Data Center Networking Market Synopsis

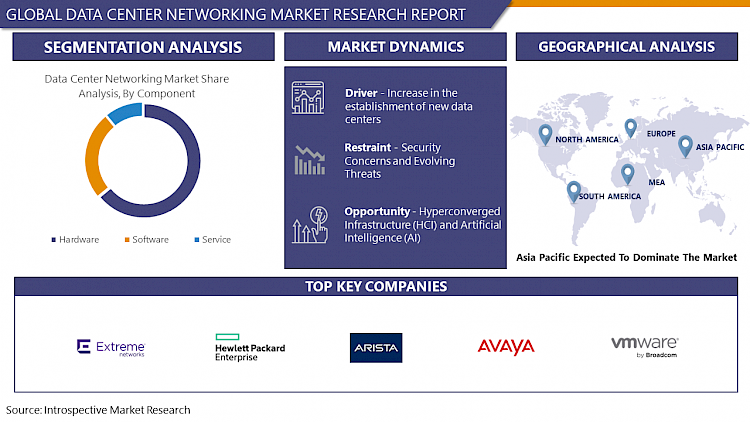

Data Center Networking Market Size Was Valued at USD 25.11 Billion in 2023 and is Projected to Reach USD 70.25 Billion by 2032, Growing at a CAGR of 12.11% From 2024-2032.

Data center networking is the infrastructure and technologies used for communication and data exchange within a data center environment. It includes hardware components like switches, routers, and cables, as well as software solutions like network management systems and security protocols. This infrastructure is crucial for businesses to manage, store, process, and distribute vast amounts of data efficiently.

- Data center networking is a vital component of modern digital infrastructure, offering numerous benefits and driving market trends. It facilitates efficient communication and data transfer, optimizing resource utilization, enhancing scalability, and improving performance. With technologies like virtualization and software-defined networking (SDN), it becomes more flexible, allowing for dynamic resource allocation and simplified management. Advanced security measures safeguard data integrity and protect against cyber threats. The demand for data center networking is increasing as organizations embrace cloud computing, big data analytics, IoT, and artificial intelligence. Enterprises require robust, high-speed networking solutions to support data-intensive applications and ensure seamless connectivity across distributed environments.

- Data center networking serves various industries, including finance, healthcare, retail, and entertainment, enabling efficient data storage, retrieval, and processing. It supports emerging technologies like edge computing, enabling low-latency data processing and enhancing user experiences in applications like gaming, streaming, and autonomous vehicles. Key market trends include the adoption of SDN and network virtualization, the rise of edge computing, 5G networks, and sustainability, prompting the development of energy-efficient networking technologies and eco-friendly data center designs.

Data Center Networking Market Trend Analysis

Increase in the establishment of new data centers

- The surge in establishing new data centers has become a significant catalyst for driving the Data Center Networking Market forward. As digital data creation and consumption skyrocket across various sectors, organizations find themselves compelled to set up new data centers to accommodate the rising need for data storage, processing, and analysis. These fresh data center installations, whether large-scale enterprise facilities or cloud-based platforms, require robust networking solutions to facilitate seamless communication, data transfer, and resource optimization within and between data center environments. In their quest to boost operational efficiency, scalability, and resilience, organizations are making substantial investments in cutting-edge data center networking technologies.

- Technologies encompass high-speed Ethernet switches, routers, software-defined networking (SDN), and network security apparatus, all playing crucial roles in enabling flexible, scalable, and secure data center infrastructures. Moreover, the advent of edge computing, 5G networks, and IoT applications further intensifies the demand for sophisticated data center networking solutions capable of accommodating diverse workloads and distributed architectures. Consequently, the upsurge in establishing new data centers propels innovation and expansion within the Data Center Networking Market, fostering the development of advanced networking technologies and solutions tailored to meet the ever-evolving demands of modern data center environments.

Hyperconverged Infrastructure (HCI) and Artificial Intelligence (AI)

- Hyperconverged Infrastructure (HCI) and Artificial Intelligence (AI) present substantial opportunities within the Data Center Networking Market.HCI consolidates computing, storage, and networking resources into a unified, software

- -defined platform. This streamlined setup simplifies data center management, enhances scalability, and reduces infrastructure complexity. In terms of data center networking, HCI offers avenues to optimize network performance, increase agility, and seamlessly integrate with virtualized environments. Tailored networking solutions for HCI environments can provide improved visibility, automation, and orchestration capabilities, facilitating efficient data transfer and workload mobility across the infrastructure.

