Dental Endodontics Market Synopsis

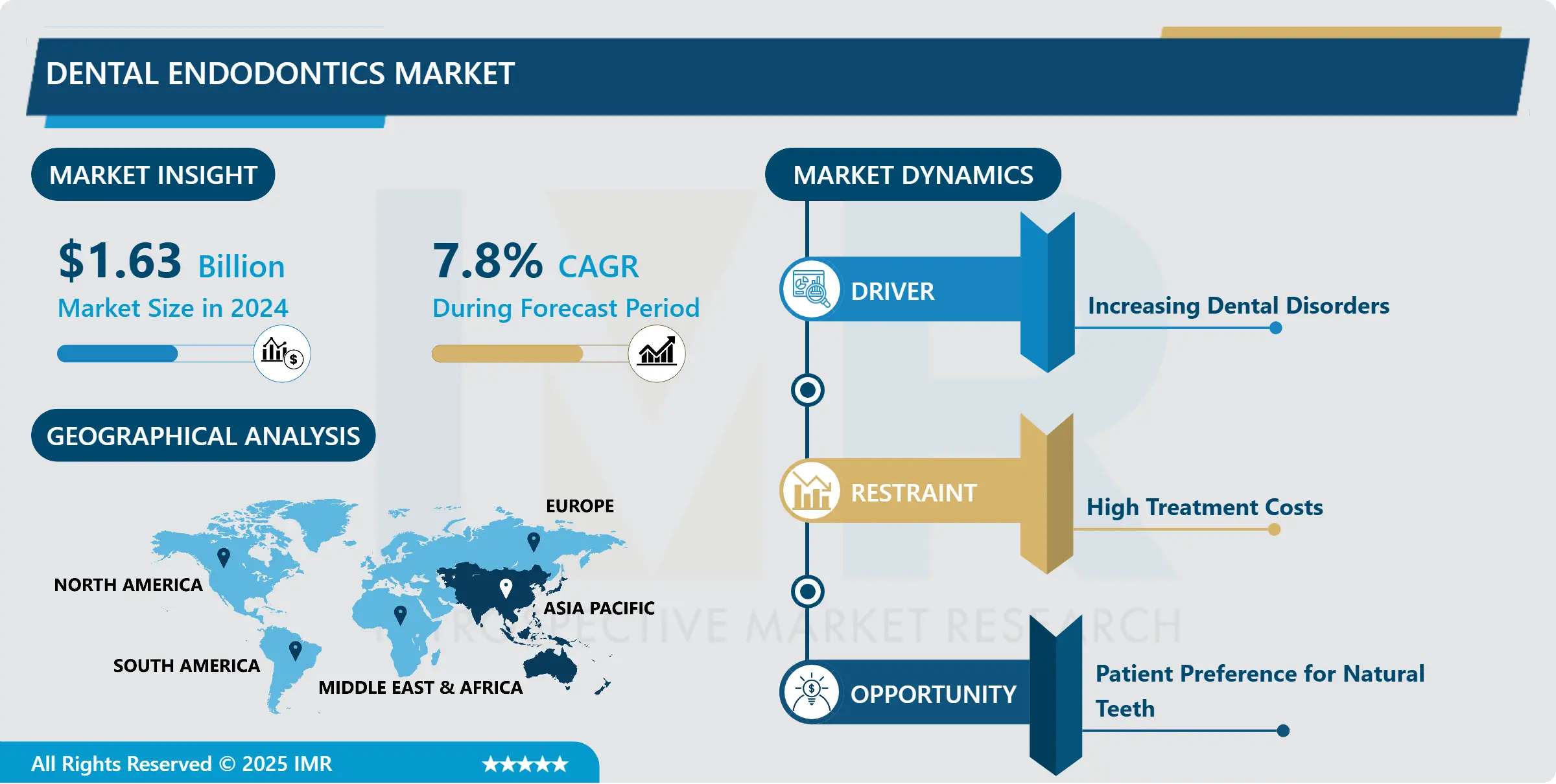

Dental Endodontics Market Size Was Valued at USD 1.63 Billion in 2024 and is Projected to Reach USD 3.72 Billion by 2035, Growing at a CAGR of 7.8% From 2025-2035.

