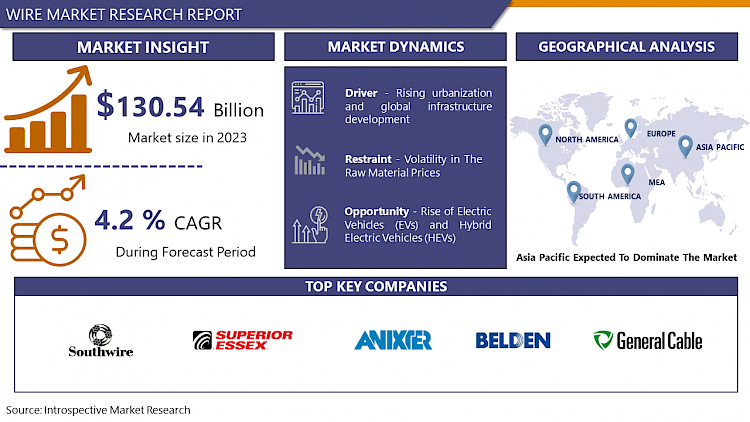

Wire Market Size Was Valued at USD 130.54 Billion in 2023, and is Projected to Reach USD 189.04 Billion by 2032, Growing at a CAGR of 4.2 % From 2024-2032

A wire is a flexible, round metal bar used to bear mechanical loads, often in the form of wire rope. In electricity and telecommunications signals, a wire can refer to an electrical cable with a solid core or separate strands. Wire can be cylindrical, square, hexagonal, flattened rectangular, or other cross-sections, used for decorative or technical purposes. Edge-wound coil springs, like the Slinky toy, are made of special flattened wire.

- Wire is essential across various industries due to its adaptability, conductivity, and resilience. Its flexibility enables it to be utilized in diverse settings, from household electrical systems to telecommunications networks and automotive components. With its efficient conductivity, wire facilitates the transmission of electricity over long distances with minimal loss. its durability ensures reliability in critical applications, sustaining operations across industrial sectors.

- The demand for wire continues to grow in response to urbanization, industrial expansion, and technological advancements. Urban development necessitates extensive electrical infrastructure, while industries rely on robust wiring solutions for machinery and automation. the rising adoption of electric vehicles and renewable energy sources further propels wire demand.

- Market trends indicate a shift towards sustainability and efficiency. Manufacturers are increasingly integrating eco-friendly materials and processes to meet environmental standards and consumer preferences. Innovations such as smart wires, equipped with IoT technology, are revolutionizing the industry by offering advanced monitoring and control capabilities.

- Wire is a vital component of modern civilization, enabling efficient and reliable systems like powering homes and facilitating global communication networks. As economies evolve and technologies advance, the demand for wire increases, reflecting its indispensable role in sustaining our way of life. Emerging trends like 5G deployment, electric vehicle adoption, and renewable energy integration are expected to further shape the wire market, shaping industries and societies for years to come.

Wire Market Trend Analysis

Rising urbanization and global infrastructure development

- The wire market is significantly influenced by increasing urbanization and ongoing global infrastructure development. As cities expand and infrastructure projects proliferate worldwide, there is a growing need for wires in various applications such as residential and commercial buildings, transportation systems, and energy distribution networks. Wires play a critical role in facilitating electrical power transmission, telecommunications, and data connectivity essential for modern urban living.

- In densely populated urban areas, efficient wire solutions are crucial to ensure smooth communication, reliable power supply, and effective transportation. Additionally, with the rise of smart cities and the integration of advanced technologies, there is a heightened demand for high-quality wires capable of supporting data-intensive applications.

- The global emphasis on sustainability drives the demand for energy-efficient wire solutions designed to enhance energy transmission while minimizing environmental impact. Overall, with urbanization and infrastructure development continuing to accelerate, the wire market is poised for sustained growth to meet the evolving needs of modern societies.

Rise of Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs)

- The emergence of Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs) presents a notable opportunity for the wire market. As the global trend shifts towards eco-friendly transportation options to mitigate carbon emissions and address environmental concerns, the demand for electric and hybrid vehicles is rapidly expanding. Wires play a pivotal role in the production of these vehicles, fulfilling crucial functions such as power distribution, charging infrastructure, and connectivity systems.