- AI is transforming various facets of data center operations, including network management, security, and performance enhancement. AI-powered networking solutions can analyze extensive network data in real-time, recognizing patterns and proactively identifying anomalies or security risks. Through AI algorithms, data center networks can dynamically adjust to evolving traffic patterns, optimize resource utilization, and mitigate network congestion. Moreover, AI-driven predictive analytics enable proactive maintenance and fault detection, enhancing network reliability and uptime. As AI progresses, data center networking can harness innovative AI-driven technologies to enhance operational efficiency, resilience, and intelligence.

Data Center Networking Market Segment Analysis:

Data Center Networking Market Segmented based on Product, Component, and End-User.

By Product, the Ethernet Switches segment is expected to dominate the market during the forecast period

- The Ethernet Switches segment is poised to lead the Data Center Networking Market due to several factors. Ethernet switches serve as the cornerstone of data center networks, enabling efficient and high-speed data packet transmission among network devices. With the continual expansion of data centers in terms of size and complexity, the demand for Ethernet switches rises to accommodate the growing network infrastructure.

- The surge in cloud computing, big data analytics, IoT, and other data-intensive applications underscores the need for high-performance networking solutions capable of managing substantial traffic volumes. Ethernet switches offer scalability, flexibility, and reliability, making them well-suited for addressing the varied workloads and traffic patterns prevalent in modern data centers.

- Ongoing advancements in Ethernet switch technologies, such as increased port densities, faster data transfer rates, and improved features like Quality of Service (QoS) and virtualization support, further bolster their prominence in the market. These innovations empower data center operators to optimize network performance, enhance resource utilization, and ensure seamless connectivity across their infrastructure.

By Component, Hardware segment is expected to dominate the market during the forecast period

- The Hardware segment is poised to maintain its dominance in the Data Center Networking Market for several key reasons. Hardware serves as the fundamental building block of data center networking, encompassing critical components such as switches, routers, servers, and storage devices. These hardware elements are essential for establishing the physical connections and facilitating data transmission within data centers. given the rise of data-heavy applications, cloud computing, and emerging technologies like edge computing and IoT, there is an increasing demand for robust and scalable hardware infrastructure to handle the growing data volumes and processing requirements.

- As organizations expand their digital presence, the necessity for high-performance hardware components in data center networking continues to grow. Continuous advancements in hardware technology, such as faster processors, higher-density storage solutions, and more efficient networking equipment, enable data centers to achieve improved performance, reliability, and scalability. Companies are heavily investing in upgrading their hardware infrastructure to remain competitive and address the evolving demands of modern data center environments.

Data Center Networking Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to lead the Data Center Networking market due to several pivotal reasons. Initially, the region's rapid economic expansion and industrial growth spurred a heightened demand for digital infrastructure and data center services. As businesses across diverse sectors embrace digitalization, there arises an increasing necessity for robust, scalable data center networking solutions to accommodate their evolving IT needs.

- The Asia Pacific region boasts a sizable and swiftly expanding population alongside rising rates of internet penetration and adoption of smartphones. This trend propels the demand for data-heavy applications and services, thus driving the requirement for high-performance data center networking infrastructure to ensure seamless connectivity and dependable access to digital resources.

- Governments in the Asia Pacific region actively invest in digital initiatives and infrastructure development to foster innovation, enhance competitiveness, and bolster socio-economic progress. Initiatives like smart city projects, digital transformation agendas, and investments in broadband connectivity further stimulate the growth of the data center networking market in the region.

Data Center Networking Market Top Key Players:

- Cisco Systems Inc. (U.S.)

- Juniper Networks Inc. (U.S.)

- Arista Networks Inc. (U.S.)

- VMware Inc. (U.S.)

- Hewlett Packard Enterprise (U.S.)

- Dell Inc. (U.S.)

- IBM Corporation (U.S.)

- Intel Corporation (U.S.)

- Microsoft Corporation (U.S.)

- Avaya Inc. (U.S.)

- Extreme Networks (U.S.)

- Equinix Inc. (U.S.)

- Curvature (U.S.)

- Pluribus Networks (U.S.)

- Apstra (U.S.)

- Broadcom (U.S.)

- Rahi Systems (U.S.)