The dental endodontics market can be defined as a branch of the dentistry industry which deals with diagnosis, treatment, and prevention of diseases and injuries of tooth pulp and the tissues. Endodontic mainly refers to root canal procedures in which its main objective is to remove the infected or inflamed pulp in the tooth, clean disinsect the root canal via proper filing and then, seal it with suitable material. Current trends in this market comprise endodontic instruments; obturation material; imaging systems; and treatment approaches that focus on keeping the natural dentition and promoting oral health. Dental endodontics has been growing round the world due to awareness of oral health, improvement of technology in dental treatments, and increased in demand for root canal treatment and other non-surgical endodontic treatments.

Rising and aging population more prone to dental issues, advancement in endodontic technology and increasing dental health consciousness, are some of the aspect that are rapidly expanding the global dental endodontics market. There were advancements in technology with relation to endodontics this branch of dentistry deals with the tissues of the tooth roots and the pulp. These improvements include the application of digital imaging as well the minimally invasive procedures. Promising developments of medical technologies make symptoms last for shorter periods of time, reduce the suffering of patients, and increase effectiveness of therapies.As more people in developing countries enjoy higher disposable income levels, it is occasioning market growth as more people can afford complex dental care.al health are all driving the strong expansion of the global dental endodontics market. Significant technological breakthroughs have been made in endodontics, a specialty of dentistry that treats the tissues and dental pulp surrounding tooth roots. These advancements include the use of digital imaging techniques and minimally invasive procedures. These advancements shorten recuperation periods and lessen patient suffering while also improving treatment results.

Growing disposable incomes in developing nations are driving the market's expansion as more people can now afford sophisticated dental services. As well, an increasing prevalence of dental cavities and severe oral trauma that demands root canal therapy also contributes to the industry. Dental tools and equipment used in endodontic work are now being produced in high tech technology thus putting pressure on dental offices and hospitals to meet the demands of the patients through expensive equipment and instruments. Buyer power and the need for dental endodontics is most concentrated in the North America owing to the highly developed and sophisticated healthcare structure, relatively high spending on the healthcare facilities, and adoption of the most advanced technologies in dentistry. Major advancement has been observed in the field of endodontics, which deals with tissues and pulp in and around the tooth roots. In more recent time, other improvement has been made which include the application of digital imaging and various minimally invasive surgical procedures. All these advancements help in shortening the time needed for the patient to recover as well as decreasing patient’s pain while at the same time enhancing the outcomes of treatment.

As DP incomes increase in developing countries, there is an increased demand for the new more complex dental services. Further, increase in dental caries and critical oral injuries demanding root-end treatment is propelling the industry. The demand from patients for rapid, painless treatments is putting pressure on dental offices and hospitals to meet this need, and to equip treatment rooms with top-quality, and often very costly, endodontic instruments.

North America takes the largest world share of the dental endodontics due to the well-developed healthcare infrastructure, high health care expenditure, and inclination toward the adoption of modern dental technology. Largely due to increased elderly population base and favourable rules of reimbursement, Europe comes right behind. Meanwhile, increasing economic growth, development of dental care facilities, and increasing health consciousness are helping the Asia-Pacific region to experience the expected rapid growth in the near future. Concerning the strategic position on the projected market share for new product development together with partnership agreements as the key activities undertaken by manufacturers and businesses operating in the dental endodontics industry. Noteworthy advancements have been reported in endodontics; also known as special branch of dentistry which handles with tissues and dental pulp surrounding and surrounding root canals of the teeth. These are; the use of techniques in digital imaging and relatively less invasive approaches to treatment. These advancements reduce recovery times and reduce patient suffering and at the same time enhance the outcomes of treatment.

New product development, strategic partnership and expansion of operation in the international market are some of the key strategies being pursued by the influential players of the dental endodontics industry in order to seek a larger market share. The focus to continual research and development is to explain new material and technique to avoid being ineffective and to increase the durability of endodontic treatment. The dental endodontics market will continue to grow in the next years as the demand for improved dental care is growing all over the world.

