Electric Vehicle Telematics Market Synopsis

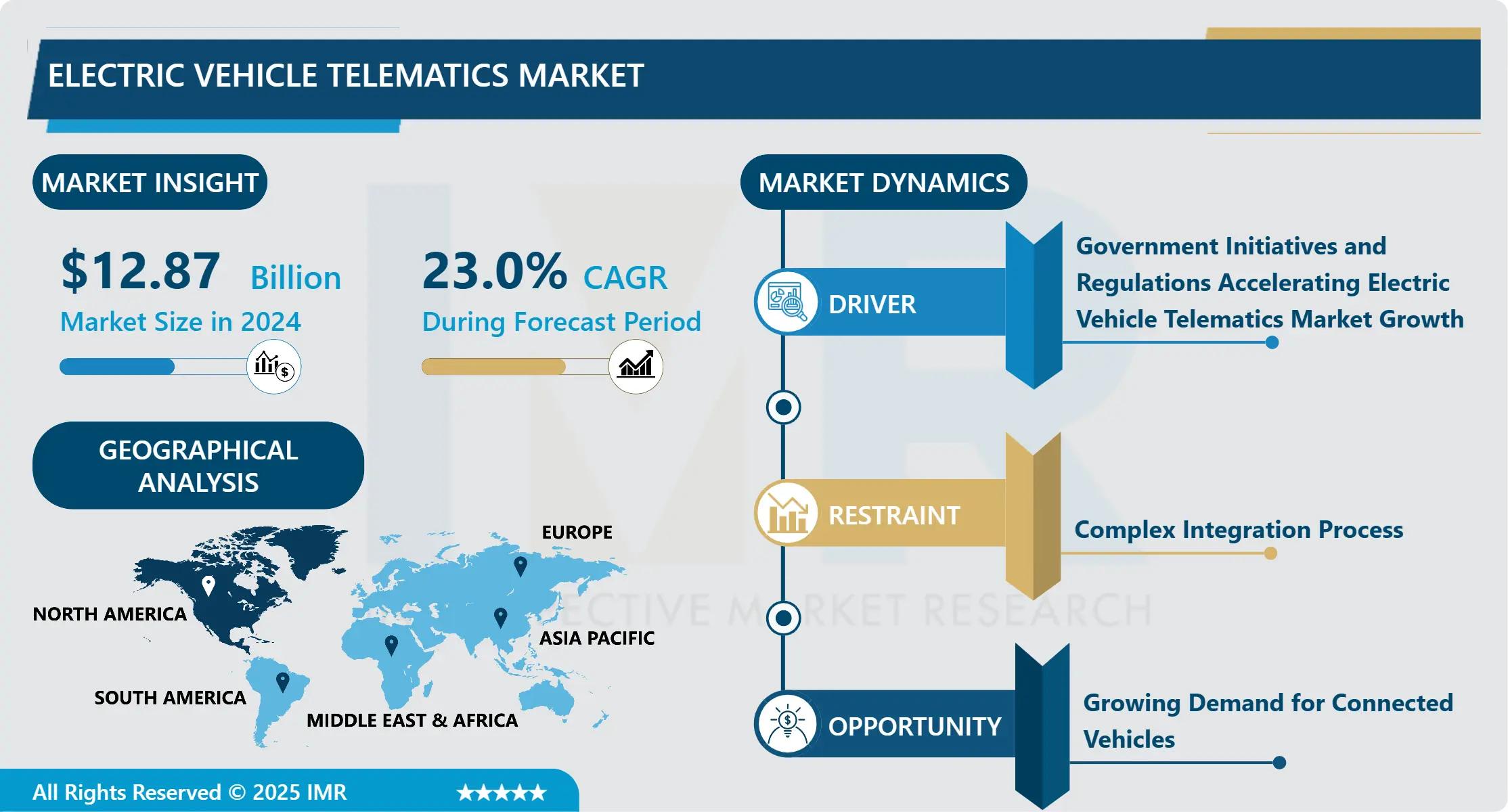

Electric Vehicle Telematics Market Size Was Valued at USD 12.87 Billion in 2024 and is Projected to Reach USD 67.42 Billion by 2032, Growing at a CAGR of 23.0% From 2025-2032.

Electric Vehicle Telematics entails the incorporation of telecommunications and informatics in electric vehicles for data collection, analysis and transmission regarding vehicle performance, battery status, location and other figures. It allows for remote monitoring, diagnostics and control of EVs, hence, improving their efficiency, range and performance.

