Data Center Physical Security Market Synopsis

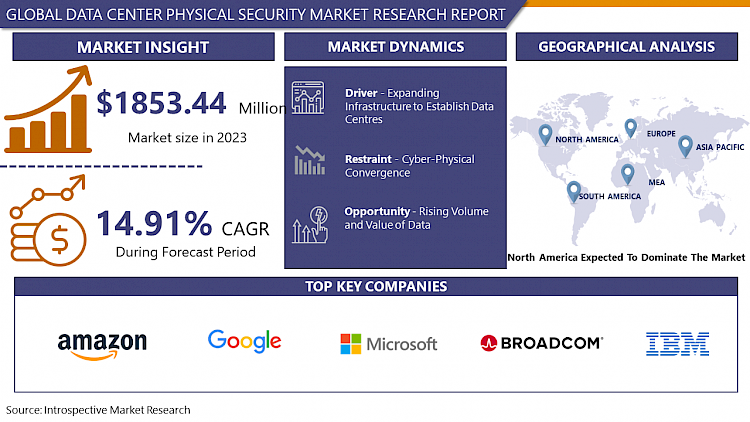

Data Center Physical Security Market Size Was Valued at USD 1853.44 Million in 2023 and is Projected to Reach USD 6474.39 Million by 2032, Growing at a CAGR of 14.91% From 2024-2032.

data center includes various built-in safety and security features that protect the premises and the equipment that stores critical data for multi-tenant applications. For the premises' safety and security, factors ranging from location selection to authenticated personnel access to the data center should be carefully considered, monitored, and audited. To avoid any physical attacks.

- Organizations all over the world rely on data centers to store and process massive amounts of sensitive information. Ensuring the physical security of these facilities is important to safeguarding the integrity, confidentiality, and availability of data. Building-wide video surveillance and controlled access points come after checks and barriers around the perimeter. Even more stringent security measures, including biometric authentication and restricted movement zones, are necessary to enter the data center floor.

- The physical security segment of the data center market is expanding rapidly as a result of the increasing reliance on digital data storage and processing. Ensuring data center physical security has become essential. Cyberattacks and physical breaches targeting data centers are becoming increasingly common and sophisticated. Organizations recognize the importance of fortifying their facilities against both physical and digital intrusions.

- The growing adoption of cloud computing, edge computing, and IoT devices is expanding data center footprints around the globe. The increasing number of data center facilities, combined with the rising value of data assets, highlights the importance of protecting physical infrastructure from threats such as theft, vandalism, and sabotage. As a result, there is an increasing demand for integrated physical security solutions that can scale and adapt to the changing requirements of modern data centre environments.

Data Center Physical Security Market Trend Analysis

Expanding Infrastructure to Establish Data Centres

- As data distribution and IT consumerization increase, organizations require more hardware, resources, and data center bandwidth. The cloud is having an impact on the design of modern data centers. Virtually every type of business requires a data center, and the demand for digital asset storage and management is increasing at an exponential rate. Influences concerning cloud computing, virtualization, and the expansion of data.

- Data centre operators anticipate future technological trends when designing new buildings or upgrading or expanding existing ones. Today, the effects of a large corporate capital investment are cumulative. Keep this in mind as you try to understand the requirements for the construction or expansion of mission-critical data centres for site development.

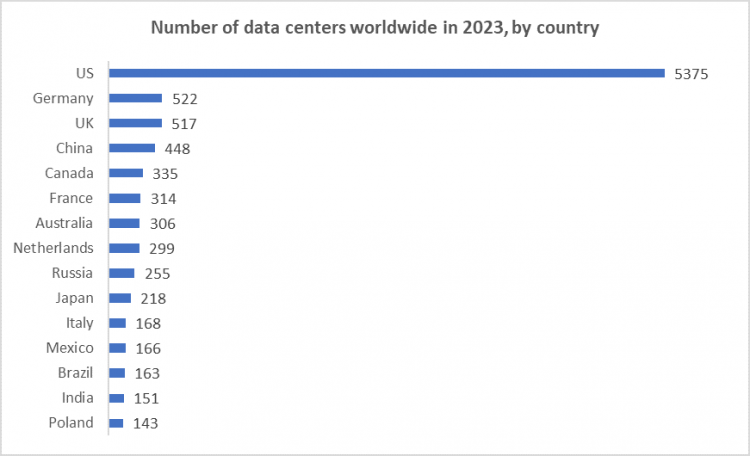

- The bar chart shows the number of data centres by country, with the United States having the most at 5,375. Germany and the United Kingdom come next, with 522 and 517 data centres, respectively. China and Canada also have a significant number of data centres (448 and 335, respectively). The chart depicts a notable disparity in data centre distribution globally, with certain countries like the US, Germany, and the UK housing a significantly larger number than others.

