Defoamers Market Synopsis

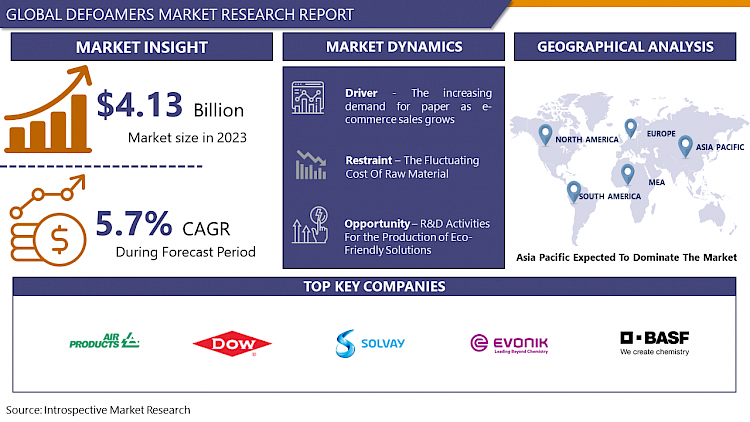

Defoamers Market Size Was Valued at USD 4.13 Billion in 2023, and is Projected to Reach USD 6.83 Billion by 2032, Growing at a CAGR of 5.7% From 2024-2032.

Foam is a coarse dispersion of a gas in a liquid in which the volume percentage of gas is larger than the volume fraction of liquid. Foams are a major issue in industrial processes. They cause damage to the surface coatings.

- They obstruct efficient container filling. Defoamers are chemical additives that minimize or prevent foam formation in industrial process liquids such as paints, inks, adhesives, and even construction materials. Although the phrases antifoam agent and defoamer are frequently used interchangeably, antifoam agents refer to compounds that prevent the creation and development of bubbles.

- They are composed of polydimethylsiloxanes and other silicones, insoluble oils, stearates, and glycols, as well as inorganics such as silicates and talc, depending on the application and performance requirements Defoamer is a surface-active agent that is insoluble in foamy media.

- The capacity to spread quickly on foamy surfaces is a critical quality of a defoamer. To be effective in a coating system, defoamers compete with foam-stabilizing chemicals. The increasing applications of defoamers in various industries are anticipated to propel the development of the market over the forecasted period.

Defoamers Market Trend Analysis

The increasing demand for paper as e-commerce sales grows

- Due to changes in consumer behavior and increased digitalization, the paper industry has undergone significant changes in recent decades. Only 20 years ago, newsprint accounted for 12% of global paper and paperboard production; however, the transition to digital media platforms has reduced its share of global production to less than 4%. Printing and writing papers have also suffered, with an annual global output of these paper grades falling by 25% since 2010.

- Paper packaging, on the other hand, has thrived in the digital age, particularly since the e-commerce boom. For instance, the annual production of corrugated case material, which is critical in e-commerce, has increased nearly 30% in the last decade and now accounts for 43% of global paper and paperboard production. Corrugated case material demand is expected to grow further over the next decade, reaching 221 million metric tons, a 30% increase over 2020 levels. In 2023, global online sales are expected to exceed $5.5 trillion. This will have a significant impact on packaging demand, particularly in the corrugated industry, which accounts for 80% of e-commerce demand. E-commerce packages are expected to be handled up to 20 times or more during standard distribution due to the increasingly complex logistics chain for direct-to-consumer delivery thus, increasing the demand for corrugated boxes which in turn is likely to promote the expansion of the defoamers market over the projected period.

R&D Activities For The Production Of Eco-Friendly Solutions Creates An Opportunity

- The Growing applications of defoamers in several industries have increased their demand. In order to maintain the demand-supply chain, market players have increased their production capacity.

- Additionally, key players are adopting organic strategies such as mergers & acquisitions and investments to strengthen their position in the market. In February 2021, the new defoamer satisfies the requirements of current low-pollutant paint and coating labels, such as the European Ecolabel’s and relevant IKEA standards.

- The defoamer complies with Swiss A and FDA requirements for food contact applications, among others. There are no biocides or reportable SVHC substances in TEGO® Foamex 812. Therefore, the production of defoamers that are eco-friendly is anticipated to create lucrative opportunities for market players in the projected period.

Defoamers Market Segment Analysis:

Defoamers Market Segmented on the basis of type, application.

By Type, the silicone segment is expected to dominate the market during the forecast period

- The silicone-based segment is anticipated to have the highest share of the defoamers market over the studied period. Silicones spread evenly and quickly over a foam film due to their low surface tension, allowing for foam penetration and collapse. They also have the advantage of being non-contaminating since they are inert and work at much lower concentrations than non-silicone defoamers.

