Electric Vehicle Specific Tires Market Synopsis

Global Electric Vehicle Specific Tires Market Size Was Valued at USD 22.08 Billion in 2023 And Is Projected to Reach USD 205.95 Billion By 2032, Growing at A CAGR of 28.16% From 2024 To 2032.

Electric Vehicle Particulars EV tires, also known as specialised tire variations, are designed with the unique overall performance desires of electrical automobiles (EVs) in thoughts. The layout of these tires takes into consideration different factors, including the weight distribution, torque shipping, and common efficacy of the electric vehicle.

- EV-particular tires are designed to house a extensive variety of electrical cars, together with plug-in hybrids, electric SUVs, and completely electric motors. The design of those automobiles is intending to maximize performance and use amusement thru the availability of more desirable traction, decreased rolling resistance, and an prolonged variety.

- One vital gain of EV-specific tires is their capability to augment the range and efficacy of electric cars. They frequently feature tread styles and specialized compounds with low rolling resistance. By lowering the quantity of strength required for propulsion, this design correctly improves the overall mileage. In addition, these tires correctly manage the immediate torque application of electrical motors, thereby handing over improved adhesion and traction, especially while accelerating.

- Furthermore, subtle tread designs and production traits of EV-specific tires make contributions to a greater satisfactory and quieter riding enjoy. By minimizing street noise, this design enhances the convenience of electric car (EV) passengers and drivers.

Electric Vehicle Specific Tires Market Trend Analysis

Implications of Tire Technology for the Electric Vehicle Industry

- The expansion of the global electric car (EV) unique tires market is extensively propelled by way of tyre technological advancements. Significant improvements have been made to the efficacy, overall performance, and environmental impact of electric motors as a result of these innovations, that are especially designed to deal with their demands.

- Rolling resistance reduction is the number one objective of tyre innovation for electric powered motors. As a end result of this reduction, the strength efficacy of electrical cars is more desirable, which has a direct effect on their range extension. In an attempt to provide tires with decreased resistance even as keeping protection and sturdiness, tire producers are making widespread investments in research and development. Consumers may be more willing to purchase electric motors due to this technological advancement, that is crucial for optimizing their mileage and normal efficacy.

- The goal of trends in tire era is to lessen tiers of operational disturbance. An additional benefit of quieter tires is they complement the clean and silent operation of electric cars, which in addition improves the riding enjoy for EV proprietors. To fulfill the call for for a greater cushty driving enjoy and differentiate EV-unique tires from wellknown ones, tire producers are integrating noise-reducing elements into tire designs. Furthermore, attuned to the unique attributes of electric automobiles, those technological traits prioritize greater overall performance with the aid of making certain superior traction, handling, and deceleration. In pursuit of pleasing the overall performance necessities of electrical cars (EVs) whilst concurrently advancing sustainability goals, manufacturers put in force novel materials and creation strategies.

Penetration Growth in Diverse EV Segments

- The expanding market for electric vehicles (EVs) across multiple transportation sectors, including passenger cars, buses, lorries, and motorcycles, has provided the global electric vehicle specific tires market with substantial growth prospects. The increasing adoption of electric vehicles across various vehicle categories has generated a demand for specialized tires that meet the distinct specifications of each segment.

- The rapid integration of electric vehicles into the passenger car industry, propelled by regulatory measures and environmental considerations, has generated a demand for specialized tyres. Designed particularly to enhance the performance, gas financial system, and riding range of electric cars, those tires are optimized. Tire producers are presently putting emphasis on the improvement of tires that minimize rolling resistance, show off enhanced traction, and extend their lifespans which will fulfill the developing needs of this expanding marketplace.

- Similarly, there was a extensive boom inside the electrification of buses and automobiles applied for commercial and public transportation. Tires designed for electric buses and automobiles must be able to withstand greater hundreds with out sacrificing overall performance or sturdiness. As a end result, tire manufacturers are present process improvements to develop tires tailor-made particularly for electric powered cars (EVs) that may bear elevated loads, supply longer distances, and reveal improved durability in opposition to degradation, as a consequence meeting the wishes of those sturdy cars. As city mobility solutions, the proliferation of electric motorcycles and scooters has generated a gap market for tires engineered to improve traction, stability, and electricity performance; for this reason, the riding enjoy for electric motorcycle and scooter riders has been more advantageous.