Rising Volume and Value of Data

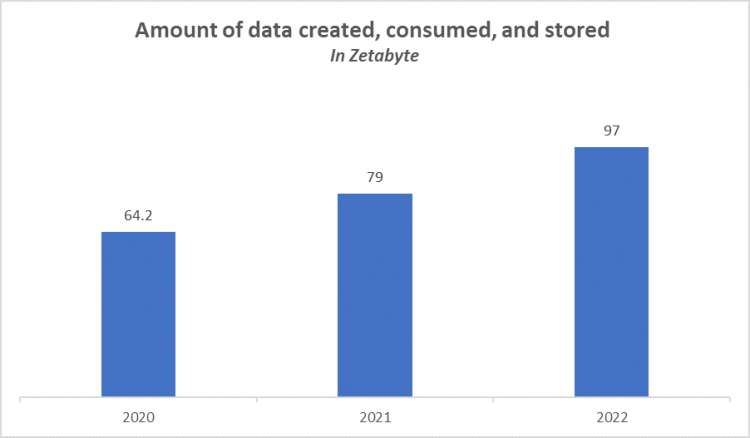

- Data is regarded as the new fuel in the modern era. The increasing number of digital devices, internet-connected sensors, and online platforms has increased the volume of data generated globally. This includes structured data from traditional sources such as databases and transaction systems, as well as unstructured data from social media, weblogs, sensors, and multimedia content.

- Additionally, the value of data has grown significantly as organizations use data analytics and artificial intelligence to extract insights, drive decision-making, and create competitive advantages. Data has evolved into a strategic asset that drives innovation, improves customer experiences, optimizes operations, and generates revenue growth. Businesses can uncover hidden patterns, trends, and correlations by analyzing large datasets with advanced analytics techniques such as machine learning and predictive modeling.

- It allows them to make more informed decisions while also better understanding customer behavior, market dynamics, and business opportunities. As data grows in volume and value, organizations are investing heavily in data management, analytics, and security capabilities to capitalize on the opportunities presented by the data-driven economy while mitigating risks associated with data privacy, security, and compliance.

- The graphs show an increase in data volume over three years (2020-2022). Starting at 64.2 in 2020, the volume increased to 79 in 2021 and again to 97 in 2022. This consistent increase reflects the exponential growth in data generation, emphasizing the expanding digital footprint and the growing importance of data management and analytics.

Data Center Physical Security Market Segment Analysis:

Data Center Physical Security Market Segmented on the basis of Type, Layers, and End-Users.

By Type, Video Surveillance segment is expected to dominate the market during the forecast period

- Video surveillance is a cost-effective way to prevent and reduce crime. Video surveillance consists of a network of cameras, monitors/display units, and recorders that can capture images and videos to protect the data center. According to Mark Soto, internal users account for 30% of data breaches. Video surveillance can easily record who enters which areas and what they do once inside.

- As cameras are required to be placed on every server row as well as at the computer room's entrances and exits, security staff will have no trouble identifying the person(s) who are in charge if a server is damaged or gains unauthorized access. This includes keeping an eye on events at work, home, or potential issues with the property. A real-time stream of what's happening on smartphones is also available to customers.

- By using cloud-based platforms, data center operators can centrally deploy and manage video surveillance cameras. This facilitates seamless integration with other security systems and real-time monitoring from any location with an internet connection. Video surveillance cameras are a dominant force in the data center physical security market because of their efficiency, adaptability, and compatibility with contemporary security infrastructure.

By End-User, Colocation Data Centers segment held the largest share of 38.32% in 2023

- Colocation data centers are facilities where multiple organizations can rent space for their IT infrastructure, which includes servers, storage, and networking equipment. This shared infrastructure model concentrates valuable assets and sensitive data within colocation facilities, making them prime targets for security threats such as theft, sabotage, and cyberattacks. Colocation data center operators prioritize physical security measures to protect their tenants' assets while also ensuring compliance with data protection and privacy regulations.

