Electric-Driven Fixed Wing Unmanned Aerial Vehicles MarketSynopsis

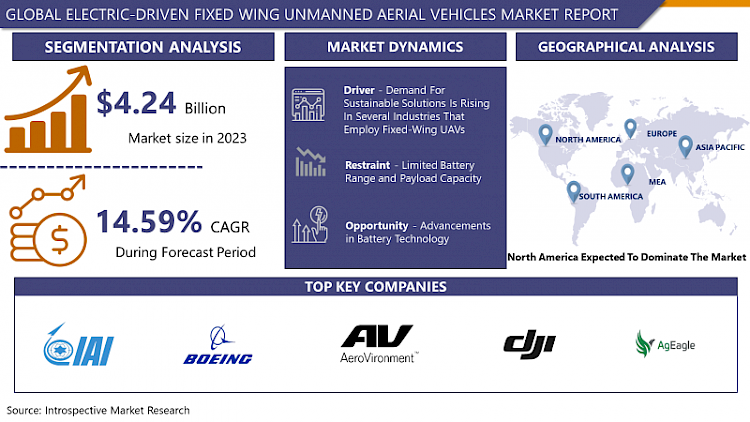

Global Electric-Driven Fixed Wing Unmanned Aerial Vehicles Market Size Was Valued at USD 4.24 Billion in 2023 and is Projected to Reach USD 14.44 Billion by 2032, Growing at a CAGR of 14.59% From 2024-2032.

The Electric-Driven fixed-wing unmanned Aerial Vehicle (UAV) market has experienced significant growth in recent years, driven by advancements in battery technology, electric propulsion systems, and increasing demand for efficient and environmentally friendly UAVs. These electric UAVs are favored for their lower operational costs, reduced maintenance requirements, and minimal environmental impact compared to traditional fuel-powered drones.

- Military applications dominate the electric fixed-wing UAV market, with these drones being used for surveillance, reconnaissance, and intelligence gathering. Their quiet operation and reduced thermal signatures make them ideal for covert operations. The military sector's adoption is further bolstered by advancements in autonomy and artificial intelligence, enhancing the operational capabilities of these UAVs. Governments worldwide are investing heavily in electric UAVs to modernize their defense systems and improve operational efficiency.

- Commercial applications are also a significant growth area for electric fixed-wing UAVs. These drones are increasingly used in agriculture for crop monitoring, precision farming, and aerial mapping. In the logistics sector, companies are exploring electric UAVs for last-mile delivery services, aiming to reduce delivery times and operational costs. The renewable energy sector uses these UAVs for monitoring and inspecting solar panels and wind turbines, leveraging their ability to cover large areas efficiently.

- Civil applications of electric fixed-wing UAVs include disaster management, environmental monitoring, and infrastructure inspection. These UAVs provide real-time data and high-resolution imagery, aiding in disaster response, wildlife conservation, and urban planning. Their ability to operate in remote and hard-to-reach areas makes them invaluable for search and rescue missions, providing timely assistance and reducing the risk to human responders.

- The market for electric-driven fixed-wing UAVs is supported by continuous technological advancements and regulatory developments. Improvements in battery life, energy efficiency, and payload capacity are making these UAVs more versatile and capable. Regulatory bodies are establishing frameworks to ensure safe and efficient UAV operations, promoting market growth. Overall, the electric-driven fixed-wing UAV market is poised for substantial expansion, driven by technological innovation and increasing adoption across various sectors.

Electric-Driven Fixed Wing Unmanned Aerial Vehicles MarketTrend Analysis

The growing demand for sustainable solutions that are applied in various industries.

- The electric-driven fixed-wing unmanned aerial vehicles (UAVs) market is growing rapidly because of the raised demand for environment-friendly solutions in different sectors. In the face of increasing fear about the environmental consequences and carbon emissions, different sectors such as infrastructure inspection, environmental monitoring, and agriculture are gradually using electric-powered unmanned aerial vehicles (UAVs) to perform their tasks.

- These aircraft have a major advantage over conventional models because of their lower emissions, quieter operation, and reduced operating expenses. Besides, electric-driven fixed-wing UAVs are very flexible and maneuverable hence the perfect fit for a wide range of tasks such as wildlife conservation and precision agriculture. The market is expected to grow and develop as the demand for electric-powered fixed-wing UAVs increases in different areas, while sustainability remains a major business value.