Electric Vehicle Specific Tires Market Segment Analysis:

Electric Vehicle Specific Tires Market Segmented based on Type, Technology, and Distribution Channel.

By Type, Passenger Vehicle segment is expected to dominate the market during the forecast period

- Consumers have end up increasingly more inquisitive about electric powered automobiles as a result of environmental considerations, government subsidies, and technological improvements. Consequently, there has been a surge in the call for for tires that had been engineered specifically for electric powered passenger motors.

- Compared to traditional inner combustion engine automobiles, EVs have distinct qualities, which includes instant torque shipping and a heavier battery. To account for these variations, tire producers have created specialised tires which have been optimized to acquire more efficacy and an prolonged lifespan.

- The increasing adoption of electrical motors with the aid of purchasers has ended in a sizeable rise inside the demand for passenger vehicle tires designed particularly for electric automobiles.

By Technology, Radial Tire segment held the largest share in 2023

- In comparison to bias-ply tires, radial tires typically show off reduced rolling resistance, thereby facilitating progressed gas efficiency. This feature is especially tremendous for electric powered automobiles that strive to obtain prolonged variety. The performance necessities of electric cars are met by the enhanced traction, progressed dealing with, and smoother journey traits of radial tires.

- In contrast to bias-ply tires, these commonly have an extended period, which is tremendous for EV proprietors who prioritize affordability and durability. Radial tires are nicely-applicable for electric vehicles because of their houses, which consist of the capability to distribute the burden of electric automobile additives (which include batteries) and withstand the on the spot torque produced with the aid of electric powered motors.

Electric Vehicle Specific Tires Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

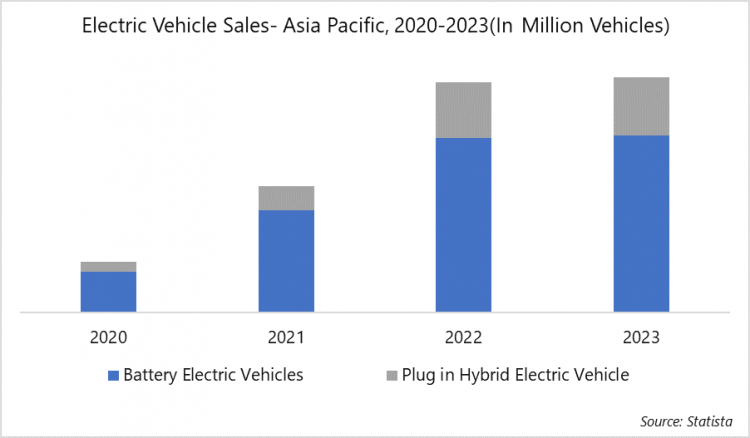

- The exponential growth of electrical automobile utilization in international locations together with China, Japan, and South Korea can be attributed to a convergence of various factors. The proliferation of technological improvements, extended governmental incentives, and heightened environmental focus have all contributed to the meteoric upward push in electric powered car demand inside the Asia-Pacific vicinity. The heightened fascination with electric cars has appreciably elevated the marketplace for specialised additives, consisting of tires designed in particular for electric cars.

- The Asia-Pacific area serves as a foremost hub for electric vehicle manufacturing. The presence of numerous distinguished electric car (EV) manufacturers in those countries has drastically expanded the call for for specialized tires designed specially for EVs. The dominance in manufacturing has considerably increased the call for for these tires, thereby playing a vital function in positioning the area as a pacesetter inside the global electric car market.

- The proliferation of charging infrastructure investments through governments and the implementation of various projects to advance electric mobility have appreciably contributed to the increase of the electrical automobile (EV) marketplace in Asia-Pacific nations. The proliferation of electric cars has been facilitated with the aid of the collaborative endeavors to assemble a resilient infrastructure; as a end result, the demand for associated additives, which includes specialised tires, has extended.

Active Key Players in the Electric Vehicle Specific Tires Market

- Goodyear Tire & Rubber Company (U.S.)

- Cooper Tire & Rubber Company (U.S.)

