Electric Vehicle Heat Exchanger Market Synopsis

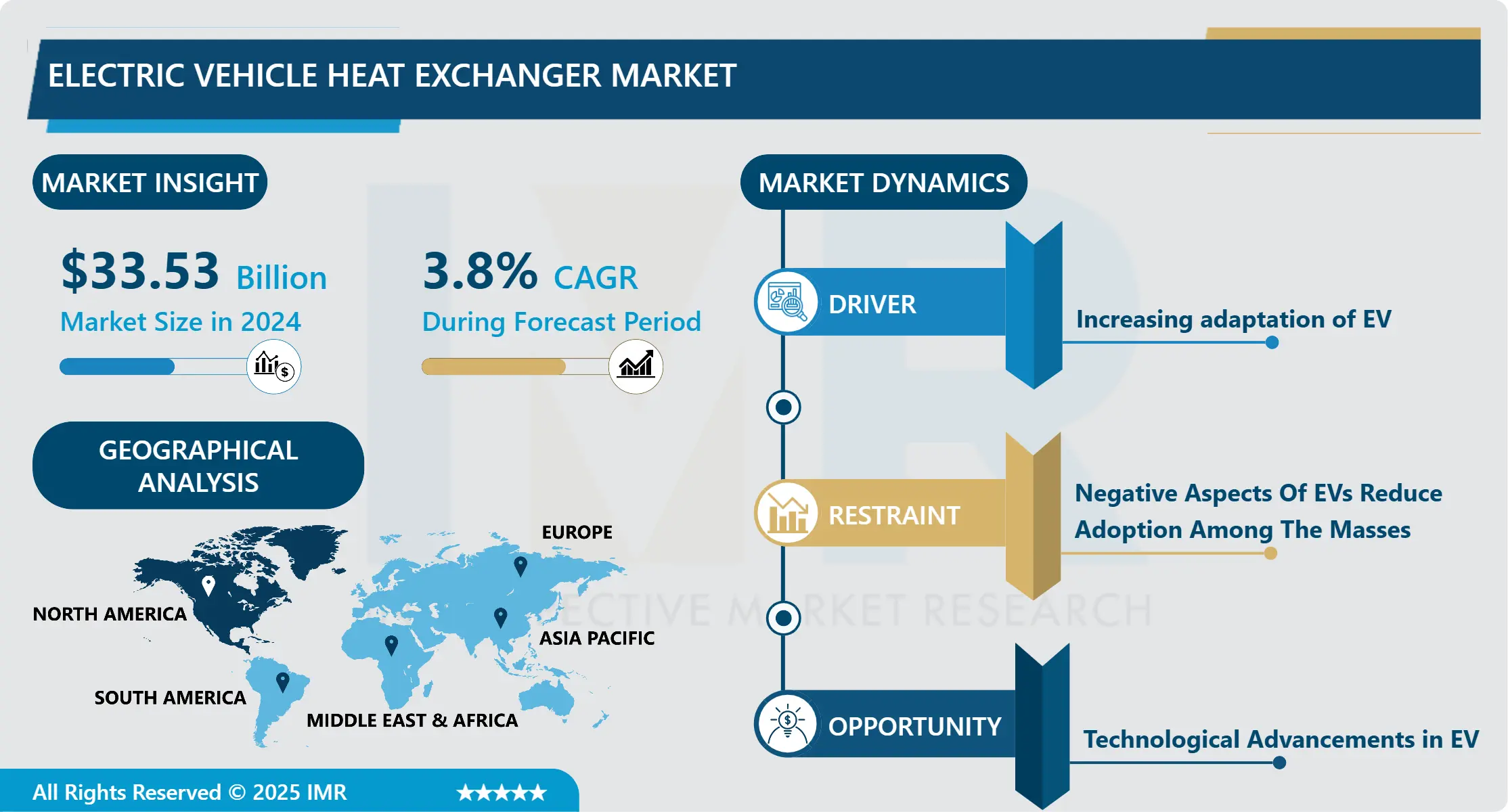

Electric Vehicle Heat Exchanger Market size was Valued at USD 33.53 Billion in 2024 and is Projected to Reach USD 45.19 Billion by 2032, Growing at a CAGR of 3.8% From 2025-2032.

The electric-powered automobile (EV) warmness exchanger regulates the temperature of crucial additives such as the battery cell, electric-powered motor, and electricity electronics. It is a vital element of the thermal control gadget in EVs. By enabling the dissipation of surplus warmness far from these components, it guarantees the upkeep of perfect working temperatures, for this reason ensuring capability, effectiveness, and protection. In standard, electric vehicle warmness exchangers hire coolant fluids or air to take in warmness from the electric gadget components and in the end release it into the encompassing surroundings. This procedure serves to avert overheating and extend the operational longevity of the EV.