Integration Of Advance Technologies In UAV

- The integration of advanced technologies creates a great chance for the Electric-Driven fixed-wing unmanned Aerial Vehicles (UAVs) market, thus, innovation and extension of these aircraft capabilities are going to be promoted. The major area of progress is in the field of autonomy and artificial intelligence (AI) which makes UAVs do more and more complicated tasks with less human intervention.

- With AI algorithms, UAVs can fully navigate in the air by themselves, avoid obstacles, and make real-time decisions that make their work more efficient and safe in such applications as surveillance, mapping, search, and rescue operations.

- Besides, the inclusion of advanced sensors and payloads increases the usefulness of electric-driven fixed-wing UAVs. High-resolution cameras, LiDAR systems, multispectral sensors, and thermal imaging cameras can be attached to these aircraft to get precise data for environmental monitoring, infrastructure inspection, and precision agriculture.

- Besides, the advancement of communication and data transmission technologies allows for real-time data streaming and remote control capabilities that enable operators to monitor and control UAVs from almost everywhere in the world. The more these technologies develop and are available, the more they open up new possibilities for electric-driven fixed-wing UAVs to change different industries and thus, drive growth and adoption in the market.

Electric-Driven Fixed Wing Unmanned Aerial Vehicles MarketSegment Analysis:

Electric-Driven Fixed Wing Unmanned Aerial Vehicles Market is Segmented based on Maximum takeoff weight, application.

By Maximum takeoff weight, < 25 Kilograms segment is expected to dominate the market during the forecast period

- The Electric-Driven Fixed Wing Unmanned Aerial Vehicles (UAVs) that have a maximum launch weight of not exceeding 25 kilograms are the market segment that is of high importance. Compared to heavier unmanned aerial vehicles, these lightweight UAVs have several advantages such as easier deployment, cheaper operational costs, and fewer regulatory restrictions.

- These gadgets are flexible, which is why they can be used for a great number of things such as surveillance, aerial photography, videography, and even small-scale mapping. Besides, their small size and exceptional maneuverability make them perfectly suitable for missions that are carried out in restricted areas or treacherous landscapes where larger unmanned aerial vehicles might have problems with navigation. Thus, this industry faces great demand from sectors like construction, cinematography, agriculture, and emergency response which in turn help to expand the market and bring new ideas.

- While UAVs with a maximum launch weight of 25 to 170 kilograms do make up a considerable part of the market, their main job is to serve special applications that need larger payload capacities or longer endurance capabilities.

- Most often these medium-sized UAVs are used for long-range surveillance, aerial imaging of wide areas, cargo transportation, and environmental monitoring. Although they may face more severe operational problems and regulatory issues than lightweight unmanned aerial vehicles (UAVs) do, they offer better performance and flexibility for certain mission profiles.

- The medium-sized electric-powered fixed-wing UAVs are used in various fields such as infrastructure inspection, wildlife conservation, government, and defense oil and gas industry. These sectors are the main locomotives of growth and diversification in this market sector.

By Application, Beyond Line of Sight segment held the largest share in 2023

- The part that seizes the major share in the Electric-Powered Fixed Wing Unmanned Aerial Vehicles (UAVs) market is the BLOS segment. This dominance is the result of several important factors.

- To start with, the beyond-of-line-of-sight (BLOS) abilities make it possible for unmanned aerial vehicles (UAVs) to go a long way without having to have direct visual contact with the ground operator. This feature, therefore, extends the range and applications of these UAVs hence they are very versatile and can be used in various sectors like infrastructure inspection, agriculture surveillance, and emergency response.

- Besides, electric-powered fixed-wing UAVs with BLOS capability often have high-tech navigation and communication systems that allow them to maintain a stable flight and transmit data across long distances. Missions that are ruined because of the constant monitoring or data collection in remote and inaccessible areas require critical importance to this reliability.

- Additionally, the battery technology developments have greatly increased the operational time of electric-powered fixed-wing UAVs and thus made them very suitable for BLOS missions. The continuous increase of the regulations on beyond visual line of sight (BLOS) operations is expected to be the reason for electric-powered fixed-wing UAVs with such capabilities, thereby securing their market leadership.

Electric-Driven Fixed Wing Unmanned Aerial Vehicles Market Regional Insights:

The market in North America will be the leader over the forecast period.

- The Electric-Driven fixed-wing unmanned Aerial Vehicles (UAVs) market is currently dominated by several regions, and North America is leading the way. This influence can be put down to a mixture of reasons.

- North America is the land that produces a lot of UAVs, their components, and end-users from different industries. In the region, there has been a lot of money put into research and development which is why we have such modern electric-powered fixed-wing UAVs with advanced characteristics.

