Electrocompetent Cells Market Synopsis

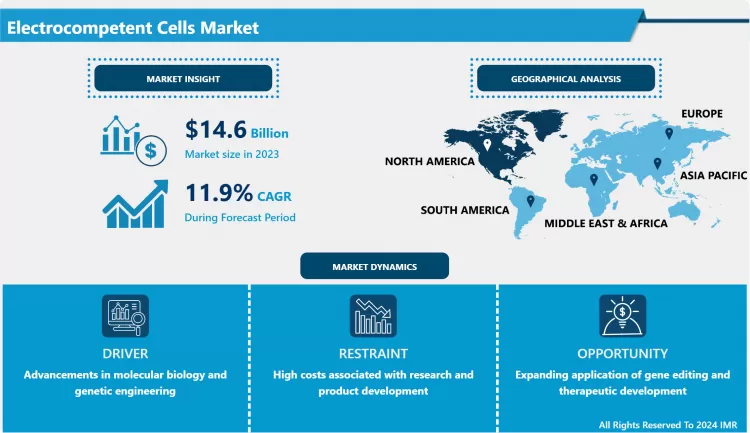

Electrocompetent Cells Market Size Was Valued at USD 14.6 Billion in 2023, and is Projected to Reach USD 40.2 Billion by 2032, Growing at a CAGR of 11.9% From 2024-2032.

Electrocompetent cells market pertains to the niche market for biotechnology dedicated to providing and selling specially prepared bacterial cells that become competent to recruiting outside DNA by electroporation. These cells are employable in research, pharmaceutical, and biotechnology for genetic transformations. The cells provide high transformation efficiency, making the cells important for cloning, protein expression, and gene editing studies.

- Electrocompetent cells market is growing at a fast pace because of increased use of molecular biological advancements in the field of biotechnology, healthcare, agriculture and biopharmaceutical industries. Due to reviving interests in the improvement of the R&D sectors with special emphasis on synthetic biology and genome editing, there is rising demand of the efficient electrocompetent cells. These cells have served, and continue to serve, cell lines of laboratories internationally by indicating the potential for recombinant DNA technologies as well as foreign gene expression – elements which are fundamental to driving advancements in various fields of science.

- As the concept of process of making disease-specific treatment more individualized increases, so does the use of electrocompetent cells in clinical research as an important contribution to drug discovery. These cells are also being utilized in numerous research laboratories within academes, biotechnology companies, and CROs to advance the entrepreneurial outcomes of genetic engineering undertakings. Consequently, the current demand for market products is rather high and is stably growing throughout various sectors of the market, such as agricultural, diagnostics, and pharmaceutical markets, as the recombinant DNA technology remains critical to the development of innovative solutions in various industries.

Electrocompetent Cells Market Trend Analysis

The Rising Popularity of Synthetic Biology

- Synthetic Biology as the Key Factor Another factor that is contributing to growth of the electrocompetent cells is synthetic biology. Synthetic biology means the fabrication of localized novel biological systems or the re-design of existing biological frameworks for specific purposes and it totally depends upon genetic engineering tools. Electrocompetent cells are also used in this regard as they enhance the insertion of synthetic DNA to host cells. Given the rapid development of synthetic biology due to improvements in biomanufacturing, environmental applications, and therapeutics, it is possible to assume the need for high quality electrocompetent cells will rise significantly. Because more and more sophisticated biological constructs are manufactured by researchers, it will remain essential to use those cells that offer high accuracy and work effectively in achieving advancements in the field.

Growing Application in Gene Editing and Therapeutics

- Applications in Gene Editing and Therapeutics Electroporation competent cells are expected to have a huge market in gene editing and therapeutics segment which is growing at a fast pace. There are now new tools available for a precise genetic alteration such as the CRISPR-Cas 9 system. Electrocompetent cells play an important role as they allow the researcher to manipulate bacteria or other model organism by making genetic changes efficiently. In connection with the growth in precision medicine and corresponding funding in genetic research, the application of electrocompetent cells as therapeutic delivery vehicles in gene therapies to treat genetic diseases, cancer, and orphan diseases, is becoming the most profitable segment. In accordance with the increasing availability of therapies that are involved in clinical trials or within the market, it is anticipated that the market for electrocompetent cells in the research as well as for commercial use will also grow.

Electrocompetent Cells Market Segment Analysis:

Electrocompetent Cells Market Segmented on the basis of type and application.