In electric-powered motors, the Electric Vehicle Heat Exchanger is a constituent hired for thermal regulation originating from numerous systems, together with vehicles, electricity electronics, and batteries. It aids in temperature regulation and the preservation of ultimate operating situations for these crucial components.

Electric car (EV) heat exchangers are of paramount significance inside the thermal control device of EVs, as they're designed to accommodate the distinct demands of electric propulsion structures. In assessment to inner combustion engines, which generate heat via combustion, electric vehicles predominantly rely on chemical reactions and electrical resistance occurring within the battery cells. It is important to modify this heat, as excessive temperatures can lead to adverse consequences on battery overall performance, shortened lifespan, and, in extreme times, even safety hazards like thermal runaway.

The fast growth of the electric car market is a direct result of the increasing global adoption of electric vehicles. The growing marketplace call for electric motors necessitates the implementation of extra powerful thermal management systems, which include warmth exchangers. The electric-powered car market is experiencing a considerable boom because of the increasing call for long-lasting and excessive-performing batteries and the increasing electric car market.

Electric Vehicle Heat Exchanger Market Trend Analysis

Rapid Technological Advancement Increases the Demand

- Rapid technological trends, consisting of the incorporation of artificial intelligence (AI), the Internet of Things (IoT), and blockchain, are reshaping the area of electrical vehicle (EV) thermal management systems. The call for for electric powered car warmness exchangers is being fueled with the aid of the great improvements in efficiency, security, and scalability that those trends are facilitating. By leveraging IoT-enabled sensors and AI-powered predictive analytics, manufacturers have the potential to constantly screen and manipulate temperatures, thereby optimizing warmth trade strategies and increasing the lifespan of structures. In addition, blockchain technology ensures the security and integrity of statistics, that is vital for preserving confidence in electric powered automobile thermal control structures. The growing global adoption of electric vehicles (EVs) will result in a heightened want for stylish heat exchangers that comprise these present day technologies. These warmth exchangers will serve the evolving necessities of each electric powered car producers and consumers.

- In addition, the incorporation of blockchain, AI, and IoT into electric car warmness exchangers presents extraordinary possibilities for marketplace differentiation and innovation. Automobile producers have the potential to optimize cooling strategies by using using AI algorithms according with environmental conditions and vehicle usage styles. This can bring about better electric powered automobile variety and multiplied electricity efficiency. Connectivity to the Internet of Things lets in far flung diagnostics and tracking, which allows proactive upkeep and decreases disruption. In addition, throughout the deliver chain, blockchain era guarantees facts integrity and transparency, thereby bolstering self assurance and traceability. These developments now not most effective enhance the efficiency and dependability of heat exchangers for electric powered cars however additionally set up manufacturers as frontrunners within the unexpectedly progressing ecosystem of electric motors. Consequently, there is an anticipated surge in call for for these cutting-edge electric vehicle warmth exchangers, so that you can drastically propel the electric vehicle thermal control market forward in the coming years.

Global adoption of electric vehicles

- Rapid growth is being propelled by using the increasing international adoption of electrical vehicles (EVs) into the electric car warmness exchanger market. As electric powered vehicle adoption will increase, so does the call for for efficient thermal control systems. Heat exchangers are critical for optimizing the overall performance and sturdiness of electric vehicle components, which includes electricity electronics and batteries. Additionally, technological advances in warmness exchangers, along with the incorporation of light-weight substances and compact designs, are propelling the marketplace. It is expected that the electrical car warmness exchanger market will revel in consistent increase in tandem with the enterprise's expansion.

- For a whole lot of reasons, the marketplace for warmth exchangers for electric powered motors is increasing. To begin with, the call for for green thermal management systems is increasing because of extra stringent pollution policies and governmental incentives promoting the adoption of electric vehicles. Increasing purchaser cognizance concerning the financial and ecological advantages of electrical motors is the second one element propelling market boom. The market is moreover expanding because of advancements in warmth exchanger materials and designs that goal to decorate efficiency even as decreasing weight. Furthermore, with the multiplied investment in electric powered automobile infrastructure, including charging stations, there is a corresponding surge inside the need for heat exchangers to optimize the overall performance and variety of automobiles.

Electric Vehicle Heat Exchanger Market Segment Analysis:

- Electric Vehicle Heat Exchanger Market is segmented based on Electric Vehicle Type, Design, and Vehicle Type.