The dynamic of the Electric Vehicle Telematics market is driven by the ever-increasing number of EVs in the world. Through telematics systems, data collection on EV performance, battery status, and location is possible, therefore enhancing fleet management as well as the overall driving experience. Factors, for example, governmental initiatives encouraging clean energy vehicles, growing environmental awareness and telematics technology which is developing rapidly are all driving the market growth.

The use of telematics together with other advancements such as IoT and AI is making it possible for predictive maintenance, real-time monitoring, and safety functions in EVs to happen. As the automotive industry undergoes the transition towards the inclusive pursuit of sustainable mobility solutions, the Electric Vehicle Telematics market is set for a continuous expansion, creating a ripe platform for innovation and investment in the electrification ecosystem.

The Electric Vehicle Telematics market is increasingly demanded because of the growing trend to connectivity and digitalization in the automotive sector. Besides vehicle performance, telematics systems have features such as remote diagnostics, over-the-air software updates, and vehicle-to-grid communication that increase the comfort and efficiency of electric vehicle ownership.

Consumers get more conscious of their carbon footprint and gravitate towards eco-friendly travel, and EV manufacturers take advantage of telematics solutions to provide individualized services such as energy-efficient route-planning and charging station recommendations. The merging of telematics data with cloud-based systems and smart grid infrastructure brings to the capacity for the optimal electricity management and grid stability. As the electric vehicle and telematics technology field is constantly advancing, the Electric Vehicle Telematics market will make a profound contribution to the future of transport, improving the sustainability and connectivity of the transport system.

Electric Vehicle Telematics Market Trend Analysis

Integration of Advanced Driver Assistance Systems (ADAS) with Telematics

- The integration of Advanced Driver Assistance Systems (ADAS) with Telematics in the Electric Vehicle (EV) market sets a new milestone in automotive technology. ADAS systems are made up of features such as adaptive cruise control, lane departure warning, and automatic emergency braking. These features can improve driver safety and convenience by using sensors and AI algorithms. The benefits expand if the telematics service, which facilitate the transmission of data from vehicles to networks, are integrated. Telematics however offers real-time monitoring of vehicle performance, location tracking, and remote diagnostics through various functions. Through the amalgamation of ADAS with telematics in EVs, both manufacturers and service providers have the capability to offer holistic solutions that not only provide safety enhancement but also enable productivity improvement and efficient fleet management. Through this integration predictive maintenance, remote software updates, and the personalized driving experiences tailored to user preferences, become possible.

- Autonomous driving for forwarding progress, as vehicles can collect and process data from both internal and external sources to make appropriate choices. In the face of the trend of the auto industry to electrify and connect, the combination of ADAS with telematics in electric vehicles is expected to be a vital player in transportation transformation.

- Security and performance solutions, the combination of ADAS with telematics in the electric vehicle system makes available a myriad of other benefits. Energy efficiency is another important point. ADAS-fitted electric vehicles can use live data about driving styles, traffic congestion, and overall use of energy to improve their energy efficiency and increase battery range as well as reducing overall energy consumption.

- ADAS and telematics in conjunction, make it possible for more advanced vehicle-to-infrastructure (V2I) and vehicle-to-vehicle (V2V) communication systems. This enables electric vehicles to have interactions with smart transportation infrastructure and other vehicles on the road, thus, improving the road flow, guidance, and safety by features like intersection collision avoidance and cooperative adaptive cruise control.

Growing Demand for Connected Vehicles

- The connected cars segment of the automotive industry continues to grow, and EV telematics is a major subsegment within this trend. Telematics, the blending of telecommunications and informatics, allows for real-time data transfer and communication between vehicles and outward systems. The widespread adoption of electric vehicles, the development of which is motivated by environmental sustainability and regulatory impositions, has resulted in the need for advanced telematics intended for their use. These systems give outstanding functionalities which include remote diagnostics, battery monitoring, and predictive maintenance that improve performance and provide ultimate user experience.

- EV telematics can help manage the charging infrastructure efficiently and bring about services such as smart grid integration and vehicle-to-grid communication. With consumers putting emphasis on connectivity, safety and sustainability in their vehicle choice, the electric vehicle telematics market is set to witness considerable growth, offering great business opportunities to players in the industry to innovate and meet changing market demands.

Electric Vehicle Telematics Market Segment Analysis:

Electric Vehicle Telematics Market is Segmented on the basis of Type , Vehicle, and application.

Based on the Type, Embedded Type that is expected to dominate the market during the forecast period.

