Enterprise Cloud Storage Market Synopsis

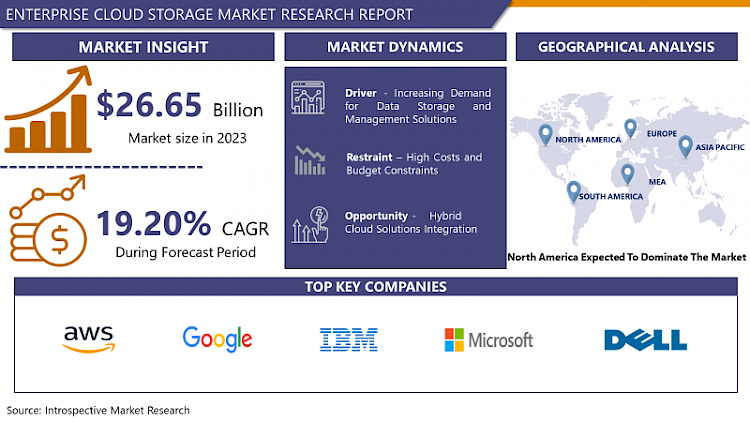

Enterprise Cloud Storage Market Size Was Valued at USD 26.65 Billion in 2023, and is Projected to Reach USD 129.47 Billion by 2032, Growing at a CAGR of 19.20% From 2024-2032.

Enterprise cloud storage refers to the provision of cloud-based storage solutions tailored to meet the needs of large-scale organizations. It encompasses a range of services and technologies designed to securely store and manage vast amounts of data, including documents, files, databases, and multimedia content. Enterprises leverage cloud storage to improve scalability, accessibility, and reliability of their data storage infrastructure while reducing the burden of managing on-premises hardware. These solutions typically offer features such as data encryption, high availability, automated backups, and seamless integration with existing IT environments, empowering organizations to efficiently store, retrieve, and protect their critical data assets.

- Enterprise cloud storage refers to a scalable and secure data storage solution tailored for large organizations. It provides businesses with the flexibility to store, manage, and access their data in a centralized, off-site location through a cloud-based infrastructure. This infrastructure is typically managed by third-party providers, allowing enterprises to focus on their core operations while leveraging the expertise and resources of cloud service providers.

- One of the key features of enterprise cloud storage is scalability. Organizations generate vast amounts of data, and their storage needs can vary greatly over time. Enterprise cloud storage offers the ability to seamlessly scale up or down based on demand, ensuring that businesses have the capacity they need without over-provisioning resources or incurring unnecessary costs. This scalability is particularly valuable for enterprises with fluctuating workloads or seasonal demands, as it allows them to adapt their storage capacity accordingly.

- In addition to scalability, enterprise cloud storage provides high levels of reliability and availability. Cloud service providers typically operate multiple data centers across different geographic regions, ensuring redundancy and minimizing the risk of data loss or downtime due to hardware failures or natural disasters. These providers also employ advanced data replication and backup techniques to further enhance data resilience and protect against potential disruptions.

- Security is another critical aspect of enterprise cloud storage. Cloud service providers implement robust security measures to safeguard sensitive data against unauthorized access, data breaches, and cyber threats. This includes encryption of data both in transit and at rest, access controls, authentication mechanisms, and regular security audits and assessments. By leveraging the expertise and resources of cloud service providers, enterprises can enhance their overall security posture and comply with industry regulations and standards governing data protection and privacy.

- Enterprise cloud storage also offers advanced data management capabilities. Through features such as data deduplication, compression, and tiered storage, organizations can optimize storage efficiency and reduce costs. Moreover, cloud storage solutions often integrate with other enterprise applications and services, enabling seamless data integration, collaboration, and workflow automation across the organization.

- Furthermore, enterprise cloud storage facilitates remote access to data from any location and device with an internet connection. This enables employees to collaborate effectively, access critical information on the go, and work more flexibly, improving productivity and business agility.

