E-learning Market Synopsis

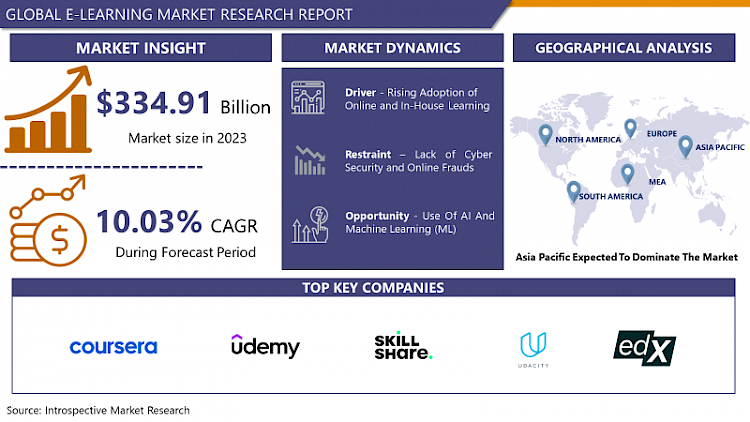

Global E-learning Market size was valued at USD 334.91 Billion in 2023 and is projected to reach USD 791.64 Billion by 2032, growing at a CAGR of 10.03% From 2024-2032.

E-Learning is a learning system that is an advanced built of formalized teaching system but with the help of electronic resources. The Internet and supporting devices form the major component of E-learning system. E-learning serves a large group of people like, engineers, teachers, non-commissioned and military officers, accountants, healthcare professionals and many others in their professional development.

- The market witnessed a proliferation of virtual classrooms, online courses, and interactive learning modules. EdTech companies played a pivotal role in shaping the e-learning landscape, introducing innovative technologies such as artificial intelligence, virtual reality, and gamification to enhance the learning experience. This shift towards digital learning not only catered to traditional academic subjects but also addressed professional development needs across various industries.

- Key trends included the rise of mobile learning, adaptive learning systems, and microlearning modules, making education more accessible and flexible. The market saw increased investments, collaborations, and partnerships among education providers, tech companies, and investors.

- Looking ahead, the e-learning market is poised for sustained growth, driven by ongoing digitalization efforts, the need for upskilling and reskilling, and the recognition of the long-term benefits of online education. As the educational landscape continues to evolve, e-learning is expected to play a central role in shaping the future of learning and training

E-learning Market Trend Analysis

Rising Adoption of Online and In-House Learning

- The E-learning market has witnessed a significant upswing, primarily fueled by the escalating adoption of online and in-house learning methodologies. As technology continues to permeate every aspect of education and training, institutions, corporations, and individuals are increasingly turning to E-learning solutions to enhance skills and knowledge. The convenience of accessing educational resources remotely, coupled with the flexibility of self-paced learning, has catapulted the popularity of online education.

- Corporations are embracing in-house E-learning to streamline employee training, reduce costs, and ensure consistent skill development across their workforce. Moreover, the COVID-19 pandemic has accelerated the shift towards digital learning, with traditional educational institutions transitioning to online platforms to ensure continuity in the face of disruptions.

- The rising demand for personalized learning experiences, the proliferation of mobile devices, and advancements in virtual reality and artificial intelligence further contribute to the robust growth of the E-learning market. As the global landscape becomes increasingly digital, E-learning is poised to play a pivotal role in shaping the future of education and professional development.

Use Of AI, Machine Learning (ML) And Immersive UX To Offer Specialized and Personalized Learning Structure To A Large Population Base creates an Opportunity

- The integration of AI, machine learning (ML), and immersive user experience (UX) in e-learning has revolutionized the education landscape, presenting a significant opportunity for market growth. This innovative combination enables the creation of specialized and personalized learning structures that cater to the diverse needs of a large population.

- AI algorithms analyze user behavior, track progress, and identify individual learning patterns, allowing for the customization of educational content. Machine learning algorithms enhance adaptability by continuously refining recommendations based on user interactions, optimizing the learning experience. Additionally, immersive UX, including virtual reality and augmented reality, brings a new dimension to learning, making it engaging and interactive.

- This convergence addresses the challenges of scalability and personalization in education, making it accessible to a broader audience. The e-learning market benefits from increased efficiency, effectiveness, and learner satisfaction, leading to widespread adoption.

E-learning Market Segment Analysis:

E-learning Market Segmented on the basis of Type, End User, Function, Deployment Mode.