- Michelin (France)

- Pirelli & C. S.p.A. (Italy)

- Nokian Tyres plc (Finland)

- Continental AG (Germany)

- Qingdao Sentury Tire Co., Ltd. (China)

- Triangle Tyre Co., Ltd. (China)

- Apollo Tyres Limited (India)

- Bridgestone (Japan)

- Yokohama Rubber Co., Ltd. (Japan)

- Sumitomo Rubber Industries, Ltd. (Japan)

- Giti Tire (Singapore)

- Hankook Tire & Technology Co., Ltd. (South Korea)

- Cheng Shin Rubber Industry Co., Ltd. (Taiwan)

- Zeetex Tyre Corporation (Taiwan)

- Nankang Rubber Tire Co., Ltd. (Taiwan)

- Other Key Players

|

Global Electric Vehicle Specific Tires Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 22.08 Bn. |

|

Forecast Period 2024-32 CAGR: |

28.16% |

Market Size in 2032: |

USD 205.95 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ELECTRIC VEHICLE SPECIFIC TIRES MARKET BY TYPE (2017-2032)

- ELECTRIC VEHICLE SPECIFIC TIRES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PASSENGER VEHICLES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL VEHICLES

- TWO WHEELERS

- ELECTRIC VEHICLE SPECIFIC TIRES MARKET BY TECHNOLOGY (2017-2032)

- ELECTRIC VEHICLE SPECIFIC TIRES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RADIAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- Bias

- Composite

- ELECTRIC VEHICLE SPECIFIC TIRES MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- ELECTRIC VEHICLE SPECIFIC TIRES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AFTERMARKET

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OEM

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Electric Vehicle Specific Tires Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- GOODYEAR TIRE & RUBBER COMPANY (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- COOPER TIRE & RUBBER COMPANY (U.S.)

- MICHELIN (FRANCE)

- PIRELLI & C. S.P.A. (ITALY)

- NOKIAN TYRES PLC (FINLAND)

- CONTINENTAL AG (GERMANY)

- QINGDAO SENTURY TIRE CO., LTD. (CHINA)

- TRIANGLE TYRE CO., LTD. (CHINA)

- APOLLO TYRES LIMITED (INDIA)

- BRIDGESTONE (JAPAN)

- YOKOHAMA RUBBER CO., LTD. (JAPAN)

- SUMITOMO RUBBER INDUSTRIES, LTD. (JAPAN)

- GITI TIRE (SINGAPORE)

- HANKOOK TIRE & TECHNOLOGY CO., LTD. (SOUTH KOREA)

- CHENG SHIN RUBBER INDUSTRY CO., LTD. (TAIWAN)

- ZEETEX TYRE CORPORATION (TAIWAN)

- NANKANG RUBBER TIRE CO., LTD. (TAIWAN)

- COMPETITIVE LANDSCAPE

- GLOBAL ELECTRIC VEHICLE SPECIFIC TIRES MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Technology

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Electric Vehicle Specific Tires Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 22.08 Bn. |

|

Forecast Period 2024-32 CAGR: |

28.16% |

Market Size in 2032: |

USD 205.95 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ELECTRIC VEHICLE SPECIFIC TIRES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ELECTRIC VEHICLE SPECIFIC TIRES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ELECTRIC VEHICLE SPECIFIC TIRES MARKET COMPETITIVE RIVALRY

TABLE 005. ELECTRIC VEHICLE SPECIFIC TIRES MARKET THREAT OF NEW ENTRANTS

TABLE 006. ELECTRIC VEHICLE SPECIFIC TIRES MARKET THREAT OF SUBSTITUTES

TABLE 007. ELECTRIC VEHICLE SPECIFIC TIRES MARKET BY TYPE

TABLE 008. PASSENGER VEHICLES MARKET OVERVIEW (2016-2028)

TABLE 009. COMMERCIAL VEHICLES MARKET OVERVIEW (2016-2028)

TABLE 010. TWO WHEELERS MARKET OVERVIEW (2016-2028)

TABLE 011. ELECTRIC VEHICLE SPECIFIC TIRES MARKET BY TECHNOLOGY

TABLE 012. RADIAL MARKET OVERVIEW (2016-2028)

TABLE 013. BIAS MARKET OVERVIEW (2016-2028)

TABLE 014. COMPOSITE MARKET OVERVIEW (2016-2028)

TABLE 015. ELECTRIC VEHICLE SPECIFIC TIRES MARKET BY DISTRIBUTION CHANNEL

TABLE 016. AFTERMARKET MARKET OVERVIEW (2016-2028)

TABLE 017. OEM MARKET OVERVIEW (2016-2028)