- Embedded Telematics: Incorporated telematics implies putting the telematics system’s hardware and software inside the car during its production. In other words, the telematics system is already part of the vehicle's design and infrastructure during its development. Integration with the vehicle's onboard systems is common among embedded systems, allowing users to access real-time data on the vehicle location, battery status, performance indicators and other parameters. Generally, they provide higher reliability and performance relative to retrofitted solutions however they can be costlier because of the requirement for specific hardware and software integration during manufacturing.

- Retrofitted Telematics: As opposed to the telematics solutions which have been retrofitted into a vehicle after the vehicle has been manufactured and is already in use, the telematics devices or systems are added to a vehicle. They are mostly installed externally and can be used for a more extensive array of vehicles, including older models that may not be manufactured with telematics systems. Retrofitting systems can make use of readily available plug-and-play devices or modules that can be installed very fast and simply, without substantial alterations to the vehicle’s structure. Retrofitted systems can offer cost savings and high compatibility, but not always precision of performance and integration of embedded systems.

By Application, Safety and Security segment held the largest share in 2024

- Safety and Security: Telematics in electric cars can track parameters like speed, location and driver's behavior among others. Safety measures including remote vehicle tracking, anti-theft alerts and geofencing can be integrated to ensure that the vehicle and its occupants are safe.

- Entertainment: Electric vehicles can have telematics including entertainment options such as infotainment systems, streaming services, and connectivity options for passengers to pass the time on a trip.

- Information and Navigation: Telematics systems are real-time information and navigation services to EV drivers which comprise of traffic updates, nearby charging stations, route optimization for EVs and other location-based services to improve time efficiency for EV drivers.

- Diagnostics: Telematics is a significant player in the area of diagnostics and monitoring of electric vehicle health, such as battery performance, energy consumption, system faults, and prognostic maintenance notifications. This application allows for increased efficiency and improves the lifespan of EV components.

- Others: This category might also include other services including control of vehicles from a distance. g. , pre-conditioning the cabin temperature before travel, vehicle-to-grid (V2G) integration for smart charging, fleet management solutions for electric vehicle fleets, and customized telematics service that focuses on the specific needs of individual users or industry requirements.

Electric Vehicle Telematics Market Regional Insights:

North America holds a significant position in the electric vehicle telematics market

- Evidently, North America holds a pivotal position in the electric vehicle (EV) telematics market due to numerous factors propelling its growth and application. Among these factors is the well-developed system of electric vehicle charging stations in the region which provides for the widespread use of EVs. At the same time, stricter emission regulations from the government and government incentives encouraging cleaner transportation also add more wings to the market.

- Also, North America hosts tech-oriented consumers with the ambition of adopting green solutions such as fully electric vehicles integrated with complex telematics systems. These systems provide real-time vehicle tracking, remote diagnostics, and predictive maintenance, improving the user experience and vehicle efficiency. With the world's demand for sustainable transportation developing, North America is set to remain a key player in the EV telematics industry, stimulating technology improvements and the popularity of these technologies on a continent-wide scale.

Active Key Players in the Electric Vehicle Telematics Market

- TomTom International (Netherlands)

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- Trimble, Inc. (U.S.)

- Geotab Inc. (Canada)

- CSS Electronics (Denmark)

- Intellicar (India)

- Inventure Ltd (Hungary)

- Agero, Inc. (U.S.)

- Airbiquity, Inc. (U.S.)

- Aptiv PLC (USA)

- Harman International (USA)

- NXP Semiconductors (Netherlands)

- Valeo (France)

- Denso Corporation (Japan)

- Bosch Mobility Solutions (Germany)

- Magna International (Canada)

- Zonar Systems (USA)

- BlackBerry Limited (Canada)

- Teleflex Inc. (USA) and Other Active Players

Key Industry Developments in the Electric Vehicle Telematics Market:

- In May 2024, Magenta Mobility, an integrated electric mobility solutions provider, and Switch Mobility, the electric vehicle arm of the Hinduja Group, signed a Memorandum of Understanding (MoU) to deploy electric light commercial vehicles (CVs) across India. The agreement, finalized in the past, involved the procurement of 500 SWITCH IeV4 (Intelligent EV) units over two years. This partnership aimed to bolster the adoption of electric vehicles in the commercial sector, reflecting both companies' commitment to advancing sustainable transportation solutions in the Indian market.