- ALE International (France)

- NEC Corporation (Japan)

- H3C Holding Limited (China)

- Huawei Technologies Co. Ltd. (China), and Other Major Players.

Key Industry Developments in the Data Center Networking Market:

- In June 2023, Cisco Systems Inc., a prominent software company, unveiled a comprehensive observability platform. This innovative solution consolidates data from various domains, including networking and applications, streamlining analysis and insights generation.

- In March 2023, Arista Networks introduced the Arista WAN Routing System. This system integrates three new networking offerings: enterprise-grade routing platforms, carrier/cloud-neutral internet transit capabilities, and the CloudVision Pathfinder Service. By leveraging Arista's EOS routing capabilities and CloudVision management, the Arista WAN Routing System aims to simplify and enhance customer-wide area networks. It offers architecture, features, and platforms designed to modernize federated and software-defined wide-area networks.

|

Global Data Center Networking Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 25.11 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.11 % |

Market Size in 2032: |

USD 70.25 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Component |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- DATA CENTER NETWORKING MARKET BY PRODUCT (2017-2032)

- DATA CENTER NETWORKING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ETHERNET SWITCHES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ROUTERS

- STORAGE AREA NETWORK (SAN) COMPONENTS

- NETWORK SECURITY EQUIPMENT

- APPLICATION DELIVERY CONTROLLERS (ADCS)

- WIDE AREA NETWORK (WAN)

- DATA CENTER NETWORKING MARKET BY COMPONENT (2017-2032)

- DATA CENTER NETWORKING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HARDWARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SOFTWARE

- SERVICE

- DATA CENTER NETWORKING MARKET BY END-USER (2017-2032)

- DATA CENTER NETWORKING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- IT AND TELECOM SECTOR

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BANKING

- FINANCIAL SERVICES AND INSURANCE (BFSI)

- HEALTHCARE

- RETAIL

- GOVERNMENT

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Data Center Networking Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CISCO SYSTEMS INC. (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- JUNIPER NETWORKS INC. (U.S.)

- ARISTA NETWORKS INC. (U.S.)

- VMWARE INC. (U.S.)

- HEWLETT PACKARD ENTERPRISE (U.S.)

- DELL INC. (U.S.)

- IBM CORPORATION (U.S.)

- INTEL CORPORATION (U.S.)

- MICROSOFT CORPORATION (U.S.)

- AVAYA INC. (U.S.)

- EXTREME NETWORKS (U.S.)

- EQUINIX INC. (U.S.)

- CURVATURE (U.S.)

- PLURIBUS NETWORKS (U.S.)

- APSTRA (U.S.)

- BROADCOM (U.S.)

- RAHI SYSTEMS (U.S.)

- ALE INTERNATIONAL (FRANCE)

- NEC CORPORATION (JAPAN)

- H3C HOLDING LIMITED (CHINA)

- HUAWEI TECHNOLOGIES CO. LTD. (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL DATA CENTER NETWORKING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Data Center Networking Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 25.11 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.11 % |

Market Size in 2032: |

USD 70.25 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Component |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DATA CENTER NETWORKING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DATA CENTER NETWORKING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DATA CENTER NETWORKING MARKET COMPETITIVE RIVALRY

TABLE 005. DATA CENTER NETWORKING MARKET THREAT OF NEW ENTRANTS

TABLE 006. DATA CENTER NETWORKING MARKET THREAT OF SUBSTITUTES

TABLE 007. DATA CENTER NETWORKING MARKET BY COMPONENT

TABLE 008. HARDWARE MARKET OVERVIEW (2016-2028)

TABLE 009. SOFTWARE MARKET OVERVIEW (2016-2028)

TABLE 010. SERVICE MARKET OVERVIEW (2016-2028)

TABLE 011. DATA CENTER NETWORKING MARKET BY END USER

TABLE 012. TELECOMMUNICATIONS MARKET OVERVIEW (2016-2028)

TABLE 013. GOVERNMENT MARKET OVERVIEW (2016-2028)

TABLE 014. COLOCATION MARKET OVERVIEW (2016-2028)

TABLE 015. DEFENSE MARKET OVERVIEW (2016-2028)

TABLE 016. RETAIL MARKET OVERVIEW (2016-2028)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 018. NORTH AMERICA DATA CENTER NETWORKING MARKET, BY COMPONENT (2016-2028)

TABLE 019. NORTH AMERICA DATA CENTER NETWORKING MARKET, BY END USER (2016-2028)