By Electric Vehicle Type, BEV segment is expected to dominate the market during the forecast period

- On the Electric Vehicle Heat Exchanger Market, battery electric powered vehicles (BEVs) are rising because the dominant phase. In mild of the worldwide car sector's paradigm transition closer to electrification and the growing client call for for environmentally pleasant transportation, battery electric powered motors (BEVs) have garnered giant attention and assist.

By Vehicle Type, Passenger Car segment held the largest share in 2024

- The passenger vehicle segment is presently protecting the very best marketplace proportion within the electric powered vehicle heat exchanger industry. Growing consumer interest in electric passenger cars instigated through environmental issues, government incentives, and technological improvements is the driving force behind this trend.

Electric Vehicle Heat Exchanger Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The electric powered automobile (EV) heat exchanger market is anticipated to be ruled by way of North America for several massive motives. To begin with, the location is renowned for its advanced automobile area, which possesses well-set up manufacturing capacities and locations full-size emphasis on technological improvements and innovation. In addition, substantial government funding and guide for the adoption of electric motors had been determined in North America, in which a range of subsidies and incentives have been carried out to encourage companies and purchasers to transition to electric powered mobility. Furthermore, the proliferation of prominent electric powered car (EV) producers, generation titans, and entrepreneurs inside the region fosters the advancement of sophisticated EV technology, which include warmness exchangers and thermal control structures. Finally, the growing focus of environmental problems and the implementation of rigorous emissions policies in North America make contributed to the surge in demand for electric vehicles and related components, organising the region as a huge contender inside the marketplace for EV heat exchangers.

- The United States offers BEV clients a USD 7,500 tax credit reduction, whilst PHEV users are eligible for a variable decrease. A Toyota Prius Prime plug-in hybrid is offered at a reduced fee of USD four,500, whereas a Tesla Model three is discounted via USD 7,500.

Active Key Players in the Electric Vehicle Heat Exchanger Market

- AKG Thermal Systems Inc.

- American Industrial Heat Transfer Inc.

- Banco Products (India) Ltd

- Climetal SL - Heat Exchanger

- Constellium SE

- DENSO Corporation

- G&M Radiator Mfg Ltd

- Hanon Systems

- MAHLE GmbH

- MODINE MANUFACTURING COMPANY

- Nippon Light Metal Holdings Co. Ltd

- Dana Incorporated (USA)

- Hanon Systems (South Korea)

- Visteon Corporation (USA)

- Webasto SE (Germany)

- Adient plc (Ireland)

- Valeo SA , and other major players.

Key Industry Developments in the Electric Vehicle Heat Exchanger Market:

- In June 2024, Marelli successfully secured a substantial contract from a leading global automaker to provide Battery Thermal Plates (BTP) for upcoming Battery Electric Vehicles (BEVs). This solution, essential for managing thermal energy in electric vehicles, was internally developed and manufactured by Marelli. The contract underscores Marelli's commitment to advancing sustainable mobility through innovative thermal management solutions tailored for the electric vehicle market.

- In January 2024, Bosch Rexroth and Modine partnered on thermal management for electrified off-highway machinery. As part of its efforts to electrify critical off-highway machinery, Bosch Rexroth announced a collaboration with thermal management manufacturer Modine (NYSE: MOD). The two organizations worked together to integrate Modine EVantage (™) thermal management systems into Bosch Rexroth's portfolio of eLION products for electrified off-highway machinery globally. This partnership aimed to advance the electrification of customer platforms in the off-highway segment, ensuring low emissions and high-performance EV technology.

|

Global Electric Vehicle Heat Exchanger Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 33.53 Bn. |

|

Forecast Period 2025-32 CAGR: |

3.8% |

Market Size in 2032: |

USD 45.19 Bn. |

|

Segments Covered: |

By Electric Vehicle Type |

|

|

|

By Design |

|

||

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electric Vehicle Heat Exchanger Market by Electric Vehicle Type (2018-2032)

4.1 Electric Vehicle Heat Exchanger Market Snapshot and Growth Engine

4.2 Market Overview

4.3 BEV

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 PHEV

4.5 HEV

Chapter 5: Electric Vehicle Heat Exchanger Market by Design (2018-2032)

5.1 Electric Vehicle Heat Exchanger Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Plate Bar

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Tube Fin

Chapter 6: Electric Vehicle Heat Exchanger Market by Vehicle Type (2018-2032)