- Besides, North America has a friendly regulatory system that allows the UAVs to be integrated into civilian airspace, especially for Beyond Line of Sight (BLOS) operations. Regulatory bodies like the Federal Aviation Administration (FAA) in the United States have been proactive in issuing guidelines and regulations to make possible safe and efficient UAV operations, thus raising market growth.

- North America has a lot of different industries, such as agriculture, energy, defense, and public safety that are perfect for the use of electric-driven fixed-wing UAVs for various purposes. Thus, North America still controls the Electric-Driven Fixed-wing UAV market and its growth is to continue in the future.

Active Key Players in the Electric-Driven Fixed Wing Unmanned Aerial Vehicles Market

- AeroVironment Inc (US)

- AgEagle Aerial Systems Inc (US)

- Boeing Company (US)

- DJI Innovations (China)

- IdeaForge (India)

- Israel Aerospace Industries Ltd (Israel)

- Latitude Engineering (US)

- Lockheed Martin Corporation (US)

- Northrop Grumman Corporation (US)

- Saab Group (Sweden)

- Schiebel Elektronische Gerate GmbH (Austria)

- Textron Inc (US)

- Parrot SA (France)

- General Atomics Aeronautical Systems, Inc. (US)

- AeroVironment, Inc. (US)

- senseFly SA (Switzerland)

- Kespry Inc. (US)

- Turkish Aerospace Industries Inc (Turkey), Other Key Players

Key Industry Developments in the Electric-Driven Fixed Wing Unmanned Aerial Vehicles Market:

- In June 2023, Skydio released a new product called the Skydio X2 which is an Electric Fixed-Wing Unmanned Aerial Vehicle (E-FW UAV) that will change the field where complex inspections are conducted. The Skydio X2, which has the most advanced obstacle avoidance and autonomous flight features, is now the new benchmark of efficiency and precision in aerial operations.

- In February 2023, on the date of February 16, China Petroleum & Chemical Corporation held inauguration ceremonies in Beijing, Hohhot, and Erdos for its first hydrogen demonstration project which is called Inner Mongolia Erdos Wind-Solar Green Hydrogen Project.

|

Global Electric-Driven Fixed Wing Unmanned Aerial Vehicles Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.24 Bn. |

|

Forecast Period 2024-32 CAGR: |

14.59% |

Market Size in 2032: |

USD 14.44 Bn. |

|

|

By Maximum takeoff weight

|

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET BY MAXIMUM TAKEOFF WEIGHT (2017-2032)

- ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- < 25 KILOGRAMS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- 25-170 KILOGRAMS

- > 170 KILOGRAMS

- ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET BY APPLICATION (2017-2032)

- ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MILITARY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GOVERNMENT

- COMMERCIAL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AEROVIRONMENT INC (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- AGEAGLE AERIAL SYSTEMS INC (US)

- BOEING COMPANY (US)

- DJI INNOVATIONS (CHINA)

- IDEAFORGE (INDIA)

- ISRAEL AEROSPACE INDUSTRIES LTD (ISRAEL)

- LATITUDE ENGINEERING (US)

- LOCKHEED MARTIN CORPORATION (US)

- NORTHROP GRUMMAN CORPORATION (US)

- SAAB GROUP (SWEDEN)

- SCHIEBEL ELEKTRONISCHE GERATE GMBH (AUSTRIA)

- TEXTRON INC (US)

- TURKISH AEROSPACE INDUSTRIES INC (TURKEY)

- COMPETITIVE LANDSCAPE

- GLOBAL ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Maximum Takeoff Weight

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Electric-Driven Fixed Wing Unmanned Aerial Vehicles Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.24 Bn. |

|

Forecast Period 2024-32 CAGR: |

14.59% |

Market Size in 2032: |

USD 14.44 Bn. |

|

|

By Maximum takeoff weight

|

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET COMPETITIVE RIVALRY

TABLE 005. ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET THREAT OF NEW ENTRANTS

TABLE 006. ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET THREAT OF SUBSTITUTES

TABLE 007. ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET BY APPLICATION

TABLE 008. MILITARY MARKET OVERVIEW (2016-2028)

TABLE 009. GOVERNMENT MARKET OVERVIEW (2016-2028)

TABLE 010. COMMERCIAL MARKET OVERVIEW (2016-2028)

TABLE 011. ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET BY MAXIMUM TAKEOFF WEIGHT

TABLE 012. < 25 KILOGRAMS MARKET OVERVIEW (2016-2028)