Enterprise Cloud Storage Market Trend Analysis

Increased Adoption of Multi-Cloud Strategies

- The enterprise cloud storage market has witnessed a notable surge in the adoption of multi-cloud strategies in recent years. This shift is primarily driven by organizations seeking to mitigate risks associated with vendor lock-in, enhance flexibility, and optimize performance. By distributing workloads across multiple cloud providers, enterprises can avoid dependency on a single vendor and leverage the strengths of different cloud platforms for various applications and data types. Additionally, multi-cloud approaches offer resilience against potential outages and enable cost optimization by allowing organizations to select the most cost-effective cloud services for their specific needs.

- The proliferation of specialized cloud services and the growing complexity of business requirements have propelled the adoption of multi-cloud architectures. Enterprises are increasingly recognizing the importance of agility and innovation in a competitive landscape, and multi-cloud strategies empower them to mix and match cloud services to meet evolving business demands. However, managing multiple cloud environments efficiently poses challenges related to governance, security, and interoperability. Thus, as the adoption of multi-cloud strategies continues to rise, organizations are investing in robust management and orchestration tools to streamline operations and maximize the benefits of distributed cloud infrastructures.

Hybrid Cloud Solutions Integration

- Hybrid cloud solutions integration has emerged as a pivotal strategy for enterprises seeking a flexible and efficient approach to managing their data storage needs. By combining the benefits of both public and private cloud infrastructures, organizations can leverage the scalability and cost-effectiveness of the public cloud while maintaining the security and control of their sensitive data on-premises. This hybrid approach enables seamless data movement between different environments, allowing businesses to optimize performance, meet regulatory requirements, and adapt to evolving workloads.

- In the enterprise cloud storage market, the demand for hybrid cloud solutions integration is driving significant growth and innovation. As businesses continue to generate vast amounts of data, they require storage solutions that can accommodate diverse workloads and provide reliable access to information across distributed environments. Providers are responding with hybrid cloud storage offerings that prioritize interoperability, security, and performance, empowering enterprises to unlock the full potential of their data assets while navigating the complexities of modern IT infrastructure.

Enterprise Cloud Storage Market Segment Analysis:

Enterprise Cloud Storage Market is segmented based on the Type and Application .

By Type, SaaS segment is expected to dominate the market during the forecast period

- In the realm of SaaS (Software as a Service), the market continues to witness robust growth, driven by the increasing adoption of cloud-based solutions across various industries. SaaS offerings provide organizations with scalable software solutions without the need for extensive infrastructure investments or maintenance. This has led to a surge in demand for applications ranging from customer relationship management (CRM) to enterprise resource planning (ERP) and collaboration tools. With the flexibility and accessibility offered by SaaS, businesses can streamline their operations, enhance productivity, and adapt more swiftly to changing market dynamics.

- On the other hand, the IaaS (Infrastructure as a Service) and PaaS (Platform as a Service) segments of the enterprise cloud storage market are experiencing similar momentum. IaaS provides virtualized computing resources over the internet, enabling businesses to scale their IT infrastructure dynamically without the constraints of physical hardware. PaaS, meanwhile, offers a platform for developers to build, deploy, and manage applications efficiently. Together, these cloud service models empower organizations to leverage advanced computing capabilities, storage solutions, and development tools on a pay-as-you-go basis, fostering innovation and agility in the digital age. As enterprises increasingly embrace cloud technologies to drive efficiency and competitiveness, the SaaS, IaaS, and PaaS segments are poised for continued expansion in the global enterprise cloud storage market.

By Application , Enterprise segment held the largest share in 2023

- The enterprise cloud storage market is experiencing robust growth driven by several factors. Enterprises across various industries are increasingly adopting cloud storage solutions to address their ever-growing data storage needs. Cloud storage offers scalability, flexibility, and cost-effectiveness compared to traditional on-premises storage solutions. Moreover, with the proliferation of data-intensive technologies such as big data analytics, artificial intelligence, and Internet of Things (IoT), enterprises are seeking reliable and secure storage solutions to manage and analyze large volumes of data efficiently. Additionally, the growing trend of remote work and the need for seamless collaboration among geographically dispersed teams further drive the demand for cloud storage solutions tailored for enterprise needs.