- Colocation data centers frequently serve as hubs for interconnection and network connectivity, allowing tenants to connect directly to multiple carriers, cloud service providers, and other enterprises within the same facility. The interconnected nature of colocation data centers raises additional security concerns, as unauthorized access to one tenant's infrastructure may jeopardize the security and privacy of other tenants' data.

- Colocation data centers are more scalable, flexible, and cost-effective than building and managing private data center facilities. Outsourcing their IT infrastructure to colocation providers allows organizations to benefit from shared resources, economies of scale, and access to advanced security technologies. Colocation data centers are the dominant end users of Data Centre Physical Security due to their shared infrastructure, interconnection capabilities, and security advantages.

Data Center Physical Security Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America has a higher concentration of data centers than other regions, with the United States leading the way with 5375 in 2023, due to a large number of technology companies, financial institutions, and other enterprises that rely heavily on data-intensive operations. These organizations require a strong IT infrastructure to support their digital services, applications, and storage requirements, creating a high demand for data center space.

- With more data centers, there is more surface area for potential security breaches, necessitating a significant investment in data center physical security measures. This increased risk of security threats has resulted in a significant increase in the market for Data Centre Physical Security solutions in North America. Data center security strategies now require investment in access control systems, surveillance cameras, biometric authentication, and perimeter security fencing.

- Investments in access control systems, surveillance cameras, biometric authentication, and perimeter security fencing are now critical components of data center security strategies. The concentration of data centers in North America has resulted in a significant increase in the market for Data Centre Physical Security solutions, as businesses seek to reduce security risks and protect critical assets from cyber threats.

Data Center Physical Security Market Top Key Players:

- Amazon Web Services (US)

- Google (US)

- Microsoft (US)

- IBM (US)

- Broadcom (US)

- Honeywell (US)

- VMware (US)

- Cisco (US)

- McAfee (US)

- Citrix Systems (US)

- Trend Micro (Japan)

- Juniper Networks (US)

- Dell (US)

- Securitas Technology (US)

- Equinix (US)

- American Integrated Security Group (US)

- Sunbird DCIM (US)

- CyrusOne (US)

- Digital Realty (US)

- Coresite (US)

- Cyxtera (US)

- Siemens (Germany)

- Meesons (UK)

- Schneider Electric (France)

- Check Point Software (Israel), and other major players.

Key Industry Developments in the Data Center Physical Security Market:

- In July 2023, Securitas signed an agreement with Microsoft to provide data center security in 31 countries. The agreement includes risk management, comprehensive security technology as a system integrator, specialized safety and security resources, guarding services and digital interfaces, and global account management.

- In November 2023, Broadcom Acquired VMware for $69 billion, the combined company will focus on helping enterprises create and modernize their private and hybrid cloud environments, prioritizing both physical and virtual security. VMware will continue to offer its catalog of cloud and Edge software.

|

Global Data Center Physical Security Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1853.44 Mn. |

|

Forecast Period 2024-32 CAGR: |

14.91 % |

Market Size in 2032: |

USD 6474.39 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Layers |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- DATA CENTER PHYSICAL SECURITY MARKET BY TYPE (2017-2032)

- DATA CENTER PHYSICAL SECURITY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- VIDEO SURVEILLANCE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ACCESS CONTROL

- INTRUSION DETECTION

- FENCING AND SECURITY GATES

- TEMPERATURE AND HUMIDITY CONTROL

- DATA CENTER PHYSICAL SECURITY MARKET BY LAYERS (2017-2032)

- DATA CENTER PHYSICAL SECURITY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PERIMETER SECURITY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FACILITY CONTROLS

- COMPUTER ROOM CONTROLS

- CABINET CONTROLS

- DATA CENTER PHYSICAL SECURITY MARKET BY END-USER (2017-2032)

- DATA CENTER PHYSICAL SECURITY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- COLOCATION DATA CENTERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HYPERSCALE DATA CENTERS

- ENTERPRISE DATA CENTERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Data Center Physical Security Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AMAZON WEB SERVICES (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- GOOGLE (US)

- MICROSOFT (US)

- IBM (US)

- BROADCOM (US)

- HONEYWELL (US)

- VMWARE (US)

- CISCO (US)

- MCAFEE (US)

- CITRIX SYSTEMS (US)

- TREND MICRO (JAPAN)

- JUNIPER NETWORKS (US)