By Type, One-On-One Learning segment is expected to dominate the market during the forecast period

- The prominence of this segment is fueled by its ability to address the diverse learning needs of users, offering a bespoke learning experience that caters to individual strengths and weaknesses. It promotes a direct interaction between the learner and the instructor, fostering a supportive and engaging environment. This model is particularly effective for skill development, as it enables focused attention on specific areas of improvement.

- The rise of technology, including virtual classrooms, video conferencing, and interactive learning platforms, has further amplified the efficacy of one-on-one learning. As the e-learning market continues to expand, the One-On-One Learning segment is anticipated to maintain its dominance, heralding a new era of personalized and efficient education delivery.

By Application, Academic segment held the largest share of 62.3% in 2022

- The Academic segment is poised to dominate the E-learning market, reflecting the significant impact of digital education on traditional learning paradigms. As technology continues to evolve, educational institutions worldwide are increasingly embracing E-learning solutions to enhance the teaching and learning experience. The Academic segment encompasses schools, colleges, and universities, making it a pivotal driver of growth in the E-learning market.

- Several factors contribute to the dominance of the Academic segment. Firstly, the growing demand for flexible and accessible learning options has led educational institutions to adopt E-learning platforms. These platforms offer a diverse range of courses and resources that cater to the varied needs of students and educators. Additionally, the COVID-19 pandemic has accelerated the adoption of online learning, with academic institutions relying on digital solutions to ensure continuity in education during lockdowns and social distancing measures.

E-learning Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific region was already a significant player in the e-learning market, and it was expected to continue dominating the industry. The region's growth in e-learning can be attributed to several factors.

- The increasing adoption of digital technology and internet penetration has facilitated access to online education across diverse demographics. Governments and businesses in the Asia Pacific have recognized the importance of investing in e-learning solutions to address the growing demand for education and skill development.

- The region's large population, including a sizable youth demographic, has fueled the demand for flexible and accessible learning solutions. E-learning offers a convenient way to reach a wide audience and cater to diverse learning needs.

E-learning Market Top Key Players:

- Coursera (USA)

- Udemy (USA)

- Skillshare (USA)

- LinkedIn Learning (USA)

- Udacity (USA)

- edX (USA)

- FutureLearn (UK)

- Docebo (Canada)

- Cornerstone OnDemand (USA)

- Blackboard (USA)

- D2L (Canada)

- Litmos (USA)

- SAP Litmos (USA)

- McGraw-Hill Education (USA)

- Pearson (UK)

- Cengage Learning (USA)

- Khan Academy (USA)

- Byju's (India)

- Veduca (Brazil)

- New Oriental (China)

Key Industry Developments in the E-learning Market:

In February 2023, Coursera launched Career Paths, a program offering learners personalized mentorship from industry professionals alongside online courses.

In January 2023, 2U, a global leader in online programs, acquired the non-profit online learning platform edX for $800 million. This strategic move aimed to create a powerful network of universities and edtech companies, expanding access to high-quality online education.

In February 2024, Union Education Minister Dharmendra Pradhan launched 'SWAYAM Plus', a new Advanced E-Learning Platform enhancing employability and professional growth through courses developed with industry giants like L&T, Microsoft, and CISCO. Aimed at college students and lifelong learners, SWAYAM Plus merges academic rigor with practical skills, fostering job readiness by integrating real-world expertise. This initiative represents a significant collaboration between academia and leading industry partners, aiming to bridge the gap between education and employment.

|

Global E-learning Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 334.91 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.03 % |

Market Size in 2032: |

USD 791.64 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application

|

|

||

|

By Function |

|

||

|

By Deployment Mode |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- E-LEARNING MARKET BY TYPE (2017-2032)

- E-LEARNING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ONE-ON-ONE LEARNING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GROUP LEARNING

- COURSE-BASED LEARNING

- VIDEO-BASED LEARNING

- E-LEARNING MARKET BY APPLICATION (2017-2032)

- E-LEARNING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ACADEMIC

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CORPORATE

- GOVERNMENT

- E-LEARNING MARKET BY FUNCTION (2017-2032)

- E-LEARNING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TRAINING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TESTING

- E-LEARNING MARKET BY DEPLOYMENT MODE (2017-2032)

- E-LEARNING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CLOUD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ON-PREMISE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- E-LEARNING Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- COURSERA (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- UDEMY (USA)

- SKILLSHARE (USA)

- LINKEDIN LEARNING (USA)

- UDACITY (USA)

- EDX (USA)