TABLE 020. N DATA CENTER NETWORKING MARKET, BY COUNTRY (2016-2028)

TABLE 021. EUROPE DATA CENTER NETWORKING MARKET, BY COMPONENT (2016-2028)

TABLE 022. EUROPE DATA CENTER NETWORKING MARKET, BY END USER (2016-2028)

TABLE 023. DATA CENTER NETWORKING MARKET, BY COUNTRY (2016-2028)

TABLE 024. ASIA PACIFIC DATA CENTER NETWORKING MARKET, BY COMPONENT (2016-2028)

TABLE 025. ASIA PACIFIC DATA CENTER NETWORKING MARKET, BY END USER (2016-2028)

TABLE 026. DATA CENTER NETWORKING MARKET, BY COUNTRY (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA DATA CENTER NETWORKING MARKET, BY COMPONENT (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA DATA CENTER NETWORKING MARKET, BY END USER (2016-2028)

TABLE 029. DATA CENTER NETWORKING MARKET, BY COUNTRY (2016-2028)

TABLE 030. SOUTH AMERICA DATA CENTER NETWORKING MARKET, BY COMPONENT (2016-2028)

TABLE 031. SOUTH AMERICA DATA CENTER NETWORKING MARKET, BY END USER (2016-2028)

TABLE 032. DATA CENTER NETWORKING MARKET, BY COUNTRY (2016-2028)

TABLE 033. ARISTA NETWORKS: SNAPSHOT

TABLE 034. ARISTA NETWORKS: BUSINESS PERFORMANCE

TABLE 035. ARISTA NETWORKS: PRODUCT PORTFOLIO

TABLE 036. ARISTA NETWORKS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. BROADCOM INC: SNAPSHOT

TABLE 037. BROADCOM INC: BUSINESS PERFORMANCE

TABLE 038. BROADCOM INC: PRODUCT PORTFOLIO

TABLE 039. BROADCOM INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. ALCATEL LUCENT: SNAPSHOT

TABLE 040. ALCATEL LUCENT: BUSINESS PERFORMANCE

TABLE 041. ALCATEL LUCENT: PRODUCT PORTFOLIO

TABLE 042. ALCATEL LUCENT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. AVAYA INC: SNAPSHOT

TABLE 043. AVAYA INC: BUSINESS PERFORMANCE

TABLE 044. AVAYA INC: PRODUCT PORTFOLIO

TABLE 045. AVAYA INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. CISCO SYSTEMS INC: SNAPSHOT

TABLE 046. CISCO SYSTEMS INC: BUSINESS PERFORMANCE

TABLE 047. CISCO SYSTEMS INC: PRODUCT PORTFOLIO

TABLE 048. CISCO SYSTEMS INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. DELTA ELECTRONICS INC: SNAPSHOT

TABLE 049. DELTA ELECTRONICS INC: BUSINESS PERFORMANCE

TABLE 050. DELTA ELECTRONICS INC: PRODUCT PORTFOLIO

TABLE 051. DELTA ELECTRONICS INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. DELL INC: SNAPSHOT

TABLE 052. DELL INC: BUSINESS PERFORMANCE

TABLE 053. DELL INC: PRODUCT PORTFOLIO

TABLE 054. DELL INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. FUJITSU LTD: SNAPSHOT

TABLE 055. FUJITSU LTD: BUSINESS PERFORMANCE

TABLE 056. FUJITSU LTD: PRODUCT PORTFOLIO

TABLE 057. FUJITSU LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. EXTREME NETWORKS: SNAPSHOT

TABLE 058. EXTREME NETWORKS: BUSINESS PERFORMANCE

TABLE 059. EXTREME NETWORKS: PRODUCT PORTFOLIO

TABLE 060. EXTREME NETWORKS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. HUAWEI TECHNOLOGIES CO LTD: SNAPSHOT

TABLE 061. HUAWEI TECHNOLOGIES CO LTD: BUSINESS PERFORMANCE

TABLE 062. HUAWEI TECHNOLOGIES CO LTD: PRODUCT PORTFOLIO

TABLE 063. HUAWEI TECHNOLOGIES CO LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. HEWLETT PACKARD ENTERPRISE: SNAPSHOT