- DELL (US)

- SECURITAS TECHNOLOGY (US)

- EQUINIX (US)

- AMERICAN INTEGRATED SECURITY GROUP (US)

- SUNBIRD DCIM (US)

- CYRUSONE (US)

- DIGITAL REALTY (US)

- CORESITE (US)

- CYXTERA (US)

- SIEMENS (GERMANY)

- MEESONS (UK)

- SCHNEIDER ELECTRIC (FRANCE)

- CHECK POINT SOFTWARE (ISRAEL)

- COMPETITIVE LANDSCAPE

- GLOBAL DATA CENTER PHYSICAL SECURITY MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Layers

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Data Center Physical Security Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1853.44 Mn. |

|

Forecast Period 2024-32 CAGR: |

14.91 % |

Market Size in 2032: |

USD 6474.39 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Layers |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DATA CENTER PHYSICAL SECURITY MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DATA CENTER PHYSICAL SECURITY MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DATA CENTER PHYSICAL SECURITY MARKET COMPETITIVE RIVALRY

TABLE 005. DATA CENTER PHYSICAL SECURITY MARKET THREAT OF NEW ENTRANTS

TABLE 006. DATA CENTER PHYSICAL SECURITY MARKET THREAT OF SUBSTITUTES

TABLE 007. DATA CENTER PHYSICAL SECURITY MARKET BY SOLUTION

TABLE 008. VIDEO SURVEILLANCE MARKET OVERVIEW (2016-2028)

TABLE 009. MONITORING AND ACCESS CONTROL MARKET OVERVIEW (2016-2028)

TABLE 010. DATA CENTER PHYSICAL SECURITY MARKET BY SERVICE

TABLE 011. CONSULTING MARKET OVERVIEW (2016-2028)

TABLE 012. SYSTEM INTEGRATION MARKET OVERVIEW (2016-2028)

TABLE 013. PROFESSIONAL SERVICES MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA DATA CENTER PHYSICAL SECURITY MARKET, BY SOLUTION (2016-2028)

TABLE 015. NORTH AMERICA DATA CENTER PHYSICAL SECURITY MARKET, BY SERVICE (2016-2028)

TABLE 016. N DATA CENTER PHYSICAL SECURITY MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE DATA CENTER PHYSICAL SECURITY MARKET, BY SOLUTION (2016-2028)

TABLE 018. EUROPE DATA CENTER PHYSICAL SECURITY MARKET, BY SERVICE (2016-2028)

TABLE 019. DATA CENTER PHYSICAL SECURITY MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC DATA CENTER PHYSICAL SECURITY MARKET, BY SOLUTION (2016-2028)

TABLE 021. ASIA PACIFIC DATA CENTER PHYSICAL SECURITY MARKET, BY SERVICE (2016-2028)

TABLE 022. DATA CENTER PHYSICAL SECURITY MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA DATA CENTER PHYSICAL SECURITY MARKET, BY SOLUTION (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA DATA CENTER PHYSICAL SECURITY MARKET, BY SERVICE (2016-2028)

TABLE 025. DATA CENTER PHYSICAL SECURITY MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA DATA CENTER PHYSICAL SECURITY MARKET, BY SOLUTION (2016-2028)

TABLE 027. SOUTH AMERICA DATA CENTER PHYSICAL SECURITY MARKET, BY SERVICE (2016-2028)

TABLE 028. DATA CENTER PHYSICAL SECURITY MARKET, BY COUNTRY (2016-2028)

TABLE 029. SCHNEIDER ELECTRIC: SNAPSHOT

TABLE 030. SCHNEIDER ELECTRIC: BUSINESS PERFORMANCE

TABLE 031. SCHNEIDER ELECTRIC: PRODUCT PORTFOLIO

TABLE 032. SCHNEIDER ELECTRIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. ROBERT BOSCH GMBH: SNAPSHOT

TABLE 033. ROBERT BOSCH GMBH: BUSINESS PERFORMANCE

TABLE 034. ROBERT BOSCH GMBH: PRODUCT PORTFOLIO

TABLE 035. ROBERT BOSCH GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. DAHUA TECHNOLOGY: SNAPSHOT

TABLE 036. DAHUA TECHNOLOGY: BUSINESS PERFORMANCE

TABLE 037. DAHUA TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 038. DAHUA TECHNOLOGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. AXIS COMMUNICATION: SNAPSHOT