- Within EVs and HEVs, wires are essential for transmitting power from the battery to the electric motors and facilitating communication between various vehicle components. Moreover, the charging infrastructure supporting electric vehicles relies heavily on wires to efficiently transfer electricity from the grid to the vehicle's battery.

- The growing adoption of electric and hybrid vehicles also drives advancements in wire technology, leading to the creation of lighter, more durable, and higher-capacity wires tailored to meet the specific demands of these vehicles. Additionally, with governments worldwide implementing incentives and regulations to encourage electric vehicle adoption, the demand for wires in this sector is poised for continuous growth, offering substantial opportunities for manufacturers and suppliers in the wire market.

Wire Market Segment Analysis:

Wire Market Segmented based on Type, Voltage, Application, Installation, and End-User.

By Type, the Copper Wire segment is expected to dominate the market during the forecast period

- The copper wire segment is poised to lead the wire market for several reasons. Firstly, copper's exceptional conductivity, durability, and resistance to corrosion have long made it the preferred material for wiring across diverse industries like construction, electronics, automotive, and telecommunications. the escalating global demand for electricity, propelled by urbanization, industrialization, and infrastructure expansion, drives the necessity for copper wires. Copper remains the material of choice due to its efficiency in conducting electricity over long distances while minimizing energy loss.

- Moreover, the surge in electric vehicles, renewable energy systems, and smart technologies further amplifies the demand for copper wires. Electric vehicles require significant amounts of copper for wiring harnesses and batteries, while renewable energy systems such as solar and wind farms depend on copper for effective power generation and distribution.

- Copper's recyclability and sustainability reinforce its prominence in the wire market, aligning with the growing focus on environmentally friendly materials and practices. Overall, the combination of copper's inherent qualities, adaptability, and increasing demand in various sectors positions it as the dominant force in the wire market.

By Voltage, Low Voltage segment is expected to dominate the market during the forecast period

- The low voltage segment is poised to dominate the wire market due to several key reasons. Firstly, these wires are extensively utilized in residential, commercial, and industrial settings to power lighting systems, appliances, and machinery. As urbanization and industrialization continue to expand, there's a heightened demand for infrastructure development, consequently driving the need for low-voltage wires.

- Additionally, the increasing uptake of renewable energy sources like solar and wind power necessitates the installation of low-voltage wiring systems to link these sources to the electrical grid and distribution networks. Moreover, the growing trend toward smart homes and buildings, equipped with interconnected devices and systems, further amplifies the requirement for low voltage wires for data transmission and communication purposes.

- Furthermore, technological advancements have led to the emergence of energy-efficient appliances and electronic devices that operate at lower voltages, thereby fueling the demand for compatible low-voltage wiring solutions. Overall, the adaptability, widespread application, and technological progress in low-voltage wiring position this segment to dominate the wire market.

Wire Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia Pacific is poised to lead the wire market due to several key factors. Firstly, the region is undergoing rapid urbanization and industrialization, driving up the demand for wires across various sectors including construction, automotive, electronics, and telecommunications. With a growing population and expanding economies, there is a significant need for wire products in infrastructure development, such as building construction, power transmission, and telecommunications networks.

- Asia Pacific boasts several emerging economies like China, India, and countries in Southeast Asia, which are experiencing substantial growth in manufacturing activities. This growth further boosts the demand for wires in industries like automotive manufacturing, electronics production, and consumer goods manufacturing. Supportive government initiatives, such as infrastructure investments and incentives for renewable energy adoption, contribute to the region's dominance in the wire market.

- The presence of major wire manufacturers and suppliers in countries such as China, Japan, South Korea, and India strengthens Asia Pacific's position as the leading player in the global wire market. Overall, the combination of economic growth, infrastructure development, and favorable government policies positions Asia Pacific as the frontrunner in the wire market.