TABLE 018. NORTH AMERICA ELECTRIC VEHICLE SPECIFIC TIRES MARKET, BY TYPE (2016-2028)

TABLE 019. NORTH AMERICA ELECTRIC VEHICLE SPECIFIC TIRES MARKET, BY TECHNOLOGY (2016-2028)

TABLE 020. NORTH AMERICA ELECTRIC VEHICLE SPECIFIC TIRES MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 021. N ELECTRIC VEHICLE SPECIFIC TIRES MARKET, BY COUNTRY (2016-2028)

TABLE 022. EUROPE ELECTRIC VEHICLE SPECIFIC TIRES MARKET, BY TYPE (2016-2028)

TABLE 023. EUROPE ELECTRIC VEHICLE SPECIFIC TIRES MARKET, BY TECHNOLOGY (2016-2028)

TABLE 024. EUROPE ELECTRIC VEHICLE SPECIFIC TIRES MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 025. ELECTRIC VEHICLE SPECIFIC TIRES MARKET, BY COUNTRY (2016-2028)

TABLE 026. ASIA PACIFIC ELECTRIC VEHICLE SPECIFIC TIRES MARKET, BY TYPE (2016-2028)

TABLE 027. ASIA PACIFIC ELECTRIC VEHICLE SPECIFIC TIRES MARKET, BY TECHNOLOGY (2016-2028)

TABLE 028. ASIA PACIFIC ELECTRIC VEHICLE SPECIFIC TIRES MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 029. ELECTRIC VEHICLE SPECIFIC TIRES MARKET, BY COUNTRY (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA ELECTRIC VEHICLE SPECIFIC TIRES MARKET, BY TYPE (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA ELECTRIC VEHICLE SPECIFIC TIRES MARKET, BY TECHNOLOGY (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA ELECTRIC VEHICLE SPECIFIC TIRES MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 033. ELECTRIC VEHICLE SPECIFIC TIRES MARKET, BY COUNTRY (2016-2028)

TABLE 034. SOUTH AMERICA ELECTRIC VEHICLE SPECIFIC TIRES MARKET, BY TYPE (2016-2028)

TABLE 035. SOUTH AMERICA ELECTRIC VEHICLE SPECIFIC TIRES MARKET, BY TECHNOLOGY (2016-2028)

TABLE 036. SOUTH AMERICA ELECTRIC VEHICLE SPECIFIC TIRES MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 037. ELECTRIC VEHICLE SPECIFIC TIRES MARKET, BY COUNTRY (2016-2028)

TABLE 038. FALKEN TIRE: SNAPSHOT

TABLE 039. FALKEN TIRE: BUSINESS PERFORMANCE

TABLE 040. FALKEN TIRE: PRODUCT PORTFOLIO

TABLE 041. FALKEN TIRE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. MICHELIN: SNAPSHOT

TABLE 042. MICHELIN: BUSINESS PERFORMANCE

TABLE 043. MICHELIN: PRODUCT PORTFOLIO

TABLE 044. MICHELIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. NOKIAN TYRE: SNAPSHOT

TABLE 045. NOKIAN TYRE: BUSINESS PERFORMANCE

TABLE 046. NOKIAN TYRE: PRODUCT PORTFOLIO

TABLE 047. NOKIAN TYRE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. COOPER TYRE AND RUBBER COMPANY: SNAPSHOT

TABLE 048. COOPER TYRE AND RUBBER COMPANY: BUSINESS PERFORMANCE

TABLE 049. COOPER TYRE AND RUBBER COMPANY: PRODUCT PORTFOLIO

TABLE 050. COOPER TYRE AND RUBBER COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. APOLLO TYRE: SNAPSHOT

TABLE 051. APOLLO TYRE: BUSINESS PERFORMANCE

TABLE 052. APOLLO TYRE: PRODUCT PORTFOLIO

TABLE 053. APOLLO TYRE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. PIRELLI AND CO: SNAPSHOT