Dental Endodontics Market Trend Analysis

Technological Advancements and Demographic Shifts

- Time to change: The advancement in technology is severely impacting the dental endodontics business altering patient experience and treatment. In endodontics technology such as digital radiography, CAD/CAM and 3D imaging has revolutionalised the field and its ability to diagnose and plan treatment accurately. However, with the help of these technology, it becomes easier for the dentists to diagnose the root canals architecture and the treatment planning thus attained is of high end. Additionally, use of laser technology and robotic assisted devices make endodontic treatment less discomforting and quicker therefore changing the face of minimally invasive dentistry. There are demographic drivers that that are making patients require endodontic services including the current global population aging and increased life expectancy. it is one of the ways that digital means such as digital radiography, CAD/CAM and also the three dimensional imaging have revolutionized the diagnostic ability and the precision of endodontic treatment planning. These technologies have in recent past enabled the dentists to have an actual view of the structural nature of the root canals that would have before been difficult to diagnose and plan appropriately. Above all, the integration of laser technology and the usage of robotic assisted devices has not only minimized patient trp but also enhanced the degree of precision and speed by which the procedures are conducted, putting endodontics in front line of minimally invasive dental processes.

- The demand for endodontic treatment is being brought by altered demography including; Increased global life span. Since older persons are preserving their natural dentition, age-related oral diseases pose more complex endodontic treatments for efficient treatment. Up-to-date endodontic procedures keeping patient’s function and esthetics are popular because younger generation patients want to keep their teeth healthy and avoid having to seek treatment in later years. These changes in the population underscore the need to embrace endodontics in the delivery of full-scope dental care hence the nuclearity of how important it is to maintain oral health in a variety of patient populations.

- Dental endodontics market is relatively growing, where demographic factors and technological changes have a role to play.nological advancements like digital radiography, computer-aided design/computer-aided manufacture (CAD/CAM), and 3D imaging have completely changed the field's capacity for diagnosis and precise treatment planning. With the aid of these technology, dentists can now see the complex architecture of root canals with a level of clarity never before possible, improving diagnosis and treatment planning. Furthermore, the incorporation of laser technology and robotic-assisted devices has reduced patient discomfort and increased procedural efficiency, placing endodontics at the forefront of minimally invasive dental care.

Endodontic Procedures and Technological Advancements

- Technology has greatly impacted the specialty area of endodontics in that it provides considerable patient benefits in comfort, accuracy, and time. For instance, while today’s rotary devices have assumed the position of hand instruments in root canal cleaning and shaping, they offer more controlled and standardized operations. This development not only expedites the course of treatment but also guarantees complete excision of diseased tissue, lowering the risk of reinfection and boosting the long-term efficacy of root canal therapy.Apex locators have also completely changed how accurately the working length of root canals may be determined. Apex locators help dentists minimize the danger of over-instrumentation and related consequences by accurately determining the endpoint of root canal instrumentation. This allows dentists to perform treatments with greater confidence and accuracy. The predictability and effectiveness of root canal treatments have greatly increased thanks to this technology, which has improved results and raised patient satisfaction.

- Further, dental operating microscope has opened up the way of visualizing endodontic treatment in a manner that was never thought of before. Microscopes in use today provide better lighting and magnification and enable one to see better the even the bridal structure of the root canals and other details that normal, naked eye would not see. Such level of precision enables dentists to perfectly perform operations knowing that root canal system is entirely cleaned and prepared while preserving as much sound pulpal dentin tissue as possible. Patients report less pain following surgery and quicker recovery periods as a result, which raises their level of satisfaction with the overall results of their endodontic therapy.

Dental Endodontics Market Segment Analysis:

Dental Endodontics Market is Segmented based on Product Type and End-user.

By End-user, Dental Hospitalssegment is expected to dominate the market during the forecast period

- In the discipline of endodontics, dental hospitals and clinics are the key end-users that hold a dominant market share. Many patients needing complete dental care, including intricate endodontic procedures like root canal therapy, are served by these facilities. Because of the rapid patient turnover, a wide range of endodontic devices and supplies are required in order to effectively handle different tooth diseases and treatment complexity. Tools like endodontic scalers and lasers are essential for properly cleaning and sanitizing root canals and guaranteeing the best possible results from therapy. Effective root canal operations depend on precise canal preparation and measurement, which is made possible by the use of motors and apex locators, two invaluable instruments. Furthermore, effective root canal filling and sealing are made possible by machine-assisted obturation systems, which improve treatment dependability and patient comfort.