- They are particularly useful in the production of adhesives, pulp, and paper, coatings, cutting oils, water base paints, latex, aromatic glycol extractions in the petroleum industry, and many types of food processing. Years ago, the positive impact of silicone defoamers on sustainability and carbon balance in the pulp and paper industry was assessed.

- According to research, silicone defoamer has a carbon balance of 27, which means that for every ton of CO2 emitted in its production, the use of silicone defoamer saves 27 tons of CO2. Due to the aforementioned qualities, the silicone-based segment is expected to continue its dominance in the projected period.

By Application, pulp & paper segment held the largest share of 36.4% in 2022

- The pulp & paper segment is expected to lead the growth of the defoamers market in the forecasted timeframe. Pulp mill defoamers are used in brown stock washing, screen rooms, and bleach plants since they are effective at high temperatures and can withstand the high acid and alkaline conditions of the pulp mill process.

- The majority of mills use water-based silicone defoamers. However, finished product pulping processes, such as acetate dissolving pulp, will not tolerate silicone and/or silica. Oil-based defoamers are used in these processes. Furthermore, paper machine defoamers are required to run at or above the machine's designed capacity.

- A good paper machine defoamer program will reduce entrained air in the head box and on the formation wire, increasing paper machine drainage. It will also decrease steam cost on the dryers over and above the capacity of retention and drainage aide programs thereby, propelling the growth of the pulp & paper segment over the estimated period.

Defoamers Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region is anticipated to have the highest share of the defoamers market over the forecasted period. India, China, Singapore, South Korea, Japan, and Thailand are the major countries strengthening the development of the market. There has been tremendous growth in the construction industry in this region.

- In India, over 232 thousand housing units were launched on the residential market in 2021. Additionally, in China, the housing construction area of real estate development enterprises was 9,753.87 million square meters in 2021, an increase of 5.2 percent over the previous year. In 2021, over 232 thousand housing units were launched on the Indian residential market. Furthermore, the housing construction area of real estate development enterprises in China was 9,753.87 million square meters in 2021, a 5.2 percent increase over the previous year. With the growth in the construction sector, the demand for paints and coatings is also anticipated to increase thereby, pushing the growth of the defoamers market in respective countries.

- Furthermore, to boost self-sufficiency, Singapore developed an advanced sewage treatment system that included a network of tunnels and high-tech plants. This recycled wastewater supplies 40% of Singapore's water needs. According to the country's water agency, this figure is expected to rise to 55% by 2060 thus, supporting the development of the defoamers market.

Defoamers Market Top Key Players:

- Air Products and Chemicals Inc.(USA)

- Momentive Performance Materials Inc. (USA)

- Lubrizol Corporation (USA)

- Wilflex Corporation (USA)

- Alzo International Inc. (USA)

- Dow Corning Corporation (USA)

- Chemours Company (USA)

- Ashland Inc. (USA)

- Dow Chemical Company (USA)

- Solvay SA (Belgium)

- Evonik Industries AG (Germany)

- Clariant AG (Switzerland)

- Wacker Chemie AG (Germany)

- Arkema SA (France)

- Lanxess AG (Germany)

- BASF SE (Germany)

- Kemira Oyj (Finland)

- Elements Plc (UK)

- Croda International Plc (UK)

- Shin-Etsu Chemical Co. Ltd. (Japan)

Key Industry Developments in the Defoamers Market:

- In June 2023, Evonik's Coating Additives business line announced the expansion of its TEGO® Rad range with the introduction of TEGO® Rad 2550, a novel radically cross-linkable defoaming slip additive. This addition to the TEGO® Rad portfolio signifies Evonik's commitment to providing tailored solutions to meet the evolving needs of coating manufacturers, particularly in the realm of UV- and LED-cured formulations. TEGO® Rad 2550 is characterized by several key attributes that distinguish it as a versatile and high-performance additive for coatings.

|

Global Defoamers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.13 Bn. |

|

Forecast Period 2023-30 CAGR: |

5.7 % |

Market Size in 2032: |

USD 6.83 Bn. |

|

Segments Covered: |

By Defoamer Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- DEFOAMERS MARKET BY DEFOAMERS TYPE (2016-2030)

- DEFOAMERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- WATER BASED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OIL BASED

- SILICONE BASED

- DEFOAMERS MARKET BY APPLICATION (2016-2030)

- DEFOAMERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PULP & PAPER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PAINTINGS & COATINGS

- WATER TREATMENT

- FOOD & BEVERAGES

- TEXTILE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- DEFOAMERS Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AIR PRODUCTS AND CHEMICALS INC. (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- MOMENTIVE PERFORMANCE MATERIALS INC. (USA)