- Government agencies are also significant players in the enterprise cloud storage market. They are embracing cloud storage solutions to modernize their IT infrastructure, enhance data security, and improve operational efficiency. Government organizations deal with vast amounts of sensitive data, ranging from citizen records to national security information, making data protection and compliance paramount. Cloud storage providers offer advanced security features, such as encryption, access controls, and compliance certifications, to meet the stringent security requirements of government agencies. Furthermore, cloud storage enables government entities to streamline data sharing and collaboration while ensuring data integrity and regulatory compliance, driving adoption across various government sectors.

Enterprise Cloud Storage Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is poised to dominate the Enterprise Cloud Storage Market over the forecast period, driven by several key factors. The region's technological infrastructure is highly advanced, supported by substantial investments in cloud technology from major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. These companies continue to innovate and expand their offerings, providing scalable, secure, and cost-effective cloud storage solutions that meet the evolving needs of enterprises. Additionally, the high adoption rate of cloud services among businesses in North America, including small and medium-sized enterprises (SMEs), further fuels market growth. The regulatory environment in North America, which often sets the pace for global standards, also encourages enterprises to migrate to cloud storage solutions to ensure compliance with data protection and privacy laws.

- Moreover, North America's dominance is bolstered by its robust economic environment and the presence of a significant number of enterprises seeking to enhance their operational efficiency through cloud adoption. The region's emphasis on digital transformation, along with the increasing use of big data, artificial intelligence (AI), and Internet of Things (IoT) technologies, creates a burgeoning demand for cloud storage solutions capable of handling large volumes of data. As businesses in North America continue to prioritize agility and innovation, the enterprise cloud storage market is expected to witness sustained growth, reinforcing the region's leading position over the forecast period.

Active Key Players in the Enterprise Cloud Storage Market

- AWS (Amazon Web Services) (US)

- Google (US)

- IBM (US)

- Microsoft (US)

- Dell (US)

- Baidu (China)

- Alibaba (China)

- Tencent (China)

- Akamai Technologies (US)

- CA Technologies (US)

- Cisco Systems (US)

- ENKI (US)

- Huawei (China)

- ILand (US)

- Joyent (US)

- Netsuite (US)

- Oracle (US)

- SAP (Germany)

- Other Key Players

|

Global Enterprise Cloud Storage Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 31.77 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.20% |

Market Size in 2032: |

USD 129.47 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ENTERPRISE CLOUD STORAGE MARKET BY TYPE (2017-2032)

- ENTERPRISE CLOUD STORAGE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SAAS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- IAAS

- PAAS

- ENTERPRISE CLOUD STORAGE MARKET BY APPLICATION (2017-2032)

- ENTERPRISE CLOUD STORAGE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ENTERPRISE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GOVERNMENT

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Enterprise Cloud Storage Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AWS (AMAZON WEB SERVICES) (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- GOOGLE (US)

- IBM (US)

- MICROSOFT (US)

- DELL (US)

- BAIDU (CHINA)

- ALIBABA (CHINA)

- TENCENT (CHINA)

- AKAMAI TECHNOLOGIES (US)

- CA TECHNOLOGIES (US)

- CISCO SYSTEMS (US)

- ENKI (US)

- HUAWEI (CHINA)

- ILAND (US)

- JOYENT (US)

- NETSUITE (US)

- ORACLE (US)

- SAP (GERMANY)

- COMPETITIVE LANDSCAPE

- GLOBAL ENTERPRISE CLOUD STORAGE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Enterprise Cloud Storage Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 31.77 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.20% |

Market Size in 2032: |

USD 129.47 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ENTERPRISE CLOUD STORAGE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ENTERPRISE CLOUD STORAGE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ENTERPRISE CLOUD STORAGE MARKET COMPETITIVE RIVALRY

