Enterprise Storage Systems Market Synopsis

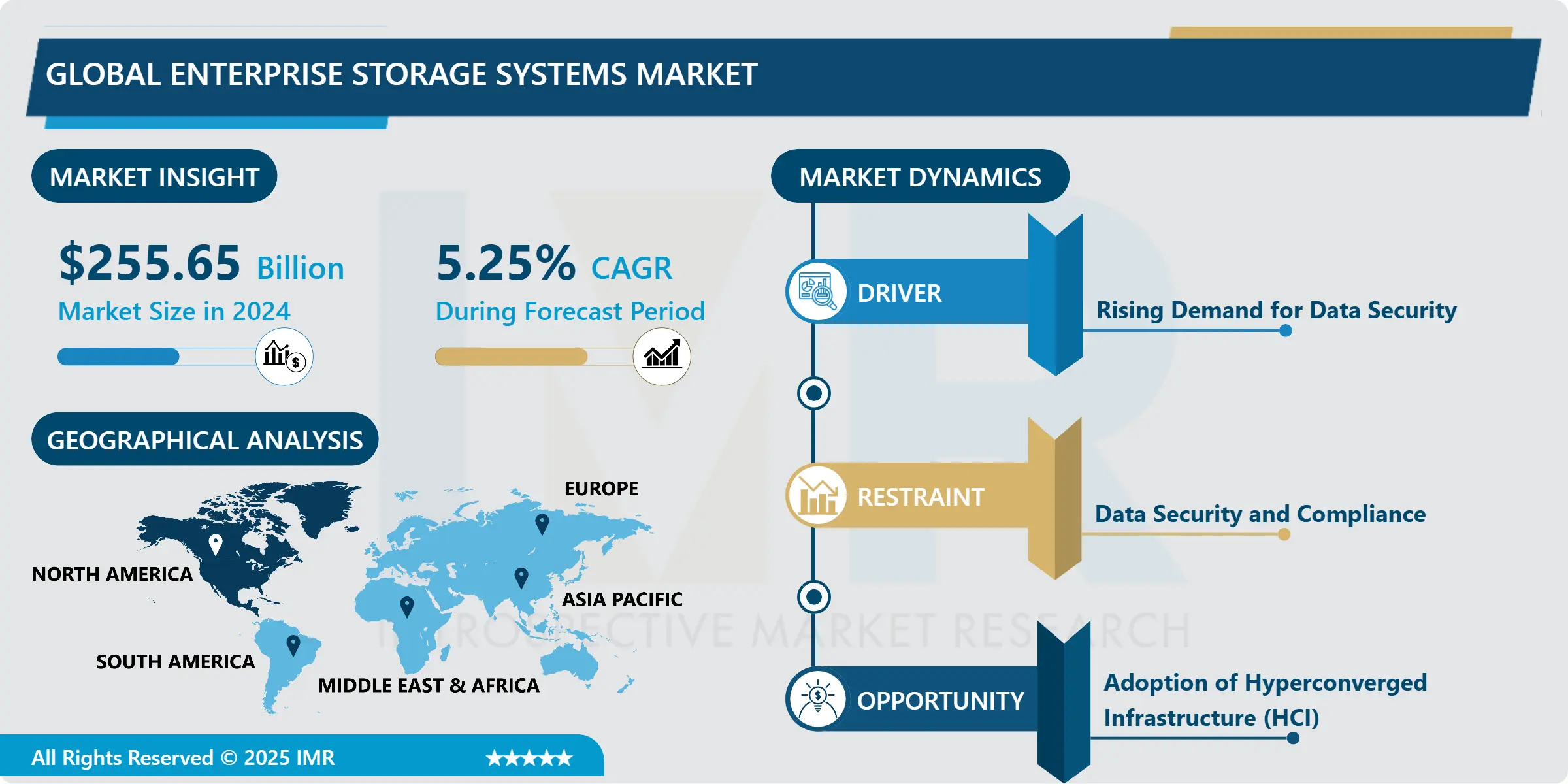

Global Enterprise Storage Systems Market Size Was Valued at USD 255.65 Billion in 2024 and is Projected to Reach USD 384.97 Billion by 2032, Growing at a CAGR of 5.25% From 2025-2032.