- LUBRIZOL CORPORATION (USA)

- WILFLEX CORPORATION (USA)

- ALZO INTERNATIONAL INC. (USA)

- DOW CORNING CORPORATION (USA)

- CHEMOURS COMPANY (USA)

- ASHLAND INC. (USA)

- DOW CHEMICAL COMPANY (USA)

- SOLVAY SA (BELGIUM)

- EVONIK INDUSTRIES AG (GERMANY)

- CLARIANT AG (SWITZERLAND)

- WACKER CHEMIE AG (GERMANY)

- ARKEMA SA (FRANCE)

- LANXESS AG (GERMANY)

- BASF SE (GERMANY)

- KEMIRA OYJ (FINLAND)

- ELEMENTS PLC (UK)

- CRODA INTERNATIONAL PLC (UK)

- SHIN-ETSU CHEMICAL CO. LTD. (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL DEFOAMERS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Defoamers Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Defoamers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.13 Bn. |

|

Forecast Period 2023-30 CAGR: |

5.7 % |

Market Size in 2032: |

USD 6.83 Bn. |

|

Segments Covered: |

By Defoamer Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DEFOAMERS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DEFOAMERS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DEFOAMERS MARKET COMPETITIVE RIVALRY

TABLE 005. DEFOAMERS MARKET THREAT OF NEW ENTRANTS

TABLE 006. DEFOAMERS MARKET THREAT OF SUBSTITUTES

TABLE 007. DEFOAMERS MARKET BY DEFOAMER TYPE

TABLE 008. WATER-BASED MARKET OVERVIEW (2016-2028)

TABLE 009. OIL-BASED MARKET OVERVIEW (2016-2028)

TABLE 010. SILICONE-BASED MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. DEFOAMERS MARKET BY APPLICATION

TABLE 013. PULP & PAPER MARKET OVERVIEW (2016-2028)

TABLE 014. PAINTINGS & COATINGS MARKET OVERVIEW (2016-2028)

TABLE 015. WATER TREATMENT MARKET OVERVIEW (2016-2028)

TABLE 016. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 018. NORTH AMERICA DEFOAMERS MARKET, BY DEFOAMER TYPE (2016-2028)

TABLE 019. NORTH AMERICA DEFOAMERS MARKET, BY APPLICATION (2016-2028)

TABLE 020. N DEFOAMERS MARKET, BY COUNTRY (2016-2028)

TABLE 021. EUROPE DEFOAMERS MARKET, BY DEFOAMER TYPE (2016-2028)

TABLE 022. EUROPE DEFOAMERS MARKET, BY APPLICATION (2016-2028)

TABLE 023. DEFOAMERS MARKET, BY COUNTRY (2016-2028)

TABLE 024. ASIA PACIFIC DEFOAMERS MARKET, BY DEFOAMER TYPE (2016-2028)

TABLE 025. ASIA PACIFIC DEFOAMERS MARKET, BY APPLICATION (2016-2028)

TABLE 026. DEFOAMERS MARKET, BY COUNTRY (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA DEFOAMERS MARKET, BY DEFOAMER TYPE (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA DEFOAMERS MARKET, BY APPLICATION (2016-2028)

TABLE 029. DEFOAMERS MARKET, BY COUNTRY (2016-2028)

TABLE 030. SOUTH AMERICA DEFOAMERS MARKET, BY DEFOAMER TYPE (2016-2028)

TABLE 031. SOUTH AMERICA DEFOAMERS MARKET, BY APPLICATION (2016-2028)

TABLE 032. DEFOAMERS MARKET, BY COUNTRY (2016-2028)

TABLE 033. KEMIRA OYJ: SNAPSHOT

TABLE 034. KEMIRA OYJ: BUSINESS PERFORMANCE

TABLE 035. KEMIRA OYJ: PRODUCT PORTFOLIO

TABLE 036. KEMIRA OYJ: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. WACKER CHEMIE AG: SNAPSHOT

TABLE 037. WACKER CHEMIE AG: BUSINESS PERFORMANCE

TABLE 038. WACKER CHEMIE AG: PRODUCT PORTFOLIO

TABLE 039. WACKER CHEMIE AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. UNIVAR SOLUTIONS INC.: SNAPSHOT

TABLE 040. UNIVAR SOLUTIONS INC.: BUSINESS PERFORMANCE

TABLE 041. UNIVAR SOLUTIONS INC.: PRODUCT PORTFOLIO

TABLE 042. UNIVAR SOLUTIONS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. BASF SE: SNAPSHOT