Wire Market Top Key Players:

- Southwire Company, LLC (US)

- Superior Essex Inc. (US)

- Anixter International Inc. (US)

- Belden Inc. (US)

- General Cable Corporation (US)

- Encore Wire Corporation (US)

- TPC Wire & Cable Corp. (US)

- Okonite Company (US)

- Leoni AG (Germany)

- LS Cable & System Ltd. (South Korea)

- Taihan Electric Wire Co., Ltd. (South Korea)

- NKT A/S (Denmark)

- Prysmian Group (Italy)

- Nexans S.A. (France)

- Sumitomo Electric Industries, Ltd. (Japan)

- Furukawa Electric Co., Ltd. (Japan)

- Fujikura Ltd. (Japan)

- Hitachi Metals, Ltd. (Japan)

- Hengtong Group (China)

- Jiangsu Shangshang Cable Group Co., Ltd. (China)

- KEI Industries Limited (India)

- Polycab India Limited (India)

- Finolex Cables Ltd. (India)

- LS-VINA Cable & System Co., Ltd. (Vietnam)

- KEF Holdings (United Arab Emirates), and Other Major Players.

Key Industry Developments in the Wire Market:

- In May 2023, LS Cable and System announced plans to invest $26.9 million in expanding its Tarboro facility located in North Carolina, USA. The investment, provided by the wire and cable manufacturer, aims to enhance the production capacity of low and medium-voltage cables. Over the next three years, the factory expansion project will be implemented. Currently, the Tarboro plant, which employs 188 individuals, is set to add 86 new jobs as a result of this expansion initiative.

- In April 2023, Amedeon received aviation-quality cables from Nexans for its IMOCA vessel, Fabrice. Nexans supplied Amedeo's technical team with nine variants of lightweight, secure, flexible, and efficient flight cables, totaling 2,655 meters in length, to meet the specific restrictions of the IMOCA class. This partnership with Nexans allowed for the utilization of high-quality cables and contributed to the ongoing development of the vessel.

|

Global Wire Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 130.54 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.2 % |

Market Size in 2032: |

USD 189.04 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Voltage |

|

||

|

By Application |

|

||

|

By Installation |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- WIRE MARKET BY TYPE (2017-2032)

- WIRE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- COPPER WIRE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ALUMINUM WIRE

- STEEL WIRE

- BRASS WIRE

- WIRE MARKET BY VOLTAGE (2017-2032)

- WIRE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LOW VOLTAGE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MEDIUM VOLTAGE

- HIGH VOLTAGE

- EXTRA-HIGH VOLTAGE

- WIRE MARKET BY APPLICATION (2017-2032)

- WIRE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ELECTRICAL WIRE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INDUSTRIAL WIRE

- RESIDENTIAL WIRE

- SPECIALTY WIRE

- WIRE MARKET BY INSTALLATION (2017-2032)

- WIRE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- OVERHEAD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- UNDERGROUND

- WIRE MARKET BY END-USER (2017-2032)

- WIRE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONSTRUCTION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AUTOMOTIVE

- ELECTRONICS

- TELECOMMUNICATIONS

- AEROSPACE

- ENERGY & POWER

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Wire Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- SOUTHWIRE COMPANY, LLC (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- SUPERIOR ESSEX INC. (US)

- ANIXTER INTERNATIONAL INC. (US)

- BELDEN INC. (US)

- GENERAL CABLE CORPORATION (US)

- ENCORE WIRE CORPORATION (US)

- TPC WIRE & CABLE CORP. (US)

- OKONITE COMPANY (US)

- LEONI AG (GERMANY)

- LS CABLE & SYSTEM LTD. (SOUTH KOREA)

- TAIHAN ELECTRIC WIRE CO., LTD. (SOUTH KOREA)

- NKT A/S (DENMARK)

- PRYSMIAN GROUP (ITALY)

- NEXANS S.A. (FRANCE)

- SUMITOMO ELECTRIC INDUSTRIES, LTD. (JAPAN)

- FURUKAWA ELECTRIC CO., LTD. (JAPAN)

- FUJIKURA LTD. (JAPAN)

- HITACHI METALS, LTD. (JAPAN)

- HENGTONG GROUP (CHINA)

- JIANGSU SHANGSHANG CABLE GROUP CO., LTD. (CHINA)

- KEI INDUSTRIES LIMITED (INDIA)

- POLYCAB INDIA LIMITED (INDIA)

- FINOLEX CABLES LTD. (INDIA)

- LS-VINA CABLE & SYSTEM CO., LTD. (VIETNAM)

- KEF HOLDINGS (UNITED ARAB EMIRATES)