TABLE 054. PIRELLI AND CO: BUSINESS PERFORMANCE

TABLE 055. PIRELLI AND CO: PRODUCT PORTFOLIO

TABLE 056. PIRELLI AND CO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. BRIDGESTONE: SNAPSHOT

TABLE 057. BRIDGESTONE: BUSINESS PERFORMANCE

TABLE 058. BRIDGESTONE: PRODUCT PORTFOLIO

TABLE 059. BRIDGESTONE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. CONTINENTAL AG: SNAPSHOT

TABLE 060. CONTINENTAL AG: BUSINESS PERFORMANCE

TABLE 061. CONTINENTAL AG: PRODUCT PORTFOLIO

TABLE 062. CONTINENTAL AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. YOKOHAMA RUBBER: SNAPSHOT

TABLE 063. YOKOHAMA RUBBER: BUSINESS PERFORMANCE

TABLE 064. YOKOHAMA RUBBER: PRODUCT PORTFOLIO

TABLE 065. YOKOHAMA RUBBER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. GOODYEAR TYRE AND RUBBER COMPANY: SNAPSHOT

TABLE 066. GOODYEAR TYRE AND RUBBER COMPANY: BUSINESS PERFORMANCE

TABLE 067. GOODYEAR TYRE AND RUBBER COMPANY: PRODUCT PORTFOLIO

TABLE 068. GOODYEAR TYRE AND RUBBER COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 069. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 070. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 071. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ELECTRIC VEHICLE SPECIFIC TIRES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ELECTRIC VEHICLE SPECIFIC TIRES MARKET OVERVIEW BY TYPE

FIGURE 012. PASSENGER VEHICLES MARKET OVERVIEW (2016-2028)

FIGURE 013. COMMERCIAL VEHICLES MARKET OVERVIEW (2016-2028)

FIGURE 014. TWO WHEELERS MARKET OVERVIEW (2016-2028)

FIGURE 015. ELECTRIC VEHICLE SPECIFIC TIRES MARKET OVERVIEW BY TECHNOLOGY

FIGURE 016. RADIAL MARKET OVERVIEW (2016-2028)

FIGURE 017. BIAS MARKET OVERVIEW (2016-2028)

FIGURE 018. COMPOSITE MARKET OVERVIEW (2016-2028)

FIGURE 019. ELECTRIC VEHICLE SPECIFIC TIRES MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 020. AFTERMARKET MARKET OVERVIEW (2016-2028)

FIGURE 021. OEM MARKET OVERVIEW (2016-2028)

FIGURE 022. NORTH AMERICA ELECTRIC VEHICLE SPECIFIC TIRES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. EUROPE ELECTRIC VEHICLE SPECIFIC TIRES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. ASIA PACIFIC ELECTRIC VEHICLE SPECIFIC TIRES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. MIDDLE EAST & AFRICA ELECTRIC VEHICLE SPECIFIC TIRES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. SOUTH AMERICA ELECTRIC VEHICLE SPECIFIC TIRES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Electric Vehicle Specific Tires Market research report is 2024-2032.

Goodyear Tire & Rubber Company (U.S.), Cooper Tire & Rubber Company (U.S.), Michelin (France), Pirelli & C. S.p.A. (Italy), Nokian Tyres plc (Finland), Continental AG (Germany), Qingdao Sentury Tire Co., Ltd. (China), Triangle Tyre Co., Ltd. (China), Apollo Tyres Limited (India), Bridgestone (Japan), Yokohama Rubber Co., Ltd. (Japan), Sumitomo Rubber Industries, Ltd. (Japan), Giti Tire (Singapore), Hankook Tire & Technology Co., Ltd. (South Korea), Cheng Shin Rubber Industry Co., Ltd. (Taiwan), Zeetex Tyre Corporation (Taiwan), Nankang Rubber Tire Co., Ltd. (Taiwan), and other key players.

The Electric Vehicle Specific Tires Market is segmented into Type, Technology, Distribution Channel, and region. By Type, the market is categorized into Passenger Vehicles, Commercial Vehicles, and Two wheelers. By Technology, the market is categorized into Radial, Bias, and Composite. By Distribution Channel, the market is categorized into Aftermarket and OEM. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Electric Vehicle Particulars EV tires, also known as specialized tire variations, are designed with the unique overall performance desires of electrical automobiles (EVs) in thoughts. The layout of these tires takes into consideration different factors, including the weight distribution, torque shipping, and common efficacy of the electric vehicle.

Global Electric Vehicle Specific Tires Market Size Was Valued at USD 22.08 Billion In 2023 And Is Projected to Reach USD 205.95 Billion By 2032, Growing at A CAGR of 28.16% From 2024 To 2032.