Enterprise storage systems encompass advanced infrastructure solutions designed to store, manage, and protect vast amounts of data for organizations. These systems utilize cutting-edge technologies like cloud storage, software-defined storage, and high-speed storage arrays to ensure secure and efficient data storage and retrieval, supporting various business operations and digital initiatives. Enterprise storage systems find extensive application across industries, serving as the backbone for data-intensive operations and digital transformation initiatives. These systems are utilized for storing and managing large volumes of structured and unstructured data, including databases, files, multimedia content, and business applications. They provide a centralized and scalable storage infrastructure that enables efficient data access, backup, recovery, and archival processes, supporting critical business functions such as analytics, decision-making, and regulatory compliance.

They incorporate technologies like flash storage, data deduplication, encryption, and automated tiering to optimize storage efficiency, reduce latency, and ensure data integrity and security. Moreover, these systems support seamless integration with cloud platforms, enabling hybrid and multi-cloud deployments that enhance flexibility, scalability, and cost-effectiveness for organizations. The enterprise storage systems are driven by several factors, including the exponential growth of data, emerging technologies like AI and IoT, and evolving business requirements for real-time data processing and insights. As organizations continue to digitalize their operations and adopt data-driven strategies, the need for advanced storage solutions that can handle diverse workloads, ensure data availability and compliance, and facilitate agile data management practices will continue to rise, fueling the expansion of the enterprise storage market.

Enterprise Storage Systems Market Trend Analysis:

Rising Demand for Data Security and Compliance Requirement

- The escalating demand for stringent data security measures and regulatory compliance requirements acts as a pivotal driver propelling the growth of the enterprise storage systems market. Organizations across various industries are increasingly prioritizing data security to safeguard sensitive information from cyber threats and unauthorized access. This heightened focus on security is driving the adoption of advanced storage solutions equipped with robust encryption, access controls, and security protocols to ensure data confidentiality, integrity, and availability.

- Moreover, regulatory compliance mandates, such as GDPR, HIPAA, and PCI DSS, impose strict requirements on data handling, storage, and privacy practices. As businesses strive to comply with these regulations and avoid penalties, they are investing in enterprise storage systems that offer compliance-specific features and capabilities. These include audit trails, data retention policies, data masking, and secure data disposal mechanisms, enabling organizations to meet regulatory obligations and mitigate compliance risks effectively.

- The convergence of data security and compliance requirements not only fuels the demand for sophisticated storage solutions but also drives innovation in the storage industry. Vendors are continuously enhancing their offerings with advanced security features, compliance management tools, and risk mitigation strategies to address evolving cybersecurity threats and regulatory landscapes. This trend underscores the critical role of enterprise storage systems in enabling secure, compliant, and resilient data management practices amid growing cybersecurity challenges and regulatory complexities.

Adoption of Hyperconverged Infrastructure (HCI)

- The adoption of hyper-converged infrastructure (HCI) presents a significant opportunity for driving the growth of the enterprise storage systems market. HCI integrates computing, storage, networking, and virtualization capabilities into a unified platform, offering simplified management, scalability, and cost efficiencies for organizations. As businesses increasingly embrace HCI solutions to modernize their IT infrastructure, there is a growing demand for advanced storage systems that can seamlessly integrate with HCI environments and provide enhanced storage performance and flexibility.

- Storage and compute resources within HCI deployments. By consolidating storage functions into the HCI stack, organizations can optimize resource utilization, reduce hardware footprint, and streamline data management processes. This convergence also enables dynamic resource allocation, automated provisioning, and simplified data migration, enhancing agility and scalability for storage infrastructure.

- HCI solutions enable organizations to leverage software-defined storage (SDS) capabilities, allowing for greater flexibility and control over storage policies, performance tuning, and data protection. SDS in HCI environments supports features such as data deduplication, compression, snapshots, and replication, optimizing storage efficiency and resilience. This convergence of HCI and SDS creates opportunities for storage vendors to innovate and deliver tailored solutions that align with the evolving needs of HCI-driven IT architectures, driving growth and competitiveness in the enterprise storage systems market.

Enterprise Storage Systems Market Segment Analysis:

The Enterprise Storage Systems Market Segmented based on Type, Deployment Mode, Enterprise Size, Storage Technology, and End-User.