- FUTURELEARN (UK)

- DOCEBO (CANADA)

- CORNERSTONE ONDEMAND (USA)

- BLACKBOARD (USA)

- D2L (CANADA)

- LITMOS (USA)

- SAP LITMOS (USA)

- MCGRAW-HILL EDUCATION (USA)

- PEARSON (UK)

- CENGAGE LEARNING (USA)

- KHAN ACADEMY (USA)

- BYJU'S (INDIA)

- VEDUCA (BRAZIL)

- NEW ORIENTAL (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL E-LEARNING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Function

- Historic And Forecasted Market Size By Deployment Mode

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global E-learning Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 334.91 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.03 % |

Market Size in 2032: |

USD 791.64 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application

|

|

||

|

By Function |

|

||

|

By Deployment Mode |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. E-LEARNING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. E-LEARNING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. E-LEARNING MARKET COMPETITIVE RIVALRY

TABLE 005. E-LEARNING MARKET THREAT OF NEW ENTRANTS

TABLE 006. E-LEARNING MARKET THREAT OF SUBSTITUTES

TABLE 007. E-LEARNING MARKET BY TECHNOLOGY

TABLE 008. ONLINE E-LEARNING MARKET OVERVIEW (2016-2028)

TABLE 009. LMS MARKET OVERVIEW (2016-2028)

TABLE 010. MOBILE E-LEARNING MARKET OVERVIEW (2016-2028)

TABLE 011. RAPID E-LEARNING MARKET OVERVIEW (2016-2028)

TABLE 012. E-LEARNING MARKET BY APPLICATION

TABLE 013. ACADEMIC MARKET OVERVIEW (2016-2028)

TABLE 014. VIRTUAL CLASSROOM MARKET OVERVIEW (2016-2028)

TABLE 015. CORPORATE MARKET OVERVIEW (2016-2028)

TABLE 016. GOVERNMENT MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA E-LEARNING MARKET, BY TECHNOLOGY (2016-2028)

TABLE 018. NORTH AMERICA E-LEARNING MARKET, BY APPLICATION (2016-2028)

TABLE 019. N E-LEARNING MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE E-LEARNING MARKET, BY TECHNOLOGY (2016-2028)

TABLE 021. EUROPE E-LEARNING MARKET, BY APPLICATION (2016-2028)

TABLE 022. E-LEARNING MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC E-LEARNING MARKET, BY TECHNOLOGY (2016-2028)

TABLE 024. ASIA PACIFIC E-LEARNING MARKET, BY APPLICATION (2016-2028)

TABLE 025. E-LEARNING MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA E-LEARNING MARKET, BY TECHNOLOGY (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA E-LEARNING MARKET, BY APPLICATION (2016-2028)

TABLE 028. E-LEARNING MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA E-LEARNING MARKET, BY TECHNOLOGY (2016-2028)

TABLE 030. SOUTH AMERICA E-LEARNING MARKET, BY APPLICATION (2016-2028)

TABLE 031. E-LEARNING MARKET, BY COUNTRY (2016-2028)

TABLE 032. ADOBE: SNAPSHOT

TABLE 033. ADOBE: BUSINESS PERFORMANCE

TABLE 034. ADOBE: PRODUCT PORTFOLIO

TABLE 035. ADOBE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. BLACKBOARD: SNAPSHOT

TABLE 036. BLACKBOARD: BUSINESS PERFORMANCE

TABLE 037. BLACKBOARD: PRODUCT PORTFOLIO

TABLE 038. BLACKBOARD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. CISCO: SNAPSHOT

TABLE 039. CISCO: BUSINESS PERFORMANCE

TABLE 040. CISCO: PRODUCT PORTFOLIO

TABLE 041. CISCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. INSTRUCTURE: SNAPSHOT

TABLE 042. INSTRUCTURE: BUSINESS PERFORMANCE

TABLE 043. INSTRUCTURE: PRODUCT PORTFOLIO

TABLE 044. INSTRUCTURE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. NIIT: SNAPSHOT

TABLE 045. NIIT: BUSINESS PERFORMANCE

TABLE 046. NIIT: PRODUCT PORTFOLIO

TABLE 047. NIIT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. PEARSON: SNAPSHOT

TABLE 048. PEARSON: BUSINESS PERFORMANCE

TABLE 049. PEARSON: PRODUCT PORTFOLIO

TABLE 050. PEARSON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. CORNERSTONE: SNAPSHOT