TABLE 005. ENTERPRISE CLOUD STORAGE MARKET THREAT OF NEW ENTRANTS

TABLE 006. ENTERPRISE CLOUD STORAGE MARKET THREAT OF SUBSTITUTES

TABLE 007. ENTERPRISE CLOUD STORAGE MARKET BY TYPE

TABLE 008. SAAS MARKET OVERVIEW (2016-2028)

TABLE 009. IAAS MARKET OVERVIEW (2016-2028)

TABLE 010. PAAS MARKET OVERVIEW (2016-2028)

TABLE 011. ENTERPRISE CLOUD STORAGE MARKET BY APPLICATION

TABLE 012. APPLICATION A MARKET OVERVIEW (2016-2028)

TABLE 013. APPLICATION B MARKET OVERVIEW (2016-2028)

TABLE 014. APPLICATION C MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA ENTERPRISE CLOUD STORAGE MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA ENTERPRISE CLOUD STORAGE MARKET, BY APPLICATION (2016-2028)

TABLE 017. N ENTERPRISE CLOUD STORAGE MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE ENTERPRISE CLOUD STORAGE MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE ENTERPRISE CLOUD STORAGE MARKET, BY APPLICATION (2016-2028)

TABLE 020. ENTERPRISE CLOUD STORAGE MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC ENTERPRISE CLOUD STORAGE MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC ENTERPRISE CLOUD STORAGE MARKET, BY APPLICATION (2016-2028)

TABLE 023. ENTERPRISE CLOUD STORAGE MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA ENTERPRISE CLOUD STORAGE MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA ENTERPRISE CLOUD STORAGE MARKET, BY APPLICATION (2016-2028)

TABLE 026. ENTERPRISE CLOUD STORAGE MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA ENTERPRISE CLOUD STORAGE MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA ENTERPRISE CLOUD STORAGE MARKET, BY APPLICATION (2016-2028)

TABLE 029. ENTERPRISE CLOUD STORAGE MARKET, BY COUNTRY (2016-2028)

TABLE 030. AWS: SNAPSHOT

TABLE 031. AWS: BUSINESS PERFORMANCE

TABLE 032. AWS: PRODUCT PORTFOLIO

TABLE 033. AWS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. GOOGLE: SNAPSHOT

TABLE 034. GOOGLE: BUSINESS PERFORMANCE

TABLE 035. GOOGLE: PRODUCT PORTFOLIO

TABLE 036. GOOGLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. IBM: SNAPSHOT

TABLE 037. IBM: BUSINESS PERFORMANCE

TABLE 038. IBM: PRODUCT PORTFOLIO

TABLE 039. IBM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. MICROSOFT: SNAPSHOT

TABLE 040. MICROSOFT: BUSINESS PERFORMANCE

TABLE 041. MICROSOFT: PRODUCT PORTFOLIO

TABLE 042. MICROSOFT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. DELL: SNAPSHOT

TABLE 043. DELL: BUSINESS PERFORMANCE

TABLE 044. DELL: PRODUCT PORTFOLIO

TABLE 045. DELL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. BAIDU: SNAPSHOT

TABLE 046. BAIDU: BUSINESS PERFORMANCE

TABLE 047. BAIDU: PRODUCT PORTFOLIO

TABLE 048. BAIDU: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. ALIBABA: SNAPSHOT

TABLE 049. ALIBABA: BUSINESS PERFORMANCE

TABLE 050. ALIBABA: PRODUCT PORTFOLIO

TABLE 051. ALIBABA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. TENCENT: SNAPSHOT

TABLE 052. TENCENT: BUSINESS PERFORMANCE

TABLE 053. TENCENT: PRODUCT PORTFOLIO

TABLE 054. TENCENT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. AKAMAI TECHNOLOGIES: SNAPSHOT

TABLE 055. AKAMAI TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 056. AKAMAI TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 057. AKAMAI TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. CA TECHNOLOGIES: SNAPSHOT

TABLE 058. CA TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 059. CA TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 060. CA TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. CISCO SYSTEMS: SNAPSHOT