By Type, Cloned Competent Cells segment is expected to dominate the market during the forecast period

- It is predicted that the cloned competent cells segment will be the largest during the forecast period as these cells have a broad range of applications ranging from cloning to protein expression. Cloned competent cells are developed in such a way that they can transport plasmids and recombinant DNA well for gene cloning exercises. These cells have high efficiency of transformation where more their foreign DNA is inserted into the host cells. Owing to their polyclonal utility in research, drug discovery and synthetic biology, copied competent cells are now widely embraced by scientists and researchers. They are also dominant due to increased use of technology such as in molecular biology as well as because accurate, high performance cells are needed in highly specific experiments, thus, maintaining their place in the market.

By Application, Subcloning & Routine Cloning segment expected to held the largest share

- Subcloning & Routine Cloning Segment is Expected to grow at a Faster Pace During the forecast period, it is expected that the subcloning and routine cloning segment will generate the highest market share of the Electrocompetent cells market. This segment has-significant importance in genetic studies where through subcloning, the gene to be studied is moved from one plasmid to another. Somatic cell replication which is the general copying of DNA segments is a basic procedure central to genetic experiments and is employed in cloning genes, production of drugs and recombinant proteins. The increasing use of these cloning techniques in MOLECULAR BIOLOGY LABORATORIES, ACADEMIC INSTITUTIONS and BIOPHARMACEUTICAL COMPANIES justifies the high percentage of this segment in the market.

Electrocompetent Cells Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The largest share holder of the total market In 2023, North America held the largest share of the market due to the concentration of several biotechnology companies, advance research facilities and a large investment in life science. The reasons that can be suggested for the region’s domination include progress in genetic engineering, development of recombinant DNA mainstream technology, and the shift towards the individualized medicine treatment. The U.S meanwhile has a very a large and active biopharmaceutical market and active research in gene editing technologies. According to a particular market analysis, North America dominated over 40% of the market in 2023 filing the leadership place. The availability of key players, combined with governments’ attempts to develop the biotechnological potential boosts North America’s position as the uppermost region in this market.

Active Key Players in the Electrocompetent Cells Market

- Addgene (USA)

- Agilent Technologies (USA)

- BioDynamics Laboratory Inc. (Japan)

- Bio-Rad Laboratories (USA)

- Cell Applications, Inc. (USA)

- GenScript Biotech (China)

- Lucigen Corporation (USA)

- Merck KGaA (Germany)

- New England Biolabs (USA)

- OriGene Technologies, Inc. (USA)

- Promega Corporation (USA)

- QIAGEN N.V. (Netherlands)

- Takara Bio (Japan)

- Thermo Fisher Scientific (USA)

- Zymo Research (USA), and Other Active Players

|

Global Electrocompetent Cells Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 14.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.9% |

Market Size in 2032: |

USD 40.2 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electrocompetent Cells Market by Type (2018-2032)

4.1 Electrocompetent Cells Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cloned Competent Cells

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Agrobacterium Tumefaciens Competent Cells

4.5 Expression Competent Cells

Chapter 5: Electrocompetent Cells Market by Application (2018-2032)

5.1 Electrocompetent Cells Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Subcloning & Routine Cloning

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Phage Display Library Construction

5.5 Toxic/unstable Dna Cloning

5.6 High-throughput Cloning

5.7 Protein Expression

5.8 Mutagenesis

5.9 Single-stranded Dna Production

5.10 Bacmid Creation

5.11 Cre-lox Recombination (pir1/pir2)

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Electrocompetent Cells Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ADDGENE (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 AGILENT TECHNOLOGIES (USA)

6.4 BIODYNAMICS LABORATORY INC. (JAPAN)

6.5 BIO-RAD LABORATORIES (USA)

6.6 CELL APPLICATIONS INC. (USA)

6.7 GENSCRIPT BIOTECH (CHINA)

6.8 LUCIGEN CORPORATION (USA)

6.9 MERCK KGAA (GERMANY)

6.10 NEW ENGLAND BIOLABS (USA)

6.11 ORIGENE TECHNOLOGIES INC. (USA)

6.12 PROMEGA CORPORATION (USA)

6.13 QIAGEN N.V. (NETHERLANDS)

6.14 TAKARA BIO (JAPAN)

6.15 THERMO FISHER SCIENTIFIC (USA)

6.16 ZYMO RESEARCH (USA)

6.17 AND

Chapter 7: Global Electrocompetent Cells Market By Region

7.1 Overview

7.2. North America Electrocompetent Cells Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Cloned Competent Cells

7.2.4.2 Agrobacterium Tumefaciens Competent Cells

7.2.4.3 Expression Competent Cells

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Subcloning & Routine Cloning