6.1 Electric Vehicle Heat Exchanger Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Passenger Car

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 LCV

6.5 Truck

6.6 Bus

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Electric Vehicle Heat Exchanger Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 TOMTOM INTERNATIONAL (NETHERLANDS)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ROBERT BOSCH GMBH (GERMANY)

7.4 CONTINENTAL AG (GERMANY)

7.5 TRIMBLE INC. (U.S.)

7.6 GEOTAB INC. (CANADA)

7.7 CSS ELECTRONICS (DENMARK)

7.8 INTELLICAR (INDIA)

7.9 INVENTURE LTD (HUNGARY)

7.10 AGERO INC. (U.S.)

7.11 AIRBIQUITY INC.(U.S.)

7.12 APTIV PLC (USA)

7.13 HARMAN INTERNATIONAL (USA)

7.14 NXP SEMICONDUCTORS (NETHERLANDS)

7.15 VALEO (FRANCE)

7.16 DENSO CORPORATION (JAPAN)

7.17 BOSCH MOBILITY SOLUTIONS (GERMANY)

7.18 MAGNA INTERNATIONAL (CANADA)

7.19 ZONAR SYSTEMS (USA)

7.20 BLACKBERRY LIMITED (CANADA)

7.21 TELEFLEX INC. (USA)

Chapter 8: Global Electric Vehicle Heat Exchanger Market By Region

8.1 Overview

8.2. North America Electric Vehicle Heat Exchanger Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Electric Vehicle Type

8.2.4.1 BEV

8.2.4.2 PHEV

8.2.4.3 HEV

8.2.5 Historic and Forecasted Market Size by Design

8.2.5.1 Plate Bar

8.2.5.2 Tube Fin

8.2.6 Historic and Forecasted Market Size by Vehicle Type

8.2.6.1 Passenger Car

8.2.6.2 LCV

8.2.6.3 Truck

8.2.6.4 Bus

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Electric Vehicle Heat Exchanger Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Electric Vehicle Type

8.3.4.1 BEV

8.3.4.2 PHEV

8.3.4.3 HEV

8.3.5 Historic and Forecasted Market Size by Design

8.3.5.1 Plate Bar

8.3.5.2 Tube Fin

8.3.6 Historic and Forecasted Market Size by Vehicle Type

8.3.6.1 Passenger Car

8.3.6.2 LCV

8.3.6.3 Truck

8.3.6.4 Bus

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Electric Vehicle Heat Exchanger Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Electric Vehicle Type

8.4.4.1 BEV

8.4.4.2 PHEV

8.4.4.3 HEV

8.4.5 Historic and Forecasted Market Size by Design

8.4.5.1 Plate Bar

8.4.5.2 Tube Fin

8.4.6 Historic and Forecasted Market Size by Vehicle Type

8.4.6.1 Passenger Car

8.4.6.2 LCV

8.4.6.3 Truck

8.4.6.4 Bus

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Electric Vehicle Heat Exchanger Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Electric Vehicle Type

8.5.4.1 BEV

8.5.4.2 PHEV

8.5.4.3 HEV

8.5.5 Historic and Forecasted Market Size by Design

8.5.5.1 Plate Bar

8.5.5.2 Tube Fin

8.5.6 Historic and Forecasted Market Size by Vehicle Type

8.5.6.1 Passenger Car

8.5.6.2 LCV

8.5.6.3 Truck

8.5.6.4 Bus

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Electric Vehicle Heat Exchanger Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Electric Vehicle Type

8.6.4.1 BEV

8.6.4.2 PHEV

8.6.4.3 HEV

8.6.5 Historic and Forecasted Market Size by Design

8.6.5.1 Plate Bar

8.6.5.2 Tube Fin

8.6.6 Historic and Forecasted Market Size by Vehicle Type

8.6.6.1 Passenger Car

8.6.6.2 LCV

8.6.6.3 Truck

8.6.6.4 Bus

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Electric Vehicle Heat Exchanger Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Electric Vehicle Type

8.7.4.1 BEV

8.7.4.2 PHEV

8.7.4.3 HEV

8.7.5 Historic and Forecasted Market Size by Design

8.7.5.1 Plate Bar

8.7.5.2 Tube Fin

8.7.6 Historic and Forecasted Market Size by Vehicle Type

8.7.6.1 Passenger Car

8.7.6.2 LCV

8.7.6.3 Truck

8.7.6.4 Bus

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Electric Vehicle Heat Exchanger Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 33.53 Bn. |

|

Forecast Period 2025-32 CAGR: |

3.8% |

Market Size in 2032: |

USD 45.19 Bn. |

|

Segments Covered: |

By Electric Vehicle Type |

|

|

|

By Design |

|

||

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||