By Type, Storage Area Network (SAN) segment is expected to dominate the market during the forecast period

- The Storage Area Network (SAN) segment is poised to dominate the growth of the enterprise storage systems market. SANs offer a dedicated network infrastructure for storage devices, enabling high-speed data transfers, centralized storage management, and scalability for large-scale deployments. As organizations increasingly rely on data-intensive applications, virtualization technologies, and cloud services, the demand for SAN solutions that can deliver superior performance, reliability, and flexibility is on the rise.

- SANs provide features like Fibre Channel and iSCSI protocols, storage virtualization, and tiered storage architectures, catering to diverse workload types and performance needs. This makes SANs particularly suitable for enterprises seeking robust storage solutions for database management systems, high-performance computing clusters, and enterprise resource planning (ERP) applications. Moreover, advancements in SAN technologies, such as all-flash arrays, software-defined SANs, and hyper-converged SAN solutions, further enhance their appeal to organizations looking to optimize storage performance, efficiency, and cost-effectiveness. The SAN segment's dominance reflects the continued relevance and evolution of storage networking solutions in meeting the evolving storage demands of modern businesses.

By Application, Cloud-based segment held the largest share in 2024

- The cloud-based segment has emerged as the leader, holding the largest share in driving the growth of the enterprise storage systems market. This segment encompasses storage solutions delivered through cloud platforms, offering organizations scalable, on-demand storage resources without the need for extensive on-premises infrastructure. The increasing adoption of cloud computing across industries has propelled the demand for cloud-based storage solutions, driven by factors such as cost efficiencies, agility, and scalability benefits.

- cloud-based storage is its ability to provide flexible storage capacity, allowing businesses to scale storage resources up or down based on changing needs. This scalability feature enables organizations to optimize storage costs, avoid over-provisioning, and accommodate fluctuating data storage requirements effectively. Additionally, cloud-based storage solutions offer data redundancy, backup, and disaster recovery capabilities, enhancing data protection and business continuity for organizations leveraging cloud infrastructure. As cloud adoption continues to grow, driven by digital transformation initiatives and evolving business needs, the cloud-based storage segment is expected to maintain its leadership position in driving growth within the enterprise storage systems market

Enterprise Storage Systems Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is anticipated to dominate as the leading region for the growth of the enterprise storage systems market. This dominance is attributed to several factors, including the strong presence of major technology companies, robust IT infrastructure, and high adoption rates of advanced storage technologies among enterprises across various sectors. The region's mature market ecosystem, coupled with a strong focus on digital transformation and data-driven strategies, fuels the demand for innovative storage solutions and drives market growth.

- North America benefits from a supportive regulatory environment, favorable economic conditions, and a well-established cloud computing landscape, which contribute to the widespread adoption of enterprise storage systems. The region's leadership in sectors such as finance, healthcare, manufacturing, and technology drives substantial data generation and storage requirements, driving the need for scalable, secure, and efficient storage solutions. With ongoing investments in data center infrastructure, hybrid cloud environments, and emerging technologies like AI and IoT, North America is poised to maintain its dominant position in the enterprise storage systems market.

Enterprise Storage Systems Market Top Key Players:

- Dell Technologies (U.S.)

- Hewlett Packard Enterprise (HPE) (U.S.)

- NetApp (U.S.)

- IBM Corporation (U.S.)

- Cisco Systems (U.S.)

- Pure Storage (U.S.)

- Hitachi Vantara (U.S.)

- Western Digital Corporation (U.S.)

- Cohesity (U.S.)

- Nutanix (U.S.)

- StorCentric (U.S.)

- DataCore Software (U.S.)

- Panasas (U.S.)

- Seagate Technology (Ireland)

- Toshiba Corporation (Japan)

- NEC Corporation (Japan)

- Fujitsu Limited (Japan)

- Inspur Group (China)

- Huawei Technologies Co., Ltd. (China),

- Other Active Players.