TABLE 061. CISCO SYSTEMS: BUSINESS PERFORMANCE

TABLE 062. CISCO SYSTEMS: PRODUCT PORTFOLIO

TABLE 063. CISCO SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. ENKI: SNAPSHOT

TABLE 064. ENKI: BUSINESS PERFORMANCE

TABLE 065. ENKI: PRODUCT PORTFOLIO

TABLE 066. ENKI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. HUAWEI: SNAPSHOT

TABLE 067. HUAWEI: BUSINESS PERFORMANCE

TABLE 068. HUAWEI: PRODUCT PORTFOLIO

TABLE 069. HUAWEI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. HP: SNAPSHOT

TABLE 070. HP: BUSINESS PERFORMANCE

TABLE 071. HP: PRODUCT PORTFOLIO

TABLE 072. HP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. ILAND: SNAPSHOT

TABLE 073. ILAND: BUSINESS PERFORMANCE

TABLE 074. ILAND: PRODUCT PORTFOLIO

TABLE 075. ILAND: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. JOYENT: SNAPSHOT

TABLE 076. JOYENT: BUSINESS PERFORMANCE

TABLE 077. JOYENT: PRODUCT PORTFOLIO

TABLE 078. JOYENT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. NETSUITE: SNAPSHOT

TABLE 079. NETSUITE: BUSINESS PERFORMANCE

TABLE 080. NETSUITE: PRODUCT PORTFOLIO

TABLE 081. NETSUITE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. ORACLE: SNAPSHOT

TABLE 082. ORACLE: BUSINESS PERFORMANCE

TABLE 083. ORACLE: PRODUCT PORTFOLIO

TABLE 084. ORACLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. SAP: SNAPSHOT

TABLE 085. SAP: BUSINESS PERFORMANCE

TABLE 086. SAP: PRODUCT PORTFOLIO

TABLE 087. SAP: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ENTERPRISE CLOUD STORAGE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ENTERPRISE CLOUD STORAGE MARKET OVERVIEW BY TYPE

FIGURE 012. SAAS MARKET OVERVIEW (2016-2028)

FIGURE 013. IAAS MARKET OVERVIEW (2016-2028)

FIGURE 014. PAAS MARKET OVERVIEW (2016-2028)

FIGURE 015. ENTERPRISE CLOUD STORAGE MARKET OVERVIEW BY APPLICATION

FIGURE 016. APPLICATION A MARKET OVERVIEW (2016-2028)

FIGURE 017. APPLICATION B MARKET OVERVIEW (2016-2028)

FIGURE 018. APPLICATION C MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA ENTERPRISE CLOUD STORAGE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE ENTERPRISE CLOUD STORAGE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC ENTERPRISE CLOUD STORAGE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA ENTERPRISE CLOUD STORAGE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA ENTERPRISE CLOUD STORAGE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Enterprise Cloud Storage Market research report is 2024-2032.

AWS (Amazon Web Services) (US),Google (US),IBM (US), Microsoft (US),Dell (US),Baidu (China),Alibaba (China),Tencent (China),Akamai Technologies (US),CA Technologies (US),and Other Major Players.

The Enterprise Cloud Storage Market is segmented into Type ,Application and Region. By Type the market is categorized into SaaS, IaaS,PaaS By Enterprise the market is categorized into Government, Others .By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Enterprise cloud storage refers to the provision of cloud-based storage solutions tailored to meet the needs of large-scale organizations. It encompasses a range of services and technologies designed to securely store and manage vast amounts of data, including documents, files, databases, and multimedia content. Enterprises leverage cloud storage to improve scalability, accessibility, and reliability of their data storage infrastructure while reducing the burden of managing on-premises hardware. These solutions typically offer features such as data encryption, high availability, automated backups, and seamless integration with existing IT environments, empowering organizations to efficiently store, retrieve, and protect their critical data assets.

Enterprise Cloud Storage Market Size Was Valued at USD 26.65 Billion in 2023, and is Projected to Reach USD 129.47 Billion by 2032, Growing at a CAGR of 19.20% From 2024-2032.