TABLE 013. 25-170 KILOGRAMS MARKET OVERVIEW (2016-2028)

TABLE 014. > 170 KILOGRAMS MARKET OVERVIEW (2016-2028)

TABLE 015. ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET BY RANGE

TABLE 016. BEYOND LINE OF SIGHT MARKET OVERVIEW (2016-2028)

TABLE 017. VISUAL LINE OF SIGHT MARKET OVERVIEW (2016-2028)

TABLE 018. EXTENDED VISUAL LINE OF SIGHT MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET, BY APPLICATION (2016-2028)

TABLE 020. NORTH AMERICA ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET, BY MAXIMUM TAKEOFF WEIGHT (2016-2028)

TABLE 021. NORTH AMERICA ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET, BY RANGE (2016-2028)

TABLE 022. N ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET, BY APPLICATION (2016-2028)

TABLE 024. EUROPE ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET, BY MAXIMUM TAKEOFF WEIGHT (2016-2028)

TABLE 025. EUROPE ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET, BY RANGE (2016-2028)

TABLE 026. ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET, BY APPLICATION (2016-2028)

TABLE 028. ASIA PACIFIC ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET, BY MAXIMUM TAKEOFF WEIGHT (2016-2028)

TABLE 029. ASIA PACIFIC ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET, BY RANGE (2016-2028)

TABLE 030. ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET, BY APPLICATION (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET, BY MAXIMUM TAKEOFF WEIGHT (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET, BY RANGE (2016-2028)

TABLE 034. ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET, BY APPLICATION (2016-2028)

TABLE 036. SOUTH AMERICA ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET, BY MAXIMUM TAKEOFF WEIGHT (2016-2028)

TABLE 037. SOUTH AMERICA ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET, BY RANGE (2016-2028)

TABLE 038. ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET, BY COUNTRY (2016-2028)

TABLE 039. LATITUDE ENGINEERING: SNAPSHOT

TABLE 040. LATITUDE ENGINEERING: BUSINESS PERFORMANCE

TABLE 041. LATITUDE ENGINEERING: PRODUCT PORTFOLIO

TABLE 042. LATITUDE ENGINEERING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. NORTHROP GRUMMAN CORPORATION: SNAPSHOT

TABLE 043. NORTHROP GRUMMAN CORPORATION: BUSINESS PERFORMANCE

TABLE 044. NORTHROP GRUMMAN CORPORATION: PRODUCT PORTFOLIO

TABLE 045. NORTHROP GRUMMAN CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. TURKISH AEROSPACE INDUSTRIES INC: SNAPSHOT

TABLE 046. TURKISH AEROSPACE INDUSTRIES INC: BUSINESS PERFORMANCE

TABLE 047. TURKISH AEROSPACE INDUSTRIES INC: PRODUCT PORTFOLIO

TABLE 048. TURKISH AEROSPACE INDUSTRIES INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. TEXTRON INC: SNAPSHOT

TABLE 049. TEXTRON INC: BUSINESS PERFORMANCE

TABLE 050. TEXTRON INC: PRODUCT PORTFOLIO

TABLE 051. TEXTRON INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. SAAB GROUP: SNAPSHOT

TABLE 052. SAAB GROUP: BUSINESS PERFORMANCE

TABLE 053. SAAB GROUP: PRODUCT PORTFOLIO

TABLE 054. SAAB GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. AEROVIRONMENT INC: SNAPSHOT

TABLE 055. AEROVIRONMENT INC: BUSINESS PERFORMANCE

TABLE 056. AEROVIRONMENT INC: PRODUCT PORTFOLIO

TABLE 057. AEROVIRONMENT INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. IDEAFORGE: SNAPSHOT

TABLE 058. IDEAFORGE: BUSINESS PERFORMANCE

TABLE 059. IDEAFORGE: PRODUCT PORTFOLIO

TABLE 060. IDEAFORGE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. SCHIEBEL ELEKTRONISCHE GERATE GMBH: SNAPSHOT

TABLE 061. SCHIEBEL ELEKTRONISCHE GERATE GMBH: BUSINESS PERFORMANCE

TABLE 062. SCHIEBEL ELEKTRONISCHE GERATE GMBH: PRODUCT PORTFOLIO

TABLE 063. SCHIEBEL ELEKTRONISCHE GERATE GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. ISRAEL AEROSPACE INDUSTRIES LTD: SNAPSHOT