Key Industry Developments in the Enterprise Storage Systems Market:

- In February 2024, Hewlett Packard Enterprise announced Release 3 of HPE GreenLake for Block Storage, based on HPE Alletra Storage MP – the industry’s first scale-out disaggregated block storage that enables enterprises to scale capacity and performance independently. Powered by a shared-everything storage architecture, and managed via the HPE GreenLake Cloud Platform, this unique block storage offering brings an on-premises cloud experience, efficient scale, and extreme resiliency and performance to modern mission-critical workloads.

|

Global Enterprise Storage Systems Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 255.65 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.25 % |

Market Size in 2032: |

USD 384.97 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment Mode |

|

||

|

By Enterprise Size |

|

||

|

By Storage Technology |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Enterprise Storage Systems Market by Type (2018-2032)

4.1 Enterprise Storage Systems Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Storage Area Network (SAN)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Network Attached Storage (NAS)

4.5 Direct Attached Storage (DAS)

4.6 Hybrid Storage

Chapter 5: Enterprise Storage Systems Market by Deployment Mode (2018-2032)

5.1 Enterprise Storage Systems Market Snapshot and Growth Engine

5.2 Market Overview

5.3 On-Premises

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cloud-based

Chapter 6: Enterprise Storage Systems Market by Enterprise Size (2018-2032)

6.1 Enterprise Storage Systems Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Small and Medium Enterprises (SMEs)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Large Enterprises

Chapter 7: Enterprise Storage Systems Market by Storage Technology (2018-2032)

7.1 Enterprise Storage Systems Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hard Disk Drives

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Solid-State Drives

7.5 Hybrid Storage Arrays

Chapter 8: Enterprise Storage Systems Market by End-User (2018-2032)

8.1 Enterprise Storage Systems Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Banking

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Financial Services & Insurance (BFSI

8.5 Retail

8.6 Information Technology & Telecommunications

8.7 Healthcare

8.8 Government & Utilities

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Enterprise Storage Systems Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 DAPULSE (ISRAEL)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 CONFLUENCE (AUSTRALIA)

9.4 ZOHO (US)

9.5 EVERNOTE (US)

9.6 SLACK (US)

9.7 BASECAMP (US)

9.8 MICROSOFT (US)

9.9 OFFICE.COM (US)

9.10 HOOTSUITE MEDIA (CANADA)

9.11 TEAMVIEWER (GERMANY)

9.12 EXO (US)

9.13 OTHER KEY PLAYERS

Chapter 10: Global Enterprise Storage Systems Market By Region

10.1 Overview

10.2. North America Enterprise Storage Systems Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 Storage Area Network (SAN)

10.2.4.2 Network Attached Storage (NAS)

10.2.4.3 Direct Attached Storage (DAS)

10.2.4.4 Hybrid Storage

10.2.5 Historic and Forecasted Market Size by Deployment Mode

10.2.5.1 On-Premises

10.2.5.2 Cloud-based

10.2.6 Historic and Forecasted Market Size by Enterprise Size

10.2.6.1 Small and Medium Enterprises (SMEs)

10.2.6.2 Large Enterprises

10.2.7 Historic and Forecasted Market Size by Storage Technology

10.2.7.1 Hard Disk Drives

10.2.7.2 Solid-State Drives

10.2.7.3 Hybrid Storage Arrays

10.2.8 Historic and Forecasted Market Size by End-User

10.2.8.1 Banking

10.2.8.2 Financial Services & Insurance (BFSI

10.2.8.3 Retail

10.2.8.4 Information Technology & Telecommunications

10.2.8.5 Healthcare

10.2.8.6 Government & Utilities

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Enterprise Storage Systems Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 Storage Area Network (SAN)

10.3.4.2 Network Attached Storage (NAS)

10.3.4.3 Direct Attached Storage (DAS)

10.3.4.4 Hybrid Storage

10.3.5 Historic and Forecasted Market Size by Deployment Mode

10.3.5.1 On-Premises

10.3.5.2 Cloud-based

10.3.6 Historic and Forecasted Market Size by Enterprise Size

10.3.6.1 Small and Medium Enterprises (SMEs)

10.3.6.2 Large Enterprises

10.3.7 Historic and Forecasted Market Size by Storage Technology

10.3.7.1 Hard Disk Drives

10.3.7.2 Solid-State Drives

10.3.7.3 Hybrid Storage Arrays

10.3.8 Historic and Forecasted Market Size by End-User

10.3.8.1 Banking

10.3.8.2 Financial Services & Insurance (BFSI

10.3.8.3 Retail

10.3.8.4 Information Technology & Telecommunications

10.3.8.5 Healthcare

10.3.8.6 Government & Utilities

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Enterprise Storage Systems Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 Storage Area Network (SAN)