TABLE 043. BASF SE: BUSINESS PERFORMANCE

TABLE 044. BASF SE: PRODUCT PORTFOLIO

TABLE 045. BASF SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. EVONIK INDUSTRIES: SNAPSHOT

TABLE 046. EVONIK INDUSTRIES: BUSINESS PERFORMANCE

TABLE 047. EVONIK INDUSTRIES: PRODUCT PORTFOLIO

TABLE 048. EVONIK INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. DOW INC.: SNAPSHOT

TABLE 049. DOW INC.: BUSINESS PERFORMANCE

TABLE 050. DOW INC.: PRODUCT PORTFOLIO

TABLE 051. DOW INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. ELKEM SILICONES: SNAPSHOT

TABLE 052. ELKEM SILICONES: BUSINESS PERFORMANCE

TABLE 053. ELKEM SILICONES: PRODUCT PORTFOLIO

TABLE 054. ELKEM SILICONES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. MÜNZING CORPORATION: SNAPSHOT

TABLE 055. MÜNZING CORPORATION: BUSINESS PERFORMANCE

TABLE 056. MÜNZING CORPORATION: PRODUCT PORTFOLIO

TABLE 057. MÜNZING CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. ELEMENTIS: SNAPSHOT

TABLE 058. ELEMENTIS: BUSINESS PERFORMANCE

TABLE 059. ELEMENTIS: PRODUCT PORTFOLIO

TABLE 060. ELEMENTIS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. ASHLAND GLOBAL HOLDINGS INC.: SNAPSHOT

TABLE 061. ASHLAND GLOBAL HOLDINGS INC.: BUSINESS PERFORMANCE

TABLE 062. ASHLAND GLOBAL HOLDINGS INC.: PRODUCT PORTFOLIO

TABLE 063. ASHLAND GLOBAL HOLDINGS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. PLATINUM EQUITY: SNAPSHOT

TABLE 064. PLATINUM EQUITY: BUSINESS PERFORMANCE

TABLE 065. PLATINUM EQUITY: PRODUCT PORTFOLIO

TABLE 066. PLATINUM EQUITY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. CLARIANT AG: SNAPSHOT

TABLE 067. CLARIANT AG: BUSINESS PERFORMANCE

TABLE 068. CLARIANT AG: PRODUCT PORTFOLIO

TABLE 069. CLARIANT AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 070. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 071. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 072. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DEFOAMERS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DEFOAMERS MARKET OVERVIEW BY DEFOAMER TYPE

FIGURE 012. WATER-BASED MARKET OVERVIEW (2016-2028)

FIGURE 013. OIL-BASED MARKET OVERVIEW (2016-2028)

FIGURE 014. SILICONE-BASED MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. DEFOAMERS MARKET OVERVIEW BY APPLICATION

FIGURE 017. PULP & PAPER MARKET OVERVIEW (2016-2028)

FIGURE 018. PAINTINGS & COATINGS MARKET OVERVIEW (2016-2028)

FIGURE 019. WATER TREATMENT MARKET OVERVIEW (2016-2028)

FIGURE 020. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 022. NORTH AMERICA DEFOAMERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. EUROPE DEFOAMERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. ASIA PACIFIC DEFOAMERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. MIDDLE EAST & AFRICA DEFOAMERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. SOUTH AMERICA DEFOAMERS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Defoamers Market research report is 2024-2032.

Air Products and Chemicals Inc. (USA), Momentive Performance Materials Inc. (USA), Lubrizol Corporation (USA), Wilflex Corporation (USA), Alzo International Inc. (USA), Dow Corning Corporation (USA), Chemours Company (USA), Ashland Inc. (USA), Dow Chemical Company (USA), Solvay SA (Belgium), Evonik Industries AG (Germany), Clariant AG (Switzerland), Wacker Chemie AG (Germany), Arkema SA (France), Lanxess AG (Germany), BASF SE (Germany), Kemira Oyj (Finland), Elements Plc (UK), Croda International Plc (UK), Shin-Etsu Chemical Co. Ltd. (Japan) and Other Major Players.

The Defoamers Market is segmented into Defoamer Type, Application, and Region. By Defoamer Type, the market is categorized into Water-Based, Oil-Based, Silicone-Based, and Others. By Application, the market is categorized into Pulp & Paper, Paintings & Coatings, Water Treatment, Food & Beverages. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Defoamers are chemical additives that minimize or prevent foam formation in industrial process liquids such as paints, inks, adhesives, and even construction materials.

Defoamers Market Size Was Valued at USD 4.13 Billion in 2023, and is Projected to Reach USD 6.83 Billion by 2032, Growing at a CAGR of 5.7% From 2024-2032.