- COMPETITIVE LANDSCAPE

- GLOBAL WIRE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Voltage

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Installation

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Wire Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 130.54 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.2 % |

Market Size in 2032: |

USD 189.04 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Voltage |

|

||

|

By Application |

|

||

|

By Installation |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. WIRE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. WIRE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. WIRE MARKET COMPETITIVE RIVALRY

TABLE 005. WIRE MARKET THREAT OF NEW ENTRANTS

TABLE 006. WIRE MARKET THREAT OF SUBSTITUTES

TABLE 007. WIRE MARKET BY VOLTAGE

TABLE 008. LOW VOLTAGE MARKET OVERVIEW (2016-2030)

TABLE 009. MEDIUM VOLTAGE MARKET OVERVIEW (2016-2030)

TABLE 010. HIGH VOLTAGE MARKET OVERVIEW (2016-2030)

TABLE 011. EXTRA-HIGH VOLTAGE MARKET OVERVIEW (2016-2030)

TABLE 012. WIRE MARKET BY INSTALLATION

TABLE 013. OVERHEAD MARKET OVERVIEW (2016-2030)

TABLE 014. UNDERGROUND MARKET OVERVIEW (2016-2030)

TABLE 015. WIRE MARKET BY APPLICATION

TABLE 016. BUILDING WIRE MARKET OVERVIEW (2016-2030)

TABLE 017. POWER DISTRIBUTION MARKET OVERVIEW (2016-2030)

TABLE 018. COMMUNICATION MARKET OVERVIEW (2016-2030)

TABLE 019. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 020. WIRE MARKET BY END-USER INDUSTRY

TABLE 021. AUTOMOTIVE MARKET OVERVIEW (2016-2030)

TABLE 022. CONSTRUCTION MARKET OVERVIEW (2016-2030)

TABLE 023. ENERGY AND POWER MARKET OVERVIEW (2016-2030)

TABLE 024. AGRICULTURE MARKET OVERVIEW (2016-2030)

TABLE 025. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 026. NORTH AMERICA WIRE MARKET, BY VOLTAGE (2016-2030)

TABLE 027. NORTH AMERICA WIRE MARKET, BY INSTALLATION (2016-2030)

TABLE 028. NORTH AMERICA WIRE MARKET, BY APPLICATION (2016-2030)

TABLE 029. NORTH AMERICA WIRE MARKET, BY END-USER INDUSTRY (2016-2030)

TABLE 030. N WIRE MARKET, BY COUNTRY (2016-2030)

TABLE 031. EASTERN EUROPE WIRE MARKET, BY VOLTAGE (2016-2030)

TABLE 032. EASTERN EUROPE WIRE MARKET, BY INSTALLATION (2016-2030)

TABLE 033. EASTERN EUROPE WIRE MARKET, BY APPLICATION (2016-2030)

TABLE 034. EASTERN EUROPE WIRE MARKET, BY END-USER INDUSTRY (2016-2030)

TABLE 035. WIRE MARKET, BY COUNTRY (2016-2030)

TABLE 036. WESTERN EUROPE WIRE MARKET, BY VOLTAGE (2016-2030)

TABLE 037. WESTERN EUROPE WIRE MARKET, BY INSTALLATION (2016-2030)

TABLE 038. WESTERN EUROPE WIRE MARKET, BY APPLICATION (2016-2030)

TABLE 039. WESTERN EUROPE WIRE MARKET, BY END-USER INDUSTRY (2016-2030)

TABLE 040. WIRE MARKET, BY COUNTRY (2016-2030)

TABLE 041. ASIA PACIFIC WIRE MARKET, BY VOLTAGE (2016-2030)

TABLE 042. ASIA PACIFIC WIRE MARKET, BY INSTALLATION (2016-2030)

TABLE 043. ASIA PACIFIC WIRE MARKET, BY APPLICATION (2016-2030)

TABLE 044. ASIA PACIFIC WIRE MARKET, BY END-USER INDUSTRY (2016-2030)

TABLE 045. WIRE MARKET, BY COUNTRY (2016-2030)

TABLE 046. MIDDLE EAST & AFRICA WIRE MARKET, BY VOLTAGE (2016-2030)