TABLE 039. AXIS COMMUNICATION: BUSINESS PERFORMANCE

TABLE 040. AXIS COMMUNICATION: PRODUCT PORTFOLIO

TABLE 041. AXIS COMMUNICATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. ASSA ABLOY: SNAPSHOT

TABLE 042. ASSA ABLOY: BUSINESS PERFORMANCE

TABLE 043. ASSA ABLOY: PRODUCT PORTFOLIO

TABLE 044. ASSA ABLOY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. MORPHO (SAFRAN): SNAPSHOT

TABLE 045. MORPHO (SAFRAN): BUSINESS PERFORMANCE

TABLE 046. MORPHO (SAFRAN): PRODUCT PORTFOLIO

TABLE 047. MORPHO (SAFRAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. HONEYWELL: SNAPSHOT

TABLE 048. HONEYWELL: BUSINESS PERFORMANCE

TABLE 049. HONEYWELL: PRODUCT PORTFOLIO

TABLE 050. HONEYWELL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. HIKVISION DIGITAL TECHNOLOGY CO LTD: SNAPSHOT

TABLE 051. HIKVISION DIGITAL TECHNOLOGY CO LTD: BUSINESS PERFORMANCE

TABLE 052. HIKVISION DIGITAL TECHNOLOGY CO LTD: PRODUCT PORTFOLIO

TABLE 053. HIKVISION DIGITAL TECHNOLOGY CO LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. SIEMENS AG: SNAPSHOT

TABLE 054. SIEMENS AG: BUSINESS PERFORMANCE

TABLE 055. SIEMENS AG: PRODUCT PORTFOLIO

TABLE 056. SIEMENS AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. TYCO INTERNATIONAL: SNAPSHOT

TABLE 057. TYCO INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 058. TYCO INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 059. TYCO INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 060. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 061. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 062. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DATA CENTER PHYSICAL SECURITY MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DATA CENTER PHYSICAL SECURITY MARKET OVERVIEW BY SOLUTION

FIGURE 012. VIDEO SURVEILLANCE MARKET OVERVIEW (2016-2028)

FIGURE 013. MONITORING AND ACCESS CONTROL MARKET OVERVIEW (2016-2028)

FIGURE 014. DATA CENTER PHYSICAL SECURITY MARKET OVERVIEW BY SERVICE

FIGURE 015. CONSULTING MARKET OVERVIEW (2016-2028)

FIGURE 016. SYSTEM INTEGRATION MARKET OVERVIEW (2016-2028)

FIGURE 017. PROFESSIONAL SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA DATA CENTER PHYSICAL SECURITY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE DATA CENTER PHYSICAL SECURITY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC DATA CENTER PHYSICAL SECURITY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA DATA CENTER PHYSICAL SECURITY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA DATA CENTER PHYSICAL SECURITY MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Data Center Physical Security Market research report is 2024-2032.

Amazon Web Services (US), Google (US), Microsoft (US), IBM (US), Broadcom (US), Honeywell (US), VMware (US), Cisco (US), McAfee (US), Citrix Systems (US), Trend Micro (Japan), Juniper Networks (US), Dell (US), Securitas Technology (US), Equinix (US), American Integrated Security Group (US), Sunbird DCIM (US), CyrusOne (US), Digital Realty (US), Coresite (US), Cyxtera (US), Siemens (Germany), Meesons (UK), Schneider Electric (France), Check Point Software (Israel) and Other Major Players.

The Data Center Physical Security Market is segmented into Type, Layers, End-User, and region. By Type, the market is categorized into Video Surveillance, Access Control, Intrusion Detection, Fencing and Security Gates, and Temperature and Humidity Control. By Layers, the market is categorized into Perimeter Security, Facility Controls, Computer Room Controls, and Cabinet Controls. By End-User, the market is categorized into Colocation Data Centers, Hyperscale Data Centers, and Enterprise Data Centers. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Physical security in a data center includes various built-in safety and security features that protect the premises and the equipment that stores critical data for multi-tenant applications. For the premises' safety and security, factors ranging from location selection to authenticated personnel access to the data center should be carefully considered, monitored, and audited. To avoid any physical attacks.

Data Center Physical Security Market Size Was Valued at USD 1853.44 Million in 2023 and is Projected to Reach USD 6474.39 Million by 2032, Growing at a CAGR of 14.91% From 2024-2032.