Battery Swapping Mode of Electric Vehicles Market Synopsis

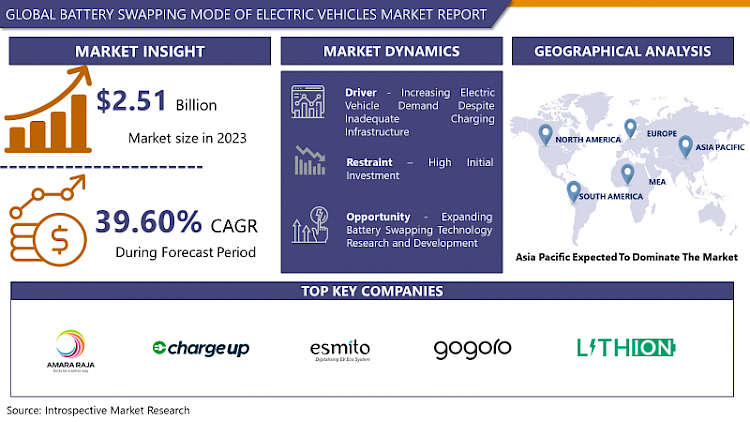

Battery Swapping Mode of Electric Vehicles Market Size Was Valued at USD 2.51 Billion in 2023 and is Projected to Reach USD 50.5 Billion by 2032, Growing at a CAGR of 39.60% From 2024-2032.

- "Battery Swapping - Mode of Electric Vehicles (EV) Market" comprises a technology where batteries of EVs could be swapped with fully charged batteries at some designated charging stations. This is so because it does not call for a long period of charge lead. Via this option, electric vehicles are provided with a choice, to which they can opt, and this consequently leads to less idle time. The universal battery design is under development with swappable infrastructure charging stations aimed at large-scale applications. The strategy seeks to make EVs more viable in the market and increase their adoption, especially in areas where the EV charging infrastructure is lacking.

- Owners of electric vehicles may now opt to substitute their old lithium batteries with fresh ones that have already been charged, thereby cutting down on the total time spent during a charging session when compared to an ordinary charging session.

- Using battery swapping, it is possible to increase the driving range of an electric vehicle by supplying the consumers with a fully charged battery set, thereby eliminating their range anxiety.

- It makes it highly scalable and easily adaptable to infrastructure compared to the charging stations of traditional architecture. This will result in the fast establishment of electric vehicle charging networks.

- On the other hand, shifting to electric vehicles means that users will not have to wait for the batteries to be recharged. This feature makes the alternative method apply not only for commuter transport but even for long-distance travel.

Battery Swapping Mode of Electric Vehicles Market Trend Analysis

Enhancing Electric Vehicle Convenience with Battery Switching

- Charging used to be hard but nowadays it is becoming easy and fast. The other option of solving this is battery replacement which is a short time spent compared to traditional methods of charging. This is not only how the issue of electric vehicle range anxiety is solved but it also allows easy electric vehicle ownership to be accomplished.

- The emergence of shared mobility services: Fleet operators and shared mobility companies in this case may consider battery swapping as the most practical solution because it eliminates charging-related immobilizations and provides continuity of the electric vehicles’ operations.

- Standardized Swapping Station Development: The fact that one single battery size and swapping protocol has become more and more common, as the harmonization of various brands and EV models proceeds, also helps in this.

- Some battery exchange stations have adopted renewable energy such as solar power as a way of diverting electricity sources for their vehicles away from non-renewables.

Swift Resolution for Electric Vehicles

- On the other side, battery switching is more rapid than charging which decreases or even gets rid of the downtime of electric vehicles and makes them continue working punctually.

- Scalable Infrastructure: With a fast installation procedure, and introduction of battery exchange sites, EV owners will have a convenient choice.

- Enhanced Convenience: The fact that depleted batteries can be replaced by a fully charged one on the go nullifies the need to be stuck for a time with an inconvenient and draining charging delay.

- Battery swap is an add-on capacity that enhances the duration of EVs (electric vehicles) by facilitating the easy switch of an exhausted battery for a fully charged one.

- The standardization of battery change can promote cooperation between different electric vehicle models, as that is beneficial for the development of the market.

Battery Swapping Mode of Electric Vehicles Market Segment Analysis:

Battery Swapping Mode of Electric Vehicles Market is segmented on the Basis of Station Type, Vehicle Type, and Service Type.

By Station Type, Battery Swapping Mode of Electric Vehicles Market segment is expected to dominate the market during the forecast period

- By station type, the market for electric vehicle battery swapping can be divided into two primary categories: automatic and manual stations.