- Equally important to the functioning of dental clinics and hospitals are consumables. Obturation Filling Materials are necessary to properly seal root canals, stop reinfection, and encourage healing. Consumables for root canal shaping and cleaning, such as lubricants, endodontic tools, and irrigating solutions, are essential for properly cleaning and shaping the canals before obturation. Consumables for access cavity preparation, such as endodontic burs, make it easier to precisely prepare teeth and guarantee the best possible access to the root canal system. When used together, these supplies facilitate effective workflow management and help busy healthcare settings achieve consistent treatment outcomes.

By Product Type, Endodontic Scalers & Lasers segment held the largest share in 2023

- Endodontic Scalers & Lasers are unique among dental devices, holding a significant market share because of their indispensable functions in contemporary endodontic operations. When performing procedures like root canal therapy, dentists employ endodontic scalers as vital instruments to carefully clean and shape the root canals. With the use of these tools, it is possible to precisely remove diseased or damaged tissue from the tooth's complex canal system, providing complete cleaning and setting the stage for further treatment. The degree of treatment success and patient comfort are greatly impacted by their capacity to efficiently remove debris and form canals.

- In a similar vein, lasers have become revolutionary instruments in endodontics, providing unmatched accuracy and adaptability across a range of therapeutic modalities. Because of its increased precision and low invasiveness while performing activities like sick tissue removal and root canal disinfecting, lasers are becoming more and more popular. Lasers help patients heal more quickly and experience less agony after surgery by focusing on targeted tissues with the least amount of damage to nearby healthy structures. Because of this feature, they are especially useful in complicated endodontic instances where using conventional procedures could be difficult.

- The widespread use and acceptance of endodontic scalers and lasers in contemporary practices attests to their crucial contribution to the advancement of endodontics. The increasing need for dental procedures that are both minimally invasive and effective is met by their efficiency, precision, and capacity to improve treatment outcomes. These tools are anticipated to have a greater impact as technology develops, spurring innovation and raising standards of care in endodontic offices across the globe. Their continued advancement and incorporation into dental workflows emphasize their importance as pillars of modern endodontic care, guaranteeing patients the best possible care and results.

Dental Endodontics Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- In the Asia-Pacific region, the dental endodontics market is experiencing significant growth driven by several key factors. Rapid urbanization across countries like China, India, and Japan has led to increased access to healthcare services, including dental care. Urban populations tend to have higher disposable incomes and greater awareness of oral health, contributing to a rising demand for dental treatments, including endodontic procedures. As more individuals in these urban centers prioritize oral health and seek advanced dental solutions, the market for dental endodontics has expanded rapidly.

- Moreover, the growing middle-class population in Asia-Pacific plays a crucial role in driving the demand for dental endodontics. With rising incomes, this demographic segment is more willing to spend on preventive and corrective dental procedures, which includes root canals and other endodontic treatments. This trend is further supported by evolving consumer preferences towards maintaining dental health and aesthetics, spurred by increased exposure to global dental care standards and practices.

- Furthermore, improving healthcare infrastructure in countries like China and India has enhanced accessibility to dental services, thereby facilitating the growth of the endodontics market. Government initiatives and policies aimed at promoting oral health awareness and preventive care have also contributed to this growth trajectory. As a result, Asia-Pacific is emerging as a dominant region in the global dental endodontics market, with robust growth expected to continue as healthcare facilities expand and consumer demand for quality dental care remains strong.

Active Key Players in the Dental Endodontics Market

- Dentsply Sirona,

- Danaher Corporation,

- Ivoclar Vivadent,

- Ultradent Products,

- Septodont Holding,

- FKG Dentaire S.A.,

- Peter Brasseler Holdings,

- LLC, Mani, Inc.,

- Coltene Holding AG,

- Henry Schein, Inc.