- In February 2024, WeaveGrid and Toyota collaborated to enhance EV driver experiences and optimize grid charging. The partnership involved WeaveGrid’s managed charging platform integrating directly with Toyota Motor North America (Toyota), covering both Toyota and Lexus battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). This direct integration, which was active in select utility territories across the US and aimed to expand further, provided significant benefits. BEV and PHEV owners were able to save money on charging while supporting a cleaner and more resilient electric grid.

|

Global Electric Vehicle Telematics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 12.87 Bn. |

|

Forecast Period 2024-32 CAGR: |

23.0% |

Market Size in 2032: |

USD 67.42 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Vehicle Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electric Vehicle Telematics Market by Type (2018-2032)

4.1 Electric Vehicle Telematics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Embedded

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Retrofitted

Chapter 5: Electric Vehicle Telematics Market by Vehicle Type (2018-2032)

5.1 Electric Vehicle Telematics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Two Wheelers

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Passenger Vehicles

5.5 Commercial Vehicles

Chapter 6: Electric Vehicle Telematics Market by Application (2018-2032)

6.1 Electric Vehicle Telematics Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Safety and Security

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Entertainment

6.5 Information and Navigation

6.6 Diagnostics

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Electric Vehicle Telematics Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 DASSAULT

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 TATA ELXSI

7.4 EV CONNECT

7.5 CHARGENET

7.6 BOSCH SOFTWARE INNOVATIONS

7.7 MAPLESOFT

7.8 BOLT

7.9 DRIIVZ LTDCHARGELAB INCHARMAN INTERNATIONAL

7.10 S-PRO

7.11 TESLA

7.12 EV BOX

7.13 BLINK CHARGING COQUALITYZE INCOTHER KEY PLAYERS

Chapter 8: Global Electric Vehicle Telematics Market By Region

8.1 Overview

8.2. North America Electric Vehicle Telematics Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Embedded

8.2.4.2 Retrofitted

8.2.5 Historic and Forecasted Market Size by Vehicle Type

8.2.5.1 Two Wheelers

8.2.5.2 Passenger Vehicles

8.2.5.3 Commercial Vehicles

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Safety and Security

8.2.6.2 Entertainment

8.2.6.3 Information and Navigation

8.2.6.4 Diagnostics

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Electric Vehicle Telematics Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Embedded

8.3.4.2 Retrofitted

8.3.5 Historic and Forecasted Market Size by Vehicle Type

8.3.5.1 Two Wheelers

8.3.5.2 Passenger Vehicles

8.3.5.3 Commercial Vehicles

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Safety and Security

8.3.6.2 Entertainment

8.3.6.3 Information and Navigation

8.3.6.4 Diagnostics

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Electric Vehicle Telematics Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Embedded

8.4.4.2 Retrofitted

8.4.5 Historic and Forecasted Market Size by Vehicle Type

8.4.5.1 Two Wheelers

8.4.5.2 Passenger Vehicles

8.4.5.3 Commercial Vehicles

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Safety and Security

8.4.6.2 Entertainment

8.4.6.3 Information and Navigation

8.4.6.4 Diagnostics

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Electric Vehicle Telematics Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Embedded

8.5.4.2 Retrofitted

8.5.5 Historic and Forecasted Market Size by Vehicle Type

8.5.5.1 Two Wheelers

8.5.5.2 Passenger Vehicles

8.5.5.3 Commercial Vehicles

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Safety and Security

8.5.6.2 Entertainment

8.5.6.3 Information and Navigation

8.5.6.4 Diagnostics

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Electric Vehicle Telematics Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Embedded

8.6.4.2 Retrofitted

8.6.5 Historic and Forecasted Market Size by Vehicle Type

8.6.5.1 Two Wheelers

8.6.5.2 Passenger Vehicles

8.6.5.3 Commercial Vehicles

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Safety and Security

8.6.6.2 Entertainment

8.6.6.3 Information and Navigation

8.6.6.4 Diagnostics

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Electric Vehicle Telematics Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Embedded

8.7.4.2 Retrofitted

8.7.5 Historic and Forecasted Market Size by Vehicle Type

8.7.5.1 Two Wheelers

8.7.5.2 Passenger Vehicles

8.7.5.3 Commercial Vehicles

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Safety and Security

8.7.6.2 Entertainment

8.7.6.3 Information and Navigation

8.7.6.4 Diagnostics

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Electric Vehicle Telematics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 12.87 Bn. |

|

Forecast Period 2024-32 CAGR: |

23.0% |

Market Size in 2032: |

USD 67.42 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Vehicle Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||