- Furthermore, the charging stations may have automatic battery exchange systems designed to exchange batteries for electric vehicles in a timely and reliable way. This system aims to reduce the person's involvement and provides an EV owner with a low-stress operation. Ultimately, they work faster and offer you that convenience that is not present in ordinary stations that slow down the process of battery replacement.

- However, humans still cannot be removed from the process of manual terminal replacement. However, the initial capacity of these stations might be lower, in terms of speed and efficiency. However, there are scenarios where semi-automatic machines are still favorable. These are e.g. in the cases of low financial resources or incomplete infrastructure for full automation.

By Vehicle Type, the Battery Swapping Mode of the Electric Vehicles Market segment held the largest share in 2023

- Bearing in mind the fact that refueling electric two-wheelers, namely motorcycles, and scooters, is much more straightforward since you only need to swap the batteries. In cities where a large number of cars are used and have more frequent charging levels, this segment is loved best.

- For load shifting of electric three-wheelers (like cargo carriers and auto-rickshaws), this is a practical solution for addressing their recharging requirements. Transportation of commodities and filling the gaps of last-mile transportation between urban and rural areas require this segment.

- Automobiles, vans, trucks, and electric cars could be made more flexible while there is a place for swapping the batteries. As infrastructures improve and standards are set, battery shifting could become a feasible option instead of four-wheelers, considering that this market is in its early stages.

- Switching from batteries to swapping them over may be the solution for commercial electric vehicles like trucks and buses. This is because they allow you to minimize the downtime and increase the overall productivity. Such a segment of the market could most likely observe nearly exponential growth as more car companies would switch their fleets to electric models.

Battery Swapping Mode of Electric Vehicles Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The electric vehicle market in the Asia-Pacific region is in booming condition with mature growth which is driven by factors like environmental concern, improvement in technology, and government support.

- Battery Swapping Mode: Through the use of this technology, EV owners have the option of reducing charging time by one of the methods, e.g. exchanging completely charged batteries with depleted batteries at swapping stations.

- Key Players: The battery market for Asia-Pacific consists of replacement mode that has different major players, including global carmakers, battery providers, and technologists.

- With this in mind, appropriate battery-swapping infrastructure should be developed to cater to such needs. These include setting up battery swapping stations, battery management systems, and logistics networks.

- Government Support: One of the tools that the governments of the Asia-Pacific are using to facilitate sustainable transportation is that they provide incentives and support the development of EV infrastructure which includes battery-switching technology.

- Nevertheless, the battery switching mode market looks promising despite the challenges of huge start-up investment, standardization problems, and the complexity of the switching point networks.

- In the upcoming years, the Asia-Pacific region has a very high potential to grow its battery-shifting mode market, primarily due to an increase in the EVs usage accompanied by a need for efficient charging systems.

Active Key Players in the Battery Swapping Mode of Electric Vehicles Market

- Amara Raja Batteries Ltd.

- ECHARGEUP

- Esmito Solutions Pvt Ltd

- Gogoro

- Lithion Power Private Limited

- NIO

- Numocity

- Oyika

- Aulton New Energy Automotive Technology Co., Ltd.

- KYMCO

- Other Key Players

Key Industry Developments in the Battery Swapping Mode of Electric Vehicles Market:

- In April 2023-: Precisely! NIO successfully implements the battery exchange technology in Germany through its European Power Swap Station. When motorists go to this facility they will experience the ease of swapping their low-battery devices with charged counterparts that can extend their driving range as far as 500 kilometers. The automated process involves picking up the car, removing the charged battery, and putting in an empty battery to allow NIO electric car owners to extend their going time quickly and efficiently.

- Esmito Solutions Pvt. Ltd. which is a battery-swap service provider and ElectricFuel which is an EV charging service platform, in collaboration, launched an energy-as-a-service (EaaS) infrastructure to provide affordable and efficient battery-swap solutions. The leading Chinese two-wheel motorcycle makers, DCJ and Yadea, have intentions to team up with Gogoro for the implementation of the electric refueling system in China which will be using the battery-swapping technology launched by Gogoro.

|

Battery Swapping Mode of Electric Vehicles Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.51 Bn. |

|

Forecast Period 2024-32 CAGR: |

39.60 % |

Market Size in 2034: |

USD 50.5 Bn. |

|

Segments Covered: |

By Station Type |

|

|

|

By Vehicle Type |

|

||

|

By Service Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET BY STATION TYPE (2017-2032)

- BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AUTOMATED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MANUAL

- BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET BY VEHICLE TYPE (2017-2032)

- BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TWO-WHEELER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- THREE-WHEELER

- FOUR-WHEELER

- COMMERCIAL VEHICLES

- BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET BY SERVICE TYPE (2017-2032)

- BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SUBSCRIPTION MODEL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PAY-PER-USE MODEL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Battery Swapping Mode Of Electric Vehicles Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AMARA RAJA BATTERIES LTD.