TABLE 051. CORNERSTONE: BUSINESS PERFORMANCE

TABLE 052. CORNERSTONE: PRODUCT PORTFOLIO

TABLE 053. CORNERSTONE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. CITRIX EDUCATION: SNAPSHOT

TABLE 054. CITRIX EDUCATION: BUSINESS PERFORMANCE

TABLE 055. CITRIX EDUCATION: PRODUCT PORTFOLIO

TABLE 056. CITRIX EDUCATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. APTARA: SNAPSHOT

TABLE 057. APTARA: BUSINESS PERFORMANCE

TABLE 058. APTARA: PRODUCT PORTFOLIO

TABLE 059. APTARA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. MEDIAN KNOWLEDGE SYSTEMS: SNAPSHOT

TABLE 060. MEDIAN KNOWLEDGE SYSTEMS: BUSINESS PERFORMANCE

TABLE 061. MEDIAN KNOWLEDGE SYSTEMS: PRODUCT PORTFOLIO

TABLE 062. MEDIAN KNOWLEDGE SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. MICROSFT: SNAPSHOT

TABLE 063. MICROSFT: BUSINESS PERFORMANCE

TABLE 064. MICROSFT: PRODUCT PORTFOLIO

TABLE 065. MICROSFT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. LEANING POOL: SNAPSHOT

TABLE 066. LEANING POOL: BUSINESS PERFORMANCE

TABLE 067. LEANING POOL: PRODUCT PORTFOLIO

TABLE 068. LEANING POOL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. ALLEN INTERACTIONS INC.: SNAPSHOT

TABLE 069. ALLEN INTERACTIONS INC.: BUSINESS PERFORMANCE

TABLE 070. ALLEN INTERACTIONS INC.: PRODUCT PORTFOLIO

TABLE 071. ALLEN INTERACTIONS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. APOLLO EDUCATIONS GROUP: SNAPSHOT

TABLE 072. APOLLO EDUCATIONS GROUP: BUSINESS PERFORMANCE

TABLE 073. APOLLO EDUCATIONS GROUP: PRODUCT PORTFOLIO

TABLE 074. APOLLO EDUCATIONS GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 075. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 076. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 077. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. E-LEARNING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. E-LEARNING MARKET OVERVIEW BY TECHNOLOGY

FIGURE 012. ONLINE E-LEARNING MARKET OVERVIEW (2016-2028)

FIGURE 013. LMS MARKET OVERVIEW (2016-2028)

FIGURE 014. MOBILE E-LEARNING MARKET OVERVIEW (2016-2028)

FIGURE 015. RAPID E-LEARNING MARKET OVERVIEW (2016-2028)

FIGURE 016. E-LEARNING MARKET OVERVIEW BY APPLICATION

FIGURE 017. ACADEMIC MARKET OVERVIEW (2016-2028)

FIGURE 018. VIRTUAL CLASSROOM MARKET OVERVIEW (2016-2028)

FIGURE 019. CORPORATE MARKET OVERVIEW (2016-2028)

FIGURE 020. GOVERNMENT MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA E-LEARNING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE E-LEARNING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC E-LEARNING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA E-LEARNING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA E-LEARNING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the E-learning Market research report is 2024-2032.

Coursera (USA), Udemy (USA), Skillshare (USA), LinkedIn Learning (USA), Udacity (USA), edX (USA), FutureLearn (UK), Docebo (Canada), Cornerstone OnDemand (USA), Blackboard (USA), D2L (Canada), Litmos (USA), SAP Litmos (USA), McGraw-Hill Education (USA), Pearson (UK), Cengage Learning (USA), Khan Academy (USA), Byju's (India), Veduca (Brazil), New Oriental (China) and Other Major Players.

The Global E-Learning Market is segmented into Type, End User, Function, Deployment Mode and region. By Type, the market is categorized into One-on-one learning, Group learning, Course-based learning, Video-based learning. By End User, the market is categorized into Academic, Corporate and Government. By Function, the market is categorized into Training and Testing. By Deployment Mode, the market is categorized into Cloud and On-Premise. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

E-Learning is a learning system that is an advanced built of formalized teaching system but with the help of electronic resources. The Internet and supporting devices form the major component of E-learning system. E-learning serves a large group of people like, engineers, teachers, non-commissioned and military officers, accountants, healthcare professionals and many others in their professional development.

Global E-learning Market size was valued at USD 334.91 Billion in 2023 and is projected to reach USD 791.64 Billion by 2032, growing at a CAGR of 10.03% From 2024-2032.