7.2.5.2 Phage Display Library Construction

7.2.5.3 Toxic/unstable Dna Cloning

7.2.5.4 High-throughput Cloning

7.2.5.5 Protein Expression

7.2.5.6 Mutagenesis

7.2.5.7 Single-stranded Dna Production

7.2.5.8 Bacmid Creation

7.2.5.9 Cre-lox Recombination (pir1/pir2)

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Electrocompetent Cells Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Cloned Competent Cells

7.3.4.2 Agrobacterium Tumefaciens Competent Cells

7.3.4.3 Expression Competent Cells

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Subcloning & Routine Cloning

7.3.5.2 Phage Display Library Construction

7.3.5.3 Toxic/unstable Dna Cloning

7.3.5.4 High-throughput Cloning

7.3.5.5 Protein Expression

7.3.5.6 Mutagenesis

7.3.5.7 Single-stranded Dna Production

7.3.5.8 Bacmid Creation

7.3.5.9 Cre-lox Recombination (pir1/pir2)

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Electrocompetent Cells Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Cloned Competent Cells

7.4.4.2 Agrobacterium Tumefaciens Competent Cells

7.4.4.3 Expression Competent Cells

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Subcloning & Routine Cloning

7.4.5.2 Phage Display Library Construction

7.4.5.3 Toxic/unstable Dna Cloning

7.4.5.4 High-throughput Cloning

7.4.5.5 Protein Expression

7.4.5.6 Mutagenesis

7.4.5.7 Single-stranded Dna Production

7.4.5.8 Bacmid Creation

7.4.5.9 Cre-lox Recombination (pir1/pir2)

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Electrocompetent Cells Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Cloned Competent Cells

7.5.4.2 Agrobacterium Tumefaciens Competent Cells

7.5.4.3 Expression Competent Cells

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Subcloning & Routine Cloning

7.5.5.2 Phage Display Library Construction

7.5.5.3 Toxic/unstable Dna Cloning

7.5.5.4 High-throughput Cloning

7.5.5.5 Protein Expression

7.5.5.6 Mutagenesis

7.5.5.7 Single-stranded Dna Production

7.5.5.8 Bacmid Creation

7.5.5.9 Cre-lox Recombination (pir1/pir2)

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Electrocompetent Cells Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Cloned Competent Cells

7.6.4.2 Agrobacterium Tumefaciens Competent Cells

7.6.4.3 Expression Competent Cells

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Subcloning & Routine Cloning

7.6.5.2 Phage Display Library Construction

7.6.5.3 Toxic/unstable Dna Cloning

7.6.5.4 High-throughput Cloning

7.6.5.5 Protein Expression

7.6.5.6 Mutagenesis

7.6.5.7 Single-stranded Dna Production

7.6.5.8 Bacmid Creation

7.6.5.9 Cre-lox Recombination (pir1/pir2)

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Electrocompetent Cells Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Cloned Competent Cells

7.7.4.2 Agrobacterium Tumefaciens Competent Cells

7.7.4.3 Expression Competent Cells

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Subcloning & Routine Cloning

7.7.5.2 Phage Display Library Construction

7.7.5.3 Toxic/unstable Dna Cloning

7.7.5.4 High-throughput Cloning

7.7.5.5 Protein Expression

7.7.5.6 Mutagenesis

7.7.5.7 Single-stranded Dna Production

7.7.5.8 Bacmid Creation

7.7.5.9 Cre-lox Recombination (pir1/pir2)

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Electrocompetent Cells Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 14.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.9% |

Market Size in 2032: |

USD 40.2 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Electrocompetent Cells Market research report is 2024-2032.

Addgene (USA), Agilent Technologies (USA), BioDynamics Laboratory Inc. (Japan), Bio-Rad Laboratories (USA) and Other Major Players.

The Electrocompetent Cells Market is segmented into Type, Application and region. By Type, the market is categorized into Cloned Competent Cells, Agrobacterium Tumefaciens Competent Cells, Expression Competent Cells. By Application, the market is categorized into Subcloning & Routine Cloning, Phage Display Library Construction, Toxic/unstable Dna Cloning, High-throughput Cloning, Protein Expression, Mutagenesis, Single-stranded Dna Production, Bacmid Creation, Cre-lox Recombination (pir1/pir2. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Electrocompetent cells market pertains to the niche market for biotechnology dedicated to providing and selling specially prepared bacterial cells that become competent to recruiting outside DNA by electroporation. These cells are employable in research, pharmaceutical, and biotechnology for genetic transformations. The cells provide high transformation efficiency, making the cells important for cloning, protein expression, and gene editing studies.

Electrocompetent Cells Market Size Was Valued at USD 14.6 Billion in 2023, and is Projected to Reach USD 40.2 Billion by 2032, Growing at a CAGR of 11.9% From 2024-2032.