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ECHARGEUP

- ESMITO SOLUTIONS PVT LTD

- GOGORO

- LITHION POWER PRIVATE LIMITED

- NIO

- NUMOCITY

- OYIKA

- AULTON NEW ENERGY AUTOMOTIVE TECHNOLOGY CO., LTD.

- KYMCO

- COMPETITIVE LANDSCAPE

- GLOBAL BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Station Type

- Historic And Forecasted Market Size By Vehicle Type

- Historic And Forecasted Market Size By Service Type

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Battery Swapping Mode of Electric Vehicles Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.51 Bn. |

|

Forecast Period 2024-32 CAGR: |

39.60 % |

Market Size in 2034: |

USD 50.5 Bn. |

|

Segments Covered: |

By Station Type |

|

|

|

By Vehicle Type |

|

||

|

By Service Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET COMPETITIVE RIVALRY

TABLE 005. BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET THREAT OF NEW ENTRANTS

TABLE 006. BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET THREAT OF SUBSTITUTES

TABLE 007. BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET BY PRODUCT TYPE

TABLE 008. SOFTWOOD MARKET OVERVIEW (2016-2028)

TABLE 009. HARDWOOD MARKET OVERVIEW (2016-2028)

TABLE 010. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 011. BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET BY RAW MATERIAL

TABLE 012. FOREST CHIPS MARKET OVERVIEW (2016-2028)

TABLE 013. WOOD RESIDUE CHIPS MARKET OVERVIEW (2016-2028)

TABLE 014. SAWING RESIDUE CHIPS MARKET OVERVIEW (2016-2028)

TABLE 015. SHORT ROTATION COPPICE CHIPS MARKET OVERVIEW (2016-2028)

TABLE 016. BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET BY APPLICATION

TABLE 017. COMBINED HEAT AND POWER MARKET OVERVIEW (2016-2028)

TABLE 018. RESIDENTIAL AND COMMERCIAL HEATING MARKET OVERVIEW (2016-2028)

TABLE 019. PLAYGROUND SURFACING MARKET OVERVIEW (2016-2028)

TABLE 020. PULP MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 021. MULCH MARKET OVERVIEW (2016-2028)

TABLE 022. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 023. NORTH AMERICA BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 024. NORTH AMERICA BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET, BY RAW MATERIAL (2016-2028)

TABLE 025. NORTH AMERICA BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET, BY APPLICATION (2016-2028)

TABLE 026. N BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET, BY COUNTRY (2016-2028)

TABLE 027. EUROPE BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 028. EUROPE BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET, BY RAW MATERIAL (2016-2028)

TABLE 029. EUROPE BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET, BY APPLICATION (2016-2028)

TABLE 030. BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET, BY COUNTRY (2016-2028)

TABLE 031. ASIA PACIFIC BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 032. ASIA PACIFIC BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET, BY RAW MATERIAL (2016-2028)

TABLE 033. ASIA PACIFIC BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET, BY APPLICATION (2016-2028)

TABLE 034. BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET, BY COUNTRY (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET, BY RAW MATERIAL (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET, BY APPLICATION (2016-2028)

TABLE 038. BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET, BY COUNTRY (2016-2028)

TABLE 039. SOUTH AMERICA BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 040. SOUTH AMERICA BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET, BY RAW MATERIAL (2016-2028)

TABLE 041. SOUTH AMERICA BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET, BY APPLICATION (2016-2028)

TABLE 042. BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET, BY COUNTRY (2016-2028)

TABLE 043. AMARA RAJA BATTERIES LTD.: SNAPSHOT

TABLE 044. AMARA RAJA BATTERIES LTD.: BUSINESS PERFORMANCE

TABLE 045. AMARA RAJA BATTERIES LTD.: PRODUCT PORTFOLIO

TABLE 046. AMARA RAJA BATTERIES LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. AMPLIFY CLEANTECH SOLUTION PVT LTD.: SNAPSHOT

TABLE 047. AMPLIFY CLEANTECH SOLUTION PVT LTD.: BUSINESS PERFORMANCE

TABLE 048. AMPLIFY CLEANTECH SOLUTION PVT LTD.: PRODUCT PORTFOLIO

TABLE 049. AMPLIFY CLEANTECH SOLUTION PVT LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. CHARGEMYGAADI: SNAPSHOT

TABLE 050. CHARGEMYGAADI: BUSINESS PERFORMANCE

TABLE 051. CHARGEMYGAADI: PRODUCT PORTFOLIO

TABLE 052. CHARGEMYGAADI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. ECHARGEUP: SNAPSHOT