- Other Key Players

Key Industry Developments in the Dental Endodontics Market:

- In October 2023, Dentsply Sirona introduced the new X-Smart Pro+ endodontic motor with an integrated apex locator. This portable motor is designed to optimize the performance of Dentsply Sirona endodontic file systems (including VDW file systems).

- In April 2023, FKG Dentaire launched BC Universal Sealer and BC Universal RRM to complement its endodontic obturation portfolio in the European Union (EU), the U.K., and Israel

|

Global Dental Endodontics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.63 Bn. |

|

Forecast Period 2025-35 CAGR: |

7.8 % |

Market Size in 2035: |

USD 3.72 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Dental Endodontics Market by Product Type (2018-2035)

4.1 Dental Endodontics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Instruments

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Endodontic Scalers & Lasers

4.5 Motors

4.6 Apex Locators

4.7 Machine-assisted Obturation Systems

4.8 Others

4.9 Consumables

4.10 Obturation

4.11 Obturation Filling Materials

4.12 Other Consumables

4.13 Shaping and Cleaning

4.14 Irrigating Solution & Lubricants

4.15 Endodontic Files & Shapers

4.16 Other Shaping and Cleaning Consumables

4.17 Access Cavity Preparation

4.18 Endodontic Burs

4.19 Other Consumables

Chapter 5: Dental Endodontics Market by End-user (2018-2035)

5.1 Dental Endodontics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Dental Hospitals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Dental Clinics

5.5 Dental Academic & Research Institutes

5.6 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Dental Endodontics Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 DENTSPLY SIRONA

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 DANAHER CORPORATION

6.4 IVOCLAR VIVADENT

6.5 ULTRADENT PRODUCTS

6.6 SEPTODONT HOLDING

6.7 FKG DENTAIRE S.A.

6.8 PETER BRASSELER HOLDINGS

6.9 LLC

6.10 MANI INC.

6.11 COLTENE HOLDING AG

6.12 HENRY SCHEIN INC.

6.13 OTHER KEY PLAYERS

Chapter 7: Global Dental Endodontics Market By Region

7.1 Overview

7.2. North America Dental Endodontics Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product Type

7.2.4.1 Instruments

7.2.4.2 Endodontic Scalers & Lasers

7.2.4.3 Motors

7.2.4.4 Apex Locators

7.2.4.5 Machine-assisted Obturation Systems

7.2.4.6 Others

7.2.4.7 Consumables

7.2.4.8 Obturation

7.2.4.9 Obturation Filling Materials

7.2.4.10 Other Consumables

7.2.4.11 Shaping and Cleaning

7.2.4.12 Irrigating Solution & Lubricants

7.2.4.13 Endodontic Files & Shapers

7.2.4.14 Other Shaping and Cleaning Consumables

7.2.4.15 Access Cavity Preparation

7.2.4.16 Endodontic Burs

7.2.4.17 Other Consumables

7.2.5 Historic and Forecasted Market Size by End-user

7.2.5.1 Dental Hospitals

7.2.5.2 Dental Clinics

7.2.5.3 Dental Academic & Research Institutes

7.2.5.4 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Dental Endodontics Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product Type

7.3.4.1 Instruments

7.3.4.2 Endodontic Scalers & Lasers

7.3.4.3 Motors

7.3.4.4 Apex Locators

7.3.4.5 Machine-assisted Obturation Systems

7.3.4.6 Others

7.3.4.7 Consumables

7.3.4.8 Obturation

7.3.4.9 Obturation Filling Materials

7.3.4.10 Other Consumables

7.3.4.11 Shaping and Cleaning

7.3.4.12 Irrigating Solution & Lubricants

7.3.4.13 Endodontic Files & Shapers

7.3.4.14 Other Shaping and Cleaning Consumables

7.3.4.15 Access Cavity Preparation

7.3.4.16 Endodontic Burs

7.3.4.17 Other Consumables

7.3.5 Historic and Forecasted Market Size by End-user

7.3.5.1 Dental Hospitals

7.3.5.2 Dental Clinics

7.3.5.3 Dental Academic & Research Institutes

7.3.5.4 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Dental Endodontics Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product Type