TABLE 047. MIDDLE EAST & AFRICA WIRE MARKET, BY INSTALLATION (2016-2030)

TABLE 048. MIDDLE EAST & AFRICA WIRE MARKET, BY APPLICATION (2016-2030)

TABLE 049. MIDDLE EAST & AFRICA WIRE MARKET, BY END-USER INDUSTRY (2016-2030)

TABLE 050. WIRE MARKET, BY COUNTRY (2016-2030)

TABLE 051. SOUTH AMERICA WIRE MARKET, BY VOLTAGE (2016-2030)

TABLE 052. SOUTH AMERICA WIRE MARKET, BY INSTALLATION (2016-2030)

TABLE 053. SOUTH AMERICA WIRE MARKET, BY APPLICATION (2016-2030)

TABLE 054. SOUTH AMERICA WIRE MARKET, BY END-USER INDUSTRY (2016-2030)

TABLE 055. WIRE MARKET, BY COUNTRY (2016-2030)

TABLE 056. SOUTHWIRE COMPANY LLC: SNAPSHOT

TABLE 057. SOUTHWIRE COMPANY LLC: BUSINESS PERFORMANCE

TABLE 058. SOUTHWIRE COMPANY LLC: PRODUCT PORTFOLIO

TABLE 059. SOUTHWIRE COMPANY LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. NEXANS: SNAPSHOT

TABLE 060. NEXANS: BUSINESS PERFORMANCE

TABLE 061. NEXANS: PRODUCT PORTFOLIO

TABLE 062. NEXANS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. BELDEN INC.: SNAPSHOT

TABLE 063. BELDEN INC.: BUSINESS PERFORMANCE

TABLE 064. BELDEN INC.: PRODUCT PORTFOLIO

TABLE 065. BELDEN INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. PRYSMIAN S.P.A: SNAPSHOT

TABLE 066. PRYSMIAN S.P.A: BUSINESS PERFORMANCE

TABLE 067. PRYSMIAN S.P.A: PRODUCT PORTFOLIO

TABLE 068. PRYSMIAN S.P.A: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. FURUKAWA ELECTRIC CO. LTD.: SNAPSHOT

TABLE 069. FURUKAWA ELECTRIC CO. LTD.: BUSINESS PERFORMANCE

TABLE 070. FURUKAWA ELECTRIC CO. LTD.: PRODUCT PORTFOLIO

TABLE 071. FURUKAWA ELECTRIC CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. SUMITOMO ELECTRIC INDUSTRIES LTD.: SNAPSHOT

TABLE 072. SUMITOMO ELECTRIC INDUSTRIES LTD.: BUSINESS PERFORMANCE

TABLE 073. SUMITOMO ELECTRIC INDUSTRIES LTD.: PRODUCT PORTFOLIO

TABLE 074. SUMITOMO ELECTRIC INDUSTRIES LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. FUJIKURA LTD.: SNAPSHOT

TABLE 075. FUJIKURA LTD.: BUSINESS PERFORMANCE

TABLE 076. FUJIKURA LTD.: PRODUCT PORTFOLIO

TABLE 077. FUJIKURA LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. LEONI AG: SNAPSHOT

TABLE 078. LEONI AG: BUSINESS PERFORMANCE

TABLE 079. LEONI AG: PRODUCT PORTFOLIO

TABLE 080. LEONI AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. TONGLING JINGDA SPECIAL MAGNET WIRE CO. LTD.: SNAPSHOT

TABLE 081. TONGLING JINGDA SPECIAL MAGNET WIRE CO. LTD.: BUSINESS PERFORMANCE

TABLE 082. TONGLING JINGDA SPECIAL MAGNET WIRE CO. LTD.: PRODUCT PORTFOLIO

TABLE 083. TONGLING JINGDA SPECIAL MAGNET WIRE CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. LS CABLE & SYSTEM LTD.: SNAPSHOT

TABLE 084. LS CABLE & SYSTEM LTD.: BUSINESS PERFORMANCE

TABLE 085. LS CABLE & SYSTEM LTD.: PRODUCT PORTFOLIO

TABLE 086. LS CABLE & SYSTEM LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. VON ROLL: SNAPSHOT