TABLE 053. ECHARGEUP: BUSINESS PERFORMANCE

TABLE 054. ECHARGEUP: PRODUCT PORTFOLIO

TABLE 055. ECHARGEUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. ESMITO SOLUTION PVT LTD.: SNAPSHOT

TABLE 056. ESMITO SOLUTION PVT LTD.: BUSINESS PERFORMANCE

TABLE 057. ESMITO SOLUTION PVT LTD.: PRODUCT PORTFOLIO

TABLE 058. ESMITO SOLUTION PVT LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. GOGORO INC.: SNAPSHOT

TABLE 059. GOGORO INC.: BUSINESS PERFORMANCE

TABLE 060. GOGORO INC.: PRODUCT PORTFOLIO

TABLE 061. GOGORO INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. LITHION POWER PVT LTD.: SNAPSHOT

TABLE 062. LITHION POWER PVT LTD.: BUSINESS PERFORMANCE

TABLE 063. LITHION POWER PVT LTD.: PRODUCT PORTFOLIO

TABLE 064. LITHION POWER PVT LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. NIO INC.: SNAPSHOT

TABLE 065. NIO INC.: BUSINESS PERFORMANCE

TABLE 066. NIO INC.: PRODUCT PORTFOLIO

TABLE 067. NIO INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. NUMOCITY TECHNOLOGIES PVT LTD.: SNAPSHOT

TABLE 068. NUMOCITY TECHNOLOGIES PVT LTD.: BUSINESS PERFORMANCE

TABLE 069. NUMOCITY TECHNOLOGIES PVT LTD.: PRODUCT PORTFOLIO

TABLE 070. NUMOCITY TECHNOLOGIES PVT LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. OYIKA: SNAPSHOT

TABLE 071. OYIKA: BUSINESS PERFORMANCE

TABLE 072. OYIKA: PRODUCT PORTFOLIO

TABLE 073. OYIKA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 074. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 075. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 076. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. SOFTWOOD MARKET OVERVIEW (2016-2028)

FIGURE 013. HARDWOOD MARKET OVERVIEW (2016-2028)

FIGURE 014. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 015. BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET OVERVIEW BY RAW MATERIAL

FIGURE 016. FOREST CHIPS MARKET OVERVIEW (2016-2028)

FIGURE 017. WOOD RESIDUE CHIPS MARKET OVERVIEW (2016-2028)

FIGURE 018. SAWING RESIDUE CHIPS MARKET OVERVIEW (2016-2028)

FIGURE 019. SHORT ROTATION COPPICE CHIPS MARKET OVERVIEW (2016-2028)

FIGURE 020. BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET OVERVIEW BY APPLICATION

FIGURE 021. COMBINED HEAT AND POWER MARKET OVERVIEW (2016-2028)

FIGURE 022. RESIDENTIAL AND COMMERCIAL HEATING MARKET OVERVIEW (2016-2028)

FIGURE 023. PLAYGROUND SURFACING MARKET OVERVIEW (2016-2028)

FIGURE 024. PULP MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 025. MULCH MARKET OVERVIEW (2016-2028)

FIGURE 026. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 027. NORTH AMERICA BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. EUROPE BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. ASIA PACIFIC BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. MIDDLE EAST & AFRICA BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. SOUTH AMERICA BATTERY SWAPPING MODE OF ELECTRIC VEHICLES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Battery Swapping Mode of Electric Vehicles Market research report is 2024-2032.

Amara Raja Batteries Ltd., Amplify Cleantech Solution Pvt Ltd., Chargemygaadi, Echargeup, Esmito Solution Pvt Ltd., and Other Major Players.

The Battery Swapping Mode of Electric Vehicles Market is segmented into By Station Type: Automated, Manual; By Vehicle Type: Two-wheeler, Three-wheeler, Four-wheeler, Commercial Vehicles; By Service Type: Subscription model, Pay-per-use model. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The term "Battery Swapping Mode of Electric Vehicles Market" pertains to a mechanism whereby batteries of electric vehicles (EVs) may be expeditiously substituted at designated swapping stations with completely charged batteries. This eliminates the necessity for protracted charging durations. By providing this mode as an alternative to conventional charging, electric vehicles can experience less inactivity, which allays concerns regarding their limited driving range. Standardized battery designs and infrastructure for battery switching are currently under development to facilitate extensive implementation. This strategy intends to increase the viability and accessibility of electric vehicles, particularly in areas with limited charging infrastructure.

Battery Swapping Mode of Electric Vehicles Market Size Was Valued at USD 2.51 Billion in 2023 and is Projected to Reach USD 50.5 Billion by 2032, Growing at a CAGR of 39.60% From 2024-2032.