TABLE 064. HEWLETT PACKARD ENTERPRISE: BUSINESS PERFORMANCE

TABLE 065. HEWLETT PACKARD ENTERPRISE: PRODUCT PORTFOLIO

TABLE 066. HEWLETT PACKARD ENTERPRISE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. MICROSOFT CORPORATION: SNAPSHOT

TABLE 067. MICROSOFT CORPORATION: BUSINESS PERFORMANCE

TABLE 068. MICROSOFT CORPORATION: PRODUCT PORTFOLIO

TABLE 069. MICROSOFT CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. IBM CORPORATION: SNAPSHOT

TABLE 070. IBM CORPORATION: BUSINESS PERFORMANCE

TABLE 071. IBM CORPORATION: PRODUCT PORTFOLIO

TABLE 072. IBM CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. JUNIPER NETWORKS: SNAPSHOT

TABLE 073. JUNIPER NETWORKS: BUSINESS PERFORMANCE

TABLE 074. JUNIPER NETWORKS: PRODUCT PORTFOLIO

TABLE 075. JUNIPER NETWORKS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. INTEL CORPORATION: SNAPSHOT

TABLE 076. INTEL CORPORATION: BUSINESS PERFORMANCE

TABLE 077. INTEL CORPORATION: PRODUCT PORTFOLIO

TABLE 078. INTEL CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. NEC CORPORATION: SNAPSHOT

TABLE 079. NEC CORPORATION: BUSINESS PERFORMANCE

TABLE 080. NEC CORPORATION: PRODUCT PORTFOLIO

TABLE 081. NEC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 082. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 083. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 084. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DATA CENTER NETWORKING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DATA CENTER NETWORKING MARKET OVERVIEW BY COMPONENT

FIGURE 012. HARDWARE MARKET OVERVIEW (2016-2028)

FIGURE 013. SOFTWARE MARKET OVERVIEW (2016-2028)

FIGURE 014. SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 015. DATA CENTER NETWORKING MARKET OVERVIEW BY END USER

FIGURE 016. TELECOMMUNICATIONS MARKET OVERVIEW (2016-2028)

FIGURE 017. GOVERNMENT MARKET OVERVIEW (2016-2028)

FIGURE 018. COLOCATION MARKET OVERVIEW (2016-2028)

FIGURE 019. DEFENSE MARKET OVERVIEW (2016-2028)

FIGURE 020. RETAIL MARKET OVERVIEW (2016-2028)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 022. NORTH AMERICA DATA CENTER NETWORKING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. EUROPE DATA CENTER NETWORKING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. ASIA PACIFIC DATA CENTER NETWORKING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. MIDDLE EAST & AFRICA DATA CENTER NETWORKING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. SOUTH AMERICA DATA CENTER NETWORKING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Data Center Networking Market research report is 2024-2032.

Cisco Systems Inc. (U.S.), Juniper Networks Inc. (U.S.), Arista Networks Inc. (U.S.), VMware Inc. (U.S.), Hewlett Packard Enterprise (U.S.), Dell Inc. (U.S.), IBM Corporation (U.S.), Intel Corporation (U.S.), Microsoft Corporation (U.S.), Avaya Inc. (U.S.), Extreme Networks (U.S.), Equinix Inc. (U.S.), Curvature (U.S.), Pluribus Networks (U.S.), Apstra (U.S.), Broadcom (U.S.), Rahi Systems (U.S.), ALE International (France), NEC Corporation (Japan), H3C Holding Limited (China), Huawei Technologies Co. Ltd. (China) and Other Major Players.

The Data Center Networking Market is segmented into Product, Component, End-User, and region. By Product, the market is categorized into Ethernet Switches, Routers, Storage Area Network (SAN) Components, Network Security Equipment, Application Delivery Controllers (ADCs), and Wide Area Network (WAN). By Component, the market is categorized into Hardware, Software, and Service. By End-User, the market is categorized into IT And Telecom Sector, Banking, Financial Services and Insurance (BFSI), Healthcare, Retail, and Government. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Data center networking is the infrastructure and technologies used for communication and data exchange within a data center environment. It includes hardware components like switches, routers, and cables, as well as software solutions like network management systems and security protocols. This infrastructure is crucial for businesses to manage, store, process, and distribute vast amounts of data efficiently.

Data Center Networking Market Size Was Valued at USD 25.11 Billion in 2023 and is Projected to Reach USD 70.25 Billion by 2032, Growing at a CAGR of 12.11% From 2024-2032.