7.4.4.1 Instruments

7.4.4.2 Endodontic Scalers & Lasers

7.4.4.3 Motors

7.4.4.4 Apex Locators

7.4.4.5 Machine-assisted Obturation Systems

7.4.4.6 Others

7.4.4.7 Consumables

7.4.4.8 Obturation

7.4.4.9 Obturation Filling Materials

7.4.4.10 Other Consumables

7.4.4.11 Shaping and Cleaning

7.4.4.12 Irrigating Solution & Lubricants

7.4.4.13 Endodontic Files & Shapers

7.4.4.14 Other Shaping and Cleaning Consumables

7.4.4.15 Access Cavity Preparation

7.4.4.16 Endodontic Burs

7.4.4.17 Other Consumables

7.4.5 Historic and Forecasted Market Size by End-user

7.4.5.1 Dental Hospitals

7.4.5.2 Dental Clinics

7.4.5.3 Dental Academic & Research Institutes

7.4.5.4 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Dental Endodontics Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product Type

7.5.4.1 Instruments

7.5.4.2 Endodontic Scalers & Lasers

7.5.4.3 Motors

7.5.4.4 Apex Locators

7.5.4.5 Machine-assisted Obturation Systems

7.5.4.6 Others

7.5.4.7 Consumables

7.5.4.8 Obturation

7.5.4.9 Obturation Filling Materials

7.5.4.10 Other Consumables

7.5.4.11 Shaping and Cleaning

7.5.4.12 Irrigating Solution & Lubricants

7.5.4.13 Endodontic Files & Shapers

7.5.4.14 Other Shaping and Cleaning Consumables

7.5.4.15 Access Cavity Preparation

7.5.4.16 Endodontic Burs

7.5.4.17 Other Consumables

7.5.5 Historic and Forecasted Market Size by End-user

7.5.5.1 Dental Hospitals

7.5.5.2 Dental Clinics

7.5.5.3 Dental Academic & Research Institutes

7.5.5.4 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Dental Endodontics Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product Type

7.6.4.1 Instruments

7.6.4.2 Endodontic Scalers & Lasers

7.6.4.3 Motors

7.6.4.4 Apex Locators

7.6.4.5 Machine-assisted Obturation Systems

7.6.4.6 Others

7.6.4.7 Consumables

7.6.4.8 Obturation

7.6.4.9 Obturation Filling Materials

7.6.4.10 Other Consumables

7.6.4.11 Shaping and Cleaning

7.6.4.12 Irrigating Solution & Lubricants

7.6.4.13 Endodontic Files & Shapers

7.6.4.14 Other Shaping and Cleaning Consumables

7.6.4.15 Access Cavity Preparation

7.6.4.16 Endodontic Burs

7.6.4.17 Other Consumables

7.6.5 Historic and Forecasted Market Size by End-user

7.6.5.1 Dental Hospitals

7.6.5.2 Dental Clinics

7.6.5.3 Dental Academic & Research Institutes

7.6.5.4 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Dental Endodontics Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product Type

7.7.4.1 Instruments

7.7.4.2 Endodontic Scalers & Lasers

7.7.4.3 Motors

7.7.4.4 Apex Locators

7.7.4.5 Machine-assisted Obturation Systems

7.7.4.6 Others

7.7.4.7 Consumables

7.7.4.8 Obturation

7.7.4.9 Obturation Filling Materials

7.7.4.10 Other Consumables

7.7.4.11 Shaping and Cleaning

7.7.4.12 Irrigating Solution & Lubricants

7.7.4.13 Endodontic Files & Shapers

7.7.4.14 Other Shaping and Cleaning Consumables

7.7.4.15 Access Cavity Preparation

7.7.4.16 Endodontic Burs

7.7.4.17 Other Consumables

7.7.5 Historic and Forecasted Market Size by End-user

7.7.5.1 Dental Hospitals

7.7.5.2 Dental Clinics

7.7.5.3 Dental Academic & Research Institutes

7.7.5.4 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Dental Endodontics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.63 Bn. |

|

Forecast Period 2025-35 CAGR: |

7.8 % |

Market Size in 2035: |

USD 3.72 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||