TABLE 087. VON ROLL: BUSINESS PERFORMANCE

TABLE 088. VON ROLL: PRODUCT PORTFOLIO

TABLE 089. VON ROLL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 090. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 091. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 092. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. WIRE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. WIRE MARKET OVERVIEW BY VOLTAGE

FIGURE 012. LOW VOLTAGE MARKET OVERVIEW (2016-2030)

FIGURE 013. MEDIUM VOLTAGE MARKET OVERVIEW (2016-2030)

FIGURE 014. HIGH VOLTAGE MARKET OVERVIEW (2016-2030)

FIGURE 015. EXTRA-HIGH VOLTAGE MARKET OVERVIEW (2016-2030)

FIGURE 016. WIRE MARKET OVERVIEW BY INSTALLATION

FIGURE 017. OVERHEAD MARKET OVERVIEW (2016-2030)

FIGURE 018. UNDERGROUND MARKET OVERVIEW (2016-2030)

FIGURE 019. WIRE MARKET OVERVIEW BY APPLICATION

FIGURE 020. BUILDING WIRE MARKET OVERVIEW (2016-2030)

FIGURE 021. POWER DISTRIBUTION MARKET OVERVIEW (2016-2030)

FIGURE 022. COMMUNICATION MARKET OVERVIEW (2016-2030)

FIGURE 023. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 024. WIRE MARKET OVERVIEW BY END-USER INDUSTRY

FIGURE 025. AUTOMOTIVE MARKET OVERVIEW (2016-2030)

FIGURE 026. CONSTRUCTION MARKET OVERVIEW (2016-2030)

FIGURE 027. ENERGY AND POWER MARKET OVERVIEW (2016-2030)

FIGURE 028. AGRICULTURE MARKET OVERVIEW (2016-2030)

FIGURE 029. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 030. NORTH AMERICA WIRE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 031. EASTERN EUROPE WIRE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 032. WESTERN EUROPE WIRE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 033. ASIA PACIFIC WIRE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 034. MIDDLE EAST & AFRICA WIRE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 035. SOUTH AMERICA WIRE MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Wire Market research report is 2024-2032.

Southwire Company, LLC (US), Superior Essex Inc. (US), Anixter International Inc. (US), Belden Inc. (US), General Cable Corporation (US), Encore Wire Corporation (US), TPC Wire & Cable Corp. (US), Okonite Company (US), Leoni AG (Germany), LS Cable & System Ltd. (South Korea), Taihan Electric Wire Co., Ltd. (South Korea), NKT A/S (Denmark), Prysmian Group (Italy), Nexans S.A. (France), Sumitomo Electric Industries, Ltd. (Japan), Furukawa Electric Co., Ltd. (Japan), Fujikura Ltd. (Japan), Hitachi Metals, Ltd. (Japan), Hengtong Group (China), Jiangsu Shangshang Cable Group Co., Ltd. (China), KEI Industries Limited (India), Polycab India Limited (India), Finolex Cables Ltd. (India), LS-VINA Cable & System Co., Ltd. (Vietnam), KEF Holdings (United Arab Emirates) and Other Major Players.

The Wire Market is segmented into Type, Voltage, Application, Installation, End-User, and region. By Type, the market is categorized into Copper Wire, Aluminum Wire, Steel Wire, and Brass Wire. By Voltage, the market is categorized into Low Voltage, Medium Voltage, High Voltage, and Extra-High Voltage. By Application, the market is categorized into Electrical Wire, Industrial Wire, Residential Wire, and Specialty Wire. By Installation, the market is categorized into Overhead, Underground. By End-User, the market is categorized into Construction, Automotive, Electronics, Telecommunications, Aerospace, Energy & Power. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A wire is a flexible, round metal bar used to bear mechanical loads, often in the form of wire rope. In electricity and telecommunications signals, a wire can refer to an electrical cable with a solid core or separate strands. Wire can be cylindrical, square, hexagonal, flattened rectangular, or other cross-sections, used for decorative or technical purposes. Edge-wound coil springs, like the Slinky toy, are made of special flattened wire.

Wire Market Size Was Valued at USD 130.54 Billion in 2023, and is Projected to Reach USD 189.04 Billion by 2032, Growing at a CAGR of 4.2 % From 2024-2032