10.4.4.2 Network Attached Storage (NAS)

10.4.4.3 Direct Attached Storage (DAS)

10.4.4.4 Hybrid Storage

10.4.5 Historic and Forecasted Market Size by Deployment Mode

10.4.5.1 On-Premises

10.4.5.2 Cloud-based

10.4.6 Historic and Forecasted Market Size by Enterprise Size

10.4.6.1 Small and Medium Enterprises (SMEs)

10.4.6.2 Large Enterprises

10.4.7 Historic and Forecasted Market Size by Storage Technology

10.4.7.1 Hard Disk Drives

10.4.7.2 Solid-State Drives

10.4.7.3 Hybrid Storage Arrays

10.4.8 Historic and Forecasted Market Size by End-User

10.4.8.1 Banking

10.4.8.2 Financial Services & Insurance (BFSI

10.4.8.3 Retail

10.4.8.4 Information Technology & Telecommunications

10.4.8.5 Healthcare

10.4.8.6 Government & Utilities

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Enterprise Storage Systems Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 Storage Area Network (SAN)

10.5.4.2 Network Attached Storage (NAS)

10.5.4.3 Direct Attached Storage (DAS)

10.5.4.4 Hybrid Storage

10.5.5 Historic and Forecasted Market Size by Deployment Mode

10.5.5.1 On-Premises

10.5.5.2 Cloud-based

10.5.6 Historic and Forecasted Market Size by Enterprise Size

10.5.6.1 Small and Medium Enterprises (SMEs)

10.5.6.2 Large Enterprises

10.5.7 Historic and Forecasted Market Size by Storage Technology

10.5.7.1 Hard Disk Drives

10.5.7.2 Solid-State Drives

10.5.7.3 Hybrid Storage Arrays

10.5.8 Historic and Forecasted Market Size by End-User

10.5.8.1 Banking

10.5.8.2 Financial Services & Insurance (BFSI

10.5.8.3 Retail

10.5.8.4 Information Technology & Telecommunications

10.5.8.5 Healthcare

10.5.8.6 Government & Utilities

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Enterprise Storage Systems Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 Storage Area Network (SAN)

10.6.4.2 Network Attached Storage (NAS)

10.6.4.3 Direct Attached Storage (DAS)

10.6.4.4 Hybrid Storage

10.6.5 Historic and Forecasted Market Size by Deployment Mode

10.6.5.1 On-Premises

10.6.5.2 Cloud-based

10.6.6 Historic and Forecasted Market Size by Enterprise Size

10.6.6.1 Small and Medium Enterprises (SMEs)

10.6.6.2 Large Enterprises

10.6.7 Historic and Forecasted Market Size by Storage Technology

10.6.7.1 Hard Disk Drives

10.6.7.2 Solid-State Drives

10.6.7.3 Hybrid Storage Arrays

10.6.8 Historic and Forecasted Market Size by End-User

10.6.8.1 Banking

10.6.8.2 Financial Services & Insurance (BFSI

10.6.8.3 Retail

10.6.8.4 Information Technology & Telecommunications

10.6.8.5 Healthcare

10.6.8.6 Government & Utilities

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Enterprise Storage Systems Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 Storage Area Network (SAN)

10.7.4.2 Network Attached Storage (NAS)

10.7.4.3 Direct Attached Storage (DAS)

10.7.4.4 Hybrid Storage

10.7.5 Historic and Forecasted Market Size by Deployment Mode

10.7.5.1 On-Premises

10.7.5.2 Cloud-based

10.7.6 Historic and Forecasted Market Size by Enterprise Size

10.7.6.1 Small and Medium Enterprises (SMEs)

10.7.6.2 Large Enterprises

10.7.7 Historic and Forecasted Market Size by Storage Technology

10.7.7.1 Hard Disk Drives

10.7.7.2 Solid-State Drives

10.7.7.3 Hybrid Storage Arrays

10.7.8 Historic and Forecasted Market Size by End-User

10.7.8.1 Banking

10.7.8.2 Financial Services & Insurance (BFSI

10.7.8.3 Retail

10.7.8.4 Information Technology & Telecommunications

10.7.8.5 Healthcare

10.7.8.6 Government & Utilities

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Enterprise Storage Systems Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 255.65 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.25 % |

Market Size in 2032: |

USD 384.97 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment Mode |

|

||

|

By Enterprise Size |

|

||

|

By Storage Technology |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||