TABLE 064. ISRAEL AEROSPACE INDUSTRIES LTD: BUSINESS PERFORMANCE

TABLE 065. ISRAEL AEROSPACE INDUSTRIES LTD: PRODUCT PORTFOLIO

TABLE 066. ISRAEL AEROSPACE INDUSTRIES LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. AGEAGLE AERIAL SYSTEMS INC: SNAPSHOT

TABLE 067. AGEAGLE AERIAL SYSTEMS INC: BUSINESS PERFORMANCE

TABLE 068. AGEAGLE AERIAL SYSTEMS INC: PRODUCT PORTFOLIO

TABLE 069. AGEAGLE AERIAL SYSTEMS INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. BOEING COMPANY: SNAPSHOT

TABLE 070. BOEING COMPANY: BUSINESS PERFORMANCE

TABLE 071. BOEING COMPANY: PRODUCT PORTFOLIO

TABLE 072. BOEING COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. LOCKHEED MARTIN CORPORATION: SNAPSHOT

TABLE 073. LOCKHEED MARTIN CORPORATION: BUSINESS PERFORMANCE

TABLE 074. LOCKHEED MARTIN CORPORATION: PRODUCT PORTFOLIO

TABLE 075. LOCKHEED MARTIN CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. DJI INNOVATIONS: SNAPSHOT

TABLE 076. DJI INNOVATIONS: BUSINESS PERFORMANCE

TABLE 077. DJI INNOVATIONS: PRODUCT PORTFOLIO

TABLE 078. DJI INNOVATIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 079. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 080. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 081. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET OVERVIEW BY APPLICATION

FIGURE 012. MILITARY MARKET OVERVIEW (2016-2028)

FIGURE 013. GOVERNMENT MARKET OVERVIEW (2016-2028)

FIGURE 014. COMMERCIAL MARKET OVERVIEW (2016-2028)

FIGURE 015. ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET OVERVIEW BY MAXIMUM TAKEOFF WEIGHT

FIGURE 016. < 25 KILOGRAMS MARKET OVERVIEW (2016-2028)

FIGURE 017. 25-170 KILOGRAMS MARKET OVERVIEW (2016-2028)

FIGURE 018. > 170 KILOGRAMS MARKET OVERVIEW (2016-2028)

FIGURE 019. ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET OVERVIEW BY RANGE

FIGURE 020. BEYOND LINE OF SIGHT MARKET OVERVIEW (2016-2028)

FIGURE 021. VISUAL LINE OF SIGHT MARKET OVERVIEW (2016-2028)

FIGURE 022. EXTENDED VISUAL LINE OF SIGHT MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA ELECTRIC-DRIVEN FIXED WING UNMANNED AERIAL VEHICLES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Electric-Driven Fixed Wing Unmanned Aerial Vehicles Market Research Report is 2024-2032.

• AeroVironment Inc (US),• AgEagle Aerial Systems Inc (US),• Boeing Company (US),• DJI Innovations (China),• IdeaForge (India),• Israel Aerospace Industries Ltd (Israel),• Latitude Engineering (US),• Lockheed Martin Corporation (US),• Northrop Grumman Corporation (US),• Saab Group (Sweden),• Schiebel Elektronische Gerate GmbH (Austria),• Textron Inc (US),• Parrot SA (France),• General Atomics Aeronautical Systems, Inc. (US),• AeroVironment, Inc. (US),• senseFly SA (Switzerland),• Kespry Inc. (US),• Turkish Aerospace Industries Inc (Turkey), Other Key Players

The Electric-Driven Fixed Wing Unmanned Aerial Vehicles market is segmented into Range, Maximum takeoff weight, Application, and region. By Range, the market is categorized into Beyond Line of Sight, Visual Line of Sight, and Extended Visual Line of Sight. By Maximum takeoff weight, the market is categorized into < 25 Kilograms, 25-170 Kilograms, and > 170 kilograms. By Application, the market is categorized into Military, Government, and Commercial. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Electric-Driven Fixed Wing Unmanned Aerial Vehicles (UAVs) are a type of unmanned aircraft that rely on electric propulsion systems for flight. Unlike traditional UAVs powered by internal combustion engines, electric-driven fixed-wing UAVs utilize electric motors and batteries to generate thrust and achieve sustained flight.

Global Electric-Driven Fixed Wing Unmanned Aerial Vehicles Market Size Was Valued at USD 4.24 Billion in 2023 and is Projected to Reach USD 14.44 Billion by 2032, Growing at a CAGR of 14.59% From 2024-2032.